Professional Documents

Culture Documents

Well Documented Document On Rbi

Well Documented Document On Rbi

Uploaded by

Surendra Singh ChandravatCopyright:

Available Formats

You might also like

- Assignment 1 Solutions: FINA 455FDocument23 pagesAssignment 1 Solutions: FINA 455FLakshya guptaNo ratings yet

- Star Engineering CompanyDocument5 pagesStar Engineering CompanyChleo Espera100% (1)

- Bancom - Memoirs - by DR Sixto K Roxas - Ebook PDFDocument305 pagesBancom - Memoirs - by DR Sixto K Roxas - Ebook PDFVinci RoxasNo ratings yet

- Money Market Operations As On May 29, 2023: Press ReleaseDocument2 pagesMoney Market Operations As On May 29, 2023: Press ReleaseVasu Ram JayanthNo ratings yet

- Money Market Operations As On January 15, 2022: Press ReleaseDocument2 pagesMoney Market Operations As On January 15, 2022: Press ReleaseAayush GuptaNo ratings yet

- Amount in Rupees Crore, Rate in Per CentDocument2 pagesAmount in Rupees Crore, Rate in Per CentA-Series OfficialNo ratings yet

- Amount in Rupees Crore, Rate in Per CentDocument2 pagesAmount in Rupees Crore, Rate in Per CentVasu Ram JayanthNo ratings yet

- Amount in Rupees Crore, Rate in Per CentDocument2 pagesAmount in Rupees Crore, Rate in Per CentTrollTrends inc.No ratings yet

- Money Market Operations As On July 16, 2021Document2 pagesMoney Market Operations As On July 16, 2021Vasu Ram JayanthNo ratings yet

- 2023 07 03 Margin Statements DSJ181Document3 pages2023 07 03 Margin Statements DSJ181kundanmaity2No ratings yet

- Trade Coms: Investment To Tradecom Capital Add: Intt. On Capita Add: Salary Add: Share PF ProfitDocument5 pagesTrade Coms: Investment To Tradecom Capital Add: Intt. On Capita Add: Salary Add: Share PF ProfitAbhishek Kr SinghNo ratings yet

- All File Dra CommercialDocument110 pagesAll File Dra CommercialKevin JaroNo ratings yet

- MS08092022Document3 pagesMS08092022Hoàng Minh ChuNo ratings yet

- Trade Coms: Investment To Tradecom Capital Add: Intt. On Capital Add: Salary Add: Share PF ProfitDocument5 pagesTrade Coms: Investment To Tradecom Capital Add: Intt. On Capital Add: Salary Add: Share PF ProfitAbhishek Kr SinghNo ratings yet

- Option Chain (Equity Derivatives)Document3 pagesOption Chain (Equity Derivatives)RJ LaxmikaantNo ratings yet

- Patihindo Inv13 Jun16Document6 pagesPatihindo Inv13 Jun16SidikNakDurtuNo ratings yet

- Agricultural Development Bank Limited: Unaudited Financial Results (Quarterly)Document3 pagesAgricultural Development Bank Limited: Unaudited Financial Results (Quarterly)sanjiv sahNo ratings yet

- CIRP Expenses - BreakupDocument2 pagesCIRP Expenses - BreakupsnigdhabeeNo ratings yet

- 2023 02 07 Margin Statements HB6596Document3 pages2023 02 07 Margin Statements HB6596Nageswara Rao VemulaNo ratings yet

- KSP Mitra Dhuafa (Komida) : Monthly Project Statement - Konsolidasi Periode 31 Oktober 2020Document2 pagesKSP Mitra Dhuafa (Komida) : Monthly Project Statement - Konsolidasi Periode 31 Oktober 2020Icha ChairunNo ratings yet

- BusiDev - CM&T Danao Transfer To GroundDocument6 pagesBusiDev - CM&T Danao Transfer To GroundJhon Rey LaycoNo ratings yet

- Financial Statement AnalysisDocument14 pagesFinancial Statement AnalysisManoj ManchandaNo ratings yet

- 4 HW On Gov't Grant, Depreciation, Revaluation and Impairment T3 Answer KeyDocument9 pages4 HW On Gov't Grant, Depreciation, Revaluation and Impairment T3 Answer KeyJessica Mikah Lim AgbayaniNo ratings yet

