Professional Documents

Culture Documents

NPS Transaction Statement For Tier I Account: Current Scheme Preference

NPS Transaction Statement For Tier I Account: Current Scheme Preference

Uploaded by

Bhanu PrakashOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

NPS Transaction Statement For Tier I Account: Current Scheme Preference

NPS Transaction Statement For Tier I Account: Current Scheme Preference

Uploaded by

Bhanu PrakashCopyright:

Available Formats

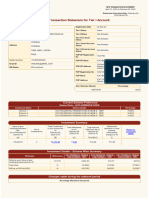

NPS TRANSACTION STATEMENT

April 01, 2021 to August 24, 2021

Statement Generation Date :August 24, 2021

03:01 PM

NPS Transaction Statement for Tier I Account

PRAN 110151433286 Registration Date 15-Jun-17

Subscriber Name SHRI BHANU PRAKASH Tier I Status Active

S/O DR.KK.KADAM Tier II Status Not Activated

E35 HEC COLONY Tier II Tax Saver Not Activated

Status

SECTOR 2 DHURWA

CBO Registration No 6514454

Address

RANCHI CBO Name Ciena Communications India Private Limited

JHARKHAND - 834004 United Consultancy Ser India, 1st Flr, Navjyoti

CBO Address Institute

INDIA Sector-B,Pocket-II,Vasant Kunj, Delhi, 110070

CHO Registration No 5514294

Mobile Number +919899714716

CHO Name Ciena Communications India Private Limited

Email ID BHANU.NITKS@GMAIL.COM

CHO Address C/O United Consultancy, 1st Flr, Navjyoti Institute

IRA Status IRA compliant Sector-B,Pocket-II,Vasant Kunj, Delhi, 110070

Tier I Nominee Name/s Percentage

DEEPIKA 50%

AAYANSH KADAM 50%

Current Scheme Preference

Scheme Choice - MODERATE AUTO CHOICE

Investment Option Scheme Details Percentage

Scheme 1 SBI PENSION FUND SCHEME E - TIER I 44.00%

Scheme 2 SBI PENSION FUND SCHEME C - TIER I 27.00%

Scheme 3 SBI PENSION FUND SCHEME G - TIER I 29.00%

Investment Summary

Value of your Total Contribution Total Withdrawal Total Notional Withdrawal/

Holdings(Investme No of in your account as as on Gain/Loss as on deduction in units

nts) on towards Return on

Contributions August 24, August 24, Investment

as on August 24, August 24, 2021 (in ₹) 2021 (in ₹) intermediary

2021 (in ₹) 2021 (in ₹) charges (in ₹) (XIRR)

(A) (B) (C) D=(A-B)+C E

₹ 2,33,593.62 52 ₹ 1,88,528.60 ₹ 0.00 ₹ 45,065.02 ₹ 81.39 Returns for the

Financial Year

Investment Details - Scheme Wise Summary

Particulars References SBI PENSION FUND SCHEME E SBI PENSION FUND SCHEME C SBI PENSION FUND SCHEME G

- TIER I - TIER I - TIER I

Scheme wise Value of your E=U*N 1,08,572.66 61,088.34 63,932.62

Holdings(Investments) (in ₹)

Total Units U 3,033.3660 1,808.5568 2,057.6565

NAV as on 23-Aug-2021 N 35.7928 33.7774 31.0706

Changes made during the selected period

No change affected in this period

Contribution/Redemption Details during the selected period

Contribution

Date Particulars Uploaded By Employee Employer's Total

Contribution Contribution (₹)

(₹) (₹)

26-Apr-2021 For April, 2021 Kotak Mahindra Bank Limited (5000041), 0.00 2,971.40 2,971.40

28-May- For May, 2021 Kotak Mahindra Bank Limited (5000041), 0.00 2,971.40 2,971.40

2021

28-Jun- For June, 2021 Kotak Mahindra Bank Limited (5000041), 0.00 2,971.40 2,971.40

2021

26-Jul-2021 For July, 2021 Kotak Mahindra Bank Limited (5000041), 0.00 2,971.40 2,971.40

Transaction Details

SBI PENSION FUND SCHEME SBI PENSION FUND SCHEME SBI PENSION FUND SCHEME

Withdrawal/ E - TIER I C - TIER I G - TIER I

Date Particulars deduction in units

towards intermediary Amount (₹) Amount (₹) Amount (₹)

charges (₹) Units Units Units

NAV (₹) NAV (₹) NAV (₹)

