Professional Documents

Culture Documents

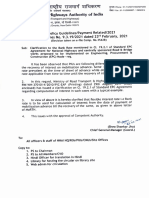

Safari - Jan 2, 2024 at 7:14 PM

Safari - Jan 2, 2024 at 7:14 PM

Uploaded by

syansyncOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Safari - Jan 2, 2024 at 7:14 PM

Safari - Jan 2, 2024 at 7:14 PM

Uploaded by

syansyncCopyright:

Available Formats

Search Wikipedia

Economy of Australia

Article Talk

Australia is a highly developed country with a mixed economy.[30][31] As of 2023, Australia was the 14th-

largest national economy by nominal GDP (gross domestic product),[32] the 19th-largest by PPP-adjusted

GDP,[33] and was the 21st-largest goods exporter and 24th-largest goods importer.[34] Australia took the

record for the longest run of uninterrupted GDP growth in the developed world with the March 2017

financial quarter. It was the 103rd quarter and the 26th year since the country had a technical recession

(two consecutive quarters of negative growth).[35] As of June 2021, the country's GDP was estimated at

$1.98 trillion.[36]

The Australian economy is dominated by its

service sector, which in 2017 comprised 62.7% of Economy of

Australia

the GDP and employed 78.8% of the labour

force.[5] At the height of the mining boom in

2009–10, the total value-added of the mining

industry was 8.4% of GDP.[37] Despite the recent

decline in the mining sector, the Australian

economy had remained resilient and stable[38][39]

and did not experience a recession from 1991

until 2020.[40][41]

The Australian Securities Exchange in Sydney is

the 16th-largest stock exchange in the world in

terms of domestic market capitalisation[42] and Sydney's central business district is Australia's

has one of the largest interest rate derivatives largest financial and business services hub.

[43]

markets in the Asia-Pacific region. Some of

Australia's largest companies include Currency Australian dollar (AUD)

Commonwealth Bank, BHP, CSL, Westpac, NAB,

Fiscal year 1 July – 30 June

ANZ, Fortescue Metals Group, Wesfarmers,

Macquarie Group, Woolworths Group, Rio Tinto, Trade organisations APEC, CPTPP, G20,

Telstra, Woodside Energy, and Transurban.[44] OECD, WTO

The currency of Australia and its territories is the

Country group Developed/Advanced[1]

Australian dollar, which it shares with several

High-income

Pacific nation states.

economy[2]

Australia's economy is strongly intertwined with

Statistics

the countries of East and Southeast Asia, also

known as ASEAN Plus Three (APT), accounting Population 25,890,773 (2021

for about 64% of exports in 2016.[45] China in Census)

particular is Australia's main export and import

GDP $1.688 trillion

partner by a wide margin.[46] Australia is a

(nominal; 2023)[3]

member of the APEC, G20, OECD and WTO. The $1.719 trillion (PPP;

country has also entered into free trade 2023)[3]

agreements with ASEAN, Canada, Chile, China,

South Korea, Malaysia, New Zealand, Peru, GDP rank 14th (nominal, 2023)

Japan, Singapore, Thailand and the United 20th (PPP, 2023)

States.[47][48][49] The ANZCERTA agreement with

GDP growth 3.7% (2022)[4]

New Zealand has greatly increased integration 1.6% (2023f)[4]

with the economy of New Zealand.[50] 1.7% (2024f)[4]

GDP per capita $63,487 (nominal;

Contents

2023)[3]

History $64,674 (PPP;

20th century 2023)[3]

Economic liberalisation

GDP per capita rank 10th (nominal, 2023)

Early 1990s recession 23rd (PPP, 2023)

Mining

GDP by sector Services: 62.7%

Global financial crisis Construction: 7.4%

Mining: 5.8%

2020 recession Manufacturing: 5.8%

Data Agriculture: 2.8%

(2017)[5]

Overview

Regional differences Inflation (CPI) 7% (March 2023)[6]

Taxation Population below 13.4% (2020)[7]

poverty line

Employment

Employment for newly qualified Gini coefficient 33.0 medium

professionals (2021)[8]

States and territories ranked by

Human Development 0.951 very high

unemployment rates Index

(2021)[9] (5th)

Sectors 0.876 very high IHDI

Industry (11th) (2021)[10]

Mining

Labour force 13.7 million

Manufacturing (December 2022)[11]

Agriculture 74.6% employment

rate (Q1-2020)[12]

Services

Finance Labour force by Services: 78.8%

occupation

Construction: 9.2%

Tourism

Manufacturing: 7.5%

Creativity and culture Agriculture: 2.5%

Mining: 1.9% (2017)[5]

Media

Unemployment 3.6% (September

Education

2023)[11]

Logistics 520.5 thousand

unemployed

Infrastructure

(September 2023)[11]

Transportation

8.0% youth

Energy unemployment

(September 2023; 15 to

Trade and economic performance

24 year-olds)[11]

Australian national debt

Chinese investment Average gross salary A$7,890 / $5,031.37

monthly[13] (2022)

Trade agreements

Average net salary A$6,076 / $3,874.21

Australia's balance of payments

monthly[14][15] (2022)

Personal wealth

Main industries Financial and insurance

Mergers and acquisitions services · Construction ·

Poverty Healthcare and social

assistance · Mining ·

Homelessness Professional, scientific

Climate change and technical

Agriculture forestry and livestock services[16] ·

Manufacturing[17]

Electricity demand

External

See also

Notes Exports A$670.04 billion

(2022)[18]

References

Export goods iron ore, coal, natural

Further reading

gas, gold, aluminium,

External links beef, crude petroleum,

copper, meat (non-

beef)[18]

History Main export partners China(-) 32.6%

Japan(+) 13.1%

Main article: Economic history of Australia South Korea(+)

5.9%

20th century United States(+)

5.3%

Main article: Australian settlement India(+) 4.9%

New Zealand(+)

Australia's average GDP growth rate for the

3.4%[18]

period 1901–2000 was 3.4% annually. As

opposed to many neighbouring Southeast Asian Imports A$529.95 billion

countries, the process towards independence (2022)[18]

was relatively peaceful and thus did not have

significant negative impact on the economy and Import goods petroleum, cars,

telecom equipment and

standard of living.[51] Growth peaked during the

parts, goods vehicles,

1920s, followed by the 1950s and the 1980s. By

computers,

contrast, the late 1910s/early 1920s, the 1930s,

medicaments, gold, civil

the 1970s and early 1990s were marked by engineering equipment,

financial crises. furniture[18]

Economic liberalisation Main import partners China(-) 19.4%

United States(+)

From the 12.3%

early Japan(+) 6.4%

1980s Germany(+) 4.5%

onwards, Thailand(+) 4.1%

the United Kingdom(+)

Australian 4.0%[18]

economy

ABC News report, featuring Paul FDI stock Inward: $682.9 billion

Keating, on the first day of trading with a has Outward: $491.0 billion

floating Australian dollar. undergone (UNCTAD 2018)[19]

Current account A$14.1 billion

(2022)[20]

Gross external debt US$2.095 trillion (Q1,

2019)[21]

Public finances

Annual percentage growth in real (chain Government debt 66.4% of GDP (October

volume) GDP per capita since 1961 2021)[22]

intermittent economic liberalisation. In 1983, Budget balance −0.2% (of GDP)

under prime minister Bob Hawke, but mainly (2019)[23][24]

driven by treasurer Paul Keating, the Australian

dollar was floated and financial deregulation was Revenues A$485.2 billion

(2019)[23]

undertaken.