- Financial Analysis of WSPsDocument3 pagesFinancial Analysis of WSPsAnju KarkiNo ratings yet

- Cia DAMDocument24 pagesCia DAMvishalNo ratings yet

- Option Chain 25 JuneDocument3 pagesOption Chain 25 JuneRJ LaxmikaantNo ratings yet

- IA2 Ch. 5 6Document12 pagesIA2 Ch. 5 6JessaNo ratings yet

- Tabel3 1 2Document2 pagesTabel3 1 2Hapiz1101No ratings yet

- TABLE 5.1 Components of Monetary AssetsDocument9 pagesTABLE 5.1 Components of Monetary AssetsfaysalNo ratings yet

- M/S Rajesh Vishwakarma Hardware Aluminium Ply Glass HouseDocument7 pagesM/S Rajesh Vishwakarma Hardware Aluminium Ply Glass Housebizlawn servicesNo ratings yet

- Budget Expenditures and Sources of FinancingDocument5 pagesBudget Expenditures and Sources of FinancingkQy267BdTKNo ratings yet

- The Chief General Manager, State Bank of India, Local Head Office, All Circles/CCG/CAG/SARG/IBG EtcDocument8 pagesThe Chief General Manager, State Bank of India, Local Head Office, All Circles/CCG/CAG/SARG/IBG EtcNiharika GuptaNo ratings yet

- Attractive Bluechips 15 Mar 2023 1425Document5 pagesAttractive Bluechips 15 Mar 2023 1425P.g. SunilkumarNo ratings yet

- Sub Contractor Interim Payment CertificateDocument10 pagesSub Contractor Interim Payment CertificateUditha AnuruddthaNo ratings yet

- Budget Summary - FinalDocument1 pageBudget Summary - FinalSheena Mae de LeonNo ratings yet

- Pak DebtDocument1 pagePak Debtmadihaishaq077No ratings yet

- Project Report For Manufacturing & Trading of Embroidery SareeDocument11 pagesProject Report For Manufacturing & Trading of Embroidery SareeSHRUTI AGRAWALNo ratings yet

- It FebDocument3 pagesIt Febchandra veerNo ratings yet

- Uploads Admin Schedule of FeesDocument3 pagesUploads Admin Schedule of Feesllewop100% (2)

- Invoice-27 MOA-4 Rekap PDFDocument1 pageInvoice-27 MOA-4 Rekap PDFdeeb1987No ratings yet

- Abrar Engro Excel SheetDocument4 pagesAbrar Engro Excel SheetManahil FayyazNo ratings yet

- 0.summary of Cost (F)Document11 pages0.summary of Cost (F)M ShahidNo ratings yet

- Bs Fa ScheduleDocument2 pagesBs Fa Schedulesamir.bandopadhyayNo ratings yet

- Hazim Brothers QpidDocument13 pagesHazim Brothers QpidMILINDSWNo ratings yet

- Cutting List Rebar WBDocument8 pagesCutting List Rebar WBMHD.RIAN FIRDAUSNo ratings yet

- PPR008204932858-Repayment ScheduleDocument4 pagesPPR008204932858-Repayment ScheduleanitaratnaniNo ratings yet

- AHI - Cash Projection Until Maret - Mei 2023Document4 pagesAHI - Cash Projection Until Maret - Mei 2023Zesthotel YogyakartaNo ratings yet

- SY 2024-2025 Fees - Makati - Media Studies, Computer - Technology ProgramsDocument1 pageSY 2024-2025 Fees - Makati - Media Studies, Computer - Technology ProgramsNecrosisGaming YTNo ratings yet

- Sattva Bliss - Cost SheetDocument1 pageSattva Bliss - Cost Sheetathulyasathyan16No ratings yet

- Purchase OrderDocument54 pagesPurchase OrderTuao United Builders Transport CooperativeNo ratings yet

- IPC 08 THDocument80 pagesIPC 08 THNarendra BokreNo ratings yet

- Unrealised Profit and Loss RM - 3228264 - 05 01 24 04 00 43Document2 pagesUnrealised Profit and Loss RM - 3228264 - 05 01 24 04 00 43ErUmangKoyaniNo ratings yet