01-Apr-

Opening balance 2,878.2294 1,713.0052 1,946.8439

2021

10-Apr- (19.24) (11.68) (12.42)

Billing for Q4, 2020-2021 (43.34) (0.5958) (0.3546) (0.4032)

2021 32.2887 32.9348 30.8033

26-Apr- 1,307.41 802.27 861.72

By Contribution for April,2021 41.5967 24.2759 27.9881

2021 31.4306 33.0480 30.7887

28-May- 1,307.41 802.27 861.72

By Contribution for May,2021 38.9927 24.0401 27.7939

2021 33.5296 33.3721 31.0039

28-Jun- 1,307.41 802.27 861.72

By Contribution for June,2021 37.8912 24.0066 27.9091

2021 34.5043 33.4186 30.8759

03-Jul- (17.38) (10.07) (10.60)

Billing for Q1, 2021-2022 (38.05) (0.5061) (0.3015) (0.3435)

2021 34.3375 33.3942 30.8579

26-Jul- 1,307.41 802.27 861.72

By Contribution for July,2021 37.7579 23.8851 27.8682

2021 34.6261 33.5887 30.9212

24-Aug- Closing Balance 3,033.3660 1,808.5568 2,057.6565

2021

Notes

1.The 'Investment Details' section gives an overall status of the total contribution processed under the account and the returns accrued

2.'Notional Gain / Loss' indicates the overall gain or loss after factoring for the withdrawals processed in the account.

3.Returns based on Inflows' gives the annualized effective compounded return rate in PRAN account and is calculated using the formula of XIRR. The

calculation is done considering all the contribution / redemptions processed in PRAN account since inception and the latest valuation of the

investments. The transactions are sorted based on the NAV date.

View More

Retired life ka sahara, NPS hamara

Home | Contact Us | System Configuration / Best Viewed | Entrust Secured | Privacy Policy | Grievance Redressal Policy

You might also like

- NPS Transaction Statement For Tier I AccountDocument2 pagesNPS Transaction Statement For Tier I AccountAkash RahangdaleNo ratings yet

- NPS Transaction Statement For Tier I Account: Current Scheme PreferenceDocument2 pagesNPS Transaction Statement For Tier I Account: Current Scheme PreferenceAmit Gupta50% (2)

- NPS Transaction Statement For Tier I Account: Current Scheme PreferenceDocument2 pagesNPS Transaction Statement For Tier I Account: Current Scheme PreferenceRaj Bharath33% (3)

- NPS Transaction Statement For Tier I Account: Current Scheme PreferenceDocument2 pagesNPS Transaction Statement For Tier I Account: Current Scheme PreferenceRahul PanwarNo ratings yet

- NPS Transaction Statement For Tier I Account: Current Scheme PreferenceDocument2 pagesNPS Transaction Statement For Tier I Account: Current Scheme PreferenceRajakumar Reddy25% (4)

- Central Recordkeeping AgencyDocument3 pagesCentral Recordkeeping AgencyKaran RamchandaniNo ratings yet

- NPS Transaction Statement For Tier I Account: Current Scheme PreferenceDocument3 pagesNPS Transaction Statement For Tier I Account: Current Scheme PreferencePullakiranreddy ReddyNo ratings yet

- NPS CertificateDocument2 pagesNPS CertificateSatish Tiwari100% (1)

- Recruiting and Selecting Leaders For InnovationDocument7 pagesRecruiting and Selecting Leaders For InnovationPattyNo ratings yet

- NPS Transaction Statement For Tier II Account: Current Scheme PreferenceDocument3 pagesNPS Transaction Statement For Tier II Account: Current Scheme PreferenceVikash ChetiwalNo ratings yet

- NPS Transaction Statement For Tier I Account: Current Scheme PreferenceDocument3 pagesNPS Transaction Statement For Tier I Account: Current Scheme Preferencekids funNo ratings yet

- NPS Transaction Statement For Tier I Account: Current Scheme PreferenceDocument2 pagesNPS Transaction Statement For Tier I Account: Current Scheme PreferenceGaurav SrivastavNo ratings yet

