Professional Documents

Culture Documents

Global Q1b

Global Q1b

Uploaded by

seahbryantyCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Global Q1b

Global Q1b

Uploaded by

seahbryantyCopyright:

Available Formats

1b.

Using real world examples and taking into consideration the welfare losses of trade protection

measure, discuss whether production subsidies or tariffs are preferable from society’s point of view.

[15]

Introduction

A subsidy is a payment by the government to a firm for each unit of output produced. There

are two kinds of subsidies: production subsidy which is aimed at protecting domestic firms

from competing imports and export subsidy that is intended to protect firms that export.

We will illustrate with production subsidy. Tariffs are taxes on imported goods

Body: Explain effects on stakeholders

Tariffs Production Subsidy (need to compare effects

with those of tariff)

Tariffs are taxes on imported goods and it has Production subsidy is aimed at protecting

two objectives viz., to protect a domestic domestic firms from competing imports.

industry from foreign competition and to help

raise revenue for the government. Assume country accepts world price Pw and

Initial position under free trade – country produces quantity Q1 and demands quantity

accepts world price Pw; produces quantity Q1 Q2 with imports of Q2-Q1 (Figure 2).

and demands quantity Q4; imports Q4-Q1

Suppose a production subsidy is granted

Suppose a tariff is imposed on imports; the by the government to domestic firms to

world supply curve shifts upwards with price make them more competitive. This will

rising from Pw to Pw+t in the country effectively shift the domestic supply curve

assuming that the country is a price taker. downwards by the amount of the subsidy

At Pw+t, domestic quantity supplied of to Ss.

inefficient US producers increases from Q1 to The goods continue to sell at the world

price Pw. But, after the subsidy, domestic

Q2. Domestic quantity demanded falls from

quantity supplied increases from Q1 to Q3.

Q4 to Q3. Quantity of imports falls to Q2Q3 As a result, the quantity of imports falls

from Q1Q4. This happened in the US when the from Q2-Q1 to Q3-Q1. For example, China

country imposed a 20% tariff on EU government has been accused of giving

automobile imports in 2018, which affected production subsidy to domestic firms in

many stakeholders in the US and EU. industries such as the solar panel, electric

battery and shipbuilding. This will have

Figure 1: Tariff consequences on the different

stakeholders.

Effects on different stakeholders

Figure 2: Production Subsidy

Effects on different stakeholders

Unlike tariffs, domestic consumers who

Inefficient US domestic producers receive buys electric batteries in China are not

higher price (Pw+t) and sell larger quantity of affected. They continue to pay Pw.

Q2 instead of Q1. So, they are better off with Although they buy more of the domestic

producer surplus rising from area g to g+c. good whose production has increased and

Government receives revenue as shown by less of the imported good, the total

the area e in Figure 1. amount consumed remains unchanged at

However, US domestic consumers were worse Q2 units of output after the subsidy.

off as they pay a higher price (Pw+t) and buy Given that a production subsidy is a trade

smaller quantity of Q3 instead of Q4. So, they protection measure like a tariff, domestic

are worse off. This is also indicated by falling producers receive higher price (Pw+s) and

consumer surplus from off as indicated by a sell larger quantity of Q3 instead of Q1. So,

fall in the consumer surplus from areas abcdef they are better off. This is indicated by a

to ab (Figure 1). producer surplus gain of area a (Figure 2).

Foreign producers like EU automobile Unlike a tariff, the Chinese government

producers such as BMW and Volkswagen who is negatively impacted as they must

have a comparative advantage or lower spend tax revenues on the subsidy

opportunity cost in the production of cars are which is equal to (Pw+s-Pw) X Q3 (or the

worst off as their imports in the US market fell amount produced domestically).

from Q4-Q1 to Q3-Q2 (Figure 1) translating Budget deficit deteriorates. There is an

into lower export revenues thus decreasing opportunity cost to taxpayers as the

employment in the important car industry in amount spend on the subsidy could

Europe. have been used elsewhere that would

A global misallocation of resources results. benefit taxpayers. This includes

The decrease in consumption and the shift of spending on merit goods such as

production away from efficient foreign education, healthcare, manpower

producers and towards more inefficient training etc.

