Professional Documents

Culture Documents

AMFI Reports

AMFI Reports

Uploaded by

rm44143230 ratings0% found this document useful (0 votes)

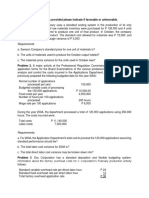

9 views4 pagesThe document is a table showing asset under management and folio data for various mutual fund schemes in India as of September 30, 2023. It provides details on the amount of assets (in Rs. Crores), percentage of total assets, and number of folios for different investor classifications (corporates, banks/FIs, FIIs, HNIs, retail) and types of schemes (liquid funds, gilt funds, debt oriented, equity oriented, hybrids, etc.). The total assets under management across all schemes was Rs. 4,65,775.2 Crores held in 1,57,096,187 folios.

Original Description:

Original Title

AMFI_Reports (2)

Copyright

© © All Rights Reserved

Available Formats

TXT, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document is a table showing asset under management and folio data for various mutual fund schemes in India as of September 30, 2023. It provides details on the amount of assets (in Rs. Crores), percentage of total assets, and number of folios for different investor classifications (corporates, banks/FIs, FIIs, HNIs, retail) and types of schemes (liquid funds, gilt funds, debt oriented, equity oriented, hybrids, etc.). The total assets under management across all schemes was Rs. 4,65,775.2 Crores held in 1,57,096,187 folios.

Copyright:

© All Rights Reserved

Available Formats

Download as TXT, PDF, TXT or read online from Scribd

Download as txt, pdf, or txt

0 ratings0% found this document useful (0 votes)

9 views4 pagesAMFI Reports

AMFI Reports

Uploaded by

rm4414323The document is a table showing asset under management and folio data for various mutual fund schemes in India as of September 30, 2023. It provides details on the amount of assets (in Rs. Crores), percentage of total assets, and number of folios for different investor classifications (corporates, banks/FIs, FIIs, HNIs, retail) and types of schemes (liquid funds, gilt funds, debt oriented, equity oriented, hybrids, etc.). The total assets under management across all schemes was Rs. 4,65,775.2 Crores held in 1,57,096,187 folios.

Copyright:

© All Rights Reserved

Available Formats

Download as TXT, PDF, TXT or read online from Scribd

Download as txt, pdf, or txt

You are on page 1of 4

<div class="full-contnet"><p><b>TABLE 1 ASSET UNDER MANAGEMENT AND

FOLIOS - CATEGORY WISE - AGGREGATE - AS ON September 30, 2023</b></p> <div

class="scroll-cont"><table cellpadding="0" cellspacing="0" border="0"><tbody>

<tr><th>Types of Schemes</th><th>Investor Classification</th><th>AUM

(Rs. Cr)</th><th>% to Total</th><th>No of Folios</th><th>% to Total</th></tr> <tr

style="background-color: rgb(240, 240, 240);"><td>Liquid Fund/Money Market Fund/

Floater Fund</td><td>Corporates</td><td>518055.19</td><td>78.3</td><td>82052</

td><td>2.52</td></tr><tr><td> </td><td>Banks/FIs</td><td>33199.29</

td><td>5.02</td><td>1280</td><td>0.04</td></tr><tr style="background-color:

rgb(240, 240, 240);"><td> </td><td>FIIs</td><td>31.05</td><td>0</td><td>13</

td><td>0</td></tr><tr><td> </td><td>High Networth

Individuals<sup>*</sup></td><td>100202.84</td><td>15.15</td><td>648277</

td><td>19.93</td></tr><tr style="background-color: rgb(240, 240,

240);"><td> </td><td>Retail</td><td>10133.51</td><td>1.53</td><td>2521548</

td><td>77.51</td></tr><tr><th> </th><th>Total</th><th>661621.88</

th><th>100.00</th><th>3253170</th><th>100.00</th></tr><tr style="background-color:

rgb(240, 240, 240);"><td>Gilt Fund/ Glit Fund with 10 year constant

duration</td><td>Corporates</td><td>14242.11</td><td>50.89</td><td>4324</

td><td>1.95</td></tr><tr><td> </td><td>Banks/FIs</td><td>117.67</

td><td>0.42</td><td>43</td><td>0.02</td></tr><tr style="background-color: rgb(240,

