Professional Documents

Culture Documents

Bob Form12ba

Bob Form12ba

Uploaded by

ruchi561Original Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Bob Form12ba

Bob Form12ba

Uploaded by

ruchi561Copyright:

Available Formats

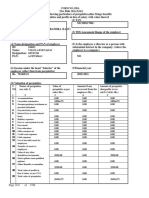

FORM NO.

12BA (See Rule 26A(2)(b))

Statement showing particulars of perquisites, other fringe benefits

or amenities and profits in lieu of salary with value thereof

1. Name and Address of the Employer BANK OF BARODA

SISENDI

2. TAN MUMB22923F

3. TDS Assessment Range of employer 81(3),MUM

4. Name, Designation, PAN of employee MR. BARUN KUMAR SINGH

E.C.No 175945

Clerical

APPPS6294G

5. Is the employee a director or a person with substantial No

interest in the company(where the employer is a

company)

6. Income under the head 'Salaries' of the employee 1344214.00

(other than from perquisites)

7. Financial Year April 2022 - March 2023

8. Valuation of perquisites : 64400.00

Sr Nature of Perquisites (See rule 3) Value of Amount if any , Amount of

No Perquisites as recovered from perquisites

per rules the Employee chargeable to tax [

Rs Rs Col. (3)- Col(4) ]

Rs

(1) (2) (3) (4) (5)

1 ACCOMMODATION 0.00 0.00

2 CARS/OTHER AUTOMOTIVES 0.00 0.00

3 SWEEPER,GARDENER,WATCHMAN 0.00 0.00

4 GAS,ELECTRICITY,WATER 4500.00 4500.00

5 INTEREST FREE OR CONCESSIONAL LOANS 59900.00 59900.00

6 HOLIDAY EXPENSES 0.00 0.00

7 FREE OR CONCESSIONAL TRAVEL 0.00 0.00

8 FREE MEALS 0.00 0.00

9 FREE EDUCATION 0.00 0.00

10 GIFT , VOUCHER ETC 0.00 0.00

11 CREDIT CARDS EXPENSES 0.00 0.00

12 CLUB EXPENSES 0.00 0.00

13 USE OF MOVABLE ASSETS BY EMPLOYEE 0.00 0.00

14 TRANSFER OF ASSETS TO EMPLOYEE 0.00 0.00

15 STOCK OPTIONS (NON-QUALIFIEDOPT) 0.00 0.00

16 VALUEOF ANYOTHERBENEFIT / AMENITY/ 0.00 0.00

SERVICE / PRIVILIEGE

17 TOTALVALUEOF PERQUISITES 64400.00 64400.00

18 PROFITS IN LIEUOF SALARYU/S 17(3) 0.00 0.00

9. Details of tax :-

(a) Tax deducted from salary of the employee under 118720.00

section 192(1)

(b) Tax paid by employer on behalf of the employee 18124.00

under section 192 (1A)

(c) Total Tax Paid 136844.00

(d) Date of payment into Government treasury Refer Form16

DECLARATION BY EMPLOYER

I son/daughter of working as do

hereby declare on behalf of that the information given above is based on the books of account, documents and other

relevant records or information available with us and the details of the value of each such perquisite are in

accordance with section 17 and rules framed there under and that such information is true and correct.

For BANK OF BARODA

Signature of the person responsible for deduction of tax

Full Name:

Designation :

Place:

Date:

You might also like

- Form 16 2021-2022Document10 pagesForm 16 2021-2022ArchanaNo ratings yet

- Mother - Please Speak Out: Income Statement For The Year Ended March 31, 2019 ($000s) Net Sales 100,000Document3 pagesMother - Please Speak Out: Income Statement For The Year Ended March 31, 2019 ($000s) Net Sales 100,000Jayash Kaushal0% (2)

- TX - Employment IncomeDocument21 pagesTX - Employment IncomeSarad Kharel0% (1)

- Teach Yourself Beginner's Hindi ScriptDocument174 pagesTeach Yourself Beginner's Hindi ScriptSteve Motilal100% (1)

- Form No.12Ba: Savan Gurudas Anvekar Development Manager AAOPA9108A NODocument3 pagesForm No.12Ba: Savan Gurudas Anvekar Development Manager AAOPA9108A NOsavan anvekarNo ratings yet