- Nepal Rastra Bank: Public Debt Management DepartmentDocument3 pagesNepal Rastra Bank: Public Debt Management DepartmentPrakash PahariNo ratings yet

- Master in Information Technology - PT - OnlineDocument2 pagesMaster in Information Technology - PT - Onlinemarina sulaimanNo ratings yet

- ProjectDocument17 pagesProjectshubham shauravNo ratings yet

- P1 TransactionsDocument10 pagesP1 TransactionstejmystNo ratings yet

- No Doc Date Terms Currency Code Current MTH 1 Month 2 Months 3 Mths & Above TotalDocument1 pageNo Doc Date Terms Currency Code Current MTH 1 Month 2 Months 3 Mths & Above TotalSasiram RajasekaranNo ratings yet

- PayDocument2 pagesPaytilakra100% (3)

- BSE Intimation 27072023 Signed-V1Document9 pagesBSE Intimation 27072023 Signed-V1adityamohanty2206No ratings yet

- Securities Operations: A Guide to Trade and Position ManagementFrom EverandSecurities Operations: A Guide to Trade and Position ManagementRating: 4 out of 5 stars4/5 (3)

- Market Risk Management for Hedge Funds: Foundations of the Style and Implicit Value-at-RiskFrom EverandMarket Risk Management for Hedge Funds: Foundations of the Style and Implicit Value-at-RiskNo ratings yet

- Liquidity ManagementDocument17 pagesLiquidity ManagementshoaibdastanNo ratings yet

- Chapter Two: Financial Market and InstrumentsDocument179 pagesChapter Two: Financial Market and InstrumentsYismawNo ratings yet

- Insta 75 Days Revision Plan 16 03 2023Document16 pagesInsta 75 Days Revision Plan 16 03 2023Amit KumarNo ratings yet

- Central Banking and Monetary PolicyDocument6 pagesCentral Banking and Monetary Policyrishit0504No ratings yet

- Ut - 1 Economics - Xii 2021-22Document5 pagesUt - 1 Economics - Xii 2021-22Nandini JhaNo ratings yet

- Financial Services: Securities Brokerage and Investment BankingDocument16 pagesFinancial Services: Securities Brokerage and Investment BankingSta KerNo ratings yet

- 6.debt Market and Forex Market-TheoriticalDocument27 pages6.debt Market and Forex Market-TheoriticaljashuramuNo ratings yet

- Efficient Client Onboarding The Key To Empowering Banks PDFDocument9 pagesEfficient Client Onboarding The Key To Empowering Banks PDFsaumilshuklaNo ratings yet

- Mba II Financial Management (14mba22) NotesDocument53 pagesMba II Financial Management (14mba22) NotesPriya PriyaNo ratings yet

- Repo HandbookDocument38 pagesRepo Handbooknick_williams_38No ratings yet

- Repport GabinDocument45 pagesRepport Gabinkenfouet ouamba gabinNo ratings yet

- Money & BankingDocument65 pagesMoney & BankingHusain IraniNo ratings yet

- 1.Bd InitialaDocument4,241 pages1.Bd InitialaCorovei EmiliaNo ratings yet

- Navi US Total Stock Market Fund of FundDocument100 pagesNavi US Total Stock Market Fund of FundPerumal DuraiNo ratings yet

- Saraswat Co-Oprative Bank FINALDocument45 pagesSaraswat Co-Oprative Bank FINALVivek Rabadia100% (1)

- Financial Markets Midterm ReviewerDocument8 pagesFinancial Markets Midterm ReviewerFiona Erica ComplitadoNo ratings yet

- Equities ModuleDocument26 pagesEquities ModuleRahul M. DasNo ratings yet

- Indian Institute of Banking & FinanceDocument53 pagesIndian Institute of Banking & FinanceDipti DalviNo ratings yet

- Boz Annual Report 2011Document146 pagesBoz Annual Report 2011SamNo ratings yet

- International Financial Reporting StandardsDocument23 pagesInternational Financial Reporting StandardsAneela AamirNo ratings yet

