Professional Documents

Culture Documents

AIA Elite Balanced Fund SGD Product Highlights Sheet

AIA Elite Balanced Fund SGD Product Highlights Sheet

Uploaded by

desmondOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

AIA Elite Balanced Fund SGD Product Highlights Sheet

AIA Elite Balanced Fund SGD Product Highlights Sheet

Uploaded by

desmondCopyright:

Available Formats

Prepared on: 1 April 2023

This Product Highlights Sheet is an important document.

• It highlights the key terms and risks of the ILP Sub-Fund and complements the Product Summary.

• It is important to read the Product Summary before deciding whether to purchase the ILP Sub-Fund. If you do not

have a copy, please contact us to ask for one.

• You should not invest in the ILP Sub-Fund if you do not understand it or are not comfortable with the accompanying

risks.

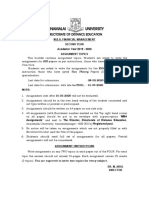

AIA ELITE BALANCED FUND

(the “ILP Sub-Fund”)

Product Type ILP Sub-Fund2 Launch Date 19 July 2019

(Units in the ILP sub-

fund are not Excluded

Investment Products)1

PRODUCT HIGHLIGHTS SHEET

Manager of the ILP Sub- AIA Investment Custodian Citibank N.A.

Fund (the “Manager”) Management Private Limited Singapore Branch

Capital Guaranteed No Dealing Frequency Every Business Day3

Expense Ratio for year

Name of Guarantor N.A 1.33%

ended 31 December 2022

ILP SUB-FUND SUITABILITY

WHO IS THE ILP SUB-FUND SUITABLE FOR? Please refer to the AIA

Investment Fund Product

• The ILP Sub-Fund is only suitable for investors who:

Summary for further

° Seek to achieve long-term total return with moderate risk through direct and information on the suitability

indirect investments in equities and bonds; and of the Sub-Fund.

° Are willing to accept some short-term fluctuations in the value of their investments.

Investments in this ILP Sub-Fund are subject to investment risks including the

possible loss of the principal amount invested.

Units in the ILP Sub-fund are not Excluded Investment Products.

KEY FEATURES OF THE ILP SUB-FUND

WHAT ARE YOU INVESTING IN? Please refer to the AIA

Investment Fund Product

• You are investing in an ILP Sub-Fund constituted in Singapore, which feeds

Summary for further

predominantly into the underlying funds that resides under AIA Investment Funds,

information on features of the

an open-ended investment company incorporated in Luxembourg and its home

Sub-Fund.

regulator is the Commission de Surveillance du Secteur Financier (CSSF).

• The ILP Sub-Fund’s expected average direct and indirect exposure to equities will

be approximately 60% over the long-term, however this exposure may vary from

time to time. The other 40% will be invested in fixed income or money market

instruments.

Investment Strategy

• The ILP Sub-Fund seeks to achieve its investment objective by obtaining direct or Please refer to the AIA

indirect exposure to a broad range of asset classes, which may include equity and Investment Fund Product

equity-related securities (including, but not limited to, common shares, preference Summary for further

shares, warrants, rights issues and depositary receipts (American Depository information.

Receipts (ADRs) and Global Depository Receipts (GDRs)), fixed income and

fixed income-related securities, money market instruments and cash. Indirect

TM3300208 (10/2021 02/2022 04/2023)

exposure to these asset classes will be achieved through investments in units or

shares of eligible collective investment schemes, including but not limited to the

Underlying Funds, exchange traded funds and other index funds.

• The asset mix may vary, depending on market conditions. There will be periodic

rebalancing to minimize deviation from the stated proportions set above.

Parties Involved

WHO ARE YOU INVESTING WITH? Please refer to the AIA

Investment Fund Product

• Product Provider: AIA Singapore Private Limited

Summary for further

• Manager of the ILP Sub-Fund: AIA Investment Management Private Limited information, including what

• Fund Administrator and Custodian of AIA Investment Funds: HSBC France happens if they become

(Luxembourg branch) insolvent.