Expenses A$482.7 billion

Early 1990s recession

(2019)[23]

Main articles: Early 1990s recession and Early

1990s recession in Australia Economic aid donor: ODA,

$4.09 billion (2022)[25]

The early 1990s recession came swiftly after the

Black Monday of October 1987, as a result of a Credit rating Standard & Poor's:[26]

AAA · Outlook: Stable

stock collapse of unprecedented size which

Moody's:[27]

caused the Dow Jones Industrial Average to fall

AAA · Outlook: Stable

by 22.6%. This collapse, larger than the stock

Fitch:[28]

market crash of 1929, was handled effectively by AAA · Outlook: Stable

the global economy and the stock market began

to quickly recover. But in North America, the Foreign reserves $66.58 billion (31

lumbering savings and loans industry was facing December 2017 est.)[29]

decline, which eventually led to a savings and

Main data source: CIA World Fact Book

loan crisis which compromised the well-being of All values, unless otherwise stated, are in US dollars.

millions of US people. The following recession

thus impacted the many countries closely linked to the US, including

Australia. Paul Keating, who was treasurer at the time, famously

referred to it as "the recession that Australia had to have."[52] During

the recession, GDP fell by 1.7%, employment by 3.4% and the

unemployment rate rose to 10.8%.[53] However, the recession did

assist in reducing long-term inflation rate expectations and Australia

has maintained a low inflation environment since the 1990s to the

present day.

Real GDP per capita development in

Australia and New Zealand

Mining

Main article: Mining in Australia

Mining has contributed to Australia's high level of economic growth, from the gold rush in the 1840s to the

present day. The opportunities for large profits in pastoralism and mining attracted considerable amounts of

British capital, while expansion was supported by enormous government outlays for transport,

communication, and urban infrastructures, which also depended heavily on British finance. As the economy

expanded, large-scale immigration satisfied the growing demand for workers, especially after the end of

convict transportation to the eastern mainland in 1840. Australia's mining operations secured continued

economic growth and Western Australia itself benefited strongly from mining iron ore and gold from the

1960s and 1970s which fuelled the rise of suburbanisation and consumerism in Perth, the capital and most

populous city of Western Australia, as well as other regional centres.

Global financial crisis

Main articles: Great Recession, Great Recession in Oceania § Australia, and Financial crisis of 2007–2008

Further information: Rudd Government (2007–10)

The Australian government stimulus package ($11.8 billion) helped to prevent a recession.[54]

The World Bank expected Australia's GDP growth rate to be 3.2% in 2011 and 3.8% in 2012.[55] The

economy expanded by 0.4% in the fourth quarter of 2011, and expanded by 1.3% in the first quarter of

2012.[56][57] The growth rate was reported to be 4.3% year-on-year.[58]

The International Monetary Fund in April 2012 predicted that Australia would be the best-performing major

advanced economy in the world over the next two years; the Australian Government Department of the

Treasury anticipated "forecast growth of 3.0% in 2012 and 3.5% in 2013",[59] the National Australia Bank in

April 2012 cut its growth forecast for Australia to 2.9% from 3.2%.,[60] and JP Morgan in May 2012 cut its

growth forecast to 2.7% in calendar 2012 from a previous forecast of 3.0%, also its forecast for growth in

2013 to 3.0% from 3.3%.[61] Deutsche Bank in August 2012, and Société Générale in October 2012, warned

that there is risk of recession in Australia in 2013.[62][63]

While Australia's overall national economy grew, some non-mining states and Australia's non-mining

economy experienced a recession.[64][65][66]

2020 recession

Main article: COVID-19 recession § Australia

In September 2020, it was confirmed that due to the effects of the COVID-19 pandemic, the Australian

economy had gone into recession for the first time in nearly thirty years, as the country's GDP fell 7 per cent

in the June 2020 quarter, following a 0.3 per cent drop in the March quarter.[67][68][69] It officially ended at

the beginning of December 2020.[70]

Data

The following table shows the main economic indicators in 1980–2021 (with IMF staff estimates in 2022–

2027). Inflation under 5% is in green.[71]

GDP per GDP per Inflation Government

GDP GDP GDP

capita capita rate Unemployment debt

(in Bil. (in Bil. growth

Year (in Int$ (in US$ (in (in Percent) (in % of

Int$ PPP) US$nominal) (real)

PPP) nominal) Percent) GDP)

