Professional Documents

Culture Documents

Factsheet NiftyIndiaDefence

Factsheet NiftyIndiaDefence

Uploaded by

subhashismukherjee5Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Factsheet NiftyIndiaDefence

Factsheet NiftyIndiaDefence

Uploaded by

subhashismukherjee5Copyright:

Available Formats

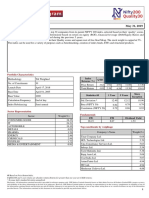

November 30, 2023

NSE Indices has developed the Nifty India Defence Index which aims to track the performance of portfolio of stocks that broadly

represent the Defence theme. From the Nifty Total Market index, stocks forming part of eligible basic industries or those which obtain

at least 10% of revenues from the defence industry are eligible to be included in the index and are chosen based on 6 month average

free-float market capitalisation. The weight of the stocks in the index is based on their free-float market capitalization. Stock weights

are capped at 20% each.

The index can be used for a variety of purposes such as benchmarking, creation of index funds, ETFs and structured products.

Index Variant: Nifty India Defence Total Returns Index.

Portfolio Characteristics

Methodology Periodic Capped Free Float Index Since

QTD YTD 1 Year 5 Years

No. of Constituents 14 Returns (%) Inception

Launch Date January 19, 2022 Price Return 11.41 65.26 58.71 37.84 25.65

Base Date April 02, 2018 Total Return 11.51 66.90 60.28 39.94 27.58

Base Value 1000 Since

Calculation Frequency End of day Statistics ## 1 Year 5 Years

Inception

Index Rebalancing Semi - Annually Std. Deviation * 21.86 24.98 24.68

Sector Representation Beta (NIFTY 50) 1.00 0.75 0.75

Sector Weight(%) Correlation (NIFTY 50) 0.45 0.57 0.56

Capital Goods 83.02

Fundamentals

Chemicals 16.98

P/E P/B Dividend Yield

39.28 8.59 0.68

Top constituents by weightage

Company’s Name Weight(%)

Hindustan Aeronautics Ltd. 22.02

Bharat Electronics Ltd. 18.98

Solar Industries India Ltd. 16.98

Mazagoan Dock Shipbuilders Ltd. 6.73

Bharat Dynamics Ltd. 5.89

Astra Microwave Products Ltd. 5.39

Data Patterns (India) Ltd. 4.98

Cochin Shipyard Ltd. 4.73

MTAR Technologies Ltd. 4.65

Garden Reach Shipbuilders & Engineers Ltd. 2.79

## Based on Price Return Index.

# QTD,YTD and 1 year returns are absolute returns.Returns for greater than one year are CAGR returns.

* Average daily standard deviation annualised.

Disclaimer: All information contained herewith is provided for reference purpose only. NSE Indices Limited (formerly known as India Index Services & Products Limited-IISL) ensures accuracy and reliability of the above

information to the best of its endeavors. However, NSE Indices Limited makes no warranty or representation as to the accuracy, completeness or reliability of any of the information contained herein and disclaim any and all

liability whatsoever to any person for any damage or loss of any nature arising from or as a result of reliance on any of the information provided herein. The information contained in this document is not intended to provide any

professional advice. 1

November 30, 2023

Index Methodology

• Stocks part of / going to form part of the Nifty Total Market index at the time of review are eligible for inclusion in the index.

• Stocks forming part of the certain eligible ‘basic industries’ based on AMFI Industry Classification or stocks which are present in the

Society of Indian Defence Manufacturers (SIDM) member list and obtain at least 10% of revenues from the defence segment are

eligible to be included from the universe at the time of review.

• Minimum number of stocks within the index is 10.

• The weight of each stock in the index is based on its free float market capitalization.

• Stocks weights are capped at 20% each.

• The Index is reconstituted semi-annually along with Nifty Broad-based indices.

Index Governance: A professional team manages all NSE indices. There is a three-tier governance structure comprising the Board of

Directors of NSE Indices Limited, the Index Advisory Committee (Equity) and the Index Maintenance Sub-Committee.