- FY2022 23 Annexure To Form16Document3 pagesFY2022 23 Annexure To Form16Joydip MukhopadhyayNo ratings yet

- Annexure To Form 16 Part B (2020)Document3 pagesAnnexure To Form 16 Part B (2020)Dharmendra ParmarNo ratings yet

- Akcpm0324m 12ba 2023-24Document2 pagesAkcpm0324m 12ba 2023-24Indra Nath MishraNo ratings yet

- Ay2021-22 12baDocument2 pagesAy2021-22 12bazaffsanNo ratings yet

- Annexure To Form 16 - TCSDocument3 pagesAnnexure To Form 16 - TCSRupini RavichandranNo ratings yet

- 2 (F) Amount of Any Other Exemption Under Section 10: Annexure To Form 16 Part BDocument3 pages2 (F) Amount of Any Other Exemption Under Section 10: Annexure To Form 16 Part BAnonymous IIj5AONo ratings yet

- 12BADocument1 page12BAmanas022No ratings yet

- R17 Acepa6021b 20-21Document1 pageR17 Acepa6021b 20-21rajeshre2No ratings yet

- F12ba 1005009 2016Document2 pagesF12ba 1005009 2016Nikhil121314No ratings yet

- Annexure To Form 16 - TCS - 20202021Document3 pagesAnnexure To Form 16 - TCS - 20202021Kritansh BindalNo ratings yet

- Place Mumbai: Annexure To Form 16 Part BDocument3 pagesPlace Mumbai: Annexure To Form 16 Part BsivaNo ratings yet

- Form No. 12ba: Declaration by EmployerDocument1 pageForm No. 12ba: Declaration by EmployerVaibhav Sharad DhandeNo ratings yet

- Place Mumbai: Annexure To Form 16 Part BDocument3 pagesPlace Mumbai: Annexure To Form 16 Part BVikram RaiNo ratings yet

- Annexure To Form 16 Part B (2019)Document3 pagesAnnexure To Form 16 Part B (2019)Dharmendra ParmarNo ratings yet

- 2023-24 12baDocument3 pages2023-24 12baiammouliNo ratings yet

- Invetech Lighting PVT LTD Form 16Document5 pagesInvetech Lighting PVT LTD Form 16Saikiran SharonNo ratings yet

- Annexure To Form 16Document3 pagesAnnexure To Form 16mohitverma.840No ratings yet

- Capt. Culanag Pay SlipDocument1 pageCapt. Culanag Pay Slipvatosreal187No ratings yet

- 2f10k 2022-23 1Document3 pages2f10k 2022-23 1Md shamirNo ratings yet

- Form 16 Data 1 PDFDocument5 pagesForm 16 Data 1 PDFRISHABH JAINNo ratings yet

- Form 16: Wavelabs Technologies Private LimitedDocument11 pagesForm 16: Wavelabs Technologies Private LimitedrshserhsrtNo ratings yet

- Certfcate No.: NB/01992 Form No. 12 BaDocument7 pagesCertfcate No.: NB/01992 Form No. 12 BaKanishk JamwalNo ratings yet

- Soa 1709927089217Document5 pagesSoa 1709927089217Amit20099No ratings yet

- Apr22 Mar23 TaxsheetDocument3 pagesApr22 Mar23 TaxsheetKritika GuptaNo ratings yet

- 2020 - Form16 - PART B AnnexureDocument3 pages2020 - Form16 - PART B AnnexureUtkarsh KadamNo ratings yet

- 2f10k 2023-24 1Document3 pages2f10k 2023-24 1PRAMOD KUMAR SHARMANo ratings yet

- Chintha Hari PrasadDocument4 pagesChintha Hari Prasadchintha hari prasadNo ratings yet

- FormANNX 2022 1Document3 pagesFormANNX 2022 1spider14No ratings yet

- Salary Slip - Dec - 2023Document1 pageSalary Slip - Dec - 2023lonely mudasirNo ratings yet