1980 155.4 10,498.0 162.8 11,000.1 2.9% 10.1% 6.1% n/a

1981 177.1 11,776.5 188.3 12,520.0 4.1% 9.5% 5.8% n/a

1982 188.2 12,307.7 186.9 12,226.6 0.1% 11.4% 7.2% n/a

1983 194.6 12,569.1 179.4 11,584.2 -0.5% 10.0% 10.0% n/a

1984 214.4 13,678.0 197.0 12,566.6 6.3% 4.0% 9.0% n/a

1985 233.3 14,671.4 174.3 10,960.2 5.5% 6.7% 8.3% n/a

1986 243.8 15,106.9 181.4 11,237.7 2.4% 9.1% 8.1% n/a

1987 262.1 213.0 12,989.9 4.9% 8.5% 8.1% n/a

15,984.6

1988 282.8 270.9 16,235.1 4.3% 7.3% 7.2% n/a

16,949.7

1989 307.6 18,159.0 308.1 18,191.4 4.6% 7.6% 6.1% 17.0%

1990 323.8 323.8 18,859.6 1.5% 7.2% 6.9% 16.4%

18,859.9

1991 331.4 19,070.9 324.2 18,656.5 -1.0% 3.3% 9.6% 21.6%

1992 347.7 317.9 18,106.7 2.6% 1.0% 10.7% 27.6%

19,802.5

1993 369.9 309.2 17,447.6 3.9% 1.8% 10.9% 30.7%

20,877.2

1994 396.1 353.2 19,736.3 4.8% 1.9% 9.7% 31.7%

22,138.3

1995 416.4 378.9 20,908.4 3.0% 4.6% 8.5% 31.2%

22,980.0

1996 441.1 424.4 23,153.8 4.0% 2.7% 8.5% 29.4%

24,064.7

1997 469.4 426.2 23,023.6 4.6% 0.2% 8.4% 25.9%

25,357.9

1998 496.7 381.1 20,374.7 4.7% 0.9% 7.7% 23.7%

26,555.0

1999 525.6 411.5 21,748.0 4.3% 1.4% 6.9% 22.6%

27,782.8

2000 554.2 399.7 20,879.2 3.1% 4.5% 6.3% 19.5%

28,953.2

2001 581.8 30,010.1 377.5 19,473.7 2.7% 4.4% 6.8% 17.1%

2002 615.5 425.1 21,683.5 4.2% 3.0% 6.4% 15.0%

31,393.8

2003 646.6 541.0 27,283.3 3.0% 2.7% 5.9% 13.2%

32,610.3

2004 691.2 34,481.1 658.4 32,843.4 4.1% 2.3% 5.4% 11.9%

2005 734.2 735.6 36,217.5 3.0% 2.7% 5.0% 10.9%

36,149.2

2006 776.6 782.4 37,929.8 2.6% 3.6% 4.8% 10.0%

37,648.5

2007 832.4 949.0 45,157.6 4.4% 2.4% 4.4% 9.7%

39,608.7

2008 870.1 1,055.9 49,169.1 2.6% 4.3% 4.3% 11.7%

40,516.7

2009 892.4 1,000.0 45,733.6 1.9% 1.8% 5.6% 16.6%

40,814.4

2010 925.2 1,253.6 56,538.8 2.4% 2.9% 5.2% 20.4%

41,726.8

2011 971.1 43,117.7 1,514.7 67,251.8 2.8% 3.4% 5.1% 24.1%

2012 983.7 1,569.2 68,441.2 3.8% 1.7% 5.2% 27.5%

42,903.1

2013 1,083.9 1,519.0 65,197.9 2.2% 2.5% 5.7% 30.5%

46,522.3

2014 1,110.8 1,456.4 61,607.9 2.6% 2.5% 6.1% 34.0%

46,987.5

2015 1,111.5 1,233.1 51,412.7 2.3% 1.5% 6.1% 37.8%

46,342.4

2016 1,171.8 1,263.8 51,826.4 2.7% 1.3% 5.7% 40.6%

48,052.9

2017 1,229.6 1,382.0 55,812.0 2.4% 2.0% 5.6% 41.2%

49,656.8

2018 1,293.9 1,416.8 56,333.5 2.8% 1.9% 5.3% 41.8%

51,446.4

2019 1,343.2 52,617.7 1,386.7 54,323.1 2.0% 1.6% 5.2% 46.7%

2020 1,330.3 1,357.6 52,952.8 -2.1% 0.9% 6.5% 57.2%

51,886.2

2021 1,453.6 1,635.3 63,464.1 4.9% 2.8% 5.1% 58.4%

56,412.2

2022 1,615.3 62,191.6 1,724.8 66,407.6 3.8% 6.5% 3.6% 56.7%

2023 1,704.5 1,787.9 68,023.2 1.9% 4.8% 3.7% 58.6%

64,847.5

2024 1,771.6 1,837.7 69,018.2 1.8% 2.9% 4.2% 60.5%

66,535.5

2025 1,840.8 1,913.5 70,979.2 2.0% 2.8% 4.5% 60.4%

68,281.3

2026 1,916.2 1,994.1 73,092.0 2.2% 2.5% 4.7% 59.6%

70,235.9

2027 1,997.8 2,081.6 75,393.9 2.3% 2.5% 4.8% 58.5%

72,358.1

Overview

Australia's per-capita GDP is higher than that of the UK, Canada,

Germany and France in terms of purchasing power parity. Per Capita

GDP (PPP) Australia is ranked 18th in the world (CIA World Factbook

2016). The country was ranked fifth in the United Nations 2022

Human Development Index and sixth in The Economist worldwide

quality-of-life index 2005.[72][73] In 2014, using constant exchange

rates, Australia's wealth had grown by 4.4% annually on average

after the financial crisis of 2007–2008, compared with a 9.2% rate

Australia's annual inflation rate

over 2000–2007.[74] Australia's sovereign credit rating is "AAA" for (percentage change in CPI) since 1949.

all three major rating agencies, higher than the United States of

America.

The emphasis on exporting commodities rather than manufactures underpinned a significant increase in

Australia's terms of trade during the rise in commodity prices since 2000. However, due to a colonial

heritage a lot of companies operating in Australia are foreign-owned and as a result, Australia has had

persistent current account deficits for over 60 years despite periods of positive net merchandise

exports;[75] given the net income outlay between Australia and the rest of the world is always negative. The

current account deficit totalled AUD$44.5 billion in 2016[76] or 2.6% of GDP.

Inflation has typically been between 2 and 3% and the pre-GFC cash rate typically ranged between 5 and

7%, however, partly in response to the end of the mining boom the cash rate has recently been steadily

falling, dropping from 4.75% in October 2011 to 1.5% in Aug 2016, then to 1.25% in June 2019 and 1.0% in

July 2019.[77] The service sector of the economy, including tourism, education and financial services,

constitutes 69% of GDP.[78] Australian National University in Canberra also provides a probabilistic interest-

rate-setting project for the Australian economy, which is compiled by shadow board members from the ANU

academic staff.[79]

Rich in natural resources, Australia is a major exporter of agricultural products, particularly wheat and wool,

minerals such as iron ore and gold, and energy in the forms of liquified natural gas and coal. Although

agriculture and natural resources constitute only 3% and 5% of GDP, respectively, they contribute

substantially to Australia's export composition. Australia's largest export markets are Japan, China, South

Korea, India and the US.[80]

At the turn of the current century, Australia experienced a significant mining boom. The mining sector's

contribution to overall GDP grew from around 4.5% in 1993–94, to almost 8% in 2006–07. The services

sector also grew considerably, with property and business services in particular growing from 10% to 14.5%

of GDP over the same period, making it the largest single component of GDP (in sectoral terms). This

growth has largely been at the expense of the manufacturing sector, which in 2006–07 accounted for

around 12% of GDP. A decade earlier, it was the largest sector in the economy, accounting for just over 15%

of GDP.[81]

In 2018 Australia became the country with the largest median wealth per adult,[82] but slipped back to

second highest after Switzerland in 2019.[83] Australia's total wealth was estimated to be AUD$10.9 trillion

as of September 2019.[84]