- FIM Chapter 4Document16 pagesFIM Chapter 4Surafel BefekaduNo ratings yet

- Investment Environment and Investment Management ProcessDocument66 pagesInvestment Environment and Investment Management ProcessRony TolingNo ratings yet

- Indian Money MarketDocument77 pagesIndian Money MarketNitish GuptaNo ratings yet

- Repo Rate AssignmentDocument1 pageRepo Rate AssignmentDeepak KaushikNo ratings yet

- Basic Economy ConceptsDocument4 pagesBasic Economy ConceptsCharu JainNo ratings yet

- Ind AS 115Document21 pagesInd AS 115Vrinda KNo ratings yet

- Lol - 2019 09 06 Financial OpportunitiesDocument3 pagesLol - 2019 09 06 Financial OpportunitiesOildeals Ng100% (1)

- ACI Diploma New Version Syllabus (10p, ACI, 2019)Document10 pagesACI Diploma New Version Syllabus (10p, ACI, 2019)Farah EgalNo ratings yet

Well Documented Document On Rbi

Well Documented Document On Rbi

Uploaded by

Surendra Singh ChandravatOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Well Documented Document On Rbi

Well Documented Document On Rbi

Uploaded by

Surendra Singh ChandravatCopyright:

Available Formats

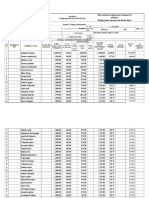

�ेस �काशनी PRESS RELEASE

भारतीय �रज़व� ब�क

RESERVE BANK OF INDIA

वेबसाइट : www.rbi.org.in/hindi संचार िवभाग, क� �ीय कायार्लय, शहीद भगत �संह मागर्, फोटर्, मुंबई-400001

Website : www.rbi.org.in Department of Communication, Central Office, Shahid Bhagat Singh Marg, Fort,

ई-मेल/email : helpdoc@rbi.org.in Mumbai-400001 फोन/Phone: 022- 22660502

September 01, 2023

Money Market Operations as on August 31, 2023

(Amount in ₹ Crore, Rate in Per cent)