- NPS Transaction Statement For Tier I Account: Current Scheme PreferenceDocument3 pagesNPS Transaction Statement For Tier I Account: Current Scheme PreferenceAbburi Kumar AshokNo ratings yet

- NPS Transaction Statement For Tier I Account: Current Scheme PreferenceDocument2 pagesNPS Transaction Statement For Tier I Account: Current Scheme PreferenceAbburi Kumar AshokNo ratings yet

- Central Recordkeeping AgencyDocument3 pagesCentral Recordkeeping AgencyAnuj SoniNo ratings yet

- Centralrecordkeepingagency: National Pension System Transaction Statement - Tier IDocument2 pagesCentralrecordkeepingagency: National Pension System Transaction Statement - Tier Izuheb0% (1)

- NPS Transaction Statement For Tier I Account: Current Scheme PreferenceDocument4 pagesNPS Transaction Statement For Tier I Account: Current Scheme PreferencerahulNo ratings yet

- NPS Transaction Statement For Tier I Account: Current Scheme PreferenceDocument3 pagesNPS Transaction Statement For Tier I Account: Current Scheme PreferenceAbburi Kumar AshokNo ratings yet

- NPS Transaction Statement For Tier I AccountDocument3 pagesNPS Transaction Statement For Tier I Accountvikas0207ikash0% (1)

- NPS Transaction Statement For Tier I Account: Current Scheme PreferenceDocument5 pagesNPS Transaction Statement For Tier I Account: Current Scheme Preferencedk1100861No ratings yet

- NPS Transaction Statement For Tier I Account: Current Scheme PreferenceDocument2 pagesNPS Transaction Statement For Tier I Account: Current Scheme PreferenceLaya DonthulaNo ratings yet

- NPS 2021Document2 pagesNPS 2021Jagannath PradhanNo ratings yet

- NPS Transaction Statement For Tier I Account: Current Scheme PreferenceDocument3 pagesNPS Transaction Statement For Tier I Account: Current Scheme PreferenceHrshiya SharmaNo ratings yet

- NPS Transaction Statement For Tier I Account: Current Scheme PreferenceDocument2 pagesNPS Transaction Statement For Tier I Account: Current Scheme PreferenceKuldeep JadhavNo ratings yet

- Nps StatementDocument3 pagesNps StatementLokesh KevinNo ratings yet

- NPS Transaction Statement For Tier I Account: Current Scheme PreferenceDocument2 pagesNPS Transaction Statement For Tier I Account: Current Scheme PreferencevasumscrmNo ratings yet

- The PrologueDocument2 pagesThe Prologueanuprabhakara.gNo ratings yet

- NPS Transaction Statement For Tier I Account: Current Scheme PreferenceDocument2 pagesNPS Transaction Statement For Tier I Account: Current Scheme PreferenceAbhineet Kumar SinhaNo ratings yet

- NPS Transaction Statement For Tier I Account: Current Scheme PreferenceDocument3 pagesNPS Transaction Statement For Tier I Account: Current Scheme PreferencegyanNo ratings yet

- NPS Transaction Statement For Tier I Account: Current Scheme PreferenceDocument2 pagesNPS Transaction Statement For Tier I Account: Current Scheme PreferenceHmingsanga HauhnarNo ratings yet

- NPS Contribution PDFDocument2 pagesNPS Contribution PDFNishank MadaanNo ratings yet

- NPS Transaction Statement For Tier I Account: Current Scheme PreferenceDocument3 pagesNPS Transaction Statement For Tier I Account: Current Scheme PreferenceHrshiya SharmaNo ratings yet

- Central Recordkeeping AgencyDocument11 pagesCentral Recordkeeping AgencyRudra GourNo ratings yet

- NPS Transaction Statement For Tier I AccountDocument2 pagesNPS Transaction Statement For Tier I AccountABhishekNo ratings yet

- NPS Transaction Statement For Tier I Account: Current Scheme PreferenceDocument2 pagesNPS Transaction Statement For Tier I Account: Current Scheme PreferenceHmingsanga HauhnarNo ratings yet

- NPS Transaction Statement For Tier I Account: Current Scheme PreferenceDocument3 pagesNPS Transaction Statement For Tier I Account: Current Scheme PreferenceHrshiya SharmaNo ratings yet