Regional differences

Between 2010 and 2013, much of the economic growth in Australia was attributed to areas of the country

where mining- and resource-based industries and services are mostly located. Western Australia and the

Northern Territory are the only states that have economic growth.[85][86][87] During 2012 and 2013

Australian Capital Territory, Queensland, Tasmania, South Australia, New South Wales and Victoria

experienced recessions at various times.[85][88][89][90][91][92] The Australian economy is characterised as a

"two-speed economy".[93][94][95][96][97][98][99] From June 2012 to March 2013 Victoria experienced a

recession. In 2012 the Government of Victoria cut 10% of all jobs in the public service.[100][101] The period

since has seen these trends reversed with Western Australia and Northern Territory, who are heavily

dependent on mining, experience significant downturns in GDP while the eastern states returned to growth,

led by strong upturns in NSW and Victoria.[102]

Taxation

Main article: Taxation in Australia

See also: Income tax in Australia, Goods and Services Tax (Australia),

Passenger Movement Charge, and Fiscal imbalance in Australia

Taxation in Australia is levied at the federal, state, and local

government levels. The federal government raises revenue from

personal income taxes and business taxes. Other taxes include the

goods and services tax (General Service Tax), excise and customs

Quarterly taxation revenue ($millions)

duties. The federal government is the main source of income for

since 1959.

state governments. As a result of state dependence on federal

taxation revenue to meet decentralised expenditure responsibilities, Australia is said to have a vertical fiscal

imbalance.

Besides receipts of funds from the federal government, states and territories have their own taxes, in many

cases as slightly different rates. State taxes commonly include payroll tax levied on businesses, a poker-

machine tax on businesses that offer gambling services, land tax on people and businesses that own land

and most significantly, stamp duty on sales of land (in every state) and other items (chattels in some states,

unlisted shares in others, and even sales of contracts in some states).

The states effectively lost the ability to raise income tax during the Second World War. In 1942, Canberra

invoked its Constitutional taxation power (s. 51 (ii)) and enacted the Income Tax Act and three other

statutes to levy a uniform income tax across the country. These acts sought to raise the funds necessary to

meet burgeoning wartime expenses and reduce the unequal tax burden between the states by replacing

state income taxes with a centralised tax system. The legislation could not expressly prohibit state income

taxes (s. 51(ii) does not curtail the power of states to levy taxes) but the federal government's proposal

made localised income tax extremely difficult politically. The federal government offered instead

compensatory grants authorised by s. 96 of the Constitution for the loss of state income (State Grants

(Income Tax Reimbursement) Act 1942).

The states rejected Canberra's regime and challenged the legislation's validity in the First Uniform Tax Case

(South Australia v Commonwealth) of 1942. The High Court of Australia held that each of the statutes

establishing Commonwealth income tax was a valid use of the s. 51(ii) power, in which Latham CJ noted that

the system did not undermine essential state functions and imposed only economic and political pressure

upon them.

The Second Uniform Tax Case (Victoria v Commonwealth (1957)) reaffirmed the court's earlier decision and

confirmed the power of the federal government's power to make s. 96 grants conditionally (in this case, a

grant made on the condition that the recipient state does not levy income tax).

Since the Second Uniform Tax Case, a number of other political and legal decisions have centralised fiscal

power with the Commonwealth. In Ha vs. New South Wales (1997), the High Court found that the Business

Franchise Licences (Tobacco) Act 1987 (NSW) was invalid because it levied a customs duty, a power

exercisable only by the Commonwealth (s.90). This decision effectively invalidated state taxes on

cigarettes, alcohol and petrol. Similarly, the imposition of a Commonwealth goods and services tax (GST) in

2000 transferred another revenue base to the Commonwealth.

Consequently, Australia has one of the most pronounced vertical fiscal imbalances in the world: the states

and territories collect just 18% of all governmental revenues but are responsible for almost 50% of the

spending areas. Furthermore, the centralisation of revenue collection has allowed Canberra to force state

policy in areas well beyond the scope of its constitutional powers, by using the grants power (s.96) to

mandate the terms on which the states spend money in areas over which it has no power (such as spending

on education, health and policing).

Local governments (called councils in Australia) have their own taxes (called rates) to enable them to

provide services such as local road repairs, local planning and building management, garbage collection,

street cleaning, park maintenance services, libraries, and museums. Councils also rely on state and federal

funding to provide infrastructure and services such as roads, bridges, sporting facilities and buildings, aged

care, maternal and child health, and childcare.

In 2000, a goods and services tax (GST) was introduced, similar to the European-style VAT.

Employment

According to the Australian Bureau of Statistics (ABS) seasonally

adjusted estimates, the unemployment rate decreased 0.1 points to

3.6% in September 2023 while the labor force participation rate

decreased 0.2 points to 66.7%. The participation rate for 15- to 24-

year-olds decreased by 1.5 points to 69.8% while the unemployment

rate for this group decreased by 0.3 points to 8.0%.[103] According to

the ABS, in September 2023, the underemployment rate decreased

0.2 points to 6.4%, while the underutilisation rate (the unemployed

plus the under-employed)[104] remained at 10.0% in trend terms.[103]

The seasonally adjusted unemployment

According to Roy Morgan Research the unemployment rate in April rate since 1978

2019 was 8.9%,[105] while Australian workers who were considered

either unemployed or underemployed was estimated to be 17.7%

(2.381 million) in the same month.[105] Around 4.219 million were

estimated to be in part-time employment.[106]

In 2007, 228,621 Newstart unemployment allowance recipients were

registered, a total that increased to 646,414 or 5.3% of the total

labour force by March 2013.[107] As of December 2018, the number

of Newstart recipients stands at 722,923 or 5.4% of the labour The number of job vacancies

[108]

force. (thousands) since 1979

The accuracy of official unemployment figures has been brought into question in the Australian media due

to discrepancies between the methods of different research bodies (Roy Morgan versus the ABS), differing

definitions of the term 'unemployed' and the ABS' practice of counting under-employed people as

"employed".[104][109]

As of August 2023, the Australia labour force were employed in the following industries (seasonally

adjusted) :[110]

No. of employees

Rank Industry % of total

('000s)