MONEY MARKETS@ Volume Weighted Range

(One Leg) Average Rate

A. Overnight Segment (I+II+III+IV) 523,651.86 6.63 5.00-6.80

I. Call Money 8,199.30 6.58 5.00-6.75

II. Triparty Repo 369,382.60 6.62 6.25-6.70

III. Market Repo 146,069.96 6.64 6.25-6.80

IV. Repo in Corporate Bond 0.00 - -

B. Term Segment

I. Notice Money** 114.76 6.39 5.80-6.63

II. Term Money@@ 109.50 - 6.65-7.00

III. Triparty Repo 280.50 6.64 6.60-6.65

IV. Market Repo 532.62 6.85 6.85-6.85

V. Repo in Corporate Bond 0.00 - -

RBI OPERATIONS@ Auction Tenor Maturity Amount Current

Date (Days) Date Rate/Cut

off Rate

C. Liquidity Adjustment Facility (LAF), Marginal Standing Facility (MSF) & Standing Deposit Facility (SDF)

I Today's Operations

1. Fixed Rate

2. Variable Rate&

(I) Main Operation

(a) Repo

(b) Reverse Repo

(II) Fine Tuning Operations

(a) Repo

(b) Reverse Repo

3. MSF Thu, 31/08/2023 1 Fri, 01/09/2023 3,092.00 6.75

4. SDFΔ Thu, 31/08/2023 1 Fri, 01/09/2023 76,129.00 6.25

5. Net liquidity injected from today's

-73,037.00

operations [injection (+)/absorption (-)]*

II Outstanding Operations

1. Fixed Rate

2. Variable Rate&

(I) Main Operation

(a) Repo

(b) Reverse Repo Fri, 25/08/2023 14 Fri, 08/09/2023 22,419.00 6.49

(II) Fine Tuning Operations

(a) Repo

(b) Reverse Repo

3. MSF

4. SDFΔ

2

5. On Tap Targeted Long Term Repo Mon, 22/03/2021 1095 Thu, 21/03/2024 5,000.00 4.00

Operations€ Mon, 14/06/2021 1096 Fri, 14/06/2024 320.00 4.00

Mon, 30/08/2021 1095 Thu, 29/08/2024 50.00 4.00

Mon, 13/09/2021 1095 Thu, 12/09/2024 200.00 4.00

Mon, 27/09/2021 1095 Thu, 26/09/2024 600.00 4.00

Mon, 04/10/2021 1095 Thu, 03/10/2024 350.00 4.00

Mon, 15/11/2021 1095 Thu, 14/11/2024 250.00 4.00

Mon, 27/12/2021 1095 Thu, 26/12/2024 2,275.00 4.00

6. Special Long-Term Repo Operations Mon, 17/05/2021 1095 Thu, 16/05/2024 400.00 4.00

(SLTRO) for Small Finance Banks Tue, 15/06/2021 1095 Fri, 14/06/2024 490.00 4.00

(SFBs)£ Thu, 15/07/2021 1093 Fri, 12/07/2024 750.00 4.00

Tue, 17/08/2021 1095 Fri, 16/08/2024 250.00 4.00

Wed, 15/09/2021 1094 Fri, 13/09/2024 150.00 4.00

Mon, 15/11/2021 1095 Thu, 14/11/2024 105.00 4.00

Mon, 22/11/2021 1095 Thu, 21/11/2024 100.00 4.00

Mon, 29/11/2021 1095 Thu, 28/11/2024 305.00 4.00

Mon, 13/12/2021 1095 Thu, 12/12/2024 150.00 4.00

Mon, 20/12/2021 1095 Thu, 19/12/2024 100.00 4.00

Mon, 27/12/2021 1095 Thu, 26/12/2024 255.00 4.00

D. Standing Liquidity Facility (SLF) Availed from RBI$ 3,122.43

E. Net liquidity injected from outstanding operations [injection

-7,196.57

(+)/absorption (-)]*

F. Net liquidity injected (outstanding including today's

-80,233.57

operations) [injection (+)/absorption (-)]*

RESERVE POSITION@

G. Cash Reserves Position of Scheduled Commercial Banks

(i) Cash balances with RBI as on August 31, 2023 1,027,502.00

(ii) Average daily cash reserve requirement for the fortnight ending September 08, 2023 1,005,790.00

H. Government of India Surplus Cash Balance Reckoned for Auction as on¥ August 31, 2023 0.00

I. Net durable liquidity [surplus (+)/deficit (-)] as on August 11, 2023 360,558.00

@ Based on Reserve Bank of India (RBI) / Clearing Corporation of India Limited (CCIL).

- Not Applicable / No Transaction.

** Relates to uncollateralized transactions of 2 to 14 days tenor.

@@ Relates to uncollateralized transactions of 15 days to one year tenor.

$ Includes refinance facilities extended by RBI.

& As per the Press Release No. 2019-2020/1900 dated February 06, 2020.

Δ As per the Press Release No. 2022-2023/41 dated April 08, 2022.

* Net liquidity is calculated as Repo+MSF+SLF-Reverse Repo-SDF.

€ As per the Press Release No. 2020-2021/520 dated October 21, 2020, Press Release No. 2020-2021/763 dated December 11, 2020,

Press Release No. 2020-2021/1057 dated February 05, 2021 and Press Release No. 2021-2022/695 dated August 13, 2021.

¥ As per the Press Release No. 2014-2015/1971 dated March 19, 2015.

£ As per the Press Release No. 2021-2022/181 dated May 07, 2021 and Press Release No. 2021-2022/1023 dated October 11, 2021.

Ajit Prasad

Press Release: 2023-2024/848 Director (Communications)

You might also like

- Assignment 1 Solutions: FINA 455FDocument23 pagesAssignment 1 Solutions: FINA 455FLakshya guptaNo ratings yet

- Star Engineering CompanyDocument5 pagesStar Engineering CompanyChleo Espera100% (1)

- Bancom - Memoirs - by DR Sixto K Roxas - Ebook PDFDocument305 pagesBancom - Memoirs - by DR Sixto K Roxas - Ebook PDFVinci RoxasNo ratings yet

- Money Market Operations As On May 29, 2023: Press ReleaseDocument2 pagesMoney Market Operations As On May 29, 2023: Press ReleaseVasu Ram JayanthNo ratings yet

