Professional Documents

Culture Documents

Crypto-Currency and Financial Digital Inclusion in Tanzania

Crypto-Currency and Financial Digital Inclusion in Tanzania

Uploaded by

kichupa1234Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Crypto-Currency and Financial Digital Inclusion in Tanzania

Crypto-Currency and Financial Digital Inclusion in Tanzania

Uploaded by

kichupa1234Copyright:

Available Formats

CRYPTO-CURRENCY AND FINANCIAL DIGITAL INCLUSION IN

TANZANIA

Crypto-Currency and financial digital inclusion in Tanzania

Commerce has evolved from a traditional physical exchange of goods, services and

payments from it being done digitally/ cyberspace commerce. This does not leave apart the

trading of currencies, in a crypto manner.

When we talk of crypto-currency we are talking about a form of payment that can be

exchanged online for goods and services. Crypto-currencies work using a technology

called block-chain. Blockchain is a decentralized technology spread across many computers

that manage and record transactions. Part of the appeal of this technology is its security and

the untraceable power by the issuing bank, the government and or third party.

It involves the acquisition of digital asset designed to work as a medium of exchange

wherein individual coin ownership records are stored in a ledger existing in a form of a

computerized database using strong cryptography to secure transaction records, to control

the creation of additional coins, and to verify the transfer of coin ownership.

From ecash to bitcoin and the likes that followed afterward we the world has experienced a

shift from the first idea of crypto-currency from 1983 to the present. From David Chaum to

Satoshi Nakamoto and the rest the growth and the number of interested traders have forced

some governments to study how they can best regulate the market and measure if it’s worth

it or not.

Most countries apart from El Salvador which became the first country to accept bitcoin as

legal tender, after the Legislative Assembly had voted 62–22 to pass a bill submitted by

President Nayib Bukele in June 2021 on the crypto-currency claim the dangers that follow

this type of trading and some of the concerns to narrow them include:

Transactions in virtual currencies such as bitcoin are largely untraceable and

anonymous making them susceptible to abuse by criminals in money laundering and

financing of terrorism.

Virtual currencies are traded on exchange platforms that tend to be unregulated all

over the world. Consumers may therefore lose their money without having any legal

redress in the event these exchanges collapse or close business.

There is no underlying or backing of assets and the value of virtual currencies is

speculative. This may result in high volatility in the value of virtual currencies thus

exposing users to potential losses.

Crypto-currency transactions and accounts are not connected to real-world identities,

a phenomenon is known as ‘pseudonymity’. Experts argue that this could promote

money laundering and fraudulent activities.

www.abcattorneys.co.tz |+255 688 609 931 | info@abcattorneys.co.tz. | 1

CRYPTO-CURRENCY AND FINANCIAL DIGITAL INCLUSION IN

TANZANIA

The Bank of Tanzania’s ban on crypto-Currency lies in its minimal regulation, with no

requirement for investors and traders to hold a license or certificate proving their identities

and trading history.

Critics have argued that the ban by BoT is unreasonable and lacks legal backing from

neither Acts nor Legislations(the BoT nor the Foreign Exchange Act ) cited that could help

shine a light on the reasons for the bar on the trading system. circular states, among other

things, that ‘The only acceptable and used legal tender in the country is the Tanzanian

Shilling’.

Some argue crypto-currency is more of a property rather than a proxy for legal tender, they

go further to argue that a crypto-currency transaction is essentially an electronically

facilitated exchange of property for property – a form of barter.

However, under the purview of section 15 of the National Payments System Act No. 4 of

2015 (the NPS). Section 15 of the NPS provides that “a person shall not issue an electronic

payment system without a license or approval from BoT”. Hence the grounding for the

decision may have been solemnly based on the provisions of this section, hence the ban.

Suggestively given the rapid technological advancements taking place across the world, it

may be more beneficial to the Tanzanian economy to find means to regulate the use of

crypto-currency, thus addressing the concerns while also enabling the country to derive the

economic benefits associated with crypto-currencies.

www.abcattorneys.co.tz |+255 688 609 931 | info@abcattorneys.co.tz. | 2

You might also like

- Financial Analysis of A BMW-2021 and 2020Document4 pagesFinancial Analysis of A BMW-2021 and 2020Mukoya Odede100% (1)

- J 7 IJAL 2019 1 Kkartikeya14 Gmailcom 20200509 000011Document14 pagesJ 7 IJAL 2019 1 Kkartikeya14 Gmailcom 20200509 000011kumar kartikeyaNo ratings yet

