Professional Documents

Culture Documents

Black Rock

Black Rock

Uploaded by

MarketsWikiCopyright:

Available Formats

You might also like

- Ism Case Study SCB Standard Chartered Pakistan - TPS Applications ImplementationDocument2 pagesIsm Case Study SCB Standard Chartered Pakistan - TPS Applications ImplementationVishal Kumar NankaniNo ratings yet

- Arcadian CaseDocument18 pagesArcadian CaseYulianaXie0% (1)

- Joanne MederoDocument4 pagesJoanne MederoMarketsWikiNo ratings yet

- Joanne MederoDocument9 pagesJoanne MederoMarketsWikiNo ratings yet

- Chris YoungDocument11 pagesChris YoungMarketsWikiNo ratings yet

- MFA3Document8 pagesMFA3MarketsWikiNo ratings yet

- Black RockDocument4 pagesBlack RockMarketsWikiNo ratings yet

- Investment Company InstituteDocument10 pagesInvestment Company InstituteMarketsWikiNo ratings yet

- Re: Blackrock Comments On Proposed Margin Requirements For Uncleared SwapsDocument5 pagesRe: Blackrock Comments On Proposed Margin Requirements For Uncleared SwapsMarketsWikiNo ratings yet

- I. Summary of CommentsDocument5 pagesI. Summary of CommentsMarketsWikiNo ratings yet

- Via Electronic SubmissionDocument8 pagesVia Electronic SubmissionMarketsWikiNo ratings yet

- MFADocument6 pagesMFAMarketsWikiNo ratings yet

- William HenleyDocument3 pagesWilliam HenleyMarketsWikiNo ratings yet

- Karrie McmillanDocument9 pagesKarrie McmillanMarketsWikiNo ratings yet

- Stuart KaswellDocument12 pagesStuart KaswellMarketsWikiNo ratings yet

- Via Electronic Submission To: Comments@Sec - Gov: With A Copy ToDocument10 pagesVia Electronic Submission To: Comments@Sec - Gov: With A Copy ToMarketsWikiNo ratings yet

- Requirements For Processing, Clearing, and Transfer of Customer PositionsDocument4 pagesRequirements For Processing, Clearing, and Transfer of Customer PositionsMarketsWikiNo ratings yet

- Clearing and Execution Release")Document17 pagesClearing and Execution Release")MarketsWikiNo ratings yet

- Deutsche Bank: Consistent RulemakingDocument14 pagesDeutsche Bank: Consistent RulemakingMarketsWikiNo ratings yet

- Mandatory Clearing of Security-Based Swaps, End-User Exception and Security-Based Swap Clearing AgenciesDocument5 pagesMandatory Clearing of Security-Based Swaps, End-User Exception and Security-Based Swap Clearing AgenciesMarketsWikiNo ratings yet

- Re: Antidisruptive Practices Authority Contained in The Dodd-Frank Wall Street Reform and Consumer Protection Act RIN No. 3038-AD26Document6 pagesRe: Antidisruptive Practices Authority Contained in The Dodd-Frank Wall Street Reform and Consumer Protection Act RIN No. 3038-AD26MarketsWikiNo ratings yet

- Swap ParticipantsDocument6 pagesSwap ParticipantsMarketsWikiNo ratings yet

- Via Agency Website & Courier: General CounselDocument6 pagesVia Agency Website & Courier: General CounselMarketsWikiNo ratings yet

- Via Electronic Mail: Chief Executive OfficerDocument5 pagesVia Electronic Mail: Chief Executive OfficerMarketsWikiNo ratings yet

- Walt Luk KenDocument4 pagesWalt Luk KenMarketsWikiNo ratings yet

- Metlife 3Document5 pagesMetlife 3MarketsWikiNo ratings yet

- Sifma: Invested AmericaDocument9 pagesSifma: Invested AmericaMarketsWikiNo ratings yet

- Confirmation, Portfolio Reconciliation and Portfolio Compression Requirements For Swaps Dealers and Major Swaps ParticipantsDocument2 pagesConfirmation, Portfolio Reconciliation and Portfolio Compression Requirements For Swaps Dealers and Major Swaps ParticipantsMarketsWikiNo ratings yet

- Submitted Via Agency WebsiteDocument7 pagesSubmitted Via Agency WebsiteMarketsWikiNo ratings yet

- Tara HairstonDocument6 pagesTara HairstonMarketsWikiNo ratings yet

- Re: RIN 3038-AC98, 3038-AD02 "Financial Resources Requirements For Derivatives Clearing OrganizationsDocument4 pagesRe: RIN 3038-AC98, 3038-AD02 "Financial Resources Requirements For Derivatives Clearing OrganizationsMarketsWikiNo ratings yet

- Dodd-Frank Essentials For End Users of Otc Derivatives - Update 6Document4 pagesDodd-Frank Essentials For End Users of Otc Derivatives - Update 6LameuneNo ratings yet

- Barbara Wier Zy N SkiDocument9 pagesBarbara Wier Zy N SkiMarketsWikiNo ratings yet

- Via Electronic SubmissionDocument2 pagesVia Electronic SubmissionMarketsWikiNo ratings yet

- EdwardRosen - All FirmsDocument16 pagesEdwardRosen - All FirmsMarketsWikiNo ratings yet

- U.S. Commodity Futures Trading Commission: Etter O Dvisories CtoberDocument6 pagesU.S. Commodity Futures Trading Commission: Etter O Dvisories CtoberMichaelPatrickMcSweeneyNo ratings yet

- AIMA Comment Letter On Dec 23, 2010 - Swaps For Mandatory ClearingDocument4 pagesAIMA Comment Letter On Dec 23, 2010 - Swaps For Mandatory ClearingMarketsWikiNo ratings yet

