Professional Documents

Culture Documents

List of Investment With Section Limit

List of Investment With Section Limit

Uploaded by

Rohit yadavOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

List of Investment With Section Limit

List of Investment With Section Limit

Uploaded by

Rohit yadavCopyright:

Available Formats

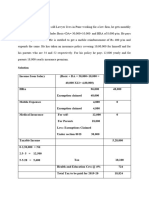

Tax Deduction allowed for those opted for Old Regime

Section Criteria Limit

Life Insurance Premium

Provident Fund – Employee

Subscription to certain equity shares

80C Tuition Fees

National Savings Certificate, Combined deduction limit of ₹

Housing Loan Principal 1,50,000

Other various items - PPF , Sukanya Smruddhi Yojna

80CCC Annuity plan of LIC or other insurer towards Pension Scheme

80CCC(1) Pension Scheme of Central Government

Deduction limit of

24 Interest Paid On Housing Loan House been let out / Self Occupied Property ₹ 2,00,000

on the interest paid on loan taken

Deduction limit of

Deduction towards interest payments made on loan for purchase of Electric Vehicle where the

80EEB ₹ 1,50,000

loan is sanctioned between 1st April 2019 to 31st March 2023

on the interest paid on loan taken

80CCD(1B)

Deduction limit of ₹ 50,000

80CCD(1B) Deduction towards payments made to Pension Scheme of Central Government, excluding

deduction claimed under 80CCD (1)

80D For Self / Spouse or Dependent Children ₹ 25,000

₹ 25,000 - for Age group Below 60

For Parents

₹50,000 if any person is a Senior

Citizen

Actual HRA received

50% of [basic salary + DA] for those

HRA House Rent Allowance (HRA) living in metro cities

40% of [basic salary + DA] for those

living in non-metros

You might also like

- Inc Tax DedDocument38 pagesInc Tax DedpoojaNo ratings yet

- DeclarationDocument3 pagesDeclarationPatrick Jude Lucas PsychologyNo ratings yet

- IT Detections From Gross Total Income Pt-1Document25 pagesIT Detections From Gross Total Income Pt-1syedfareed596100% (1)

- India Income Tax Deductions How To Save TaxDocument24 pagesIndia Income Tax Deductions How To Save TaxRK PHOTO LABSNo ratings yet

- On Employee Tax SavingDocument21 pagesOn Employee Tax SavingChaitanya MadisettyNo ratings yet

- Income Tax DepartmentDocument4 pagesIncome Tax Departmentmansi joshiNo ratings yet

- Income Tax Deductions ListDocument4 pagesIncome Tax Deductions Listamitks525No ratings yet

- Income Tax DeductionsDocument17 pagesIncome Tax DeductionsSaikat PayraNo ratings yet

- Section 80 Deduction TableDocument6 pagesSection 80 Deduction TablevineyNo ratings yet

- Employee Declaration FormDocument3 pagesEmployee Declaration Formmeshakjunior13No ratings yet

- DEDUCTIONS FROM GROSS TOTAL INCOME (CHAPTER VI-A (Autosaved)Document19 pagesDEDUCTIONS FROM GROSS TOTAL INCOME (CHAPTER VI-A (Autosaved)rathnamano186No ratings yet

- Employee Declaration Form FY 2020-21Document2 pagesEmployee Declaration Form FY 2020-21Harsha I100% (2)

- Income Tax Guide FY 2023-24Document11 pagesIncome Tax Guide FY 2023-24akshay yadavNo ratings yet

- Summary Charts Deduction Chapter ViaDocument4 pagesSummary Charts Deduction Chapter ViaUttam Gagan18100% (1)

- It PPT For F.Y 2023-24Document24 pagesIt PPT For F.Y 2023-24iampnkjjnNo ratings yet

- DeductionsDocument7 pagesDeductionsAnurag BishtNo ratings yet

- Deductions From Gross Total IncomeDocument12 pagesDeductions From Gross Total Incomeansh071102No ratings yet

- Principles of Taxation Law - (Week 8)Document56 pagesPrinciples of Taxation Law - (Week 8)Snigdha RohillaNo ratings yet

- Employee Declaration Form 15Document4 pagesEmployee Declaration Form 15Bliss BilluNo ratings yet

- Unit 4 Financial Planning and Tax ManagementDocument15 pagesUnit 4 Financial Planning and Tax Managementdivy waliaNo ratings yet

- Employee Tax Declaration - FY 22-23-DBMPDocument3 pagesEmployee Tax Declaration - FY 22-23-DBMPthetrilight2023No ratings yet

- 5.1.5 Income Tax DeductionDocument7 pages5.1.5 Income Tax DeductionCommon ManNo ratings yet

- Deductions From Gross Total IncomeDocument4 pagesDeductions From Gross Total Income887 shivam guptaNo ratings yet