240, 240);"><td> </td><td>FIIs</td><td>6.98</td><td>0.02</td><td>3</

td><td>0</td></tr><tr><td> </td><td>High Networth

Individuals<sup>*</sup></td><td>12251.37</td><td>43.78</td><td>45579</

td><td>20.56</td></tr><tr style="background-color: rgb(240, 240,

240);"><td> </td><td>Retail</td><td>1366.41</td><td>4.88</td><td>171785</

td><td>77.47</td></tr><tr><th> </th><th>Total</th><th>27984.55</

th><th>100.00</th><th>221734</th><th>100.00</th></tr><tr style="background-color:

rgb(240, 240, 240);"><td>Remaining Income/ Debt Oriented

Schemes</td><td>Corporates</td><td>360926.54</td><td>56.44</td><td>94660</

td><td>2.3</td></tr><tr><td> </td><td>Banks/FIs</td><td>18320.98</

td><td>2.87</td><td>1338</td><td>0.03</td></tr><tr style="background-color:

rgb(240, 240,

240);"><td> </td><td>FIIs</td><td>1010.74</td><td>0.16</td><td>35</td><td>0</

td></tr><tr><td> </td><td>High Networth

Individuals<sup>*</sup></td><td>232935.79</td><td>36.43</td><td>1226553</

td><td>29.86</td></tr><tr style="background-color: rgb(240, 240,

240);"><td> </td><td>Retail</td><td>26260.57</td><td>4.11</td><td>2785550</

td><td>67.81</td></tr><tr><th> </th><th>Total</th><th>639454.62</

th><th>100.00</th><th>4108136</th><th>100.00</th></tr><tr style="background-color:

rgb(240, 240, 240);"><td>Growth/ Equity Oriented

Schemes</td><td>Corporates</td><td>169624.88</td><td>8.87</td><td>625411</

td><td>0.58</td></tr><tr><td> </td><td>Banks/FIs</td><td>587.2</td><td>0.03</

td><td>716</td><td>0</td></tr><tr style="background-color: rgb(240, 240,

240);"><td> </td><td>FIIs</td><td>2983.14</td><td>0.16</td><td>70</td><td>0</

td></tr><tr><td> </td><td>High Networth

Individuals<sup>*</sup></td><td>717987.51</td><td>37.55</td><td>7103376</

td><td>6.62</td></tr><tr style="background-color: rgb(240, 240,

240);"><td> </td><td>Retail</td><td>1020834.53</td><td>53.39</

td><td>99533030</td><td>92.79</td></tr><tr><th> </th><th>Total</

th><th>1912017.26</th><th>100.00</th><th>107262603</th><th>100.00</th></tr><tr

style="background-color: rgb(240, 240, 240);"><td>Hybrid

Schemes</td><td>Corporates</td><td>88388.37</td><td>15.04</td><td>108309</

td><td>0.87</td></tr><tr><td> </td><td>Banks/FIs</td><td>255.32</

td><td>0.04</td><td>171</td><td>0</td></tr><tr style="background-color: rgb(240,

240, 240);"><td> </td><td>FIIs</td><td>266.22</td><td>0.05</td><td>28</

td><td>0</td></tr><tr><td> </td><td>High Networth

Individuals<sup>*</sup></td><td>390780.85</td><td>66.48</td><td>2912168</

td><td>23.4</td></tr><tr style="background-color: rgb(240, 240,

240);"><td> </td><td>Retail</td><td>108092.01</td><td>18.39</td><td>9424746</

td><td>75.73</td></tr><tr><th> </th><th>Total</th><th>587782.77</

th><th>100.00</th><th>12445422</th><th>100.00</th></tr><tr style="background-color:

rgb(240, 240, 240);"><td>Solution Oriented

Schemes</td><td>Corporates</td><td>90.89</td><td>0.24</td><td>376</td><td>0.01</

td></tr><tr><td> </td><td>Banks/FIs</td><td>0</td><td>0</td><td>0</td><td>0</

td></tr><tr style="background-color: rgb(240, 240,

240);"><td> </td><td>FIIs</td><td>0</td><td>0</td><td>0</td><td>0</td></

tr><tr><td> </td><td>High Networth

Individuals<sup>*</sup></td><td>11754.7</td><td>30.67</td><td>113475</

td><td>1.98</td></tr><tr style="background-color: rgb(240, 240,

240);"><td> </td><td>Retail</td><td>26480.73</td><td>69.09</td><td>5630071</

td><td>98.02</td></tr><tr><th> </th><th>Total</th><th>38326.32</

th><th>100.00</th><th>5743922</th><th>100.00</th></tr><tr style="background-color:

