Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

8 viewsYosias Wellem - 231210055

Yosias Wellem - 231210055

Uploaded by

eliesersteven1. Electronic exchange involves the identification of parties, transmission of information over a network, validation and authentication of information, execution of authorized transactions, and confirmation of completed transactions.

2. The pros of electronic exchange include efficiency, speed, and accessibility, while the cons include security risks, technology dependence, reduced social interaction, and implementation costs.

3. Key issues that may complicate consortium formation between competitors include competition between members, differences in corporate culture, security and trust issues, and regulatory restrictions. Marriott should consider strategic objectives, company readiness, ability to collaborate, manage strategic issues, and compare risks and benefits to other alternatives before pursuing a consortium.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You might also like

- E CommerceDocument29 pagesE Commerceparoothi0% (1)

- Allgon PDFDocument290 pagesAllgon PDFКурбан УмархановNo ratings yet

- IEEE STD 242-2001 Errata Only - Protection and Coordination of Industrial and Commercial Power Systems - Buff BookDocument1 pageIEEE STD 242-2001 Errata Only - Protection and Coordination of Industrial and Commercial Power Systems - Buff BookHeather CarterNo ratings yet

- Essentials of E-CommerceDocument9 pagesEssentials of E-CommerceSanmeet ShetiyaNo ratings yet

- E CommerceDocument103 pagesE Commercejoleymagar4444No ratings yet

- 1083 - UNIT-1 E-CommerceDocument10 pages1083 - UNIT-1 E-Commerce21.094akhilaNo ratings yet

- Design and Implementation of Secured E CDocument10 pagesDesign and Implementation of Secured E CÊmpěřøř MářvNo ratings yet

- Ebm Assesment 2Document21 pagesEbm Assesment 2neymarvikeshNo ratings yet

- CSC-370 E - Commerce: (BSC Csit, Tu)Document33 pagesCSC-370 E - Commerce: (BSC Csit, Tu)Nezuko KamadoNo ratings yet

- Chapter - 1 Electronic Commerce Environment and OpportunitiesDocument35 pagesChapter - 1 Electronic Commerce Environment and OpportunitiesSharada HarwadekarNo ratings yet

- Ecommerce Notes Sem 6Document7 pagesEcommerce Notes Sem 6tousifansari2002No ratings yet

- Business Ethics and GovernanceDocument10 pagesBusiness Ethics and GovernanceSaurabh NavaleNo ratings yet

- ECOMMERCEDocument5 pagesECOMMERCECourier systemNo ratings yet

- E BankingDocument77 pagesE BankingDEEPAKNo ratings yet

- Future Trends in The Stock Market-12Document2 pagesFuture Trends in The Stock Market-12Elakkiyan RNo ratings yet

- Ecommerce, Also Known As Electronic Commerce or Internet Commerce, Refers To TheDocument14 pagesEcommerce, Also Known As Electronic Commerce or Internet Commerce, Refers To TheBhavnaNo ratings yet

- On The Security Mechanisms Implemented On: Best E-CommerceDocument3 pagesOn The Security Mechanisms Implemented On: Best E-CommerceMd.sabbir Hossen875No ratings yet

- BBM 7TH Note (E-Commerce)Document14 pagesBBM 7TH Note (E-Commerce)shree ram prasad sahaNo ratings yet

- EcommerceDocument53 pagesEcommerceTushar GuptaNo ratings yet

- E CommerceDocument125 pagesE Commercekeshav315No ratings yet

- A) Explain Electronic Data InterchangeDocument5 pagesA) Explain Electronic Data InterchangeJkuat MSc. P & LNo ratings yet

- E - Marketing RevDocument53 pagesE - Marketing Revabdelamuzemil8No ratings yet

- Report On Building A Custom Payment Gateway System 2023Document13 pagesReport On Building A Custom Payment Gateway System 2023Joe RexaNo ratings yet

- Quiz Topic 7Document4 pagesQuiz Topic 7Fire burnNo ratings yet

- Impact of e Commerce On BusinessDocument3 pagesImpact of e Commerce On BusinessMaira Hussain100% (1)

- Economic of Information and Communication Very ShortDocument16 pagesEconomic of Information and Communication Very Shortprashant koiralaNo ratings yet

- Wolkite University: College of Computing and Informatics Department of Information Technology Extension ProgramDocument28 pagesWolkite University: College of Computing and Informatics Department of Information Technology Extension ProgramGetnete degemuNo ratings yet

- E Commerce (Sem 2)Document29 pagesE Commerce (Sem 2)Gyan PrakashNo ratings yet

- ITT ChapterDocument18 pagesITT ChapterHiruthik RajaNo ratings yet

- (COMPUTERS) DEGREE COURSE (III YEAR) E-COMMERCE - nOTESDocument36 pages(COMPUTERS) DEGREE COURSE (III YEAR) E-COMMERCE - nOTESKingpinNo ratings yet

- MainDocument33 pagesMainSolomon GodwinNo ratings yet

- E Session 1Document5 pagesE Session 1Alex MianoNo ratings yet

- EcommerceDocument118 pagesEcommerceDewsun RiseonNo ratings yet

- CA 2 FINM 809 BhrigunDocument18 pagesCA 2 FINM 809 BhrigunBhrigun GuptaNo ratings yet

- Block Chain Presentation-1Document29 pagesBlock Chain Presentation-1Ashutosh PatkarNo ratings yet

- E Ommerce Notes PDFDocument35 pagesE Ommerce Notes PDFRoop Ch Jha75% (4)

- E CommerceDocument4 pagesE Commerceshriyanshrauthan833No ratings yet

- Digital PaymentsDocument7 pagesDigital Paymentskavya joshiNo ratings yet

- Tim 2020 PDFDocument159 pagesTim 2020 PDFVipul SardessaiNo ratings yet

- Benefits, Costs and Limitations of Online Investing To The Individual InvestorDocument6 pagesBenefits, Costs and Limitations of Online Investing To The Individual InvestorAbhijeet MurdioNo ratings yet

- Unit I, Ii & Iii NotesDocument32 pagesUnit I, Ii & Iii NotesIts AlokNo ratings yet

- E Commerce NotesDocument52 pagesE Commerce NoteschsureshchandraNo ratings yet

- © The Institute of Chartered Accountants of IndiaDocument9 pages© The Institute of Chartered Accountants of IndiaGao YungNo ratings yet

- 2 MarksDocument5 pages2 MarksSharron Rose HNo ratings yet

- Unit 1 Introduction To Electronic CommerceDocument25 pagesUnit 1 Introduction To Electronic Commercetekendra nathNo ratings yet

- Marketsn WhitepaperDocument26 pagesMarketsn WhitepaperRohan Gulati100% (1)

- E Business 2Document37 pagesE Business 2Kenneth O'BrienNo ratings yet

- Digitalization of Securities MarketDocument8 pagesDigitalization of Securities Marketmrinal kumarNo ratings yet

- Unit 1 Fundamental of E-Commerce (Bba-606) - CompleteDocument56 pagesUnit 1 Fundamental of E-Commerce (Bba-606) - CompleteGaurav VikalNo ratings yet

- Unit-1 Introduction To EcommerceDocument24 pagesUnit-1 Introduction To EcommerceNezuko KamadoNo ratings yet

- Secure Online Business: Exploring The Security Threats To E-CommerceDocument7 pagesSecure Online Business: Exploring The Security Threats To E-CommerceAshmita BhattacharjeeNo ratings yet

- Degree Course (Iii Year) ECOMMERCE Notes: Unit-IDocument30 pagesDegree Course (Iii Year) ECOMMERCE Notes: Unit-IrohitNo ratings yet

- Question Answer E-BUSINESSDocument33 pagesQuestion Answer E-BUSINESSMD Rakibul Islam ZakariaNo ratings yet

- CH 13 ISC class 11 CommerceDocument7 pagesCH 13 ISC class 11 CommerceRanjan purkiteNo ratings yet

- Unit Understanding E-CommerceDocument5 pagesUnit Understanding E-CommerceeugeneNo ratings yet

- PT 2 AnswersDocument9 pagesPT 2 AnswersSUSEENDRAN VNo ratings yet

- E-Commerce Consumer ApplicationsDocument15 pagesE-Commerce Consumer ApplicationsRam KumarNo ratings yet

- E-Commerce Short NotesDocument5 pagesE-Commerce Short NotesThangathurai Kartheeswaran83% (18)

- MC EcDocument35 pagesMC EcAparna MittalNo ratings yet

- Implementation of a Central Electronic Mail & Filing StructureFrom EverandImplementation of a Central Electronic Mail & Filing StructureNo ratings yet

- Above the Clouds: Managing Risk in the World of Cloud ComputingFrom EverandAbove the Clouds: Managing Risk in the World of Cloud ComputingNo ratings yet

- B4U GLOBAL Group of Companies (PDF) - 1Document40 pagesB4U GLOBAL Group of Companies (PDF) - 1عبدالسبحان بھمبھانیNo ratings yet

- S.Y. 2020-2021 Second Semester Teaching & Learning Plan Panitikang Pilipino (Fil 2)Document6 pagesS.Y. 2020-2021 Second Semester Teaching & Learning Plan Panitikang Pilipino (Fil 2)Rexson Dela Cruz TagubaNo ratings yet

- Agosto 2022.COMPUTERS FOR THE DISABLEDDocument2 pagesAgosto 2022.COMPUTERS FOR THE DISABLEDSoraSosaNo ratings yet

- DDBMS PracticalsDocument24 pagesDDBMS PracticalsDoon ValyNo ratings yet

- Living in The It Era Social Media App Chap 1 To 10Document104 pagesLiving in The It Era Social Media App Chap 1 To 10Earone MacamNo ratings yet

- Stealing Bitcoin With MathDocument98 pagesStealing Bitcoin With MathДмитрий Канилов50% (2)

- Review 1Document16 pagesReview 1Ashwini PanchalNo ratings yet

- Pad Cratering: Pad Cratering Is A Mechanically Induced Fracture in The Resin Between Copper Foil and Outermost Layer ofDocument4 pagesPad Cratering: Pad Cratering Is A Mechanically Induced Fracture in The Resin Between Copper Foil and Outermost Layer ofMadhusudanan AshokNo ratings yet

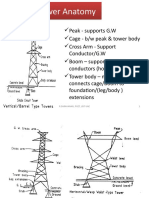

- Tower AnatomyDocument12 pagesTower Anatomyazamislam727843No ratings yet

- DATE SHEET For One-Year Diploma Level Course in D.I.T (Diploma in Information Technology) 1 Term Examination 2021Document1 pageDATE SHEET For One-Year Diploma Level Course in D.I.T (Diploma in Information Technology) 1 Term Examination 2021ZohaibNo ratings yet

- Emmi-Lab ManualDocument43 pagesEmmi-Lab ManualNakum PrakashNo ratings yet

- Rumus Dasar Well ControlDocument2 pagesRumus Dasar Well Controlwindaru kusumaNo ratings yet

- LUCAS 3, 3 - 1 Data SheetDocument4 pagesLUCAS 3, 3 - 1 Data SheetForum PompieriiNo ratings yet

- Lagori FiguresDocument15 pagesLagori FiguresSAMPANo ratings yet

- 2022 JamesCook Katalog EN HomepageDocument36 pages2022 JamesCook Katalog EN HomepageAlvaro Daniel MarquezNo ratings yet

- Clustering Analysis: Reading The DataDocument15 pagesClustering Analysis: Reading The DataKATHIRVEL S100% (1)

- Chapter 7 Exam Style QuestionsDocument6 pagesChapter 7 Exam Style QuestionsUmm ArafaNo ratings yet

- DHQ Hafizabad Site VisitDocument9 pagesDHQ Hafizabad Site Visitarooj anjumNo ratings yet

- Hermetic Compressor PDFDocument17 pagesHermetic Compressor PDFchildey100% (1)

- Why YUV Is Preferred Over RGBDocument5 pagesWhy YUV Is Preferred Over RGBKavya AnandNo ratings yet

- DB413Document2 pagesDB413Daniel BelmonteNo ratings yet

- Design of Marine Vehicle Powered by Magnetohydrodynamic ThrusterDocument16 pagesDesign of Marine Vehicle Powered by Magnetohydrodynamic ThrusterJoximar MoriNo ratings yet

- General Medical Merate S.PaDocument21 pagesGeneral Medical Merate S.PaFrancisco AvilaNo ratings yet

- Delock Usb-C™, Hdmi or Mini Displayport To 4K Hdmi Adapter Cable 1.8 MDocument3 pagesDelock Usb-C™, Hdmi or Mini Displayport To 4K Hdmi Adapter Cable 1.8 MMihanikNo ratings yet

- 5G Radio Network Planning CPDocument29 pages5G Radio Network Planning CPanangga89No ratings yet

- SMM Services in HyderabadDocument1 pageSMM Services in Hyderabadharisha pathaniNo ratings yet

- Arduino - How To Control Servo Motor With Potentiometer - 5 Steps (With Pictures) - InstructablesDocument7 pagesArduino - How To Control Servo Motor With Potentiometer - 5 Steps (With Pictures) - InstructablesboucharebNo ratings yet

- Vesa CVT 1.2Document26 pagesVesa CVT 1.2Tvrtko LovrićNo ratings yet

Yosias Wellem - 231210055

Yosias Wellem - 231210055

Uploaded by

eliesersteven0 ratings0% found this document useful (0 votes)

8 views3 pages1. Electronic exchange involves the identification of parties, transmission of information over a network, validation and authentication of information, execution of authorized transactions, and confirmation of completed transactions.

2. The pros of electronic exchange include efficiency, speed, and accessibility, while the cons include security risks, technology dependence, reduced social interaction, and implementation costs.

3. Key issues that may complicate consortium formation between competitors include competition between members, differences in corporate culture, security and trust issues, and regulatory restrictions. Marriott should consider strategic objectives, company readiness, ability to collaborate, manage strategic issues, and compare risks and benefits to other alternatives before pursuing a consortium.

Original Description:

Original Title

yosias Wellem_231210055 (1)

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Document1. Electronic exchange involves the identification of parties, transmission of information over a network, validation and authentication of information, execution of authorized transactions, and confirmation of completed transactions.

2. The pros of electronic exchange include efficiency, speed, and accessibility, while the cons include security risks, technology dependence, reduced social interaction, and implementation costs.

3. Key issues that may complicate consortium formation between competitors include competition between members, differences in corporate culture, security and trust issues, and regulatory restrictions. Marriott should consider strategic objectives, company readiness, ability to collaborate, manage strategic issues, and compare risks and benefits to other alternatives before pursuing a consortium.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

0 ratings0% found this document useful (0 votes)

8 views3 pagesYosias Wellem - 231210055

Yosias Wellem - 231210055

Uploaded by

eliesersteven1. Electronic exchange involves the identification of parties, transmission of information over a network, validation and authentication of information, execution of authorized transactions, and confirmation of completed transactions.

2. The pros of electronic exchange include efficiency, speed, and accessibility, while the cons include security risks, technology dependence, reduced social interaction, and implementation costs.

3. Key issues that may complicate consortium formation between competitors include competition between members, differences in corporate culture, security and trust issues, and regulatory restrictions. Marriott should consider strategic objectives, company readiness, ability to collaborate, manage strategic issues, and compare risks and benefits to other alternatives before pursuing a consortium.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

You are on page 1of 3

Nama : yosias Wellem kainama

Nim : 231210055

Review question

Page 229

1. Electronic exchange is the process of exchanging information or financial

transactions through a computer system or electronic network. This

process can operate with the following steps:

a. Identification of the parties involved: The parties involved in the

electronic exchange must be identified, such as the recipient and

sender of the information or funds.

b. Transmission of information: The information to be exchanged,

such as messages, data, or instructions, is transmitted over an

electronic network, such as the internet or a company’s internal

network.

c. Validation and authentication: The information received usually

goes through a validation and authentication process to ensure its

authenticity and integrity.

d. Transaction execution: If a financial transaction is authorized,

funds can be allocated and recorded in the relevant financial

system.

e. Confirmation and reconciliation: The parties involved usually

receive confirmation of the transaction and perform reconciliation

to ensure that the transaction was completed correctly.

2. Pros and cons of participating in electronic exchange:

Pros:

- Efficiency: Electronic exchanges can increase efficiency in

business processes by reducing the time and costs

associated with manual transactions.

- Speed: Electronic transactions can be processed quickly,

which allows customers or businesses to get services or

products faster.

- Accuracy: With process automation, human error rates can

be reduced, potentially improving accuracy.

- Accessibility: Transactions can be conducted from almost

anywhere with an internet connection.

Cons:

- Security: Electronic exchanges are vulnerable to security

risks such as hacking and data theft.

- Dependence on technology: Depending on technology

means vulnerability to technical glitches or system failure.

- Digital isolation: Electronic exchanges can reduce social

interaction in transactions, which can remove the human

aspect of business.

- Implementation costs: Implementation of electronic

exchanges requires investment in infrastructure and

training.

Critical thinking

1. Strategic and competitive issues that may complicate consortium

formation may include:

a. Competition between members: When several major competitors

in the industry work together in a consortium, it may be difficult to

reach agreement on strategic issues or divide profits fairly.

b. Differences in corporate culture: Companies in the consortium

may have different cultures and philosophies, which may hinder

cooperation and coordination.

c. Security and trust issues: When it comes to customer data and

sensitive information, security and trust issues can be significant

barriers to consortium formation.

d. Regulatory and legal: The regulations and laws of the hospitality

sector and travel companies may restrict or regulate the formation

of consortia.

2. Recommendation for Marriott to continue to explore the feasibility of

forming a consortium depending on a number of factors, including

strategic objectives and company readiness. Some considerations may

include:

- Will the consortium help Marriott to overcome challenges

or capitalize on significant business opportunities?

- Does Marriott have the necessary capabilities and

resources to collaborate effectively with competitors in the

consortium

- To what extent can Marriott manage strategic issues such

as competition and corporate culture in the context of the

consortium.

- How do the risks, benefits and potential advantages of

forming a consortium compare with other alternatives.

You might also like

- E CommerceDocument29 pagesE Commerceparoothi0% (1)

- Allgon PDFDocument290 pagesAllgon PDFКурбан УмархановNo ratings yet

- IEEE STD 242-2001 Errata Only - Protection and Coordination of Industrial and Commercial Power Systems - Buff BookDocument1 pageIEEE STD 242-2001 Errata Only - Protection and Coordination of Industrial and Commercial Power Systems - Buff BookHeather CarterNo ratings yet

- Essentials of E-CommerceDocument9 pagesEssentials of E-CommerceSanmeet ShetiyaNo ratings yet

- E CommerceDocument103 pagesE Commercejoleymagar4444No ratings yet

- 1083 - UNIT-1 E-CommerceDocument10 pages1083 - UNIT-1 E-Commerce21.094akhilaNo ratings yet

- Design and Implementation of Secured E CDocument10 pagesDesign and Implementation of Secured E CÊmpěřøř MářvNo ratings yet