Key Indices

Broad Market Sectoral Indices Thematic Indices Strategy Indices Fixed Income

Nifty 50 Nifty Bank Nifty CPSE Nifty100 Equal Weight Nifty 10 yr Benchmark G-Sec

Nifty Next 50 Nifty IT Nifty Commodities Nifty50 PR 1x Inverse Nifty 8-13 yr G-Sec

Nifty 100 Nifty PSU Bank Nifty Energy Nifty50 PR 2x Leverage Nifty 4-8 yr G-Sec

Nifty 200 Nifty FMCG Nifty Shariah 25 Nifty50 Value 20 Nifty 11-15 yr G-Sec

Nifty 500 Nifty Private Bank Nifty 100 Liquid15 Nifty100 Quality 30 Nifty 15 yr and above G-Sec

Nifty Midcap 50 Nifty Metal Nifty Infrastructure Nifty Low Volatility 50 Nifty Composite G-Sec

Nifty Midcap 100 Nifty Financial Services Nifty Corporate Group Nifty Alpha 50 Nifty 1D Rate

Contact Us:

Email: indices@nse.co.in | Tel: +91 22 26598386 | Fax: +91 22 26598120

Learn more at: www.niftyindices.com

2

You might also like

- Spring 1999: Problem 1Document30 pagesSpring 1999: Problem 1ShubhamNo ratings yet

- Case 9-2 Innovative Engineering CoDocument4 pagesCase 9-2 Innovative Engineering CoFaizal PradhanaNo ratings yet

- IFR Magazine March 24 2018Document108 pagesIFR Magazine March 24 2018santoshcal3183No ratings yet

- A Value Investment Strategy That Combines Security Selection and Market Timing SignalsDocument16 pagesA Value Investment Strategy That Combines Security Selection and Market Timing SignalsVarun KumarNo ratings yet

- Factsheet NiftyMidcap150Momentum50Document2 pagesFactsheet NiftyMidcap150Momentum50Jose CANo ratings yet

- Ind Nifty FMCGDocument2 pagesInd Nifty FMCGDharmendra Singh GondNo ratings yet

- 9 Factsheet - Nifty - Consumer - DurablesDocument2 pages9 Factsheet - Nifty - Consumer - DurablesKapilSahuNo ratings yet

- Factsheet Nifty India Manufacturing IndexDocument2 pagesFactsheet Nifty India Manufacturing IndexShubhamNo ratings yet

- Factsheet_NiftyEVNewAgeAutomotiveDocument2 pagesFactsheet_NiftyEVNewAgeAutomotiveDEBANJAN DUTTANo ratings yet

- Nifty50 Value20Document2 pagesNifty50 Value20shahid aliNo ratings yet

- Factsheet NiftyMidcap150Momentum50Document2 pagesFactsheet NiftyMidcap150Momentum50jvnaveenpassiveincomeNo ratings yet

- Factsheet NiftyEVNewAgeAutomotiveDocument2 pagesFactsheet NiftyEVNewAgeAutomotiveramayogi somuNo ratings yet

- Ind Nifty FMCGDocument2 pagesInd Nifty FMCGJackNo ratings yet

- Ind Nifty FMCGDocument2 pagesInd Nifty FMCGdebajitduarah72No ratings yet

- Factsheet Nifty50 ShariahDocument2 pagesFactsheet Nifty50 ShariahtabinzargarNo ratings yet

- Ind Nifty FMCGDocument2 pagesInd Nifty FMCGsubhamNo ratings yet

- Ind Nifty FMCGDocument2 pagesInd Nifty FMCGSinghNo ratings yet

- Ind Nifty India ConsumptionDocument2 pagesInd Nifty India ConsumptionbhattjgNo ratings yet

- Ind Nifty 200Document2 pagesInd Nifty 200badasserytechNo ratings yet

- Nifty - India - Mobility IndexDocument2 pagesNifty - India - Mobility Indexkaygee.kapilgandhiNo ratings yet

- Ind Nifty FMCGDocument2 pagesInd Nifty FMCGKevinSuriyanNo ratings yet

- Factsheet Nifty200 Momentum30Document2 pagesFactsheet Nifty200 Momentum30Kiran SunkuNo ratings yet

- Factsheet NiftyMidcapSelectDocument2 pagesFactsheet NiftyMidcapSelectvinitshahi739No ratings yet

- Nifty India Manufacturing IndexDocument2 pagesNifty India Manufacturing Indexkaygee.kapilgandhiNo ratings yet

- Ind Nifty FMCGDocument2 pagesInd Nifty FMCGGopi nathNo ratings yet

- Ind Niftysmallcap100Document2 pagesInd Niftysmallcap100Samriddh DhareshwarNo ratings yet

- Portfolio Characteristics: Since Inception 5 Years 1 Year QTD Ytd Index Returns (%)Document2 pagesPortfolio Characteristics: Since Inception 5 Years 1 Year QTD Ytd Index Returns (%)Atul KaulNo ratings yet