rgb(240, 240, 240);"><td>Index

Funds</td><td>Corporates</td><td>88914.36</td><td>48.32</td><td>26924</

td><td>0.5</td></tr><tr><td> </td><td>Banks/FIs</td><td>381.67</td><td>0.21</

td><td>79</td><td>0</td></tr><tr style="background-color: rgb(240, 240,

240);"><td> </td><td>FIIs</td><td>12.26</td><td>0.01</td><td>7</td><td>0</

td></tr><tr><td> </td><td>High Networth

Individuals<sup>*</sup></td><td>71448.74</td><td>38.82</td><td>300732</

td><td>5.58</td></tr><tr style="background-color: rgb(240, 240,

240);"><td> </td><td>Retail</td><td>23271.09</td><td>12.65</td><td>5060728</

td><td>93.92</td></tr><tr><th> </th><th>Total</th><th>184028.12</

th><th>100.00</th><th>5388470</th><th>100.00</th></tr><tr style="background-color:

rgb(240, 240, 240);"><td>Gold

ETF</td><td>Corporates</td><td>12982.34</td><td>54.55</td><td>9185</td><td>0.19</

td></tr><tr><td> </td><td>Banks/FIs</td><td>1.41</td><td>0.01</td><td>5</

td><td>0</td></tr><tr style="background-color: rgb(240, 240,

240);"><td> </td><td>FIIs</td><td>0</td><td>0</td><td>0</td><td>0</td></

tr><tr><td> </td><td>High Networth

Individuals<sup>*</sup></td><td>8121.61</td><td>34.13</td><td>51164</td><td>1.06</

td></tr><tr style="background-color: rgb(240, 240,

240);"><td> </td><td>Retail</td><td>2693.45</td><td>11.32</td><td>4745786</

td><td>98.74</td></tr><tr><th> </th><th>Total</th><th>23798.81</

th><th>100.00</th><th>4806140</th><th>100.00</th></tr><tr style="background-color:

rgb(240, 240, 240);"><td>ETFs(other than

Gold)</td><td>Corporates</td><td>510071.34</td><td>90.97</td><td>61298</

td><td>0.49</td></tr><tr><td> </td><td>Banks/FIs</td><td>3430.21</

td><td>0.61</td><td>33</td><td>0</td></tr><tr style="background-color: rgb(240,

240, 240);"><td> </td><td>FIIs</td><td>88.64</td><td>0.02</td><td>12</

td><td>0</td></tr><tr><td> </td><td>High Networth

Individuals<sup>*</sup></td><td>35621.96</td><td>6.35</td><td>213140</

td><td>1.71</td></tr><tr style="background-color: rgb(240, 240,

240);"><td> </td><td>Retail</td><td>11511.99</td><td>2.05</td><td>12187571</

td><td>97.8</td></tr><tr><th> </th><th>Total</th><th>560724.13</

th><th>100.00</th><th>12462054</th><th>100.00</th></tr><tr style="background-color:

rgb(240, 240, 240);"><td>Fund of Funds investing

Overseas</td><td>Corporates</td><td>3904.33</td><td>17.73</td><td>8926</

td><td>0.64</td></tr><tr><td> </td><td>Banks/FIs</td><td>2.66</td><td>0.01</

td><td>5</td><td>0</td></tr><tr style="background-color: rgb(240, 240,

240);"><td> </td><td>FIIs</td><td>0.08</td><td>0</td><td>4</td><td>0</td></

tr><tr><td> </td><td>High Networth

Individuals<sup>*</sup></td><td>12066.57</td><td>54.81</td><td>116310</

td><td>8.28</td></tr><tr style="background-color: rgb(240, 240,

240);"><td> </td><td>Retail</td><td>6043.1</td><td>27.45</td><td>1279291</

td><td>91.08</td></tr><tr><th> </th><th>Total</th><th>22016.73</

th><th>100.00</th><th>1404536</th><th>100.00</th></tr><tr style="background-color:

rgb(240, 240, 240);"><th> </th><th>Grand

Total</th><th>4657755.2</th><th> </th><th>157096187</th><th> </th></

tr></tbody></table></div><div class="clr"></div><div style="padding-bottom:

