Professional Documents

Culture Documents

Calcuation of HRA and Leave Encashment

Calcuation of HRA and Leave Encashment

Uploaded by

Chinmay HarshCopyright:

Available Formats

You might also like

- Problems On Taxable Salary Income-AdditionalDocument24 pagesProblems On Taxable Salary Income-AdditionalBasappaSarkar82% (49)

- IEEM 666 (Industrial Environmental Audits and Impact Assessment) H.W. #1 (Individual Assignment) Student Name: Reg. NumberDocument2 pagesIEEM 666 (Industrial Environmental Audits and Impact Assessment) H.W. #1 (Individual Assignment) Student Name: Reg. NumberAkramBabonjiNo ratings yet

- Payment of GratuityDocument11 pagesPayment of GratuityHari NaamNo ratings yet

- Retirement Benefits: Taxable Limits and ExemptionsDocument38 pagesRetirement Benefits: Taxable Limits and ExemptionsVineet GargNo ratings yet

- QuestionsDocument16 pagesQuestionsAayush SunejaNo ratings yet

- SCDL - PGDBA - Finance - Sem 4 - TaxationDocument23 pagesSCDL - PGDBA - Finance - Sem 4 - Taxationapi-3762419100% (2)

- Income Tax 05Document17 pagesIncome Tax 05AMJAD ULLA RNo ratings yet

- Income Under The Head Salaries: (Section 15 - 17)Document55 pagesIncome Under The Head Salaries: (Section 15 - 17)leela naga janaki rajitha attiliNo ratings yet

- Enhancement in Gratuity Limit Under Payment of Gratuity ActDocument4 pagesEnhancement in Gratuity Limit Under Payment of Gratuity ActPaymaster ServicesNo ratings yet

- IfsalariesDocument53 pagesIfsalariesSiva SankariNo ratings yet

- GratuityDocument7 pagesGratuitySandeep TakNo ratings yet

- Income From SalaryDocument23 pagesIncome From Salaryparthbajaj2703No ratings yet

- 40 40 Income From Salary BTDocument55 pages40 40 Income From Salary BTkiranshingoteNo ratings yet

- Salaxy Examples (Taxation)Document21 pagesSalaxy Examples (Taxation)PARTH NAIKNo ratings yet

- Meaning of Salary': Condition For Charging Income U/H "Salaries"Document21 pagesMeaning of Salary': Condition For Charging Income U/H "Salaries"kiranshingoteNo ratings yet

- Tax On Leave EncashmentDocument2 pagesTax On Leave EncashmentMZNo ratings yet

- Income From Salary: Ca Pranjal Joshi M/s Pranjal Joshi & Co Chartered AccountantsDocument28 pagesIncome From Salary: Ca Pranjal Joshi M/s Pranjal Joshi & Co Chartered AccountantsPriya AgarwalNo ratings yet

- EFFORTS BY-Ravleen Kaur Roll No-01391101818Document8 pagesEFFORTS BY-Ravleen Kaur Roll No-01391101818Harleen KaurNo ratings yet

- 4.2 Home Assignment Questions - Income From SalaryDocument3 pages4.2 Home Assignment Questions - Income From SalaryAashi Gupta100% (1)

- Salary SimplifiedDocument16 pagesSalary SimplifiedaruunstalinNo ratings yet

- Leave EncashmentDocument8 pagesLeave Encashmentcooldude690No ratings yet

- Income From Salary QUESTIONSDocument20 pagesIncome From Salary QUESTIONSSiva SankariNo ratings yet

- Income Tax Salary NotesDocument48 pagesIncome Tax Salary NotesTanya AntilNo ratings yet

- Taxation of Leave SalaryDocument1 pageTaxation of Leave SalaryJPNo ratings yet

- Income From SalaryDocument54 pagesIncome From SalaryMohsin ShaikhNo ratings yet

- Income From SalaryDocument54 pagesIncome From SalaryJyoti Kalotra70% (10)

- Income From SalaryDocument10 pagesIncome From SalaryShubham BajajNo ratings yet

- GratuityDocument3 pagesGratuityTariq MahmoodNo ratings yet

- Salary HeadDocument34 pagesSalary Headrathnamano186No ratings yet

- Incomes On RetirementDocument11 pagesIncomes On RetirementShabnam HabeebNo ratings yet

- Benefits of Government EmployeesDocument2 pagesBenefits of Government EmployeesBitta Saha HridoyNo ratings yet