- Payslip Nov 2023Document1 pagePayslip Nov 2023lonely mudasirNo ratings yet

- Soa 1707625204911Document6 pagesSoa 1707625204911mayankmkg92No ratings yet

- Payslip Feb 2024Document1 pagePayslip Feb 2024lonely mudasirNo ratings yet

- 406GDFFB883219 SoaDocument10 pages406GDFFB883219 SoaVishal Vijay SoniNo ratings yet

- Payslip Aug2021Document1 pagePayslip Aug2021Umesh BabuNo ratings yet

- IGA69636 SalSlipWithTaxDetailsMiscDocument1 pageIGA69636 SalSlipWithTaxDetailsMiscHrithik ghoshNo ratings yet

- Loan Financial Summary As On 12/08/2020: Component Due (RS.) Receipt (RS.) Overdue (RS.)Document2 pagesLoan Financial Summary As On 12/08/2020: Component Due (RS.) Receipt (RS.) Overdue (RS.)Alexander SNo ratings yet

- Web Payslip 266675 202304Document2 pagesWeb Payslip 266675 202304prabhat.finnproNo ratings yet

- Amc Bill and Payment Receipts 2023Document7 pagesAmc Bill and Payment Receipts 2023Gyayak BhutaNo ratings yet

- Amc Bill and Payment Receipts 2023 Opt AllDocument7 pagesAmc Bill and Payment Receipts 2023 Opt AllGyayak BhutaNo ratings yet

- PART B (Annexure)Document4 pagesPART B (Annexure)AnbarasanNo ratings yet

- IGA74304 SalSlipWithTaxDetailsMiscDocument1 pageIGA74304 SalSlipWithTaxDetailsMiscSandeep SinghNo ratings yet

- Praveen B 21-22Document2 pagesPraveen B 21-22psyamala2004No ratings yet

- Payslip Dec 2023Document1 pagePayslip Dec 2023lonely mudasirNo ratings yet

- March 2023 CapgeminiDocument1 pageMarch 2023 CapgeminimanojkallemuchikkalNo ratings yet

- Ajay Kumar Jaiswal TDS 2019-20Document10 pagesAjay Kumar Jaiswal TDS 2019-20AJAY KUMAR JAISWALNo ratings yet

- Loan Account Statement For 453Dpffd078248Document3 pagesLoan Account Statement For 453Dpffd078248Rajan waghmareNo ratings yet

- T S REDDYB MAY 20 CrystalViewer - 2020-06-24T121055.800Document1 pageT S REDDYB MAY 20 CrystalViewer - 2020-06-24T121055.800Tallapureddy SarweswarareddyNo ratings yet

- Form No. 16: Part ADocument6 pagesForm No. 16: Part AVinaya ChennadiNo ratings yet

- Amdavad Municipal Corporation: Mahanagar Sewa SadanDocument1 pageAmdavad Municipal Corporation: Mahanagar Sewa Sadansamrockz05No ratings yet

- File 07092023201232728Document3 pagesFile 07092023201232728dummysold7No ratings yet

- Form 16: Warora Kurnool Transmission LimitedDocument10 pagesForm 16: Warora Kurnool Transmission LimitedBHASKAR pNo ratings yet

- LatestDocument3 pagesLatestAman SinghNo ratings yet

- SOA06122023084304PMDocument2 pagesSOA06122023084304PMneeravsingh310No ratings yet

- Form16 2022 2023Document8 pagesForm16 2022 2023HeetNo ratings yet

- Details of Salary Paid and Any Other Income and Tax DeductedDocument3 pagesDetails of Salary Paid and Any Other Income and Tax DeductedRajesh KharmaleNo ratings yet

- Vitran Pvt. Ltd. Grp4 OC-6Document27 pagesVitran Pvt. Ltd. Grp4 OC-6ADNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- 10th Acid Base and Salt Chapte Study NotesDocument5 pages10th Acid Base and Salt Chapte Study Notesruchi561No ratings yet

- Complete Fundamental of ComputerDocument42 pagesComplete Fundamental of Computeraashishanshu100% (3)

- Clss V Evs1Document6 pagesClss V Evs1ruchi561No ratings yet

- Enabling Assessment 4Document7 pagesEnabling Assessment 4Nicole BatoyNo ratings yet

