Professional Documents

Culture Documents

Amort 1320012720430 2942023203851

Amort 1320012720430 2942023203851

Uploaded by

ladkibadianjanihaiOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Amort 1320012720430 2942023203851

Amort 1320012720430 2942023203851

Uploaded by

ladkibadianjanihaiCopyright:

Available Formats

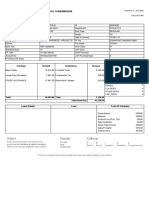

AMORTIZATION SCHEDULE

Sr. MRA MRA(Rs)$ Interest(Rs.) Principal(Rs.) Balance(Rs.) Applicable

No. Billing taxes (Rs.)#

Date*

1 02/05/2023 4524.72 645.84 3878.88 46121.12 116.25

2 02/06/2023 4524.72 595.73 3928.99 42192.13 107.23

3 02/07/2023 4524.72 544.98 3979.74 38212.39 98.1

4 02/08/2023 4524.72 493.58 4031.14 34181.25 88.84

5 02/09/2023 4524.72 441.51 4083.21 30098.04 79.47

6 02/10/2023 4524.72 388.77 4135.95 25962.09 69.98

7 02/11/2023 4524.72 335.34 4189.38 21772.71 60.36

8 02/12/2023 4524.72 281.23 4243.49 17529.22 50.62

9 02/01/2024 4524.72 226.42 4298.3 13230.92 40.76

10 02/02/2024 4524.72 170.9 4353.82 8877.1 30.76

11 02/03/2024 4524.72 114.66 4410.06 4467.04 20.64

12 02/04/2024 4524.72 57.68 4467.04 0 10.38

Request Id 1320012720430

Principal Rs. 50000

MRA Rs. 4524.72

R.O.I.(p.m.)** 15.5 %

Tenure 12 Months

*MRA billing date is monthly statement date, for due date please refer monthly statement.

$MRA (Monthly Repayment Amount) is excluding applicable taxes.

# Applicable taxes means:

· For the cardholders having state of residence in the records of SBI Card on the statement date

as "Haryana" - Central Tax @ 9% and State Tax @ 9%

· For the cardholders having state of residence in the records of SBI Card on the statement date

as other than "Haryana" - Integrated Tax @ 18%

**This is a flat rate of interest and is used to calculate the monthly repayment amount.

**The above rate of interest translates into 15.5% p.a. reducing interest rate.

You might also like

- 1 LOPES E MACEDO Teorias de CurrículoDocument15 pages1 LOPES E MACEDO Teorias de Currículoribeiro_denilson50% (4)

- XLX250R 86 Regulagem Do Carburador Duplo Da XLX 250r 86Document2 pagesXLX250R 86 Regulagem Do Carburador Duplo Da XLX 250r 86Itan Itan ItanNo ratings yet

- Remembering, Bartlett (1932)Document11 pagesRemembering, Bartlett (1932)andreea4etc100% (1)

- Profitability of simple fixed strategies in sport betting: Soccer, Italy Serie A League, 2009-2019From EverandProfitability of simple fixed strategies in sport betting: Soccer, Italy Serie A League, 2009-2019No ratings yet

- A Investment Platform for Future: Self Help a Self Operating BankingFrom EverandA Investment Platform for Future: Self Help a Self Operating BankingNo ratings yet

- Math Practice Simplified: Decimals & Percents (Book H): Practicing the Concepts of Decimals and PercentagesFrom EverandMath Practice Simplified: Decimals & Percents (Book H): Practicing the Concepts of Decimals and PercentagesRating: 5 out of 5 stars5/5 (3)

- 12144229Document1 page12144229BHASKAR pNo ratings yet

- 1 Jan 22 To 15 Jan 2022Document3 pages1 Jan 22 To 15 Jan 2022BHASKAR pNo ratings yet

- March 2023Document2 pagesMarch 2023BHASKAR pNo ratings yet

- Jan 2022Document5 pagesJan 2022BHASKAR pNo ratings yet

- 1 Dec To 31 Dec 2021Document6 pages1 Dec To 31 Dec 2021BHASKAR pNo ratings yet

- Vasudha 03-08-2022Document30 pagesVasudha 03-08-2022BHASKAR p100% (2)

- 1 July To 17 Aug 2022Document6 pages1 July To 17 Aug 2022BHASKAR pNo ratings yet

- 1 June To 30 June 2022Document5 pages1 June To 30 June 2022BHASKAR pNo ratings yet

- Rahul Sharma Emi Clearance BankingDocument7 pagesRahul Sharma Emi Clearance BankingBHASKAR pNo ratings yet

- AC GST Tax InvoiceDocument1 pageAC GST Tax InvoiceBHASKAR pNo ratings yet

- Ilovepdf MergedDocument3 pagesIlovepdf MergedBHASKAR pNo ratings yet

- My - Bill - 11 Jul, 2022 - 10 Aug, 2022 - 299370356140Document8 pagesMy - Bill - 11 Jul, 2022 - 10 Aug, 2022 - 299370356140BHASKAR pNo ratings yet