- Template - Restructuring-Tax Computation-BER-Salary Tracker For FY 2015-16 - CKDocument9 pagesTemplate - Restructuring-Tax Computation-BER-Salary Tracker For FY 2015-16 - CKajaykrsinghpintuNo ratings yet

- Salary IllustrationDocument10 pagesSalary IllustrationSarvar Pathan100% (1)

- Salaries PresentationDocument21 pagesSalaries PresentationDipika PandaNo ratings yet

- Numericals of SalaryDocument7 pagesNumericals of SalaryAnas ShaikhNo ratings yet

- Chapter 4 Income From Salaries: (Sec.15 To 17)Document32 pagesChapter 4 Income From Salaries: (Sec.15 To 17)kiranshingoteNo ratings yet

- Chapter 4 Income From Salaries: (Sec.15 To 17)Document32 pagesChapter 4 Income From Salaries: (Sec.15 To 17)kiranshingoteNo ratings yet

- Retirement Benefits (Theoretical)Document62 pagesRetirement Benefits (Theoretical)Venkatasubbu MadhavanNo ratings yet

- Problems On Income From Salaries: Tax SupplementDocument20 pagesProblems On Income From Salaries: Tax SupplementJkNo ratings yet

- Tax Treatment of Gratuity and Leave Encashment Write UpDocument3 pagesTax Treatment of Gratuity and Leave Encashment Write UpAvinash RajuNo ratings yet

- Lecture 11 GratuityDocument16 pagesLecture 11 GratuityVikas WadmareNo ratings yet

- RIGHT ACCOUTNANCY - Tax Law MCQ Income From Salary QUESTION 06.02.16Document7 pagesRIGHT ACCOUTNANCY - Tax Law MCQ Income From Salary QUESTION 06.02.16Sangeetha AchyuthNo ratings yet

- Retirement Workbook 1Document27 pagesRetirement Workbook 1Pankaj Mathpal100% (1)

- Retirement Workbook 3.2Document31 pagesRetirement Workbook 3.2Tejas Shah83% (6)

- Welcome!: Income Under Head - SalariesDocument66 pagesWelcome!: Income Under Head - SalariesKalpana ChoudharyNo ratings yet

- ITLP (Unit 3) 09-11-2021Document86 pagesITLP (Unit 3) 09-11-2021anushkaNo ratings yet

- 80.deductions or Allowances Allowed To Salaried EmployeeDocument11 pages80.deductions or Allowances Allowed To Salaried Employeehustlerstupid737No ratings yet

- Income Tax LawDocument7 pagesIncome Tax LawPrableen KaurNo ratings yet

- Salary IncomeDocument47 pagesSalary Incomearchana_anuragiNo ratings yet

- Head Salary PDFDocument48 pagesHead Salary PDFRvi MahayNo ratings yet

- Problems On Business/Profession Income: SEM It AssignmentDocument9 pagesProblems On Business/Profession Income: SEM It AssignmentNikhilNo ratings yet

- Lecture 11 Income From Salary - Till Leave SalaryDocument19 pagesLecture 11 Income From Salary - Till Leave Salarynileshshengule12No ratings yet

- AssignmentDocument1 pageAssignmentVivek SharmaNo ratings yet

- GRATUITY BY Pooja MiglaniDocument9 pagesGRATUITY BY Pooja MiglaniBrahamdeep KaurNo ratings yet

- Salaries 3Document2 pagesSalaries 3soumyajeetkundu123No ratings yet

- Questions Case StudyDocument4 pagesQuestions Case StudyKrupa VoraNo ratings yet

- Salary Presentation 1Document56 pagesSalary Presentation 1NIRAVNo ratings yet

- Incone From Salary Ppts - pdf348Document48 pagesIncone From Salary Ppts - pdf348saloniagarwalagarwal3No ratings yet

- How to Reverse Recession and Remove Poverty in India: Prove Me Wrong & Win 10 Million Dollar Challenge Within 60 DaysFrom EverandHow to Reverse Recession and Remove Poverty in India: Prove Me Wrong & Win 10 Million Dollar Challenge Within 60 DaysNo ratings yet

- A Haven on Earth: Singapore Economy Without Duties and TaxesFrom EverandA Haven on Earth: Singapore Economy Without Duties and TaxesNo ratings yet

- The Incentive Plan for Efficiency in Government Operations: A Program to Eliminate Government DeficitsFrom EverandThe Incentive Plan for Efficiency in Government Operations: A Program to Eliminate Government DeficitsNo ratings yet

- PaymentDocument2 pagesPaymentChinmay HarshNo ratings yet

- Regulating Transnational Dissident Cyber EspionageDocument16 pagesRegulating Transnational Dissident Cyber EspionageChinmay HarshNo ratings yet

