Professional Documents

Culture Documents

Feesand Service Charges

Feesand Service Charges

Uploaded by

gbadamosistephen0 ratings0% found this document useful (0 votes)

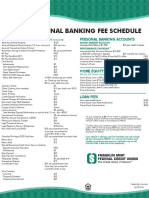

6 views2 pagesThis document provides a schedule of fees and service charges for various financial services offered by a credit union in October 2023. General fees include $3 for money orders and treasurer's checks, $3.95 for gift cards, $25 for stop payments, and $1-2 fees for statements and copies of checks or deposits. Overdraft fees are $15 per paid item and $0 returned item. There are no fees for DCU checking accounts. ATM fees include no charges for non-DCU ATM transactions up to $10-$25 monthly depending on account level. Credit card fees include a late fee up to $35 and no foreign transaction fees. Early closing penalties for certificates range from 60-180

Original Description:

Service charges

Original Title

FeesandServiceCharges

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document provides a schedule of fees and service charges for various financial services offered by a credit union in October 2023. General fees include $3 for money orders and treasurer's checks, $3.95 for gift cards, $25 for stop payments, and $1-2 fees for statements and copies of checks or deposits. Overdraft fees are $15 per paid item and $0 returned item. There are no fees for DCU checking accounts. ATM fees include no charges for non-DCU ATM transactions up to $10-$25 monthly depending on account level. Credit card fees include a late fee up to $35 and no foreign transaction fees. Early closing penalties for certificates range from 60-180

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

6 views2 pagesFeesand Service Charges

Feesand Service Charges

Uploaded by

gbadamosistephenThis document provides a schedule of fees and service charges for various financial services offered by a credit union in October 2023. General fees include $3 for money orders and treasurer's checks, $3.95 for gift cards, $25 for stop payments, and $1-2 fees for statements and copies of checks or deposits. Overdraft fees are $15 per paid item and $0 returned item. There are no fees for DCU checking accounts. ATM fees include no charges for non-DCU ATM transactions up to $10-$25 monthly depending on account level. Credit card fees include a late fee up to $35 and no foreign transaction fees. Early closing penalties for certificates range from 60-180

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 2

Schedule of Fees and

Service Charges

October 2023

GENERAL

$3.00 Money Order ($1,000 max)

$3.00 Treasurer’s Check

$30.00 Replacement of Lost/Stolen Treasurer’s Check

$3.95 Visa® Gift Card

$25.00 Stop Payment

FREE Text Alerts (Message and data rates may apply)

$2.00 Current Demand Statement

(FREE in Digital Banking)

Duplicate/Copy:

$1.00 • DCU Check (FREE in Digital Banking)

$1.00 • Withdrawal slip

$2.50 • Deposited check

$1.00/page • Statement

$25.00/hr Research Fee (Such as account reconciliation,

research, immigration letter, levy/trustee summons,

locator fee, etc. Attorney fees billed separately.)

Foreign Item Collection: (Collecting Bank Fee)

FREE • Canadian-U.S. funds (Exchange fees may

also apply)

Outgoing Wire Transfer: (Additional fees may be

charged by the receiving institution)

$15.00 • Domestic

• International

$40.00 o Sent in Foreign Currency

$50.00 o Sent in US Currency

FREE Shared Branch Transaction

$15.00-$35.00 Courier Charge (Standard, Priority,

Overnight, International)

$10.00 Expedited Payment/Deposit

(Ex. Western Union/Speed Pay)

$0.10/item Business Account Deposit Volume Fee

$25.00/one- Escheat (Abandoned Property)

time processing

OVERDRAFTS, CHECKS and

CHECKING ACCOUNTS

$15.00 Paid - Nonsufficient Funds1 (Overdraft Item Paid)

$0.00 Returned - Nonsufficient Funds

$1.00/check Temporary Checks

FREE Bill Pay Transaction

$30.00 • Overnight check convenience fee

Printer’s Charge Check Order

NONE Monthly Fee

• DCU FREE Checking

1

Individual items that 1) are $10 or less, or 2) draw the account

balance negative by $10 or less are not subject to Paid -

Nonsufficient Funds fees. Aggregate two (2) fees per day

per account.

ATM and Visa® DEBIT CARD

NONE Non-DCU ATM Transaction Fee3

NONE Foreign Currency Conversion Fee

$10.00 Replacement Card (Additional courier charge

applies for rush orders)

3

Some institutions may surcharge you for using their ATMs.

