Professional Documents

Culture Documents

New Stop Order Documentation For EoD Files

New Stop Order Documentation For EoD Files

Uploaded by

jmanzungu2820Copyright:

Available Formats

You might also like

- Scam Tengiz Oil and Gas Field Refinery (Ci Jet-A1) To LMS Commodity Trading DMCC SaDocument4 pagesScam Tengiz Oil and Gas Field Refinery (Ci Jet-A1) To LMS Commodity Trading DMCC SaS. L. (“laolou”)No ratings yet

- Detailed Proforma Invoice TemplateDocument2 pagesDetailed Proforma Invoice TemplateNajam KhanNo ratings yet

- B-64693en-1, Fanuc 0i-Model F Plus Connection Manual (Function)Document3,108 pagesB-64693en-1, Fanuc 0i-Model F Plus Connection Manual (Function)VladimirAgeev100% (2)

- Crane PartsDocument931 pagesCrane Partstecnicomanel100% (3)

- Ramtech Code For Mold and Tooling Rev2Document17 pagesRamtech Code For Mold and Tooling Rev2Dhenil ManubatNo ratings yet

- 15 Dinora 115557 PDFDocument91 pages15 Dinora 115557 PDFMadhur GuptaNo ratings yet

- Points - 4 v1Document69 pagesPoints - 4 v1m.awaisuohNo ratings yet

- Points - 4 v5Document119 pagesPoints - 4 v5m.awaisuohNo ratings yet

- SH 2300011534Document1 pageSH 2300011534Ganesh BharaneNo ratings yet

- SPL ProcurementDocument49 pagesSPL ProcurementMallu LoharNo ratings yet

- BKCOM - Structure BknomDocument29 pagesBKCOM - Structure BknomPouedeou TchambaNo ratings yet

- Doc. de Transporte.Document3 pagesDoc. de Transporte.Paula ContrerasNo ratings yet

- Additional Tyre Req Mahalaxmi Truck NylonDocument4 pagesAdditional Tyre Req Mahalaxmi Truck Nylonjayesh singh rathoreNo ratings yet

- Item Code Opening FormDocument16 pagesItem Code Opening FormAbhiNo ratings yet

- Oocl Invoice Inv Afl-6948 BL Oolu2726566460 Los Angeles 1x40 RHDocument1 pageOocl Invoice Inv Afl-6948 BL Oolu2726566460 Los Angeles 1x40 RHsnowmine666No ratings yet

- SAILESH PROJECTDocument11 pagesSAILESH PROJECTRP TechNo ratings yet

- Commercial Invoice/Packing ListDocument2 pagesCommercial Invoice/Packing ListAchmad PurwantoNo ratings yet

- America Samoa OfferDocument1 pageAmerica Samoa OfferJohn MansNo ratings yet

- TASWEEQ FOB TTV FORMAT DafsR264PDocument9 pagesTASWEEQ FOB TTV FORMAT DafsR264PxsensonicNo ratings yet

- יישום MMDocument124 pagesיישום MMsama greedyNo ratings yet

- Group No 9 Baf BS 1BDocument10 pagesGroup No 9 Baf BS 1BseverinmsangiNo ratings yet

- SKQUOT230-304 MergedDocument5 pagesSKQUOT230-304 MergedSK EnterprisesNo ratings yet

- A A A A AaaaaaaaaaaaaaaDocument1 pageA A A A Aaaaaaaaaaaaaaajharkhandexpress914No ratings yet

- Disp Vaidys - Loyalty Programme 2010-11Document2 pagesDisp Vaidys - Loyalty Programme 2010-11Mahesh DhakaNo ratings yet

- PT Amanah Latihan LSPDocument79 pagesPT Amanah Latihan LSPDragrexsNo ratings yet

- OCN68463Document3 pagesOCN68463RonyNo ratings yet

- CARPER LAD Form No. 64 Transmittal Memorandum To ROD For Registration of CLOAsDocument3 pagesCARPER LAD Form No. 64 Transmittal Memorandum To ROD For Registration of CLOAsart83360911554No ratings yet

- PI Shaym IndustriesDocument1 pagePI Shaym IndustriesJS INDUSTRIESNo ratings yet

- Brazil Withholding Tax AccumulationDocument10 pagesBrazil Withholding Tax Accumulationvitoriamodena556No ratings yet

- Report - Tax by Bank GLDocument16 pagesReport - Tax by Bank GLFakhar AbbasNo ratings yet

- Master Mto Sheet-Unit 1Document541 pagesMaster Mto Sheet-Unit 1shreearihantamolsNo ratings yet

- Logsheet GT#1Document47 pagesLogsheet GT#1rendalpltghaltimNo ratings yet

- San San Marketing (SSM) : Description CodeDocument3 pagesSan San Marketing (SSM) : Description CodeiyaNo ratings yet

- GL Over ViewDocument28 pagesGL Over ViewSurendranath PinnaNo ratings yet

- De Boef Betty - 1237 - ScannedDocument4 pagesDe Boef Betty - 1237 - ScannedZach EdwardsNo ratings yet

- Transit Losses: Goods Receipt Note For Dairy ProductsDocument2 pagesTransit Losses: Goods Receipt Note For Dairy ProductsRomagnoli GozaliNo ratings yet

- Symbol List DirectionsDocument31 pagesSymbol List DirectionsMohits952No ratings yet

- Format MT940Document18 pagesFormat MT940Hamdani MuhammadNo ratings yet

- Overseas Purchase Order: VEN OR ..: San DR LL CanadaDocument1 pageOverseas Purchase Order: VEN OR ..: San DR LL CanadaRimal ButtNo ratings yet

- Accounting Voucher Useless DumDocument1 pageAccounting Voucher Useless Dumsrishanth9aNo ratings yet

- As Is DocumentDocument37 pagesAs Is DocumentJyotiraditya BanerjeeNo ratings yet

- Carnet de Soudure - Ligne 20'' Du MG HNIA 05 Vers CPF ALRARDocument59 pagesCarnet de Soudure - Ligne 20'' Du MG HNIA 05 Vers CPF ALRARbahousmustapha31No ratings yet

- Btca 302 ModelsDocument37 pagesBtca 302 ModelslbaamagolaNo ratings yet

- Galileo Quick Reference Tins ReportDocument27 pagesGalileo Quick Reference Tins ReportMomin QadirNo ratings yet