- 3 Cryptocurrency RegulationDocument6 pages3 Cryptocurrency RegulationAmmar KattoulaNo ratings yet

- CryptocurrenciesDocument13 pagesCryptocurrenciesTawfiqul WahidNo ratings yet

- CryptocurrencyDocument9 pagesCryptocurrencyRaghavNo ratings yet

- Cryptocurrency - India's Likely Belligerent Response Amid Covid-19Document8 pagesCryptocurrency - India's Likely Belligerent Response Amid Covid-19Pulkit AgarwalNo ratings yet

- Cashless India: Is Cryptocurrency The Future of Money?: I-AbstractDocument11 pagesCashless India: Is Cryptocurrency The Future of Money?: I-AbstractShreya ModiNo ratings yet

- Final Assignment - Crypto 23Document9 pagesFinal Assignment - Crypto 23Vinessen SevatheanNo ratings yet

- The Philippines Cryptocurrency OverviewDocument8 pagesThe Philippines Cryptocurrency OverviewCLINT SHEEN CABIASNo ratings yet

- CRYPTODocument62 pagesCRYPTOMubeenNo ratings yet

- Cryptocurrency and Modern ImplicationsDocument6 pagesCryptocurrency and Modern ImplicationsKaran VyasNo ratings yet

- CRYPTOCURRENCYDocument5 pagesCRYPTOCURRENCYCLINT SHEEN CABIASNo ratings yet

- CryptocurrenciesarticleDocument12 pagesCryptocurrenciesarticlegczdkcvhv5No ratings yet

- Cryptocurrency Trading: The Ultimate Guide to Understanding the Cryptocurrency TradingFrom EverandCryptocurrency Trading: The Ultimate Guide to Understanding the Cryptocurrency TradingRating: 4 out of 5 stars4/5 (1)

- A Beneficial Rise in Economic ActivitiesDocument3 pagesA Beneficial Rise in Economic Activitiesmuskaan madanNo ratings yet

- Sakshee Sahay Proposed Ban On Cryptocurrency A Step in Right DirectionDocument10 pagesSakshee Sahay Proposed Ban On Cryptocurrency A Step in Right DirectionSakshee SahayNo ratings yet

- Crypto-Currencies and Their Possible Impact in BusinessDocument5 pagesCrypto-Currencies and Their Possible Impact in BusinessApoorv aroraNo ratings yet

- Briefing PaperDocument5 pagesBriefing PaperRHEALYN GEMOTONo ratings yet

- Digital CurrencyDocument2 pagesDigital Currencyshey achiNo ratings yet

- Professor Abdulrazaq Alaro, Head Department of Islamic Law, University of Ilorin, Kwara StateDocument15 pagesProfessor Abdulrazaq Alaro, Head Department of Islamic Law, University of Ilorin, Kwara Statenurhairin nizanNo ratings yet

- CRYPTOCURRENCYDocument3 pagesCRYPTOCURRENCYfaizanashraffiNo ratings yet

- Crypto CurrencyDocument15 pagesCrypto CurrencySrivatsa B NaiduNo ratings yet

- Bit Coin Regulations in IndiaDocument15 pagesBit Coin Regulations in IndiaVaishnavi CNo ratings yet

- LIOP 3724 JournalDocument2 pagesLIOP 3724 Journalsiyanda milisiNo ratings yet

- Digital Currency and The Law The Way ForDocument32 pagesDigital Currency and The Law The Way ForesthereliaweNo ratings yet

- Ministry of Defence - Sri LankaDocument8 pagesMinistry of Defence - Sri Lankasharafernando2No ratings yet

- Should Crypto Currencies Be Used For Main Transactions?Document3 pagesShould Crypto Currencies Be Used For Main Transactions?Kaviesh KingNo ratings yet

- Cryptocurrency PDFDocument7 pagesCryptocurrency PDFRanjani AnandNo ratings yet

- A Survey On Crypto CurrenciesDocument7 pagesA Survey On Crypto CurrenciesidescitationNo ratings yet

- Cryptocurrency and Its FutureDocument4 pagesCryptocurrency and Its FuturePRASANG NANDWANANo ratings yet

- Crypto Assets As New Investment ToolDocument14 pagesCrypto Assets As New Investment Toolsamuel kanyikaNo ratings yet

- New OpenDocument TextDocument6 pagesNew OpenDocument Textalaa hawatmehNo ratings yet

