Professional Documents

Culture Documents

Harman Connected Services 1

Harman Connected Services 1

Uploaded by

ramitkatyalOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Harman Connected Services 1

Harman Connected Services 1

Uploaded by

ramitkatyalCopyright:

Available Formats

taxsutra All rights reserved

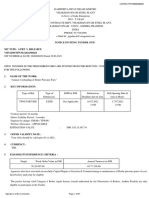

IN THE INCOME TAX APPELLATE TRIBUNAL

“B” BENCH : BANGALORE

BEFORE SHRI N. V. VASUDEVAN, VICE PRESIDENT AND

MS. PADMAVATHY S, ACCOUNTANT MEMBER

IT(TP)A No.49/Bang/2019

Assessment Year : 2014-15

M/s. Harman Connected Services Vs. Deputy Commissioner of

Corporation India Private Limited, Income Tax,

4A, Jupiter, Prestige Technology Park, Circle - 3(1)(2),

Sarjapur, Marathahalli Road, Bengaluru.

Kadubeesanahalli Village,

Bengaluru – 560 103.

PAN: AACCH 1585 J

APPELLANT RESPONDENT

Assessee by : Shri. T. Suryanarayana, Senior Advocate

Revenue by : Dr. Manjunath Karkihalli, CIT(DR)(ITAT), Bengaluru.

Date of hearing : 27.06.2022

Date of Pronouncement : 30.06.2022

ORDER

Per N V Vasudevan, Vice President

This is an appeal by the assessee against the final Order of

Assessment dated 10.10.2018 passed by the DCIT, Circle – 3(1)(2),

Bengaluru, under section 143(3) r.w.s. 144C of the Income Tax Act, 1961

(hereinafter called ‘the Act’), relating to Assessment Year 2014-15.

2. The assessee is a subsidiary of Harman International Industries Inc.,

USA and is engaged in rendering services in the nature of SWD services

and related professional services to Harman Group companies. The SWD

services rendered by the assessee include software coding, testing,

Downloaded by 1neeraj@vaishlaw.com at 11/07/23 07:48pm

taxsutra All rights reserved

IT(TP)A No. 49/Bang/2019

Page 2 of 31

integration, release and post release support. The assessee is also engaged in

trading of the infotainment systems, where the assessee purchases

professional loudspeakers, audio special effect equipment, audio mixing

consolers, consumer electronics and microphones and headphones from its

Associate Enterprises (AEs) to be sold to domestic third-party customers.

3. During the previous year relevant to Assessment Year 2014-15, the

assessee, inter alia, provided SWD services to its AEs for a consideration of

Rs. 102,38,70,343/- and earned a net cost-plus mark-up of 19.64%. The

assessee also purchased goods from its AEs for a consideration of

Rs. 64,41,74,821/- for trading segment. In the trading segment, the assessee

earned a gross profit margin of Rs. 24.94%.

4. On a reference made by the Assessing Officer (‘AO’) to the TPO,

the TPO passed an order dated 31.10.2017 under Section 92CA of the

Income-tax Act, 1961 (‘the Act’) determining a TP adjustment of

Rs.8,34,81,655/- in respect of the SWD services segment and

Rs.11,36,10,183/- in the trading segment, aggregating to total TP

adjustment of Rs.19,70,91,838/-.

5. Initially, a draft assessment order dated 15.12.2017 came to be

passed by the AO in which, inter alia, the aforesaid TP adjustment was

incorporated. The AO also proposed to restrict the depreciation claimed on

computer software at 25% as opposed to 60% claimed by the assessee and

proposed to disallow the provision for warranty in excess of the utilization.

6. Aggrieved, the assessee filed its objections before the DRP which,

vide its directions dated 24.09.2018, rejected the assessee’s objections to a

large extent while granting marginal relief.

Downloaded by 1neeraj@vaishlaw.com at 11/07/23 07:48pm

taxsutra All rights reserved

IT(TP)A No. 49/Bang/2019

Page 3 of 31

7. Pursuant to the directions of the DRP, the AO passed the final

assessment order dated 30.10.2018 in which the TP adjustment was

reworked to Rs. 16,75,21,761/-. The other additions made on corporate tax

were sustained.

8. Aggrieved by the final assessment order, the assessee has filed the

appeal before this Hon’ble Tribunal. We will deal with the addition made

on account of determination of Arm’s Length Price (ALP) in the SWD

services segment, trading segment and thereafter the Corporate Tax issues

raised by the assessee in its appeal, in that order.

9. SWD SERVICES SEGMENT OF THE ASSESSEE

The Net mark-up on cost earned by the assessee (as reflected in the

TP Order):

Operating Income Rs. 1,02,38,70,343/-

Operating Cost Rs.85,57,58,886/-

Operating Profit (Op. Income – Op. Cost) Rs.16,80,84,457/-

Operating/Net cost plus mark-up (‘OP/OC’) 19.64%

10. Both the assessee and the TPO chose Transaction Net Margin

Method (TNMM) as the Most Appropriate Method (MAM) for determining

ALP. The profit level indicator chosen for the purpose of comparing

assessee’s margin with that of comparable companies was OP/OC. The

assessee’s OP/OC was 19.64%. The assessee chose 9 comparable

companies whose average arithmetic mean profit margin was 14.22%. The

assessee therefore claimed that the price received from the AE was to be

treated as at arm’s length under section 92 of the Act. The TOP accepted 2

out of 9 comparable companies chosen by the assessee and he on his own

Downloaded by 1neeraj@vaishlaw.com at 11/07/23 07:48pm

taxsutra All rights reserved

IT(TP)A No. 49/Bang/2019

Page 4 of 31

identified 6 other comparable companies. The TPO determined ALP as

follows:

Comparables selected by the TPO and their arithmetic mean:

Sl. No. Name of the Company OP/OC

(WC-unadj)

(in %)

1 Infosys Ltd. 36.13

2 Larsen & Toubro Infotech Ltd. 24.61

3 Mindtree Ltd. 20.43

4 Persistent Systems Ltd. 35.10

5 R S Software (India) Ltd. 24.25

6 Cigniti Technologies Ltd. 27.62

7 SQS India Ltd. 22.37

8 Thirdware Solution Ltd. 44.68

Arithmetic mean 29.40

Computation of arm’s length price by the TPO and the adjustment

made:

Arm’s length mean Mark-up 29.40%

Operating Cost Rs. 85,57,58,886/-

Arm’s Length Price @129.40% of cost Rs.1,10,73,51,998/-

Price Received Rs.1,02,38,70,343/-

Shortfall being adjustment u/s. 92CA of the Act Rs.8,34,81,655/-

11. The addition of Rs.8,34,81,655/- suggested by the TPO as short fall

in the ALP was added to the total income by the AO in the Draft Order of

Assessment. The assessee filed objections before the Dispute Resolution

Panel (DRP) against the Draft Order of Assessment under section 144C of

the Act.

12. The DRP issued the following directions to the TPO:

Downloaded by 1neeraj@vaishlaw.com at 11/07/23 07:48pm

taxsutra All rights reserved

IT(TP)A No. 49/Bang/2019

Page 5 of 31

The following companies were directed by the DRP to be excluded from the

list of comparables by accepting the contentions of the assessee:

(i) Cigniti Technologies Ltd.; and

(ii) SQS India Ltd.

