Professional Documents

Culture Documents

Calculation Sheet F.Y. 2022 - 23 New

Calculation Sheet F.Y. 2022 - 23 New

Uploaded by

mandalsomithmandal19860 ratings0% found this document useful (0 votes)

32 views1 pageThis document outlines the particulars for computing income tax for the financial year 2023-2024 under the new tax regimes in India. It provides details on calculating total income by adding income from salaries and other sources, deducting applicable exemptions, and determining tax payable based on taxable income thresholds of up to Rs. 15 lakhs at tax rates ranging from nil to 30%. It also includes details on tax credits, relief, and tax deducted at source that can be used to calculate the final tax payable or refund amount.

Original Description:

Calculation

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document outlines the particulars for computing income tax for the financial year 2023-2024 under the new tax regimes in India. It provides details on calculating total income by adding income from salaries and other sources, deducting applicable exemptions, and determining tax payable based on taxable income thresholds of up to Rs. 15 lakhs at tax rates ranging from nil to 30%. It also includes details on tax credits, relief, and tax deducted at source that can be used to calculate the final tax payable or refund amount.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

32 views1 pageCalculation Sheet F.Y. 2022 - 23 New

Calculation Sheet F.Y. 2022 - 23 New

Uploaded by

mandalsomithmandal1986This document outlines the particulars for computing income tax for the financial year 2023-2024 under the new tax regimes in India. It provides details on calculating total income by adding income from salaries and other sources, deducting applicable exemptions, and determining tax payable based on taxable income thresholds of up to Rs. 15 lakhs at tax rates ranging from nil to 30%. It also includes details on tax credits, relief, and tax deducted at source that can be used to calculate the final tax payable or refund amount.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 1

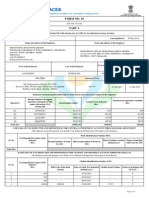

PARTICULARS FOR COMPUTATION OF INCOME TAX FINANCIAL YEAR 2023 – 2024

New Tax Regimes

1. a) Income from Salaries (Current Employer) a) Rs. …………………………………..

For All Citizens

b) Income from Salaries (Previous Employer) b) Rs. ………………………………….. Upto Rs. 3,00,000 Nil

Rs. 3,00,001 to Rs. 6,00,000 5%

2. Gross Salary (1a+1b) 2 .Rs. …………………………………..

Rs. 6,00,001 to Rs. 9,00,000 10%

3. Standard Deduction u/s 16(ia)(Rs. 50000.00) 3 .Rs. ………………………………….. Rs. 9,00,001 to Rs. 12,00,000 15%

Rs. 12,00,001 to Rs. 15,00,000 20%

4. Income from other sources Above Rs. 15,00,000 30%

a) Int. on bank A/C (Savings) a) Rs. …………………………………..

b) Int. on bank A/C (Fixed,who 15G filed on Bank) b) Rs. ………………………………….. U/S 87A upto 25000 for individuals with

c) Int. on NSC / Others c) Rs. ………………………………….. Taxable income (Sl No7 ) upto 7 laks.

5. Gross Total Income (2+4a+4b+4c-3) 5. Rs. …………………………………

6. Other deduction chapter VI A

a) Section 80CCD(2) [Employer’s Contribution) a) Rs. …………………………………..

Name -

7. Taxable Income (5 - 6) 7. Rs. …………………………………..

8. Tax Payable 8. Rs. ………………………………….. PAN –

9. Tax credit U/S 87A(Max 25000,whose Sl No.7 <=7Laks) 9. Rs. ………………………………….. D.O.B –

10. Education cess [(8-9) x 4%] 10. Rs. …………………………………..

11. Total Tax Payable (8-9+10) 11. Rs. ………………………………….. I,

12. Relief U/S 89(1) 12. Rs. …………………………………..

………………………………………………………………

……………………………………. declare that

13. Balance Tax Payable (11 – 12) 13. Rs. …………………………………..

this statement is true to the best of my

14. a)TDS upto January (Current Employer) a) Rs. …………………………………..

information and belief.

b)TDS upto January (Previous Employer) b) Rs. …………………………………..