• Manager of AIA Investment Funds: AIA Investment Management Private Limited

• Sub-Manager(s)* of AIA Investment Funds: Baillie Gifford Overseas Limited,

Wellington Management Company LLP, BlackRock Financial Management, Inc.

Capital International, Inc. and FIL Investment Management (Singapore) Limited

* Initial list of Sub-Managers under AIA Investment Funds for reference only and is

not intended to be exhaustive.

KEY RISKS

WHAT ARE THE KEY RISKS OF THIS INVESTMENT? Please refer to the AIA

PRODUCT HIGHLIGHTS SHEET

Investment Fund Product

The value of the ILP Sub-Fund and its distribution (if any) may rise or fall. These risk

Summary for further

factors may cause you to lose some or all of your investment:

information on risks of

investing in the Sub-Fund.

Market and Credit Risks

• You are exposed to market risks.

° As the ILP Sub-Fund invests in securities globally, the Net Asset Value of the ILP

Sub-Fund will be influenced by the prices of these investments. The investments

in these markets may be affected by changes in political conditions, regulatory,

economic and interest rates environment.

• You are exposed to credit risks.

° Bonds and other fixed income securities in which the ILP Sub-Fund may invest

in are subject to credit risks, such as risk of default by issuers.

• You are exposed to risks of investing in specific markets.

° While investments in a single country, specific industries, sectoral or regional

funds may present greater opportunities and potential for capital appreciation,

they may be subjected to higher risks as they may be less diversified than a

global portfolio.

° The regulatory, disclosure and financial reporting standards may differ

significantly from, and offer less investor protection compared to, internationally

recognised standards.

• You are exposed to currency risk.

° The income earned by the ILP Sub-Fund may be affected by fluctuations in

foreign exchange rates. The Manager may actively monitor and manage the ILP

Sub-Fund’s exposure to adverse foreign exchange risks by hedging through the

forwards or futures markets.

Liquidity Risks

• The ILP Sub-Fund is not listed and you can only redeem on Valuation Days4.

° There is no secondary market for the ILP Sub-Fund. All redemption requests

should be made to the AIA Customer Service Centre or through your AIA

Financial Services Consultant or Insurance Representative.

Product-Specific Risks

• You are exposed to risks of investing in equities.

° The value of the securities in which the ILP Sub-Fund will invest will fluctuate

depending upon the general trends of stock markets and prevailing interest rates..

° The economic environment of the countries in which the ILP Sub-Fund invests

will have an impact on the value of the securities acquired. The value of the ILP

Sub-Fund is affected by such changes in the market conditions and interest rates.

• You are exposed to risks of investing in fixed income securities.

o An increase in interest rates and/or credit risk premiums will generally reduce the

value of the fixed income securities.

• You are exposed to risks of using derivative instruments.

° The ILP Sub-Fund is authorised to use derivative instruments from time to time.

As the volatility of prices of derivative instruments may be higher than that of

their underlying stocks, commodities or other benchmarks, these derivative

instruments are riskier.

FEES AND CHARGES

WHAT ARE THE FEES AND CHARGES OF THIS INVESTMENT?

Payable directly by you Please refer to “Fees and

PRODUCT HIGHLIGHTS SHEET

Charges” section of the

• You will need to pay the following fees and charges as a percentage of your gross

Product Summary of your

investment sum:

Insurance Plan.

Sales charge / premium

charge / bid-offer spread ° N.A

Switching fee ° N.A

There may be other fees and charges imposed at the investment-linked product level.

Please refer to the Product Summary applicable to the investment-linked policy which

you have purchased or intend to purchase for these applicable fees and charges.

Please refer to the AIA

Payable by the ILP Sub-Fund from invested proceeds Investment Fund Product

• The ILP Sub-Fund will pay the following fees and charges to the Manager and Summary for further

other parties: information on the fees and

charges.

