Professional Documents

Culture Documents

Adobe Scan Dec 29, 2023

Adobe Scan Dec 29, 2023

Uploaded by

jarnav003Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Adobe Scan Dec 29, 2023

Adobe Scan Dec 29, 2023

Uploaded by

jarnav003Copyright:

Available Formats

Commercial

Imoney

supply

ppublic. andOpen

Reserve

though multiplier cash Institutions

ofFinancial (1997-98). Financial

trom

includes andthee

of

ASgregates

Aggregates

Liquidity highly 1sSuch cash and or by 16

country.

Role

control

Role So

Ths Moncy Money i multiplier.

andSupply

Symbolically. Ans.

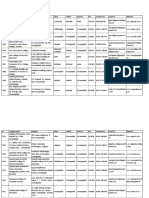

commercial Q. L3 L2Ll The RBI TheAggregate soldAns. the .

narket change or 13. = follotwing = = the assets as 12

suppiy

Depending

Similarly of Ratios.Issue of inplies High-powered reserves Ihe

L2+ LI L3 public financial and

Third

commodity Liquidity inThird

Central multiplier H MC + D Explain

Institutions dependentthon e cah the What

Commercial is + and wth

Banks the in =C+ Monetary

the Public Postal th e

of Working liquidity market

equiv Working are

in operations, man Tern

price currency money that

Moreover, banks apart not

the

frequency on gven as

is ratio of why Liquuditv Banking respcct indicates

Bank liabilities

Conoy.Commercial level

M (m) RR dcterminants

the Deposits Moncy Deposits with futuresalents aggregates?

liquidity

Mention

the supply money of base and th e from([DFD refers

without

Banks GrOup Group?

reserve Sclective (). in mH is ER central

money respct to Shiv

in

Central Money given money aggregates svstem

Aggregates like, the

refers the Pst and of the

availability contracts,

of to

of the It can is Borowngs,

toith(excludng nontleKIsitory Das

in central differentiated affocting degree

bank Bankseconomy. also as given supply bank Office nature

to stocks,

requireents, Money Non-Benking the DELHI

credit bankSupply.Occur supply

tonon-banking

of that ther

ansactions,

influcnces as ease

the

are

uses due to

Itmoney bank? have

Saving attr1butes

is, is and that

bonds. which the to

Supply. IS National that

required control Central supply UNIVERSITY

high also mightetificate of andthe of asset's

credit

investors

to been functioning

Depository the Monetarv execution

other

Cedit Bank change powercdcalled

supply

financial

Banksfinancial

Fnancial derivatives an

mechanisms

Demand Bank. of change fornula former The

banking policy Saring price.asset

to Reserves funds can these

reation keep in

of basit

directly are-Monetary

high corporatons The or

includesAggTegats

Deposits corporations of tor SERIES

high Keserves

Excess

ER- money due Certifcates)

institutions. ted easly agKTegates

deposits irstruments Corporathons size of or

security

habitreserves available

powered by dist1x the financial examples

by

powered

to conttols to ther

reacts the institutions sell

controlling

influence Currency

Demand

Required

Reserves change

of and the tion moneythe can

Third such fron instrumens

hnancial

tor

public toand are for transactions

such money monetary-hablih

accepting between cash. of be tor

incTease available

provide

monetarymoney

use

bae in Tern while

as liquid

Deposits held

the

Working other bounk. India

quickly

moncy as Developmens whch

etc. or by (H) ofard supply

Bank

regulating behaviour Deposits th e MonctaFinanial assets as

in

influence credit with base public

of either deposits supply

noncy supply Moncy Money (2021) Groun whik give

hanks lae in.

rate,

to the (H) as of

In Give

the Ans. cent o

(im) () (i) (in

(i)

reason 14.

interest ()

banksDisount

trom urrentmore

theat If public an What

money.there Moneyentral

increase for

and the noney rate, impact

which ts increases bank your

Central rate increase supply

this moncy in

in

interest means inTeases cach

answer.