10px;">* Defined as individuals investing Rs 2 lakhs and above</div><div

class="clr"></div><p><b>TABLE 2 - AGEWISE ANALYSIS OF ASSETS UNDER MANAGEMENT AS ON

September 30, 2023 - AGGREGATE (Rs. in crores)</b></p><div class="scroll-

cont"><table cellpadding="0" cellspacing="0" border="0"><tbody><tr><th>Types of

Schemes</th><th>Investor Classification</th><th>0-1 Month</th><th>% to

category</th><th>1-3 Month</th><th>% to category</th><th>3-6 Month</th><th>% to

category</th><th>6-12 Month</th><th>% to category</th><th>12-24 Month</th><th>% to

category</th><th>>24 Month</th><th>% to category</th><th>Total</th></tr><tr

style="background-color: rgb(240, 240,

240);"><td>EQUITY</td><td>Corporates</td><td>45351.28</td><td>6.57</

td><td>39075.58</td><td>5.66</td><td>47380.69</td><td>6.86</td><td>106359.1</

td><td>15.4</td><td>109772.87</td><td>15.89</td><td>342678.1</td><td>49.62</

td><td>690617.62</td></tr><tr><td> </td><td>Banks/FIs</td><td>108.15</

td><td>10.98</td><td>239.37</td><td>24.31</td><td>111.06</td><td>11.28</

td><td>186.55</td><td>18.94</td><td>184.48</td><td>18.73</td><td>155.14</

td><td>15.75</td><td>984.75</td></tr><tr style="background-color: rgb(240, 240,

240);"><td> </td><td>FIIs</td><td>62.93</td><td>1.99</td><td>11.64</

td><td>0.37</td><td>52.86</td><td>1.67</td><td>44.51</td><td>1.41</td><td>213.78</

td><td>6.76</td><td>2778.24</td><td>87.81</td><td>3163.96</td></

tr><tr><td> </td><td>High Networth

Individuals*</td><td>42773.08</td><td>4.1</td><td>64627.32</td><td>6.2</

td><td>70587.12</td><td>6.77</td><td>120684.28</td><td>11.57</td><td>219987.04</

td><td>21.09</td><td>524197.28</td><td>50.27</td><td>1042856.11</td></tr><tr

style="background-color: rgb(240, 240,

240);"><td> </td><td>Retail</td><td>32126.24</td><td>2.87</td><td>48803.72</

td><td>4.36</td><td>62372.32</td><td>5.57</td><td>121204.62</td><td>10.82</

td><td>218242.68</td><td>19.48</td><td>637549.82</td><td>56.91</

td><td>1120299.39</td></tr><tr><th> </th><th>Total</th><th>120421.68</

th><th>4.21</th><th>152757.63</th><th>5.35</th><th>180504.04</th><th>6.32</

th><th>348479.06</th><th>12.19</th><th>548400.85</th><th>19.19</

th><th>1507358.58</th><th>52.74</th><th>2857921.83</th></tr><tr style="background-

color: rgb(240, 240,

240);"><td>NON-EQUITY</td><td>Corporates</td><td>264695.43</td><td>24.59</

td><td>142401.83</td><td>13.23</td><td>101281.53</td><td>9.41</td><td>171109.83</

