Professional Documents

Culture Documents

Salary Breakup

Salary Breakup

Uploaded by

bhupender.bt1998Original Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Salary Breakup

Salary Breakup

Uploaded by

bhupender.bt1998Copyright:

Available Formats

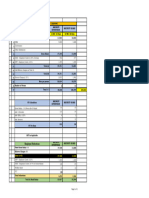

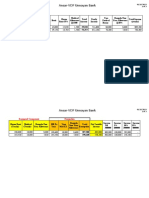

Mr. …… Vipin Singh……. CTC / P.

M

CTC 26,000

Details of employer's part deduction from CTC

1 P.F @ 13 % Of Earn Gross (Excluding HRA & Celling Amt-15 K) 1950

2 ESI @ 3.25 % Of Earn Gross (Celling Amt 21 K Gross Salary) 0

3 LWF @ 0.4 % Of Earn Gross (Sub to Maximun of Rs - 50) 50

4 BONUS @ 20 % Of Minimum wages 2107

5 MEDICLAIM Approx - P.M 180

Total Employer's Part Deduction 4287

CTC Minus Employers part = Gross Salary 21713

Breakup Of Gross Salary

1 Basic 30% 6513.9

2 Hra 20% 4342.6

3 Con 17% 3691.21

4 Medical 10% 2171.3

5 Lta 13% 2822.69

6 Canteen 5% 1085.65

7 Child Ed. 5% 1085.65

Total 100% 21713

Gross minus Employee Part = Take Home / Net Salary

Details of employee part deduction from Gross Salary

1 P.F @ 12 % Of Earn Gross (Excluding HRA & Celling Amt-15 K) 1800

2 ESI @ 0.75 % Of Earn Gross (Celling Amt 21 K Gross Salary) 0

3 LWF @ 0.2 % Of Earn Gross (Sub to Maximun of Rs - 25) 25

Total Deduction 1825

Take Home / Net Salary (Sub to TDS) 19888

You might also like

- SalarySlip 5564050 AprDocument1 pageSalarySlip 5564050 AprsayanNo ratings yet

- Online CTC Calculator With Salary Annexure Excel DownloadDocument1 pageOnline CTC Calculator With Salary Annexure Excel DownloadFaruk PatelNo ratings yet

- Salary Breakup Calculator Excel 1Document2 pagesSalary Breakup Calculator Excel 1Rajinder KumarNo ratings yet

- Salary Calculation Yearly & Monthly Break Up of Gross SalaryDocument1 pageSalary Calculation Yearly & Monthly Break Up of Gross SalarySRS ENTERPRISESNo ratings yet

- Salary Breakup Calculator Excel 2018Document3 pagesSalary Breakup Calculator Excel 2018YogeshNo ratings yet

- CTC Salary CalculatorDocument1 pageCTC Salary CalculatorsavideshwalNo ratings yet

- Salary Break CalculatorDocument1 pageSalary Break CalculatortrickyNo ratings yet

- Quikchex CTC CalculatorDocument8 pagesQuikchex CTC CalculatoriamgodrajeshNo ratings yet

- Salary Breakup Calculator ExcelDocument5 pagesSalary Breakup Calculator Excelviv.jsinghNo ratings yet

- CTC - Salary CalculatorDocument4 pagesCTC - Salary Calculatorboopathi.nNo ratings yet

- CTC Break UpDocument2 pagesCTC Break UpAtul MishraNo ratings yet

- Paystub 202011Document1 pagePaystub 202011Bangkit Fajar NugrahaNo ratings yet

- ADAMA - Sec Break UpDocument1 pageADAMA - Sec Break UpyggdrasiladvisorsNo ratings yet

- Salary FileDocument2 pagesSalary FileRamesh kumarNo ratings yet

- Rate Break Up 15500Document1 pageRate Break Up 15500Yash Raj Bhardwaj100% (1)

- PracticeDocument3 pagesPracticeSaleha UmerNo ratings yet

- Pushpam - ComplianceDocument6 pagesPushpam - ComplianceRamdas NagareNo ratings yet

- Industrial Wage StructureDocument5 pagesIndustrial Wage StructureRamdas NagareNo ratings yet

- $valueseptDocument1 page$valueseptashok sahooNo ratings yet

- Hafeez Ullah - DecemberDocument1 pageHafeez Ullah - DecembermankerasdoNo ratings yet

- 1109277 (21)Document1 page1109277 (21)armvideos001No ratings yet

- STEAG Energy Services (India) Pvt. LTD: Provisional Pay Slip For The Month of March 2019Document1 pageSTEAG Energy Services (India) Pvt. LTD: Provisional Pay Slip For The Month of March 2019Amaresh NayakNo ratings yet

- Gorakhnath Construction Company: SALARY SLIP (01-Oct-2019)Document2 pagesGorakhnath Construction Company: SALARY SLIP (01-Oct-2019)pardeep sanwalNo ratings yet

