Professional Documents

Culture Documents

Statement December21

Statement December21

Uploaded by

kunsmanbaby16Copyright:

Available Formats

You might also like

- Harris JANUARY-2024Document4 pagesHarris JANUARY-2024Md MasumNo ratings yet

- USA Citibank Statement Word and PDF Template - PDF.PDF - 20240403 - 070654 - 0000Document2 pagesUSA Citibank Statement Word and PDF Template - PDF.PDF - 20240403 - 070654 - 0000abooddeleNo ratings yet

- Document 3Document2 pagesDocument 3garrettloehrNo ratings yet

- Bank Grindord StatementDocument5 pagesBank Grindord StatementBD MahamudNo ratings yet

- Virtual Annual Meeting Friday, June 12 at 1:30 P.M. PT: Direct Inquiries ToDocument2 pagesVirtual Annual Meeting Friday, June 12 at 1:30 P.M. PT: Direct Inquiries Tosusu ultra men100% (1)

- PDF DocumentDocument5 pagesPDF DocumentNicolauNo ratings yet

- Bank Statement LanayaDocument3 pagesBank Statement LanayashrondaNo ratings yet

- Statement of Account: American Express Membership Rewards® Credit CardDocument4 pagesStatement of Account: American Express Membership Rewards® Credit CardDiwakar ChaturvediNo ratings yet

- Tdecu MarchDocument3 pagesTdecu MarchMuhammad MudassarNo ratings yet

- Traditional Individual Retirement Account - Advisory Solutions Fund Model Custodian: Edward Jones Trust CompanyDocument8 pagesTraditional Individual Retirement Account - Advisory Solutions Fund Model Custodian: Edward Jones Trust CompanyMike BarnhartNo ratings yet

- Tyarrie Lee: Moneylion IncDocument3 pagesTyarrie Lee: Moneylion IncIvan ĐukićNo ratings yet

- SATS - Anon Write Up 02 13 2012Document10 pagesSATS - Anon Write Up 02 13 2012cnm3dNo ratings yet

- Modern Money Mechanics PDFDocument40 pagesModern Money Mechanics PDFwestelm12No ratings yet

- Treasury and Fund Management in BanksDocument40 pagesTreasury and Fund Management in Bankseknath2000100% (2)

- 20220608-Platinum Card Statement-6185Document6 pages20220608-Platinum Card Statement-6185freakenscoutNo ratings yet

- Monthly Statement: Name Address Account Number Statement PeriodDocument8 pagesMonthly Statement: Name Address Account Number Statement PeriodAzeez AyomideNo ratings yet

- Account Summary Payment Information: New Balance $2,102.08 Minimum Payment Due $86.42 Payment Due Date March 6, 2021Document2 pagesAccount Summary Payment Information: New Balance $2,102.08 Minimum Payment Due $86.42 Payment Due Date March 6, 2021franklin reid rosarioNo ratings yet

- Statement of Account: Membership Summary Information For Member # 56228 As of 3/31/20Document4 pagesStatement of Account: Membership Summary Information For Member # 56228 As of 3/31/20Mark HolobaughNo ratings yet

- ReneeDocument2 pagesReneeAseadNo ratings yet

- Account # 030753616: Lifegreen CheckingDocument4 pagesAccount # 030753616: Lifegreen Checkingmy nameNo ratings yet

- Account StatementDocument2 pagesAccount StatementinashumedaNo ratings yet

- Bluebird Statement - Bluebird - 8409Document2 pagesBluebird Statement - Bluebird - 8409dalowerNo ratings yet

- April Bank StatementDocument1 pageApril Bank StatementQuiskeya LLCNo ratings yet

- WNBStatementDocument3 pagesWNBStatementNancy TorresNo ratings yet

- Questions? Call 1.888.662.4722 TTY 1.800.898.5999 or Write: HSBC P.O. Box 9 Buffalo, New York 14240Document2 pagesQuestions? Call 1.888.662.4722 TTY 1.800.898.5999 or Write: HSBC P.O. Box 9 Buffalo, New York 14240cathy clarkNo ratings yet

- Account Summary Contact UsDocument1 pageAccount Summary Contact Usshamekagardner.ailNo ratings yet

- Victor Owusu: Account StatementDocument2 pagesVictor Owusu: Account Statementploteg66No ratings yet

- Result PDF Watermark J0CircODocument4 pagesResult PDF Watermark J0CircOHAMID EL ASRINo ratings yet

- Truist Statement 2Document2 pagesTruist Statement 2Adnan HussainNo ratings yet

- Attachment 16268014602Document5 pagesAttachment 16268014602Web TreamicsNo ratings yet

- ListDocument4 pagesListNestor MartinezNo ratings yet

- DocumentDocument4 pagesDocumentMammies ScottNo ratings yet

- Oct 21Document2 pagesOct 21girichote0% (1)

- UtilityBillingStatement AGO2022Document2 pagesUtilityBillingStatement AGO2022MexLex Tramites LegalesNo ratings yet

- USA First Century BankDocument2 pagesUSA First Century BankOPL OJJJNo ratings yet

- Texas Bank April30Document4 pagesTexas Bank April3076xzv4kk5vNo ratings yet

- MCCLOUDY Jan Statements2021Document7 pagesMCCLOUDY Jan Statements2021David GarciaNo ratings yet

- Your Account Statement: Contact UsDocument4 pagesYour Account Statement: Contact UsAll PeaceNo ratings yet

- Dec Evolve and TrustDocument2 pagesDec Evolve and TrustSafeBit ProsNo ratings yet

- 29 Jan 2024 StaementDocument2 pages29 Jan 2024 StaementmalumeskinyNo ratings yet

- Michael Partain Piermont Statement 1Document1 pageMichael Partain Piermont Statement 1Jonathan Seagull LivingstonNo ratings yet

- Chime Checking Statement May 2021 PDFDocument3 pagesChime Checking Statement May 2021 PDFKalila JamesNo ratings yet

- Account Summary Contact Us: Search DocumentDocument7 pagesAccount Summary Contact Us: Search Documentmr w hrNo ratings yet

- Statement of Account: Credit Limit Rs Available Credit Limit RsDocument2 pagesStatement of Account: Credit Limit Rs Available Credit Limit RsGanesh KumarNo ratings yet

- Virginia Credit UnionDocument1 pageVirginia Credit Unionbaga ibakNo ratings yet

- BillSTMT 4588260001812272 19Document2 pagesBillSTMT 4588260001812272 19EhitishamNo ratings yet

- Oj G59 Dy WPgzi 3 K IiDocument4 pagesOj G59 Dy WPgzi 3 K IiAndrew WeiglerNo ratings yet

- December 2023Document8 pagesDecember 2023Esteban Mateus100% (1)

- PNC Access Checking Account SummaryDocument2 pagesPNC Access Checking Account SummaryNiao PjNo ratings yet

- Aliyu STTMNTDocument2 pagesAliyu STTMNTShelvya ReeseNo ratings yet

- Estmt - 2021 05 24Document4 pagesEstmt - 2021 05 24Aditya Pangestu ArdanaNo ratings yet

- Tfcu George ArtisDocument5 pagesTfcu George Artistroymc101No ratings yet

- Chime Bank Statement-5Document1 pageChime Bank Statement-5dmarcumNo ratings yet

- Thomas Bank StatmentDocument1 pageThomas Bank StatmentAhsan ShabirNo ratings yet

- List UnlockedDocument4 pagesList UnlockedNestor MartinezNo ratings yet

- Visa Gold Low Rates Statement: Account Name MR John DoeDocument3 pagesVisa Gold Low Rates Statement: Account Name MR John DoeWenjie65No ratings yet

- Discover Statement 20221105 9126Document4 pagesDiscover Statement 20221105 9126colle ctorNo ratings yet

- Statements New 1Document4 pagesStatements New 1Bhuwesh SinghNo ratings yet

- Robinhood: Account Summary Portfolio AllocationDocument3 pagesRobinhood: Account Summary Portfolio Allocationkrushnavadan5666No ratings yet

- Hilary Stonewall 107 N Oak ST Freemansburg Pa 18017-0000 Account 6789067948Document2 pagesHilary Stonewall 107 N Oak ST Freemansburg Pa 18017-0000 Account 6789067948Shelvya ReeseNo ratings yet

- Zilyn Jackson BOA Statement OctDocument4 pagesZilyn Jackson BOA Statement OctLillian AwtNo ratings yet

- Shaheed Taylor 2223 Florey LN Apt. E8 ROSLYN PA 19001: Return Service RequestedDocument3 pagesShaheed Taylor 2223 Florey LN Apt. E8 ROSLYN PA 19001: Return Service Requestedshaheed taylorNo ratings yet

- Methods to Overcome the Financial and Money Transfer Blockade against Palestine and any Country Suffering from Financial BlockadeFrom EverandMethods to Overcome the Financial and Money Transfer Blockade against Palestine and any Country Suffering from Financial BlockadeNo ratings yet

- Stock Market Black BookDocument85 pagesStock Market Black BookJayesh GuptaNo ratings yet

- Reuter GuideDocument98 pagesReuter GuideJames WarrenNo ratings yet

- Status Report On Pvf2 For ScribDDocument8 pagesStatus Report On Pvf2 For ScribDLee PedersonNo ratings yet

- The Dark Side of Universal BankingDocument89 pagesThe Dark Side of Universal BankingTrương Nguyễn Quốc HuyNo ratings yet

- Order in The Matter of Sarang Viniyog Ltd. (Formerly Known As Pincon Spirit LTD.)Document10 pagesOrder in The Matter of Sarang Viniyog Ltd. (Formerly Known As Pincon Spirit LTD.)Shyam SunderNo ratings yet

- Problem No. 1Document6 pagesProblem No. 1Jinrikisha TimoteoNo ratings yet

- ZacksEquityReport Z2280134059Document10 pagesZacksEquityReport Z2280134059infoNo ratings yet

- A Study On "Risk Analysis and Risk Management" Karvy Stock BrokingDocument46 pagesA Study On "Risk Analysis and Risk Management" Karvy Stock BrokingbagyaNo ratings yet

- AQR JPM Quant Style Investing 2018 PDFDocument14 pagesAQR JPM Quant Style Investing 2018 PDFAbhimanyu GuptaNo ratings yet

- FIN 201 Chapter 01Document32 pagesFIN 201 Chapter 01Bushra HaqueNo ratings yet

- Investment PortfolioDocument23 pagesInvestment PortfolioProfessional Service100% (1)

- UCSP Module 7Document39 pagesUCSP Module 7jomari.rafael001No ratings yet

- Rural and Women EnterpreneurshipDocument60 pagesRural and Women Enterpreneurshipgurudarshan100% (1)

- Anti Money Laundering Reviewer (Caveat)Document16 pagesAnti Money Laundering Reviewer (Caveat)Daryll Phoebe EbreoNo ratings yet

- Bank Management ProblemsDocument2 pagesBank Management ProblemsAHMED MOHAMED YUSUFNo ratings yet

- Pakistan Stock Exchange Limited: List of Trading Right Entitlement (Tre) Certificate HoldersDocument36 pagesPakistan Stock Exchange Limited: List of Trading Right Entitlement (Tre) Certificate HoldersWaqas AkramNo ratings yet

- Ucsp Module 8 Economic and Nonstate Institutions PDFDocument8 pagesUcsp Module 8 Economic and Nonstate Institutions PDFBernadette ReyesNo ratings yet

- Euro Currency Market and Its Instruments: Presentation byDocument21 pagesEuro Currency Market and Its Instruments: Presentation bypavan3690No ratings yet

- LESSON 5 Equity Securities MarketDocument20 pagesLESSON 5 Equity Securities MarketLove Bella Mae AstilloNo ratings yet

- DTC PARTICIPANTS Listing Alphabetical ListDocument14 pagesDTC PARTICIPANTS Listing Alphabetical Listjacque zidaneNo ratings yet

- Pmla, 2002Document29 pagesPmla, 2002viren thakkarNo ratings yet

- T4 B16 Team 4 Interviews FDR - Internal Memo - Preliminary Meeting - SEC Joseph Cella 289Document3 pagesT4 B16 Team 4 Interviews FDR - Internal Memo - Preliminary Meeting - SEC Joseph Cella 2899/11 Document ArchiveNo ratings yet

- Galvez, John Christian B. Rflib Final Exam January 28, 2021Document5 pagesGalvez, John Christian B. Rflib Final Exam January 28, 2021Christian GalvezNo ratings yet

- N130 NIKUNJ PACHISIA. (Phone: 40077000) (Mobile No.: 9820085300)Document12 pagesN130 NIKUNJ PACHISIA. (Phone: 40077000) (Mobile No.: 9820085300)sandip joshiNo ratings yet

- 2 Financial Services AssignmentDocument10 pages2 Financial Services AssignmentajayNo ratings yet

- 2023 Cryptoassets Blockchain SwitzerlandDocument26 pages2023 Cryptoassets Blockchain SwitzerlandSarang PokhareNo ratings yet

- Amendments To The Anti-Money Laundering ActDocument30 pagesAmendments To The Anti-Money Laundering Actlorkan19No ratings yet

Statement December21

Statement December21

Uploaded by

kunsmanbaby16Original Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Statement December21

Statement December21

Uploaded by

kunsmanbaby16Copyright:

Available Formats

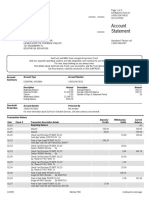

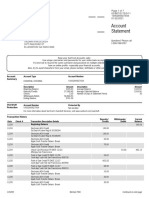

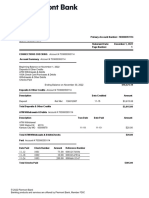

Primary Account Holder Address Account Number

Janice Hatton P.O. Box 218 410019200151

Member since Sep 28, 2021 Monthly Statement Period

Fortcobb, OK 73038 Dec 1, 2021 - Dec 31, 2021

Current Balance Current Interest Rate1 Monthly Interest Paid1

$0.03 0.25% $0.03

as of Dec 31, 2021

Beginning Balance Annual Percentage Yield Earned1 Year-to-date Interest Paid1

$0.00 0.28% $0.03

as of Dec 1, 2021

Current balances include the amount of interest paid.

Transaction Details

Balances below are the total funds resulting from the transaction(s) posted on that day.

Spending balance

DATE TYPE DESCRIPTION AMOUNT BALANCE

Dec 31, 2021 Interest Earned Interest earned $0.03 $0.03

Transaction ID: 27-1

Dec 29, 2021 Direct Payment ROBINHOOD Funds -$12.70 $0.00

Transaction ID: 26-29015001

Dec 21, 2021 Other SoFi Rewards Redemption $12.70 $12.70

Transaction ID: 25-1465001

Dec 17, 2021 Direct Payment ROBINHOOD Funds -$1,439.00 $0.00

Transaction ID: 24-23746001

Dec 16, 2021 Pay a Friend Kathryn Linhoff -$1,000.00 $1,439.00

Transaction ID: 22-1

Dec 15, 2021 Deposit INDI BANK XFER FNDTRNSFR $2,439.00 $2,439.00

Transaction ID: 12-24967001

Contact Information

Website Mailing Address Contact Us

www.sofi.com SoFi Securities LLC (855) 456-SOFI (7634)

234 1st Street

San Francisco, CA 94105

1

Interest accrues daily at the funds rate as described in your SoFi Securities LLC Brokerage Customer Agreement (the “Customer Agreement”) and is paid on the last day of the Statement Period.

2

Interest accrues at the same rate on all funds in your SoFi Money Account, including funds allocated to a SoFi Money Vault. References to “interest” in connection with any SoFi Money Vault reflect the portion of the

interest earned on your SoFi Money Account in the preceding month which is allocated to the applicable SoFi Money Vault. The amount of interest allocated to each SoFi Money Vault is equal to the proportion the

balance in each SoFi Money Vault bears to your total SoFi Money Account balance.

SoFi Money is offered through SoFi Securities, LLC. Page 1 of 2

Important Information

Please refer to the SoFi Securities LLC Brokerage Customer Agreement (the “Customer Agreement”) for a complete discussion of the terms and conditions governing your account. Deposits, bill pay, P2P transfers and

other products or services described on this statement are offered by SoFi Securities, LLC (“SoFi Securities”), a member of FINRA and SIPC, which maintains your account.

All transactions executed for your account shall be subject to the constitution, rules, regulations, customs, and usages of the exchange or market, and its clearing house, where the transactions are executed by SoFi

Securities, LLC or its agents. Your account and transactions executed for your account are subject to applicable federal laws and the rules of FINRA and any other applicable self-regulatory organization. For information

about FINRA’s Broker Check Program, including an investor brochure, please contact FINRA at 1-800-289-9999 or www.finra.org

You should re-confirm any oral communications in writing to further protect your rights, include rights under the Securities Investor Protection Act (SIPA).

Questions About Your Statement or Electronic Transfer Errors

You are in the best position to discover errors and unauthorized transactions on your account statement. It is your duty to review your account statements promptly and carefully and immediately notify us of any errors.

If you have questions about your statement, need more information about a transaction or think an electronic transaction is incorrect or unauthorized, please telephone us at 1-855-456-7634 immediately or write us at

SoFi Securities LLC, 234 1st Street, San Francisco, CA 94105.

If you fail to notify us in writing of suspected errors or an unauthorized transaction within the time period specified in your Customer Agreement (in which periods are no more than 60 days after we make the FIRST

statement available to you on which the error or problem appeared and in some cases are 30 days or less), we are not liable to you for any damages resulting from an error you fail to timely report and you agree to not

make a claim against us for such damages.

If you write us, please include the following information:

(1) Your full name and account number (if any).

(2) A clear description of the error or suspected unauthorized transaction or explanation of why you need more information.

(3) The dollar amount of any suspected error.

We will investigate your complaint and correct any confirmed error promptly. If we take more than 10 business days to complete our investigation, we will credit your account with a provisional credit equal to the disputed

amount, so that you will have the use of the money during the time it takes us to complete our investigation. In the event our investigation concludes that your account was correctly debited or charged for the amount in

dispute, we will deduct the provisional credit from your account.

Free Credit Balances.

Any cash balance in your securities account is payable to you upon demand (“Free Credit Balances”). These amounts transferred into an interest bearing account at an FDIC insured bank as more fully described below

under Sweep Program. If you elect not to have the Free Credit Balances paid to you and choose not to participate in the Sweep Program, the Free Credit Balances will be retained in your account, and will be subject to

use by SoFi Securities in the conduct of its business, subject to the limitations of Rule 15c3-3 under the Securities Exchange Act of 1934, as amended.

SIPC Coverage.

SoFi Securities is a member of the Securities Investor Protection Corporation (“SIPC”). SIPC protects (i) the securities in your account up to a maximum of $500,000, and (ii) cash in your account up to a maximum of

$250,000. Cash deposits that are not intended to be used to purchase securities, or that do not originate from the sale of securities, are ineligible for SIPC coverage. Therefore, Free Credit Balances in your Account will

not be eligible for SIPC coverage. Visit www.sipc.org or call (202) 371-8300 for more information including a brochure on SIPC protection.

Sweep Program.

If you elected to participate in the “Sweep Program”, Free Credit Balances in your securities account will be automatically transferred to omnibus accounts in the name of SoFi Securities for the benefit of SoFi Money

customers, in a network of six (6) FDIC insured banks (the “Program Banks”). Free Credit Balances in the Sweep Program will accrue interest daily and such interest will be credited by SoFi Securities to your Account on

the last Business Day of each month. Each Program Bank will provide FDIC insurance up to $250K, for an aggregate insured amount of up to $1.5M. After your funds clear, it can take up to 48 hours for Free Credit

Balances to reach the Program Banks. During this period, your Free Credit Balances will be insured by a combination of FDIC coverage and a private bond secured by SoFi Securities for the benefit of SoFi Money

customers. Free Credit Balances will not be insured by SIPC coverage at any time. More information about the terms of the Sweep Program, including interest rates, terms of the private bond and Program Bank

information can be found at www.sofi.com/my/money/sweep

Interest/Dividends.

We are required by law to report annually to you and to the Internal Revenue Service on Form 1099 any taxable interest credited to your account, as well as any taxes withheld. The year-to-date figures shown on your

statement reflect these amounts classified to the best of our current knowledge. However, some payments are subject to reclassification, which will be reflected on subsequent statements if we are advised of them prior

to the end of the calendar year.

Statement of Financial Condition

A copy of SoFi Securities’ unaudited Statement of Financial Condition for the period ending June 30, 2020 can now be viewed at the following: https://www.sofi.com/statement-of-financial-condition/. The Company’s

most recent Audited Financial Statement, pursuant to Rule 17A-5 of the Securities Exchange Act of 1934, is available for your inspection at its home office in San Francisco, CA, or at https://www.sofi.com/statement-of-

financial-condition/, or will be mailed to you upon your written request. The Statement may also be viewed at the Regional Office of the Securities and Exchange Commission in San Francisco, CA.

Net Capital Requirement

The Company is subject to the SEC’s Uniform Net Capital Rule ("Exchange Act Rule 15c3-1"), which requires the maintenance of minimum net capital. The Company elected to use the alternative method, permitted by

Exchange Act Rule 15c3-1, which requires that the Company maintain net capital equal to the greater of $250,000 or 2% of aggregate debit items. These regulations also prohibit a broker-dealer from repaying

subordinated borrowings, paying cash dividends, making loans to its parent, affiliates or employees, or otherwise entering into transactions which would result in a reduction of its total net capital to less than 150% of its

required minimum capital. Moreover, broker-dealers are required to notify the SEC and other regulators prior to repaying subordinated borrowings, paying dividends and making loans to its parent, affiliates or

employees, or otherwise entering into transactions, which, if executed, would result in a reduction of 10% or more of its excess net capital (net capital less minimum requirement). The SEC and FINRA have the ability to

prohibit or restrict such transactions if the result is detrimental to the financial integrity of the broker-dealer.

As of the period December 31, 2020, the Company had net capital of $40,168,563 which was $39,918,563 in excess of its required net capital of $250,000.