13. The DRP, on holding that Sagarsoft India Ltd. is functionally

comparable to the assessee, directed the TPO to verify if the company passes

other filters applied by him, and if so, to include it in the final list of

comparables. The other contentions of the assessee seeking the exclusion of

incomparable companies and inclusion of comparable companies came to be

rejected.

14. The DRP upheld the action of the TPO in not granting any

adjustment towards the differences in working capital (“WC Adjustment”)

of the assessee and the comparable companies. The AO passed the

impugned final assessment order in line with the directions of the DRP in

which the SWD services TP adjustment was reworked to Rs.5,49,84,884/-.

Aggrieved by the aforesaid addition, the assessee is in appeal before the

Tribunal. Briefly, the grounds in the appeal which are being pressed are as

follows:

(i) That the DRP erred in upholding the inclusion of:

(a) Infosys Ltd.; (Ground No. 1(f))

(b) Larsen and Toubro Infotech Ltd.; (Ground No. 1(g));

(c) Persistent Systems Ltd.; (Ground No. 1(i)); and

(d) Thirdware Solutions Ltd. (Ground No. 1(k))

Downloaded by 1neeraj@vaishlaw.com at 11/07/23 07:48pm

taxsutra All rights reserved

IT(TP)A No. 49/Bang/2019

Page 6 of 31

(ii) That the DRP erred in upholding the exclusion Akshay Software

Technologies Ltd., and Maveric Systems Ltd. (Ground Nos. 1(l) and

(n)).

(iii) That the lower authorities erred in not granting WC Adjustment

(Ground No. 1(e)).

15. As far as ground Nos. 1(f), (g), (i) and (k) and Ground No. 8 in the

appeal are concerned, the assessee in these grounds seeks exclusion of

Infosys Ltd., Larsen and Toubro Infotech Ltd., Persistent Systems Ltd. and

Thirdware Solutions Ltd. from the list of comparables.

(a) Infosys Ltd. (‘Infosys’):

This company earns income from both rendering software services and

development of products. Despite rendering diverse services, there are no

segmental details in respect of the services rendered. The company provides

end-to-end business solutions like business consulting, technology,

engineering and outsourcing services. In addition, the company offers

software products and platforms for banking industry. The company also

invests in products which helped the company establish itself as a credible

IP Owner. The company owns seven Edge products/platforms and six other

product based solutions. The company leverages on its premium banking

solution ‘Finnacle ®’. The company owns significant brand value and

focuses on immense brand building. For this purpose, it incurs significant

brand building expenses, which goes to help the company have a premium

pricing for its services. The company also heavily focuses on research and

development activity and incurs significant expenditure for this account.

Downloaded by 1neeraj@vaishlaw.com at 11/07/23 07:48pm

taxsutra All rights reserved

IT(TP)A No. 49/Bang/2019

Page 7 of 31

Further, the company operates in diversified markets. Thus, the services

rendered by the company are not functionally comparable to the routine

SWD services rendered by the assessee.

16. We find that it is submitted that this company is consistently

excluded from the final list of comparables in cases of other assessees who

are placed similar to the assessee. Reliance in this regard is placed on the

decisions of this Hon’ble Tribunal in the cases of LG Soft India Pvt. Ltd. v.

DCIT (Order dated 28.05.2019 passed by this Hon’ble Tribunal in IT(TP)A

No. 3122/Bang/2018 for the assessment year 2014-15), EMC Software and

Services India Pvt. Ltd. v. JCIT (Order dated 18.12.2019 passed in IT(TP)A

No. 3375/Bang/2018) and Brocade Communications Systems Pvt. Ltd. v.

DCIT (Order dated 19.02.2020 passed by this Hon’ble Tribunal in IT(TP)A

No. 79/Bang/2019), wherein in the cases of the assessee which is similar to

the assessee, the company was directed to be excluded from the final set of

comparables. In view of the above, we direct exclusion of this company

from the final list of comparables.

(b) Larsen and Toubro Infotech Ltd. (‘L&T’) –

This company deals with software products and renders aftermarket service

management services, integrated Information Technology (‘IT’) service

management Software as a Solution, business process management

implementation services, cloud computing, consulting, enterprise

integration, geographical information system and infrastructure management

services. Despite rendering these diverse services, the segmental details of

the various services and products are not available. The company’s business

segments are divided into service cluster, industrial cluster and telecom

Downloaded by 1neeraj@vaishlaw.com at 11/07/23 07:48pm

taxsutra All rights reserved

IT(TP)A No. 49/Bang/2019

Page 8 of 31

business. In the absence of segmental data being made available as regards

the diverse services, it is not possible to determine whether the company

passes the filters applied by the TPO. Therefore, the company ought to be

excluded. Further, the company is a market leader and thus enjoys

significant benefits on account of ownership of marketing intangibles,

intellectual property rights and business rights. Also, in addition to the

above, the company owns proprietary software products which are

developed in-house. Accordingly, it was submitted that L&T is a product

company having significant intangibles and is thus not comparable to

captive software development service providers such as the assessee who

does not own any significant or non-routine intangibles. Further, L&T

enjoys significant brand value. As a result of this high brand value, the

company enjoys a high bargaining power in the market.

17. We find that this company is consistently excluded from the final list

of comparables in cases of assessees which are placed similar to the

assessee. Reliance in this regard is placed on the decisions of this Hon’ble

Tribunal in the cases of LG Soft India Pvt. Ltd. v. DCIT (Order dated

27.09.2019 passed by this Hon’ble Tribunal in M.P. No. 95/Bang/2019 in

IT(TP)A No. 3122/Bang/2018 for the assessment year 2014-15), EMC

Software and Services India Pvt. Ltd. v. JCIT (Order dated 18.12.2019

passed in IT(TP)A No. 3375/Bang/2018) and Brocade Communications

Systems Pvt. Ltd. v. DCIT (Order dated 19.02.2020 passed by this Hon’ble

Tribunal in IT(TP)A No. 79/Bang/2019), wherein in the cases of the

assessee which is similar to the assessee, the company was directed to be

excluded. We therefore direct that this company should be excluded from

the final list of comparables.

Downloaded by 1neeraj@vaishlaw.com at 11/07/23 07:48pm

taxsutra All rights reserved

IT(TP)A No. 49/Bang/2019

Page 9 of 31

(c) Persistent Systems Ltd. (‘Persistent’) –

As far as exclusion of this company as a comparable company is concerned,

it is submitted that this company is functionally dissimilar as it is engaged in

rendering IT services and in the development of software products without

there being separate segmental information disclosed in its Annual Report

for such activities. In the absence of segmental data being made available as

regards the IT services and products offered by it, it is not possible to

determine whether the company passes the filters applied by the TPO. The

operations of the company predominantly relate to providing software

products, services and technology innovation covering full life cycle of

product to its customers, which is completely different from the services

rendered by the assessee. The company also made significant investment in

intellectual property led solutions and also had a dedicated team for research

and Intellectual Property (‘IP’) developments. The company also owns

several IP solutions, and during the year under consideration, it acquired

four products. Further, it is submitted that Persistent undertakes significant

Research and Development (‘R&D’) activities and has an in-house R&D

centre approved by the Department of Scientific and Industrial Research.

The company also made significant investments towards R&D activities in

the relevant previous year. Persistent Systems, Inc. which is a subsidiary of

the company acquired CloudSquads, Inc during the year under

consideration. There acquisitions constitute peculiar economic

circumstances for which no adjustment can be made to Persistent’s mark-up

to eliminate the material effects thereof.