- CMS Base II - Non-Monetary Transaction ProcessingDocument16 pagesCMS Base II - Non-Monetary Transaction ProcessingvaradhanrgNo ratings yet

- Status Legend Customer Broker PO# Supplier DescriptionDocument6 pagesStatus Legend Customer Broker PO# Supplier DescriptionJohn Carlo EstabilloNo ratings yet

- 0 - 0 - Petty Cash Inn Singosari Periode 18-24!3!2022Document18 pages0 - 0 - Petty Cash Inn Singosari Periode 18-24!3!2022Fikri AziZNo ratings yet

- Document 4142023 120029 PM 3zM3UtTbDocument8 pagesDocument 4142023 120029 PM 3zM3UtTbCynthia CaballeroNo ratings yet

- Functional Template E-Invoice Template - 1june2021Document490 pagesFunctional Template E-Invoice Template - 1june2021AkshayNo ratings yet

- BLG-CIE-ODZ-M-DWG-001-A3 Rev.3 - General and Arrangement Drawing AppDocument6 pagesBLG-CIE-ODZ-M-DWG-001-A3 Rev.3 - General and Arrangement Drawing AppMochamad TaufikNo ratings yet

- Hsbcs Guide To Straight Through ProcessingDocument8 pagesHsbcs Guide To Straight Through ProcessingZayd Iskandar Dzolkarnain Al-HadramiNo ratings yet

- Mo024mil24Document1 pageMo024mil24Wahyu IkhsanNo ratings yet

- Development PlanDocument1 pageDevelopment Plangaurigamingd80No ratings yet

- PAN AO Codes International Taxation Ver2.7 18062013Document12 pagesPAN AO Codes International Taxation Ver2.7 18062013Mutyala VijayNo ratings yet

- T7 - 082 - Ni Made Ari SarasuandewiDocument1 pageT7 - 082 - Ni Made Ari SarasuandewisarasNo ratings yet

- Daily Packing Report 2018-19Document23 pagesDaily Packing Report 2018-19pthimanshuNo ratings yet

- Ibs Tawau 1 31/03/24Document43 pagesIbs Tawau 1 31/03/24deemardiah.dmNo ratings yet

- DRILL BITS BitsDocument1 pageDRILL BITS BitsProbal ProsoilNo ratings yet

- CategoryDocument5 pagesCategoryRowena SolomonNo ratings yet

- SAP TablesDocument4 pagesSAP Tableskavuri_ramuNo ratings yet

- Today's Mbare Commodity Prices 20200124Document4 pagesToday's Mbare Commodity Prices 20200124jmanzungu2820No ratings yet

- Default Chart of AccountsDocument4 pagesDefault Chart of Accountsjmanzungu2820No ratings yet

- Expectations From The Lead SystemDocument2 pagesExpectations From The Lead Systemjmanzungu2820No ratings yet

- Process Workflowa - DrawioDocument8 pagesProcess Workflowa - Drawiojmanzungu2820No ratings yet

- Terp - Process - Workflowa-01.2 Automated FloorOperations - DrawioDocument1 pageTerp - Process - Workflowa-01.2 Automated FloorOperations - Drawiojmanzungu2820No ratings yet

- 01 JCAC - Cockpet Arena Cagayan Valley 31 Aug 2022Document2 pages01 JCAC - Cockpet Arena Cagayan Valley 31 Aug 2022Jehyo Florence JepaNo ratings yet

- QCS 2010 Section 17 Part 3 Metal Doors and WindowsDocument10 pagesQCS 2010 Section 17 Part 3 Metal Doors and Windowsbryanpastor106No ratings yet

- Grammar Flip ClassroomDocument7 pagesGrammar Flip ClassroomAJ STYLESNo ratings yet

- BSNL JTO 2009 Question Paper Detail SolutionsDocument18 pagesBSNL JTO 2009 Question Paper Detail SolutionsAkula NAGESHWAR RAONo ratings yet

- Managing Business Process Outsourcing JUNE 2022Document12 pagesManaging Business Process Outsourcing JUNE 2022Rajni KumariNo ratings yet

- Six Sigma Green Belt New PDFDocument9 pagesSix Sigma Green Belt New PDFAshwani KumarNo ratings yet

- DF250 2012Document526 pagesDF250 2012dwi ariNo ratings yet

- BIOLOGY INVESTIGATORY PROJECT Class 12Document21 pagesBIOLOGY INVESTIGATORY PROJECT Class 12SNIGDHA APPANABHOTLANo ratings yet

- Professional Development in ScienceDocument87 pagesProfessional Development in ScienceUdaibir PradhanNo ratings yet

- ch1 Nature of MathDocument22 pagesch1 Nature of MathEYENNo ratings yet

- Mufon UFO JournalDocument25 pagesMufon UFO JournalSAB78100% (1)

- Urbanpromise Honduras: Urbanpromise History Urbanpromise Ministries Started in CamdenDocument1 pageUrbanpromise Honduras: Urbanpromise History Urbanpromise Ministries Started in Camdenapi-67779196No ratings yet

- CT VT Basics SonnenbergDocument71 pagesCT VT Basics SonnenbergAnonymous OCDJg17Z67% (3)

- Annex B - (Draft) Annual Accomplishment Report TemplateDocument1 pageAnnex B - (Draft) Annual Accomplishment Report TemplateBarangay LGRCNo ratings yet

- Cambridge IGCSE: PHYSICS 0625/62Document12 pagesCambridge IGCSE: PHYSICS 0625/62AdilNo ratings yet

- Sral XD Antenna CodesDocument17 pagesSral XD Antenna CodessamNo ratings yet

- Monsalvo, Victor M Ecological Technologies For Industrial WastewaterDocument299 pagesMonsalvo, Victor M Ecological Technologies For Industrial Wastewaterhamza A.laftaNo ratings yet

- RJ3 Controller RestoreDocument8 pagesRJ3 Controller RestoreSam KarnsNo ratings yet

- Kvpy Prmo CompendiumDocument54 pagesKvpy Prmo CompendiumSamir MukherjeeNo ratings yet

- 16 Front+suspension PDFDocument28 pages16 Front+suspension PDFtomNo ratings yet

- All Universities of PakistanDocument131 pagesAll Universities of PakistanziaNo ratings yet

- PreviewpdfDocument36 pagesPreviewpdfOrkun TürkmenNo ratings yet

- EEE 231 - Lecture 9 PDFDocument9 pagesEEE 231 - Lecture 9 PDFMahfuj EmonNo ratings yet