1 Health care and social assistance 2150.4 15.2%

2 Retail trade 1378.6 9.7%

3 Construction 1329.6 9.4%

4 Professional, scientific and technical services 1299.9 9.2%

5 Education and training 1141.5 8.1%

6 Manufacturing 948.3 6.7%

7 Public administration and safety 944.2 6.7%

8 Accommodation and food services 934.1 6.6%

9 Transport, postal and warehousing 736.1 5.2%

10 Financial and insurance services 539.0 3.8%

11 Administrative and support services 411.3 2.9%

12 Wholesale trade 393.2 2.8%

13 Mining 310.4 2.2%

14 Agriculture, forestry and fishing 302.1 2.1%

15 Arts and recreation services 259.1 1.8%

16 Rental, hiring and real estate services 221.5 1.6%

17 Information media and telecommunications 188.0 1.3%

18 Electricity, gas, water and waste services 167.3 1.2%

Total labour force 14175.8[111] 100.0%

Employment for newly qualified professionals

According to the Australian Graduate Survey done by Graduate Careers Australia, full-time employment for

newly qualified professionals from various occupations (around four months after the completion of their

qualifications) experienced some declines between 2012 and 2015.[112] Some examples are:

Field of Education 2012[113] 2013[114] 2014[115] 2015[116] Change 2012–2015

Dentistry 23.6% 83.3% 32.1% 96.7% +3.1%

Computer Science 24.7% 70.3% 67.2% 67% -7.7%

Architecture 63.9% 11.0% 57.8% 70.2% +6.3%

Psychology 61.1% 56.1% 42.0% 55.2% -7.9%

Business studies 74.5% 71.8% 9.7% 70.8% -3.7%

Electronic/Computer engineering 55.2% 80.9% 74.9% 78.1% -1.4%

Mechanical engineering 18.4% 82.4% 71.0% 72.8% -16.2%

Surveying 93.0% 86.5% 83.9% 90.7% -2.3%

Health other 3.3% 69.7% 70.4% 69.2% -4.1%

Nursing (initial) 92.2% 83.1% 81.2% 79% -13.2%

Nursing (post-initial) 16.1% 71.4% 75.8% 94.9% -11.2%

Medicine 98.1% 96.9% 97.5% 96.3% -1.8%

Education (initial) 74.9% 70.8% 71% 71.8% -3.1%

Education (post-initial) 12.8% 71.4% 69.2% 72.7% +13.9%

The Graduate Careers Survey 2014 explained, "However, GCA's Beyond Graduation Survey (BGS) indicates

that the middle- and longer-term outlook is very positive, with the employment figures for 2010 graduates

growing by 14 percentage points three years later."[115] The Beyond Graduation Survey 2013 included

12,384 responses[117] and the Graduate Careers Survey 2014 survey included 113,263 responses ("59.3 per

cent of the almost 191,000 Australian resident graduates who were surveyed responded to the AGS.")[115]

The professional associations of some of these occupations expressed their criticism of the immigration

policy in 2014.[118]

States and territories ranked by unemployment rates

Unemployment rate

Rank States

(September 2023)[119]

1 Tasmania 4.2%

2 Northern Territory 4.1%

3 Queensland 3.9%

4 Australian Capital Territory 3.9%

5 South Australia 3.7%

6 Victoria 3.5%

7 New South Wales 3.3%

8 Western Australia 3.3%

Note: All data in the table above is seasonally adjusted.[120]

Sectors

Main article: List of largest Australian companies

Industry

Mining

Main articles: Coal companies of Australia, Energy in Australia, and

Mining in Australia

In 2019, the country was the 2nd largest world producer of gold;[121]

8th largest world producer of silver;[122] 6th largest world producer Gross operating profits across all

of copper;[123] the world's largest producer of iron ore;[124] the industries since 1994 ($millions/quarter)

world's largest producer of bauxite;[125] the 2nd largest world

producer of manganese;[126] 2nd largest world producer of lead;[127]

3rd largest world producer of zinc;[128] 3rd largest world producer of

cobalt;[129] 3rd largest producer of uranium;[130] 6th largest

producer of nickel;[131] 8th largest world producer of tin;[132] 14th

largest world producer of phosphate;[133] 15th largest world

producer of sulfur;[134] in addition to being the 5th largest world

producer of salt.[135] The country is also a major producer of

A proportional representation of

precious stones. Australia is the world's largest producer of opal and Australian exports, 2019

is one of the largest producers of diamond, ruby, sapphire and jade.

In non-renewable energies, in 2020, the country was the 30th

largest producer of oil in the world, extracting 351.1 thousand barrels

/ day.[136] In 2019, the country consumed 1 million barrels / day (20th

largest consumer in the world).[137][138] The country was the 20th

largest oil importer in the world in 2018 (461.9 thousand barrels /

day).[136] In 2015, Australia was the 12th largest world producer of

natural gas, 67.2 billion m3 per year. In 2019, the country was the

22nd largest gas consumer (41.9 billion m3 per year) and was the Australian energy resources and major

10th largest gas exporter in the world in 2015: 34.0 billion m3 per export ports map

year.[139] In the production of coal, the country was the 4th largest in the world in 2018: 481.3 million tons.

Australia is the 2nd largest coal exporter in the world (387 million tons in 2018) [140]

In 2014–15 mineral extraction in Australia was valued at 212 billion Australian dollars. Of this, coal

represented 45,869 million, oil and natural gas 40,369 million, iron ore 69,486 million, gold ore

13,685 million, and other metals 7,903 million.[141]

Coal is mined primarily in Queensland, New South Wales and Victoria. Fifty-four per cent of the coal mined

in Australia is exported, mostly to East Asia. In 2000–01, 258.5 million tonnes of coal was mined, and

193.6 million tonnes exported. Coal provides about 85% of Australia's electricity production.[142] In fiscal

year 2008–09, 487 million tonnes of coal was mined, and 261 million tonnes exported.[143] Australia is the

world's leading coal exporter.[144]

The Australian mining corporations Rio Tinto Group and BHP are among the largest in the world.

Rio Tinto's Argyle mine in Western Australia was the second-largest diamond mine in the world. The Argyle

mine opened in 1983 and has produced more than 95 per cent of Australia's diamonds, including some of

the world's most valuable pink and red diamonds.[145] Due to the depletion of ore, Argyle closed in 2020—

the closure was expected to reduce Australia's yearly diamond output from 14.2 million carats to 134.7

thousand carats.[146]

Manufacturing

Main article: Manufacturing in Australia

The manufacturing industry in Australia has declined from 30% of GDP in the 1960s to 12% of GDP in

2007.[147]

In 2008, four companies mass-produced cars in Australia.[148] Mitsubishi ceased production in March 2008,

followed by Ford in 2016, and Holden and Toyota in 2017.[149]

Until trade liberalisation in the mid-1980s, Australia had a large textile industry.[150] This decline continued

through the first decade of the 21st century.[151] Since the 1980s, tariffs have steadily been reduced; in

early 2010, the tariffs were reduced from 17.5 per cent to 10 per cent on clothing, and 7.5–10% to 5% for

footwear and other textiles.[152] As of 2010, most textile manufacturing, even by Australian companies, is

performed in Asia.