domestic producers translate into a Foreign producers from the US, for

misallocation of resources both domestically example, are worse off as their imports

and globally. Hence there is a welfare or in China fell from Q2-Q1 to Q2-Q3. The

deadweight loss equal to the area d+f (Figure production subsidy lowers export

1). revenue of the more efficient foreign

Moreover, tariff is a regressive tax which producers with negative effects on

burdens people on lower incomes employment in the country. The effects

proportionately more than people on higher are similar to that of tariff. Hence, it will

incomes. This is because as income increases, also provoke a trade war as in the case

the proportion of income paid as taxes falls. of China’s production subsidies which

Hence the lower income consumes are led to tariff retaliation by the US.

disproportionately worse off. The subsidy is also similar to the tariff in

Trade protectionism also provokes trade terms of misallocation of resources as it

retaliation. In response to the US tariffs on shifts production away from efficient

imports from Europe on a wide range of goods foreign producers and towards more

including automobiles, aircrafts and wine, the inefficient domestic producers. Hence,

EU responded with retaliatory tariffs on US resources are not allocated efficiently

imports such as spirits, Boeing aircraft US and both domestically and globally. Hence

Salmon. The trade war erupted that between there is a welfare or deadweight loss

US and many of its trading partners including equal to the area b in Figure 1 as the

Europe and Japan led to falling exports in gain in producer surplus is more than

these countries, hence slower economic offset by government expenditure on

growths. the production subsidy for inefficient

domestic producers.

Evaluation

While both production subsidies and tariffs protect domestic producers and their workers from

foreign competition, the economic cost is high from a welfare point of view as they shift

production away from efficient foreign producers and towards more inefficient domestic

producers leading to global misallocation of resources. However, given that production subsidies

do not affect consumer surplus, which remains the same, welfare losses may therefore be smaller

compared with a tariff. Hence, of the two, subsidies could be preferred to tariffs. In the final

analysis, however, they both incur a substantial cost on society benefiting only the inefficient

domestic producers at a cost to foreign producers, consumers (tariff) and government (production

society) which increases if they provoke a trade war which is likely as demonstrated empirically

between US and its trading partners.

You might also like

- Global Marketing 9th Edition by Warren J Keegan Ebook PDFDocument41 pagesGlobal Marketing 9th Edition by Warren J Keegan Ebook PDFrobert.higa74793% (42)

- Russian and Ukrainian Fast Food Industry OverviewDocument8 pagesRussian and Ukrainian Fast Food Industry Overviewgeopan88No ratings yet

- Cunha, Poorter, Schreuder - IE - Assignment 4Document6 pagesCunha, Poorter, Schreuder - IE - Assignment 4Jeff CunhaNo ratings yet

- Eco Hons AssignmentDocument6 pagesEco Hons AssignmentDeeksha ThakurNo ratings yet

- Topic 2-Tariffs and QuotasDocument7 pagesTopic 2-Tariffs and QuotasJamesNo ratings yet

- Present The Economic Case Assignment Tariffs Effect On Washing Machine ECON 358 Presenter: Group 3: Brigitta Ramos, David Ringhiser, Kazuki OkadaDocument10 pagesPresent The Economic Case Assignment Tariffs Effect On Washing Machine ECON 358 Presenter: Group 3: Brigitta Ramos, David Ringhiser, Kazuki Okadaapi-557133689No ratings yet

- Assignment 4 International TradeDocument7 pagesAssignment 4 International TradeMohammad MoosaNo ratings yet

- Tutorial 8 For Discussion On The Week of 8 June 2020: Importing CountryDocument21 pagesTutorial 8 For Discussion On The Week of 8 June 2020: Importing CountryShiouqian ChongNo ratings yet