- AC GST Tax InvoiceDocument1 pageAC GST Tax InvoiceBHASKAR pNo ratings yet

- Arun Reddy Salary July Credited Bank StatementDocument2 pagesArun Reddy Salary July Credited Bank StatementBHASKAR pNo ratings yet

- June 2022Document1 pageJune 2022BHASKAR pNo ratings yet

- Form 16: Warora Kurnool Transmission LimitedDocument10 pagesForm 16: Warora Kurnool Transmission LimitedBHASKAR pNo ratings yet

- PhotoDocument1 pagePhotoBHASKAR pNo ratings yet

- Welcome Kit Blindaje PlusDocument2 pagesWelcome Kit Blindaje PlusDwn DugNo ratings yet

- Panel de Capacidades y Destrezas BloomDocument2 pagesPanel de Capacidades y Destrezas Bloomyulisa_379No ratings yet

- Proyecto BDDocument10 pagesProyecto BDLeonardo ChicaizaNo ratings yet

- LibroOO 2da Ed Cap7 WebDocument32 pagesLibroOO 2da Ed Cap7 WebRuddy MoranteNo ratings yet

- Aira Cesar - La LiebreDocument246 pagesAira Cesar - La Liebreayelen tabordaNo ratings yet

- Examen de Recuperación para BásicoDocument6 pagesExamen de Recuperación para BásicoEDWAR AGUSTINNo ratings yet

- Prólogo "Este Es El Apra, ¿Qué Les Parece?"Document4 pagesPrólogo "Este Es El Apra, ¿Qué Les Parece?"MoisesRojas2287No ratings yet

- Tutorial Saint NominaDocument9 pagesTutorial Saint NominaclaritzaNo ratings yet

- Novoplural9 Lprofessor Teste Sumativo4 EpicoDocument5 pagesNovoplural9 Lprofessor Teste Sumativo4 EpicoMarisa Montes100% (1)

- Bethell Tomo 9 Capítulo 2 Revolución MexicanaDocument26 pagesBethell Tomo 9 Capítulo 2 Revolución MexicanaValentina FernandezNo ratings yet

- Procedimiento de Reforma Constitucional: Titulares IniciativaDocument1 pageProcedimiento de Reforma Constitucional: Titulares Iniciativasaranya1919No ratings yet

- Cosas Que Nunca DijimosDocument325 pagesCosas Que Nunca DijimosPepe AguiarNo ratings yet

- Week 1 - The Swamp LessonDocument2 pagesWeek 1 - The Swamp LessonEccentricEdwardsNo ratings yet

- Ie 2e Level 4 Unit 9-4Document4 pagesIe 2e Level 4 Unit 9-4Stasya EgorovaNo ratings yet

- Bellann Summer-The Men of The Crazy Angle Ranch 1 - La Transformacion de TylerDocument111 pagesBellann Summer-The Men of The Crazy Angle Ranch 1 - La Transformacion de TylerIVY0% (1)

- KNX System Specifications: Document OverviewDocument8 pagesKNX System Specifications: Document OverviewGentritNo ratings yet

- Canara BankDocument21 pagesCanara BankRajesh MaityNo ratings yet

- TG0012 enDocument24 pagesTG0012 enDhexter VillaNo ratings yet

- 2 - Fundamentos Da Prótese Fixa (Resumo)Document5 pages2 - Fundamentos Da Prótese Fixa (Resumo)danielgomes.ssNo ratings yet

- Sistema de Proteccion Integral de Los Discapacitados Decreto 312-10Document5 pagesSistema de Proteccion Integral de Los Discapacitados Decreto 312-10Ana GallaraNo ratings yet

- Comprehension Toolkit 1Document3 pagesComprehension Toolkit 1api-510893209No ratings yet

- Tiapa, Francisco. Antropologia, Historia Colonial y Descolonizacion Del Pasado.Document18 pagesTiapa, Francisco. Antropologia, Historia Colonial y Descolonizacion Del Pasado.CamilaEspinozaNo ratings yet

- Not in His Image (15th Anniversary Edition) - Preface and IntroDocument17 pagesNot in His Image (15th Anniversary Edition) - Preface and IntroChelsea Green PublishingNo ratings yet

- Electric Circuits - M. Navhi and J. A. Edminister PDFDocument113 pagesElectric Circuits - M. Navhi and J. A. Edminister PDFNamratha ThataNo ratings yet

- Metals and Non Metals NotesDocument3 pagesMetals and Non Metals NotesVUDATHU SHASHIK MEHERNo ratings yet

- Computer Awareness Topic Wise - TerminologiesDocument15 pagesComputer Awareness Topic Wise - TerminologiesdhirajNo ratings yet

- Proceso Seleccion Tigo SeptiembreDocument16 pagesProceso Seleccion Tigo SeptiembreCristian Camilo Trujillo LopezNo ratings yet