- Money Market Operations As On January 15, 2022: Press ReleaseDocument2 pagesMoney Market Operations As On January 15, 2022: Press ReleaseAayush GuptaNo ratings yet

- Amount in Rupees Crore, Rate in Per CentDocument2 pagesAmount in Rupees Crore, Rate in Per CentA-Series OfficialNo ratings yet

- Amount in Rupees Crore, Rate in Per CentDocument2 pagesAmount in Rupees Crore, Rate in Per CentVasu Ram JayanthNo ratings yet

- Amount in Rupees Crore, Rate in Per CentDocument2 pagesAmount in Rupees Crore, Rate in Per CentTrollTrends inc.No ratings yet

- Money Market Operations As On July 16, 2021Document2 pagesMoney Market Operations As On July 16, 2021Vasu Ram JayanthNo ratings yet

- 2023 07 03 Margin Statements DSJ181Document3 pages2023 07 03 Margin Statements DSJ181kundanmaity2No ratings yet

- Trade Coms: Investment To Tradecom Capital Add: Intt. On Capita Add: Salary Add: Share PF ProfitDocument5 pagesTrade Coms: Investment To Tradecom Capital Add: Intt. On Capita Add: Salary Add: Share PF ProfitAbhishek Kr SinghNo ratings yet

- All File Dra CommercialDocument110 pagesAll File Dra CommercialKevin JaroNo ratings yet

- MS08092022Document3 pagesMS08092022Hoàng Minh ChuNo ratings yet

- Trade Coms: Investment To Tradecom Capital Add: Intt. On Capital Add: Salary Add: Share PF ProfitDocument5 pagesTrade Coms: Investment To Tradecom Capital Add: Intt. On Capital Add: Salary Add: Share PF ProfitAbhishek Kr SinghNo ratings yet

- Option Chain (Equity Derivatives)Document3 pagesOption Chain (Equity Derivatives)RJ LaxmikaantNo ratings yet

- Patihindo Inv13 Jun16Document6 pagesPatihindo Inv13 Jun16SidikNakDurtuNo ratings yet

- Agricultural Development Bank Limited: Unaudited Financial Results (Quarterly)Document3 pagesAgricultural Development Bank Limited: Unaudited Financial Results (Quarterly)sanjiv sahNo ratings yet

- CIRP Expenses - BreakupDocument2 pagesCIRP Expenses - BreakupsnigdhabeeNo ratings yet

- 2023 02 07 Margin Statements HB6596Document3 pages2023 02 07 Margin Statements HB6596Nageswara Rao VemulaNo ratings yet

- KSP Mitra Dhuafa (Komida) : Monthly Project Statement - Konsolidasi Periode 31 Oktober 2020Document2 pagesKSP Mitra Dhuafa (Komida) : Monthly Project Statement - Konsolidasi Periode 31 Oktober 2020Icha ChairunNo ratings yet

- BusiDev - CM&T Danao Transfer To GroundDocument6 pagesBusiDev - CM&T Danao Transfer To GroundJhon Rey LaycoNo ratings yet

- Financial Statement AnalysisDocument14 pagesFinancial Statement AnalysisManoj ManchandaNo ratings yet

- 4 HW On Gov't Grant, Depreciation, Revaluation and Impairment T3 Answer KeyDocument9 pages4 HW On Gov't Grant, Depreciation, Revaluation and Impairment T3 Answer KeyJessica Mikah Lim AgbayaniNo ratings yet

- Financial Analysis of WSPsDocument3 pagesFinancial Analysis of WSPsAnju KarkiNo ratings yet

- Cia DAMDocument24 pagesCia DAMvishalNo ratings yet

- Option Chain 25 JuneDocument3 pagesOption Chain 25 JuneRJ LaxmikaantNo ratings yet

- IA2 Ch. 5 6Document12 pagesIA2 Ch. 5 6JessaNo ratings yet

- Tabel3 1 2Document2 pagesTabel3 1 2Hapiz1101No ratings yet

- TABLE 5.1 Components of Monetary AssetsDocument9 pagesTABLE 5.1 Components of Monetary AssetsfaysalNo ratings yet

- M/S Rajesh Vishwakarma Hardware Aluminium Ply Glass HouseDocument7 pagesM/S Rajesh Vishwakarma Hardware Aluminium Ply Glass Housebizlawn servicesNo ratings yet