Downloaded by 1neeraj@vaishlaw.com at 11/07/23 07:48pm

taxsutra All rights reserved

IT(TP)A No. 49/Bang/2019

Page 10 of 31

18. We find that this Tribunal in the cases of LG Soft India Pvt. Ltd. v.

DCIT (Order dated 28.05.2019 passed by this Hon’ble Tribunal in IT(TP)A

No. 3122/Bang/2018 for the assessment year 2014-15), EMC Software and

Services India Pvt. Ltd. v. JCIT (Order dated 18.12.2019 passed in IT(TP)A

No. 3375/Bang/2018) and Brocade Communications Systems Pvt. Ltd. v.

DCIT (Order dated 19.02.2020 passed by this Hon’ble Tribunal in IT(TP)A

No. 79/Bang/2019), wherein in the cases of assessee which is placed similar

to the assessee, this company was directed to be excluded. Consequently,

we direct submitted that this company is not comparable to the assessee and

ought to be excluded from the list of comparables for the above reasons.

(d) Thirdware Solutions Ltd. (‘Thirdware’):

As far as exclusion of this company as a comparable company is concerned,

it is submitted that this company is an IT consulting firm engaged in

consulting, design, implementing and support of enterprise applications. The

company has significant capabilities in the transaction, analytics and cloud

layers of enterprise application. The company also renders industry-specific

solutions spanning business applications consulting, design, implementation

and support. The said services are in the nature of knowledge process

outsourcing services and are entirely different from the routine SWD

services rendered by the assessee. The company is also engaged in

development of software products and earns revenues from sale of user

licenses for software applications. These diverse services are reported under

one segment without any details being available as regards these services.

19. We find that this company is consistently excluded from the final list

of comparables in cases of assessees placed similar to that of the assessee.

Downloaded by 1neeraj@vaishlaw.com at 11/07/23 07:48pm

taxsutra All rights reserved

IT(TP)A No. 49/Bang/2019

Page 11 of 31

Reliance in this regard is placed on the decisions of this Hon’ble Tribunal in

the cases of LG Soft India Pvt. Ltd. v. DCIT (Order dated 28.05.2019

passed by this Hon’ble Tribunal in IT(TP)A No. 3122/Bang/2018 for the

assessment year 2014-15), EMC Software and Services India Pvt. Ltd. v.

JCIT (Order dated 18.12.2019 passed in IT(TP)A No. 3375/Bang/2018) and

Brocade Communications Systems Pvt. Ltd. v. DCIT (Order dated

19.02.2020 passed by this Hon’ble Tribunal in IT(TP)A No. 79/Bang/2019),

wherein in the cases of assessee which is placed similar to the assessee, the

company was directed to be excluded. Therefore, this company is directed

to be excluded from the final list of comparables.

20. Ground Nos. 1(l), and (n) in the appeal:

Vide these grounds, the assessee is seeking inclusion of Akshay Software

Technologies Ltd., and Maveric Systems Ltd.

(a) Akshay Software Technologies Ltd. (‘Akshay’):

This company was selected by the assessee as a comparable company in its

TP study but came to be rejected by the TPO for the reason that the

company is engaged in providing professional services, procurement,

installation, implementation, support and maintenance of ERP products and

services, and that the company incurred expenditure to the tune of 85% on

foreign branches, which suggested that the business model adopted by the

company was different from that of the assessee. The exclusion of this

company came to be upheld by the DRP on the latter basis.

21. In this regard, it was submitted that firstly, perusal of the functions of

the company listed in its annual report shows that the company is

Downloaded by 1neeraj@vaishlaw.com at 11/07/23 07:48pm

taxsutra All rights reserved

IT(TP)A No. 49/Bang/2019

Page 12 of 31

functionally similar to the assessee. The website of the company states that

the company is engaged in rendering IT services, which are in the nature of

SWD and caters to the needs of corporate bodies, banks and financial

institutions. Further, it is submitted that the income from commission and

sale of software licenses constitutes a meagre 0.5% of the total revenue and

therefore, the same would not have any impact on the profitability of the

company.

22. It was submitted that the action of the DRP in upholding the

exclusion of this company on the basis that it incurs foreign branch expenses

indicating that the business model adopted by it is different is erroneous as

the TPO did not apply the onsite development filter. Therefore, the action of

the DRP is arbitrarily rejecting Akshay on this count, without applying the

filter at a uniform threshold across all companies is erroneous and

unsustainable. In any event, it is submitted that foreign branch expenses per

se do not indicate onsite development. There is no difference in the business

model adopted by the company and the assessee, and without prejudice, it

was submitted that the difference if any, would not have any impact on the

profitability of the company.

23. We find that this Tribunal in the cases of EMC Software and

Services India Pvt. Ltd. v. JCIT (Order dated 18.12.2019 passed in IT(TP)A

No. 3375/Bang/2018) and Brocade Communications Systems Pvt. Ltd. v.

DCIT (Order dated 19.02.2020 passed by this Hon’ble Tribunal in IT(TP)A

No. 79/Bang/2019), wherein in the case of an assessee which placed similar

to the assessee, the comparability of this company was remanded to the

Downloaded by 1neeraj@vaishlaw.com at 11/07/23 07:48pm

taxsutra All rights reserved

IT(TP)A No. 49/Bang/2019

Page 13 of 31

TPO. We accordingly remand the comparability of this company with the

assessee to the AO/TPO for a decision afresh.

(b) Maveric Systems Ltd. (“Maveric”):

As far as exclusion of this company is concerned, the TPO without any

specific reason being assigned did not include this company as a comparable

company. The DRP rejected the contention of the assessee seeking its

inclusion on the basis that generally, companies with R&D expenditure of

less than 3% alone were considered. In this regard, it is submitted that the

action of the DRP is wholly erroneous in as much as the TPO did not apply a

filter to exclude companies incurring R&D expenses. In the absence of

application of a filter, rejecting a company on an arbitrary basis, more so

when it is otherwise functionally comparable, is erroneous. Therefore, this

company ought to be included in the final list of comparables.

24. We find that this Tribunal in the cases of EMC Software and

Services India Pvt. Ltd. v. JCIT (Order dated 18.12.2019 passed in IT(TP)A

No. 3375/Bang/2018) and Brocade Communications Systems Pvt. Ltd. v.

DCIT (Order dated 19.02.2020 passed by this Hon’ble Tribunal in IT(TP)A

No. 79/Bang/2019), wherein in the case of an assessee which is placed

similar to the assessee, the company was remanded to the TPO. We

therefore remand the question of comparability of this company to the

TPO/AO for consideration afresh.

25. Ground No. 1(e) projects the grievance of the assessee regarding non-

granting of working capital adjustment. The assessee submits that that Rule

10B(3) of the Income-tax Rules, 1962, itself categorically provides that an

Downloaded by 1neeraj@vaishlaw.com at 11/07/23 07:48pm

taxsutra All rights reserved

IT(TP)A No. 49/Bang/2019

Page 14 of 31

adjustment ought to be provided for any differences in the economic factors

between the tested party and the comparables. A working capital adjustment

is one such adjustment which is to be applied in order to adjust for the

differences between the working capital positions of the tested party and of

the comparable. The learned Counsel for the assessee placed reliance on the

decision of this Hon’ble Tribunal in the case of Brocade Communications

Systems Pvt. Ltd. v. DCIT (Order dated 19.02.2020 passed by this Hon’ble

Tribunal in IT(TP)A No. 79/Bang/2019), wherein working capital

adjustment was directed to be granted.