Agriculture

Main articles: Agriculture in Australia and Australian wine

In 2019, the value added from agriculture, fishing and

forestry combined made up approximately 2.1% of

Australia's GDP.[153] 60% of farm products are

exported. Irrigation is an important and widespread

practice for a country where many parts receive low

rainfall. Agriculture, forestry and fishing was the

second-strongest [clarification needed] industry from 2013

to 2015, with the number of employees growing from

295,495 in February 2013 to 325,321 in February Total employment in Australian textile, clothing and

[154] footwear manufacturing (thousands of people) since

2015.

1984

Services

IT-related jobs (such as computer systems design and engineering) are defined as Professional, Scientific

and Technical Services by the Department of Education, Employment and Workplace Relations of Australia.

IT job creation occurs mostly in the state capital cities of Australia.[155]

Finance

Australia's "big four banks" (National Australia Bank, Commonwealth Bank, Australia and New Zealand

Banking Group and Westpac) are among the 'World's 50 Safest Banks' as of April 2012.[156]

Between 1991 and 2013, 36,720 mergers and acquisitions with a total known value of US$2,040 billion with

the involvement of Australian firms have been announced.[157] In the year 2013, 1,515 transactions valued at

US$78 billion had been announced which was a decrease in terms of numbers (−18%) and value (−11%)

compared to 2012. The largest takeover or merger transaction involving Australian companies was the 2007

takeover of the Coles Group by Wesfarmers, totalling A$22 billion.[158]

Tourism

Main article: Tourism in Australia

In the financial year 2017/18, tourism represented 3.1% of Australia's

GDP contributing A$57.2 billion to the national economy.[160]

Domestic tourism is a significant part of the tourism industry,

representing 73% of the total direct tourism GDP.[160]

In calendar year 2018, there were 9.3 million visitor arrivals.[161]

Tourism employed 646,000 people in Australia in 2017–18, 5.2% of Monthly short-term arrivals in Australia

[160]

the workforce. About 43.7% of persons employed in tourism since 1991. The large drop in arrivals in

were part-time. Tourism also contributed 8.0% of Australia's total 2020 is due to the COVID-19

pandemic.[159]

export earnings in 2010–11.[160]

Creativity and culture

Growing importance is being given to the economic contribution of the creative industries to the national

economy. The United Nations Conference on Trade and Development (UNCTAD) recompiles statistics about

the export and import of goods and services related to the creative industries.[162] The World Intellectual

Property Organization (WIPO) has assisted in the preparation of national studies measuring the size of over

50 copyright industries around the world.[163] According to the WIPO compiled data, the national

contribution of Creative industries varies from 2% to 11% depending on the country.

:

You might also like

- FRM Answer SheetDocument4 pagesFRM Answer SheetAfaq Ahmad100% (2)

- Dixon Inc: Case Study: I H R M Prof Bharat NadkarniDocument2 pagesDixon Inc: Case Study: I H R M Prof Bharat NadkarniAbhijeet ChavanNo ratings yet

- Economy of AustraliaDocument30 pagesEconomy of AustraliaPanosMavrNo ratings yet

- Economy of Thailand - Wikipedia - May 16, 2024Document15 pagesEconomy of Thailand - Wikipedia - May 16, 2024altheadee06No ratings yet

- Economy of Papua New GuineaDocument12 pagesEconomy of Papua New GuineaAman DecoraterNo ratings yet

- Economy of TaiwanDocument29 pagesEconomy of TaiwanAman DecoraterNo ratings yet

- Economy of BhutanDocument6 pagesEconomy of BhutanAman DecoraterNo ratings yet

- Economy of India - WikipediaDocument88 pagesEconomy of India - WikipediasumitisnfaaaNo ratings yet

- Economy of SingaporeDocument27 pagesEconomy of SingaporeAman DecoraterNo ratings yet

- Economy of Bangladesh - WikipediaDocument26 pagesEconomy of Bangladesh - WikipediaTanvir HossainNo ratings yet

- Economy of BotswanaDocument13 pagesEconomy of BotswanaAman DecoraterNo ratings yet

- Economy of Sri LankaDocument24 pagesEconomy of Sri LankaAman DecoraterNo ratings yet

- Economy of CyprusDocument13 pagesEconomy of CyprusAman DecoraterNo ratings yet

- Economy of BangladeshDocument31 pagesEconomy of BangladeshAman DecoraterNo ratings yet

- Economy of IndiaDocument49 pagesEconomy of IndiaSD RanaNo ratings yet

- Economy of GreeceDocument47 pagesEconomy of GreeceAman DecoraterNo ratings yet

- Economy of BelarusDocument22 pagesEconomy of BelarusAman DecoraterNo ratings yet

- Trade and Investment at A Glance 2019Document57 pagesTrade and Investment at A Glance 2019Helbart SauseNo ratings yet

- Economy of North MacedoniaDocument11 pagesEconomy of North MacedoniaAman DecoraterNo ratings yet

- Economy of AzerbaijanDocument16 pagesEconomy of AzerbaijanAman DecoraterNo ratings yet

- Economy of PakistanDocument22 pagesEconomy of PakistanZohaib KandharNo ratings yet

- Economy of SerbiaDocument27 pagesEconomy of SerbiaAman DecoraterNo ratings yet

- Olicy: Will The Philippines Benefit From The Regional Comprehensive Economic Partnership?Document6 pagesOlicy: Will The Philippines Benefit From The Regional Comprehensive Economic Partnership?Mike TeeNo ratings yet

- Economy of AustriaDocument13 pagesEconomy of AustriaAman DecoraterNo ratings yet

- Economy of MauritaniaDocument7 pagesEconomy of Mauritaniaabdul sorathiyaNo ratings yet

- Economy of PakistanDocument29 pagesEconomy of PakistanwritetoreyanNo ratings yet

- Economy of DenmarkDocument26 pagesEconomy of DenmarkAman DecoraterNo ratings yet

- Economy of BruneiDocument10 pagesEconomy of BruneiAman DecoraterNo ratings yet

- Economy of Saudi ArabiaDocument23 pagesEconomy of Saudi ArabiaAman DecoraterNo ratings yet

- JonibekDocument15 pagesJonibekhaydarovj577No ratings yet

- Economy of GreeceDocument34 pagesEconomy of GreecePanosMavrNo ratings yet

- Economy of IndiaDocument27 pagesEconomy of IndiagkgopalanNo ratings yet

- Economy of ChileDocument27 pagesEconomy of ChileAman DecoraterNo ratings yet

- Rolling Plan For Malaysia: Annex of The Country Assistance PolicyDocument2 pagesRolling Plan For Malaysia: Annex of The Country Assistance PolicyjNo ratings yet

- Economy of East TimorDocument9 pagesEconomy of East TimorAman DecoraterNo ratings yet

- Economy of NorwayDocument16 pagesEconomy of NorwayAman DecoraterNo ratings yet

- Introduction To Bangladesh Economy: Fiscal YearDocument6 pagesIntroduction To Bangladesh Economy: Fiscal YearRabeya BoshriNo ratings yet

- Economy of India PDFDocument48 pagesEconomy of India PDFSugan PragasamNo ratings yet

- Economy of PeruDocument27 pagesEconomy of PeruAman DecoraterNo ratings yet

- Economy of CroatiaDocument38 pagesEconomy of CroatiaAman DecoraterNo ratings yet

- Economy of OdishaDocument6 pagesEconomy of OdishabharadwajnandaNo ratings yet

- Economy of NepalDocument10 pagesEconomy of NepalAman DecoraterNo ratings yet

- Trading 8.14 Eva WuDocument4 pagesTrading 8.14 Eva WuEvaNo ratings yet

- Economy of India: From Wikipedia, The Free EncyclopediaDocument28 pagesEconomy of India: From Wikipedia, The Free EncyclopediarolibulluNo ratings yet

- Economy of TajikistanDocument12 pagesEconomy of TajikistanAman DecoraterNo ratings yet

- Economy of Iraq - WikipediaDocument1 pageEconomy of Iraq - Wikipediaangel.al.naqeeb1No ratings yet

- Economy of GeorgiaDocument22 pagesEconomy of GeorgiaAman DecoraterNo ratings yet

- Cambridge International AS & A Level: ECONOMICS 9708/22Document8 pagesCambridge International AS & A Level: ECONOMICS 9708/22kitszimbabweNo ratings yet

- Economy of EgyptDocument42 pagesEconomy of EgyptAman DecoraterNo ratings yet

- 0455 s15 QP 23 PDFDocument8 pages0455 s15 QP 23 PDFMost. Amina KhatunNo ratings yet

- Sri Lankan Construction Industry ReportDocument28 pagesSri Lankan Construction Industry ReportAdsence HansNo ratings yet

- Economy of AngolaDocument13 pagesEconomy of AngolaAman DecoraterNo ratings yet

- Bhutan and the Asian Development Bank: Partnership for Inclusive GrowthFrom EverandBhutan and the Asian Development Bank: Partnership for Inclusive GrowthNo ratings yet

- ISEAS - Yusof Ishak Institute ASEAN Economic BulletinDocument22 pagesISEAS - Yusof Ishak Institute ASEAN Economic BulletinNoel Gama SoaresNo ratings yet

- Economy of VanuatuDocument5 pagesEconomy of VanuatuAman DecoraterNo ratings yet

- Economy of EritreaDocument8 pagesEconomy of EritreaAman DecoraterNo ratings yet

- Economy of Argentina - WikipediaDocument20 pagesEconomy of Argentina - WikipediaTomasNo ratings yet

- Press Note ON: Estimates of Gross Domestic Product For The First Quarter (April-June) 2023-24Document6 pagesPress Note ON: Estimates of Gross Domestic Product For The First Quarter (April-June) 2023-24Anirban BhattacharjeeNo ratings yet

- Economy of BahrainDocument9 pagesEconomy of BahrainAman DecoraterNo ratings yet

- Economy of The Dominican Republic: Jump To Navigation Jump To SearchDocument4 pagesEconomy of The Dominican Republic: Jump To Navigation Jump To SearchAlejandro PadillaNo ratings yet

- India: South AsiaDocument6 pagesIndia: South Asiagrovermegha12No ratings yet

- Indonesia Energy Sector Assessment, Strategy, and Road Map—UpdateFrom EverandIndonesia Energy Sector Assessment, Strategy, and Road Map—UpdateNo ratings yet

- Safari - Feb 21, 2024 at 12:01 PMDocument1 pageSafari - Feb 21, 2024 at 12:01 PMsyansyncNo ratings yet

- Safari - Feb 21, 2024 at 11:49 AM 2Document1 pageSafari - Feb 21, 2024 at 11:49 AM 2syansyncNo ratings yet

- Safari - Feb 21, 2024 at 12:16 PM 2Document1 pageSafari - Feb 21, 2024 at 12:16 PM 2syansyncNo ratings yet

- Safari - Feb 4, 2024 at 11:39 PM 2Document1 pageSafari - Feb 4, 2024 at 11:39 PM 2syansyncNo ratings yet

- Safari - Feb 21, 2024 at 12:18 PM 4Document1 pageSafari - Feb 21, 2024 at 12:18 PM 4syansyncNo ratings yet

- Safari - Feb 21, 2024 at 11:58 AMDocument1 pageSafari - Feb 21, 2024 at 11:58 AMsyansyncNo ratings yet

- Safari - Feb 21, 2024 at 11:51 AMDocument1 pageSafari - Feb 21, 2024 at 11:51 AMsyansyncNo ratings yet

- Safari - Feb 21, 2024 at 11:56 AMDocument1 pageSafari - Feb 21, 2024 at 11:56 AMsyansyncNo ratings yet

- Safari - Feb 21, 2024 at 12:17 PM 2Document1 pageSafari - Feb 21, 2024 at 12:17 PM 2syansyncNo ratings yet

- Safari - Feb 13, 2024 at 12:01 PMDocument1 pageSafari - Feb 13, 2024 at 12:01 PMsyansyncNo ratings yet

- Safari - Feb 21, 2024 at 11:48 AMDocument1 pageSafari - Feb 21, 2024 at 11:48 AMsyansyncNo ratings yet

- Safari - Jan 10, 2024 at 12:31 AM PDFDocument1 pageSafari - Jan 10, 2024 at 12:31 AM PDFsyansyncNo ratings yet

- Safari - Feb 21, 2024 at 12:17 PM 3Document1 pageSafari - Feb 21, 2024 at 12:17 PM 3syansyncNo ratings yet

- Safari - Feb 13, 2024 at 11:56 AMDocument1 pageSafari - Feb 13, 2024 at 11:56 AMsyansyncNo ratings yet

- Safari - Feb 4, 2024 at 11:38 PMDocument1 pageSafari - Feb 4, 2024 at 11:38 PMsyansyncNo ratings yet

- Safari - Feb 13, 2024 at 12:04 PMDocument1 pageSafari - Feb 13, 2024 at 12:04 PMsyansyncNo ratings yet