- Law 9780199231690 E830Document30 pagesLaw 9780199231690 E830Chinmay HarshNo ratings yet

- Ihls Article p331 - 331Document17 pagesIhls Article p331 - 331Chinmay HarshNo ratings yet

- Cyber Attacks MootDocument25 pagesCyber Attacks MootChinmay HarshNo ratings yet

- J 2018 SCC OnLine Tri 112 Devaiah Mdtpartnerscom 20240111 205112 1 6Document6 pagesJ 2018 SCC OnLine Tri 112 Devaiah Mdtpartnerscom 20240111 205112 1 6Chinmay HarshNo ratings yet

- 1666013226Document17 pages1666013226Chinmay HarshNo ratings yet

- UNIT-II - Env Law PrinciplesDocument41 pagesUNIT-II - Env Law PrinciplesChinmay HarshNo ratings yet

- UNIT-I Env Law and Policy Int Developments - All PptsDocument150 pagesUNIT-I Env Law and Policy Int Developments - All PptsChinmay HarshNo ratings yet

- PA INAMDAR CaseDocument3 pagesPA INAMDAR CaseChinmay HarshNo ratings yet

- Final SECULARISM CONCEPT, ORIGIN AND ITS IMPORTANCEDocument18 pagesFinal SECULARISM CONCEPT, ORIGIN AND ITS IMPORTANCEChinmay HarshNo ratings yet

- Issue 3 IismrrDocument7 pagesIssue 3 IismrrChinmay HarshNo ratings yet

- The Subject of Bettale Seve (Nude Worship) at Chandragutti, South IndiaDocument9 pagesThe Subject of Bettale Seve (Nude Worship) at Chandragutti, South IndiapankajdharmadhikariNo ratings yet

- Tamil Nadu Rera (General) Regulations, 2018Document7 pagesTamil Nadu Rera (General) Regulations, 2018Chinmay HarshNo ratings yet

- NCWA I To XIDocument1 pageNCWA I To XIRohit GoswamiNo ratings yet

- CC-308 Industrial Law 2022Document2 pagesCC-308 Industrial Law 2022Prem BhojwaniNo ratings yet

- Labor Law in Pakistan Is Broad and Contains Several OrdinancesDocument9 pagesLabor Law in Pakistan Is Broad and Contains Several OrdinancesQueen CancerianNo ratings yet

- Safety Data Sheet: TR Requisition NR: 0856417013 Doc. Number: FAC10005-CHI-000-PCS-DTS-0001 Rev: Sheet 7 of 23Document5 pagesSafety Data Sheet: TR Requisition NR: 0856417013 Doc. Number: FAC10005-CHI-000-PCS-DTS-0001 Rev: Sheet 7 of 23Bn BnNo ratings yet

- Entitlement to Benefits Language/ भाषाDocument2 pagesEntitlement to Benefits Language/ भाषाinfoprincemachinesNo ratings yet

- Chapter 8 IR MALAYSIADocument25 pagesChapter 8 IR MALAYSIAadibaumairahNo ratings yet

- 2020 Calendar PDFDocument12 pages2020 Calendar PDFHaneef ShaikNo ratings yet

- Standard Bank Chartered Employees Union v. Confesor, G.R. No. 114974 (2004)Document2 pagesStandard Bank Chartered Employees Union v. Confesor, G.R. No. 114974 (2004)rudilyn.palero9No ratings yet

- Method Statement and HIRAC Guide Ao 061024Document12 pagesMethod Statement and HIRAC Guide Ao 061024Kim Ryan PomarNo ratings yet

- SDS PS Afff A3f1hec - Msa3f1%Document8 pagesSDS PS Afff A3f1hec - Msa3f1%Cristobal HernandezNo ratings yet

- Job Safety Analysis (Jsa) and Risk Assessment FormDocument2 pagesJob Safety Analysis (Jsa) and Risk Assessment FormHery KurniawanNo ratings yet

- Trade Union Case StudyDocument2 pagesTrade Union Case Studysananda_sikdar100% (3)

- The Differences and Similarities Between IHRM and HRMDocument16 pagesThe Differences and Similarities Between IHRM and HRMMohamed SobahNo ratings yet

- Practice Occupational Health and Safety Procedures (Dressmaking)Document47 pagesPractice Occupational Health and Safety Procedures (Dressmaking)Arjerene Gador Dela Cruz100% (5)

- Resource Manager Resource Manager: EconomicsDocument16 pagesResource Manager Resource Manager: EconomicsPLAYVONo ratings yet