- Biomechanics of RunningDocument19 pagesBiomechanics of RunningJaviera Paz VegaNo ratings yet

- 463-Article Text-1065-1-10-20190722Document7 pages463-Article Text-1065-1-10-20190722Meilinia NingrumNo ratings yet

- Design and Testing of A 6 Inch Control Valve With A Multi-Stage Anti-Cavitation Trim PDFDocument149 pagesDesign and Testing of A 6 Inch Control Valve With A Multi-Stage Anti-Cavitation Trim PDFCarlos HilarioNo ratings yet

- 1memo Physics, NmuDocument63 pages1memo Physics, NmuHlulo WyntonNo ratings yet

- Distillation Column Report PDFDocument81 pagesDistillation Column Report PDFpavan kumarNo ratings yet

New Stop Order Documentation For EoD Files

New Stop Order Documentation For EoD Files

Uploaded by

jmanzungu2820Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

New Stop Order Documentation For EoD Files

New Stop Order Documentation For EoD Files

Uploaded by

jmanzungu2820Copyright:

Available Formats

Stop Order System Documentation

Tables of Contents

1. Data transfer

a. Sale file 2

b. Stop order file 4

c. Deduction file 9

d. Bale file 10

e. Transporter file 12

f. Daily buyer stats file 13

g. Rejections file 14

Stop order Documentation (Nov 2018) Page 1

DATA TRANSFER

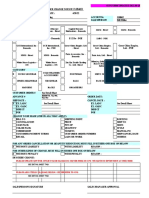

1. SALE FILE

When a selling point uploads a Sale File, a link on the TIMB website will be

automatically generated where they can download their Stop Order File. The

TIMB system will automatically reject files with errors. A detailed error log file will

be generated. Each morning a selling point must upload, through the TIMB

website a file of all the growers selling that day. The file must be in the following

format:

Grower Type varchar2 (1)

Grower number number (6)

Grower Suffix varchar2 (2)

This file must be called XXSAmmdd.V

Where XX identifies the selling point, SA is short for SAle file, mm = month,

dd=day of the sale date. The following identifiers will be used for XX

FILE SYMBOL NAME

AQ AQUA TOBACCO COMPANY

AZ AGRITRADE RUSAPE

BC GOLD LEAF SERVICES

BK BOKA TOBACCO FLOORS

CA CURVERID ACHIEVERS

CB CONSOLIDATED TOBACCO BURLEY

CH CONSOLIDATED TOBACCO

CN CENTRAL LEAF TOBACCO

CR TIMB Support - Curverid

CT CURVERID TOBACCO

CV CURVERID TOBACCO

CZ TIMB Support - Chidziva

EJ ETHICAL LEAF TOBACCO

EL NORTHERN TOBACCO

GL GOLDEN LEAF MERCHANTS

GR GLS RUSAPE

HR HURUYADZO

IL INTERCONTINENTAL LEAF TOBACCO

IR INTEROL TRADING

KC KRATOS

LN LEANRISE AGRICULTURE

LT LEAF TRADE TOBACCO

M1 MTC Karoi

M2 MTC Rusape

M3 MTC Mwurwi

Stop order Documentation (Nov 2018) Page 2

M4 MTC Karoi 2

MA MAJESTIC TOBACCO

MF MTC TSF

MG MAGUIRES

MK MUNAKIRI TOBACCO

MT MASHONALAND TOBACCO COMPANY

MX MAXLUCY INV

OH ONHART TOBACCO

PB BOOST AFRICA

PC PREMIER CONTRACT

PG ZPTFA GBT

PL PREMIUM LEAF TOBACCO

PM PAMUKA

PT PREMIER TOBACCO

SC SAG CIVILS

SH SHASHA TOBACCO

SL SALTLAKES

SS SUB SAHARA TOBACCO

SV SAVANNAH TOBACCO

TL TSL

TR TRIBAC

TS TOBACCO SALES FLOORS

TX TIAN ZE TOBACCO COMPANY

TZ TIAN ZE TOBACCO COMPANY

VD VOESDEL

ZD TIMB Support - ZLT

ZL ZIMBABWE LEAF TOBACCO

ZP ZPTFU

ZS ZLT SMALL SCALE

ZT AGRITRADE

Stop order Documentation (Nov 2018) Page 3

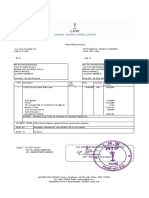

2. STOP ORDER FILE

The TIMB system will extract a file enabling a floor/contractor to deduct stop

orders and invoice creditors for those growers. The file will be in the following

format:

Sale-ID varchar2(1)

Record-Type number(2)

Grower-Type varchar2(1)

Grower number(6)

Grower-Suffix varchar2(2)

Creditor No number(5)

Priority number(2)

Creditor Ref varchar2(10)

Account No varchar2(14)

Amount 1 number(20)

Sign 1 varchar2(1)

Amount 2 number(20)

Sign2 varchar2(1)

Amount3 number(20)

Sign3 varchar2(1)

Percent number(7)

Int_date number(8)

Type varchar2(1)

Serial_no number(2)

This file will contain records with three different record types, 02, 03 and 05.

Record Type 05 – Hessian

Contains the standard fields plus the following:

Amount 1 – (Hessian Deposit) This will contain the total amount, in cents of

deposit paid to a Hessian Supplier

Amount 2 – (Hessian Refund) This will contain the total refund amount in

cents paid to the grower to date.

Amount 3 – This will contain the year to date number of bales sold.

The rest of the fields will be left blank. The grower must be refunded the Hessian

refund amount for every bale sold until his/her Hessian Deposit (Amount1) is

exhausted.

At floors

+ refund

- deduction

Hessian Algorithm

Stop order Documentation (Nov 2018) Page 4

1. Calculate the total number of year to date bales sold, including today’s

sale. 16+3

2. Calculate refund amount ('number of bales sold todate' * 'current refund

amount') 34.20

3. If the answer in step 2 < Amount1, take the answer in 2, otherwise, take

Amount1

4. Subtract Amount2 from the answer in step 3.

5. If the answer in step 4 is positive, refund this amount to the grower, if it is

negative, deduct this amount from the grower.

New wraps - 2.20, Old wraps – 1.80

Record type 01 – Invoice Creditors - USD

Contains the standard fields plus the following:

Account Number – this will contain the creditors account number where the

money is to be deposited.

Amount 1 – Amount to be deducted.

A floor/contractor is to deduct the ‘amount to be deducted’ from the grower and

pay it to the creditor. If the amount is negative then the amount must be refunded

to the grower and the floor/contractor has to recover the money from the creditor.

Record type 02 – Invoice Creditors - ZWL

Contains the standard fields plus the following:

Account Number – this will contain the creditors account number where the

money is to be deposited.

Amount 1 – Amount to be deducted.

A floor/contractor is to deduct the ‘amount to be deducted’ from the grower and

pay it to the creditor. If the amount is negative then the amount must be refunded

to the grower and the floor/contractor has to recover the money from the creditor.

Record Type 03 – ZW$ Stop Orders

Contains the standards fields plus the following:

Priority – Contains the priority number of the stop order

Stop order Documentation (Nov 2018) Page 5

Reference – Contains the reference.

Type – Contains the stop order type

Serial Number – Contains the serial number of the stop order

a. For stop order type 01 – Deduct all proceeds until sum to pay has

been reached

Additional fields on the input record are:

Amount 1 = Amount outstanding

All proceeds must be deducted to a maximum of the total outstanding

amount. If the total amount to deduct is negative then the grower must be

given a refund of this amount.

b. For Stop order type 02 – Deduct a % of YTD net until sum to pay has

been reached

Additional fields on the input record are:

Amount 1 = Year To Date Net

Amount 2 = Total Amount paid to date

Amount 3 = Outstanding Amount

Percent = Percentage to deduct

To calculate the amount owing on this stop order:

1. If Amount 3 is negative, refund this amount to the grower and stop

further calculations

2. Add today’s Net to Amount 1.

3. Calculate a percent of Amount 1(Year To date amount to deduct)

4. Subtract Amount 2 from result of 3 above. If the answer is bigger

than Amount 3, then deduct Amount 3, else deduct answer from

the grower.

c. For Stop Order Type 03 – Deduct a % of YTD GROSS after gross has

reached sum to pay

Additional fields on the input record are:

Amount 1 = Year to date Gross

Amount 2 = Total amount paid to date

Amount 3 = Outstanding Amount

Percent = Percentage to deduct

To calculate the amount owing on this stop order:

Stop order Documentation (Nov 2018) Page 6

1. If Amount 3 is negative, refund this amount to the grower and stop

further calculations.

2. Add today’s gross to Amount 1.

3. If Amount 1 (Resultant from step 2) >= Amount 3 and Amount 3 >

0, then proceed to 4, else, do not deduct.

4. Calculate Percent of AMOUNT 1 (year to date amount to deduct).

5. Subtract Amount 2 from result of 4 above. If the answer is bigger

that Amount 3, then deduct Amount 3, else, deduct answer from

the grower.

d. For Stop Order Type 04 – Deduct a % of YTD NET after net has

reached sum to pay

Additional fields on the input record are:

Amount 1 = Year to date Net

Amount 2 = Total amount paid to date

Amount 3 = Outstanding Amount

Percent = Percentage to deduct

To calculate the amount owing on this stop order:

1. If Amount 3 is negative, refund this amount to the grower and stop

further calculations.

2. Add today’s Net to Amount 1.

3. If Amount 1 >= Amount 3 and Amount 3 > 0, then proceed to 4,

else, do not deduct.

4. Calculate Percent of AMOUNT 1 (year to date amount to deduct).

5. Subtract Amount 2 from result of 4 above. If the answer is bigger

that Amount 3, then deduct Amount 3, else, deduct answer from

the grower.

e. For Stop Order Type 05 – Deduct a % of YTD Gross

Additional fields on the input record are:

Amount 1 = Year To Date Gross

Amount 2 = Total Amount paid to date

Percent = Percentage to deduct

To calculate the amount owing on this stop order:

1. Add today’s Gross to Amount 1.

2. Calculate a percent of Amount 1(Year To date amount to deduct)

Stop order Documentation (Nov 2018) Page 7

3. Subtract Amount 2 from result of 3 above. Deduct answer from the

grower.

f. For Stop Order Type 06 – deduct a % of YTD NET

Additional fields on the input record are:

Amount 1 = Year To Date Net

Amount 2 = Total Amount paid to date

Percent = Percentage to deduct

To calculate the amount owing on this stop order:

1. Add today’s Gross to Amount 1.

2. Calculate a percent of Amount 1(Year To date amount to deduct)

3. Subtract Amount 2 from result of 3 above. Deduct answer from the

grower.

g. For Stop Order Type 07 – Deduct all proceeds

Additional fields on the input record are:

None

To calculate the amount owing on this stop order:

Deduct all proceeds.

h. For Stop Order Type 08 – Deduct a % of YTD GROSS until sum to pay

is reached.

Additional fields on the input record are:

Amount 1 = Year to date Gross

Amount 2 = Total amount paid to date

Amount 3 = Outstanding Amount

Percent = Percentage to deduct

To calculate the amount owing on this stop order:

1. If Amount 3 is negative, refund this amount to the grower and stop

further calculations.

2. Add today’s gross to Amount 1.

3. If Amount 3 > 0, then proceed to 4, else, do not deduct.

4. Calculate Percent of AMOUNT 1 (year to date amount to deduct)

(ANSWER IN 2).

Stop order Documentation (Nov 2018) Page 8

5. Subtract Amount 2 from result of 4 above. If the answer is bigger

than Amount 3, then deduct Amount 3, else, deduct answer from

the grower.

p. For Stop Order Type 09.

Additional fields on the input record are:

Amount 1 = Year to date Gross

Amount 2 = Total amount paid to date

Amount 3 = STOP ORDER Amount

Percent = Percentage to deduct

To calculate the amount owing on this stop order:

...1. If Amount 3 is negative, refund this amount to the grower and stop

further calculations.

..2. Add today’s gross to Amount 1.

...3. If Amount 3 > 0, then proceed to 4, else, do not deduct.

..4. Calculate Percent of answer in STEP 2 (year to date amount to

deduct).

..5. Subtract Amount 2 from result of 4 above.

..6. Subtract Amount 2 from Amount 3. If the answer is greater than

answer in STEP 5, then deduct answer from STEP 5, else, deduct answer

in STEP 6 from the grower.

Record Type 06 – USD$ Stop Orders

Contains the standards fields plus the following:

Priority – Contains the priority number of the stop order

Reference – Contains the reference.