- U.S. Commodity Futures Trading Commission: Gbarnett@cftc - GovDocument4 pagesU.S. Commodity Futures Trading Commission: Gbarnett@cftc - GovMarketsWikiNo ratings yet

- By Electronic SubmissionDocument38 pagesBy Electronic SubmissionMarketsWikiNo ratings yet

- Via Electronic Mail:: April 24, 2012Document6 pagesVia Electronic Mail:: April 24, 2012MarketsWikiNo ratings yet

- PCTCP FactsheetDocument2 pagesPCTCP FactsheetMarketsWikiNo ratings yet

- DeutscheDocument14 pagesDeutscheMarketsWikiNo ratings yet

- Mitigation of Conflicts of Interest: 75 FR 63732 (Oct. 18, 2010)Document7 pagesMitigation of Conflicts of Interest: 75 FR 63732 (Oct. 18, 2010)MarketsWikiNo ratings yet

- Federalregister 022411 BDocument38 pagesFederalregister 022411 BMarketsWikiNo ratings yet

- New York, New York: "CFTC") "SEC"Document5 pagesNew York, New York: "CFTC") "SEC"MarketsWikiNo ratings yet

- Morgan Stanley Regarding Proposed Rules Relating To Definitions Contained in Title VII of Dodd-Frank Wall Street Reform and Consumer Protection ActDocument10 pagesMorgan Stanley Regarding Proposed Rules Relating To Definitions Contained in Title VII of Dodd-Frank Wall Street Reform and Consumer Protection ActMarketsWikiNo ratings yet

- Co, A S: I UturDocument5 pagesCo, A S: I UturMarketsWikiNo ratings yet

- Morgan Stanley: Necessity of Phase ApproachDocument9 pagesMorgan Stanley: Necessity of Phase ApproachMarketsWikiNo ratings yet

- By Commission Website: Futures Industry AssociationDocument6 pagesBy Commission Website: Futures Industry AssociationMarketsWikiNo ratings yet

- Marcus Schue LerDocument3 pagesMarcus Schue LerMarketsWikiNo ratings yet

- Craig Do No HueDocument11 pagesCraig Do No HueMarketsWikiNo ratings yet

- Determination"), That Swap Must Be Executed On A SEF or DCM, Unless Another Exemption Applies. WeDocument6 pagesDetermination"), That Swap Must Be Executed On A SEF or DCM, Unless Another Exemption Applies. WeMarketsWikiNo ratings yet

- Isda and FiaDocument7 pagesIsda and FiaMarketsWikiNo ratings yet

- Re: Antidisruptive Practices Authority Proposed Interpretive OrderDocument9 pagesRe: Antidisruptive Practices Authority Proposed Interpretive OrderMarketsWikiNo ratings yet

- 18-14 - 0 CFTC Advisory Letter On Virtual CurrencyDocument7 pages18-14 - 0 CFTC Advisory Letter On Virtual CurrencyCrowdfundInsiderNo ratings yet

- SDMSPT FactsheetDocument1 pageSDMSPT FactsheetMarketsWikiNo ratings yet

- Via Electronic SubmissionDocument9 pagesVia Electronic SubmissionMarketsWikiNo ratings yet

- Via Electronic SubmissionDocument10 pagesVia Electronic SubmissionMarketsWikiNo ratings yet

- Via On-Line SubmissionDocument7 pagesVia On-Line SubmissionMarketsWikiNo ratings yet

- Via Electronic Mail:: Dcodcmsefgovernance@Cftc - GovDocument6 pagesVia Electronic Mail:: Dcodcmsefgovernance@Cftc - GovMarketsWikiNo ratings yet

- Curtis Cunning HamDocument7 pagesCurtis Cunning HamMarketsWikiNo ratings yet

- Legal Data for Banking: Business Optimisation and Regulatory ComplianceFrom EverandLegal Data for Banking: Business Optimisation and Regulatory ComplianceNo ratings yet

- CFTC Final RuleDocument52 pagesCFTC Final RuleMarketsWikiNo ratings yet

- Minute Entry 336Document1 pageMinute Entry 336MarketsWikiNo ratings yet

- Federal Register / Vol. 81, No. 88 / Friday, May 6, 2016 / Rules and RegulationsDocument6 pagesFederal Register / Vol. 81, No. 88 / Friday, May 6, 2016 / Rules and RegulationsMarketsWikiNo ratings yet

- 34 77617 PDFDocument783 pages34 77617 PDFMarketsWikiNo ratings yet

- Federal Register / Vol. 81, No. 55 / Tuesday, March 22, 2016 / NoticesDocument13 pagesFederal Register / Vol. 81, No. 55 / Tuesday, March 22, 2016 / NoticesMarketsWikiNo ratings yet

- Via Electronic Submission: Modern Markets Initiative 545 Madison Avenue New York, NY 10022 (646) 536-7400Document7 pagesVia Electronic Submission: Modern Markets Initiative 545 Madison Avenue New York, NY 10022 (646) 536-7400MarketsWikiNo ratings yet

- Commodity Futures Trading Commission: Office of Public AffairsDocument2 pagesCommodity Futures Trading Commission: Office of Public AffairsMarketsWikiNo ratings yet

- Eemac022516 EemacreportDocument14 pagesEemac022516 EemacreportMarketsWikiNo ratings yet

- Commodity Futures Trading Commission: Vol. 80 Wednesday, No. 246 December 23, 2015Document26 pagesCommodity Futures Trading Commission: Vol. 80 Wednesday, No. 246 December 23, 2015MarketsWikiNo ratings yet

- Douglas C I FuDocument4 pagesDouglas C I FuMarketsWikiNo ratings yet

- Commodity Futures Trading Commission: Office of Public AffairsDocument2 pagesCommodity Futures Trading Commission: Office of Public AffairsMarketsWikiNo ratings yet

