Professional Documents

Culture Documents

Advanced Corporate Accounting Jan - 2024 Supplementary

Advanced Corporate Accounting Jan - 2024 Supplementary

Uploaded by

saradhachinnaboyinaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Advanced Corporate Accounting Jan - 2024 Supplementary

Advanced Corporate Accounting Jan - 2024 Supplementary

Uploaded by

saradhachinnaboyinaCopyright:

Available Formats

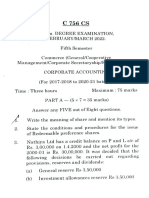

SRI VENKATESWARA UNIVERSITY

THREE YEAR B.COM DEGREE EXAMINATION, JAN – 2024 (Supplementary)

ADVANCED CORPORATE ACCOUNTING

Time: 3 Hours Max. Marks: 75

Section - A

Answer any Five of the following. Each question carries equal marks. (5x3=15)

1) Scope of Accounting Standards.

2) Accounting Standard 10

3) Purchase consideration

4) Define Amalgamation

5) What is meant by Internal reconstruction?

6) Voluntary liquidation.

7) Meaning of Secured creditors?

8) Define Holding company.

Section - B

Answer one question from each unit. Each question carries equal marks. (5×12 = 60)

UNIT-I

9) Define Accounting Standards? Write its significance.

OR

10) Write any 10 Indian accounting standards.

UNIT-II

11) Write different methods of Purchase Consideration.

OR

12) Following is the Balance Sheets of M Ltd. & N Ltd. as on 31-03-2023.

Liabilities M Ltd. N Ltd. Assets M Ltd. N Ltd.

Equity capital of ₹ 10 Land & Buildings 2,60,000 1,00,000

each 5,00,000 2,00,000 Plant 4,50,000 1,80,000

8% Pref. shares of ₹ 10 Furniture 80,000 40,000

each 2,00,000 1,00,000 Stock 1,50,000 60,000

General reserve 80,000 20,000 Debtors 1,00,000 60,000

Rebate Reserve 70,000 30,000 Cash at Bank 50,000 60,000

P & L A/C 1,00,000 50,000

10% Debentures of ₹

100 each 50,000 50,000

Creditors 40,000 30,000

Other current

Liabilities 50,000 20,000

10,90,000 5,00,000 10,90,000 5,00,000

M Ltd. takes over N Ltd. as on 31-03-23 on the following conditions

To issue 20,000 equity shares of ₹ 10 each at ₹ 12.50 to equity shareholders of N Ltd.

To issue 8% Preference Shares of ₹ 10 each to discharge the Preference Shares of N Ltd.

To convert Debentures of N Ltd. into the equivalent number of 12% Debentures of M Ltd.

of ₹ 100 each.

To maintain the Rebate Allowance of N Ltd. for two years.

The fair value of plant is ₹ 1,50,000

Pass necessary journal entries in the books of N Ltd.

UNIT-III

13) What is meant by Capital Reduction? Write model entries for company internal reconstruction.

OR

14) Following is the Balance sheet of Lovely Ltd. as on 31-3-2023.

Liabilities ₹ Assets ₹

20,000 Equity shares of ₹ 10 each 2,00,000 Good will 5,000

8% Debentures 60,000 Buildings 20,000

Outstanding Debenture Interest 10,400 Machinery 30,000

Creditors 14,100 Furniture 8,000

Stock 25,000

Debtors 6.000

Bank 3000

Preliminary expenses 2,500

P & L A/C 1,85,000

2.84,500 2.84,500

Following is the scheme of reconstruction is followed.

Equity shares are reduced by ₹ 90

Debenture holders agreed to forego outstanding interest 8% debentures and then

converted into 10% Debentures.

Creditors forgo their 50% of claim.

Buildings are revalued ₹ 30,000; Machinery is written down to ₹ 20,000 Furniture to ₹

2,000.

Pass necessary journal entries for reconstruction.

UNIT-IV

15) Define liquidation? Write about different types of creditors.

OR

16) The light company went into liquidation with the following liabilities.

Secured creditors ₹ 2,50,000 (Securities realised ₹ 3,00,000)

Preferential creditors ₹ 70,000

Unsecured creditors ₹ 3,10,000

Liquidator expenses ₹ 3,000

Liquidator’s remuneration 2% on the amounts realised.

Prepare liquidators final statement of account.

UNIT-V

17) How can you prepare consolidated Balance sheet in Holding companies.

OR

18) The following is the Balance sheet of P Ltd. and its Subsidiary Q Ltd. as on31-3-2023

Liabilities P Ltd. Q Ltd. Assets P Ltd. Q Ltd.