- Budget Expenditures and Sources of FinancingDocument5 pagesBudget Expenditures and Sources of FinancingkQy267BdTKNo ratings yet

- The Chief General Manager, State Bank of India, Local Head Office, All Circles/CCG/CAG/SARG/IBG EtcDocument8 pagesThe Chief General Manager, State Bank of India, Local Head Office, All Circles/CCG/CAG/SARG/IBG EtcNiharika GuptaNo ratings yet

- Attractive Bluechips 15 Mar 2023 1425Document5 pagesAttractive Bluechips 15 Mar 2023 1425P.g. SunilkumarNo ratings yet

- Sub Contractor Interim Payment CertificateDocument10 pagesSub Contractor Interim Payment CertificateUditha AnuruddthaNo ratings yet

- Budget Summary - FinalDocument1 pageBudget Summary - FinalSheena Mae de LeonNo ratings yet

- Pak DebtDocument1 pagePak Debtmadihaishaq077No ratings yet

- Project Report For Manufacturing & Trading of Embroidery SareeDocument11 pagesProject Report For Manufacturing & Trading of Embroidery SareeSHRUTI AGRAWALNo ratings yet

- It FebDocument3 pagesIt Febchandra veerNo ratings yet

- Uploads Admin Schedule of FeesDocument3 pagesUploads Admin Schedule of Feesllewop100% (2)

- Invoice-27 MOA-4 Rekap PDFDocument1 pageInvoice-27 MOA-4 Rekap PDFdeeb1987No ratings yet

- Abrar Engro Excel SheetDocument4 pagesAbrar Engro Excel SheetManahil FayyazNo ratings yet

- 0.summary of Cost (F)Document11 pages0.summary of Cost (F)M ShahidNo ratings yet

- Bs Fa ScheduleDocument2 pagesBs Fa Schedulesamir.bandopadhyayNo ratings yet

- Hazim Brothers QpidDocument13 pagesHazim Brothers QpidMILINDSWNo ratings yet

- Cutting List Rebar WBDocument8 pagesCutting List Rebar WBMHD.RIAN FIRDAUSNo ratings yet

- PPR008204932858-Repayment ScheduleDocument4 pagesPPR008204932858-Repayment ScheduleanitaratnaniNo ratings yet

- AHI - Cash Projection Until Maret - Mei 2023Document4 pagesAHI - Cash Projection Until Maret - Mei 2023Zesthotel YogyakartaNo ratings yet

- SY 2024-2025 Fees - Makati - Media Studies, Computer - Technology ProgramsDocument1 pageSY 2024-2025 Fees - Makati - Media Studies, Computer - Technology ProgramsNecrosisGaming YTNo ratings yet

- Sattva Bliss - Cost SheetDocument1 pageSattva Bliss - Cost Sheetathulyasathyan16No ratings yet

- Purchase OrderDocument54 pagesPurchase OrderTuao United Builders Transport CooperativeNo ratings yet

- IPC 08 THDocument80 pagesIPC 08 THNarendra BokreNo ratings yet

- Unrealised Profit and Loss RM - 3228264 - 05 01 24 04 00 43Document2 pagesUnrealised Profit and Loss RM - 3228264 - 05 01 24 04 00 43ErUmangKoyaniNo ratings yet

- Nepal Rastra Bank: Public Debt Management DepartmentDocument3 pagesNepal Rastra Bank: Public Debt Management DepartmentPrakash PahariNo ratings yet

- Master in Information Technology - PT - OnlineDocument2 pagesMaster in Information Technology - PT - Onlinemarina sulaimanNo ratings yet

- ProjectDocument17 pagesProjectshubham shauravNo ratings yet

- P1 TransactionsDocument10 pagesP1 TransactionstejmystNo ratings yet

- No Doc Date Terms Currency Code Current MTH 1 Month 2 Months 3 Mths & Above TotalDocument1 pageNo Doc Date Terms Currency Code Current MTH 1 Month 2 Months 3 Mths & Above TotalSasiram RajasekaranNo ratings yet

- PayDocument2 pagesPaytilakra100% (3)