26. Therefore, in the light of the settled proposition of law that necessary

adjustments are to be made to the margins of comparables to give effect to

the differences in the working capital positions of the tested party and of the

comparables, the TPO ought to have given the assessee the benefit of the

same. We direct the TPO/AO to give working capital adjustment in

accordance with law.

27. The TPO/AO is directed to determine ALP in the SWD services

segment in accordance with the directions contained in this order after

affording assessee opportunity of being heard.

TRADING SEGMENT OF THE ASSESSEE

28. As far as the determination of ALP in the trading segment is

concerned, the first dispute is with regard for the MAM to determine ALP.

While the assessee chose Resale Price Method (RPM) as MAM in its TP

study, the TPO chose TNMM as MAM.

Downloaded by 1neeraj@vaishlaw.com at 11/07/23 07:48pm

taxsutra All rights reserved

IT(TP)A No. 49/Bang/2019

Page 15 of 31

Gross profit earned by the assessee in the Trading Segment (as reflected

in the TP study):

Revenue from operations Rs. 2,68,32,64,288/-

Cost of goods consumed Rs. 2,01,39,27,787/-

Gross profit Rs. 66,93,36,501/-

Gross profit margin (GP/Sales) 24.94%

The assessee chose the following companies as comparable companies

and their arithmetic mean of profit margin was as follows:

Sl. No. Name of the company Weighted

average

1. Phillips Electronics India Ltd. 35.73

2. Redington (India) Ltd. 1.21

3. Salora International Ltd. 12.41

4. Sony India Pvt. Ltd. 6.80

Arithmetic mean 14.04

Since the profit margin of the assessee was higher than that of the

comparable companies, the assessee claimed that the price received from the

AE should be regarded as at Arm’s Length.

29. The TPO did not accept assessee’s choice of MAM and he chose

TNMM as MAM for the reason that data for comparability under RPM

required many details that may not be available in public domain. Apart

from the abve, the TPO also held that the assessee performs more functions

than a normal distributor and therefore RPM is not MAM. The TPO

thereafter chose the following comparable companies under TNMM.

Downloaded by 1neeraj@vaishlaw.com at 11/07/23 07:48pm

taxsutra All rights reserved

IT(TP)A No. 49/Bang/2019

Page 16 of 31

Sl. Name of the Company OP/Sales (in

No. %)

1 Hi-Tech Systems & Services Ltd. 22.75

2 Sagittarians International Ltd. 9.73

3 Yamato Scale India Pvt. Ltd. 14.50

4 Shiv Pad Engineers Pvt. Ltd. 12.89

5 Adtech Systems Ltd. 11.82

6 Airox Technologies Pvt. Ltd. 12.57

7 Ankit Air Systems Pvt. Ltd. 11.28

8 United Telelinks (Bangalore) Pvt. Ltd. 9.30

9 Asian Feb Tec Ltd. 10.35

10 Intec Infonet Pvt. Ltd. 8.61

11 B N A Technology Consulting Ltd. 9.19

12 Micromax Informatics Ltd. 5.38

13 Keith Electronics Pvt. Ltd. 7.87

14 Usart Technologies India Pvt. Ltd. 7.08

15 I B D Electronics Pvt. Ltd. 6.27

AVERAGE MARK-UP 10.82

30. The TPO computed ALP as follows:

Arm’s Length Mean Mark-up 10.82%

Operating revenue Rs.

2,68,32,64,288/-

Arm’s Length Price @89.18% of revenue Rs.2,39,29,35,092/-

Price paid Rs.2,50,65,45,275/-

Shortfall being adjustment u/s. 92CA Rs.11,36,10,183/-

31. The assessee filed objections before the DRP against the aforesaid

addition suggested by the TPO which was incorporated by the AO in the

Draft Order of Assessment. The DRP summarily rejected the contention of

the assessee challenging the application of TNMM as opposed to RPM

Downloaded by 1neeraj@vaishlaw.com at 11/07/23 07:48pm

taxsutra All rights reserved

IT(TP)A No. 49/Bang/2019

Page 17 of 31

adopted by it. The DRP rejected the contentions of the assessee seeking

exclusion of incomparable companies and inclusion of comparable

companies, while granting marginal relief by directing exclusion of Intec

Infonet Pvt. Ltd. While determining the adjustment to the trading segment,

the TPO had taken into consideration the revenue of the assessee at entity

level as opposed to transaction level, which the assessee objected to before

the DRP. The DRP rejected the assessee’s contention and upheld the action

of the TPO is determining the adjustment at entity level.

32. The AO passed the impugned final assessment order in line with the

directions of the DRP in which the TP adjustment was reworked at Rs.

11,25,36,877/-. Aggrieved by the said addition, the assessee is in appeal

before the Tribunal.

33. The grounds in the appeal which are being pressed are as follows:

(i) That the lower authorities erred in characterizing the assessee as a

full-fledged risk bearing distributor. (Ground No. 2(a)).

(ii) That the lower authorities erred in rejecting the transfer pricing

methodology adopted by the assessee in its TP study viz. RPM

and erred in adopting TNMM. (Ground No. 7).

(iii) That the lower authorities erred in including:

(i) Hi-Tech Systems & Services Ltd. (Ground No. 2(b));

(ii) Sagittarians International Ltd. (Ground No. 2(c));

(iii) Yamato Scale India Pvt. Ltd. (Ground No. 2(d));

Downloaded by 1neeraj@vaishlaw.com at 11/07/23 07:48pm

taxsutra All rights reserved

IT(TP)A No. 49/Bang/2019

Page 18 of 31

(iv) Shiv Pad Engineers Pvt. Ltd. (Ground No. 2(e));

(v) Adtech Systems Ltd. (Ground No. 2(f));

(vi) Airox Technologies Pvt. Ltd. (Ground No. 2(g));

(vii) Ankit Air Systems Pvt. Ltd. (Ground No. 2(h));

(viii) Asian Feb Tec Ltd. (Ground No. 2(i));

(ix) B N A Technology Consulting Ltd. (Ground No. 2(j));

(x) Keith Electronics Pvt. Ltd. (Ground No. 2(k));

(xi) Usart Technologies India Pvt. Ltd. (Ground No. 2(l)); and

(xii) I B D Electronics Pvt. Ltd. (Ground No. 2(m))

(iv) That the lower authorities erred in not including:

(i) Redington (India) Ltd. (Ground No. 2(n)); and

(ii) Salora International Ltd. (Ground No. 2(o))

(v) The lower authorities erred in determining the TP adjustment on the

entire trading segment including transactions undertaken with

unrelated enterprises (Ground No. 2(p)).

34. We shall take up for consideration ground No. 2(a) in the appeal re.

characterization and Ground No. 7 re. application of MAM. In this regard,

we find the following are the functions performed, assets employed and

risks assumed by the assessee (as available in the TP study at page 586

of the paperbook) :

Downloaded by 1neeraj@vaishlaw.com at 11/07/23 07:48pm

taxsutra All rights reserved

IT(TP)A No. 49/Bang/2019

Page 19 of 31

(a) Functions performed: During the year, the assessee carried on

trading activities for its Professional and Lifestyle verticals. A brief

background of the trading activities is as under:

Professional vertical- The segment is engaged in trading of large

infotainment systems and devices, which are meant for professional

usage for example in cricket stadiums, movie theatres, arenas, airports

etc. Examples of products sold under the PRO vertical include

amplifiers. Loudspeakers, mixers, microphones, etc.