- Ebm Assesment 2Document21 pagesEbm Assesment 2neymarvikeshNo ratings yet

- CSC-370 E - Commerce: (BSC Csit, Tu)Document33 pagesCSC-370 E - Commerce: (BSC Csit, Tu)Nezuko KamadoNo ratings yet

- Chapter - 1 Electronic Commerce Environment and OpportunitiesDocument35 pagesChapter - 1 Electronic Commerce Environment and OpportunitiesSharada HarwadekarNo ratings yet

- Ecommerce Notes Sem 6Document7 pagesEcommerce Notes Sem 6tousifansari2002No ratings yet

- Business Ethics and GovernanceDocument10 pagesBusiness Ethics and GovernanceSaurabh NavaleNo ratings yet

- ECOMMERCEDocument5 pagesECOMMERCECourier systemNo ratings yet

- E BankingDocument77 pagesE BankingDEEPAKNo ratings yet

- Future Trends in The Stock Market-12Document2 pagesFuture Trends in The Stock Market-12Elakkiyan RNo ratings yet

- Ecommerce, Also Known As Electronic Commerce or Internet Commerce, Refers To TheDocument14 pagesEcommerce, Also Known As Electronic Commerce or Internet Commerce, Refers To TheBhavnaNo ratings yet

- On The Security Mechanisms Implemented On: Best E-CommerceDocument3 pagesOn The Security Mechanisms Implemented On: Best E-CommerceMd.sabbir Hossen875No ratings yet

- BBM 7TH Note (E-Commerce)Document14 pagesBBM 7TH Note (E-Commerce)shree ram prasad sahaNo ratings yet

- EcommerceDocument53 pagesEcommerceTushar GuptaNo ratings yet

- E CommerceDocument125 pagesE Commercekeshav315No ratings yet

- A) Explain Electronic Data InterchangeDocument5 pagesA) Explain Electronic Data InterchangeJkuat MSc. P & LNo ratings yet

- E - Marketing RevDocument53 pagesE - Marketing Revabdelamuzemil8No ratings yet

- Report On Building A Custom Payment Gateway System 2023Document13 pagesReport On Building A Custom Payment Gateway System 2023Joe RexaNo ratings yet

- Quiz Topic 7Document4 pagesQuiz Topic 7Fire burnNo ratings yet

- Impact of e Commerce On BusinessDocument3 pagesImpact of e Commerce On BusinessMaira Hussain100% (1)

- Economic of Information and Communication Very ShortDocument16 pagesEconomic of Information and Communication Very Shortprashant koiralaNo ratings yet

- Wolkite University: College of Computing and Informatics Department of Information Technology Extension ProgramDocument28 pagesWolkite University: College of Computing and Informatics Department of Information Technology Extension ProgramGetnete degemuNo ratings yet

- E Commerce (Sem 2)Document29 pagesE Commerce (Sem 2)Gyan PrakashNo ratings yet

- ITT ChapterDocument18 pagesITT ChapterHiruthik RajaNo ratings yet

- (COMPUTERS) DEGREE COURSE (III YEAR) E-COMMERCE - nOTESDocument36 pages(COMPUTERS) DEGREE COURSE (III YEAR) E-COMMERCE - nOTESKingpinNo ratings yet

- MainDocument33 pagesMainSolomon GodwinNo ratings yet

- E Session 1Document5 pagesE Session 1Alex MianoNo ratings yet

- EcommerceDocument118 pagesEcommerceDewsun RiseonNo ratings yet

- CA 2 FINM 809 BhrigunDocument18 pagesCA 2 FINM 809 BhrigunBhrigun GuptaNo ratings yet

- Block Chain Presentation-1Document29 pagesBlock Chain Presentation-1Ashutosh PatkarNo ratings yet

- E Ommerce Notes PDFDocument35 pagesE Ommerce Notes PDFRoop Ch Jha75% (4)