- BSE Intimation 27072023 Signed-V1Document9 pagesBSE Intimation 27072023 Signed-V1adityamohanty2206No ratings yet

- Securities Operations: A Guide to Trade and Position ManagementFrom EverandSecurities Operations: A Guide to Trade and Position ManagementRating: 4 out of 5 stars4/5 (3)

- Market Risk Management for Hedge Funds: Foundations of the Style and Implicit Value-at-RiskFrom EverandMarket Risk Management for Hedge Funds: Foundations of the Style and Implicit Value-at-RiskNo ratings yet

- Liquidity ManagementDocument17 pagesLiquidity ManagementshoaibdastanNo ratings yet

- Chapter Two: Financial Market and InstrumentsDocument179 pagesChapter Two: Financial Market and InstrumentsYismawNo ratings yet

- Insta 75 Days Revision Plan 16 03 2023Document16 pagesInsta 75 Days Revision Plan 16 03 2023Amit KumarNo ratings yet

- Central Banking and Monetary PolicyDocument6 pagesCentral Banking and Monetary Policyrishit0504No ratings yet

- Ut - 1 Economics - Xii 2021-22Document5 pagesUt - 1 Economics - Xii 2021-22Nandini JhaNo ratings yet

- Financial Services: Securities Brokerage and Investment BankingDocument16 pagesFinancial Services: Securities Brokerage and Investment BankingSta KerNo ratings yet

- 6.debt Market and Forex Market-TheoriticalDocument27 pages6.debt Market and Forex Market-TheoriticaljashuramuNo ratings yet

- Efficient Client Onboarding The Key To Empowering Banks PDFDocument9 pagesEfficient Client Onboarding The Key To Empowering Banks PDFsaumilshuklaNo ratings yet

- Mba II Financial Management (14mba22) NotesDocument53 pagesMba II Financial Management (14mba22) NotesPriya PriyaNo ratings yet

- Repo HandbookDocument38 pagesRepo Handbooknick_williams_38No ratings yet

- Repport GabinDocument45 pagesRepport Gabinkenfouet ouamba gabinNo ratings yet

- Money & BankingDocument65 pagesMoney & BankingHusain IraniNo ratings yet

- 1.Bd InitialaDocument4,241 pages1.Bd InitialaCorovei EmiliaNo ratings yet

- Navi US Total Stock Market Fund of FundDocument100 pagesNavi US Total Stock Market Fund of FundPerumal DuraiNo ratings yet

- Saraswat Co-Oprative Bank FINALDocument45 pagesSaraswat Co-Oprative Bank FINALVivek Rabadia100% (1)

- Financial Markets Midterm ReviewerDocument8 pagesFinancial Markets Midterm ReviewerFiona Erica ComplitadoNo ratings yet

- Equities ModuleDocument26 pagesEquities ModuleRahul M. DasNo ratings yet

- Indian Institute of Banking & FinanceDocument53 pagesIndian Institute of Banking & FinanceDipti DalviNo ratings yet

- Boz Annual Report 2011Document146 pagesBoz Annual Report 2011SamNo ratings yet

- International Financial Reporting StandardsDocument23 pagesInternational Financial Reporting StandardsAneela AamirNo ratings yet

- FIM Chapter 4Document16 pagesFIM Chapter 4Surafel BefekaduNo ratings yet

- Investment Environment and Investment Management ProcessDocument66 pagesInvestment Environment and Investment Management ProcessRony TolingNo ratings yet

- Indian Money MarketDocument77 pagesIndian Money MarketNitish GuptaNo ratings yet

- Repo Rate AssignmentDocument1 pageRepo Rate AssignmentDeepak KaushikNo ratings yet

- Basic Economy ConceptsDocument4 pagesBasic Economy ConceptsCharu JainNo ratings yet

- Ind AS 115Document21 pagesInd AS 115Vrinda KNo ratings yet

- Lol - 2019 09 06 Financial OpportunitiesDocument3 pagesLol - 2019 09 06 Financial OpportunitiesOildeals Ng100% (1)

- ACI Diploma New Version Syllabus (10p, ACI, 2019)Document10 pagesACI Diploma New Version Syllabus (10p, ACI, 2019)Farah EgalNo ratings yet