Surcharges are those fees that are charged by the institution that

owns the ATM. With Plus or Relationship Benefits level, DCU will

reimburse you up to $10 per month in non-DCU ATM surcharges for

Plus Benefits or up to $25 per month in non-DCU ATM surcharges

for Relationship Benefits.

Visa® CREDIT CARD

Up to $35.00/m Late Payment Fee

NONE Foreign Currency Conversion Fee

$2.00 Duplicate/Copy (Statement, Sales draft, Visa® draft)

$10.00 Replacement Card (Additional courier charge

applies for rush orders)

EARLY CLOSING PENALTIES

Certificates (Including IRA)

3-11 months 60 days’ dividend

12-35 months 90 days’ dividend

36-60 months 180 days’ dividend

The same penalties apply on amounts prematurely

withdrawn from a Certificate. IRS penalties may apply on IRA

Certificate withdrawals. Jump-Up Certificate early withdrawal

penalties will be calculated at the rate being earned at the time

of withdrawal.

853 Donald Lynch Blvd. dcu.org | 800.328.8797

Marlborough, MA 01752 Insured by NCUA

M619 10.2023 ©DCU

You might also like

- Costco Anywhere Visa Card by CitiDocument4 pagesCostco Anywhere Visa Card by CitiOsvaldo CalderonUACJNo ratings yet

- Bank Statement Template 11Document2 pagesBank Statement Template 11Aida BrackenNo ratings yet

- Bank Statement Template 11Document2 pagesBank Statement Template 11Aida BrackenNo ratings yet

- Feesand Service ChargesDocument2 pagesFeesand Service ChargesVadim ShabelnikovNo ratings yet

- Schedule of Fees and Service Charges: GeneralDocument2 pagesSchedule of Fees and Service Charges: GeneralborrisNo ratings yet

- ent-consumer-fee-schedule-12_2022Document2 pagesent-consumer-fee-schedule-12_2022D.M. TrizmegistusNo ratings yet

- SV030 - Fees and Limits GuideDocument12 pagesSV030 - Fees and Limits GuidedanieljohnmildrenNo ratings yet

- Consumer Banking Schedule of Service Fees and ChargesDocument1 pageConsumer Banking Schedule of Service Fees and ChargesGerman HuizarNo ratings yet

- RetailfeescheduleDocument2 pagesRetailfeeschedulecabbattNo ratings yet

- Member Business Account Fee Schedule: EmbershipDocument1 pageMember Business Account Fee Schedule: EmbershipMikey ZhouNo ratings yet

- TD Simple Savings Account GuideDocument3 pagesTD Simple Savings Account GuideMery MelendezNo ratings yet

- Schedule of Fees & Charges: Savings AccountsDocument6 pagesSchedule of Fees & Charges: Savings AccountsBrian BobbNo ratings yet

- Fees Schedule v1Document2 pagesFees Schedule v1darcywenzel75No ratings yet

- Bank Fees & Service Charges: Quick Reference GuideDocument2 pagesBank Fees & Service Charges: Quick Reference GuideSuds NariNo ratings yet

- Account Opening and Usage: Woodforest CheckingDocument42 pagesAccount Opening and Usage: Woodforest Checkingoloyede jamiuNo ratings yet

- 2020 FCA TarrifsDocument6 pages2020 FCA TarrifsmunasheNo ratings yet

- TD Convenience Checking Account GuideDocument3 pagesTD Convenience Checking Account GuideMuhammad AliNo ratings yet

- Consumer Fee ScheduleDocument1 pageConsumer Fee ScheduleSai Sunil ChandraaNo ratings yet

- Understanding Bank of America Interest Checking: An Overview of Key Policies and FeesDocument2 pagesUnderstanding Bank of America Interest Checking: An Overview of Key Policies and FeesGheorghiu GheorgheNo ratings yet

- Debit Card Advance ConfirmationDocument1 pageDebit Card Advance Confirmationkariwilliams8595No ratings yet

- Convenience enDocument3 pagesConvenience enJaidan FreitesNo ratings yet

- Bank Statement Sample: Servi CE Charge Canadia N Accoun Charge USD Account S Unit of MeasureDocument4 pagesBank Statement Sample: Servi CE Charge Canadia N Accoun Charge USD Account S Unit of Measuremohamed elmakhzniNo ratings yet

- BlueSnap Fees TableDocument2 pagesBlueSnap Fees Tableemirav2No ratings yet

- Commission General Fee ScheduleDocument12 pagesCommission General Fee ScheduleKaren Jennifer WkcNo ratings yet

- Netspend All-Access Account: Monthly UsageDocument2 pagesNetspend All-Access Account: Monthly UsageSam BojanglesNo ratings yet