- Topic 2 - Tariffs and Quotas Draft 2Document6 pagesTopic 2 - Tariffs and Quotas Draft 2JamesNo ratings yet

- International Economics TheoryDocument19 pagesInternational Economics TheorylukeNo ratings yet

- Persson 2017Document11 pagesPersson 2017Mark TanNo ratings yet

- Economics QoutaDocument5 pagesEconomics QoutaHumaira a RashidNo ratings yet

- The Effect of Subsidies On TradeDocument6 pagesThe Effect of Subsidies On TradeSatishSharmaNo ratings yet

- Free TradeDocument2 pagesFree TradeJapie CoetzerNo ratings yet

- Effects of Tariffs Under Partial Equilibrium - Amitava Sarkar 14-12-2020Document8 pagesEffects of Tariffs Under Partial Equilibrium - Amitava Sarkar 14-12-2020Vkook ForeverNo ratings yet

- Microeconomics-International Trade Notes 2Document17 pagesMicroeconomics-International Trade Notes 2Khasheena RobertsNo ratings yet

- Answer: The Reduction of The Tariff, and Corresponding Decrease in Domestic Price in TheDocument16 pagesAnswer: The Reduction of The Tariff, and Corresponding Decrease in Domestic Price in TheAnonymous LGB1O2fANo ratings yet

- Comertul Liber Si Protectionist: Free Trade and ProtectionismDocument8 pagesComertul Liber Si Protectionist: Free Trade and ProtectionismCristina Elena BNo ratings yet

- Econ IA International Economics TextDocument3 pagesEcon IA International Economics TextPavel VondráčekNo ratings yet

- A Tariff Is A Tax Imposed by A Government On Goods and Services ImportedDocument9 pagesA Tariff Is A Tax Imposed by A Government On Goods and Services ImportedPranav SehgalNo ratings yet

- Chapter 3 IEDocument50 pagesChapter 3 IETrâm NgọcNo ratings yet

- Macro EconomicesDocument82 pagesMacro Economicessougata2384No ratings yet

- Tariffs: by Aditi, Hasmitha, Pranav B, PranaviDocument6 pagesTariffs: by Aditi, Hasmitha, Pranav B, PranaviRahul VarmaNo ratings yet

- Taxation Efficiency and International TradeDocument14 pagesTaxation Efficiency and International TradeSamia Irshad ullahNo ratings yet

- Answer:: Chapter 5 Study QuestionDocument9 pagesAnswer:: Chapter 5 Study QuestionChi IuvianamoNo ratings yet

- Project 1 EconomicsDocument4 pagesProject 1 EconomicsJanet PondecaNo ratings yet

- Economic Principles I: Measuring The Efficiency of Markets: International TradeDocument14 pagesEconomic Principles I: Measuring The Efficiency of Markets: International TradedpsmafiaNo ratings yet

- Trade Barriers 100031Document6 pagesTrade Barriers 100031Sreeparna duttaNo ratings yet

- Deadline Thãng 10Document15 pagesDeadline Thãng 10lwinsstoreNo ratings yet

- Kindleberger Has Discussed Eight Effects of Tariff On The Imposing CountryDocument3 pagesKindleberger Has Discussed Eight Effects of Tariff On The Imposing CountryappajinarasimhamNo ratings yet

- How Costly Is ProectionismDocument23 pagesHow Costly Is ProectionismCamilla ALTIERINo ratings yet

- Tariff Topic1Document10 pagesTariff Topic1lwinsstoreNo ratings yet

- Kindleberger Has Discussed Eight Effects of Tariff On The Imposing CountryDocument4 pagesKindleberger Has Discussed Eight Effects of Tariff On The Imposing Countryappajinarasimham100% (1)

- Lecture 09Document39 pagesLecture 09ayladtlNo ratings yet

- Sample - HSC Economics NotesDocument3 pagesSample - HSC Economics NotesAndrew LeeNo ratings yet

- Lecture 2 International Trade GraphsDocument44 pagesLecture 2 International Trade GraphsL SNo ratings yet