- NPS Fy23Document5 pagesNPS Fy23Sudhir Kumar SinghNo ratings yet

- Salary Slip Deepak Upadhyay: Daewoo ST India Private LimitedDocument1 pageSalary Slip Deepak Upadhyay: Daewoo ST India Private LimitedDeepak UpadhayayNo ratings yet

- NPS Transaction Statement For Tier I Account: Current Scheme PreferenceDocument2 pagesNPS Transaction Statement For Tier I Account: Current Scheme PreferenceraviNo ratings yet

- Central Recordkeeping AgencyDocument3 pagesCentral Recordkeeping Agencydeep bhattNo ratings yet

- NPS Transaction Statement For Tier I Account: Current Scheme PreferenceDocument3 pagesNPS Transaction Statement For Tier I Account: Current Scheme Preferencevikas_2No ratings yet

- 2024t1allDocument5 pages2024t1allshankargadankush98No ratings yet

- StatementDocument5 pagesStatementmayurrajput1012No ratings yet

- NPS Transaction Statement For Tier I Account: Current Scheme PreferenceDocument2 pagesNPS Transaction Statement For Tier I Account: Current Scheme PreferenceBikram NongmaithemNo ratings yet

- Pay Slip - 1421107 - Apr-22Document1 pagePay Slip - 1421107 - Apr-22Sachin ChadhaNo ratings yet

- Iffco-Tokio General Insurance Co. LTD: Regd. Office: IFFCO Sadan, C-1, Distt. Centre, Saket, New Delhi-110017Document3 pagesIffco-Tokio General Insurance Co. LTD: Regd. Office: IFFCO Sadan, C-1, Distt. Centre, Saket, New Delhi-110017vikrant sehgalNo ratings yet

- 1501137243609Document2 pages1501137243609Sougata Ghosh0% (1)

- NPS Transaction Statement For Tier I Account: Current Scheme PreferenceDocument6 pagesNPS Transaction Statement For Tier I Account: Current Scheme PreferencealokranjangoluNo ratings yet

- NPS Transaction Statement For Tier I Account: Current Scheme PreferenceDocument2 pagesNPS Transaction Statement For Tier I Account: Current Scheme PreferenceDarshan MNo ratings yet

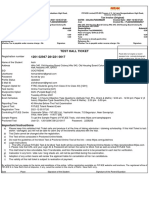

- Test Hall Ticket 1201 02947 281221 0017: Registration NumberDocument1 pageTest Hall Ticket 1201 02947 281221 0017: Registration NumberArsh DhawanNo ratings yet

- Sem 7 FeeDocument1 pageSem 7 Fee20ec074sayaNo ratings yet

- NPS Transaction Statement For Tier I Account: Current Scheme PreferenceDocument2 pagesNPS Transaction Statement For Tier I Account: Current Scheme PreferenceRaj Kumar SinghNo ratings yet

- NPS Transaction Statement For Tier I AccountDocument4 pagesNPS Transaction Statement For Tier I AccountAnonymous HvihZxGNNo ratings yet

- EProcurement System Government of Uttar PradeshDocument2 pagesEProcurement System Government of Uttar PradeshMohit SrivastavaNo ratings yet

- ETendering System Government of NCT of DelhiDocument2 pagesETendering System Government of NCT of DelhidfghjNo ratings yet

- Account StatementDocument3 pagesAccount StatementKoushik MukherjeeNo ratings yet

- Account Statement: Theme Engineering Services Private LimitedDocument1 pageAccount Statement: Theme Engineering Services Private LimitedashutoshstepcountNo ratings yet

- NPS Transaction Statement For Tier I Account: Current Scheme PreferenceDocument2 pagesNPS Transaction Statement For Tier I Account: Current Scheme PreferenceNIkhil GuptaNo ratings yet

- Umang Premiere Apartments: Gat No.677, IVY Estate Kolte Patil, Mouze Wagholi, Tal.:Haveli, Dist.:Pune-412207Document1 pageUmang Premiere Apartments: Gat No.677, IVY Estate Kolte Patil, Mouze Wagholi, Tal.:Haveli, Dist.:Pune-412207HemuNo ratings yet

- P616498467 CleanedDocument1 pageP616498467 CleanedAdil KhanNo ratings yet

- GEC State of The World FinalDocument17 pagesGEC State of The World Finalvivek0724bryantNo ratings yet