will the is the interest

has their

bank pocket supply in of

decreaseinterest a

rate people tryative

he the

So iscount cash rate

lead1ng publictends

money following

increase now holdings -Money Unit

the rate

Oney charged cash

relattonshup to rate

suppiv towill

in ncrcase holdings fall. will

demand

more

discount

suppiy inreasehasto have

to

in with

commercial the leads it

rate

Ms on

MD, prices interest money

-M: service

goocds

and

will to

makebanks uncrease

o rate supply

to

mainta As

borroWing

costlyfor tor in the in

th a

the

loans

taken

Download

You might also like

- L3 SchemaDocument1 pageL3 SchemaSelvakumar Murugesan100% (1)

- GIDCs DetailsDocument6 pagesGIDCs Detailshardikpp69% (16)

- 2017 Silicon Valley 150Document1 page2017 Silicon Valley 150BayAreaNewsGroup95% (22)

- HotlinkDocument1 pageHotlinkATNo ratings yet

- Unclaimed Property Booklet ADocument27 pagesUnclaimed Property Booklet Aelmo347No ratings yet

- Vegas 4 Hour Tunnel MethodDocument13 pagesVegas 4 Hour Tunnel MethodGreg VermeychukNo ratings yet

- Adobe Scan Dec 29, 2023Document1 pageAdobe Scan Dec 29, 2023jarnav003No ratings yet

- Tutorial 8 QuestionsDocument9 pagesTutorial 8 Questionshathutrang742003No ratings yet

- Securities Regulation CodeDocument3 pagesSecurities Regulation CodeDanica ZamoraNo ratings yet

- 150 Business DiagramsDocument154 pages150 Business DiagramsdrawpackNo ratings yet

- Adobe Scan 29-Dec-2020Document1 pageAdobe Scan 29-Dec-2020hemanthNo ratings yet

- Thirteen Foundation 2012Document39 pagesThirteen Foundation 2012cmf8926No ratings yet

- MRR Package 20 July 2019Document18 pagesMRR Package 20 July 2019K KARTHIKNo ratings yet

- When You Join Zoom, Your Computer Will Automatically Connect To The Audio StreamDocument51 pagesWhen You Join Zoom, Your Computer Will Automatically Connect To The Audio StreamRammohan PushadapuNo ratings yet

- SBH Viman NagarDocument15 pagesSBH Viman Nagarrushikesh.pawar89No ratings yet

- Chapter 10 Taxation On Equities: Stocks Mutual Funds School CorporateDocument8 pagesChapter 10 Taxation On Equities: Stocks Mutual Funds School Corporateramkrishna mahatoNo ratings yet

- Appendix 33 - Payroll - April 2021Document2 pagesAppendix 33 - Payroll - April 2021Praise BuenaflorNo ratings yet

- Deloitte - Anaplan-CoE-whitepaperDocument11 pagesDeloitte - Anaplan-CoE-whitepapersnowboardhollandNo ratings yet

- Ratio (3 Marks)Document4 pagesRatio (3 Marks)mehtaharshit0709No ratings yet

- 1976 Capital Funds For Bicycle PlanDocument1 page1976 Capital Funds For Bicycle PlanRandall MyersNo ratings yet

- Chapter 5 Trading IncomeDocument16 pagesChapter 5 Trading IncomeRahmat AliNo ratings yet

- INFINITIDocument11 pagesINFINITIapi-3757629100% (1)

- 2018 FR PDFDocument6 pages2018 FR PDFSomeone 4780No ratings yet

- 2 Cash Flows Management 2024 PartielDocument42 pages2 Cash Flows Management 2024 Partieljean.cour.00No ratings yet

- Cash Flow Ind As 7Document2 pagesCash Flow Ind As 7maninderpnnNo ratings yet

- HDN P&TDocument1 pageHDN P&Tprasad panditNo ratings yet

- Img 20220103 0005Document1 pageImg 20220103 0005SciencemanNo ratings yet

- Intac 3Document1 pageIntac 32022301307No ratings yet

- Retail Marketing 4Document41 pagesRetail Marketing 4inssoistoNo ratings yet

- Corporate Accounting PyqsDocument23 pagesCorporate Accounting PyqsEsha YadavNo ratings yet

- ?สรุปFun CorpDocument36 pages?สรุปFun CorpatNo ratings yet

- Proof of InformationDocument17 pagesProof of InformationAkshita BhattNo ratings yet