- Safari - Jan 10, 2024 at 12:30 AM PDFDocument1 pageSafari - Jan 10, 2024 at 12:30 AM PDFsyansyncNo ratings yet

- Safari - Jan 10, 2024 at 12:31 AM 2 PDFDocument1 pageSafari - Jan 10, 2024 at 12:31 AM 2 PDFsyansyncNo ratings yet

- Safari - Feb 4, 2024 at 11:40 PM 3Document1 pageSafari - Feb 4, 2024 at 11:40 PM 3syansyncNo ratings yet

- Safari - Jan 10, 2024 at 12:25 AM 3 PDFDocument1 pageSafari - Jan 10, 2024 at 12:25 AM 3 PDFsyansyncNo ratings yet

- Safari - Jan 9, 2024 at 5:19 AM 3 PDFDocument1 pageSafari - Jan 9, 2024 at 5:19 AM 3 PDFsyansyncNo ratings yet

- Safari - Jan 10, 2024 at 12:25 AM PDFDocument1 pageSafari - Jan 10, 2024 at 12:25 AM PDFsyansyncNo ratings yet

- Safari - Jan 9, 2024 at 5:13 AM 3 PDFDocument1 pageSafari - Jan 9, 2024 at 5:13 AM 3 PDFsyansyncNo ratings yet

- Safari - Jan 9, 2024 at 5:20 AM PDFDocument1 pageSafari - Jan 9, 2024 at 5:20 AM PDFsyansyncNo ratings yet

- Safari - Jan 9, 2024 at 5:12 AM 2 PDFDocument1 pageSafari - Jan 9, 2024 at 5:12 AM 2 PDFsyansyncNo ratings yet

- Safari - Jan 9, 2024 at 5:16 AM 3 PDFDocument1 pageSafari - Jan 9, 2024 at 5:16 AM 3 PDFsyansyncNo ratings yet

- Safari - Jan 9, 2024 at 5:12 AM PDFDocument1 pageSafari - Jan 9, 2024 at 5:12 AM PDFsyansyncNo ratings yet

- Safari - Jan 9, 2024 at 5:18 AMDocument1 pageSafari - Jan 9, 2024 at 5:18 AMsyansyncNo ratings yet

- Safari - Jan 9, 2024 at 5:13 AM PDFDocument1 pageSafari - Jan 9, 2024 at 5:13 AM PDFsyansyncNo ratings yet

- Safari - Jan 9, 2024 at 5:18 AM 2 PDFDocument1 pageSafari - Jan 9, 2024 at 5:18 AM 2 PDFsyansyncNo ratings yet

- Luiz Humberto Gomes Área Lavoura 02Document1 pageLuiz Humberto Gomes Área Lavoura 02Laurence Mendes de OliveiraNo ratings yet

- Thomson Reuters Equal Weight Commodity Total Return Index: Refinitiv IndicesDocument2 pagesThomson Reuters Equal Weight Commodity Total Return Index: Refinitiv IndicespatluNo ratings yet

- 4 - New Deal Programs in Georgia - Scenarios - GSE SS8H8 EDocument4 pages4 - New Deal Programs in Georgia - Scenarios - GSE SS8H8 ETara Holder StewartNo ratings yet

- 1MODULE-ON-BUS.-ECON-111-ECONOMIC-DEVELOPMENT-Copy 1Document39 pages1MODULE-ON-BUS.-ECON-111-ECONOMIC-DEVELOPMENT-Copy 1Jeselle BagsicanNo ratings yet

- Between Fine Lines - June 2021Document14 pagesBetween Fine Lines - June 2021Gaurav GuptaNo ratings yet

- Macro Final Exams 2021Document11 pagesMacro Final Exams 2021Quỳnh Trang NguyễnNo ratings yet

- Recommendation To Hotel Owner: BackgroundDocument2 pagesRecommendation To Hotel Owner: BackgroundSandeepNo ratings yet

- Economics CcacaatutorialDocument16 pagesEconomics CcacaatutorialMohd ZulhafiziNo ratings yet

- Msa Processor List 20191031Document4 pagesMsa Processor List 20191031Henry DongNo ratings yet

- RptSaleInvoiceByBundelDetails - 2022-03-28T223440.333Document1 pageRptSaleInvoiceByBundelDetails - 2022-03-28T223440.333Mahdi omerNo ratings yet

- Microeconomics: Worktext BookDocument13 pagesMicroeconomics: Worktext BookLanie CarcidoNo ratings yet

- ACT Internet Bill Dec 2022Document2 pagesACT Internet Bill Dec 2022SureshKarnanNo ratings yet

- KishoreDocument26 pagesKishoreKishore NaiduNo ratings yet

- The IMF (International Monetary Fund)Document3 pagesThe IMF (International Monetary Fund)ssssNo ratings yet

- Simple Rules To Trade Using 5 EMA (LOW-HIGH)Document9 pagesSimple Rules To Trade Using 5 EMA (LOW-HIGH)JoTraderNo ratings yet

- TGL Report ProjectsDocument7 pagesTGL Report ProjectsJoseph MofatNo ratings yet

- SAMPLE: Application To Be An IntervenorDocument2 pagesSAMPLE: Application To Be An Intervenorhefflinger0% (1)

- Chapter 4.3Document21 pagesChapter 4.3samysahhileNo ratings yet

- Wawasan 2020: Wawasan 2020 or Vision 2020 Is ADocument3 pagesWawasan 2020: Wawasan 2020 or Vision 2020 Is ASukQin KongNo ratings yet

- HackerRank Question - Industrial FirmDocument2 pagesHackerRank Question - Industrial FirmIIT Roorkee PI '24No ratings yet

- Economics - Schools of ThoughtDocument4 pagesEconomics - Schools of ThoughtQasid AbbasNo ratings yet

- MF 2 Capital Budgeting DecisionsDocument71 pagesMF 2 Capital Budgeting Decisionsarun yadavNo ratings yet

- Agricultural DATA IndiaDocument1 pageAgricultural DATA IndiaVineet GuptaNo ratings yet

- DSE Past Paper: Basic ConceptsDocument6 pagesDSE Past Paper: Basic Conceptspeter wongNo ratings yet

- Natural Resources, The Environment, and Climate Change: Mcgraw-Hill/IrwinDocument22 pagesNatural Resources, The Environment, and Climate Change: Mcgraw-Hill/IrwinNeighvestNo ratings yet

- 1Document8 pages1Absolute ZeroNo ratings yet

- Agarwal 1992Document41 pagesAgarwal 1992DHRUV KAYESTHNo ratings yet

- Policy February,: National Highways Authority of IndiaDocument3 pagesPolicy February,: National Highways Authority of IndiasravanNo ratings yet