Type – Contains the stop order type

Serial Number – Contains the serial number of the stop order

i. For stop order type 01 – Deduct all proceeds until sum to pay has

been reached

Additional fields on the input record are:

Stop order Documentation (Nov 2018) Page 9

Amount 1 = Amount outstanding

All proceeds must be deducted to a maximum of the total outstanding

amount. If the total amount to deduct is negative then the grower must be

given a refund of this amount.

j. For Stop order type 02 – Deduct a % of YTD net until sum to pay has

been reached

Additional fields on the input record are:

Amount 1 = Year To Date Net

Amount 2 = Total Amount paid to date

Amount 3 = Outstanding Amount

Percent = Percentage to deduct

To calculate the amount owing on this stop order:

5. If Amount 3 is negative, refund this amount to the grower and stop

further calculations

6. Add today’s Net to Amount 1.

7. Calculate a percent of Amount 1(Year To date amount to deduct)

8. Subtract Amount 2 from result of 3 above. If the answer is bigger

than Amount 3, then deduct Amount 3, else deduct answer from

the grower.

k. For Stop Order Type 03 – Deduct a % of YTD GROSS after gross has

reached sum to pay

Additional fields on the input record are:

Amount 1 = Year to date Gross

Amount 2 = Total amount paid to date

Amount 3 = Outstanding Amount

Percent = Percentage to deduct

To calculate the amount owing on this stop order:

6. If Amount 3 is negative, refund this amount to the grower and stop

further calculations.

7. Add today’s gross to Amount 1.

8. If Amount 1 (Resultant from step 2) >= Amount 3 and Amount 3 >

0, then proceed to 4, else, do not deduct.

9. Calculate Percent of AMOUNT 1 (year to date amount to deduct).

Stop order Documentation (Nov 2018) Page 10

10. Subtract Amount 2 from result of 4 above. If the answer is bigger

that Amount 3, then deduct Amount 3, else, deduct answer from

the grower.

l. For Stop Order Type 04 – Deduct a % of YTD NET after net has

reached sum to pay

Additional fields on the input record are:

Amount 1 = Year to date Net

Amount 2 = Total amount paid to date

Amount 3 = Outstanding Amount

Percent = Percentage to deduct

To calculate the amount owing on this stop order:

6. If Amount 3 is negative, refund this amount to the grower and stop

further calculations.

7. Add today’s Net to Amount 1.

8. If Amount 1 >= Amount 3 and Amount 3 > 0, then proceed to 4,

else, do not deduct.

9. Calculate Percent of AMOUNT 1 (year to date amount to deduct).

10. Subtract Amount 2 from result of 4 above. If the answer is bigger

that Amount 3, then deduct Amount 3, else, deduct answer from

the grower.

m. For Stop Order Type 05 – Deduct a % of YTD Gross

Additional fields on the input record are:

Amount 1 = Year To Date Gross

Amount 2 = Total Amount paid to date

Percent = Percentage to deduct

To calculate the amount owing on this stop order:

4. Add today’s Gross to Amount 1.

5. Calculate a percent of Amount 1(Year To date amount to deduct)

6. Subtract Amount 2 from result of 3 above. Deduct answer from the

grower.

n. For Stop Order Type 06 – deduct a % of YTD NET

Additional fields on the input record are:

Amount 1 = Year To Date Net

Stop order Documentation (Nov 2018) Page 11

Amount 2 = Total Amount paid to date

Percent = Percentage to deduct

To calculate the amount owing on this stop order:

4. Add today’s Gross to Amount 1.

5. Calculate a percent of Amount 1(Year To date amount to deduct)

6. Subtract Amount 2 from result of 3 above. Deduct answer from the

grower.

o. For Stop Order Type 07 – Deduct all proceeds

Additional fields on the input record are:

None

To calculate the amount owing on this stop order:

Deduct all proceeds.

p. For Stop Order Type 08 – Deduct a % of YTD GROSS until sum to pay

is reached.

Additional fields on the input record are:

Amount 1 = Year to date Gross

Amount 2 = Total amount paid to date

Amount 3 = Outstanding Amount

Percent = Percentage to deduct

To calculate the amount owing on this stop order:

6. If Amount 3 is negative, refund this amount to the grower and stop

further calculations.

7. Add today’s gross to Amount 1.

8. If Amount 3 > 0, then proceed to 4, else, do not deduct.

9. Calculate Percent of AMOUNT 1 (year to date amount to deduct)

(ANSWER IN 2).

10. Subtract Amount 2 from result of 4 above. If the answer is bigger

than Amount 3, then deduct Amount 3, else, deduct answer from

the grower.

p. For Stop Order Type 09.

Additional fields on the input record are:

Stop order Documentation (Nov 2018) Page 12

Amount 1 = Year to date Gross

Amount 2 = Total amount paid to date

Amount 3 = Storoder Amount

Percent = Percentage to deduct

To calculate the amount owing on this stop order:

...1. If Amount 3 is negative, refund this amount to the grower and stop

further calculations.

..2. Add today’s gross to Amount 1.

...3. If Amount 3 > 0, then proceed to 4, else, do not deduct.

..4. Calculate Percent of answer in STEP 2 (year to date amount to

deduct).

..5. Subtract Amount 2 from result of 4 above.

..6. Subtract Amount 2 from Amount 3. If the answer is greater than

answer in STEP 5, then deduct answer from STEP 5, else, deduct answer

in STEP 6 from the grower.

3. DEDUCTION FILE

After every sale day the floors/contractors must provide T.I.M.B with a file

containing all the stop order and invoice creditor deductions/refunds made that

day. The file must be in the following format:

SALE-ID varchar2(1)

REC-TYPE number(2)

GROWER-TYPE varchar2(1)

GROWER number(6)

GROWER_SUFFIX varchar2(2)

CR_NO number(5)

CR-REF varchar2(10)

AMOUNT number(20)

SIGN varchar2(1)

SERIAL-NO varchar(3)

SALE-ID: Sale Identifier

REC-TYPE: 02,03, 04 or 06

GROWER_TYPE: Grower Type

GROWER: Grower Number

GROWER_SUFFIX: Grower Suffix

CR_NO: Creditor Number

CR_REF: Reference

Stop order Documentation (Nov 2018) Page 13

AMOUNT: Amount

SIGN: ‘+’ or ‘-‘ for Amount (can be ‘-‘ for adjustments)

SERIAL_NO: Serial Number of Stop Order

Record Type 02: Invoice Creditors

Reference can be null.