- Proposal: (CITATION Ash21 /L 1033)Document3 pagesProposal: (CITATION Ash21 /L 1033)Leo GirlNo ratings yet

- Analysis of Pakistan Industries - Assignment No 05Document8 pagesAnalysis of Pakistan Industries - Assignment No 05Jannat AslamNo ratings yet

- Bitcoin CryptocurrencyDocument1 pageBitcoin CryptocurrencyNikki KumariNo ratings yet

- Cryptocurrency in Ghana - SampleDocument2 pagesCryptocurrency in Ghana - SampleNothing ImportantNo ratings yet

- Crypto CurrencyDocument3 pagesCrypto Currencyavaneeshy1310No ratings yet

- The Good, The Bad, and The UglyDocument13 pagesThe Good, The Bad, and The UglyTanvir AhmedNo ratings yet

- Project Business LAWDocument33 pagesProject Business LAWMahmoud ZeinNo ratings yet

- Crypto CurrencyDocument1 pageCrypto CurrencyBijesh MNo ratings yet

- Blockchain TechnologyDocument3 pagesBlockchain TechnologyKhushi chawlaNo ratings yet

- Econ AssignDocument11 pagesEcon AssignMariya StephenNo ratings yet

- Virtual Taka in Bangladesh ContextDocument3 pagesVirtual Taka in Bangladesh ContextMohammad Shahjahan SiddiquiNo ratings yet

- USB CryptocurrencyDocument18 pagesUSB CryptocurrencytabNo ratings yet

- Research CryptocurrencyDocument19 pagesResearch Cryptocurrencymayhem happening100% (1)

- Comparative Study On Cryptocurrency Transaction and Banking TransactionDocument14 pagesComparative Study On Cryptocurrency Transaction and Banking TransactionRUTHRAPRIYAN P II MBA 20-22No ratings yet

- Beginners' Guide To Cryptocurrency: What Should You Know?Document6 pagesBeginners' Guide To Cryptocurrency: What Should You Know?Khuzaima PishoriNo ratings yet

- Cryptocurrency Its Future in BangladeshDocument3 pagesCryptocurrency Its Future in Bangladeshnew placeNo ratings yet

- Debate Mitra - CryptoDocument2 pagesDebate Mitra - Cryptosaman0711994No ratings yet

- العملات الافتراضية - تقارير بنك التوسيات الدولى BISDocument6 pagesالعملات الافتراضية - تقارير بنك التوسيات الدولى BISWael HassanNo ratings yet

- The rise of cryptocurrencies: Understanding the future of money and financeFrom EverandThe rise of cryptocurrencies: Understanding the future of money and financeNo ratings yet

- CRYPTO TRADING: A Comprehensive Guide to Mastering Cryptocurrency Trading Strategies (2023)From EverandCRYPTO TRADING: A Comprehensive Guide to Mastering Cryptocurrency Trading Strategies (2023)No ratings yet

- Finance ProjectDocument12 pagesFinance ProjectElishba MustafaNo ratings yet

- Cryptocurrency Demystified: A Beginner's Guide to the World of Digital Currency: Money MattersFrom EverandCryptocurrency Demystified: A Beginner's Guide to the World of Digital Currency: Money MattersNo ratings yet

- CryptoDocument2 pagesCryptoHadia KhanNo ratings yet

- What Is CryptocurrencyDocument1 pageWhat Is CryptocurrencyJohn DoeufNo ratings yet

- A Brief History of CryptocurrencyDocument2 pagesA Brief History of CryptocurrencyJirawat TussabutNo ratings yet

- CrytocurrencyDocument7 pagesCrytocurrencySeng Cheong KhorNo ratings yet

- Ngongo Lundikazi 201813006 Instruments of Payment For 2020Document5 pagesNgongo Lundikazi 201813006 Instruments of Payment For 2020lundingongoNo ratings yet

- CryptoDocument5 pagesCryptoBucio, KhayeNo ratings yet

- FM Cia 1.2Document7 pagesFM Cia 1.2Rohit GoyalNo ratings yet

- BOIMF NFO Cobranded One Pager - CompressedDocument2 pagesBOIMF NFO Cobranded One Pager - CompressedBig DickNo ratings yet

- Local Media2369703301456694088 PDFDocument8 pagesLocal Media2369703301456694088 PDFChristian King IlardeNo ratings yet

- FM Chapter 2Document16 pagesFM Chapter 2mearghaile4No ratings yet

- PAFTI Newsletter - May 2 2023 PDFDocument3 pagesPAFTI Newsletter - May 2 2023 PDFJoel SepeNo ratings yet

- SAS#10-BAM 191 1st EXAMDocument7 pagesSAS#10-BAM 191 1st EXAMKhel SedaNo ratings yet

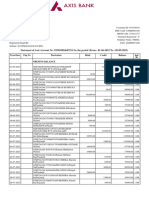

- Statement of Axis Account No:923010024647231 For The Period (From: 01-06-2023 To: 05-09-2023)Document3 pagesStatement of Axis Account No:923010024647231 For The Period (From: 01-06-2023 To: 05-09-2023)Parveen SainiNo ratings yet

- Bikaji Foods International LTDDocument3 pagesBikaji Foods International LTDdeepaksinghbishtNo ratings yet

- 10 STOCK SCREENERS FOR TRADERS Screeners For Intraday, Swing, and Positional Trading (Singh, Jaspreet) (Z-Library)Document10 pages10 STOCK SCREENERS FOR TRADERS Screeners For Intraday, Swing, and Positional Trading (Singh, Jaspreet) (Z-Library)Imran VohraNo ratings yet

- BFC 018 Key AnswerDocument6 pagesBFC 018 Key AnswerMariphie OsianNo ratings yet

- Salary Grade 2024 DigidoDocument1 pageSalary Grade 2024 DigidoJefferson ApulogNo ratings yet

- Ts Grewal Solutions For Class 11 Accountancy Chapter 10 TrialDocument22 pagesTs Grewal Solutions For Class 11 Accountancy Chapter 10 TrialMantejNo ratings yet

- Hiraoka S Aoki A Eds Management Control Systems For StrategiDocument199 pagesHiraoka S Aoki A Eds Management Control Systems For StrategiОксана ХодирєваNo ratings yet

- 2024 U.S. Stock Market Outlook - A Time For BalanceDocument5 pages2024 U.S. Stock Market Outlook - A Time For Balancesandboxkl.1No ratings yet

- Distinguishing Characteristics of Governmental and NotDocument9 pagesDistinguishing Characteristics of Governmental and NotFantayNo ratings yet

- Cost of Capital FYBAF Sem I Old F. M. 1644486598Document26 pagesCost of Capital FYBAF Sem I Old F. M. 1644486598maggiemali092No ratings yet

- Notes On PDIC LAW RA 3195 2Document8 pagesNotes On PDIC LAW RA 3195 2Diaz, Bryan ChristopherNo ratings yet

- Learn and Earn Through Candlesticks ChartsDocument99 pagesLearn and Earn Through Candlesticks ChartsZombieNo ratings yet

- Entrep-Activity No 3Document1 pageEntrep-Activity No 3Ma. Crisanta A. AntonioNo ratings yet

- Gr9 EMS (English) June 2018 Possible AnswersDocument10 pagesGr9 EMS (English) June 2018 Possible Answers6lackzamokuhleNo ratings yet

- AIB 27th Annual Report 2021..22 CompressedDocument177 pagesAIB 27th Annual Report 2021..22 Compressedfayeraleta2024No ratings yet

- Latihan Soal Kombis (Answered)Document6 pagesLatihan Soal Kombis (Answered)Fajar IskandarNo ratings yet

- Module 5 Part 4 The Corporation-Retained EarningsDocument27 pagesModule 5 Part 4 The Corporation-Retained EarningsKRISTINA CASSANDRA CUEVASNo ratings yet

- Corporate Finance-1 PDFDocument31 pagesCorporate Finance-1 PDFMahin RahmanNo ratings yet

- Time Value of MoneyDocument8 pagesTime Value of MoneySocio Fact'sNo ratings yet

- ISB-CFO - Batch 2024-2025Document18 pagesISB-CFO - Batch 2024-2025Salah ZaamoutNo ratings yet

- Ss 2 Agricultural Science Week 9 - 10Document5 pagesSs 2 Agricultural Science Week 9 - 10palmer okiemuteNo ratings yet

- Test Bank For International Accounting 5th Edition by DoupnikDocument24 pagesTest Bank For International Accounting 5th Edition by DoupnikAllen Sylvester100% (42)

- Report - 2023 11 16 - 23 56 11Document2 pagesReport - 2023 11 16 - 23 56 11jennyscol4realNo ratings yet