- OPCR Form (ISO Aligned) PDFDocument1 pageOPCR Form (ISO Aligned) PDFRovie Christal Pascual RoseteNo ratings yet

- 7.01 ClosingDocument1 page7.01 ClosingSyaza SyedNo ratings yet

- Leases Study MaterialDocument37 pagesLeases Study MaterialHammadNo ratings yet

- Good Verti SingDocument32 pagesGood Verti SingNicholas mwendwaNo ratings yet

- Adobe Scan Jun 15, 2024Document7 pagesAdobe Scan Jun 15, 2024anjupatil972No ratings yet

- Mirae Asset Flexi Cap Fund 24 Jan 2023 1 5Document5 pagesMirae Asset Flexi Cap Fund 24 Jan 2023 1 5pgubooksNo ratings yet

- (Package 2 - Pec-Dcsm) NSRP Daily Progress Report - 201910 - 23Document21 pages(Package 2 - Pec-Dcsm) NSRP Daily Progress Report - 201910 - 23duyanhNo ratings yet

- Ifrs 13 FRDocument1 pageIfrs 13 FRgetcultured69No ratings yet

- End-User/Unit: Internal Audit Service: Project Procurement Management Plan (PPMP)Document2 pagesEnd-User/Unit: Internal Audit Service: Project Procurement Management Plan (PPMP)IAS City of Sto TomasNo ratings yet

- Procurement Example Questionnaire 2016Document13 pagesProcurement Example Questionnaire 2016ARPITA MISHRANo ratings yet

- 2016 NovDocument10 pages2016 Novtreasurebts19No ratings yet

- Adobe Scan 07 Dec 2023Document2 pagesAdobe Scan 07 Dec 2023Sasmita RoutNo ratings yet

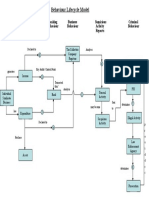

- Behavior Life CycleDocument1 pageBehavior Life CycleSubash VenkataNo ratings yet

- Schiphol Annual Report 2015Document222 pagesSchiphol Annual Report 2015יּיּ יּיּNo ratings yet

- Corporation TaxesDocument64 pagesCorporation Taxesf7vertexlearningsolutionsNo ratings yet

- Adobe Scan Dec 11, 2023Document4 pagesAdobe Scan Dec 11, 2023atul.kapse3214No ratings yet

- Chapter-4 Accounting, Finance and Operations (Responses)Document3 pagesChapter-4 Accounting, Finance and Operations (Responses)Santanu MukherjeeNo ratings yet

- ExxonMobil 2018 Financial and Operating ReviewDocument118 pagesExxonMobil 2018 Financial and Operating ReviewManish KuamrNo ratings yet

- Market Interventions and TaxesDocument4 pagesMarket Interventions and TaxesAhmad ShukriNo ratings yet

- List of O&M Mudigubba Works On 04.010.2023.Document1 pageList of O&M Mudigubba Works On 04.010.2023.Executive Engineer I.B.DivisionNo ratings yet

- Vĩ Mô Chap 10-1Document1 pageVĩ Mô Chap 10-1Tâm Bùi Thị ThanhNo ratings yet

- JICA Mula Mutha Pollution AbatementDocument1 pageJICA Mula Mutha Pollution AbatementsukhdeepNo ratings yet

- Accounting Standards PDFDocument43 pagesAccounting Standards PDFSai Krishna TejaNo ratings yet

- Revenues and Costs Plus Sources of FinanceDocument3 pagesRevenues and Costs Plus Sources of FinancesabinaNo ratings yet

- 2017 Silicon Valley 150 PDFDocument1 page2017 Silicon Valley 150 PDFSamscribdingNo ratings yet

- Handwritten Notes Copy Copy - MergeDocument162 pagesHandwritten Notes Copy Copy - Mergebarnwalayush7531No ratings yet

- It's So Easy Going Green: An Interactive, Scientific Look at Protecting Our EnvironmentFrom EverandIt's So Easy Going Green: An Interactive, Scientific Look at Protecting Our EnvironmentNo ratings yet

- Let's Practise: Maths Workbook Coursebook 8From EverandLet's Practise: Maths Workbook Coursebook 8No ratings yet

- CONTEMPORARY WORLD (Notes)Document9 pagesCONTEMPORARY WORLD (Notes)ANDREA LOUISE ELCANONo ratings yet

- Introduction To Ancient Coin CollectingDocument21 pagesIntroduction To Ancient Coin CollectingchrysNo ratings yet

- Read 6-5 1 Feudalism and Manorialism 1 Feudalism and ManorialismDocument6 pagesRead 6-5 1 Feudalism and Manorialism 1 Feudalism and Manorialismapi-296674326No ratings yet

- Advertisement ClassifiedsDocument24 pagesAdvertisement Classifiedssuraj sunishNo ratings yet

- Railway LRT Metro References 2021Document16 pagesRailway LRT Metro References 2021Dinesh SahaiNo ratings yet

- Sonata Watch BillDocument1 pageSonata Watch BillHari GNo ratings yet

- Installation Instructions: Decorative Bottle TrapDocument2 pagesInstallation Instructions: Decorative Bottle TrapAfzal FasehudeenNo ratings yet

- Chiniot's Furniture IndustryDocument26 pagesChiniot's Furniture Industryamjadnawaz85No ratings yet

- Comp4 1Document3 pagesComp4 1Kavya GopakumarNo ratings yet

- SAIKUMAR OBMMS Andhra Pradesh State OBMMS - CGGDocument3 pagesSAIKUMAR OBMMS Andhra Pradesh State OBMMS - CGGKarna Satish KumarNo ratings yet

- Reserve Bank of IndiaDocument3 pagesReserve Bank of IndiaCacptCoachingNo ratings yet

- Nri BankingDocument48 pagesNri BankingKrinal Shah50% (2)

- Chapter 03 EconomicsDocument9 pagesChapter 03 Economicsloveza lodhiNo ratings yet

- Postwar Problems and The RepublicDocument1 pagePostwar Problems and The RepublicRachel NicoleNo ratings yet

- CIMBClicks TRX HistoryDocument14 pagesCIMBClicks TRX HistoryVaishnavi KrishnanNo ratings yet

- Ficci Ey M and e Report 2019 Era of Consumer Art PDFDocument309 pagesFicci Ey M and e Report 2019 Era of Consumer Art PDFAbhishek VyasNo ratings yet

- Itr Simpal Kumari 23 24Document1 pageItr Simpal Kumari 23 24prateek gangwaniNo ratings yet

- ECO20A Tutorial 3 (1) - Read-OnlyDocument21 pagesECO20A Tutorial 3 (1) - Read-OnlymhlabawethuprojectsNo ratings yet

- Dissertation Thomas JordanDocument7 pagesDissertation Thomas JordanPaperWritingServicesForCollegeStudentsOmaha100% (1)

- Seven Figures in The History of Swedish Economic Thought Knut Wicksell, Eli Heckscher, Bertil Ohlin, Torsten Gårdlund, Sven Rydenfelt, Staffan Burenstam Linder and Jaime Behar by Mats Lundahl (Auth.)Document347 pagesSeven Figures in The History of Swedish Economic Thought Knut Wicksell, Eli Heckscher, Bertil Ohlin, Torsten Gårdlund, Sven Rydenfelt, Staffan Burenstam Linder and Jaime Behar by Mats Lundahl (Auth.)João Henrique F. VieiraNo ratings yet

- Apple Stock Analysis - EditedDocument5 pagesApple Stock Analysis - EditedMeshack MateNo ratings yet

- Roof Truss QuoteDocument3 pagesRoof Truss QuoteMmamoraka Christopher MakhafolaNo ratings yet

- Affiliated Colleges Institutes Bamu AWBDocument64 pagesAffiliated Colleges Institutes Bamu AWBSachin KhadNo ratings yet

- S4 - 1 Juan RosellonDocument41 pagesS4 - 1 Juan RosellonmauricioayoNo ratings yet

- MCM Tutorial 6&7Document6 pagesMCM Tutorial 6&7SHU WAN TEHNo ratings yet

- Wizards Trading GuideDocument14 pagesWizards Trading Guidejunaidjabbar972No ratings yet

- HCG - Wilcon LaoagDocument1 pageHCG - Wilcon LaoagNeil San JuanNo ratings yet