- 2015-10-22 Notice Dis A FR Final-RuleDocument281 pages2015-10-22 Notice Dis A FR Final-RuleMarketsWikiNo ratings yet

- Commodity Futures Trading Commission: Office of Public AffairsDocument3 pagesCommodity Futures Trading Commission: Office of Public AffairsMarketsWikiNo ratings yet

- Commodity Futures Trading Commission: Office of Public AffairsDocument5 pagesCommodity Futures Trading Commission: Office of Public AffairsMarketsWikiNo ratings yet

- Daniel Deli, Paul Hanouna, Christof W. Stahel, Yue Tang and William YostDocument97 pagesDaniel Deli, Paul Hanouna, Christof W. Stahel, Yue Tang and William YostMarketsWikiNo ratings yet

- 34 76474 PDFDocument584 pages34 76474 PDFMarketsWikiNo ratings yet

- Odrgreportg20 1115Document10 pagesOdrgreportg20 1115MarketsWikiNo ratings yet

- Cost Allocation, Customer-Profitability Analysis, and Sales-Variance AnalysisDocument59 pagesCost Allocation, Customer-Profitability Analysis, and Sales-Variance AnalysisHarold Dela Fuente100% (1)

- Final Financial Accounting (Pulkit)Document14 pagesFinal Financial Accounting (Pulkit)nitish_goel91No ratings yet

- IPO & Its RequirmentsDocument38 pagesIPO & Its RequirmentsAnuj GosaiNo ratings yet

- Larsons MCH 3Document52 pagesLarsons MCH 3Christopher John NatividadNo ratings yet

- Value Added TaxDocument38 pagesValue Added TaxAhmad AbduljalilNo ratings yet

- Defining Administration and Land ManagementDocument6 pagesDefining Administration and Land ManagementHenri PonceNo ratings yet

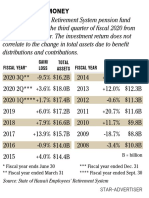

- Tracking The MoneyDocument1 pageTracking The MoneyHonolulu Star-AdvertiserNo ratings yet

- Trending The Impact of Regulatory Action On The NCMDocument17 pagesTrending The Impact of Regulatory Action On The NCMProshareNo ratings yet

- Mazor Robotics Corporate - Presentation - March 2018Document18 pagesMazor Robotics Corporate - Presentation - March 2018medtechyNo ratings yet

- PAS 41 AgricultureDocument2 pagesPAS 41 AgricultureErica UyNo ratings yet

- Chapter 16 "How Well Am I Doing?" - Financial Statement AnalysisDocument134 pagesChapter 16 "How Well Am I Doing?" - Financial Statement AnalysisTyra Joyce RevadaviaNo ratings yet

- OFCH Enterprise StructuresDocument11 pagesOFCH Enterprise StructuresjpsvsrNo ratings yet

- Bank of England Ist Quarterly Report 2008 p.103 Bottom Left paraDocument124 pagesBank of England Ist Quarterly Report 2008 p.103 Bottom Left paraBZ RigerNo ratings yet

- Internship Report On UBLDocument62 pagesInternship Report On UBLbbaahmad89No ratings yet

- LBO Valuation Model PDFDocument101 pagesLBO Valuation Model PDFAbhishek Singh100% (3)

- 4.1 Time Value of Money PDFDocument13 pages4.1 Time Value of Money PDFPractice AddaNo ratings yet

- Abstract of Financial Market 1Document8 pagesAbstract of Financial Market 1mmkrishnan94100% (1)

- English Genre of TextDocument61 pagesEnglish Genre of TextCleon Al Maliki OzzoraNo ratings yet

- Paps 1004Document30 pagesPaps 1004Erica BueNo ratings yet

- Jeevan Nishchay FINALDocument14 pagesJeevan Nishchay FINALsandy dheerNo ratings yet

- Final Fertilizer ReportDocument35 pagesFinal Fertilizer ReportAadiMalikNo ratings yet

- Telstra Case (Exam)Document21 pagesTelstra Case (Exam)alfredc20000% (1)

- Personal Tax Planning BookDocument105 pagesPersonal Tax Planning Bookcwlee7025100% (1)

- Con MixDocument9 pagesCon MixsachirocksNo ratings yet

- Bumi ArmadaDocument60 pagesBumi Armadamanimaran75No ratings yet

- 4305 01 PDFDocument28 pages4305 01 PDFSimra RiyazNo ratings yet

- RA 10963: Tax Reform For Acceleration and Inclusion (TRAIN)Document74 pagesRA 10963: Tax Reform For Acceleration and Inclusion (TRAIN)randyblanza2014100% (5)

- Resume Example 1Document1 pageResume Example 1David Bonnemort100% (4)

Black Rock

Black Rock

Uploaded by

MarketsWikiOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Black Rock

Black Rock

Uploaded by

MarketsWikiCopyright:

Available Formats

September 30, 2011

Mr. David A. Stawick Secretary Commodity Futures Trading Commission Three Lafayette Centre 1155 21st Street, N.W. Washington, D.C. 20581 Re: Customer Clearing Documentation and Timing of Acceptance for Clearing 17 CFR Parts 1, 23, and 39 (RIN 3038-AD51) Dear Mr. Stawick: BlackRock, Inc. 1 submits these comments on the Commodity Futures Trading Commissions (the Commission or the CFTC) Notice of Proposed Rulemaking entitled Customer Clearing Documentation and Timing of Acceptance for Clearing (the Proposed Rule).2 In the Proposed Rule, the Commission proposes regulations which address: (i) the documentation between a customer and a futures commission merchant (referred to as a FCM or clearing member) that clears on behalf of the customer; and (ii) the timing of acceptance or rejection of trades for clearing by derivatives clearing organizations (DCOs) and clearing members. This comment letter focuses on the second of these two issues. As an asset manager representing many different types of clients, investment vehicles, and separate accounts, we offer these comments to assist the Commission in adopting final rules that benefit all market participants and promote the success of cleared swaps as they migrate from the over the counter (OTC) private bilateral market to the centrally traded and cleared market. BlackRock supports the Commissions goals to expand access to and strengthen the financial integrity of the swap markets. In our prior comment letter on this subject, we urged the CFTC to adopt rules that provide asset managers sufficient time to process orders for multiple clients or accounts in a single transaction (a trade (block)). 3 Having reviewed the Proposed Rule, we continue to have concerns that the proposal would impair the ability of asset managers to execute trade (blocks).

1 BlackRock is one of the worlds leading asset management firms. We manage over $3.5 trillion on behalf of institutional and individual clients worldwide through a variety of equity, fixed income, cash management, alternative investment, real estate and advisory products. Our client base includes corporate, public, multi-employer pension plans, insurance companies, third-party mutual funds, endowments, foundations, charities, corporations, official institutions, banks, and individuals around the world. 2 76 Fed. Reg. 45730 (Aug. 1, 2011). 3 See BlackRock comment letter dated April 11, 2011 entitled Requirements for Processing, Clearing, and Transfer of Customer Positions (Prior Letter) (attached as Appendix A). We use the term trade (block) to refer to a swap transaction of any size that is submitted to a derivatives clearing organization (DCO) for clearing and executed on behalf of multiple clients or accounts. The term applies to block trades as well as non-block trades.

Mr. David A. Stawick September 30, 2011 Page 2

Asset managers use trade (blocks) to execute the same transaction for multiple accounts. This serves customers in two ways. First, a trade (block) ensures that all accounts receive identical pricing for the trade. Second, entering into a trade (block) is more efficient and less costly than entering into multiple transactions. However, trade (blocks) require additional processing time post-execution because they involve multiple accounts and clearing members. While we agree that minimizing the time between trade execution and acceptance for clearing is important to mitigate risks, we believe, for the reasons set forth in our Prior Letter, that sections 1.74(b), 23.608(e), 23.610(b) and 39.12(b) of the Proposed Rule would inadvertently inhibit the ability of asset managers to use trade (blocks). In particular, the Proposed Rules would require DCOs, FCMs, swap dealers, and major swap participants to facilitate the acceptance or rejection of each trade submitted by customers as soon as would be technologically practicable if fully automated systems were used. The Commission states that it anticipates that this standard would require action in a matter of milliseconds or seconds or, at most, a few minutes, not hours or days. 4 Although we appreciate that the Commission recognizes that immediate acceptance for clearing upon execution, as proposed in a Prior Rule 5 , might not be feasible for all cleared markets at this time, requiring trade (blocks) to be accepted for clearing within seconds or minutes will also limit the availability of these trades for some market participants. We reaffirm our recommendation in our Prior Letter that to accommodate the post-trade execution allocation process that is critical to allowing all asset managers to service their clients effectively, and to account for the different risk profile of OTC swaps and futures, the CFTCs final rules should provide: (i) at time of trade execution, confirmation of the trade economics is done at the block level removing uncertainty of market risk elements of the trade; and

(ii) for submission of clearing of the trade to a DCO a delay of up to 2 hours be allowed. In cases where a trade is executed by an asset manager on behalf of one fund or account using one FCM for clearing, or for multiple funds or accounts using the same FCM for clearing, the time required for allocation and submission for clearing can potentially be anticipated to be much shorter than two hours, as the allocation process is less complex.

4 Proposed Rule at 45733. 5 See section 39.12(b)(7) of a prior rule (the Prior Rule) entitled Requirements for Processing, Clearing, and Transfer of Customer Positions 17 CFR Parts 23, 37, 38, and 39.

Mr. David A. Stawick September 30, 2011 Page 3

If the Commission were to require by rule that acceptance of clearing occur immediately as in the Prior Rule or as soon as technologically practicable upon trade execution, it will be necessary for clearing members to provide to the industry trade (block) clearing services with the ability to allocate the trade (block) subsequent to execution to the multiple clearing members associated with the individual funds and accounts within a reasonable time period so post-trade allocation of the trade (block) can be done for multi fund asset managers. Providing this service transfers the risk of a clearing break to the clearing member who provides the trade (block) and as a result many clearing members may not offer this service or only provide the service to a limited number of their clients. If clearing members do not offer trade (block) clearing services, asset managers will not be able to execute trade (blocks) (since they will not be able to allocate appropriately). This will dramatically change current investment management practices and substantially increase transaction costs for clients. Thank you for the opportunity to state our views on this important issue. If you have any questions or would like further information, please contact any of us. Sincerely, Joanne Medero Richard Prager Supurna VedBrat

Appendix A (Prior Letter)

April 11, 2011 Mr. David A. Stawick Secretary Commodity Futures Trading Commission Three Lafayette Centre 1155 21st Street, N.W. Washington, DC 20581 Re: Requirements for Processing, Clearing, and Transfer of Customer Positions 17 CFR Parts 23, 37, 38, and 39 (RIN 3038AC98) Dear Mr. Stawick: BlackRock, Inc. submits these comments on the Commodity Futures Trading Commission's (the Commission or the CFTC) Notice of Proposed Rulemaking entitled Requirements for Processing, Clearing, and Transfer of Customer Positions (the "Proposing Release" or Proposed Rule). In the Proposed Rule, the Commission proposes regulation to establish the time frame for a swap dealer (SD), major swap participant (MSP), futures commission merchant, swap execution facility (SEF), and designated contract market (DCM) to process and submit contracts, agreements, or transactions to a derivatives clearing organization (DCO) for clearing; to establish certain product standards and a time frame for a DCO to clear such contracts, agreements, and transactions; and to facilitate a DCOs transfer of open positions from a carrying clearing member to another clearing member without unwinding and rebooking the position. BlackRock is one of the worlds leading asset management firms. We manage over $3.54 trillion on behalf of institutional and individual clients worldwide through a variety of equity, fixed income, cash management, alternative investment, real estate and advisory products. Our client base includes corporate, public, multi-employer pension plans, insurance companies, third-party mutual funds, endowments, foundations, charities, corporations, official institutions, banks, and individuals around the world. As an asset manager representing many different types of clients, investment vehicles, and separate accounts, we offer these comments to assist the Commission in adopting final rules that benefit all market participants and promote the success of cleared swaps as they migrate from the over the counter (OTC) bilateral market. BlackRock supports the Commissions goals to expand access to and strengthen the financial integrity of the swap markets.

Mr. David A. Stawick April 11, 2011 Page 2 However, we believe that proposed section 39.12(b)(7) would harm our clients by impairing the ability of asset managers to execute orders for multiple clients in a single transaction (a trade (block)). 6 In addition, although we support the Commission's goal of setting an appropriate time frame for the processing and submission of swaps for clearing, as well as a DCO having the capability to accept and clear a swap upon submission, we believe these time frames must account for the differences in risk profile between swaps and futures. The CFTC should not require that a swap executed on a SEF or DCM be submitted for clearing immediately.

Under proposed section 39.12(b)(7), DCOs would be required to comply with specified time frames for processing and clearing contracts, agreements, and transactions depending upon where a swap is executed. In connection with a swap executed on a SEF or DCM, the transaction would need to be submitted for clearing, immediately upon execution, for all swaps listed for clearing by the DCO.

Although we agree that a DCO must have the capability to accept and clear a trade upon submission, requiring that trades be submitted for clearing immediately upon execution on a SEF or DCM is problematic for asset managers and their clients. Asset managers like BlackRock trade on behalf of multiple funds and accounts, each of which has the choice of selecting its own clearing member. Frequently, a particular investment strategy will be linked to many different client accounts, and when applying trade ideas linked to these strategies, an asset manager will execute a single trade (block) on behalf of these multiple funds and accounts. Executing a single trade (block), instead of multiple, smaller trades, facilitates better pricing and achieves operational efficiencies and certainty of trade execution, all of which support consistent investment performance for clients benchmarked against stated investment objectives. At the time of trade execution, the economic details of the trade as a single block should be matched and confirmed. However, for purposes of clearing and settlement, the asset manager must go through the allocation process to optimize the allocation based on the notional amount finally executed, which may not be 100% of the notional amount originally requested. Once the allocation process is completed the trade information includes the individual notional amounts, the names of the funds and accounts that are the legal owners of risk, and the clearing members associated with the individual funds and accounts. Only at this stage are the individual trades ready for submission for clearing to the DCO. The futures markets today are vertically oriented; trades are executed on an exchange and cleared by an affiliated clearing house. Both trade execution and clearing are contained within the business vertical and the process for clearing a futures contract is rapid. An associated clearing member facilitates the allocation process and distribution of risk post-execution by stepping in the middle of the trade as counterparty to the clearing house while distributing or allocating risk to the

6

We use the term trade (block) to refer to a swap transaction of any size executed on or subject to the rules of a SEF or DCM on behalf of multiple clients or accounts. The term applies to block trades as well as non-block trades.

Mr. David A. Stawick April 11, 2011 Page 3 individual funds and accounts. Essentially, the associated clearing member intermediates the market and credit risk among the clearing house of which it is a member, the affiliated exchange and the funds and accounts that are clients of the clearing member. The OTC cleared swap market will potentially be a more distributed market where execution of trades is anticipated to take place on many different venues, including SEFs and DCMs that may not be affiliated with the clearing houses. As such, if a clearing member steps into a trade as allocation of risk to individual funds and accounts is taking place, the clearing member will be taking on the risk introduced by the SEF/DCM trade execution and not the exchange/clearing house for which it is a member. This would raise costs of using cleared swaps for asset managers and their clients and could frustrate the Commission's goal of encouraging the clearing of swaps. Futures and swaps have different risk profiles, so the futures model for trade allocation is not appropriate for cleared swaps. We also encourage the Commission to take into account the differences in risk profile between futures and cleared swaps and the differences in the maturity of the current cleared market structure for these two transaction types before adopting final rules. We agree that the maximum possible certainty of trade execution is very desirable, especially as swap trading migrates onto SEFs and DCMs. However, care must be taken to ensure that the procedures or rules do not put undue risk, exposure or operational burdens on certain market participants and we are concerned that the Proposed Rules do not account for differences between futures and cleared swaps. As discussed, the futures market allows for a single clearing member to assume the entire risk of a single executed trade (block) until the trade (block) is allocated and given up to the various clearing members, which can take place by the end of day. The OTC swap risk profile is different from futures and we are concerned that this approach, if applied to OTC swaps, will concentrate unnecessary risk for short periods of time onto clearing members. If clearing members are required to intermediate risk in this fashion for swaps, as they would be under proposed section 39.12(b)(7), they may be exposed to substantially greater risks in light of the larger transaction sizes and different risk profile of cleared swaps. This may limit a clearing members' willingness to provide clearing at a reasonable cost for trades of multiple funds and accounts that are executed as a single trade (block) to asset managers, even though asset managers may have diversified the risk exposure for the trade (block) among many clearing members at the individual fund/account level. Moreover, this approach would be operationally burdensome for asset mangers, as it would require the implementation of new documentation and the build out of new technology to provide the allocation breakdown and reconciliation. Proposed section 39.12(b)(7) would also create informational inefficiencies and increase the likelihood of processing errors by requiring DCOs to receive clearing information for a trade (block) twice: once as a block and once when allocated with legal ownership of risk information.

Mr. David A. Stawick April 11, 2011 Page 4 Proposed resolution To accommodate the post-trade execution allocation process that is critical to allowing asset managers to service their clients effectively, and to account for the different risk profile between OTC swaps and futures, we recommend that the CFTC's final rules provide that: (i) at time of trade execution, confirmation of the trade's economic details is done at the block level removing uncertainty of market risk elements of the trade; and (ii) for submission of clearing of the trade to a DCO a delay of up to 2 hours be allowed. In cases where the allocation process is less complex, it is anticipated that the time required for allocation and submission would potentially be much shorter. For example, when a trade is executed by an asset manager on behalf of one fund or account using one clearing member for clearing, or for multiple funds or accounts using the same clearing member for clearing, the time required for allocation and submission for clearing may potentially be much shorter than two hours. In addition, we recommend that this process be supported with SEFs and DCMs having robust trade operating procedures to accommodate any trade disputes in an operationally efficient manner. We thank the Commission for the opportunity to comment on the Proposed Rule. If you have any questions or would like further information, please contact any of us. Sincerely, Joanne Medero Richard Prager Supurna VedBrat

You might also like

- Ism Case Study SCB Standard Chartered Pakistan - TPS Applications ImplementationDocument2 pagesIsm Case Study SCB Standard Chartered Pakistan - TPS Applications ImplementationVishal Kumar NankaniNo ratings yet

- Arcadian CaseDocument18 pagesArcadian CaseYulianaXie0% (1)

- Joanne MederoDocument4 pagesJoanne MederoMarketsWikiNo ratings yet

- Joanne MederoDocument9 pagesJoanne MederoMarketsWikiNo ratings yet

- Chris YoungDocument11 pagesChris YoungMarketsWikiNo ratings yet

- MFA3Document8 pagesMFA3MarketsWikiNo ratings yet

- Black RockDocument4 pagesBlack RockMarketsWikiNo ratings yet

- Investment Company InstituteDocument10 pagesInvestment Company InstituteMarketsWikiNo ratings yet

- Re: Blackrock Comments On Proposed Margin Requirements For Uncleared SwapsDocument5 pagesRe: Blackrock Comments On Proposed Margin Requirements For Uncleared SwapsMarketsWikiNo ratings yet

- I. Summary of CommentsDocument5 pagesI. Summary of CommentsMarketsWikiNo ratings yet

- Via Electronic SubmissionDocument8 pagesVia Electronic SubmissionMarketsWikiNo ratings yet

- MFADocument6 pagesMFAMarketsWikiNo ratings yet

- William HenleyDocument3 pagesWilliam HenleyMarketsWikiNo ratings yet

- Karrie McmillanDocument9 pagesKarrie McmillanMarketsWikiNo ratings yet

- Stuart KaswellDocument12 pagesStuart KaswellMarketsWikiNo ratings yet

- Via Electronic Submission To: Comments@Sec - Gov: With A Copy ToDocument10 pagesVia Electronic Submission To: Comments@Sec - Gov: With A Copy ToMarketsWikiNo ratings yet

- Requirements For Processing, Clearing, and Transfer of Customer PositionsDocument4 pagesRequirements For Processing, Clearing, and Transfer of Customer PositionsMarketsWikiNo ratings yet

- Clearing and Execution Release")Document17 pagesClearing and Execution Release")MarketsWikiNo ratings yet

- Deutsche Bank: Consistent RulemakingDocument14 pagesDeutsche Bank: Consistent RulemakingMarketsWikiNo ratings yet

- Mandatory Clearing of Security-Based Swaps, End-User Exception and Security-Based Swap Clearing AgenciesDocument5 pagesMandatory Clearing of Security-Based Swaps, End-User Exception and Security-Based Swap Clearing AgenciesMarketsWikiNo ratings yet

- Re: Antidisruptive Practices Authority Contained in The Dodd-Frank Wall Street Reform and Consumer Protection Act RIN No. 3038-AD26Document6 pagesRe: Antidisruptive Practices Authority Contained in The Dodd-Frank Wall Street Reform and Consumer Protection Act RIN No. 3038-AD26MarketsWikiNo ratings yet

- Swap ParticipantsDocument6 pagesSwap ParticipantsMarketsWikiNo ratings yet

- Via Agency Website & Courier: General CounselDocument6 pagesVia Agency Website & Courier: General CounselMarketsWikiNo ratings yet

- Via Electronic Mail: Chief Executive OfficerDocument5 pagesVia Electronic Mail: Chief Executive OfficerMarketsWikiNo ratings yet

- Walt Luk KenDocument4 pagesWalt Luk KenMarketsWikiNo ratings yet

- Metlife 3Document5 pagesMetlife 3MarketsWikiNo ratings yet

- Sifma: Invested AmericaDocument9 pagesSifma: Invested AmericaMarketsWikiNo ratings yet

- Confirmation, Portfolio Reconciliation and Portfolio Compression Requirements For Swaps Dealers and Major Swaps ParticipantsDocument2 pagesConfirmation, Portfolio Reconciliation and Portfolio Compression Requirements For Swaps Dealers and Major Swaps ParticipantsMarketsWikiNo ratings yet

- Submitted Via Agency WebsiteDocument7 pagesSubmitted Via Agency WebsiteMarketsWikiNo ratings yet

- Tara HairstonDocument6 pagesTara HairstonMarketsWikiNo ratings yet

- Re: RIN 3038-AC98, 3038-AD02 "Financial Resources Requirements For Derivatives Clearing OrganizationsDocument4 pagesRe: RIN 3038-AC98, 3038-AD02 "Financial Resources Requirements For Derivatives Clearing OrganizationsMarketsWikiNo ratings yet

- Dodd-Frank Essentials For End Users of Otc Derivatives - Update 6Document4 pagesDodd-Frank Essentials For End Users of Otc Derivatives - Update 6LameuneNo ratings yet

- Barbara Wier Zy N SkiDocument9 pagesBarbara Wier Zy N SkiMarketsWikiNo ratings yet

- Via Electronic SubmissionDocument2 pagesVia Electronic SubmissionMarketsWikiNo ratings yet

- EdwardRosen - All FirmsDocument16 pagesEdwardRosen - All FirmsMarketsWikiNo ratings yet

- U.S. Commodity Futures Trading Commission: Etter O Dvisories CtoberDocument6 pagesU.S. Commodity Futures Trading Commission: Etter O Dvisories CtoberMichaelPatrickMcSweeneyNo ratings yet

- AIMA Comment Letter On Dec 23, 2010 - Swaps For Mandatory ClearingDocument4 pagesAIMA Comment Letter On Dec 23, 2010 - Swaps For Mandatory ClearingMarketsWikiNo ratings yet

- U.S. Commodity Futures Trading Commission: Gbarnett@cftc - GovDocument4 pagesU.S. Commodity Futures Trading Commission: Gbarnett@cftc - GovMarketsWikiNo ratings yet

- By Electronic SubmissionDocument38 pagesBy Electronic SubmissionMarketsWikiNo ratings yet

- Via Electronic Mail:: April 24, 2012Document6 pagesVia Electronic Mail:: April 24, 2012MarketsWikiNo ratings yet

- PCTCP FactsheetDocument2 pagesPCTCP FactsheetMarketsWikiNo ratings yet

- DeutscheDocument14 pagesDeutscheMarketsWikiNo ratings yet

- Mitigation of Conflicts of Interest: 75 FR 63732 (Oct. 18, 2010)Document7 pagesMitigation of Conflicts of Interest: 75 FR 63732 (Oct. 18, 2010)MarketsWikiNo ratings yet

- Federalregister 022411 BDocument38 pagesFederalregister 022411 BMarketsWikiNo ratings yet

- New York, New York: "CFTC") "SEC"Document5 pagesNew York, New York: "CFTC") "SEC"MarketsWikiNo ratings yet

- Morgan Stanley Regarding Proposed Rules Relating To Definitions Contained in Title VII of Dodd-Frank Wall Street Reform and Consumer Protection ActDocument10 pagesMorgan Stanley Regarding Proposed Rules Relating To Definitions Contained in Title VII of Dodd-Frank Wall Street Reform and Consumer Protection ActMarketsWikiNo ratings yet

- Co, A S: I UturDocument5 pagesCo, A S: I UturMarketsWikiNo ratings yet

- Morgan Stanley: Necessity of Phase ApproachDocument9 pagesMorgan Stanley: Necessity of Phase ApproachMarketsWikiNo ratings yet

- By Commission Website: Futures Industry AssociationDocument6 pagesBy Commission Website: Futures Industry AssociationMarketsWikiNo ratings yet

- Marcus Schue LerDocument3 pagesMarcus Schue LerMarketsWikiNo ratings yet

- Craig Do No HueDocument11 pagesCraig Do No HueMarketsWikiNo ratings yet

- Determination"), That Swap Must Be Executed On A SEF or DCM, Unless Another Exemption Applies. WeDocument6 pagesDetermination"), That Swap Must Be Executed On A SEF or DCM, Unless Another Exemption Applies. WeMarketsWikiNo ratings yet

- Isda and FiaDocument7 pagesIsda and FiaMarketsWikiNo ratings yet

- Re: Antidisruptive Practices Authority Proposed Interpretive OrderDocument9 pagesRe: Antidisruptive Practices Authority Proposed Interpretive OrderMarketsWikiNo ratings yet

- 18-14 - 0 CFTC Advisory Letter On Virtual CurrencyDocument7 pages18-14 - 0 CFTC Advisory Letter On Virtual CurrencyCrowdfundInsiderNo ratings yet

- SDMSPT FactsheetDocument1 pageSDMSPT FactsheetMarketsWikiNo ratings yet

- Via Electronic SubmissionDocument9 pagesVia Electronic SubmissionMarketsWikiNo ratings yet

- Via Electronic SubmissionDocument10 pagesVia Electronic SubmissionMarketsWikiNo ratings yet

- Via On-Line SubmissionDocument7 pagesVia On-Line SubmissionMarketsWikiNo ratings yet

- Via Electronic Mail:: Dcodcmsefgovernance@Cftc - GovDocument6 pagesVia Electronic Mail:: Dcodcmsefgovernance@Cftc - GovMarketsWikiNo ratings yet

- Curtis Cunning HamDocument7 pagesCurtis Cunning HamMarketsWikiNo ratings yet

- Legal Data for Banking: Business Optimisation and Regulatory ComplianceFrom EverandLegal Data for Banking: Business Optimisation and Regulatory ComplianceNo ratings yet

- CFTC Final RuleDocument52 pagesCFTC Final RuleMarketsWikiNo ratings yet

- Minute Entry 336Document1 pageMinute Entry 336MarketsWikiNo ratings yet

- Federal Register / Vol. 81, No. 88 / Friday, May 6, 2016 / Rules and RegulationsDocument6 pagesFederal Register / Vol. 81, No. 88 / Friday, May 6, 2016 / Rules and RegulationsMarketsWikiNo ratings yet

- 34 77617 PDFDocument783 pages34 77617 PDFMarketsWikiNo ratings yet

- Federal Register / Vol. 81, No. 55 / Tuesday, March 22, 2016 / NoticesDocument13 pagesFederal Register / Vol. 81, No. 55 / Tuesday, March 22, 2016 / NoticesMarketsWikiNo ratings yet