- Fdi Notes: Chain Stage in A Host Country Through FDIDocument5 pagesFdi Notes: Chain Stage in A Host Country Through FDIansarNo ratings yet

- Management of Business: Teacher: Miss. GardnerDocument33 pagesManagement of Business: Teacher: Miss. GardnerOckouri BarnesNo ratings yet

- Sales Quotation: Salesman Sign: Customer SignDocument1 pageSales Quotation: Salesman Sign: Customer SignjacobNo ratings yet

- Ebook Ebook PDF International Marketing 6Th Edition by Dana Nicoleta All Chapter PDF Docx KindleDocument41 pagesEbook Ebook PDF International Marketing 6Th Edition by Dana Nicoleta All Chapter PDF Docx Kindlemonique.simmerman868100% (32)

- Mauritius AI StrategyDocument70 pagesMauritius AI Strategyraja mohanNo ratings yet

- Modes of Entry Into Foreign MarketDocument25 pagesModes of Entry Into Foreign MarketYogesh BatraNo ratings yet

- Managerial Accounting Financial RatioDocument20 pagesManagerial Accounting Financial RatioHij PaceteNo ratings yet

- Basic Accounting Final ExamDocument7 pagesBasic Accounting Final ExamCharmae Agan Caroro75% (4)

- The Dilemma at ABC Autos: Group 12Document7 pagesThe Dilemma at ABC Autos: Group 12Aritra DasNo ratings yet

- List of Payment Banks & Small Finance Banks: For Bank and Government ExamsDocument7 pagesList of Payment Banks & Small Finance Banks: For Bank and Government Examsjiby georgeNo ratings yet

- Investment BankingDocument23 pagesInvestment BankingAnkit BhatnagarNo ratings yet

- Chapter 12 Managerial Accounting and Cost-Volume-Profit RelationshipsDocument15 pagesChapter 12 Managerial Accounting and Cost-Volume-Profit RelationshipsJue WernNo ratings yet

- Recent Amendments in TDS Under Income Tax - TVM BR CPE 03.09.2022Document64 pagesRecent Amendments in TDS Under Income Tax - TVM BR CPE 03.09.2022sushant980No ratings yet

- Arf 1 Form-TnpgtaDocument12 pagesArf 1 Form-TnpgtaGnanam SekaranNo ratings yet

- The Effect of Service Quality and Promotion To Customer Satisfaction and Implication of Customer Loyalty in Vehicle Financing Company in Jakarta IndonesiaDocument9 pagesThe Effect of Service Quality and Promotion To Customer Satisfaction and Implication of Customer Loyalty in Vehicle Financing Company in Jakarta Indonesiabuangan kuNo ratings yet

- IMC Chap-I NotesDocument10 pagesIMC Chap-I Notesmoses tilahunNo ratings yet

- Finance Homework 3Document5 pagesFinance Homework 3LâmViênNo ratings yet

- Equity MethodDocument2 pagesEquity MethodJeane Mae BooNo ratings yet

- Rubber "Hevea" Plantation in Polomolok - Chapter Vii Socio-Economic StudyDocument5 pagesRubber "Hevea" Plantation in Polomolok - Chapter Vii Socio-Economic StudyneilmacalamNo ratings yet

- The Importance of Cost ControlDocument36 pagesThe Importance of Cost ControlfajarNo ratings yet

- Service Marketing in Banking SectorDocument34 pagesService Marketing in Banking SectorpRiNcE DuDhAtRaNo ratings yet

- Practice Questions 308Document9 pagesPractice Questions 308Nidale ChehadeNo ratings yet

- Audit of Construction CompaniesDocument2 pagesAudit of Construction Companiesnicole bancoroNo ratings yet

- Clause - 49Document18 pagesClause - 49Manish AroraNo ratings yet

- MCQ - 205 - OmDocument7 pagesMCQ - 205 - Omjaitripathi26100% (1)

- Taxation of Insurance BusinessDocument19 pagesTaxation of Insurance BusinessObeng CliffNo ratings yet

- PLPEM Guidelines Vol2Document213 pagesPLPEM Guidelines Vol2Julius Dionisio100% (1)

- Financial Inclusion-An Overview of MizoramDocument15 pagesFinancial Inclusion-An Overview of MizoramLal NunmawiaNo ratings yet