Signature -

15. Tax deduction at Source in February 15. Rs. …………………………………..

16. Tax Payable / Refundable {12-(13a+13b+14)} 16. Rs. ………………………………….. Format made by JYOTSNA, Bankura

https://www.incometaxindiaefiling.gov.in/Tax_Calculator/

https://www.incometaxindia.gov.in/Pages/tools/income-tax-calculator-234ABC.aspx

You might also like

- Transaction Taxes in PayablesDocument30 pagesTransaction Taxes in PayablesAtif JavaidNo ratings yet

- General Accounting General FundDocument16 pagesGeneral Accounting General FundJanine LerumNo ratings yet

- Name and Address of The Employer Name and Designation of The EmployeeDocument4 pagesName and Address of The Employer Name and Designation of The Employeeyogesh.b.lokhande9022No ratings yet

- Form No 16Document3 pagesForm No 16thapalNo ratings yet

- Form No.16 (See Rule 31 (1) (A) )Document2 pagesForm No.16 (See Rule 31 (1) (A) )Akash ShedgeNo ratings yet

- Form 16aaDocument2 pagesForm 16aaJayNo ratings yet

- Form No 16 - Ay0607Document4 pagesForm No 16 - Ay0607api-3705645100% (1)

- Income Tax Calculation: Name: S. Ram Mohan ReddyDocument6 pagesIncome Tax Calculation: Name: S. Ram Mohan ReddyCA Swamyreddy MvNo ratings yet

- IT Saving Declaration FormDocument7 pagesIT Saving Declaration FormAbhishek MathurNo ratings yet

- 36 8 8 Income Tax Return Preparation Forall Govt Employees Fy 11 12Document11 pages36 8 8 Income Tax Return Preparation Forall Govt Employees Fy 11 12chandu3060No ratings yet

- IT FormDocument4 pagesIT FormVimal PatelNo ratings yet

- State Bank of India Initial FormzDocument2 pagesState Bank of India Initial FormzRojit SinghNo ratings yet

- Form16 Applicable From 01.04Document3 pagesForm16 Applicable From 01.04Vishaal TalwarNo ratings yet

- Ta Bill FormDocument2 pagesTa Bill FormArvind KumarNo ratings yet

- Tax Return of Asadul Haque 2015-16Document9 pagesTax Return of Asadul Haque 2015-16M R MukitNo ratings yet

- Blank Income Tax FormDocument3 pagesBlank Income Tax FormmmmukhtarNo ratings yet

- TDS TCS ADV TAX ROI SolutionDocument4 pagesTDS TCS ADV TAX ROI Solutionprajaktd19tagalpallewarNo ratings yet

- Form 16 651746Document4 pagesForm 16 651746Arslan1112No ratings yet

- It Sheet For DPSC2023-24Document3 pagesIt Sheet For DPSC2023-24katari.board.pry.schoolNo ratings yet

- Pay Bill (Treasury APTC Form 47)Document4 pagesPay Bill (Treasury APTC Form 47)gottigundlapalem panchayatNo ratings yet

- Ea Form 2018 PDFDocument1 pageEa Form 2018 PDFSpeederz freakNo ratings yet

- Income Tax Statement For Financial Year 2023-24 (Assessment Year 2024-25)Document1 pageIncome Tax Statement For Financial Year 2023-24 (Assessment Year 2024-25)ikbalbahar1992No ratings yet

- SARALDocument1 pageSARALchintamani100% (2)

- (See Rule 31 (1) (A) ) : Form No. 16Document8 pages(See Rule 31 (1) (A) ) : Form No. 16Amol LokhandeNo ratings yet

- Pay Bill (Treasury APTC Form 47)Document4 pagesPay Bill (Treasury APTC Form 47)drgvgreddy473% (15)

- Ind-Return English12Document8 pagesInd-Return English12mohibulhasan80No ratings yet

- 1 Form 16 16a LatestDocument25 pages1 Form 16 16a LatestNishant GhaseNo ratings yet

- Income Tax Law and Practice-IDocument14 pagesIncome Tax Law and Practice-Ironat43693No ratings yet

- Jammu Kashmir Employee From 16Document6 pagesJammu Kashmir Employee From 16mrnavkhanNo ratings yet

- Particulars of Salary: If You Are A Handicapped Employee, Yes/NoDocument13 pagesParticulars of Salary: If You Are A Handicapped Employee, Yes/NoMushtaq AhmadNo ratings yet

- Year 11 - Unit Test - Loan, Simultaneous Equations and PolynomialsDocument8 pagesYear 11 - Unit Test - Loan, Simultaneous Equations and PolynomialsvirgieNo ratings yet

- FVC UniformDocument2 pagesFVC UniformMahaveer SinghNo ratings yet

- Wa0040.Document12 pagesWa0040.ibbbi shkhNo ratings yet

- Old Scheme: Radhamani K SDocument4 pagesOld Scheme: Radhamani K SSUREMAN FINANCIAL SERVICESNo ratings yet

- OT CLAIM FORM orDocument2 pagesOT CLAIM FORM orpradeep kumarNo ratings yet

- Cps Tax Form Format For 23-24Document11 pagesCps Tax Form Format For 23-24sr91919No ratings yet

- Abdul Naushad SiddiquiDocument2 pagesAbdul Naushad Siddiquiahad siddiquiNo ratings yet

- CH 10 - End of Chapter Exercises SolutionsDocument57 pagesCH 10 - End of Chapter Exercises SolutionssaraNo ratings yet

- JAIIB AFB Sample Questions For Nov 2017 PDFDocument456 pagesJAIIB AFB Sample Questions For Nov 2017 PDFLn PandaNo ratings yet

- Annual ReturnsDocument13 pagesAnnual ReturnszrqsjmvjftNo ratings yet

- Anticipatory Income Tax Statement 2024-25 (MANJUSHA - 27.01.2024)Document5 pagesAnticipatory Income Tax Statement 2024-25 (MANJUSHA - 27.01.2024)prialiapradeepNo ratings yet

- 1621 Acct6174 Tabe TK1-W3-S4-R1 Team1Document11 pages1621 Acct6174 Tabe TK1-W3-S4-R1 Team1Raisul Ma'arif100% (1)

- 90 Percent AnnexDocument2 pages90 Percent AnnexJasveen SinghNo ratings yet

- Form IiiDocument2 pagesForm Iiianon_370144No ratings yet

- Form 16Document2 pagesForm 16Joyal JoseNo ratings yet

- NBR 73Document3 pagesNBR 73regforsoftNo ratings yet

- Retrenchment DocumentsDocument11 pagesRetrenchment DocumentsfizaNo ratings yet

- Government of Andhra Pradesh Abstract AllowancesDocument3 pagesGovernment of Andhra Pradesh Abstract AllowancesgsreddyNo ratings yet

- Middle East and North Africa Economic Developments and Prospects, October 2013: Investing in Turbolent TimesFrom EverandMiddle East and North Africa Economic Developments and Prospects, October 2013: Investing in Turbolent TimesNo ratings yet

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific-Seventh EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific-Seventh EditionNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionNo ratings yet

- 15% DA Declared by State GoveDocument1 page15% DA Declared by State Govemandalsomithmandal1986No ratings yet

- Calculation Sheet 2022 - 23 OLDDocument2 pagesCalculation Sheet 2022 - 23 OLDmandalsomithmandal1986No ratings yet

- DocScanner 2 Jan 2024 5-38 PMDocument2 pagesDocScanner 2 Jan 2024 5-38 PMmandalsomithmandal1986No ratings yet

- Std. Management Protocol of STEMI - AMI in WBDocument7 pagesStd. Management Protocol of STEMI - AMI in WBmandalsomithmandal1986No ratings yet