- Ind Nifty FMCGDocument2 pagesInd Nifty FMCGSUMITNo ratings yet

- Factsheet NIFTY LargeMidcap 250 IndexDocument2 pagesFactsheet NIFTY LargeMidcap 250 Indexrahulojha123No ratings yet

- HDFC Momentum150 FundDocument2 pagesHDFC Momentum150 Fundkrishnakumar kichaNo ratings yet

- Factsheet Nifty Consumer DurablesDocument2 pagesFactsheet Nifty Consumer DurablesAvinash BaldiNo ratings yet

- Ind Nifty 200Document2 pagesInd Nifty 200Aman JainNo ratings yet

- Ind Nifty FMCGDocument2 pagesInd Nifty FMCGpatsan007No ratings yet

- Factsheet Nifty Consumer DurablesDocument2 pagesFactsheet Nifty Consumer DurablesUMANG KHUNTNo ratings yet

- Factsheet Nifty50 ShariahDocument2 pagesFactsheet Nifty50 ShariahMonu GamerNo ratings yet

- NIFTY100 ESG Index FactsheetDocument2 pagesNIFTY100 ESG Index FactsheetSanket SharmaNo ratings yet

- Ind Nifty 100Document2 pagesInd Nifty 100ketuNo ratings yet

- Ind Niftymidcap100Document2 pagesInd Niftymidcap100SumitNo ratings yet

- Ind Nifty ItDocument2 pagesInd Nifty ItDharmendra Singh GondNo ratings yet

- Nifty50 Value20Document2 pagesNifty50 Value20jerkrakeshNo ratings yet

- Factsheet NiftyMidcapSelectDocument2 pagesFactsheet NiftyMidcapSelectPrakash N RamaniNo ratings yet

- Ind Nifty FMCGDocument2 pagesInd Nifty FMCGParesh chaklasiyaNo ratings yet

- Factsheet NiftyMidcapSelectDocument2 pagesFactsheet NiftyMidcapSelectRishabh GeeteNo ratings yet

- Portfolio Characteristics: Since Inception 5 Years 1 Year QTD Ytd Index Returns (%)Document2 pagesPortfolio Characteristics: Since Inception 5 Years 1 Year QTD Ytd Index Returns (%)G gfgjNo ratings yet

- Factsheet_Nifty50_ShariahDocument2 pagesFactsheet_Nifty50_ShariahMohammad AleemNo ratings yet

- Factsheet NIFTY200 Quality30Document2 pagesFactsheet NIFTY200 Quality30Rajesh KumarNo ratings yet

- Factsheet NiftyMidcap150Momentum50Document2 pagesFactsheet NiftyMidcap150Momentum50RajneeshNo ratings yet

- Ind Nifty Midcap50Document2 pagesInd Nifty Midcap50Samriddh DhareshwarNo ratings yet

- Ind Next50Document2 pagesInd Next50bhattjgNo ratings yet

- Ind Nifty Pse PDFDocument2 pagesInd Nifty Pse PDFAman DagaNo ratings yet

- Factsheet NiftyNonCyclicalConsumerDocument2 pagesFactsheet NiftyNonCyclicalConsumerdheerendra sharmaNo ratings yet

- ind_nifty_energyDocument2 pagesind_nifty_energy9879828108No ratings yet

- Ind Nifty AutoDocument2 pagesInd Nifty AutoTasal DosuNo ratings yet

- Ind Nifty AutoDocument2 pagesInd Nifty AutoPrabhakar DalviNo ratings yet

- Ind Nifty AutoDocument2 pagesInd Nifty Autodebajitduarah72No ratings yet

- Ind Nifty 200Document2 pagesInd Nifty 200hirweashwin2580No ratings yet

- Ind Nifty Midcap50Document2 pagesInd Nifty Midcap50Aqib MujtabaNo ratings yet

- Ind Nifty Smallcap 250Document2 pagesInd Nifty Smallcap 250Fighter BullNo ratings yet

- Ind Nifty PseDocument2 pagesInd Nifty PseHarDik PatelNo ratings yet

- Ind Nifty EnergyDocument2 pagesInd Nifty Energysolankisanjay2875No ratings yet

- Ind NIFTY TATA GROUPDocument2 pagesInd NIFTY TATA GROUPGautam NatrajNo ratings yet

- Ind Nifty Midcap50Document2 pagesInd Nifty Midcap50SumitNo ratings yet

- 3 Factsheet - Nifty - Oil - and - GasDocument2 pages3 Factsheet - Nifty - Oil - and - GasKapilSahuNo ratings yet

- How Does A Drug WorkDocument8 pagesHow Does A Drug Worksubhashismukherjee5No ratings yet

