Professional Documents

Culture Documents

INSOL - Extract

INSOL - Extract

Uploaded by

W.H CHIA (Leo)0 ratings0% found this document useful (0 votes)

6 views2 pagesGenting Hong Kong, a major cruise operator, filed for winding up in January 2022 due to financial difficulties from the COVID-19 pandemic. While the cruise industry had weathered past crises, pandemic restrictions erased demand. Genting attempted to restructure through debt amendments, asset sales, and aid from German state funds. However, changing COVID rules undermined plans. Disputes with lenders and the refusal of aid due to unsatisfied conditions ultimately prevented the restructuring from succeeding, leading Genting to file for insolvency.

Original Description:

Original Title

INSOL- Extract

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentGenting Hong Kong, a major cruise operator, filed for winding up in January 2022 due to financial difficulties from the COVID-19 pandemic. While the cruise industry had weathered past crises, pandemic restrictions erased demand. Genting attempted to restructure through debt amendments, asset sales, and aid from German state funds. However, changing COVID rules undermined plans. Disputes with lenders and the refusal of aid due to unsatisfied conditions ultimately prevented the restructuring from succeeding, leading Genting to file for insolvency.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

6 views2 pagesINSOL - Extract

INSOL - Extract

Uploaded by

W.H CHIA (Leo)Genting Hong Kong, a major cruise operator, filed for winding up in January 2022 due to financial difficulties from the COVID-19 pandemic. While the cruise industry had weathered past crises, pandemic restrictions erased demand. Genting attempted to restructure through debt amendments, asset sales, and aid from German state funds. However, changing COVID rules undermined plans. Disputes with lenders and the refusal of aid due to unsatisfied conditions ultimately prevented the restructuring from succeeding, leading Genting to file for insolvency.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 2

GENTING HONG KONG LIMITED –

WORSE THINGS HAPPEN AT SEA?

“Having previously weathered challenges

such as the 9/11 terrorist attacks, the 2002

SARS epidemic and the 2008 global financial

crisis, the cruise industry was no stranger to

Dirk Behnsen

adverse global events, but Covid restrictions

Dechert LLP

Hong Kong

all but erased demand for services once the

pandemic began to spread”

Introduction overheads and selling off various non-core assets, but an

attempt to secure a bridge loan as an interim cash injection

In January 2022, the Hong Kong headquartered and Hong was not successful, with negotiations with creditors and

Kong Stock Exchange listed cruise and resort operator export credit agencies extending into early 2021. Bridge

holding company Genting Hong Kong Limited (雲頂香港有 loan negotiations were eventually discontinued when no

限公司) filed a winding up petition in Hong Kong, sending a agreement could be reached.

signal that even the most successful, globally-recognised and

sizeable cruise operator brands in the industry had not been Genting’s restructuring rested on four key pillars: 1)

spared the financial effects of the Covid-19 pandemic. an amendment and extension of its material financial

indebtedness, together with a reduction of average interest

Having previously weathered challenges such as the costs and suspension of financial covenant testing under all

9/11 terrorist attacks, the 2002 SARS epidemic and the of its financing arrangements (except for a minimum liquidity

2008 global financial crisis, the cruise industry was no covenant); 2) obtention of Covid aid via funding of almost

stranger to adverse global events, but Covid restrictions all EUR500 million from the German economic stabilisation

but erased demand for services once the pandemic began fund (Wirtschaftsstabilisierungsfonds (WSF) with further

to spread. Existing contingency plans and strategies were loan funding directly from the German federal state of

rendered obsolete by this new challenge or had been scaled Mecklenburg-Western Pomerania (MV State), where Genting’s

back following years of financial success. German subsidiaries are located); 3) new financing to secure

the delivery of a new vessel; and 4) a rights issuance by

Pre-Covid, Genting operated three major cruise brands – Star

Dream Cruises.