- Appendix 1 Case StudyDocument10 pagesAppendix 1 Case StudyPearl TanNo ratings yet

- Liability Method of Recording Unearned RevenueDocument18 pagesLiability Method of Recording Unearned RevenuesajjadNo ratings yet

- FW-001-GC Fee Waiver Request - Child 1Document4 pagesFW-001-GC Fee Waiver Request - Child 1AlyssaMarie93No ratings yet

- Ch2 Financial Statement SDocument101 pagesCh2 Financial Statement SK60 NGUYỄN THỊ HƯƠNG QUỲNHNo ratings yet

- Tax 3 Midterm ReviewerDocument6 pagesTax 3 Midterm ReviewerLustrous VisionsNo ratings yet

- Evaluating The Effect of Financial Performance On Dividend Payout of Deposit Money Banks in NigeriaDocument20 pagesEvaluating The Effect of Financial Performance On Dividend Payout of Deposit Money Banks in NigeriaEditor IJTSRDNo ratings yet

- Free Cash FlowsDocument51 pagesFree Cash FlowsYagyaaGoyalNo ratings yet

- f6vnm 2016 Dec ADocument6 pagesf6vnm 2016 Dec AHuyền NguyễnNo ratings yet

- Wage and Income - BORJ - 104749485650Document4 pagesWage and Income - BORJ - 104749485650stevenhudson360No ratings yet

- Lcci LV I TextDocument65 pagesLcci LV I TextPyin Nyar AungNo ratings yet

- CVP-analysis ExcercisesDocument31 pagesCVP-analysis Excercisesგიორგი კაციაშვილიNo ratings yet

- Indian Income Tax Return Acknowledgement 2022-23: Assessment YearDocument1 pageIndian Income Tax Return Acknowledgement 2022-23: Assessment YearSaurya KumarNo ratings yet

- Chapter 5 - The Expanded Ledger and Income StatementDocument48 pagesChapter 5 - The Expanded Ledger and Income Statementcrask26No ratings yet

- 2021 ACE Half Yearly Solutions AmendedDocument5 pages2021 ACE Half Yearly Solutions AmendeddNo ratings yet

- Chapter 8: Tax Management: Planning, Avoidance and EvasionDocument16 pagesChapter 8: Tax Management: Planning, Avoidance and EvasionCharlesNo ratings yet

- Remedial 01 FAR With AnswersDocument7 pagesRemedial 01 FAR With AnswersJennifer AdvientoNo ratings yet

- Team PRTC FPB May 2023 TaxDocument8 pagesTeam PRTC FPB May 2023 TaxAra ara KawaiiNo ratings yet

- Montealto FinMan Chapter910Document7 pagesMontealto FinMan Chapter910Rey HandumonNo ratings yet

- Activity 1Document2 pagesActivity 1Cristine Joy BenitezNo ratings yet

- Polytechnic University of The Philippines College of Accountancy and Finance Sta. Mesa, Manila Junior Philippine Institute of AccountantsDocument12 pagesPolytechnic University of The Philippines College of Accountancy and Finance Sta. Mesa, Manila Junior Philippine Institute of AccountantsChristine Joyce MagoteNo ratings yet

- ACTBFAR Reflection #1Document2 pagesACTBFAR Reflection #1KRABBYPATTY PHNo ratings yet

- Straight ProblemsDocument39 pagesStraight ProblemsJev CastroverdeNo ratings yet

- Supplementary Income Sanchay Plus RetailDocument5 pagesSupplementary Income Sanchay Plus RetailSampras DsouzaNo ratings yet

- Money Mastery: (Learn How To Make, Keep and Grow Your Money)Document19 pagesMoney Mastery: (Learn How To Make, Keep and Grow Your Money)Mark BryanNo ratings yet

- Corporate Taxation & Financial PlanningDocument29 pagesCorporate Taxation & Financial PlanningMonalisa BagdeNo ratings yet

- Asmt IIT 002 2022 2023 EDocument15 pagesAsmt IIT 002 2022 2023 EChamika Madushan ManawaduNo ratings yet

- SK Scholarship Application FormDocument1 pageSK Scholarship Application Formf2n5cn2n62No ratings yet