- E CommerceDocument4 pagesE Commerceshriyanshrauthan833No ratings yet

- Digital PaymentsDocument7 pagesDigital Paymentskavya joshiNo ratings yet

- Tim 2020 PDFDocument159 pagesTim 2020 PDFVipul SardessaiNo ratings yet

- Benefits, Costs and Limitations of Online Investing To The Individual InvestorDocument6 pagesBenefits, Costs and Limitations of Online Investing To The Individual InvestorAbhijeet MurdioNo ratings yet

- Unit I, Ii & Iii NotesDocument32 pagesUnit I, Ii & Iii NotesIts AlokNo ratings yet

- E Commerce NotesDocument52 pagesE Commerce NoteschsureshchandraNo ratings yet

- © The Institute of Chartered Accountants of IndiaDocument9 pages© The Institute of Chartered Accountants of IndiaGao YungNo ratings yet

- 2 MarksDocument5 pages2 MarksSharron Rose HNo ratings yet

- Unit 1 Introduction To Electronic CommerceDocument25 pagesUnit 1 Introduction To Electronic Commercetekendra nathNo ratings yet

- Marketsn WhitepaperDocument26 pagesMarketsn WhitepaperRohan Gulati100% (1)

- E Business 2Document37 pagesE Business 2Kenneth O'BrienNo ratings yet

- Digitalization of Securities MarketDocument8 pagesDigitalization of Securities Marketmrinal kumarNo ratings yet

- Unit 1 Fundamental of E-Commerce (Bba-606) - CompleteDocument56 pagesUnit 1 Fundamental of E-Commerce (Bba-606) - CompleteGaurav VikalNo ratings yet

- Unit-1 Introduction To EcommerceDocument24 pagesUnit-1 Introduction To EcommerceNezuko KamadoNo ratings yet

- Secure Online Business: Exploring The Security Threats To E-CommerceDocument7 pagesSecure Online Business: Exploring The Security Threats To E-CommerceAshmita BhattacharjeeNo ratings yet

- Degree Course (Iii Year) ECOMMERCE Notes: Unit-IDocument30 pagesDegree Course (Iii Year) ECOMMERCE Notes: Unit-IrohitNo ratings yet

- Question Answer E-BUSINESSDocument33 pagesQuestion Answer E-BUSINESSMD Rakibul Islam ZakariaNo ratings yet

- CH 13 ISC class 11 CommerceDocument7 pagesCH 13 ISC class 11 CommerceRanjan purkiteNo ratings yet

- Unit Understanding E-CommerceDocument5 pagesUnit Understanding E-CommerceeugeneNo ratings yet

- PT 2 AnswersDocument9 pagesPT 2 AnswersSUSEENDRAN VNo ratings yet

- E-Commerce Consumer ApplicationsDocument15 pagesE-Commerce Consumer ApplicationsRam KumarNo ratings yet

- E-Commerce Short NotesDocument5 pagesE-Commerce Short NotesThangathurai Kartheeswaran83% (18)

- MC EcDocument35 pagesMC EcAparna MittalNo ratings yet

- Implementation of a Central Electronic Mail & Filing StructureFrom EverandImplementation of a Central Electronic Mail & Filing StructureNo ratings yet

- Above the Clouds: Managing Risk in the World of Cloud ComputingFrom EverandAbove the Clouds: Managing Risk in the World of Cloud ComputingNo ratings yet

- B4U GLOBAL Group of Companies (PDF) - 1Document40 pagesB4U GLOBAL Group of Companies (PDF) - 1عبدالسبحان بھمبھانیNo ratings yet

- S.Y. 2020-2021 Second Semester Teaching & Learning Plan Panitikang Pilipino (Fil 2)Document6 pagesS.Y. 2020-2021 Second Semester Teaching & Learning Plan Panitikang Pilipino (Fil 2)Rexson Dela Cruz TagubaNo ratings yet

- Agosto 2022.COMPUTERS FOR THE DISABLEDDocument2 pagesAgosto 2022.COMPUTERS FOR THE DISABLEDSoraSosaNo ratings yet