Cruises, Dream Cruises and Crystal Cruises - and enjoyed

a considerable market share, with a company structure Even from the outset, the complexities and peculiarities

spanning the world map. Ever-changing Covid rules, closures posed by such a restructuring were many, and related to,

and restrictions hampered initial attempts to adapt to what amongst others:

was at the time considered a temporary situation: in early

2020, Genting sought contractual relief on a bilateral basis 1. The worldwide spread of Genting: Challenges posed by

with its lenders, requested covenant breach waivers and Genting’s global structure - with assets and creditors in

testing holidays, but did not at the time (unlike some its US multiple jurisdictions and the applicability of numerous

counterparts) tap capital markets to address cash-flow issues. legal frameworks, rules and stakeholders that spanned

Hong Kong SAR, the PRC, Malaysia, the United States,

As the pandemic continued without improvement for Singapore and Germany;

Genting’s cash flow, attention turned to the investment

project costs expended by Genting as part of its business 2. Time pressure: the need for resolution on a tight

growth strategies, which had been based on calculations that timeline affected the optimisation of restructuring tools

assumed pre-pandemic level fleet operations. Genting had and measures and the quality of negotiations needed to

guaranteed the construction of new vessels for its Dream reach a best-case scenario for Genting;

Cruises luxury segment as part of plans to rejuvenate its

aging Crystal Cruises brand, and anticipated revenue from 3. The ever-changing Covid rules and requirements:

these vessels factored heavily into post-pandemic liquidity Financial models and forecasts often became obsolete

projections for the company. Additional costs from the warm shortly after their introduction, which led to material

layup of a cruise ship added to growing financial woes. uncertainties with respect to planning;

Attempts to restructure and challenges 4. Consensus challenges during negotiations: Reaching

agreements among all lenders (required with an out

In Autumn 2020 Genting decided to undertake a consensual of court restructuring) where the number of lenders in

out of court holistic restructuring and recapitalisation to certain syndicates exceeded 50, with varying interests

stabilise the business. The company began reducing its and requirements led to cumbersome negotiations.

10 | INSOL World – Second Quarter 2022

5. Unexpected lender decisions by a club lender that granted from the WSF in Germany. With Euler Hermes’

raised complaints by other lenders: One of two club refusal to confirm insurance coverage, a drawdown condition

lenders (each having advanced 50% of the loan) for payment remained unsatisfied: The WSF refused to

which financed Genting’s river-cruise vessels chose release funding. A further attempt to negotiate replacement

to wind down its ship financing business at a critical financing saw German authorities attaching additional

juncture. As a result, the lending bank introduced a conditions to the funds that included subordinating the

requirement for all shipping loans to be repaid by the lending banks’ rights to those of the WSF and requiring

originally documented maturity date, a move opposed Genting’s controlling shareholder to provide additional

as special treatment by other lenders that were left at a funding and guarantee at least EUR600 million of the WSF

disadvantage, having been asked to extend their loan facility. No resolution could be found.

maturity dates as part of the restructuring measures.

Potential silver bullets had become nails in the coffin for the

6. Uncertainties surrounding financial injections: Genting’s business.

controlling shareholder, Lim Kok Thay, initially refrained

from providing financial support to Genting upon Continued efforts, court proceedings in Germany and the

request by lending banks. Eventually, Lim Kok Thay domino effect

and German stakeholders provided a US$148 million

At the end of December 2021, Genting filed a motion for

backstop facility for the purpose of curing any breach of

injunctive relief in Germany that would have ordered MV

the minimum liquidity covenant.

State to provide Genting with a loan of EUR88 million. The

7. Jurisdiction-specific complications in Germany: court initially granted the motion in full, but then reduced

Insolvency-related duties of directors of Genting’s aid to zero, citing that funding from MV State would neither

ship-building subsidiaries in Germany under German improve Genting’s liquidity situation nor help avoid covenant

law created a risk that local directors would file for breaches it was facing: While the reasoning offered by the

insolvency before a restructuring could be effected. court in its judgment was criticised, it was deemed too late to

save Genting with government funding.