Serial Number = Zero

Amount = Amount Deducted or Refunded

Record Type 03 – Stop Orders

Reference can be null.

Amount = Amount deducted or refunded

Record Type 04 – Growers Net

Reference = null

Serial Number = Zero

Amount = Net of All today’s Sales

Record Type 06 – Stop Orders

Reference can be null.

Amount = Amount deducted or refunded

The file must be called: XXDEmmdd.v -- mm=month, dd=day of the sale date.

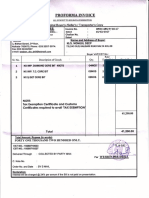

4. BALE FILE

After every sale, a selling point must provide TIMB with a file containing details of

every bale sold and rejected that day. The file must be in the following format:

SALE-ID varchar2(1)

BALE_SET varchar2(10)

GROWER_TYPE varchar2(1)

GROWER number(6)

GROWER_SUFFIX varchar2(2)

GRADE varchar2(5)

BALE_NO number(6)

MASS number(7)

SIGN varchar2(1)

PRICE number(5)

CONV_RATE number(16,4)

US_VAL number(14)

SIGN varchar2(1)

ZIM_VAL number(16)

Stop order Documentation (Nov 2018) Page 14

SIGN varchar2(1)

CULTIVAR varchar2(4)

INDICATOR varchar2(1)

BUYERCODE varchar2(5)

WRAP varchar2(3)

SALE_ID – Sale Identifier

BALE_SET - Bar Code

GROWER_TYPE - ‘V’

GROWER - Grower number

GROWER_SUFFIX - Grower suffix

GRADE - TIMB Grade for sold bales, Reason and method for not

Sold (TT RO CO or Rejection code)

BALE_NO - Bale Number

MASS - Mass

SIGN - ‘+’ or ‘-‘ for the mass (can be ‘-‘ for adjustments)

PRICE - US price in cents

CONV_RATE - Conversion Rate

US_VAL - US$ Value in US cents

SIGN - ‘+’ or ‘-‘ for US value (can be ‘-‘ for adjustments)

ZIM_VAL - ZW$ in cents

SIGN - ‘+’ or ‘-‘ for US value (can be ‘-‘ for adjustments)

CULTIVAR - Cultivar (Variety)

INDICATOR - ‘N’ = sold, ‘*’ = not sold and ‘?’ = Adjustment.

BUYERCODE - codes used for buyers

WRAP - codes used by Hessian Suppliers.

This file must be called: XXBLmmdd.v -- mm=month, dd=day of the sale date.

Stop order Documentation (Nov 2018) Page 15

5. TRANSPORTER FILE

After every sale, if there are any transporter invoices that the selling point had

captured into their systems, a file will be generated to be uploaded to the T.I.M.B

stop order system. The file must be in the following format:

REC-TYPE number(2)

Sale-ID varchar2(1)

Grower-Type varchar2(1)

Grower number(6)

Grower-Suffix varchar2(2)

Creditor No number(5)

Amount 1 number(16)

Sign 1 varchar2(1)

Date varchar2(8)

Example:

For a floor any given floor the file will look like this

Stop order Documentation (Nov 2018) Page 16

02JV100000 190700020000000000+01012006

01JV100000 190700020000000000+01012006

Where

REC-TYPE 02

Sale-ID J

Grower-Type V

Grower 100000

Grower-Suffix BLANK

Creditor No 1907

Amount 1 2,000,000.00 (note value in file is in cents)

Sign 1 + (if refund done sign should be negative)

Date 1 January 2006 (date format is ddmmyyyy)

This file must be called XXTRmmdd.v where XX identify the usual selling point

that was used for all other files, TR is short for Transporters’ file, mm = month,

dd=day of the sale date

6. DAILY BUYER STATS FILE

After every sale, a selling point must provide TIMB with a file containing a

summary daily purchases that occurred on the floor. This file upload shall be a

prerequisite for a floor to be able to upload the BL, DE and TR files. The file must

be in the following format:

This file will be submitted before the BL, DE and TR files.

BUYER varchar2(45)

BALES_LAID number(6)

BALES _REJECTED number(6)

BALES_SOLD number(6)

MASS_SOLD number(7)

US_VAL number(14,2)

ZIM_VAL number(16,2)

Stop order Documentation (Nov 2018) Page 17

HIGHEST_PRICE number(3)

LOWEST_PRICE number(3)

AVG_PRICE number(3)

FLOOR varchar2(4)

BUYER – TIMB buyer’s code

BALES_LAID - Total number of bales laid on the floor for that day

BALES _REJECTED - Total number of bales rejected by the buyer

BALES_SOLD - Total number of bales bought by the buyer

US_VAL - Value of tobacco bought by the buyer (USD)

ZIM _VAL - Value of tobacco bought by the buyer (ZWD)

HIGHEST_PRICE - Buyers highest price for the day

LOWEST _PRICE - Buyers lowest price for the day

AVG_PRICE - Average price

FLOOR - TIMB floor code

This file must be called: XXDSmmdd.v (WHERE mm=month, dd=day of the sale

date).

7. DAILY REJECTIONS FILE

After every sale, a selling point must provide TIMB with a file containing a

summary daily purchases that occurred on the floor. This file upload shall be a

prerequisite for a floor to be able to upload the BL, DE and TR files. The file must

be in the following format:

This file will be submitted before the BL, DE and TR files.

REJECTION_CODE varchar2(8)

BALES _REJECTED number(6)

REJECTED_BALE_MASS number(7)

REJECTION_CODE – TIMB rejection code

BALES _REJECTED - Total number of bales rejected

REJECTED_BALE_MASS - Total mass of rejected bales

Stop order Documentation (Nov 2018) Page 18

This file must be called: XXREmmdd.v (WHERE mm=month, dd=day of the sale

date).