- Welfare Effects of A TariffDocument7 pagesWelfare Effects of A TariffSuhaila IbrahimNo ratings yet

- TariffsDocument4 pagesTariffsahmedgalalabdalbaath2003No ratings yet

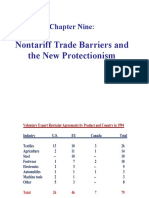

- Chapter Nine:: Nontariff Trade Barriers and The New ProtectionismDocument26 pagesChapter Nine:: Nontariff Trade Barriers and The New ProtectionismAhmad RonyNo ratings yet

- Tacn3 - Nhom Fire - Unit 1Document10 pagesTacn3 - Nhom Fire - Unit 1Nguyễn Quốc VươngNo ratings yet

- 1.4. Trade Restrictions TariffDocument48 pages1.4. Trade Restrictions TariffThu PhươngNo ratings yet

- Chapter 12 AnswerDocument14 pagesChapter 12 AnswerKathy Wong0% (1)

- U4 essay 例文Document5 pagesU4 essay 例文jinhongma1970No ratings yet

- The Instruments of Trade PolicyDocument43 pagesThe Instruments of Trade PolicyHarika HarikaNo ratings yet

- Economics Ia - 4Document4 pagesEconomics Ia - 4adityanaganathNo ratings yet

- Chapter Eight:: Trade Restrictions: TariffsDocument23 pagesChapter Eight:: Trade Restrictions: Tariffsaffanahmed111No ratings yet

- Economics Notes - 2Document17 pagesEconomics Notes - 2sindhu pNo ratings yet

- Assignment # 1 CH 23 (Measuring A National Income)Document4 pagesAssignment # 1 CH 23 (Measuring A National Income)Smart WorldNo ratings yet

- Lecture #1 Trade Policy (1) InstrumentsDocument14 pagesLecture #1 Trade Policy (1) InstrumentsAlexandra NeaguNo ratings yet

- Notes On Tariff, Import Quota and NTB'sDocument13 pagesNotes On Tariff, Import Quota and NTB'sdivyaNo ratings yet

- Aggregate Demand: Textbook Pages 144-151Document20 pagesAggregate Demand: Textbook Pages 144-151sanchit12334556No ratings yet

- Chapter 4Document33 pagesChapter 4rhitikaparajuliNo ratings yet

- Measures Which Could Improve The Current Account DeficitDocument4 pagesMeasures Which Could Improve The Current Account DeficitJasper RaithathaNo ratings yet

- Lesson 8 Absolute and Comparative Advantage & ProtectionismDocument11 pagesLesson 8 Absolute and Comparative Advantage & Protectionismjuliano gouderNo ratings yet

- Economics Notes Part-1Document51 pagesEconomics Notes Part-1Jigar Raval100% (5)

- Tariffs, Infant Industries, and The Theory of ProtectionDocument3 pagesTariffs, Infant Industries, and The Theory of ProtectionDevid BitaNo ratings yet

- Types of Tariffs and Trade BarriersDocument4 pagesTypes of Tariffs and Trade Barrierssubbu2raj3372No ratings yet

- IE-Chap7-Case Question Solution SolvedDocument9 pagesIE-Chap7-Case Question Solution SolvedKhoa DoanNo ratings yet

- Micro PPT 2Document15 pagesMicro PPT 2geetadevi15augNo ratings yet

- ECN FinalDocument8 pagesECN FinalRocel B. LigayaNo ratings yet

- Investment Report 2022/2023 - Key Findings: Resilience and renewal in EuropeFrom EverandInvestment Report 2022/2023 - Key Findings: Resilience and renewal in EuropeNo ratings yet

- Case Study On Foreign Exchange (FX)Document2 pagesCase Study On Foreign Exchange (FX)HaannaaNo ratings yet

- 685 Quiz 2Document8 pages685 Quiz 2Md.Soriful HaqueNo ratings yet

- Diagnostic Study Report of Coir, Kollam, KeralaDocument28 pagesDiagnostic Study Report of Coir, Kollam, KeralapasebanjatiNo ratings yet