- Via Electronic Submission: Modern Markets Initiative 545 Madison Avenue New York, NY 10022 (646) 536-7400Document7 pagesVia Electronic Submission: Modern Markets Initiative 545 Madison Avenue New York, NY 10022 (646) 536-7400MarketsWikiNo ratings yet

- Commodity Futures Trading Commission: Office of Public AffairsDocument2 pagesCommodity Futures Trading Commission: Office of Public AffairsMarketsWikiNo ratings yet

- Eemac022516 EemacreportDocument14 pagesEemac022516 EemacreportMarketsWikiNo ratings yet

- Commodity Futures Trading Commission: Vol. 80 Wednesday, No. 246 December 23, 2015Document26 pagesCommodity Futures Trading Commission: Vol. 80 Wednesday, No. 246 December 23, 2015MarketsWikiNo ratings yet

- Douglas C I FuDocument4 pagesDouglas C I FuMarketsWikiNo ratings yet

- Commodity Futures Trading Commission: Office of Public AffairsDocument2 pagesCommodity Futures Trading Commission: Office of Public AffairsMarketsWikiNo ratings yet

- 2015-10-22 Notice Dis A FR Final-RuleDocument281 pages2015-10-22 Notice Dis A FR Final-RuleMarketsWikiNo ratings yet

- Commodity Futures Trading Commission: Office of Public AffairsDocument3 pagesCommodity Futures Trading Commission: Office of Public AffairsMarketsWikiNo ratings yet

- Commodity Futures Trading Commission: Office of Public AffairsDocument5 pagesCommodity Futures Trading Commission: Office of Public AffairsMarketsWikiNo ratings yet

- Daniel Deli, Paul Hanouna, Christof W. Stahel, Yue Tang and William YostDocument97 pagesDaniel Deli, Paul Hanouna, Christof W. Stahel, Yue Tang and William YostMarketsWikiNo ratings yet

- 34 76474 PDFDocument584 pages34 76474 PDFMarketsWikiNo ratings yet

- Odrgreportg20 1115Document10 pagesOdrgreportg20 1115MarketsWikiNo ratings yet

- Cost Allocation, Customer-Profitability Analysis, and Sales-Variance AnalysisDocument59 pagesCost Allocation, Customer-Profitability Analysis, and Sales-Variance AnalysisHarold Dela Fuente100% (1)

- Final Financial Accounting (Pulkit)Document14 pagesFinal Financial Accounting (Pulkit)nitish_goel91No ratings yet

- IPO & Its RequirmentsDocument38 pagesIPO & Its RequirmentsAnuj GosaiNo ratings yet

- Larsons MCH 3Document52 pagesLarsons MCH 3Christopher John NatividadNo ratings yet

- Value Added TaxDocument38 pagesValue Added TaxAhmad AbduljalilNo ratings yet

- Defining Administration and Land ManagementDocument6 pagesDefining Administration and Land ManagementHenri PonceNo ratings yet

- Tracking The MoneyDocument1 pageTracking The MoneyHonolulu Star-AdvertiserNo ratings yet

- Trending The Impact of Regulatory Action On The NCMDocument17 pagesTrending The Impact of Regulatory Action On The NCMProshareNo ratings yet

- Mazor Robotics Corporate - Presentation - March 2018Document18 pagesMazor Robotics Corporate - Presentation - March 2018medtechyNo ratings yet

- PAS 41 AgricultureDocument2 pagesPAS 41 AgricultureErica UyNo ratings yet

- Chapter 16 "How Well Am I Doing?" - Financial Statement AnalysisDocument134 pagesChapter 16 "How Well Am I Doing?" - Financial Statement AnalysisTyra Joyce RevadaviaNo ratings yet

- OFCH Enterprise StructuresDocument11 pagesOFCH Enterprise StructuresjpsvsrNo ratings yet

- Bank of England Ist Quarterly Report 2008 p.103 Bottom Left paraDocument124 pagesBank of England Ist Quarterly Report 2008 p.103 Bottom Left paraBZ RigerNo ratings yet

- Internship Report On UBLDocument62 pagesInternship Report On UBLbbaahmad89No ratings yet

- LBO Valuation Model PDFDocument101 pagesLBO Valuation Model PDFAbhishek Singh100% (3)

- 4.1 Time Value of Money PDFDocument13 pages4.1 Time Value of Money PDFPractice AddaNo ratings yet

- Abstract of Financial Market 1Document8 pagesAbstract of Financial Market 1mmkrishnan94100% (1)

- English Genre of TextDocument61 pagesEnglish Genre of TextCleon Al Maliki OzzoraNo ratings yet

- Paps 1004Document30 pagesPaps 1004Erica BueNo ratings yet

- Jeevan Nishchay FINALDocument14 pagesJeevan Nishchay FINALsandy dheerNo ratings yet

- Final Fertilizer ReportDocument35 pagesFinal Fertilizer ReportAadiMalikNo ratings yet

- Telstra Case (Exam)Document21 pagesTelstra Case (Exam)alfredc20000% (1)

- Personal Tax Planning BookDocument105 pagesPersonal Tax Planning Bookcwlee7025100% (1)

- Con MixDocument9 pagesCon MixsachirocksNo ratings yet

- Bumi ArmadaDocument60 pagesBumi Armadamanimaran75No ratings yet

- 4305 01 PDFDocument28 pages4305 01 PDFSimra RiyazNo ratings yet

- RA 10963: Tax Reform For Acceleration and Inclusion (TRAIN)Document74 pagesRA 10963: Tax Reform For Acceleration and Inclusion (TRAIN)randyblanza2014100% (5)

- Resume Example 1Document1 pageResume Example 1David Bonnemort100% (4)