- IAS 12 GuideDocument52 pagesIAS 12 Guidezubair_zNo ratings yet

- GST Aftab 2.0Document76 pagesGST Aftab 2.0AFTAB PIRJADENo ratings yet

- SIP 123 AsmaDocument20 pagesSIP 123 AsmaAsma KhanNo ratings yet

- 1600 FinalDocument4 pages1600 FinalReese QuinesNo ratings yet

- Capital Gains TaxDocument3 pagesCapital Gains TaxFery AnnNo ratings yet

- 12969-Cbe Jaipur Exp Third Ac (3A) : Start Date 22-Dec-2023 Arrival 06:45 24-Dec-2023Document1 page12969-Cbe Jaipur Exp Third Ac (3A) : Start Date 22-Dec-2023 Arrival 06:45 24-Dec-2023sharesth sharmaNo ratings yet

- ATX-MJ21 AnsDocument13 pagesATX-MJ21 AnsKAM JIA LINGNo ratings yet

- XYZ Water Inc. FAN ProtestDocument16 pagesXYZ Water Inc. FAN ProtestRalf Arthur SilverioNo ratings yet

- Morales Reviewer Bus MathDocument4 pagesMorales Reviewer Bus MathKevin MoralesNo ratings yet

- CPA A2.3 - ADVANCED TAXATION - Study ManualDocument92 pagesCPA A2.3 - ADVANCED TAXATION - Study ManualZIHERAMBERE AnastaseNo ratings yet

- How To Pass Accounting Entries Under GSTDocument4 pagesHow To Pass Accounting Entries Under GSTDev RajputNo ratings yet

- Substitute Form W-8BEN (Individuals)Document1 pageSubstitute Form W-8BEN (Individuals)hector100% (1)

- Topic 10 Partnership Part 2Document31 pagesTopic 10 Partnership Part 2Baby Khor100% (1)

- Final Income TaxationDocument7 pagesFinal Income TaxationJimmyChaoNo ratings yet

- 014-PKNVidhyalya-Quotation Granite TopDocument3 pages014-PKNVidhyalya-Quotation Granite Topabinaya ChandrasekaranNo ratings yet

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Document1 pageTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Mayank PanwarNo ratings yet

- Tax Ust Golden Notes 2014pdfDocument332 pagesTax Ust Golden Notes 2014pdfnotaly mae badtingNo ratings yet

- Sum of The YearsDocument9 pagesSum of The YearsMary Joy DelgadoNo ratings yet

- Fabm2 Quarter4 Module 8.1Document16 pagesFabm2 Quarter4 Module 8.1Danny BulacsoNo ratings yet

- Chapter 1 MCQs On Income Tax Rates and Basic Concept of Income TaxDocument25 pagesChapter 1 MCQs On Income Tax Rates and Basic Concept of Income TaxSonu KumarNo ratings yet

- Deductions Under Chapter VIDocument4 pagesDeductions Under Chapter VIMonisha ParekhNo ratings yet

- Garima Bajaj: Address: House No.1327, Rani Bagh, Delhi-110034 Email: Contact No.: 8860199265Document3 pagesGarima Bajaj: Address: House No.1327, Rani Bagh, Delhi-110034 Email: Contact No.: 8860199265The Cultural CommitteeNo ratings yet

- Canadian Tax Principles 2020 21 Edition Clarence Byrd Full ChapterDocument67 pagesCanadian Tax Principles 2020 21 Edition Clarence Byrd Full Chapterkeith.cruz838100% (7)

- Iesco Online BillDocument2 pagesIesco Online BillAli AsifNo ratings yet

- Accounting For VAT in Th... Accounting Center, Inc.Document4 pagesAccounting For VAT in Th... Accounting Center, Inc.Martin EspinosaNo ratings yet

- Invoice 120Document1 pageInvoice 120Sarfaraz suajri0% (1)

- 12 Economics Notes Macro Ch04 Government Budget and The EconomyDocument7 pages12 Economics Notes Macro Ch04 Government Budget and The EconomyvatsadbgNo ratings yet

- History of TaxationDocument12 pagesHistory of TaxationHai Bui thiNo ratings yet

- VAT On ImportationDocument24 pagesVAT On ImportationShamae Duma-anNo ratings yet