- Vajra Security and Allied Services Sr. No. Description SG 12 Hrs 26days A Monthly PaymentsDocument2 pagesVajra Security and Allied Services Sr. No. Description SG 12 Hrs 26days A Monthly PaymentsRamdas NagareNo ratings yet

- Manning Burden - Assumption-Jan2020Document14 pagesManning Burden - Assumption-Jan2020shaifullahNo ratings yet

- Vigours Hospitalities Services Pvt. Ltd. Sr. No. Description HK Cum Office Boy 9 Hrs A Monthly PaymentsDocument4 pagesVigours Hospitalities Services Pvt. Ltd. Sr. No. Description HK Cum Office Boy 9 Hrs A Monthly PaymentsRamdas NagareNo ratings yet

- Salary Structure CalculatorDocument7 pagesSalary Structure CalculatorMakesh Gopalakrishnan0% (1)

- Latihan Hitung PPH 21: Deduction Taxable 125,000Document2 pagesLatihan Hitung PPH 21: Deduction Taxable 125,000Stefani KrisdayantiNo ratings yet

- Employee Tax Calculation ReportDocument10 pagesEmployee Tax Calculation ReportFawazilHamdalahNo ratings yet

- Pay Slip Dec-2019Document1 pagePay Slip Dec-2019Ratnakar AryasomayajulaNo ratings yet

- Salary Breakup Calculator ExcelDocument3 pagesSalary Breakup Calculator ExcelBabita KumariNo ratings yet

- Salary Calculator 2019Document8 pagesSalary Calculator 2019Muhammad aliNo ratings yet

- Jan 2024Document1 pageJan 2024Riken PatelNo ratings yet

- Statement of Liability 2018 476889700054Document4 pagesStatement of Liability 2018 476889700054Dana SarahNo ratings yet

- UnknownDocument1 pageUnknownNISHCHAL AGARWALNo ratings yet

- Employer DetailsDocument9 pagesEmployer DetailsKiran NayakNo ratings yet

- NON MEDICLAIM AY2024-25 SARBANI BORA-BDPPB0721G-ComputationDocument2 pagesNON MEDICLAIM AY2024-25 SARBANI BORA-BDPPB0721G-ComputationlaskarmohinNo ratings yet

- ID Salary Calculator - SalaryDocument1 pageID Salary Calculator - SalaryAzka AndyaNo ratings yet

- Calculate Grade Pay/ Specialallowance CTC Components Formula Amount MonthlyDocument3 pagesCalculate Grade Pay/ Specialallowance CTC Components Formula Amount MonthlyPriyanka BhandariNo ratings yet

- Sample COS SalaryDocument1 pageSample COS SalaryjoyNo ratings yet

- Payroll and Contribution Rates Employers PDFDocument2 pagesPayroll and Contribution Rates Employers PDFNicquainCTNo ratings yet

- Muhammad Aslam - JulyDocument1 pageMuhammad Aslam - JulyNajma KanwalNo ratings yet

- Final Project Feb.Document1 pageFinal Project Feb.S S ENTERPRISESNo ratings yet

- Final Exam Test Pay RollDocument4 pagesFinal Exam Test Pay RollPRK21MS1017 FRANCIS DANY MUKIRINo ratings yet

- Adani Wilmar Salary Breakups - 12 HoursDocument2 pagesAdani Wilmar Salary Breakups - 12 HoursPratik RoyalNo ratings yet

- Salary Solution 97Document4 pagesSalary Solution 97Al SukranNo ratings yet

- Salary Solution 97Document4 pagesSalary Solution 97Al SukranNo ratings yet

- Payslip April 2021 State Bank of India: AIOPP6062HDocument1 pagePayslip April 2021 State Bank of India: AIOPP6062HsayanNo ratings yet

- Paye 2 2023Document16 pagesPaye 2 2023v8ysqzd9pbNo ratings yet

- Tax Calculation FY 2021-2022Document3 pagesTax Calculation FY 2021-2022avub habiganjNo ratings yet

- Contor BQ RSUD Claning Servise .Document2 pagesContor BQ RSUD Claning Servise .Apa BaeNo ratings yet

- PayslipWithYTDReport MYS FGV A5Document1 pagePayslipWithYTDReport MYS FGV A5Sarbani JefriNo ratings yet

- Payslips 5Document1 pagePayslips 5Tech stackNo ratings yet

- RandomDocument80 pagesRandomAngel Lalezka CablingNo ratings yet

- Service Tax Payable Extra: Rounded Off (Cost To Company)Document1 pageService Tax Payable Extra: Rounded Off (Cost To Company)Vikesh KhedekarNo ratings yet

- Paystub 202102Document1 pagePaystub 202102Suryanto FamadiNo ratings yet

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet