Professional Documents

Culture Documents

IAS 1 - Homework 1

IAS 1 - Homework 1

Uploaded by

abraham johannesOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

IAS 1 - Homework 1

IAS 1 - Homework 1

Uploaded by

abraham johannesCopyright:

Available Formats

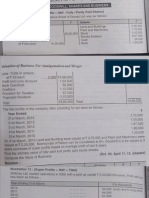

QUESTION 1

Tamar Bhd, a public limited company incorporated in Malaysia has an authorized

capital of 30,000,000 ordinary shares of N$1 each. The following balances were

extracted from the books of the company as at 31 December 2013. The financial

statements are expected to be authorized for issue on 15 February 2014.

Debit Credit

N$ N$

Ordinary share capital 15,000,000

Retained earnings as at 1 January 2013 3,343,750

Share premium 6,900,000

Land revaluation reserve 570,000

Sales revenue 36,096,650

Cost of sales 5,120,000

Administrative expenses 2,680,500

Distribution expenses 3,200,000

Interest on bank loan 100,000

Ordinary dividend paid 450,000

Freehold land at valuation as at 1 January 2013 5,200,000

Building at valuation as at 1 January 2013 20,000,000

Plant and machinery at cost as at 1 January 2013 13,300,000

Motor vehicles at cost as at 1 January 2013 2,100,000

Accumulated depreciation as at 1 January2013:

Building 1,500,000

Plant and machinery 1,330,000

Motor vehicles 420,000

Investment property 2,000,000

Biological asset 1,100,000

10% bank loan 2,000,000

Tax payable as at 1 January 2013 250,000

Income tax paid 1,350,000

Development expenditure at cost 5,500,000

Inventory 1,350,000

Trade receivables 2,950,000

Trade payables 2,030,100

Cash at bank 3,040,000

69,440,500 69,440,500

Additional information:

1. On 1 January 2013, land and buildings were revalued at N$4,650,000

and N$ 20,300,500 respectively. These have not been recorded in the

books. The revaluation reserve in the trial balance relates to the surplus

on the same land which was revalued previously. The building had an

estimated remaining useful life of 10 years at the date of the revaluation.

It is the policy of the company to provide depreciation on property, plant and

equipment as follows:

Building straight-line method on yearly basis

Plant and machinery 10% on straight-line method

Motor vehicle 10% on reducing balance method

2. In July 2013, Tamar Bhd received a letter from Shah & Co, demanding N$

160,000 compensations for a client over a motor vehicle accident. In September

2013, Tamar Bhd sought legal advice and there was a probability of losing the case

since the accident was purely the fault of the company.

3.On 5 January 2014, Tamar Bhd discovered fraudulent transactions by an ex-

employee. Cash receipts from customers totalling N$ 570,000 had been divested by

the employee since 2011. One-half was stolen in the current year while the

remaining was stolen during the previous year.

4.On 10 January 2014, a portion of the ground floor of the company’s building was

damaged due to fire. The loss was estimated to be N$ 120,000.

5.The tax expense estimated for the current year was N$ 910,000.

Required:

Prepare the following statements in accordance with MFRS 101 Presentation of Financial

Statements and other relevant Malaysian Financial Reporting Standards:

(i) Statement of Profit or Loss and other Comprehensive Income for the year ended

31 December 2013. (7 marks)

(ii) Statement of Changes in Equity for the year ended 31 December 2013. (4 marks)

(iii) Statement of Financial Position as at 31 December 2013. (9 marks)

(iv) A note on property, plant and equipment. (8 marks)

You might also like

- Tutorial - Financial StatementDocument18 pagesTutorial - Financial StatementmellNo ratings yet

- Your Dojo Invoice: 06 Mar To 05 Apr 2023 (31 Days)Document3 pagesYour Dojo Invoice: 06 Mar To 05 Apr 2023 (31 Days)Helen KingNo ratings yet

- DFA2000y 3 2014 2Document10 pagesDFA2000y 3 2014 2Mîñåk ŞhïïNo ratings yet

- Review 2 Set K Problem 1Document3 pagesReview 2 Set K Problem 1Marinel AbrilNo ratings yet

- Sample QuestionsDocument3 pagesSample QuestionstulikaNo ratings yet

- Practical Accounting 1 ValixDocument277 pagesPractical Accounting 1 ValixyzaNo ratings yet

- Advanced Financial Accounting: Question Paper 2014Document3 pagesAdvanced Financial Accounting: Question Paper 2014irfanNo ratings yet

- Company Final Accounts - ProblemsDocument5 pagesCompany Final Accounts - ProblemsDhinesh0% (1)

- Quiz - Single EntryDocument2 pagesQuiz - Single EntryGloria BeltranNo ratings yet

- Updates - Midterm Lspu ExamDocument6 pagesUpdates - Midterm Lspu ExamAngelo HilomaNo ratings yet

- Review - SFP To Interim ReportingDocument3 pagesReview - SFP To Interim ReportingAna Marie IllutNo ratings yet

- Statement of Financial PositionDocument2 pagesStatement of Financial PositionmoNo ratings yet

- Tutorial MFRS 101 Presentation Financial StatementDocument4 pagesTutorial MFRS 101 Presentation Financial StatementashabalqisNo ratings yet

- Valuation of Goodwill & Shares 45Document6 pagesValuation of Goodwill & Shares 45Sumeet KanojiaNo ratings yet

- Activity 4 CLDocument2 pagesActivity 4 CLfrancesdimplesabio06No ratings yet

- Balance SheetDocument2 pagesBalance SheetKeight NuevaNo ratings yet

- MC 3 Topic 4 Def Tax Question A232Document4 pagesMC 3 Topic 4 Def Tax Question A232thanusri0103No ratings yet

- Activtiy Balance SheetDocument5 pagesActivtiy Balance SheetMa. Jhoan DailyNo ratings yet

- 18.01.2022 11 ACCOUNTS POST MID TERM 2021-22 CC Post Mid Acc 11Document3 pages18.01.2022 11 ACCOUNTS POST MID TERM 2021-22 CC Post Mid Acc 11Jr.No ratings yet

- Cash Flow Tutorial QnsDocument13 pagesCash Flow Tutorial QnsCristian Renatus100% (1)

- Question Bank 1Document5 pagesQuestion Bank 1lavarocks23100% (1)

- Accounts QP 3Document9 pagesAccounts QP 3Sarun ChhetriNo ratings yet

- Chapter 1 11 IA3Document10 pagesChapter 1 11 IA3ZicoNo ratings yet

- D16. CAP - II - Dec - 2022 - CAP - II - Group - IDocument48 pagesD16. CAP - II - Dec - 2022 - CAP - II - Group - IBharat KhanalNo ratings yet

- Fa 2 AtdDocument95 pagesFa 2 AtdlydiamuhandiaNo ratings yet

- W-2013 Cor PDFDocument21 pagesW-2013 Cor PDFKashif NiaziNo ratings yet

- Pakistan Institute of Public Finance Accountants: Financial AccountingDocument27 pagesPakistan Institute of Public Finance Accountants: Financial AccountingMuhammad QamarNo ratings yet

- MC 4 - Deferred Tax - A231Document4 pagesMC 4 - Deferred Tax - A231Patricia TangNo ratings yet

- Icmap Past QuestionsDocument11 pagesIcmap Past QuestionsJahanzaib ButtNo ratings yet

- 04 Extra Question Pack For Chapter 4 After Initial AcquisitionDocument3 pages04 Extra Question Pack For Chapter 4 After Initial AcquisitionhlisoNo ratings yet

- Financial Accounting and Reporting Problems Freebie PDFDocument46 pagesFinancial Accounting and Reporting Problems Freebie PDFC/PVT DAET, SHAINA JOYNo ratings yet

- Final AccountDocument4 pagesFinal Accountsakshichaurasia2005No ratings yet

- Adjustments To Financial Statements Tutorial No: 13Document6 pagesAdjustments To Financial Statements Tutorial No: 13me myselfNo ratings yet

- Worksheet 5 NMIMSDocument4 pagesWorksheet 5 NMIMSvipulNo ratings yet

- CFS - ProblemsDocument5 pagesCFS - Problemskatasani likhithNo ratings yet

- Tutorial Question - Company AccountDocument3 pagesTutorial Question - Company AccountmaiNo ratings yet