Stop order Documentation (Nov 2018) Page 19

You might also like

- Scam Tengiz Oil and Gas Field Refinery (Ci Jet-A1) To LMS Commodity Trading DMCC SaDocument4 pagesScam Tengiz Oil and Gas Field Refinery (Ci Jet-A1) To LMS Commodity Trading DMCC SaS. L. (“laolou”)No ratings yet

- Detailed Proforma Invoice TemplateDocument2 pagesDetailed Proforma Invoice TemplateNajam KhanNo ratings yet

- B-64693en-1, Fanuc 0i-Model F Plus Connection Manual (Function)Document3,108 pagesB-64693en-1, Fanuc 0i-Model F Plus Connection Manual (Function)VladimirAgeev100% (2)

- Crane PartsDocument931 pagesCrane Partstecnicomanel100% (3)

- Ramtech Code For Mold and Tooling Rev2Document17 pagesRamtech Code For Mold and Tooling Rev2Dhenil ManubatNo ratings yet

- 15 Dinora 115557 PDFDocument91 pages15 Dinora 115557 PDFMadhur GuptaNo ratings yet

- Points - 4 v1Document69 pagesPoints - 4 v1m.awaisuohNo ratings yet

- Points - 4 v5Document119 pagesPoints - 4 v5m.awaisuohNo ratings yet

- SH 2300011534Document1 pageSH 2300011534Ganesh BharaneNo ratings yet

- SPL ProcurementDocument49 pagesSPL ProcurementMallu LoharNo ratings yet

- BKCOM - Structure BknomDocument29 pagesBKCOM - Structure BknomPouedeou TchambaNo ratings yet

- Doc. de Transporte.Document3 pagesDoc. de Transporte.Paula ContrerasNo ratings yet

- Additional Tyre Req Mahalaxmi Truck NylonDocument4 pagesAdditional Tyre Req Mahalaxmi Truck Nylonjayesh singh rathoreNo ratings yet

- Item Code Opening FormDocument16 pagesItem Code Opening FormAbhiNo ratings yet

- Oocl Invoice Inv Afl-6948 BL Oolu2726566460 Los Angeles 1x40 RHDocument1 pageOocl Invoice Inv Afl-6948 BL Oolu2726566460 Los Angeles 1x40 RHsnowmine666No ratings yet

- SAILESH PROJECTDocument11 pagesSAILESH PROJECTRP TechNo ratings yet

- Commercial Invoice/Packing ListDocument2 pagesCommercial Invoice/Packing ListAchmad PurwantoNo ratings yet

- America Samoa OfferDocument1 pageAmerica Samoa OfferJohn MansNo ratings yet

- TASWEEQ FOB TTV FORMAT DafsR264PDocument9 pagesTASWEEQ FOB TTV FORMAT DafsR264PxsensonicNo ratings yet

- יישום MMDocument124 pagesיישום MMsama greedyNo ratings yet

- Group No 9 Baf BS 1BDocument10 pagesGroup No 9 Baf BS 1BseverinmsangiNo ratings yet

- SKQUOT230-304 MergedDocument5 pagesSKQUOT230-304 MergedSK EnterprisesNo ratings yet

- A A A A AaaaaaaaaaaaaaaDocument1 pageA A A A Aaaaaaaaaaaaaaajharkhandexpress914No ratings yet

- Disp Vaidys - Loyalty Programme 2010-11Document2 pagesDisp Vaidys - Loyalty Programme 2010-11Mahesh DhakaNo ratings yet

- PT Amanah Latihan LSPDocument79 pagesPT Amanah Latihan LSPDragrexsNo ratings yet

- OCN68463Document3 pagesOCN68463RonyNo ratings yet

- CARPER LAD Form No. 64 Transmittal Memorandum To ROD For Registration of CLOAsDocument3 pagesCARPER LAD Form No. 64 Transmittal Memorandum To ROD For Registration of CLOAsart83360911554No ratings yet

- PI Shaym IndustriesDocument1 pagePI Shaym IndustriesJS INDUSTRIESNo ratings yet

- Brazil Withholding Tax AccumulationDocument10 pagesBrazil Withholding Tax Accumulationvitoriamodena556No ratings yet

- Report - Tax by Bank GLDocument16 pagesReport - Tax by Bank GLFakhar AbbasNo ratings yet

- Master Mto Sheet-Unit 1Document541 pagesMaster Mto Sheet-Unit 1shreearihantamolsNo ratings yet

- Logsheet GT#1Document47 pagesLogsheet GT#1rendalpltghaltimNo ratings yet

- San San Marketing (SSM) : Description CodeDocument3 pagesSan San Marketing (SSM) : Description CodeiyaNo ratings yet

- GL Over ViewDocument28 pagesGL Over ViewSurendranath PinnaNo ratings yet

- De Boef Betty - 1237 - ScannedDocument4 pagesDe Boef Betty - 1237 - ScannedZach EdwardsNo ratings yet

- Transit Losses: Goods Receipt Note For Dairy ProductsDocument2 pagesTransit Losses: Goods Receipt Note For Dairy ProductsRomagnoli GozaliNo ratings yet

- Symbol List DirectionsDocument31 pagesSymbol List DirectionsMohits952No ratings yet

- Format MT940Document18 pagesFormat MT940Hamdani MuhammadNo ratings yet

- Overseas Purchase Order: VEN OR ..: San DR LL CanadaDocument1 pageOverseas Purchase Order: VEN OR ..: San DR LL CanadaRimal ButtNo ratings yet

- Accounting Voucher Useless DumDocument1 pageAccounting Voucher Useless Dumsrishanth9aNo ratings yet

- As Is DocumentDocument37 pagesAs Is DocumentJyotiraditya BanerjeeNo ratings yet

- Carnet de Soudure - Ligne 20'' Du MG HNIA 05 Vers CPF ALRARDocument59 pagesCarnet de Soudure - Ligne 20'' Du MG HNIA 05 Vers CPF ALRARbahousmustapha31No ratings yet

- Btca 302 ModelsDocument37 pagesBtca 302 ModelslbaamagolaNo ratings yet

- Galileo Quick Reference Tins ReportDocument27 pagesGalileo Quick Reference Tins ReportMomin QadirNo ratings yet

- CMS Base II - Non-Monetary Transaction ProcessingDocument16 pagesCMS Base II - Non-Monetary Transaction ProcessingvaradhanrgNo ratings yet

- Status Legend Customer Broker PO# Supplier DescriptionDocument6 pagesStatus Legend Customer Broker PO# Supplier DescriptionJohn Carlo EstabilloNo ratings yet

- 0 - 0 - Petty Cash Inn Singosari Periode 18-24!3!2022Document18 pages0 - 0 - Petty Cash Inn Singosari Periode 18-24!3!2022Fikri AziZNo ratings yet

- Document 4142023 120029 PM 3zM3UtTbDocument8 pagesDocument 4142023 120029 PM 3zM3UtTbCynthia CaballeroNo ratings yet

- Functional Template E-Invoice Template - 1june2021Document490 pagesFunctional Template E-Invoice Template - 1june2021AkshayNo ratings yet