td><td>15.89</td><td>138775.33</td><td>12.89</td><td>258318.82</td><td>23.99</

td><td>1076582.77</td></tr><tr><td> </td><td>Banks/FIs</td><td>35330.48</

td><td>63.88</td><td>12748.39</td><td>23.05</td><td>2869.81</td><td>5.19</

td><td>1941.83</td><td>3.51</td><td>753.87</td><td>1.36</td><td>1667.28</

td><td>3.01</td><td>55311.64</td></tr><tr style="background-color: rgb(240, 240,

240);"><td> </td><td>FIIs</td><td>143.16</td><td>11.59</td><td>5.77</

td><td>0.47</td><td>331.32</td><td>26.82</td><td>16.62</td><td>1.35</

td><td>46.85</td><td>3.79</td><td>691.41</td><td>55.98</td><td>1235.15</td></

tr><tr><td> </td><td>High Networth

Individuals*</td><td>21157.9</td><td>3.84</td><td>39937.18</td><td>7.26</

td><td>38489.55</td><td>6.99</td><td>102938.16</td><td>18.71</td><td>90495.61</

td><td>16.44</td><td>257297.43</td><td>46.75</td><td>550315.83</td></tr><tr

style="background-color: rgb(240, 240,

240);"><td> </td><td>Retail</td><td>3759.4</td><td>3.23</td><td>5570.54</

td><td>4.79</td><td>6027.6</td><td>5.18</td><td>11503.82</td><td>9.88</

td><td>17831.8</td><td>15.32</td><td>71694.91</td><td>61.6</td><td>116388.06</

td></tr><tr><th> </th><th>Total</th><th>325086.37</th><th>18.06</

th><th>200663.7</th><th>11.15</th><th>148999.82</th><th>8.28</th><th>287510.26</

th><th>15.97</th><th>247903.46</th><th>13.77</th><th>589669.85</th><th>32.76</

th><th>1799833.46</th></tr><tr style="background-color: rgb(240, 240,

240);"><th> </th><th>Grand

Total</th><th>445508.04</th><th>9.56</th><th>353421.33</th><th>7.59</

th><th>329503.85</th><th>7.07</th><th>635989.33</th><th>13.65</th><th>796304.31</

th><th>17.1</th><th>2097028.43</th><th>45.02</th><th>4657755.29</th></tr></

tbody></table></div><div class="clr"></div><div style="padding-bottom: 10px;">*

Defined as individuals investing Rs 2 lakhs and above</div><div

class="clr"></div></div>

You might also like

- House Tax Appeal - BS BediDocument17 pagesHouse Tax Appeal - BS BediMrinalAgarwalNo ratings yet

- Excel BoskasirDocument1,070 pagesExcel BoskasirIrwan LettersNo ratings yet

- AMFI ReportsDocument58 pagesAMFI ReportsPrashant SukhadwalaNo ratings yet

- AMFI ReportsDocument86 pagesAMFI Reportsatul barekarNo ratings yet

- BeneficiaryDetailForSocialAuditReport ALLCS 1813009 2019-2020Document2 pagesBeneficiaryDetailForSocialAuditReport ALLCS 1813009 2019-2020Dipak Madhukar KambleNo ratings yet

- Bancamiga Movimientos 0111202030112020Document5 pagesBancamiga Movimientos 0111202030112020Ubaldo DavilaNo ratings yet

- AMFI ReportsDocument1,030 pagesAMFI ReportsDustyHouseNo ratings yet

- AhorroDocument1 pageAhorrojonathan1798.jcNo ratings yet

- Ever AbrilDocument3 pagesEver AbrilJoel Alejandro RodriguezNo ratings yet

- DSRReport For ConsDocument2 pagesDSRReport For ConspharmastudiesNo ratings yet

- V001993968Document4 pagesV001993968albertdNo ratings yet

- Rek BPP SekretariatDocument8 pagesRek BPP Sekretariatabdurahman farisyNo ratings yet

- General LedgerDocument47 pagesGeneral LedgerAbdullah MakkiNo ratings yet

- Trade RepositoryDocument57 pagesTrade RepositoryGautam MehtaNo ratings yet

- CGL2 - PENDING - Coils - 2022-08-10T160547.499Document3 pagesCGL2 - PENDING - Coils - 2022-08-10T160547.499pranjal bhawsarNo ratings yet

- Jose Huaman AbrilDocument2 pagesJose Huaman AbrilJoel Alejandro RodriguezNo ratings yet

- Detail Part OrderDocument2 pagesDetail Part OrderYudi AldinoNo ratings yet

- DTG MovimientosallDocument2 pagesDTG MovimientosallPenny The WolfNo ratings yet

- General LedgerDocument36 pagesGeneral LedgerAbdullah MakkiNo ratings yet

- BeneficiaryDetailForSocialAuditReport PMAYG 3214011 2021-2022Document3 pagesBeneficiaryDetailForSocialAuditReport PMAYG 3214011 2021-2022Raju MajhiNo ratings yet

- Movimientos 1012202316122023Document3 pagesMovimientos 1012202316122023gloriavalentina2013No ratings yet

- DataDocument1 pageDataCleber BenitesNo ratings yet

- Leyla AbrilDocument4 pagesLeyla AbrilJoel Alejandro RodriguezNo ratings yet

- CodeDocument5 pagesCoderaghuramanrdjNo ratings yet

- Laporan Cashflow 20220901 20221107Document2 pagesLaporan Cashflow 20220901 20221107amasithafasyahNo ratings yet

- Lich Su Gia Tvsi BCC 12-05-2022Document7 pagesLich Su Gia Tvsi BCC 12-05-2022Minh ThiNo ratings yet