- Financial Analysis ProblemDocument16 pagesFinancial Analysis ProblemShreyashi DasNo ratings yet

- Pamantasan NG Lungsod NG Maynila Intermediate Accounting 3 Quiz No. 1Document5 pagesPamantasan NG Lungsod NG Maynila Intermediate Accounting 3 Quiz No. 1Trixie HicaldeNo ratings yet

- Problem SolutionsDocument5 pagesProblem Solutionsmd nayonNo ratings yet

- O Level Important Questions PDFDocument55 pagesO Level Important Questions PDFibraho100% (1)

- 3rd Year Diagnostic TestDocument11 pages3rd Year Diagnostic TestRaizell Jane Masiglat CarlosNo ratings yet

- Financial Accounting and Reporting PDFDocument12 pagesFinancial Accounting and Reporting PDFanis athirahNo ratings yet

- 2, Questions and Answers 2, Questions and AnswersDocument35 pages2, Questions and Answers 2, Questions and AnswersCarlos John Talania 1923No ratings yet

- Ifrs 9 Review Questions and Ias 1 QNSDocument4 pagesIfrs 9 Review Questions and Ias 1 QNSsaidkhatib368No ratings yet

- Maf5101 Financial Accounting I Eve SuppDocument6 pagesMaf5101 Financial Accounting I Eve Suppshobasabria187No ratings yet

- Intermediate Group I Test Papers PDFDocument88 pagesIntermediate Group I Test Papers PDFkrishna PNo ratings yet

- Liquidation of CompaniesDocument12 pagesLiquidation of CompaniesFaisal ManjiNo ratings yet

- Fa Atd 2 ExamDocument5 pagesFa Atd 2 ExamNelsonMoseMNo ratings yet

- Screenshot 2023-12-02 at 6.15.54 PMDocument5 pagesScreenshot 2023-12-02 at 6.15.54 PMn8zn5278y9No ratings yet

- MOJAKOE AK1 UTS 2012 GasalDocument15 pagesMOJAKOE AK1 UTS 2012 GasalVincenttio le CloudNo ratings yet

- Sole Proprietorship Final AccountDocument4 pagesSole Proprietorship Final Accountsujan BhandariNo ratings yet

- ReviewerDocument4 pagesReviewerDrie LimNo ratings yet

- Consolidation TutorialDocument8 pagesConsolidation TutorialPrageeth Roshan WeerathungaNo ratings yet

- JKN - Acc - 13 - Question Paper - 131020Document10 pagesJKN - Acc - 13 - Question Paper - 131020adityatiwari122006No ratings yet

- CBSE Class 11 Accountancy WorksheetDocument3 pagesCBSE Class 11 Accountancy WorksheetyashNo ratings yet

- Discussion Problems Hyperinflationary and Current Cost AccountingDocument4 pagesDiscussion Problems Hyperinflationary and Current Cost AccountingFernilyn BardonNo ratings yet

- Accounting Principles AbDocument36 pagesAccounting Principles Absamson mutukuNo ratings yet

- Hot Qus Class 12thDocument13 pagesHot Qus Class 12thNaveen ShahNo ratings yet

- C.A. Foundation Final Accounts For Sole Proprietorship QuestionsDocument2 pagesC.A. Foundation Final Accounts For Sole Proprietorship Questionsgpgaming1693No ratings yet

- Industrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisFrom EverandIndustrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisNo ratings yet

- Finding Balance 2016: Benchmarking the Performance of State-Owned Enterprise in Island CountriesFrom EverandFinding Balance 2016: Benchmarking the Performance of State-Owned Enterprise in Island CountriesNo ratings yet

- Kimberly LTD - IAS 33 HomeworkDocument1 pageKimberly LTD - IAS 33 Homeworkabraham johannesNo ratings yet

- Homework - Capital StructureDocument1 pageHomework - Capital Structureabraham johannesNo ratings yet

- Homework - IAS 33Document1 pageHomework - IAS 33abraham johannesNo ratings yet

- Hypothesis TutorialsDocument5 pagesHypothesis Tutorialsabraham johannesNo ratings yet

- Interval Estimation Homework 2024Document1 pageInterval Estimation Homework 2024abraham johannesNo ratings yet