- BLG-CIE-ODZ-M-DWG-001-A3 Rev.3 - General and Arrangement Drawing AppDocument6 pagesBLG-CIE-ODZ-M-DWG-001-A3 Rev.3 - General and Arrangement Drawing AppMochamad TaufikNo ratings yet

- Hsbcs Guide To Straight Through ProcessingDocument8 pagesHsbcs Guide To Straight Through ProcessingZayd Iskandar Dzolkarnain Al-HadramiNo ratings yet

- Mo024mil24Document1 pageMo024mil24Wahyu IkhsanNo ratings yet

- Development PlanDocument1 pageDevelopment Plangaurigamingd80No ratings yet

- PAN AO Codes International Taxation Ver2.7 18062013Document12 pagesPAN AO Codes International Taxation Ver2.7 18062013Mutyala VijayNo ratings yet

- T7 - 082 - Ni Made Ari SarasuandewiDocument1 pageT7 - 082 - Ni Made Ari SarasuandewisarasNo ratings yet

- Daily Packing Report 2018-19Document23 pagesDaily Packing Report 2018-19pthimanshuNo ratings yet

- Ibs Tawau 1 31/03/24Document43 pagesIbs Tawau 1 31/03/24deemardiah.dmNo ratings yet

- DRILL BITS BitsDocument1 pageDRILL BITS BitsProbal ProsoilNo ratings yet

- CategoryDocument5 pagesCategoryRowena SolomonNo ratings yet

- SAP TablesDocument4 pagesSAP Tableskavuri_ramuNo ratings yet

- Today's Mbare Commodity Prices 20200124Document4 pagesToday's Mbare Commodity Prices 20200124jmanzungu2820No ratings yet

- Default Chart of AccountsDocument4 pagesDefault Chart of Accountsjmanzungu2820No ratings yet

- Expectations From The Lead SystemDocument2 pagesExpectations From The Lead Systemjmanzungu2820No ratings yet

- Process Workflowa - DrawioDocument8 pagesProcess Workflowa - Drawiojmanzungu2820No ratings yet

- Terp - Process - Workflowa-01.2 Automated FloorOperations - DrawioDocument1 pageTerp - Process - Workflowa-01.2 Automated FloorOperations - Drawiojmanzungu2820No ratings yet

- 01 JCAC - Cockpet Arena Cagayan Valley 31 Aug 2022Document2 pages01 JCAC - Cockpet Arena Cagayan Valley 31 Aug 2022Jehyo Florence JepaNo ratings yet

- QCS 2010 Section 17 Part 3 Metal Doors and WindowsDocument10 pagesQCS 2010 Section 17 Part 3 Metal Doors and Windowsbryanpastor106No ratings yet

- Grammar Flip ClassroomDocument7 pagesGrammar Flip ClassroomAJ STYLESNo ratings yet

- BSNL JTO 2009 Question Paper Detail SolutionsDocument18 pagesBSNL JTO 2009 Question Paper Detail SolutionsAkula NAGESHWAR RAONo ratings yet

- Managing Business Process Outsourcing JUNE 2022Document12 pagesManaging Business Process Outsourcing JUNE 2022Rajni KumariNo ratings yet

- Six Sigma Green Belt New PDFDocument9 pagesSix Sigma Green Belt New PDFAshwani KumarNo ratings yet

- DF250 2012Document526 pagesDF250 2012dwi ariNo ratings yet

- BIOLOGY INVESTIGATORY PROJECT Class 12Document21 pagesBIOLOGY INVESTIGATORY PROJECT Class 12SNIGDHA APPANABHOTLANo ratings yet

- Professional Development in ScienceDocument87 pagesProfessional Development in ScienceUdaibir PradhanNo ratings yet

- ch1 Nature of MathDocument22 pagesch1 Nature of MathEYENNo ratings yet

- Mufon UFO JournalDocument25 pagesMufon UFO JournalSAB78100% (1)

- Urbanpromise Honduras: Urbanpromise History Urbanpromise Ministries Started in CamdenDocument1 pageUrbanpromise Honduras: Urbanpromise History Urbanpromise Ministries Started in Camdenapi-67779196No ratings yet

- CT VT Basics SonnenbergDocument71 pagesCT VT Basics SonnenbergAnonymous OCDJg17Z67% (3)

- Annex B - (Draft) Annual Accomplishment Report TemplateDocument1 pageAnnex B - (Draft) Annual Accomplishment Report TemplateBarangay LGRCNo ratings yet

- Cambridge IGCSE: PHYSICS 0625/62Document12 pagesCambridge IGCSE: PHYSICS 0625/62AdilNo ratings yet

- Sral XD Antenna CodesDocument17 pagesSral XD Antenna CodessamNo ratings yet

- Monsalvo, Victor M Ecological Technologies For Industrial WastewaterDocument299 pagesMonsalvo, Victor M Ecological Technologies For Industrial Wastewaterhamza A.laftaNo ratings yet

- RJ3 Controller RestoreDocument8 pagesRJ3 Controller RestoreSam KarnsNo ratings yet

- Kvpy Prmo CompendiumDocument54 pagesKvpy Prmo CompendiumSamir MukherjeeNo ratings yet

- 16 Front+suspension PDFDocument28 pages16 Front+suspension PDFtomNo ratings yet

- All Universities of PakistanDocument131 pagesAll Universities of PakistanziaNo ratings yet

- PreviewpdfDocument36 pagesPreviewpdfOrkun TürkmenNo ratings yet

- EEE 231 - Lecture 9 PDFDocument9 pagesEEE 231 - Lecture 9 PDFMahfuj EmonNo ratings yet

- Biomechanics of RunningDocument19 pagesBiomechanics of RunningJaviera Paz VegaNo ratings yet

- 463-Article Text-1065-1-10-20190722Document7 pages463-Article Text-1065-1-10-20190722Meilinia NingrumNo ratings yet

- Design and Testing of A 6 Inch Control Valve With A Multi-Stage Anti-Cavitation Trim PDFDocument149 pagesDesign and Testing of A 6 Inch Control Valve With A Multi-Stage Anti-Cavitation Trim PDFCarlos HilarioNo ratings yet

- 1memo Physics, NmuDocument63 pages1memo Physics, NmuHlulo WyntonNo ratings yet

- Distillation Column Report PDFDocument81 pagesDistillation Column Report PDFpavan kumarNo ratings yet