- Deductions Under Chapter VI A - d17d562d b594 4627 9fb3 E1efc2352b13Document37 pagesDeductions Under Chapter VI A - d17d562d b594 4627 9fb3 E1efc2352b13Subiksha LakshNo ratings yet

- Income Tax Rate 2010Document6 pagesIncome Tax Rate 2010Vishal JwellNo ratings yet

- IT PPT For F.Y 2023-24Document24 pagesIT PPT For F.Y 2023-24pritesh.ks1409No ratings yet

- Tax Decalaration 2023-24Document3 pagesTax Decalaration 2023-24thetrilight2023No ratings yet

- Deductions Available Under Chapter VI of Income TaxDocument4 pagesDeductions Available Under Chapter VI of Income TaxDeepanjali NigamNo ratings yet

- Pravin Shinde-ARMS-01-TDS-FY 2019-20Document12 pagesPravin Shinde-ARMS-01-TDS-FY 2019-20Udaysinh PatilNo ratings yet

- Deductions Under Section 80Document3 pagesDeductions Under Section 80Ronak JainNo ratings yet

- Section 80 Deduction ListDocument6 pagesSection 80 Deduction ListMURALIDHARA S VNo ratings yet

- What Is TaxableDocument4 pagesWhat Is TaxableSaiGarimellaNo ratings yet

- Atc AtuDocument9 pagesAtc AtuKeshav SagarNo ratings yet

- Handbook - Tax Planning Level 2Document30 pagesHandbook - Tax Planning Level 2Malli Arjun staff guitar zgkNo ratings yet

- Investment Declaration Form 21-22Document14 pagesInvestment Declaration Form 21-22Jigar PatelNo ratings yet

- Income Tax Declaration Form FY 22 23 AY 23 24Document2 pagesIncome Tax Declaration Form FY 22 23 AY 23 24Aamer ShaikNo ratings yet

- Atria Institute of TechnologyDocument3 pagesAtria Institute of TechnologykiranNo ratings yet

- Net Income How To Calculate Net Income in Income TaxDocument34 pagesNet Income How To Calculate Net Income in Income TaxSeetha SenthilNo ratings yet

- 80C IndiaDocument7 pages80C IndiapingbadriNo ratings yet

- Income Tax Declaration Form FY 22023 24 AY2024 25Document1 pageIncome Tax Declaration Form FY 22023 24 AY2024 25mrleftyftwNo ratings yet

- Employee Declaration Form 1Document4 pagesEmployee Declaration Form 1rifas caNo ratings yet

- Deduction From Gross Total IncomeDocument4 pagesDeduction From Gross Total Incomedevak shelarNo ratings yet

- KFD New06012024143830079 T51Document5 pagesKFD New06012024143830079 T51Mayur NagdiveNo ratings yet

- Deductions - For StudentsDocument29 pagesDeductions - For Studentsdevkinger1212No ratings yet

- Revised - DeductionsDocument29 pagesRevised - Deductionsdevkinger1212No ratings yet

- Section Deduction On Allowed Limit (Maximum) FY 2018-19Document3 pagesSection Deduction On Allowed Limit (Maximum) FY 2018-19Praveen kumarNo ratings yet

- IT Exemption Guidelines 2023-24Document7 pagesIT Exemption Guidelines 2023-24rashiramesh31No ratings yet

- IT Declaration Form 2020-21Document1 pageIT Declaration Form 2020-21Akshay AcchuNo ratings yet

- Form No 12BB FY 2020-21 (AY 2021-22)Document6 pagesForm No 12BB FY 2020-21 (AY 2021-22)Avinash ChandraNo ratings yet

- CFP Theory MaterialDocument45 pagesCFP Theory MaterialShobhit KumarNo ratings yet

- Investment Declaration Form - FY 2022-23Document7 pagesInvestment Declaration Form - FY 2022-23varaprasadNo ratings yet

- Candidate 1Document2 pagesCandidate 1Fascino WhiteNo ratings yet

- Tax Certificate - 008857356 - 161253Document1 pageTax Certificate - 008857356 - 161253gaurav sharmaNo ratings yet

- Annexure 3 Compensation FeeDocument3 pagesAnnexure 3 Compensation FeeTech TipsNo ratings yet

- Compensation LetterDocument6 pagesCompensation LetterRashmikant RautNo ratings yet

- Income Tax Deductions and Exemptions in India 2018: MenuDocument7 pagesIncome Tax Deductions and Exemptions in India 2018: MenusandeshNo ratings yet

- Illustration 1 and 2 Salary - 21-22 Nov 2023Document5 pagesIllustration 1 and 2 Salary - 21-22 Nov 2023Chinmay HarshNo ratings yet

- Deductions From IncomeDocument29 pagesDeductions From IncomeYNM AASININo ratings yet