Management fee ° 1.25% (max 3%) per annum of its

Net Asset Value

Trailer Fee ° The trailer fee that the Company expects

to receive for balanced ILP sub-fund range

from 0% - 77% (Median: 31%) per annum

of Management fee

Trailer fee is not an added fee charged to the ILP Sub-Fund but a component of

Management fee.

These fees and charges are not guaranteed. We may change the fees and charges or

introduce new fees and charges although they will not exceed the maximum limits

stated in the applicable Product Summary or AIA Investment Fund Product Summary.

We will give you prior written notification of at least 1 month before the change.

VALUATIONS AND EXITING FROM THIS INVESTMENT

HOW OFTEN ARE VALUATIONS AVAILABLE?

• Valuations are available on every Business Day3. You may obtain the indicative Please refer to “Obtaining

Bid Price of the units of the Sub-Fund, and the dealing days to which the prices Prices of Units” section of

apply, from our corporate website at AIA.COM.SG the Product Summary of

your Insurance Plan.

HOW CAN YOU EXIT FROM THIS INVESTMENT AND WHAT ARE THE

RISKS AND COSTS IN DOING SO?

Please refer to “Policy

• You can exit the ILP Sub-Fund at any time by submitting a surrender/withdrawal

Options and Flexibilities”,

request to us at our Customer Service Centre or through your AIA Financial Services

and “Pricing and Cut-off

Consultant or Insurance Representative.

Times” under the Other

Material Information section

of the Product Summary of

your Insurance Plan.

• The price at which units are redeemed is called the Bid Price. Please refer to the

relevant Product Summary for details

• Your Bid Price is determined as follows:

o If you submit the redemption order on or before 2pm on a Valuation Day4,

you will be paid a price based on the Net Asset Value of the ILP Sub-Fund at the

close of that Business Day3

o If you submit the redemption order after 2pm, you will be paid a price based

on the Net Asset Value at the close of the next Valuation Day4

Please refer to the

• The sale proceeds that you will receive will be the Bid Price multiplied by the “Free-look Period” under the

number of units sold, less any charges. An example is as follows: Other Material Information

section of the Product

Bid Price X Number of units sold = Gross Sale Proceeds Summary of your Insurance

S$1.250 X 1,000 = S$1,250 Plan.

Gross Sale Proceeds - Exit Charge* = Net Sale Proceeds

PRODUCT HIGHLIGHTS SHEET

* Please refer to the respective product summaries for any fees and charges

applicable to the partial withdrawal and/or full surrender.

• If you cancel your policy within the Free-Look period of 14 days from the

time you receive your policy, you will get a refund of your premium paid without

interest, after the following adjustments:

a) any change in the Bid Price of the ILP Sub-Fund chosen by you since the

relevant Valuation Day4 on which units were credited to your policy, as at the

Valuation Day4 following the date of receipt of your request; and

b) any costs incurred by us in assessing the risk for your policy, including but not

limited to medical fees incurred by us in processing your application, subject

to the maximum amount of the premiums paid without interest.

If you opted for an electronic copy of your Policy, the 14-day free-look period

will start when you receive our SMS or email notification, informing you that the

policy contract documents are available for your viewing on our customer portal

(My AIA SG or such other name as we may choose for our customer portal from

time to time).

CONTACT INFORMATION

HOW DO YOU CONTACT US?

You may contact your AIA Financial Services Consultant / Insurance Representative.

or call our Customer Care hotline at 1800-248-8000 or +65-6248-8000 (if you are

calling from overseas) from Monday to Friday (excluding Public Holidays), between

8.45 a.m. to 5.30 p.m.

1

In order for units in the ILP sub-fund to be classified as Excluded Investment Products, the investment objectives and

investment focus of the ILP sub-fund, and investment approach of the manager have to be stated in the product summary:

(a) To invest only in deposits or other Excluded Investment Products; and

(b) Not to engage in securities lending or repurchase transactions for the ILP sub-fund.

