Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

11 views3

3

Uploaded by

indraCopyright:

© All Rights Reserved

Available Formats

Download as TXT, PDF, TXT or read online from Scribd

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5825)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (903)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (541)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (823)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (403)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- 6Document2 pages6indraNo ratings yet

- 5Document7 pages5indraNo ratings yet

- 2Document2 pages2indraNo ratings yet

- ThreeDocument2 pagesThreeindraNo ratings yet

- Adobe Scan 03-Dec-2023Document1 pageAdobe Scan 03-Dec-2023indraNo ratings yet

- Ooad Q.PDocument1 pageOoad Q.PindraNo ratings yet

- TechnologiesDocument4 pagesTechnologiesindraNo ratings yet

- Adobe Scan 03-Dec-2023Document1 pageAdobe Scan 03-Dec-2023indraNo ratings yet

- AI Series QuestionsDocument3 pagesAI Series QuestionsindraNo ratings yet

- Short Answers 2Document1 pageShort Answers 2indraNo ratings yet

- Short Answers 1Document1 pageShort Answers 1indraNo ratings yet

- Short Answers 3Document1 pageShort Answers 3indraNo ratings yet

- Short Answers 4Document1 pageShort Answers 4indraNo ratings yet

- Beee Internal Test 1 QPDocument3 pagesBeee Internal Test 1 QPindraNo ratings yet

- Important Kandar AnuboothiDocument3 pagesImportant Kandar AnuboothiindraNo ratings yet

- 1.4. Homogeneous Equation of Euler'S MethodDocument22 pages1.4. Homogeneous Equation of Euler'S MethodindraNo ratings yet

- Important ThiruppugazhDocument5 pagesImportant ThiruppugazhindraNo ratings yet

- 2.5 - Line Integrals PDFDocument25 pages2.5 - Line Integrals PDFindraNo ratings yet

- EDTA ProblemsDocument8 pagesEDTA ProblemsindraNo ratings yet

- 2.7 - Gauss Divergence TheoremsDocument43 pages2.7 - Gauss Divergence TheoremsindraNo ratings yet

- CSE Alagappa Syllabus 1st YearDocument69 pagesCSE Alagappa Syllabus 1st YearindraNo ratings yet

- 2.3 - Theorems On Gradient, Divergent & CurlDocument13 pages2.3 - Theorems On Gradient, Divergent & CurlindraNo ratings yet

- 2.7 - Gauss Divergence TheoremDocument44 pages2.7 - Gauss Divergence TheoremindraNo ratings yet

- Kaivalya Upanishad PDFDocument1 pageKaivalya Upanishad PDFindraNo ratings yet

3

3

Uploaded by

indra0 ratings0% found this document useful (0 votes)

11 views1 pageCopyright

© © All Rights Reserved

Available Formats

TXT, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as TXT, PDF, TXT or read online from Scribd

Download as txt, pdf, or txt

0 ratings0% found this document useful (0 votes)

11 views1 page3

3

Uploaded by

indraCopyright:

© All Rights Reserved

Available Formats

Download as TXT, PDF, TXT or read online from Scribd

Download as txt, pdf, or txt

You are on page 1of 1

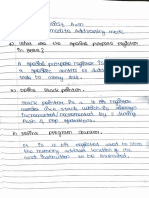

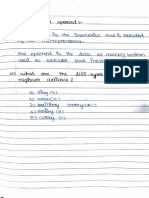

Shareholders and Managers: In publicly traded companies, shareholders (principals)

hire managers (agents) to run the company on their behalf. However, managers may

have different objectives, such as maximizing their own wealth or job security,

which may not always align with the shareholders' goal of maximizing shareholder

value.

Creditors and Managers: Similar to shareholders, creditors (e.g., bondholders) may

face an agency problem when they lend money to a company. Managers may take actions

that benefit themselves but are detrimental to the interests of creditors.

Employees and Managers: Employees (principals) hire managers (agents) to represent

their interests within a company. The agency problem may arise if managers

prioritize their own interests, potentially leading to issues such as unfair

compensation or decisions that favor managerial interests over employee well-being.

Clients and Agents: In various professional services (e.g., financial advising,

legal representation), clients (principals) hire agents to act on their behalf. The

agents may face conflicts of interest if their compensation structures or

incentives are not aligned with the best interests of the clients.

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5825)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (903)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (541)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (823)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (403)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- 6Document2 pages6indraNo ratings yet

- 5Document7 pages5indraNo ratings yet

- 2Document2 pages2indraNo ratings yet

- ThreeDocument2 pagesThreeindraNo ratings yet

- Adobe Scan 03-Dec-2023Document1 pageAdobe Scan 03-Dec-2023indraNo ratings yet

- Ooad Q.PDocument1 pageOoad Q.PindraNo ratings yet

- TechnologiesDocument4 pagesTechnologiesindraNo ratings yet

- Adobe Scan 03-Dec-2023Document1 pageAdobe Scan 03-Dec-2023indraNo ratings yet

- AI Series QuestionsDocument3 pagesAI Series QuestionsindraNo ratings yet

- Short Answers 2Document1 pageShort Answers 2indraNo ratings yet

- Short Answers 1Document1 pageShort Answers 1indraNo ratings yet

- Short Answers 3Document1 pageShort Answers 3indraNo ratings yet

- Short Answers 4Document1 pageShort Answers 4indraNo ratings yet

- Beee Internal Test 1 QPDocument3 pagesBeee Internal Test 1 QPindraNo ratings yet

- Important Kandar AnuboothiDocument3 pagesImportant Kandar AnuboothiindraNo ratings yet

- 1.4. Homogeneous Equation of Euler'S MethodDocument22 pages1.4. Homogeneous Equation of Euler'S MethodindraNo ratings yet

- Important ThiruppugazhDocument5 pagesImportant ThiruppugazhindraNo ratings yet

- 2.5 - Line Integrals PDFDocument25 pages2.5 - Line Integrals PDFindraNo ratings yet

- EDTA ProblemsDocument8 pagesEDTA ProblemsindraNo ratings yet

- 2.7 - Gauss Divergence TheoremsDocument43 pages2.7 - Gauss Divergence TheoremsindraNo ratings yet

- CSE Alagappa Syllabus 1st YearDocument69 pagesCSE Alagappa Syllabus 1st YearindraNo ratings yet

- 2.3 - Theorems On Gradient, Divergent & CurlDocument13 pages2.3 - Theorems On Gradient, Divergent & CurlindraNo ratings yet

- 2.7 - Gauss Divergence TheoremDocument44 pages2.7 - Gauss Divergence TheoremindraNo ratings yet

- Kaivalya Upanishad PDFDocument1 pageKaivalya Upanishad PDFindraNo ratings yet