SoFi Securities, LLC is a direct subsidiary of Social Finance, Inc. If you have a complaint, please call 1-855-456-7634, or write to: SoFi Securities LLC, 234 1st Street, San Francisco, CA 94105.

SoFi Money is offered through SoFi Securities, LLC. Page 2 of 2

You might also like

- Harris JANUARY-2024Document4 pagesHarris JANUARY-2024Md MasumNo ratings yet

- USA Citibank Statement Word and PDF Template - PDF.PDF - 20240403 - 070654 - 0000Document2 pagesUSA Citibank Statement Word and PDF Template - PDF.PDF - 20240403 - 070654 - 0000abooddeleNo ratings yet

- Document 3Document2 pagesDocument 3garrettloehrNo ratings yet

- Bank Grindord StatementDocument5 pagesBank Grindord StatementBD MahamudNo ratings yet

- Virtual Annual Meeting Friday, June 12 at 1:30 P.M. PT: Direct Inquiries ToDocument2 pagesVirtual Annual Meeting Friday, June 12 at 1:30 P.M. PT: Direct Inquiries Tosusu ultra men100% (1)

- PDF DocumentDocument5 pagesPDF DocumentNicolauNo ratings yet

- Bank Statement LanayaDocument3 pagesBank Statement LanayashrondaNo ratings yet

- Statement of Account: American Express Membership Rewards® Credit CardDocument4 pagesStatement of Account: American Express Membership Rewards® Credit CardDiwakar ChaturvediNo ratings yet

- Tdecu MarchDocument3 pagesTdecu MarchMuhammad MudassarNo ratings yet

- Traditional Individual Retirement Account - Advisory Solutions Fund Model Custodian: Edward Jones Trust CompanyDocument8 pagesTraditional Individual Retirement Account - Advisory Solutions Fund Model Custodian: Edward Jones Trust CompanyMike BarnhartNo ratings yet

- Tyarrie Lee: Moneylion IncDocument3 pagesTyarrie Lee: Moneylion IncIvan ĐukićNo ratings yet

- SATS - Anon Write Up 02 13 2012Document10 pagesSATS - Anon Write Up 02 13 2012cnm3dNo ratings yet

- Modern Money Mechanics PDFDocument40 pagesModern Money Mechanics PDFwestelm12No ratings yet

- Treasury and Fund Management in BanksDocument40 pagesTreasury and Fund Management in Bankseknath2000100% (2)

- 20220608-Platinum Card Statement-6185Document6 pages20220608-Platinum Card Statement-6185freakenscoutNo ratings yet

- Monthly Statement: Name Address Account Number Statement PeriodDocument8 pagesMonthly Statement: Name Address Account Number Statement PeriodAzeez AyomideNo ratings yet

- Account Summary Payment Information: New Balance $2,102.08 Minimum Payment Due $86.42 Payment Due Date March 6, 2021Document2 pagesAccount Summary Payment Information: New Balance $2,102.08 Minimum Payment Due $86.42 Payment Due Date March 6, 2021franklin reid rosarioNo ratings yet

- Statement of Account: Membership Summary Information For Member # 56228 As of 3/31/20Document4 pagesStatement of Account: Membership Summary Information For Member # 56228 As of 3/31/20Mark HolobaughNo ratings yet

- ReneeDocument2 pagesReneeAseadNo ratings yet

- Account # 030753616: Lifegreen CheckingDocument4 pagesAccount # 030753616: Lifegreen Checkingmy nameNo ratings yet

- Account StatementDocument2 pagesAccount StatementinashumedaNo ratings yet

- Bluebird Statement - Bluebird - 8409Document2 pagesBluebird Statement - Bluebird - 8409dalowerNo ratings yet

- April Bank StatementDocument1 pageApril Bank StatementQuiskeya LLCNo ratings yet

- WNBStatementDocument3 pagesWNBStatementNancy TorresNo ratings yet

- Questions? Call 1.888.662.4722 TTY 1.800.898.5999 or Write: HSBC P.O. Box 9 Buffalo, New York 14240Document2 pagesQuestions? Call 1.888.662.4722 TTY 1.800.898.5999 or Write: HSBC P.O. Box 9 Buffalo, New York 14240cathy clarkNo ratings yet

- Account Summary Contact UsDocument1 pageAccount Summary Contact Usshamekagardner.ailNo ratings yet

- Victor Owusu: Account StatementDocument2 pagesVictor Owusu: Account Statementploteg66No ratings yet

- Result PDF Watermark J0CircODocument4 pagesResult PDF Watermark J0CircOHAMID EL ASRINo ratings yet

- Truist Statement 2Document2 pagesTruist Statement 2Adnan HussainNo ratings yet

- Attachment 16268014602Document5 pagesAttachment 16268014602Web TreamicsNo ratings yet

- ListDocument4 pagesListNestor MartinezNo ratings yet

- DocumentDocument4 pagesDocumentMammies ScottNo ratings yet

- Oct 21Document2 pagesOct 21girichote0% (1)

- UtilityBillingStatement AGO2022Document2 pagesUtilityBillingStatement AGO2022MexLex Tramites LegalesNo ratings yet

- USA First Century BankDocument2 pagesUSA First Century BankOPL OJJJNo ratings yet

- Texas Bank April30Document4 pagesTexas Bank April3076xzv4kk5vNo ratings yet

- MCCLOUDY Jan Statements2021Document7 pagesMCCLOUDY Jan Statements2021David GarciaNo ratings yet

- Your Account Statement: Contact UsDocument4 pagesYour Account Statement: Contact UsAll PeaceNo ratings yet

- Dec Evolve and TrustDocument2 pagesDec Evolve and TrustSafeBit ProsNo ratings yet

- 29 Jan 2024 StaementDocument2 pages29 Jan 2024 StaementmalumeskinyNo ratings yet

- Michael Partain Piermont Statement 1Document1 pageMichael Partain Piermont Statement 1Jonathan Seagull LivingstonNo ratings yet

- Chime Checking Statement May 2021 PDFDocument3 pagesChime Checking Statement May 2021 PDFKalila JamesNo ratings yet

- Account Summary Contact Us: Search DocumentDocument7 pagesAccount Summary Contact Us: Search Documentmr w hrNo ratings yet

- Statement of Account: Credit Limit Rs Available Credit Limit RsDocument2 pagesStatement of Account: Credit Limit Rs Available Credit Limit RsGanesh KumarNo ratings yet

- Virginia Credit UnionDocument1 pageVirginia Credit Unionbaga ibakNo ratings yet

- BillSTMT 4588260001812272 19Document2 pagesBillSTMT 4588260001812272 19EhitishamNo ratings yet

- Oj G59 Dy WPgzi 3 K IiDocument4 pagesOj G59 Dy WPgzi 3 K IiAndrew WeiglerNo ratings yet

- December 2023Document8 pagesDecember 2023Esteban Mateus100% (1)

- PNC Access Checking Account SummaryDocument2 pagesPNC Access Checking Account SummaryNiao PjNo ratings yet

- Aliyu STTMNTDocument2 pagesAliyu STTMNTShelvya ReeseNo ratings yet

- Estmt - 2021 05 24Document4 pagesEstmt - 2021 05 24Aditya Pangestu ArdanaNo ratings yet

- Tfcu George ArtisDocument5 pagesTfcu George Artistroymc101No ratings yet

- Chime Bank Statement-5Document1 pageChime Bank Statement-5dmarcumNo ratings yet

- Thomas Bank StatmentDocument1 pageThomas Bank StatmentAhsan ShabirNo ratings yet

- List UnlockedDocument4 pagesList UnlockedNestor MartinezNo ratings yet

- Visa Gold Low Rates Statement: Account Name MR John DoeDocument3 pagesVisa Gold Low Rates Statement: Account Name MR John DoeWenjie65No ratings yet

- Discover Statement 20221105 9126Document4 pagesDiscover Statement 20221105 9126colle ctorNo ratings yet

- Statements New 1Document4 pagesStatements New 1Bhuwesh SinghNo ratings yet

- Robinhood: Account Summary Portfolio AllocationDocument3 pagesRobinhood: Account Summary Portfolio Allocationkrushnavadan5666No ratings yet

- Hilary Stonewall 107 N Oak ST Freemansburg Pa 18017-0000 Account 6789067948Document2 pagesHilary Stonewall 107 N Oak ST Freemansburg Pa 18017-0000 Account 6789067948Shelvya ReeseNo ratings yet

- Zilyn Jackson BOA Statement OctDocument4 pagesZilyn Jackson BOA Statement OctLillian AwtNo ratings yet

- Shaheed Taylor 2223 Florey LN Apt. E8 ROSLYN PA 19001: Return Service RequestedDocument3 pagesShaheed Taylor 2223 Florey LN Apt. E8 ROSLYN PA 19001: Return Service Requestedshaheed taylorNo ratings yet

