Professional Documents

Culture Documents

Adobe Scan 4 Jan 2024

Adobe Scan 4 Jan 2024

Uploaded by

paplujiOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Adobe Scan 4 Jan 2024

Adobe Scan 4 Jan 2024

Uploaded by

paplujiCopyright:

Available Formats

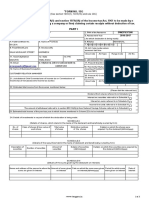

Employees' Provident Fund Organisation

Ministry of labour and Employment (Govt. of India)

Regional Office, Delhi (South)

EPFO Complex, Plot No. 23, Sector-23 Dwarka, New Delhi-110075

FORM N0.15G

(See section 197A(l), 197A(1A) and rule 29C]

DedaratlOn under section 197A(l)and section 197A(IA)or the Income-tax P.ct,1961 to be made by an lndlvklual or a person (not being a oompat'l'f or firm) dlmlng

ceru11n receipts without deduction of tax.

PART!

1. Name of Assessee (Dedarant)

2. PAN or the:

3. Assessment Year

(for which declaration is being made)

4. Rat/Door/Block No. 5. Name of Prem1~ 6. •status

7. Assessed In which Ward/Orde

10. AfJ Code(under whom assessed last

8. Road/Street/Lane 9. Area/Locality

time \

NU c.ode INJ -.ypel R.an!le Code INJ No.

11. Town/Oty/Dlstnct 12. State

113. PIN 14, Last Assessment Year In which

assessed

16. Telephone No. (with STD Code) and Mobile No. 17, Present Ward/Orde

15.Emall

I B. Residential Status (within the

19. Name of Bus1ness/Oca.lpation meaning of Section 6 of the Income nix

Act, 1961)

20. Present AV1...0CJe (1 not same as

aoove)

21. Junsdlctlonal Chief Commlss10ner of Income·tax or CommI55Ioner of Income-ta~ (if not a55essed to Area Code"lAO T'ypelR.3n!iJ' c.ode I"° No.

Income-tax eartier)

22. Estimated total income form the sources mentioned oelow :

(Please tick.the relevant box)

Dividend from shares referred to In Schedule I

Interest on securities referred to in Schedule II

Interest on sums referred to In Schedule m

Income form units referred to ln Schedule IV

The amount of withdrawal referred tom sect10n SOCCA(2)/a) from National Savinos Scheme referred to In ScheduleV

23. Estimated total tncome of the previous year In which income mentioned In Column 22 is to be mduded

Details of Investments In respect of whidi the dec1ara tJon 1s being made:

SCHEDULE·[

.

(Details of shares, wnicn stand 11\ tnc name of the dedarant and beneficially owned by him)

No.of Cass of shares& DIst1ncuve numoers of the shares Date(s) on which the shares were acquired by the

, .., race value of earo

Total value

of shares

declarant(dd/mm/yyyy)

share

SCHEDULE-II

(Details of the securities held in the fldme of declarant and benefldally owned by him)

Date(s) of securities Date(s) on which the securities were

Description of Number of securities Amoun t of securities acquired by the dedarant (dd/mm/yyyy)

(dd/mm/yyyy)

securities

SCHEOULE•lll

lOetarls of tne sums c Iven D the dedarant on mterestl

Name and ad~r~ of the Amount of Period for which sums were Rate of

Date on wnich the sums were given on

person to whom the sums are sums given

interest (dd/mm/yyyy) given on interest mterest

given on mterest on Interest

SCHEDULE-IV

(Details or the mutual fund units held in the mime of dedarant and beneficially owned by hfm)

Income ln respect of

Number of Oass of units and filce value or each Distmctive numbers of units units

Name and address of the

mutual fund units unit

SCHEDULE-V

(Details of the •1,1thor,1wal made from National Savings Scheme)

The amount of

Date on which the account

Particulars of the Post Oftice wnere cr,e account under tne Nat ional Savings Scneme withdrawal from the

was opened(dd/mm/yyyy) ac.count

IS maintainea 3nd me account numoer

""Signature of the Dedarant

Declaration Nerification

*lfWe .........................................................do hereby declare that to the best of •my/our knowledge and behef what is stated above is correct, complet;e and is truly

stated. *l{We declare that the incomes referred to in this fonn are not includ1ble ln the total mcome of any other person u/s 60 to &1 of the Income-tax Pa. 1961

•lJWe further, declare that the tax •on my/our estunated total mcome, including• Income/Incomes referred to In Column 22above, computed 1n accordance with the

provisions of the Income-tax Ac:t,1961, for the previous year endmg on ................... re~nt to the assessment year ................ will be nil. •IJWe also, declare that

*my/our•inccmefincomes referred to m COiumn 22 fur tne previous year endmg on .................. relevant to the assessment "fear ................. will not exceed the

maximum amount which 1s not chargeable to income-tax.

······••·····························"'''''''''''''''''

Plaa!: Signature of the Declarant

Date:

PARTII

[For use by the person to whom the declaration 1s furnished]

2. PAN of the person indlcated in Column 1 of Part 11

1. Name of the ~ n responsible for paying the inr.ome referred to in COiumn 22 of Pnrt I

3. Complete Addn,ss 4. TAN of the person indicated in Column 1 of Part U

s. Email 6. Telephone No. (with STD Code)ano Moolle No.

7. Status I

11. Date on which the mcome

IO. Amount of income paid

8. Date on which Oedaration 1s Furnished 9. Period m respect of whith the d1v1dend has been has been paid/

declared or the mcome has been paid/credited credited (dd/mm/YYYY)

(dd/mrnJyyyy)

12. Date of declaration, distribution or payment of dividend/withdrawal under the ,13. Account Numbcc of National Saving Scheme from which withdrawal has

National 5avings Scheme(dd/mm/yyyy) been made

Forwarded to the O'lief Commissioner or Commissioner of Income-tax.................. .

Place:-

Date: Sig.nature of the person responsible for

paying the income referrea to In

Column 22 oi Part l

Note-s:

1. The aedaration should be furnished in duphcate.

2. •Delete whichever is not applicable.

]. "Declaration can be furnished by an 1nd1vidual under section 197A(l) and a person (other than ,1 company or a firm)under section 197A{1A).

4. ••Indicate the capacity m which the declaration is furnished on behalf or a HUF. AOP, etc.

s. Before signing the dedaratian/verification, the dedarant should saUsfy himself that the information furnished in this Form 1s true, correct and complete in all

respects. Any person making a false statement ,n the declaration shall be hable to prosecution under 277 of the Income-tax Act, 1961 and on conviction be

punishable-

i) In a case where tax sought to be evaded exceeds twenty-five lakh rupees, with rigorous us impnsonment which shall not be less than 6 months but

which may extent to seven years and with fine;

ii) In any other case, with rigorous 1mpnsonment which shall not be Jess than 3 months but which may extend to two years and with fine.

_ The person responsible for paying the income referred to In column 22 of Part I shall not accept tne declaration where the amount of income of the nature

6 referred tom sut,-secbon (1) or sub-sectJon(lA) of secuon 197A or the aggregate of the amounts or sucn mcome creditea or paid or hkeiy to be credited or

paid during the previous year in whrch sudl income Is to oe mduded exceeds the maximum amount which ,snot chargeable to tax:';

Page 2 of 2

You might also like

- Salary Slip ConcentrixDocument1 pageSalary Slip Concentrixnuzhat shaikh50% (2)

- Income TX Authorities Annd Their PowersDocument6 pagesIncome TX Authorities Annd Their PowersAnu K100% (1)

- Pay SlipDocument1 pagePay SlipSaiful IslamNo ratings yet

- WND PIU4 BP Xi 235 N Z390Document2 pagesWND PIU4 BP Xi 235 N Z390Nishant VincentNo ratings yet

- Adobe Scan Mar 25, 2022Document2 pagesAdobe Scan Mar 25, 2022GaneshNo ratings yet

- Form No. 15GDocument2 pagesForm No. 15GGaneshNo ratings yet

- Form 15 GDocument2 pagesForm 15 Gthe.mentor.inNo ratings yet

- 15h PDFDocument2 pages15h PDFIndrasish BasuNo ratings yet

- Form15H PDFDocument2 pagesForm15H PDFSrinivasulu NatukulaNo ratings yet

- Form 15G PDFDocument6 pagesForm 15G PDFSmitha GowdaNo ratings yet

- Form 15GDocument2 pagesForm 15GmuraliswayambuNo ratings yet

- Area Code AO Type Range Code AO No.: Signature of The DeclarantDocument2 pagesArea Code AO Type Range Code AO No.: Signature of The Declarantyraju88No ratings yet

- "Form No. 15G: (See Section 197A (1), 197A (1A) and Rule 29C)Document3 pages"Form No. 15G: (See Section 197A (1), 197A (1A) and Rule 29C)Christopher Vinoth0% (2)

- Form No. 15 H: Bar Code: PanDocument2 pagesForm No. 15 H: Bar Code: PanSajal KulshresthaNo ratings yet

- Formno. 15G: Bar Code: PanDocument2 pagesFormno. 15G: Bar Code: PanRajesh ManogaranNo ratings yet

- Form No. 15G: Part - IDocument3 pagesForm No. 15G: Part - ImohanNo ratings yet

- Sodhadivyarajsinh15G CompressedDocument3 pagesSodhadivyarajsinh15G CompressedRishirajsinh JadejaNo ratings yet