The definition of “Excluded Investment Product” can be found in Annex 1 to the Notice on Recommendations on

Investment Products [Notice No. FAA-N16] at https://www.mas.gov.sg/regulation/notices/notice-faa-n16

2

For ILP Sub-Funds that feed 100% into an underlying Collective Investment Scheme (CIS) fund, some of the information

provided below could be similar to the underlying CIS fund.

3

“Business Day” means any day (other than a Saturday or Sunday) on which commercial banks are open for business in

Singapore or any other day as we may determine from time to time.

4

“Valuation Day” is described under the Pricing and Cut-off Times provisions of the respective Product Summary of your

Insurance Plan and means, in connection with the issuance, cancellation and redemption of units, every Business Day.

You might also like

- Active Equity Management - Compress PDFDocument435 pagesActive Equity Management - Compress PDFdnajkdfNo ratings yet

- ACF Assignment - Infineon - PDFDocument5 pagesACF Assignment - Infineon - PDFSuvinay SethNo ratings yet

- Wealthdesk IIFL PresentationDocument13 pagesWealthdesk IIFL PresentationNagesh ShettyNo ratings yet

- Chapters 6-10 PDFDocument40 pagesChapters 6-10 PDFeuwilla100% (4)

- Manulife Income Series Asian Balanced Fund - Product Highlight SheetDocument5 pagesManulife Income Series Asian Balanced Fund - Product Highlight SheetEng Soon TeoNo ratings yet

- Gbca Presentation On Aif - Aug 2021Document23 pagesGbca Presentation On Aif - Aug 2021Sri RamNo ratings yet

- AIA Elite Balanced Fund SGD SummaryDocument11 pagesAIA Elite Balanced Fund SGD SummarydesmondNo ratings yet

- Pimco Global Bond FundDocument5 pagesPimco Global Bond FundKelvin TanNo ratings yet

- Aif Taxation Regulatory FlyerDocument6 pagesAif Taxation Regulatory FlyerAmit SharmaNo ratings yet

- NipponIndia MF Factsheet January 2023Document118 pagesNipponIndia MF Factsheet January 2023Aryan MehrotraNo ratings yet

- 3rd Ed v1.0 - M9A - Keyconcepts (Chapter 4)Document4 pages3rd Ed v1.0 - M9A - Keyconcepts (Chapter 4)Samuel SaravananNo ratings yet

- NewfundoptionextpitchesDocument6 pagesNewfundoptionextpitchesSunil GuptaNo ratings yet

- Reading 47 - Introduction To Alternative InvestmentsDocument61 pagesReading 47 - Introduction To Alternative InvestmentsAllen AravindanNo ratings yet

- Impaired Investments Limited Iil Is in The Real Estate IndustryDocument1 pageImpaired Investments Limited Iil Is in The Real Estate IndustryLet's Talk With HassanNo ratings yet

- Group 1 BDO MOTORTRADE TOYOTA 1Document63 pagesGroup 1 BDO MOTORTRADE TOYOTA 1Julla Agnes EscosioNo ratings yet

- 8202 ICICIPrudential SmallCapFund ProductNoteDocument3 pages8202 ICICIPrudential SmallCapFund ProductNoteShravan RatheeshNo ratings yet

- NipponIndia MF Factsheet August 2022Document111 pagesNipponIndia MF Factsheet August 2022YogyataMishraNo ratings yet

- Capital Investments: Unicorn USD FTSE/JSE Listed PortfolioDocument1 pageCapital Investments: Unicorn USD FTSE/JSE Listed PortfoliodoogNo ratings yet

- 3rd Ed v1.0 - M9A - Chapter 1Document6 pages3rd Ed v1.0 - M9A - Chapter 1Samuel SaravananNo ratings yet