- Methods to Overcome the Financial and Money Transfer Blockade against Palestine and any Country Suffering from Financial BlockadeFrom EverandMethods to Overcome the Financial and Money Transfer Blockade against Palestine and any Country Suffering from Financial BlockadeNo ratings yet

- Stock Market Black BookDocument85 pagesStock Market Black BookJayesh GuptaNo ratings yet

- Reuter GuideDocument98 pagesReuter GuideJames WarrenNo ratings yet

- Status Report On Pvf2 For ScribDDocument8 pagesStatus Report On Pvf2 For ScribDLee PedersonNo ratings yet

- The Dark Side of Universal BankingDocument89 pagesThe Dark Side of Universal BankingTrương Nguyễn Quốc HuyNo ratings yet

- Order in The Matter of Sarang Viniyog Ltd. (Formerly Known As Pincon Spirit LTD.)Document10 pagesOrder in The Matter of Sarang Viniyog Ltd. (Formerly Known As Pincon Spirit LTD.)Shyam SunderNo ratings yet

- Problem No. 1Document6 pagesProblem No. 1Jinrikisha TimoteoNo ratings yet

- ZacksEquityReport Z2280134059Document10 pagesZacksEquityReport Z2280134059infoNo ratings yet

- A Study On "Risk Analysis and Risk Management" Karvy Stock BrokingDocument46 pagesA Study On "Risk Analysis and Risk Management" Karvy Stock BrokingbagyaNo ratings yet

- AQR JPM Quant Style Investing 2018 PDFDocument14 pagesAQR JPM Quant Style Investing 2018 PDFAbhimanyu GuptaNo ratings yet

- FIN 201 Chapter 01Document32 pagesFIN 201 Chapter 01Bushra HaqueNo ratings yet

- Investment PortfolioDocument23 pagesInvestment PortfolioProfessional Service100% (1)

- UCSP Module 7Document39 pagesUCSP Module 7jomari.rafael001No ratings yet

- Rural and Women EnterpreneurshipDocument60 pagesRural and Women Enterpreneurshipgurudarshan100% (1)

- Anti Money Laundering Reviewer (Caveat)Document16 pagesAnti Money Laundering Reviewer (Caveat)Daryll Phoebe EbreoNo ratings yet

- Bank Management ProblemsDocument2 pagesBank Management ProblemsAHMED MOHAMED YUSUFNo ratings yet

- Pakistan Stock Exchange Limited: List of Trading Right Entitlement (Tre) Certificate HoldersDocument36 pagesPakistan Stock Exchange Limited: List of Trading Right Entitlement (Tre) Certificate HoldersWaqas AkramNo ratings yet

- Ucsp Module 8 Economic and Nonstate Institutions PDFDocument8 pagesUcsp Module 8 Economic and Nonstate Institutions PDFBernadette ReyesNo ratings yet

- Euro Currency Market and Its Instruments: Presentation byDocument21 pagesEuro Currency Market and Its Instruments: Presentation bypavan3690No ratings yet

- LESSON 5 Equity Securities MarketDocument20 pagesLESSON 5 Equity Securities MarketLove Bella Mae AstilloNo ratings yet

- DTC PARTICIPANTS Listing Alphabetical ListDocument14 pagesDTC PARTICIPANTS Listing Alphabetical Listjacque zidaneNo ratings yet

- Pmla, 2002Document29 pagesPmla, 2002viren thakkarNo ratings yet

- T4 B16 Team 4 Interviews FDR - Internal Memo - Preliminary Meeting - SEC Joseph Cella 289Document3 pagesT4 B16 Team 4 Interviews FDR - Internal Memo - Preliminary Meeting - SEC Joseph Cella 2899/11 Document ArchiveNo ratings yet

- Galvez, John Christian B. Rflib Final Exam January 28, 2021Document5 pagesGalvez, John Christian B. Rflib Final Exam January 28, 2021Christian GalvezNo ratings yet

- N130 NIKUNJ PACHISIA. (Phone: 40077000) (Mobile No.: 9820085300)Document12 pagesN130 NIKUNJ PACHISIA. (Phone: 40077000) (Mobile No.: 9820085300)sandip joshiNo ratings yet

- 2 Financial Services AssignmentDocument10 pages2 Financial Services AssignmentajayNo ratings yet

- 2023 Cryptoassets Blockchain SwitzerlandDocument26 pages2023 Cryptoassets Blockchain SwitzerlandSarang PokhareNo ratings yet

- Amendments To The Anti-Money Laundering ActDocument30 pagesAmendments To The Anti-Money Laundering Actlorkan19No ratings yet