8. Specificities created by the involvement of the

Germany export credit agency Euler Hermes: As an Insolvency-related directors’ duties of Genting’s German

agency managing export credit guarantees and untied ship-building subsidiaries forced an insolvency filing with

loan guarantees on behalf of the Federal Republic the German courts. This in turn triggered an event of default

of Germany, Euler Hermes pointed to local law under the shipyard’s facilities which triggered cross defaults

requirements prohibiting haircuts on Genting’s existing on almost US$3 billion of Genting’s debt. With little cash

debt, effectively barring Genting from introducing left in its coffers, Genting filed in Bermuda to wind up the

haircuts as part of the restructuring measure package. company on 18 January 2022. Two weeks later, Dream

Furthermore, decision-making processes surrounding Cruises followed its parent company and filed a wind-up

debt management under their purview was slow petition.

as a result of consultations required with a host of

Aftermath and outlook

government ministries and stakeholders.

While in the foreground ship arrests, enforcement

9. Cultural differences between the Asian and European

procedures and disposal of remaining assets have been

lenders and governmental authorities across the

underway as the companies are being dismantled following

jurisdictions: negotiations faced challenges as culturally-

the usual procedures, market sources have begun to indicate

sensitive business practices and approaches created

that in the background the former controlling shareholder

clashes that hampered progress.

of Genting, Lim Kok Thay and former Genting CEO Colin Au

Despite such headwinds, one of the largest out of court bank have been placing offers on the various assets up for grabs.

restructurings in Asia came to fruition in June 2021. It would not be the first time the market sees a successful re-

purchase of assets of a failing entity for a substantial discount

Short-lived relief that are now free from debt and encumbrances. The re-birth

and reconstitution of an all-too-familiar Asian cruise operator

However, the breathing room offered by the restructuring may not be far behind.

was fleeting, and continuing Covid-restrictions hampered

a business rebound to pre-Covid levels. By the Fall of 2021

Genting was desperate for additional liquidity and was

negotiating the acquisition of its Dream Cruises brand by a

special purpose acquisition company (SPAC) that would have

increased Genting’s valuation to approx. US$2.5 billion and

allowed its German ship-building subsidiaries to complete

the construction and delivery of its new luxury cruise liner.

Stakeholders of the potential SPAC investor voted against

the proposed transaction leaving Genting once again

without needed funding.

The final straw seemed to come in December 2021 as

Genting attempted to draw down payments it had been

INSOL World – Second Quarter 2022 | 11

You might also like

- Project Finance in Theory and Practice: Designing, Structuring, and Financing Private and Public ProjectsFrom EverandProject Finance in Theory and Practice: Designing, Structuring, and Financing Private and Public ProjectsRating: 4.5 out of 5 stars4.5/5 (4)

- Project Financing... NotesDocument21 pagesProject Financing... NotesRoney Raju Philip75% (4)

- PAWCM PPT 3 - Principles of Project FinanceDocument44 pagesPAWCM PPT 3 - Principles of Project FinanceYashodhan JoshiNo ratings yet

- Case Project FinanceDocument9 pagesCase Project FinanceaamritaaNo ratings yet

- TLE 7/8 Computer Systems Servicing 2 Quarter: Ict (Exploratory)Document5 pagesTLE 7/8 Computer Systems Servicing 2 Quarter: Ict (Exploratory)Joan Cala-or Valones100% (2)

- Accra: Hearts of Oak SCDocument11 pagesAccra: Hearts of Oak SCJonathanNo ratings yet

- CASE STUDY - Al Dur Refinancing 1.2 BNDocument6 pagesCASE STUDY - Al Dur Refinancing 1.2 BNkamalNo ratings yet

- Project Finance An Emerging Trend On The Ghanaian Mining SceneDocument4 pagesProject Finance An Emerging Trend On The Ghanaian Mining Sceneromiee8No ratings yet

- Debt Pandemic Reinhart Rogoff Bulow TrebeschDocument5 pagesDebt Pandemic Reinhart Rogoff Bulow TrebeschTinotenda DubeNo ratings yet

- Sovereign Debt Crisis Management: Lessons From The 2012 Greek Debt RestructuringDocument28 pagesSovereign Debt Crisis Management: Lessons From The 2012 Greek Debt RestructuringMicheal GoNo ratings yet

- A Firm Foundation For Project FinanceDocument6 pagesA Firm Foundation For Project FinanceMarc BernardNo ratings yet