- Form No. 15G: (Please Tick The Relevant Box)Document4 pagesForm No. 15G: (Please Tick The Relevant Box)Santosh DasNo ratings yet

- BijayLata15G CompressedDocument3 pagesBijayLata15G CompressedRishirajsinh JadejaNo ratings yet

- Form No. 15G: Part - IDocument2 pagesForm No. 15G: Part - Ibalaji stationersNo ratings yet

- JadejaHanubha15G CompressedDocument3 pagesJadejaHanubha15G CompressedRishirajsinh JadejaNo ratings yet

- JadejaDhirubha15G CompressedDocument3 pagesJadejaDhirubha15G CompressedRishirajsinh JadejaNo ratings yet

- Form 27CDocument2 pagesForm 27Ctulsi22187No ratings yet

- Form No 15GDocument3 pagesForm No 15GSanjeeva ReddyNo ratings yet

- 15g MehandiDocument3 pages15g MehandiAjay ParidaNo ratings yet

- Pushpa Form15gDocument2 pagesPushpa Form15gimmanuel alfredNo ratings yet

- Form 27CDocument1 pageForm 27CSandesh JhawarNo ratings yet

- 15g and H AutofillDocument15 pages15g and H AutofillAnonymous 6z7noS4fNo ratings yet

- Form 27 C FormatDocument4 pagesForm 27 C FormatYash KediaNo ratings yet

- Form No 15GDocument4 pagesForm No 15Graghu_kiranNo ratings yet

- JadejaDilipsinh15G CompressedDocument3 pagesJadejaDilipsinh15G CompressedRishirajsinh JadejaNo ratings yet

- ANS - 17A - Apr2012 (AR 2011)Document488 pagesANS - 17A - Apr2012 (AR 2011)cuonghienNo ratings yet

- 15H - WellDocument2 pages15H - WellRaju KambleNo ratings yet

- IS - 3Q - 2020 - Final Quarterly ReportDocument18 pagesIS - 3Q - 2020 - Final Quarterly ReportJon DonNo ratings yet

- 0031SISS: Individual 11. Gmai TomDocument1 page0031SISS: Individual 11. Gmai TomVarun reddyNo ratings yet

- Megawide Construction Corporation - Reviewed 2Q 2021 FS - 2021 09 02Document102 pagesMegawide Construction Corporation - Reviewed 2Q 2021 FS - 2021 09 02PaulNo ratings yet

- ABS-CBN Financial StatementsDocument203 pagesABS-CBN Financial StatementsAlvin De Guzman60% (5)

- Abs A17a Dec2011 (Ar 2011 Amended)Document184 pagesAbs A17a Dec2011 (Ar 2011 Amended)cuonghienNo ratings yet

- Form15g Filled Basic DetailsDocument2 pagesForm15g Filled Basic DetailsAtulNigamNo ratings yet

- ALHI - 17-A Consolidated Report - FINALDocument193 pagesALHI - 17-A Consolidated Report - FINALOIdjnawoifhaoifNo ratings yet

- STR 17Q - 09.30.2020Document56 pagesSTR 17Q - 09.30.2020Onyeta HICUwnaNo ratings yet

- GLO 2014 Audited FSDocument129 pagesGLO 2014 Audited FSJoe CaliNo ratings yet

- Susheel Kumar. 15GDocument3 pagesSusheel Kumar. 15GRishirajsinh JadejaNo ratings yet

- 2011 Sec Form 17-A - Final 17 May 2012. - 0EDBA PDFDocument47 pages2011 Sec Form 17-A - Final 17 May 2012. - 0EDBA PDFDe Guzman JANo ratings yet

- Megawide Construction Corporation - SEC Form 17-Q 2Q2022 - 2022 08 12Document79 pagesMegawide Construction Corporation - SEC Form 17-Q 2Q2022 - 2022 08 12Mc Jim Thaddeus MasayonNo ratings yet

- Form No.15gDocument2 pagesForm No.15gPrakash GowdaNo ratings yet

- FD - Form 15 - G - Oct 2015Document6 pagesFD - Form 15 - G - Oct 2015mohantamilNo ratings yet

- Hershey 10QDocument57 pagesHershey 10QRahul MalikNo ratings yet

- 27CC 29-4-24Document2 pages27CC 29-4-24varshaben96916No ratings yet

- MM Quarterly Report Q2 2021Document36 pagesMM Quarterly Report Q2 2021PaulNo ratings yet

- 8281 2010 PIMCO ExDocument1 page8281 2010 PIMCO ExBunny Fontaine100% (1)

- PF Form 15G PDFDocument1 pagePF Form 15G PDFSorabh BhargavNo ratings yet

- PF Form 15GDocument1 pagePF Form 15GSorabh BhargavNo ratings yet

- Cover Sheet: Month Day Month DayDocument56 pagesCover Sheet: Month Day Month DayOnyeta HICUwnaNo ratings yet