Equity capital of ₹ 10 4,500 shares in

each 70,000 50,000 Q Ltd. 60,000 -

Sundry creditors 50,000 2,5000 Various assets 85,000 90,000

P & L A/C 25,000 15,000

145.000 90.000 145.000 90.000

Prepare Consolidated Balance Sheet.

You might also like

- Complaint Affidavit For LibelDocument4 pagesComplaint Affidavit For LibelAndiel100% (2)

- Inside Indian IndentureDocument504 pagesInside Indian IndentureRananjey100% (2)

- AmalDocument7 pagesAmalAkki GalaNo ratings yet

- Amalgamation Dec 2020Document46 pagesAmalgamation Dec 2020binu100% (2)

- Unit III Amalgamation With Respect To A.S - 14 Purchase ConsiderationDocument17 pagesUnit III Amalgamation With Respect To A.S - 14 Purchase ConsiderationPaulomi LahaNo ratings yet

- June 2019Document182 pagesJune 2019shankar k.c.No ratings yet

- RTP June 19 QnsDocument15 pagesRTP June 19 QnsbinuNo ratings yet

- Jorpati, Kathmandu Pre-Board Examination-2077 Subject: Principles of Accounting II Grade: XII Time: 3 Hrs FM: 100 PM: 32Document3 pagesJorpati, Kathmandu Pre-Board Examination-2077 Subject: Principles of Accounting II Grade: XII Time: 3 Hrs FM: 100 PM: 32Abin DhakalNo ratings yet

- Accountancy: Pre-Board Examinations 2078Document3 pagesAccountancy: Pre-Board Examinations 2078Herman PecassaNo ratings yet

- Paper - 5: Advanced Accounting Questions Answer The Following (Give Adequate Working Notes in Support of Your Answer)Document56 pagesPaper - 5: Advanced Accounting Questions Answer The Following (Give Adequate Working Notes in Support of Your Answer)Basant OjhaNo ratings yet

- Abc Unit 3 PDFDocument7 pagesAbc Unit 3 PDFLuckygirl JyothiNo ratings yet

- Internal Reconstruction P-1 Liabilities Rs Assets RsDocument8 pagesInternal Reconstruction P-1 Liabilities Rs Assets RsPaulomi LahaNo ratings yet

- Corporate Accounting Exam Questions PaperDocument7 pagesCorporate Accounting Exam Questions PaperAmmar Bin NasirNo ratings yet

- Illustrations AmalgamationDocument4 pagesIllustrations Amalgamationajay2741100% (1)

- Business CombinationDocument4 pagesBusiness CombinationA001AADITYA MALIKNo ratings yet

- Semester II (Ugcf) 2412091201 ADocument9 pagesSemester II (Ugcf) 2412091201 Aindukush8No ratings yet

- Bcom 4 Sem Corporate Accounting 2 21100875 Mar 2021Document6 pagesBcom 4 Sem Corporate Accounting 2 21100875 Mar 2021Zakkiya ZakkuNo ratings yet

- Unit 2 Merger & Purchase MethodDocument11 pagesUnit 2 Merger & Purchase MethodLuckygirl JyothiNo ratings yet

- OCTOBER 2019: Reg. No.Document6 pagesOCTOBER 2019: Reg. No.Selvi SelviNo ratings yet

- Fa - 6 Amalgamation & LLPDocument10 pagesFa - 6 Amalgamation & LLPalokchowdhury111No ratings yet

- KseebDocument12 pagesKseebArif ShaikhNo ratings yet

- 11 AmalgmationDocument38 pages11 AmalgmationPranaya Agrawal100% (1)

- AdvDocument19 pagesAdvashwin krishnaNo ratings yet

- Accountancy & Financial ManagementDocument12 pagesAccountancy & Financial ManagementNitin FardeNo ratings yet

- 027 Practice Test 09 Accounting Test Solution Subjective Udesh RegularDocument6 pages027 Practice Test 09 Accounting Test Solution Subjective Udesh Regulardeathp006No ratings yet

- Ca QP ModelDocument3 pagesCa QP Modelmahabalu123456789No ratings yet

- Corporate Accounting II (T)Document6 pagesCorporate Accounting II (T)BISLY MARIAM BINSONNo ratings yet

- 12 Accountancy Lyp 2012 Set1Document9 pages12 Accountancy Lyp 2012 Set1SeasonNo ratings yet

- Abyas Amalgamation IPCC G 1 & 2Document34 pagesAbyas Amalgamation IPCC G 1 & 2Caramakr ManthaNo ratings yet