- Zinger Price ListDocument3 pagesZinger Price Listsubhashismukherjee5No ratings yet

- Ind Nifty PharmaDocument2 pagesInd Nifty Pharmasubhashismukherjee5No ratings yet

- Results On 27 Dec 23 of AIUDocument12 pagesResults On 27 Dec 23 of AIUsubhashismukherjee5No ratings yet

- Swara YogaDocument41 pagesSwara Yogasubhashismukherjee50% (1)

- Scan 0008Document1 pageScan 0008subhashismukherjee5No ratings yet

- Government Securities Market in IndiaDocument66 pagesGovernment Securities Market in Indiasanketgharat83% (12)

- Latihan Soal Coc Dan WMCCDocument9 pagesLatihan Soal Coc Dan WMCCyolandaNo ratings yet

- Calculation of Index in FinanceDocument6 pagesCalculation of Index in FinanceAbhiSharmaNo ratings yet

- Important Mcqs - Chapter Iv: Company Law Share Capital and Debentures - Part 3Document28 pagesImportant Mcqs - Chapter Iv: Company Law Share Capital and Debentures - Part 3amitNo ratings yet

- Market Commentary 04/23/2012Document1 pageMarket Commentary 04/23/2012CJ MendesNo ratings yet

- Timeless ParagParikhMemoirs PDFDocument108 pagesTimeless ParagParikhMemoirs PDFSweetrush50% (2)

- Chapter 9 ExercisesDocument14 pagesChapter 9 Exercisesshiroe raabuNo ratings yet

- 2018 Re Nationality Requirement of Third Telco20211217 12Document12 pages2018 Re Nationality Requirement of Third Telco20211217 12Jadel Kaye ALJ TrainingNo ratings yet

- CharlesKindlebergerThe World in Depression, 1929-39Document12 pagesCharlesKindlebergerThe World in Depression, 1929-39Roxana BadeaNo ratings yet

- Uti Us-64 ReportDocument25 pagesUti Us-64 ReportRupam PaulNo ratings yet

- 2019 10-08 OTHERS - Top 100 Stockholders 2019-Q3Document5 pages2019 10-08 OTHERS - Top 100 Stockholders 2019-Q3Kenneth ShiNo ratings yet

- Session 6 Financial Inclusion and MSMEs Access To Finance in NepalDocument26 pagesSession 6 Financial Inclusion and MSMEs Access To Finance in NepalPrem YadavNo ratings yet

- Book BuildingDocument7 pagesBook BuildingshivathilakNo ratings yet

- SAPM by Syam Kerala University s3 MbaDocument88 pagesSAPM by Syam Kerala University s3 Mbasyam kumar sNo ratings yet

- Handout Chapter 17 Dividends Payout Policy 2024Document19 pagesHandout Chapter 17 Dividends Payout Policy 2024thutrangp147No ratings yet

- Special Address D P Jhawar EdelweissDocument4 pagesSpecial Address D P Jhawar EdelweissOlivia JacksonNo ratings yet

- List+No 347+update+Available+BGs, MTNS, CDs+&+BONDsDocument15 pagesList+No 347+update+Available+BGs, MTNS, CDs+&+BONDsJuan Pablo ArangoNo ratings yet

- PROJECT REPORT On Equity Analysis IT SectorDocument75 pagesPROJECT REPORT On Equity Analysis IT SectorSubbaRao75% (4)

- Company Project 1Document23 pagesCompany Project 1Amber SiddiquiNo ratings yet

- Hot English Magazine #223Document131 pagesHot English Magazine #223Анна ЛукьяноваNo ratings yet

- Option Chain (Equity Derivatives)Document2 pagesOption Chain (Equity Derivatives)Palanisamy BalasubramaniNo ratings yet

- Outcome of Board Meeting (Board Meeting)Document2 pagesOutcome of Board Meeting (Board Meeting)Shyam Sunder100% (1)

- TSXe ReviewDocument290 pagesTSXe ReviewexsarafNo ratings yet

- Africa InvestorDocument4 pagesAfrica InvestorTiso Blackstar GroupNo ratings yet

- AMFI Mutual Fund (Advisor) Module: Preparatory Training ProgramDocument231 pagesAMFI Mutual Fund (Advisor) Module: Preparatory Training Programallmutualfund100% (5)

- Ratio Analysis Toyota Indus Motors Company Limited: Lquidity RatiosDocument9 pagesRatio Analysis Toyota Indus Motors Company Limited: Lquidity RatiosArsl331No ratings yet