- Wallstreetjournal 20180611 TheWallStreetJournalDocument38 pagesWallstreetjournal 20180611 TheWallStreetJournalChristopher CreponNo ratings yet

- Benue Politics PDFDocument357 pagesBenue Politics PDFVictor Iduh Attah100% (1)

- Gold Price Ratios and Aggregate Stock ReturnsDocument50 pagesGold Price Ratios and Aggregate Stock ReturnslerhlerhNo ratings yet

- Jam 2023Document35 pagesJam 2023iamphilospher1No ratings yet

- Fiscal Policy UPSC Economy NotesDocument2 pagesFiscal Policy UPSC Economy Notesamalsuresh1503No ratings yet

- IMPORTANT MCQs FOR LAST MINUTE REVISIONDocument30 pagesIMPORTANT MCQs FOR LAST MINUTE REVISIONsonu123590xNo ratings yet

- Aws Romp03 1142 Aarkfab EngDocument1 pageAws Romp03 1142 Aarkfab EngNAQIB METKARNo ratings yet

- Case Study KDQT 2023Document14 pagesCase Study KDQT 2023Hiền MaiNo ratings yet

- Price DiscriminationDocument3 pagesPrice DiscriminationTrisha Gaile R. RañosaNo ratings yet

- Radico KhaitanDocument38 pagesRadico Khaitantapasya khanijouNo ratings yet

- Chandra Shekhar Deputy Director General: Bureau of Indian Standards New Delhi IndiaDocument27 pagesChandra Shekhar Deputy Director General: Bureau of Indian Standards New Delhi IndiasameeryashuNo ratings yet

- Quiz - Chapter 11 - Investments - Additional Concepts - Ia 1 - 2020 EditionDocument2 pagesQuiz - Chapter 11 - Investments - Additional Concepts - Ia 1 - 2020 EditionJennifer RelosoNo ratings yet

- Egyptian International Pharmaceutical Industries Company (EIPICO)Document1 pageEgyptian International Pharmaceutical Industries Company (EIPICO)yasser massryNo ratings yet

- Session - Oligopoly1Document62 pagesSession - Oligopoly1akshat mathurNo ratings yet

- Banking Audit Practice Guide IDocument118 pagesBanking Audit Practice Guide ISyed RizviNo ratings yet

- Option Scalping Strategy Course - by Sivakumar Jaychandra - Upsurge - ClubDocument5 pagesOption Scalping Strategy Course - by Sivakumar Jaychandra - Upsurge - Clubinvestly.vruddhiNo ratings yet

- Khin Kyawt Kyawt Phyu (Final) PDFDocument18 pagesKhin Kyawt Kyawt Phyu (Final) PDFKyaw Thu KoNo ratings yet

- Understanding RbiDocument31 pagesUnderstanding RbiBishal ShresthaNo ratings yet

- Chapter 6Document13 pagesChapter 6Princesskim MacapulayNo ratings yet

- Edu 2019 4229 en t012Document431 pagesEdu 2019 4229 en t012NicolásNo ratings yet

- Form of Application For Registration of A Public TrustDocument4 pagesForm of Application For Registration of A Public Trustiqbalshaikh1960100% (1)

- SyllabusDocument24 pagesSyllabusRipon DebNo ratings yet

- Temtop ISETC.00082020012 LKC-1000S EMC CE CertificateDocument1 pageTemtop ISETC.00082020012 LKC-1000S EMC CE CertificateRobert SwaiNo ratings yet

- RM 3Document6 pagesRM 3Harsh KumarNo ratings yet

- Page 1 of 2Document10 pagesPage 1 of 2Eashan PrasanthNo ratings yet

- Macroeconomics Course HandbookDocument6 pagesMacroeconomics Course HandbookFA20-BBA-017 (AHMAD SOHAIL) UnknownNo ratings yet

- A9022070243 HBLDocument1 pageA9022070243 HBLHamzaNo ratings yet

- ERS 3.0 - Product SheetDocument2 pagesERS 3.0 - Product SheetTonilleNo ratings yet

- Aptitude Test 2 AnswersDocument5 pagesAptitude Test 2 AnswersTrung PhạmNo ratings yet