- Corporate Accounting - I Semester ExaminationDocument7 pagesCorporate Accounting - I Semester ExaminationVijay KumarNo ratings yet

- SEM III - Advanced Accounting (EM)Document4 pagesSEM III - Advanced Accounting (EM)Abdul MalikNo ratings yet

- AccountancyDocument32 pagesAccountancysunil kumarNo ratings yet

- Adv Acc - 3 CHDocument21 pagesAdv Acc - 3 CHhassan nassereddineNo ratings yet

- Internal ReconstructionDocument8 pagesInternal Reconstructionsmit9993No ratings yet

- RTP Dec 18 QNDocument21 pagesRTP Dec 18 QNbinu100% (1)

- Absorption Questions 1Document4 pagesAbsorption Questions 1naazhim nasarNo ratings yet

- Partner Ship Accounts - I: Balance Sheet Dr. Cr. Particulars Amount Rs. Particulars Amount RsDocument17 pagesPartner Ship Accounts - I: Balance Sheet Dr. Cr. Particulars Amount Rs. Particulars Amount RsM JEEVARATHNAM NAIDUNo ratings yet

- Corrporate ModelDocument10 pagesCorrporate Modelnithinjoseph562005No ratings yet

- Accounts Parntership TestDocument6 pagesAccounts Parntership TestdhruvNo ratings yet

- Paper 1Document19 pagesPaper 1GianNo ratings yet

- 3internal Reconstruction 230725 165705Document6 pages3internal Reconstruction 230725 165705Ruchita JanakiramNo ratings yet

- CA Inter Adv. Accounting Top 50 Question May 2021Document117 pagesCA Inter Adv. Accounting Top 50 Question May 2021Sumitra yadavNo ratings yet

- Important Que Advanced Cor AccDocument18 pagesImportant Que Advanced Cor Accvineethaj2004No ratings yet

- Question Papers: SEM. - (JULY 2023)Document8 pagesQuestion Papers: SEM. - (JULY 2023)arpitgupta20050No ratings yet

- MQP Accountancy WMDocument14 pagesMQP Accountancy WMRithik PoojaryNo ratings yet

- COM203 AmalgamationDocument10 pagesCOM203 AmalgamationLogeshNo ratings yet

- Accounts Mock Test May 2019Document18 pagesAccounts Mock Test May 2019poojitha reddyNo ratings yet

- Instruction: Attempt Any 4 Questions. Each Question Carries Equal MarksDocument3 pagesInstruction: Attempt Any 4 Questions. Each Question Carries Equal MarksSaurav KumarNo ratings yet

- Corporate Accounting Ii 2020Document4 pagesCorporate Accounting Ii 2020joe josephNo ratings yet

- Il E&) Fflffiifif (I#,: Preparatori (JI, N-?IODocument4 pagesIl E&) Fflffiifif (I#,: Preparatori (JI, N-?IOdaniel_143_davidNo ratings yet

- Ca-Ii May 2022Document6 pagesCa-Ii May 2022Gayathri V GNo ratings yet

- CA Bcom PH 3rd Sem 2016Document7 pagesCA Bcom PH 3rd Sem 2016Gursirat KaurNo ratings yet

- Financial Accounting & AuditingDocument13 pagesFinancial Accounting & Auditingkashish mehtaNo ratings yet

- Worksheet 2Document4 pagesWorksheet 2singhharshu3222No ratings yet

- Paper 33Document6 pagesPaper 33AVS InfraNo ratings yet

- Revision Test - I STD - Xii (Accountancy) : Seventh Day Adventist Higher Secondary SchoolDocument3 pagesRevision Test - I STD - Xii (Accountancy) : Seventh Day Adventist Higher Secondary SchoolStudy HelpNo ratings yet

- Chartered Accountancy Professional Ii (Cap-Ii) : Revision Test Paper Group I December 2021Document81 pagesChartered Accountancy Professional Ii (Cap-Ii) : Revision Test Paper Group I December 2021Arpan ParajuliNo ratings yet

- Accounting For Managers Trimester 1 Mba Ktu 2016Document3 pagesAccounting For Managers Trimester 1 Mba Ktu 2016Mekhajith MohanNo ratings yet

- III - 5th Sem - AmalgamationDocument34 pagesIII - 5th Sem - AmalgamationAysha RiyaNo ratings yet

- Corporate Accounting ProblemDocument6 pagesCorporate Accounting ProblemparameshwaraNo ratings yet

- Liquidation of CompaniesDocument12 pagesLiquidation of CompaniesFaisal ManjiNo ratings yet

- Finding Balance 2016: Benchmarking the Performance of State-Owned Enterprise in Island CountriesFrom EverandFinding Balance 2016: Benchmarking the Performance of State-Owned Enterprise in Island CountriesNo ratings yet

- Pastor Vs Gaspar Case DigestDocument2 pagesPastor Vs Gaspar Case DigestybunNo ratings yet

- Epic of Sundiata PaperDocument4 pagesEpic of Sundiata PaperAdel MahjoubNo ratings yet

- Full Download Solutions Manual To Accompany Construction Accounting Financial Management 2nd Edition 9780135017111 PDF Full ChapterDocument36 pagesFull Download Solutions Manual To Accompany Construction Accounting Financial Management 2nd Edition 9780135017111 PDF Full Chapterurocelespinningnuyu100% (23)

- Voluntarism - IEPDocument1 pageVoluntarism - IEPLeandro BertoncelloNo ratings yet

- Module 2Document15 pagesModule 2Almie Joy Cañeda SasiNo ratings yet

- PEOPLE OF THE PHILIPPINES, Plaintiff-Appellee, vs. ALEXANDER TANO y CABALLERO, Accused-AppellantDocument11 pagesPEOPLE OF THE PHILIPPINES, Plaintiff-Appellee, vs. ALEXANDER TANO y CABALLERO, Accused-AppellantAAMCNo ratings yet

- Introduction To Temple ArtDocument31 pagesIntroduction To Temple ArtaakashNo ratings yet

- HCR230 The Welfare Reform ActDocument5 pagesHCR230 The Welfare Reform ActTinita HughesNo ratings yet

- Brief: SDG Priorities For BangladeshDocument3 pagesBrief: SDG Priorities For BangladeshMrz AshikNo ratings yet

- The Bias of The World - Curating After Szeemann & Hopps - The Brooklyn RailDocument14 pagesThe Bias of The World - Curating After Szeemann & Hopps - The Brooklyn RailALEJANDRA DUEÑASNo ratings yet

- NiCad Trans 11 - A03Document4 pagesNiCad Trans 11 - A03danielliram993No ratings yet

- R.A. 7659 PDFDocument13 pagesR.A. 7659 PDFMarion Yves MosonesNo ratings yet

- Globalization L7Document42 pagesGlobalization L7Cherrie Chu SiuwanNo ratings yet

- Jurisdiction of The Supreme CourtDocument1 pageJurisdiction of The Supreme CourtInnah A Jose Vergara-Huerta100% (1)

- Finding Our Way Again - Part 1Document10 pagesFinding Our Way Again - Part 1dscharfNo ratings yet

- GastronomyDocument3 pagesGastronomyGHERSON OSTIANo ratings yet

- UntitledDocument617 pagesUntitledMihaela SanduNo ratings yet

- PUT and GET Data Transfer Between Two S7 CPUsDocument1 pagePUT and GET Data Transfer Between Two S7 CPUsjairo73scribdNo ratings yet

- Status Correction MACN000001333Document1 pageStatus Correction MACN000001333Portia Taalib-Irvin-El: Bey100% (4)

- Exchange RateDocument27 pagesExchange RateGabriel SimNo ratings yet

- Analysis Essay (SFA)Document1 pageAnalysis Essay (SFA)saihtookhantkyaw22No ratings yet

- Computer AssociatesDocument18 pagesComputer AssociatesRosel RicafortNo ratings yet

- ADMISSION 2020-21 ADMISSION 2020-21 ADMISSION 2020-21 Deposit Slip Deposit SlipDocument2 pagesADMISSION 2020-21 ADMISSION 2020-21 ADMISSION 2020-21 Deposit Slip Deposit SlipJahanzeb Ahmed SoomroNo ratings yet

- National Geographic Afghanistan Hidden TreasuresDocument4 pagesNational Geographic Afghanistan Hidden TreasuresJohnNY_TexNo ratings yet

- FarDocument64 pagesFarBrevin PerezNo ratings yet

- Economic Growth I: Questions For ReviewDocument11 pagesEconomic Growth I: Questions For ReviewErjon SkordhaNo ratings yet

- Business Process of Walton GroupDocument33 pagesBusiness Process of Walton Groupoffja100% (1)

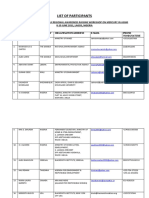

- Final List of Participants NigeriaDocument9 pagesFinal List of Participants NigeriaEtolo SoroNo ratings yet