- Advance Card FeesDocument4 pagesAdvance Card Feessir_hazarNo ratings yet

- Schedule of Charges-MDB Visa Credit CardsDocument2 pagesSchedule of Charges-MDB Visa Credit CardsBM TASINNo ratings yet

- Bac Core Checking EnusDocument2 pagesBac Core Checking Enusapi-285070305No ratings yet

- BofA CoreChecking en ADADocument2 pagesBofA CoreChecking en ADAFrank TilemanNo ratings yet

- CNB Sof 2018 19 Personal PDFDocument4 pagesCNB Sof 2018 19 Personal PDFTony GaryNo ratings yet

- NW Bus Current Account ChargesDocument2 pagesNW Bus Current Account Chargessamsingh5692No ratings yet

- RTGS TariffsDocument8 pagesRTGS TariffsmunasheNo ratings yet

- Fees & Charges EnglishDocument2 pagesFees & Charges Englishhunghl9726No ratings yet

- Foreign Products and Services PricingDocument4 pagesForeign Products and Services Pricingfoster.mbaiNo ratings yet

- Business Bonus Account v79.0Document3 pagesBusiness Bonus Account v79.0prabeshmanNo ratings yet

- 06-Cont Chase-Comisioane PDFDocument1 page06-Cont Chase-Comisioane PDFPlus CompNo ratings yet

- PdfHandler AshxDocument18 pagesPdfHandler AshxphaniNo ratings yet

- This Is A Summary Only. Please See Below This Box For Full DetailsDocument10 pagesThis Is A Summary Only. Please See Below This Box For Full DetailsSequencersNo ratings yet

- PaychekPLUS 8148384 Disclosures - 2022 UPDATED 8 - 2 - 2022Document8 pagesPaychekPLUS 8148384 Disclosures - 2022 UPDATED 8 - 2 - 2022Jeshua CaballeroNo ratings yet

- Annual Fees: (Per Month)Document2 pagesAnnual Fees: (Per Month)placido diasNo ratings yet

- Visa Rates 1Document3 pagesVisa Rates 1lwalker1545No ratings yet

- Welcome To Bank of The West!Document7 pagesWelcome To Bank of The West!Derek SharmanNo ratings yet

- BoA - Deposit Form 05731Document2 pagesBoA - Deposit Form 05731Coy IngramNo ratings yet

- Personal Banking Personal Banking Personal BankingDocument1 pagePersonal Banking Personal Banking Personal BankingSaravanan ParamasivamNo ratings yet

- De 5617 PDDocument2 pagesDe 5617 PDUS ARMY VERIFIEDNo ratings yet

- Easy SavingsDocument2 pagesEasy SavingsPepper JackNo ratings yet

- How Far Does Your Bank's Relationship Stretch?: Schedule of ChargesDocument6 pagesHow Far Does Your Bank's Relationship Stretch?: Schedule of ChargesFahim FoysalNo ratings yet

- Corporate Finance: Credit CardsDocument24 pagesCorporate Finance: Credit Cardsusmanahmadqadri100% (2)

- SOC Credit Card MayDocument20 pagesSOC Credit Card MayBDT Visa PaymentNo ratings yet

- VMBS 2017-2018 FEE GUIDE - Members - 1 August 2017 - Post June 16 RevDocument5 pagesVMBS 2017-2018 FEE GUIDE - Members - 1 August 2017 - Post June 16 RevtereveNo ratings yet

- TD FeesDocument4 pagesTD FeesPaulNo ratings yet

- Metabank Terms and ConditionsDocument17 pagesMetabank Terms and ConditionsMoses MillerNo ratings yet

- 04-29-19 Consumer Miscellaneous Schedule of Fees - EnglishDocument1 page04-29-19 Consumer Miscellaneous Schedule of Fees - EnglishgmrussomannoNo ratings yet

- 730462222Document20 pages730462222Tank ZillaNo ratings yet

- Asterisk-Free Checking Account: 1 Everyday TransactionsDocument3 pagesAsterisk-Free Checking Account: 1 Everyday TransactionsMarcells Danyel JordanNo ratings yet

- Usabank Statement 1Document3 pagesUsabank Statement 1Adnan HussainNo ratings yet

- Payment Compare GenericDocument3 pagesPayment Compare GenericrebartlettNo ratings yet

- Schedule of Charges Revised 01052022Document19 pagesSchedule of Charges Revised 01052022Chandra MohanNo ratings yet

- July 2013: Current, Call and Savings AccountsDocument1 pageJuly 2013: Current, Call and Savings AccountsBala MNo ratings yet