- United States Securities and Exchange Commission Form 10-K: Washington, D.C. 20549Document53 pagesUnited States Securities and Exchange Commission Form 10-K: Washington, D.C. 20549Cathy TorresNo ratings yet

- Allhc Sec 17-A (2020)Document179 pagesAllhc Sec 17-A (2020)backup cmbmpNo ratings yet

- AFS 2020 Annual ReportDocument178 pagesAFS 2020 Annual ReportN.a. M. TandayagNo ratings yet

- Form 8281 0 PDFDocument3 pagesForm 8281 0 PDFspcbankingNo ratings yet

- Accenture 10K For FY 2016Document137 pagesAccenture 10K For FY 2016ankit.scsNo ratings yet

- Form No. 15GDocument9 pagesForm No. 15Gjpsmu09No ratings yet

- SF17A0612Document91 pagesSF17A0612maecorrectionNo ratings yet

- IMI SEC Form 23-A (RWH) - RedactedDocument3 pagesIMI SEC Form 23-A (RWH) - RedactedJonathan AccountingNo ratings yet

- Garima Bajaj: Address: House No.1327, Rani Bagh, Delhi-110034 Email: Contact No.: 8860199265Document3 pagesGarima Bajaj: Address: House No.1327, Rani Bagh, Delhi-110034 Email: Contact No.: 8860199265The Cultural CommitteeNo ratings yet

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Document1 pageTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Shahjada ShekhNo ratings yet

- Chemalite Cash Flow StatementDocument2 pagesChemalite Cash Flow Statementrishika rshNo ratings yet

- Awb 6564652463Document1 pageAwb 6564652463Shahid SaleemNo ratings yet

- Form 210 Guidance NotesDocument4 pagesForm 210 Guidance Notes陳宣芳No ratings yet

- Uk Payslip PDFDocument3 pagesUk Payslip PDFJhonel PauloNo ratings yet

- CHAPTER 10 - Compensation IncomeDocument3 pagesCHAPTER 10 - Compensation IncomeDeviane CalabriaNo ratings yet

- Manila Electric Company v. Province of LagunaDocument1 pageManila Electric Company v. Province of LagunaRukmini Dasi Rosemary GuevaraNo ratings yet

- CHAPTER 5 Corporate Income Taxation Regular Corporations ModuleDocument10 pagesCHAPTER 5 Corporate Income Taxation Regular Corporations ModuleShane Mark CabiasaNo ratings yet

- Capital Gains TaxDocument3 pagesCapital Gains TaxFery AnnNo ratings yet

- Chapter IV Gross Income NotesDocument5 pagesChapter IV Gross Income NotesJasmin AlapagNo ratings yet

- Income From House PropertyDocument3 pagesIncome From House PropertySneha PotekarNo ratings yet

- Karan CVDocument2 pagesKaran CVkbvaliaNo ratings yet

- GST (Impact On Common Man)Document2 pagesGST (Impact On Common Man)Kajal kumariNo ratings yet

- RMC No. 21-2022Document3 pagesRMC No. 21-2022Shiela Marie MaraonNo ratings yet

- 2021 TIMTA-ANNEX B Form (With Sample)Document27 pages2021 TIMTA-ANNEX B Form (With Sample)Mark Kevin IIINo ratings yet

- Khanam Malik Malik Orangzeb 269-Abbas Block Mustafa Town LHRDocument1 pageKhanam Malik Malik Orangzeb 269-Abbas Block Mustafa Town LHRMuhammad HaroonNo ratings yet

- Rmo 9-2000Document2 pagesRmo 9-2000Martin EspinosaNo ratings yet

- !fusion Tax - CompleteDocument3 pages!fusion Tax - Completewaste wasteNo ratings yet

- Santosh AisDocument1 pageSantosh Aisjaigovind boobNo ratings yet

- Govind Rathi Lenkart BillDocument1 pageGovind Rathi Lenkart BillSmriti Srivastava0% (1)

- GST Bhavan, Raigad - 1Document7 pagesGST Bhavan, Raigad - 1Rachit BhandariNo ratings yet

- RR No. 8 2018Document35 pagesRR No. 8 2018zul fanNo ratings yet

- Reduced Increased Increase Means: The Article Reduction TheDocument1 pageReduced Increased Increase Means: The Article Reduction TherickmortyNo ratings yet

- Week 4 Day 2: Salient Features of GST ObjectivesDocument2 pagesWeek 4 Day 2: Salient Features of GST Objectivestina tanwarNo ratings yet

- 2285Document39 pages2285Michael BarnesNo ratings yet

- Tax Ust Golden Notes 2014pdfDocument332 pagesTax Ust Golden Notes 2014pdfnotaly mae badtingNo ratings yet