- Stock - Report - 2024-02-08T142542.247Document3 pagesStock - Report - 2024-02-08T142542.247aarvysinghNo ratings yet

- MovimientosDocument2 pagesMovimientosmargotevelincoalaricoNo ratings yet

- CMS2765021545 12 9 2022 185058Document28 pagesCMS2765021545 12 9 2022 185058JitendraBhartiNo ratings yet

- BeneficiaryDetailForSocialAuditReport PMAYG 3211028 2022-2023Document80 pagesBeneficiaryDetailForSocialAuditReport PMAYG 3211028 2022-2023Radhika Prasanna JanaNo ratings yet

- Freddy Guevara AbrilDocument10 pagesFreddy Guevara AbrilJoel Alejandro RodriguezNo ratings yet

- 10 09 2019 6 37 47 PMDocument17 pages10 09 2019 6 37 47 PMNapoleone GonzalezNo ratings yet

- AhorroDocument1 pageAhorroJacobo TorresNo ratings yet

- Data Prestasi MTSS TAKHASSUS AL-QUR'AN WONOSOBO Tahun 2022Document2 pagesData Prestasi MTSS TAKHASSUS AL-QUR'AN WONOSOBO Tahun 2022KarmawanAdiPratamaNo ratings yet

- CoeficentesDocument1 pageCoeficenteswlsouzaNo ratings yet

- Consumos 3Document1 pageConsumos 3maxalejandro.07No ratings yet

- Consumos 4Document2 pagesConsumos 4maxalejandro.07No ratings yet

- Reporte Compras Caja ChicaDocument70 pagesReporte Compras Caja ChicaSILVA DIAZ AUDITORESNo ratings yet

- Movimientos 0501202317042023Document5 pagesMovimientos 0501202317042023jleonardomenesesNo ratings yet

- CGL1 Pending CoilsDocument22 pagesCGL1 Pending Coilspranjal bhawsarNo ratings yet

- General LedgerDocument2 pagesGeneral LedgerAbdullah MakkiNo ratings yet

- Demonstrativo de Locações - Imobiliária Luz - Apresenta - MeDocument75 pagesDemonstrativo de Locações - Imobiliária Luz - Apresenta - Merafael52193No ratings yet

- AR Extractos BancoDocument234 pagesAR Extractos BancoJuan Carlos GiraldoNo ratings yet

- Bumdes - MAJU Prov JatimDocument33 pagesBumdes - MAJU Prov JatimmasaranbumdesaNo ratings yet

- FTO Gen Sign Verify ReportDocument22 pagesFTO Gen Sign Verify Reportمحمد شعیبNo ratings yet

- AhorroDocument1 pageAhorroHelen GameroNo ratings yet

- 10 09 2019 6 32 44 PMDocument19 pages10 09 2019 6 32 44 PMNapoleone GonzalezNo ratings yet

- Report Travel Order 07122023Document10 pagesReport Travel Order 07122023varuna.dewiNo ratings yet

- CNnote 25apr202463908pmDocument2 pagesCNnote 25apr202463908pmdps_1976No ratings yet

- AhorroDocument1 pageAhorroHernández Sánchez SaraNo ratings yet

- Repurchase BV DetailDocument1 pageRepurchase BV Detailprithvidhiman5No ratings yet

- General LedgerDocument5 pagesGeneral LedgerAbdullah MakkiNo ratings yet

- AR Extractos BancoDocument17 pagesAR Extractos BancoJuan Carlos GiraldoNo ratings yet

- Movimientos 0105202223052022.binDocument8 pagesMovimientos 0105202223052022.binGreimar AriasNo ratings yet

- IP Lab Coding329Document72 pagesIP Lab Coding3293Dotzz RnDNo ratings yet

- RunOutRawData2023 08 03T09 47 50Document144 pagesRunOutRawData2023 08 03T09 47 50ubraghuNo ratings yet

- Laporan Penjualan220720Document17 pagesLaporan Penjualan220720Kemang WorkNo ratings yet

- MovimientosDocument4 pagesMovimientosmargotevelincoalaricoNo ratings yet

- CMS2504711538 9 5 2022 225925Document23 pagesCMS2504711538 9 5 2022 225925JitendraBhartiNo ratings yet