- B. Do So Because They Get Something in Return.: B. Rely Upon One Another For The Goods and Services We ConsumeDocument4 pagesB. Do So Because They Get Something in Return.: B. Rely Upon One Another For The Goods and Services We ConsumeNaomiAlkafNo ratings yet

- Management Practices and Financial Reporting in The Sri Lankan Apparel SectorDocument26 pagesManagement Practices and Financial Reporting in The Sri Lankan Apparel SectorBhupendra RaiNo ratings yet

- Oriental Weavers Consolidated Operations DashboardDocument5 pagesOriental Weavers Consolidated Operations DashboardBalbaaAmrNo ratings yet

- Philippine IndustrializationDocument22 pagesPhilippine IndustrializationRaziele Raneses50% (2)

- Official Export Credit Agencies - Organismes de Credit À L'exportationDocument2 pagesOfficial Export Credit Agencies - Organismes de Credit À L'exportationDana Keziah AntizaNo ratings yet

- Export Credit and Guarantee CorporationDocument8 pagesExport Credit and Guarantee CorporationIndrajitNo ratings yet

- Nmake User Alu3.9Document327 pagesNmake User Alu3.9bradscriberNo ratings yet

- Lecture 1 - Multinational Financial ManagementDocument53 pagesLecture 1 - Multinational Financial ManagementAlice LowNo ratings yet

- Krugman - Chap 1Document22 pagesKrugman - Chap 1Lodhi Ismail0% (1)

- Celebrity Fashion Annual Report 2010Document56 pagesCelebrity Fashion Annual Report 2010Abhishek RajNo ratings yet

- Meat Consumption and Prices Pattern in LahoreDocument20 pagesMeat Consumption and Prices Pattern in LahoreZeeshan Asghar0% (1)

- Role of Private Sector in Agricultural DevelopmentDocument3 pagesRole of Private Sector in Agricultural Developmentkamilbisma100% (1)

- 07 Chapter 2Document154 pages07 Chapter 2HiteshPansheriyaNo ratings yet

- International BUSINESS - ToPIC 1 - Introduction To International BusinessDocument54 pagesInternational BUSINESS - ToPIC 1 - Introduction To International BusinessRodrigo Pérez VázquezNo ratings yet

- Exim PolicyDocument22 pagesExim PolicyTarun Arora100% (1)

- Balance of Trade and Balance of PaymentDocument19 pagesBalance of Trade and Balance of PaymentAzhar Sayed100% (1)

- Chapter 1: Globalization and International LinkagesDocument21 pagesChapter 1: Globalization and International LinkagesChen QingNo ratings yet

- Introduction and Scope of The StudyDocument6 pagesIntroduction and Scope of The StudyTeeJyyNo ratings yet

- 3D Printing FDI International TradeDocument19 pages3D Printing FDI International TradeSumant AlagawadiNo ratings yet

- 1segunda Entrega Cultura Y Economia Regional de EuropaDocument5 pages1segunda Entrega Cultura Y Economia Regional de EuropaMarian CadavidNo ratings yet

- Hazard Analysis Critical Control Point (Haccp) Certification of Micro and Small Scale Food Companies in The PhilippinesDocument10 pagesHazard Analysis Critical Control Point (Haccp) Certification of Micro and Small Scale Food Companies in The PhilippinesGRDS MatterNo ratings yet

- Sales Director Latin America in Washington DC Resume Manuel PerezDocument3 pagesSales Director Latin America in Washington DC Resume Manuel PerezManuelPerez1No ratings yet

- NEAT Ginger Report FinalDocument62 pagesNEAT Ginger Report FinalPabitra Magar67% (3)

- Case Study Importing and Exporting SolutionDocument2 pagesCase Study Importing and Exporting SolutionLIAQAT ALINo ratings yet

- SMEDocument16 pagesSMESupriya Pawar100% (12)