Lifestyle- The segment mostly caters to needs of small consumers

involved in trading in audio system, home infotainment and multimedia

devices. The assessee is engaged in trading of consumer products in its

lifestyle segment through authorized distributors and channel partners.

Sales and pricing: In respect of the trading operations, the assessee

purchases products mostly from its AEs for resale to domestic customers

in India. The assessee does not add value to the products procured from

ground companies and merely resells the same to domestic customers in

India.

The assessee is responsible for determining the price at which the goods

are sold to customers in India. The pricing structure is mainly dependent

on the product margin. The assessee fixes its prices in accordance with a

published price list. The prices may be changed to meet specific

customer demands. The assessee is responsible for negotiating sales

contracts.

Downloaded by 1neeraj@vaishlaw.com at 11/07/23 07:48pm

taxsutra All rights reserved

IT(TP)A No. 49/Bang/2019

Page 20 of 31

Product marketing and advertising: The assessee has established both

direct distribution networks and network of dealers for marketing its

products. The assessee also bears sales and support costs for marketing

its products in India.

Inventory management:

Inventory management is performed by the assessee. The assessee

reviews inventories on hand and records a provision for excess, slow

moving and obsolete inventory; inventory not meeting quality standards.

The assessee bears inventory cost of stocking products, which are held

by its authorized dealers prior to sale.

Credit/payment terms: The assessee manages its own outstanding

receivables with respect to products imported from AEs and sold in the

local market. The payment terms are decided by the assessee.

Order processing: The assessee is responsible for processing orders

based on requirement from distributors. The assessee is also responsible

for invoicing and collecting the amount due from its distributors for the

products sold.

(b) Risks assumed:

Contract Risk: In respect of the sales made to third party customers, the

assessee enters into contracts with third-party customers and hence, bears

the contract risk, However, in relation to import of traded goods from its

AEs, the assessee does not bear any contract risk.

Downloaded by 1neeraj@vaishlaw.com at 11/07/23 07:48pm

taxsutra All rights reserved

IT(TP)A No. 49/Bang/2019

Page 21 of 31

Market Risk: The products imported by the assessee are sold to third

party customers in India and thus, it would bear normal market risks

associated with the trading of cables in the domestic market.

Price Risk: The assessee bears the price risk in relation to sale of goods

to third-party customers. The AEs are not exposed to this risk.

Foreign Exchange Risk: The assessee is invoiced in foreign currency

for import of finished goods. The assessee bears the foreign exchange

fluctuation risk in respect of import of finished goods due to fluctuation

in the foreign exchange currency rates.

Inventory Risk: The assessee bears inventory risk in relation to the

products imported from AEs.

Credit Risk: The assessee bears the credit risk in respect of its sales to

third party customers as it enters into contracts in its own name. The AEs

are not exposed to this risk.

35. From a reading of the above, it is clear that the assessee undertakes

routine distributor functions. However, the TPO, erroneously held that the

assessee cannot be ascribed as a routine trader who merely purchases and

sells goods. The TPO arrived at this erroneous conclusion by referring to so

called page 13 of the TP study, wherein it is stated that the company is also

responsible for installation, training services to independent third party

customer and also renders additional services like after sales support and

warranty services. However, it is pertinent to note that page 13 of the

assessee’s TP study nowhere lists out the above contents, and more

importantly, the assessee does not render any such additional services.

Downloaded by 1neeraj@vaishlaw.com at 11/07/23 07:48pm

taxsutra All rights reserved

IT(TP)A No. 49/Bang/2019

Page 22 of 31

Therefore, this finding of the TPO is clearly contrary to the material placed

on record and is wholly baseless. In any case, even if such services were to

be provided, that does not alter the function of the assessee being a

distributor of products.

36. The laws by now are well settled that in the case of a routine

distributor who does not perform any value-added services to the product.

RPM is the MAM. The additional functions performed by the assessee as

stated by the TPO/DRP will not make the assessee as not a trader. The true

test is value addition to the product that is sold by the assessee as a trader.

These is no such value addition to the product and therefore the assessee has

to be regarded as a pure trade only. Since the assessee is merely a routine

trader of services, without any value addition, RPM is the MAM.

37. As already stated, the law is well settled that MAM in the case of

trader is RPM, reliance in this regard is placed on the following decisions:

(i) Textronix India (P.) Ltd. v. DCIT ([2013] 29 taxmann.com

288 (Bangalore-Trib.) at para 5);

(ii) ACIT v. Akzo Nobel Car Refinishes India (P.) Ltd. ([2017] 84

taxmann.com 199 (Delhi-Trib.) at paras 6 and 7);

(iii) ITO v. L’oreal India P. Ltd. (Order dated 25.04.2012 passed in

ITA No. 5423/Mum/2009 at paras 18 and 19) which was

upheld by the Hon’ble High Court of Bombay (reported in

[2015] 53 taxmann.com 432 (Bombay));

(iv) DCIT v. A. O. Smith India Water Heating (P.) Ltd. ([2018] 97

taxmann.com 218 (Bangalore - Trib.) at paras 16-20;

Downloaded by 1neeraj@vaishlaw.com at 11/07/23 07:48pm

taxsutra All rights reserved

IT(TP)A No. 49/Bang/2019

Page 23 of 31

(v) PCIT v. Matrix Cellular International Services (P.) Ltd.

([2018] 90 taxmann.com 54 (Delhi) at para 12);

(vi) Horiba India (P.) Ltd. v. DCIT ([2017] 81 taxmann.com 209

(Delhi - Trib.) at para 12)

38. Further, reliance is placed on the decision of the Hon’ble Mumbai

Bench of the Tribunal in the case of Bristol Myers Squibb India Private

Limited v. DCIT (Order dated 28.08.2019 passed in ITA No.

1969/Mum/2014), wherein it was held that, “Thus, if the ALP of a

transaction can be determined by applying any of the direct methods like

CUP, RPM, CPM then they should be given a preference, and it is only

where the said traditional methods have been rendered inapplicable that

under such circumstances TNMM should be resorted to”.

39. The TPO’s conclusion that complete information as regards

comparable distribution is unavailable in public domain is also baseless and

all information required for application of RPM is available in the public

domain. Therefore, we hold that the assessee is a mere distributor and the

method applied by it ought to be adopted. Pertinently, in the assessee’s own

case for assessment years 2015-16 and 2016-17, the TPO accepted the

method applied by the assessee in the trading segment. Since the facts and

circumstances involved in the year under consideration remain the same in

the assessment years 2015-16 and 2016-17, the assessee’s method ought to

be accepted and is directed to be accepted. We remand the question of

determination of ALP to the TPO/AO for fresh consideration and opting

RPM as MAM. In view of the above conclusion the other issues raised by

Downloaded by 1neeraj@vaishlaw.com at 11/07/23 07:48pm

taxsutra All rights reserved

IT(TP)A No. 49/Bang/2019

Page 24 of 31

the assessee on determination of ALP under TNMM becomes academic and

hence not decided.

40. Corporate tax issues arising in the appeal: Ground No. 11 re.

restriction of depreciation claimed on computer software: In this

ground, the assessee is challenging the action of the Revenue in restricting

the depreciation claimed on computer software at 25% instead of 60%, by

holding that ‘computer software’ is license eligible for depreciation at the

rate of 25%. The Respondent arrived at this conclusion by holding that

under Appendix-1 to the Income-tax Rules, 1962 (“the Rules”), what is

eligible for depreciation at the rate of 60% is ‘computer including computer

software’ indicating that the computer software which is eligible for

depreciation at 60% is the software which is embedded in the computer. The

DRP upheld the action of the AO.

41. It was submitted before us that the interpretation adopted by the lower

authorities is contrary to the provisions of the Rules. It was submitted that

Note No. 7 to Appendix-1 defines the term ‘computer software’, in terms of

which, a computer software means any computer program recorded on any

disc, tape, perforated media or other information storage device. The

definition does not make any distinction between a software embedded in a

computer or otherwise. In fact, the medium of storage of the software not

being restricted to a computer itself demonstrates that any computer

software is eligible for depreciation at 60%. Further, a computer software

cannot be used in isolation and independent of a computer. Reliance in this

regard was placed on the following decisions:

Downloaded by 1neeraj@vaishlaw.com at 11/07/23 07:48pm

taxsutra All rights reserved

IT(TP)A No. 49/Bang/2019

Page 25 of 31

- Computer Age Management Services Pvt. Ltd. v. The DCIT (Order

dated 14.12.2018 passed by the Chennai Bench of this Hon’ble

Tribunal in ITA Nos. 1140-1142/Chny/2018.;

- ACIT v. Voltamp Transformers Ltd. (Order dated 22.03.2013 passed

by the Delhi Bench of this Hon’ble Tribunal in ITA No.

1676/Ahd/2012;

- ACIT v. i-Flex Solutions Ltd. ([2010] 42 SOT 7 (MUM.)(URO)),

which came to be affirmed by the Hon’ble High Court of Bombay

in CIT v. i-Flex Solutions Ltd. ([2014] 46 taxmann.com 88

(Bombay)); and

- ACIT v. Zydus Infrastructure (P.) Ltd. ([2016] 72 taxmann.com 199

(Ahmedabad - Trib.)).

42. We have considered the submission and we find that the ITAT,

Chennai, in the case of Computer Age Management Services (supra) dealt

with identical issue and has held as follows:

“18. Arguing on fourth common ground, which is on restriction of the

claim of depreciation on software, ld. Authorised Representative

submitted that ld. Assessing Officer had restricted the depreciation to

25% against 60% available for computer systems. According to ld.

Authorised Representative, what was acquired were only software

license which enabled the assessee to use the applications. According

to him, by virtue of definition of software given in New Appendix I of

Income Tax Rules, computers including computer software were

eligible for 60% depreciation.

19. Per contra, ld. Departmental Representative submitted that what

were acquired by the assessee was only a licence and could at the best

be considered as an intangible asset. Thus, according to him, lower

authorities were justified in restricting the depreciation claim to 25%.

Downloaded by 1neeraj@vaishlaw.com at 11/07/23 07:48pm

taxsutra All rights reserved

IT(TP)A No. 49/Bang/2019

Page 26 of 31

20. We have considered the rival contentions and perused the orders of

the authorities below. Nature of items on which assessee had claimed

depreciation @60% are listed hereunder:-

Sl. No Description of the Asset

1 Sco Unix 6.0 Enterprise User License

2 Server Licenses and customization charges

for insurance process.

3 Server Licenses and customization charges

for insurance process.

4 PI Sql Developer/ Single User license

5 PI Sql Developer/ Single User license

6 Vfox Pro 9.0 Office Std 2010 licence

7 Dynamics Nav Final Milestone license

8 Server licenses and customization charges

for insurance process

9 Server licenses and customization charges

for insurance process

10 Citrus software license basic server licenses 1

11 Server licenses and customization charges

for insurance process

12 Server License

13 Server License

14 Server License

15 Server License

16 Cisco-firewall license

17 Window 2008 R2 standard license

What we find from the above description is that all these were nothing

but items in the nature software or software applications. Entry No.5

coming in III of Part A in New Appendix I clearly says that computer

included computer software. Note 7 of the Appendix, defines computer

software as any computer programme recorded in any information

storage device. We are therefore of the opinion that assessee was

eligible to claim depreciation at the rate of 60% on the above items.

Orders of the lower authorities on this issue are set aside and the claim

is allowed. Ground No.4 of the assessee stands allowed.”

Downloaded by 1neeraj@vaishlaw.com at 11/07/23 07:48pm

taxsutra All rights reserved

IT(TP)A No. 49/Bang/2019

Page 27 of 31

43. In view of the above, depreciation at 60% is directed to be granted.

44. Ground No. 12 re. disallowance of provision for warranty: During

the year under consideration, the assessee created a provision for warranty

for an amount of Rs. 2,16,40,265/- by debiting the Profit and Loss account

and crediting the Provision for Warranty account in the Balance Sheet. The

assessee reduces/debits the provision account in the Balance Sheet with the

amount of warranty actually utilized by the customers. For the year under

consideration the assessee has a brought forward provision from previous

year of Rs. 50,45,729/- and the current year provision when aggregated

resulted in the total provision of Rs. 2,66,85,994/- The assessee utilized Rs.

74,30,802/- out of this provision and the closing balance of the provision is

reflected in the Balance Sheet of the assessee as of 31.03.2014. The assessee

creates the provision at 0.6% of sales, which is based on past trend and

historical evidence. For the purpose of arriving at this 0.6%, the assessee

has considered the actual warranty utilized by the customers during the

entire warranty period which may vary depending on the product from 1

year to 6 years. The assessee submitted the details of provision created and

utilized year on year as per the Balance Sheet before the AO which is

produced as under:

(Amounts in Rs.)

Particulars FY 2012-13 FY 2013- FY 2014-15 FY 2015-16

14

Details of Covered Sales

Covered Sales

% increase as compared 303% 50% 12%

to previous year

Details of Warranty

Downloaded by 1neeraj@vaishlaw.com at 11/07/23 07:48pm

taxsutra All rights reserved

IT(TP)A No. 49/Bang/2019

Page 28 of 31

Provisions

Opening as on April 1

Additions during the year - 5,045,729 19,255,192 39,213,342

Utilization during the 5,475,988 21,640,265 32,362,936 47,191,482

year

Reversals during the year (430,259) (7,430,802) (12,404,786) (25,231,299)

- - - -

Closing as on March 31 5,045,729 19,255,192 39,213,342 61,173,525

As per financials

Under short-term - 12,677,212 17,696,144 29,487,216

provisions

Under long-term 5,045,729 6,577,980 21,517,198 31,686,309

provisions

Total 5,045,729 19,255,192 39,213,342 61,173,525

Breakup of Warranty

Utilization made during

the year

Year

Pertaining to sales for FY

2011-12

430,259 442,661 1,740,162 957,098

Pertaining to sales for FY

2012-13

- 1,070,053 2,209,813 2,645,128

Pertaining to sales for FY

2013-14

- 5,918,088 5,255,053 6,613,275

Pertaining to sales for FY

2014-15

- - 3,199,759 8,141,808

Pertaining to sales for FY

2015-16

- - - 6,873,988

Total 430,259 7,430,801 12,404,786 25,231,299

45. The AO disallowed the provision created in excess of the utilization,

for the reason that the provision created by the assessee at a fixed percentage

Downloaded by 1neeraj@vaishlaw.com at 11/07/23 07:48pm

taxsutra All rights reserved

IT(TP)A No. 49/Bang/2019

Page 29 of 31

of sales does not conform to the tenets of a scientific, empirical and

statistically consistent method as conceived by the Hon’ble Supreme Court

in the case of Rotork Controls India (P.) Ltd. (180 Taxman 422 (SC)). The

DRP upheld the action of the Respondent.

46. The learned Counsel for the assessee submitted that the entire basis

on which the Revenue authorities proceeded to make the impugned addition

i.e., on the basis that the provision created was much more than what was

utilized, is erroneous. In this regard, the learned Counsel for assessee drew

our attention to a letter dated 28.05.2018 filed before the DRP on

28.05.2019, wherein the assessee has explained that it sells amplifiers, loud

speakers, microphones, soundcraft, Studer and signal processing equipment

and these products / equipment are subject to a warranty for periods ranging

upto 6 years. The provision is created on past experience and on a scientific

basis at 0.6% for amplifiers loud speakers and signal processors and of 0.3%

for microphones, 0.2% for sound craft and at 1.3% for Studer. The learned

counsel therefore submitted that the provision created at a fixed percentage

of sales is based on historical trends and empirical evidence.

47. The DRP had confirmed the disallowance on the basis of the chart

above by stating that the amount of utilization is much less than the

provision created. The panel took FY 2012-13 data where the utilization of

Rs.4,30,259 was compared with the provision created for the year

Rs.54,75,988 to conclude that the % of utilization is at 7.8% which does not

justify the amount of provision created as a % of sales. In this regard the

learned counsel submitted that the warranty provision is created for the

entire period of warranty which would depend on the nature of product.

Downloaded by 1neeraj@vaishlaw.com at 11/07/23 07:48pm

taxsutra All rights reserved

IT(TP)A No. 49/Bang/2019

Page 30 of 31

Drawing reference from the letter submitted before the DRP, the learned

counsel demonstrated for example that Amplifier has warrant of 5 years and

3 years whereas Studer has a warranty of 1 year only. Therefore the

utilization of warranty for 1 year cannot be compared with provision for

warranty which is created for the entire period of 6 years warranty period.

The annexures to the letter submitted to the DRP give a complete break up

for all the items sold by the assessee like loudspeaker, microphones etc.

48. The learned counsel submitted that provision of Rs.54,75,988/- for

Assessment Year 2013-14 is for sales made in Assessment Year 2013-14

and that cannot be compared with actual utilization in Assessment Year

2013-14. In the table above the assessee had shown utilization against the

year to which the same pertains to i.e. The sum of Rs.4,30,259 is utilized out

of the provision created in the year 2011-12. This supports that contention

that the amount shown as utilization will consists of utilization, which is in

relation to warranty of that sales that may be for a period 1 to 6 years prior

to previous year relevant to Assessment Year 2013-14. Applying the same

analogy the utilization against the provision created for FY 2012-13 of

Rs.54,75,988 during the course of the warranty period is Rs.10,70,053 in FY

2013-14,, Rs.22,09,813 during FY 2014-15 and Rs.26,45,128 for FY 2015-

16. The total utilization therefore amounts to Rs. 59,24,994 which is more

than the provision created of Rs.54,75,988. The conclusion of the DRP that

the provision created and actual utilization was less is therefore incorrect. It

is thus clear from the facts of the case that the warranty provision was

provided by the assessee on a scientific basis based on past experience,

historical trend and satisfies the tests laid down by the Hon’ble Supreme

Court in the case of Rotork Controls India (P) Ltd. 314 ITR 62 (SC) and

Downloaded by 1neeraj@vaishlaw.com at 11/07/23 07:48pm

taxsutra All rights reserved

IT(TP)A No. 49/Bang/2019

Page 31 of 31

therefore the disallowance of warranty provision cannot be sustained and the

same is directed to be deleted.

49. In the result, the appeal by the assessee is partly allowed.

Pronounced in the open court on the date mentioned on the caption page.

Sd/- Sd/-

(PADMAVATHY S) (N.V. VASUDEVAN)

Accountant Member Vice President

Bangalore,

Dated: 30.06.2022.

/NS/*

Copy to:

1. Assessees 2. Respondent

3. CIT 4. CIT(A)

5. DR 6. Guard file

By order

Assistant Registrar,

ITAT, Bangalore.

Downloaded by 1neeraj@vaishlaw.com at 11/07/23 07:48pm

Powered by TCPDF (www.tcpdf.org)

You might also like

- Perfetti Van Melle IndiaDocument18 pagesPerfetti Van Melle IndiaramitkatyalNo ratings yet

- Uttar Pradesh Medical Supplies Corporation LimitedDocument71 pagesUttar Pradesh Medical Supplies Corporation Limitedmahesh thoreNo ratings yet

- TDR - 37927753Document222 pagesTDR - 37927753nirma kanNo ratings yet

- Before The Haryana Electricity Regulatory Commission at Panchkula CASE NO. HERC /RA-4 of 2015 Date of Hearing: 29/05/2015 Date of Order 18.08.2015 in The Matter ofDocument23 pagesBefore The Haryana Electricity Regulatory Commission at Panchkula CASE NO. HERC /RA-4 of 2015 Date of Hearing: 29/05/2015 Date of Order 18.08.2015 in The Matter ofer4varunNo ratings yet

- NCLT OrderDocument13 pagesNCLT Orderjainanmol0410No ratings yet

- 3 Tesla MRI-1Document57 pages3 Tesla MRI-1LenchoGudinaBegnaNo ratings yet

- Preventive MaintenanceBid Doc LT OH UG 080419Document62 pagesPreventive MaintenanceBid Doc LT OH UG 080419Mayur Satish ShendkarNo ratings yet

- ClsaDocument15 pagesClsaV RNo ratings yet

- NCLT OrderDocument17 pagesNCLT OrderMehul BhanushaliNo ratings yet

- 1 Breakdown Maintenance Bid DocHT OH UG31!07!19Document58 pages1 Breakdown Maintenance Bid DocHT OH UG31!07!19KaustubhDabeerNo ratings yet

- Coagulation AnalyserDocument70 pagesCoagulation Analyserujjawal_46No ratings yet

- Electrification and Projects Directorate: Iluminando A Transformação de MoçambiqueDocument3 pagesElectrification and Projects Directorate: Iluminando A Transformação de MoçambiqueericmNo ratings yet

- 05.querubin v. Commission On Elections en Banc20220119-12-1vybsye PDFDocument27 pages05.querubin v. Commission On Elections en Banc20220119-12-1vybsye PDFStephanie CONCHANo ratings yet

- Delhi Tribunal JudgementDocument42 pagesDelhi Tribunal JudgementvikramNo ratings yet

- T+No+148 1+MED+Fair+Tender+DocumentDocument39 pagesT+No+148 1+MED+Fair+Tender+Documentvsma gunturNo ratings yet

- Tendernotice 1Document13 pagesTendernotice 1sachin guptaNo ratings yet

- ICB-5 Procurement of Inj - DMPA - FINAL PDFDocument110 pagesICB-5 Procurement of Inj - DMPA - FINAL PDFbpharmbaNo ratings yet

- Order Us 143 (3) FY 2015-16 Disallowance 14ADocument4 pagesOrder Us 143 (3) FY 2015-16 Disallowance 14ADiksha SharmaNo ratings yet

- 27127TS 2600006828Document51 pages27127TS 2600006828svvsnrajuNo ratings yet

- LOA Draft 562Document7 pagesLOA Draft 562mahesh kumar chaudharyNo ratings yet

- RMC 23 24 84Document1 pageRMC 23 24 84gepsofodruNo ratings yet

- Gem GEM2023B2948196Document6 pagesGem GEM2023B2948196Rahul HanumanteNo ratings yet

- Bid Evaluation Report and Contract Award RecommendationDocument19 pagesBid Evaluation Report and Contract Award RecommendationEyuelNo ratings yet

- 3 Breakdown Maintenance Bid docDTC 31 - 07 - 19Document55 pages3 Breakdown Maintenance Bid docDTC 31 - 07 - 19Mahboobeh WernerNo ratings yet

- 1651569473-M.P. No. 12-Bang-2022-Marlabs Innovations Pvt. Ltd.Document7 pages1651569473-M.P. No. 12-Bang-2022-Marlabs Innovations Pvt. Ltd.bharath289No ratings yet

- 202106NITDocument14 pages202106NITyasir bhatNo ratings yet

- Show Cause NoticeDocument8 pagesShow Cause NoticeinfoNo ratings yet

- Rajasthan Medical Services Corporation LTDDocument50 pagesRajasthan Medical Services Corporation LTDRafikul RahemanNo ratings yet

- GeM Bidding 5653277Document9 pagesGeM Bidding 5653277jagdishsimariyaNo ratings yet

- Consumer Protection Law Practice: (Enforced With Effect From 20-7-2020 / 24-7-2020)Document244 pagesConsumer Protection Law Practice: (Enforced With Effect From 20-7-2020 / 24-7-2020)asterisktwo5iveNo ratings yet

- Case Brief 3Document9 pagesCase Brief 3Aditya DasNo ratings yet

- Tendernotice 1 PDFDocument11 pagesTendernotice 1 PDFKrishNo ratings yet

- GM Tech Agt Kmlbid1 29-03-19Document220 pagesGM Tech Agt Kmlbid1 29-03-19Thangaprakasam ManickamNo ratings yet

- Vodafone India Services P LTD V DCIT (Trib-Ahd) (23-Jan-2018)Document161 pagesVodafone India Services P LTD V DCIT (Trib-Ahd) (23-Jan-2018)Raj A KapadiaNo ratings yet

- TS 124 ITAT 2022DEL TP Akzo - Nobel - India - LTDDocument10 pagesTS 124 ITAT 2022DEL TP Akzo - Nobel - India - LTDruchimishra673No ratings yet

- 18 Querubin V COMELECDocument62 pages18 Querubin V COMELECSamantha NicoleNo ratings yet

- Chennai Medical College Hospital An Research Centre - MRI - CMA - Multiy...Document8 pagesChennai Medical College Hospital An Research Centre - MRI - CMA - Multiy...Biomedical Incharge SRM TrichyNo ratings yet

- Insolvency and Bankruptcy Board of IndiaDocument30 pagesInsolvency and Bankruptcy Board of IndiaVbs ReddyNo ratings yet

- RMC 23 24 85Document1 pageRMC 23 24 85gepsofodruNo ratings yet

- Tender ERC Global C18e27Document103 pagesTender ERC Global C18e27GKGKGOKUL07No ratings yet

- E-Invoices of PSPCL Jun-2023Document17 pagesE-Invoices of PSPCL Jun-2023contactajaysidharNo ratings yet

- Tender DocumentsDocument26 pagesTender DocumentsDurgesh TripathiNo ratings yet

- In ReDocument42 pagesIn ReUaba bejaNo ratings yet

- GeM Bidding 6144396Document8 pagesGeM Bidding 6144396bhumiNo ratings yet

- AMC Tender 20mar18Document20 pagesAMC Tender 20mar18riju nairNo ratings yet

- Corpo Set 4 - M1Document52 pagesCorpo Set 4 - M1Ralph Christian UsonNo ratings yet

- Zá Àääaqéã Àéj Zàäåvï Àgà Gádä Uà Àä Aiàä Ävà (Pà Áðlpà Àpáðgàzà Áé Àäåpéì M À Ànözé) Uà Àä Páaiàiáð®Aiàä, Rjã Ásé, Zá À, Éäê Àægàä-570017Document169 pagesZá Àääaqéã Àéj Zàäåvï Àgà Gádä Uà Àä Aiàä Ävà (Pà Áðlpà Àpáðgàzà Áé Àäåpéì M À Ànözé) Uà Àä Páaiàiáð®Aiàä, Rjã Ásé, Zá À, Éäê Àægàä-570017Sachin S RNo ratings yet

- 1) ITQ Consent FormDocument4 pages1) ITQ Consent FormJR FOONo ratings yet

- CIT-Vs-NCR-Corporation-Pvt.-Ltd.-Karnataka-High-Court - ATMs Are ComputerDocument15 pagesCIT-Vs-NCR-Corporation-Pvt.-Ltd.-Karnataka-High-Court - ATMs Are ComputerSoftdynamiteNo ratings yet

- E-Invoice of PSPCL of Jul-2023Document17 pagesE-Invoice of PSPCL of Jul-2023contactajaysidharNo ratings yet

- Gorakhpur Tender PDFDocument93 pagesGorakhpur Tender PDFDameras1234No ratings yet

- Website SoDocument3 pagesWebsite Sosharma_anshu_b_techNo ratings yet

- RFP For Bio Metric Deivce & SSO SoftwareDocument29 pagesRFP For Bio Metric Deivce & SSO SoftwareAnonymous mRCnYKz7xBNo ratings yet

- GeM Bidding 3855774Document10 pagesGeM Bidding 3855774Rudra ShindeNo ratings yet

- Karmic - Labs - PVT - LTD - AO Cannot Change Method of ValuationDocument17 pagesKarmic - Labs - PVT - LTD - AO Cannot Change Method of ValuationSunny MittalNo ratings yet

- Tender Dossier - Thermal CyclerDocument19 pagesTender Dossier - Thermal CyclerAndrea DimechNo ratings yet

- Stpi Bpo Rfprfp-17092017Document97 pagesStpi Bpo Rfprfp-17092017AmarendraNo ratings yet

- GeM Bidding 4955921Document11 pagesGeM Bidding 4955921RAJENDRA METALSNo ratings yet

- 1.0 Sub: Finalisation of Tender Documents For Open/press TendersDocument378 pages1.0 Sub: Finalisation of Tender Documents For Open/press TenderssubrajuNo ratings yet

- Fette Compacting Machinery India PVT LTD 1Document11 pagesFette Compacting Machinery India PVT LTD 1ramitkatyalNo ratings yet

- Everest Kanto Cylinder LTD 1Document17 pagesEverest Kanto Cylinder LTD 1ramitkatyalNo ratings yet

- Perfetti Van Melle IndiaDocument18 pagesPerfetti Van Melle IndiaramitkatyalNo ratings yet

- Pub How Oecd Impact Ip TP ItrDocument6 pagesPub How Oecd Impact Ip TP ItrramitkatyalNo ratings yet

- Boom and Bust?: A Political Economy Reading of India's Growth Experience, 1993-2013Document12 pagesBoom and Bust?: A Political Economy Reading of India's Growth Experience, 1993-2013ramitkatyalNo ratings yet