- Distribusi PKMDocument13 pagesDistribusi PKMEsty Indah PNo ratings yet

- The Urban Commons Cookbook: Strategies and Insights for Creating and Maintaining Urban CommonsFrom EverandThe Urban Commons Cookbook: Strategies and Insights for Creating and Maintaining Urban CommonsNo ratings yet

- Austrian Alpine Huts: Compiled by Irene AuerbachDocument3 pagesAustrian Alpine Huts: Compiled by Irene AuerbachPetru BriceagNo ratings yet

- IBS Manufacturer Product Assessment Certification (IMPACT) DataDocument4 pagesIBS Manufacturer Product Assessment Certification (IMPACT) DataM.Syahirudin MNNo ratings yet

- Natural Gas in IraqDocument16 pagesNatural Gas in Iraqياسين رياض بندر A-44No ratings yet

- Revised RoutineDocument18 pagesRevised Routineshahadat hossainNo ratings yet

- Table CMTA 800Document6 pagesTable CMTA 800Uro PleñosNo ratings yet

- (M4) PosttaskDocument4 pages(M4) PosttaskcarmelaNo ratings yet

- The Transactions Completed by Revere Courier Company During December 2014Document1 pageThe Transactions Completed by Revere Courier Company During December 2014Bube KachevskaNo ratings yet

- 01 Toledo Install InstructionsDocument6 pages01 Toledo Install Instructionsmrajaknight1No ratings yet

- Appendix A - Contractor ClaimsDocument3 pagesAppendix A - Contractor ClaimsChelimilla Ranga ReddyNo ratings yet

- V Guard Wires Cables Price List Dec 2023Document6 pagesV Guard Wires Cables Price List Dec 2023BhagyaNo ratings yet

- Lecture Notes 1 - Electricity MarketsDocument7 pagesLecture Notes 1 - Electricity MarketsFatima KhalidNo ratings yet

- bdf2 PDFDocument23 pagesbdf2 PDFoktavia safitriNo ratings yet

- 1994 Detrending Turning PointsDocument10 pages1994 Detrending Turning PointsProfitiserNo ratings yet

- Chiang Ch8Document61 pagesChiang Ch8Hara Tiara Pakpahan100% (1)

- AC-HS101-S4-2022-4 Business Cycles and Aggregate Demand - 1Document23 pagesAC-HS101-S4-2022-4 Business Cycles and Aggregate Demand - 1Vedang BaleNo ratings yet

- Chapter 10 - Lessee Accounting Chapter 10 - Lessee AccountingDocument53 pagesChapter 10 - Lessee Accounting Chapter 10 - Lessee AccountingApple LucinoNo ratings yet

- Assignment in Standard CostingDocument5 pagesAssignment in Standard CostingRaine PiliinNo ratings yet

- 2108AFE Topic 4 - Accounting Information Systems - StudentDocument38 pages2108AFE Topic 4 - Accounting Information Systems - StudentAnh TrầnNo ratings yet

- Variance ExercisesDocument5 pagesVariance ExercisesAntonette Marie LoonNo ratings yet

- STa301 Final Term Important Topic A&iDocument3 pagesSTa301 Final Term Important Topic A&iImran sohniNo ratings yet

- Pci 22-23Document2 pagesPci 22-23Wall Street Forex (WSFx)No ratings yet

- Right Hygiene 2022 - Press ReleaseDocument5 pagesRight Hygiene 2022 - Press ReleaseShubhendra MishraNo ratings yet

- Salary Tax Rates (2022 & 2023 Comparison)Document2 pagesSalary Tax Rates (2022 & 2023 Comparison)by kirmaniNo ratings yet

- c3pdf PDFDocument40 pagesc3pdf PDFhanifatulkhurriahNo ratings yet

- Hotel Confirmation Voucher: Your Booking Is ConfirmedDocument2 pagesHotel Confirmation Voucher: Your Booking Is Confirmedmukul.kumarsainiNo ratings yet

- Thesis Topics in Economics For M.philDocument5 pagesThesis Topics in Economics For M.philwyppfyhef100% (1)

- Company Profile Qualification Document: New Face Same DreamDocument45 pagesCompany Profile Qualification Document: New Face Same DreamRobertoNo ratings yet

- Excel Basics FinishedDocument55 pagesExcel Basics Finishedwklbs4691No ratings yet

- 3 Law of Supply and Price EqualibriumDocument22 pages3 Law of Supply and Price EqualibriumAkshay BNo ratings yet