- DDBMS PracticalsDocument24 pagesDDBMS PracticalsDoon ValyNo ratings yet

- Living in The It Era Social Media App Chap 1 To 10Document104 pagesLiving in The It Era Social Media App Chap 1 To 10Earone MacamNo ratings yet

- Stealing Bitcoin With MathDocument98 pagesStealing Bitcoin With MathДмитрий Канилов50% (2)

- Review 1Document16 pagesReview 1Ashwini PanchalNo ratings yet

- Pad Cratering: Pad Cratering Is A Mechanically Induced Fracture in The Resin Between Copper Foil and Outermost Layer ofDocument4 pagesPad Cratering: Pad Cratering Is A Mechanically Induced Fracture in The Resin Between Copper Foil and Outermost Layer ofMadhusudanan AshokNo ratings yet

- Tower AnatomyDocument12 pagesTower Anatomyazamislam727843No ratings yet

- DATE SHEET For One-Year Diploma Level Course in D.I.T (Diploma in Information Technology) 1 Term Examination 2021Document1 pageDATE SHEET For One-Year Diploma Level Course in D.I.T (Diploma in Information Technology) 1 Term Examination 2021ZohaibNo ratings yet

- Emmi-Lab ManualDocument43 pagesEmmi-Lab ManualNakum PrakashNo ratings yet

- Rumus Dasar Well ControlDocument2 pagesRumus Dasar Well Controlwindaru kusumaNo ratings yet

- LUCAS 3, 3 - 1 Data SheetDocument4 pagesLUCAS 3, 3 - 1 Data SheetForum PompieriiNo ratings yet

- Lagori FiguresDocument15 pagesLagori FiguresSAMPANo ratings yet

- 2022 JamesCook Katalog EN HomepageDocument36 pages2022 JamesCook Katalog EN HomepageAlvaro Daniel MarquezNo ratings yet

- Clustering Analysis: Reading The DataDocument15 pagesClustering Analysis: Reading The DataKATHIRVEL S100% (1)

- Chapter 7 Exam Style QuestionsDocument6 pagesChapter 7 Exam Style QuestionsUmm ArafaNo ratings yet

- DHQ Hafizabad Site VisitDocument9 pagesDHQ Hafizabad Site Visitarooj anjumNo ratings yet

- Hermetic Compressor PDFDocument17 pagesHermetic Compressor PDFchildey100% (1)

- Why YUV Is Preferred Over RGBDocument5 pagesWhy YUV Is Preferred Over RGBKavya AnandNo ratings yet

- DB413Document2 pagesDB413Daniel BelmonteNo ratings yet

- Design of Marine Vehicle Powered by Magnetohydrodynamic ThrusterDocument16 pagesDesign of Marine Vehicle Powered by Magnetohydrodynamic ThrusterJoximar MoriNo ratings yet

- General Medical Merate S.PaDocument21 pagesGeneral Medical Merate S.PaFrancisco AvilaNo ratings yet

- Delock Usb-C™, Hdmi or Mini Displayport To 4K Hdmi Adapter Cable 1.8 MDocument3 pagesDelock Usb-C™, Hdmi or Mini Displayport To 4K Hdmi Adapter Cable 1.8 MMihanikNo ratings yet

- 5G Radio Network Planning CPDocument29 pages5G Radio Network Planning CPanangga89No ratings yet

- SMM Services in HyderabadDocument1 pageSMM Services in Hyderabadharisha pathaniNo ratings yet

- Arduino - How To Control Servo Motor With Potentiometer - 5 Steps (With Pictures) - InstructablesDocument7 pagesArduino - How To Control Servo Motor With Potentiometer - 5 Steps (With Pictures) - InstructablesboucharebNo ratings yet

- Vesa CVT 1.2Document26 pagesVesa CVT 1.2Tvrtko LovrićNo ratings yet