- TraducciònDocument6 pagesTraducciònLuciaNo ratings yet

- Greece Sovereign Debt Crisis (2010-2015) - ISL RR TEAM ADocument14 pagesGreece Sovereign Debt Crisis (2010-2015) - ISL RR TEAM AAbdullah iftikharNo ratings yet

- FX Risk Case Studies Consolidated 31may2021 FinalDocument35 pagesFX Risk Case Studies Consolidated 31may2021 FinalMohamed ShedidNo ratings yet

- 2020-2022 PRC Property CrisisDocument11 pages2020-2022 PRC Property CrisisvgtoshibaNo ratings yet

- American Bar Association Business Law Today: This Content Downloaded From 132.236.27.217 On Thu, 23 Jun 2016 02:54:57 UTCDocument3 pagesAmerican Bar Association Business Law Today: This Content Downloaded From 132.236.27.217 On Thu, 23 Jun 2016 02:54:57 UTCshumizeNo ratings yet

- Report OFC 2013 FinancingStrategiesForLNG ExportDocument12 pagesReport OFC 2013 FinancingStrategiesForLNG ExportMegha BepariNo ratings yet

- Rescheduling DebtDocument50 pagesRescheduling DebtMBA...KID100% (4)

- 228-Hale - Demand BondsDocument29 pages228-Hale - Demand BondsMichael McDaidNo ratings yet

- Ppptoolkit - Icrc.gov - NG-PPP Project Case StudiesDocument12 pagesPpptoolkit - Icrc.gov - NG-PPP Project Case StudiesPriyanka KumarNo ratings yet

- Project Finance CLOsDocument3 pagesProject Finance CLOsJohn JoshiNo ratings yet

- 1 Pre Read For Introductions To Project FinancingDocument4 pages1 Pre Read For Introductions To Project FinancingChanchal MisraNo ratings yet

- Project Finance Is The Long TermDocument6 pagesProject Finance Is The Long Termnirgude_swapnilNo ratings yet

- EDCF Mid-Term Operation PlanDocument2 pagesEDCF Mid-Term Operation PlanJAMIE SHIHWAN GONo ratings yet

- Article WIND Hellas Complex RestructuringDocument9 pagesArticle WIND Hellas Complex RestructuringWengKeongKokNo ratings yet

- Petrolera Zuata: A Project Finance Case StudyDocument15 pagesPetrolera Zuata: A Project Finance Case StudySaathwik ChandanNo ratings yet

- Project Finance Is The Long TermDocument5 pagesProject Finance Is The Long TermsrinivaspdfNo ratings yet

- Contractor's Perspective (Khawaja)Document2 pagesContractor's Perspective (Khawaja)poula mamdouhNo ratings yet

- Tianjin Plastics (China) : Maple EnergyDocument11 pagesTianjin Plastics (China) : Maple EnergySoraya ReneNo ratings yet

- The Collapse of Genting Hong KongDocument35 pagesThe Collapse of Genting Hong KongCIC190020 STUDENTNo ratings yet

- CLCJPFDocument41 pagesCLCJPFranjit12345No ratings yet

- GTXMQ - 2020-09-20 - Doc 15 - First Day Declaration (CFO)Document136 pagesGTXMQ - 2020-09-20 - Doc 15 - First Day Declaration (CFO)jrweber912No ratings yet

- Middle East and North Africa Insurance Market ReportDocument16 pagesMiddle East and North Africa Insurance Market ReportvamshidsNo ratings yet

- Poland A2 Motorway: PSF Group Assignment Maulik Parekh Rahul Mohandas Shankar MohantyDocument14 pagesPoland A2 Motorway: PSF Group Assignment Maulik Parekh Rahul Mohandas Shankar MohantyMaulik Parekh100% (2)

- Aamir Ansari Himanshu SaigalDocument25 pagesAamir Ansari Himanshu SaigalAmol BagulNo ratings yet

- Water PPPDocument4 pagesWater PPPIrenataNo ratings yet

- CA Final (New) - Risk Management - Mock Test Paper - Apr 2023 - AnswersDocument8 pagesCA Final (New) - Risk Management - Mock Test Paper - Apr 2023 - AnswersBijay AgrawalNo ratings yet