- PPFAS Long Term Value Fund: (An Open Ended Equity Scheme)Document4 pagesPPFAS Long Term Value Fund: (An Open Ended Equity Scheme)Abhishek SahuNo ratings yet

- Enhanced a-EnrichGold-i (With 20pay30)Document76 pagesEnhanced a-EnrichGold-i (With 20pay30)zara0% (1)

- LFPP5800 - Unit 1 - Investment Planning 2020Document29 pagesLFPP5800 - Unit 1 - Investment Planning 2020Kekeletso MoshoeshoeNo ratings yet

- AIFs in India - An Overview - Tree of LifeDocument20 pagesAIFs in India - An Overview - Tree of LifeRose RoyalNo ratings yet

- Parag Parikh Conservative Hybrid Fund: See OverleafDocument12 pagesParag Parikh Conservative Hybrid Fund: See OverleafTunirNo ratings yet

- CLI63TANCHON Marketing Deck - Tan Chong Motor Holdings BHD Mar 2024Document20 pagesCLI63TANCHON Marketing Deck - Tan Chong Motor Holdings BHD Mar 2024Guan JooNo ratings yet

- Innovative Methods of Infa FundingDocument25 pagesInnovative Methods of Infa FundingSachinTendulkrNo ratings yet

- NFO Leaflet - Kotak FMP SR 304 - 3119 DaysDocument5 pagesNFO Leaflet - Kotak FMP SR 304 - 3119 Daystan anNo ratings yet

- A EnrichGold I Training Slides v3 UpdateCIDefApr2016 Final A45d453f 2c94 4774 9368 C76cd7f7adc3Document74 pagesA EnrichGold I Training Slides v3 UpdateCIDefApr2016 Final A45d453f 2c94 4774 9368 C76cd7f7adc3Shafika SuhaimiNo ratings yet

- Capital Indexed Bonds: Outline: 2. CalculationDocument2 pagesCapital Indexed Bonds: Outline: 2. Calculationankur4042007No ratings yet

- Alternative Investment FundsDocument10 pagesAlternative Investment Fundskrishna sharmaNo ratings yet

- Alternative Investment FundsDocument10 pagesAlternative Investment Fundskrishna sharmaNo ratings yet

- Kiidoc 2020 07 20 en CH 2020 07 30 Lu0929190568Document2 pagesKiidoc 2020 07 20 en CH 2020 07 30 Lu0929190568Isabelle ChapuysNo ratings yet

- Kiddoc 2023 10 30 en CH 2023 11 01 Ie00bdfc6q91Document3 pagesKiddoc 2023 10 30 en CH 2023 11 01 Ie00bdfc6q91trobertson041No ratings yet

- ICICI Prudential Mutual FundDocument36 pagesICICI Prudential Mutual FundChintan JainNo ratings yet

- Ammetlife - Ceilli (Eng) - Mas 2014Document159 pagesAmmetlife - Ceilli (Eng) - Mas 2014Suthakar SubramaniamNo ratings yet

- Carlye Financial StatemensDocument26 pagesCarlye Financial StatemensCarlos VillarrealNo ratings yet

- United Fixed Maturity Bond Fund 1: Who Is The Product Suitable For?Document5 pagesUnited Fixed Maturity Bond Fund 1: Who Is The Product Suitable For?Edward ChongNo ratings yet

- Asset Allocation PprcicimanipalDocument401 pagesAsset Allocation PprcicimanipalJeetin KumarNo ratings yet

- Templeton ProcessDocument42 pagesTempleton ProcessFrederico DimarzioNo ratings yet

- 03 Product Highlight Sheet - SLP Equity Fund - 209190930Document11 pages03 Product Highlight Sheet - SLP Equity Fund - 209190930aliceplaystooNo ratings yet

- Angel Funds FAQsDocument8 pagesAngel Funds FAQsJagdish RajanNo ratings yet

- ICAI - FEMA Inbound - 8 May 2020Document68 pagesICAI - FEMA Inbound - 8 May 2020Mitesh MehtaNo ratings yet