- Project Finance Petrolera Zuata, Petrozuata C.A: BackgorundDocument3 pagesProject Finance Petrolera Zuata, Petrozuata C.A: BackgorundPearly ShopNo ratings yet

- Project Finance in Developing CountriesDocument8 pagesProject Finance in Developing Countries'Daniel So-fly OramaliNo ratings yet

- Case 12-20253-KAO Doc 104 Filed 10/26/12 Ent. 10/26/12 15:31:01 Pg. 1 of 12Document12 pagesCase 12-20253-KAO Doc 104 Filed 10/26/12 Ent. 10/26/12 15:31:01 Pg. 1 of 12Chapter 11 DocketsNo ratings yet

- C061 - Enverga - Reaction PaperDocument4 pagesC061 - Enverga - Reaction Paperliberace cabreraNo ratings yet

- Issues Paper No. 1: Participation in Infrastructure: Trends in Developing Countries in 1990-2001)Document7 pagesIssues Paper No. 1: Participation in Infrastructure: Trends in Developing Countries in 1990-2001)Hemant ChamariaNo ratings yet

- N o Risk Owner Type Commercial Risks Construction Risks: - Delay Caused by Bad Weather, FloodingDocument5 pagesN o Risk Owner Type Commercial Risks Construction Risks: - Delay Caused by Bad Weather, FloodingLawrenciaUdifeNo ratings yet

- Gdsmdp20152chandrasekhar enDocument10 pagesGdsmdp20152chandrasekhar enNguyễn Hồng HạnhNo ratings yet

- Project FinanceDocument9 pagesProject FinanceAditi AggarwalNo ratings yet

- Future Banking Supervision Under The New Basel Capital Accord (Basel II)Document20 pagesFuture Banking Supervision Under The New Basel Capital Accord (Basel II)SolisterADVNo ratings yet

- Carbon Finance MechanismDocument13 pagesCarbon Finance MechanismrabiNo ratings yet

- BaselDocument43 pagesBaselKhizar Jamal SiddiquiNo ratings yet

- Artigo CEPHAS LUMINA - Sovereign Debt and Human RightsDocument14 pagesArtigo CEPHAS LUMINA - Sovereign Debt and Human Rightsgladstonmacedo8393No ratings yet

- Case 12-20253-KAO Doc 105 Filed 10/26/12 Ent. 10/26/12 15:53:02 Pg. 1 of 25Document25 pagesCase 12-20253-KAO Doc 105 Filed 10/26/12 Ent. 10/26/12 15:53:02 Pg. 1 of 25Chapter 11 DocketsNo ratings yet

- Financialisation Series 2Document23 pagesFinancialisation Series 2Wenny SetiawatiNo ratings yet

- Bank Resolution and Bail-In in The EUDocument86 pagesBank Resolution and Bail-In in The EUpoimarti100% (1)

- AMBEST Florida Report 6/3/2022Document4 pagesAMBEST Florida Report 6/3/2022ABC Action NewsNo ratings yet

- Gemi Chad CameronDocument13 pagesGemi Chad CameronavijeetboparaiNo ratings yet

- Project Finance What It Is and What It Is NotDocument22 pagesProject Finance What It Is and What It Is NotIwora AgaraNo ratings yet

- Commissioner of Inland Revenue V Frucor Suntory: New Zealand LTDDocument10 pagesCommissioner of Inland Revenue V Frucor Suntory: New Zealand LTDKwok Ming Clinton CHANNo ratings yet

- Annual Review of English Construction Law Developments: An International PerspectiveDocument44 pagesAnnual Review of English Construction Law Developments: An International PerspectiveAidan SteensmaNo ratings yet

- Project Finance CourseworkDocument16 pagesProject Finance CourseworkSHARITAHNo ratings yet

- IF11880Document3 pagesIF11880mariaemoraisNo ratings yet

- Aamir Ansari Himanshu SaigalDocument25 pagesAamir Ansari Himanshu SaigalKetan SuriNo ratings yet

- World Development Report 2022: Finance for an Equitable RecoveryFrom EverandWorld Development Report 2022: Finance for an Equitable RecoveryNo ratings yet

- Week 2Document7 pagesWeek 2ZsazsaNo ratings yet

- Conservation Strategies Final DraftDocument61 pagesConservation Strategies Final DraftsebascianNo ratings yet

- Airplane Flight Manual Supplement: Gps/Waas Nav ComDocument7 pagesAirplane Flight Manual Supplement: Gps/Waas Nav Comraisul dianaNo ratings yet

- Homework Practice OnlineDocument6 pagesHomework Practice Onlineh681x9gn100% (1)

- ReadingDocument2 pagesReadingLucíaNo ratings yet

- Aircraft Fuelling Operation - Risk Assessment Case StudyDocument9 pagesAircraft Fuelling Operation - Risk Assessment Case StudyDavid GrimaNo ratings yet

- Hoja Tecnica Control de NivelDocument3 pagesHoja Tecnica Control de NivelpawerxlNo ratings yet

- 3D PythagorasDocument4 pages3D Pythagorasraghed alkelaniNo ratings yet

- Curriculum Vitae: Current PositionDocument10 pagesCurriculum Vitae: Current PositionEngineer 1122No ratings yet

- System Manuals: EBTS and Integrated Site ControllerDocument3 pagesSystem Manuals: EBTS and Integrated Site ControllerIsac LimaNo ratings yet

- Dioscorea L. (PROSEA) - PlantUse EnglishDocument29 pagesDioscorea L. (PROSEA) - PlantUse Englishfortuna_dNo ratings yet

- Mosquito RepellentDocument11 pagesMosquito RepellentAkhil RajanNo ratings yet

- Cell:Fundamental Unit of LifeDocument3 pagesCell:Fundamental Unit of LifeShweta DixitNo ratings yet

- GeccomDocument16 pagesGeccomMelaine Grace Gemoranion GeopanoNo ratings yet

- Grade 6 Maths Igcse FinalDocument16 pagesGrade 6 Maths Igcse FinalPRATHAP CHITRANo ratings yet

- Handbook - Curtin UniversityDocument12 pagesHandbook - Curtin UniversityJuni KasthakarNo ratings yet

- Risk AssessmentDocument101 pagesRisk Assessmentrevu dasNo ratings yet

- COA CH 1Document33 pagesCOA CH 1DesyilalNo ratings yet

- Flashcards - Topic 7 Human Nutrition - CAIE Biology IGCSEDocument153 pagesFlashcards - Topic 7 Human Nutrition - CAIE Biology IGCSESamiullah TahirNo ratings yet

- Overview of Active Deposit Systems Alpha GammaDocument1 pageOverview of Active Deposit Systems Alpha GammaEngels RamírezNo ratings yet

- Craig-1977-The Structure of JacaltecDocument442 pagesCraig-1977-The Structure of JacaltecmaclbaisNo ratings yet

- Bla BlaDocument8 pagesBla BladharwinNo ratings yet

- Information Requirement AnalysisDocument3 pagesInformation Requirement Analysis5ladyNo ratings yet

- Dumps: Pdfdumps Can Solve All Your It Exam Problems and Broaden Your KnowledgeDocument10 pagesDumps: Pdfdumps Can Solve All Your It Exam Problems and Broaden Your KnowledgeyeddekfiihNo ratings yet

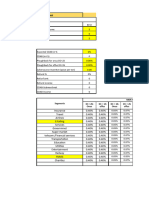

- Pricing Calculator Excel Used in BanksDocument15 pagesPricing Calculator Excel Used in Banksrahul kr raiNo ratings yet

- H43701 3P Cylinder (Component Parts) (New) ## L1421Dt: Update Date: 28/05/2021 Printing Date: 18/06/2021Document2 pagesH43701 3P Cylinder (Component Parts) (New) ## L1421Dt: Update Date: 28/05/2021 Printing Date: 18/06/2021SpinNo ratings yet

- Alywn Cosgrove Real World Fat Loss PDFDocument75 pagesAlywn Cosgrove Real World Fat Loss PDFJM Gym Manticao100% (1)

- Mi-171A1 RFM Part-IDocument310 pagesMi-171A1 RFM Part-IJulio Mello50% (2)