- Parag Parikh Flexi Cap Fund PPT DirectDocument21 pagesParag Parikh Flexi Cap Fund PPT DirectRajNo ratings yet

- IRDA (Investment) (4 TH Amendment) Regulations, 2008 - RegDocument16 pagesIRDA (Investment) (4 TH Amendment) Regulations, 2008 - RegSivahariNo ratings yet

- Alternative Investment Fund.Document3 pagesAlternative Investment Fund.Snigdha DasNo ratings yet

- Professional Factsheet FF - Global Technology Fund Y-ACC-USD 122020Document7 pagesProfessional Factsheet FF - Global Technology Fund Y-ACC-USD 122020Rithi JantararatNo ratings yet

- Ipo Note BukaDocument16 pagesIpo Note BukaAri WijayaNo ratings yet

- HDFC MF Factsheet - October 2022Document104 pagesHDFC MF Factsheet - October 2022srivatsanpersonalNo ratings yet

- Firststepblue 010622Document3 pagesFirststepblue 010622boss savla VikmaniNo ratings yet

- Mutual Fund IndustryDocument21 pagesMutual Fund IndustryVamsi KrishnaNo ratings yet

- 2023 - 01 - 04 3 PDFDocument3 pages2023 - 01 - 04 3 PDFjessica callesNo ratings yet

- BDO Easy Investment PlanDocument12 pagesBDO Easy Investment Planannair_redNo ratings yet

- Prudent Investing: Invest in Mirae Asset Prudence Fund (MAPF)Document2 pagesPrudent Investing: Invest in Mirae Asset Prudence Fund (MAPF)api-349453187No ratings yet

- Quarterly-Fund-Fact-Sheet ManulifeDocument22 pagesQuarterly-Fund-Fact-Sheet ManulifeJOHNNo ratings yet

- Indian Association of Alternative Investment Funds (IAAIF)Document22 pagesIndian Association of Alternative Investment Funds (IAAIF)subhash parasharNo ratings yet

- NFO Large and Mid Cap Fund FormDocument4 pagesNFO Large and Mid Cap Fund FormVikrantNo ratings yet

- Calcy-Dynamic (Version 1)Document13 pagesCalcy-Dynamic (Version 1)Ankush DhawanNo ratings yet

- Benefits: An Investment WithDocument2 pagesBenefits: An Investment WithrkotichaNo ratings yet

- 5 Reasons To Invest in Business Cycle FundDocument1 page5 Reasons To Invest in Business Cycle FundRahul SinhaNo ratings yet

- Tata Balanced Advantage Fund Nfo Scheme BrochureDocument4 pagesTata Balanced Advantage Fund Nfo Scheme BrochureNaveen VaryaniNo ratings yet

- Financial Statement Analysis: K R Subramanyam John J WildDocument39 pagesFinancial Statement Analysis: K R Subramanyam John J WildDwi Ahdini100% (1)

- Investments Profitability, Time Value & Risk Analysis: Guidelines for Individuals and CorporationsFrom EverandInvestments Profitability, Time Value & Risk Analysis: Guidelines for Individuals and CorporationsNo ratings yet

- AIA Quarterly Investment InsightsDocument10 pagesAIA Quarterly Investment InsightsdesmondNo ratings yet

- ACSPL Programmers GuideDocument410 pagesACSPL Programmers GuidedesmondNo ratings yet

- AIA-Elite-Adventurous - Fund-Factsheet - May 22Document3 pagesAIA-Elite-Adventurous - Fund-Factsheet - May 22desmondNo ratings yet

- SpecDocument2 pagesSpecdesmondNo ratings yet

- Acuvim-CL - Brochure - V3 - 2205Document9 pagesAcuvim-CL - Brochure - V3 - 2205desmondNo ratings yet

- Rotman MFEDocument28 pagesRotman MFEfanatik123No ratings yet

- The State of Bitcoin As CollateralDocument71 pagesThe State of Bitcoin As CollateralNikos IoannidisNo ratings yet

- Fouzul Khan, Robert Parra - Financing Large Projects - Using Project Finance Techniques and Practices-Prentice Hall (2003) PDFDocument672 pagesFouzul Khan, Robert Parra - Financing Large Projects - Using Project Finance Techniques and Practices-Prentice Hall (2003) PDFnguyen duongNo ratings yet

- DT Ebook BasicTrainingforFutureTradersDocument13 pagesDT Ebook BasicTrainingforFutureTradersZen Trader100% (1)

- Incentive Scheme 2021Document11 pagesIncentive Scheme 2021shyam krishnaNo ratings yet

- Short Notes Financial Management and International FinanceDocument8 pagesShort Notes Financial Management and International FinanceRehaan_Khan_RangerNo ratings yet

- Inventories and Investment Theories v2Document10 pagesInventories and Investment Theories v2Joovs JoovhoNo ratings yet

- Brochure EurexDocument14 pagesBrochure EurexdamianNo ratings yet

- International Finance: Foreign Exchange MarketDocument14 pagesInternational Finance: Foreign Exchange MarketAnusha G RajuNo ratings yet

- Assingment of MbaDocument4 pagesAssingment of MbaSenthil KumarNo ratings yet

- The Role of Green Finance in Environmental Protection Two Aspects of Market Mechanism and PoliciesDocument6 pagesThe Role of Green Finance in Environmental Protection Two Aspects of Market Mechanism and PolicieschinkiNo ratings yet

- Manappuram Finance - A Gold DerivativeDocument2 pagesManappuram Finance - A Gold DerivativeRaghu.GNo ratings yet

- Parivartana Yoga IIDocument35 pagesParivartana Yoga IIGauravNo ratings yet

- Saunders 8e PPT Chapter10Document32 pagesSaunders 8e PPT Chapter10sdgdfs sdfsfNo ratings yet

- CH 02 Hull Fundamentals 9 The DDocument27 pagesCH 02 Hull Fundamentals 9 The DTrang LeNo ratings yet

- Unit Guide BFC3340Document12 pagesUnit Guide BFC3340ShangEn ChanNo ratings yet

- FX Forward Exchange Contract PdsDocument24 pagesFX Forward Exchange Contract Pdsswatisin93No ratings yet

- SM-FOI-Unit 1,4,5Document168 pagesSM-FOI-Unit 1,4,5Priyanshu BhattNo ratings yet

- Fundamentals and Technical Analysis of Equity Derivatives: A Project Report ONDocument71 pagesFundamentals and Technical Analysis of Equity Derivatives: A Project Report ONtarun nemalipuriNo ratings yet

- FINC3019 Semester 2 2016 UoSDocument5 pagesFINC3019 Semester 2 2016 UoSRyan LinNo ratings yet

- RMDocument23 pagesRMVarun MoodbidriNo ratings yet

- EFB344 Lecture08, Options 1Document39 pagesEFB344 Lecture08, Options 1Tibet LoveNo ratings yet

- L1 R48 DVMI Q-BankDocument8 pagesL1 R48 DVMI Q-BankShehroz JamshedNo ratings yet

- ProjectDocument7 pagesProjectmalik waseemNo ratings yet

- GsnubeDocument169 pagesGsnubeAnonymous 4yXWpDNo ratings yet

- MScFE 560 Financial Markets Syllabus 1.2.19 PDFDocument12 pagesMScFE 560 Financial Markets Syllabus 1.2.19 PDFsiddarthNo ratings yet

- Investments 7E by Bodie Kane Marcus Ch1 TB SAMPLEDocument37 pagesInvestments 7E by Bodie Kane Marcus Ch1 TB SAMPLEtestingscribNo ratings yet

- ACI Dealing Certificate: SyllabusDocument12 pagesACI Dealing Certificate: SyllabusKhaldon AbusairNo ratings yet