- Strikes and Lockouts (Labor Review)Document6 pagesStrikes and Lockouts (Labor Review)Lois DNo ratings yet

- 04 - Labour Law Health and SafetyDocument2 pages04 - Labour Law Health and SafetyBhavya RayalaNo ratings yet

- 4 Billboard PDFDocument1 page4 Billboard PDFIvan BaracNo ratings yet

- Collective Bargaining and Labour Relations: Lecture-9Document75 pagesCollective Bargaining and Labour Relations: Lecture-9Promiti SarkerNo ratings yet

- Test OhsDocument1 pageTest OhsTracy Faye A. SalinasNo ratings yet

- Employee Movement Form.v01 - Recg - Mohamed Adam Izhar Bin Mohamed RidzwanDocument1 pageEmployee Movement Form.v01 - Recg - Mohamed Adam Izhar Bin Mohamed RidzwanXiao Minn NeohNo ratings yet

- Commercial Proposal - Hans HR - 05.12 (UAE)Document3 pagesCommercial Proposal - Hans HR - 05.12 (UAE)JOhnNo ratings yet

- Night Shift Differential: Article 86Document12 pagesNight Shift Differential: Article 86jeongchaeng no jam brotherNo ratings yet

- Job Hazard Analysis: OSHA 3071 2002 (Revised)Document50 pagesJob Hazard Analysis: OSHA 3071 2002 (Revised)slamet suryantoNo ratings yet

- Question Paper MIR PDFDocument2 pagesQuestion Paper MIR PDFManoj KumarNo ratings yet

- FORM 10 - Government Safety Engineer's Accident Investigation ReportDocument1 pageFORM 10 - Government Safety Engineer's Accident Investigation ReportTomas del RosarioNo ratings yet

- Employee'S Daily Time Record Employee'S Daily Time Record: Reynaldo Dinglasan Reynaldo DinglasanDocument1 pageEmployee'S Daily Time Record Employee'S Daily Time Record: Reynaldo Dinglasan Reynaldo DinglasanIstib Adriatico AlcanciaNo ratings yet

- Chapter 10 Understanding Labour Relations and Collective Bargaining PDFDocument24 pagesChapter 10 Understanding Labour Relations and Collective Bargaining PDFSung-il LeeNo ratings yet

- Santa Rosa Coca Cola Plant Employee Union Vs Coca Cola BottlersDocument3 pagesSanta Rosa Coca Cola Plant Employee Union Vs Coca Cola BottlersRuth Hazel GalangNo ratings yet

Calcuation of HRA and Leave Encashment

Calcuation of HRA and Leave Encashment

Uploaded by

Chinmay HarshOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Calcuation of HRA and Leave Encashment

Calcuation of HRA and Leave Encashment

Uploaded by

Chinmay HarshCopyright:

Available Formats

Rules Regarding Leave Encashment and House Rent Allowance

1. House Rent Allowance: You may claim the least of the following as HRA exemption.

a. Total HRA received from your employer

b. Rent paid less 10% of (Basic salary +DA)

c. 40% of salary (Basic+DA) for non-metros and 50% of salary (Basic+DA) for metros

Read more about how to claim HRA exemption.

Illustration: Mr. Hrehaan is Sports Broadcaster and lives in Mumbai working for

ESPN. His annual salary is 40 Lakh rupees. His Basic Salary is 16 lakh rupees while He

gets 8 Lakh as Dearness Allowance. He gets 80,000 as per month HRA from his

employer. Kindly Calculate the HRA Exemption which could be claimed by Mr. Hrehaan.

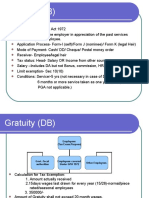

2. Leave Encashment: Leave encashment received at the time of retirement /

resignation is fully exempt for Central or State Government employee. Leave encashment

received by non-Government employee is exempt to the extent of lower of the following:

1. Amount notified by the Government- Rs 3 lakh

2. Actual leave encashment amount

3. Average salary of last 10 months

4. Cash equivalent to Earned Leave in credit of Employee at time of retirement

(should not exceed more than 30 days per year)

Illustration: For instance, Gopal resigns from company XYZ. His monthly salary is Rs. 1.5 lakh.

He was entitled to 30 days leave per year. His leave balance at the time of retirement is 20 leaves.

His leave encashment of Rs. 1 lakh.

Hence the exempt leave encashment will be lower of:

1. Amount notified by the Government- Rs 3 lakh

2. Actual leave encashment amount – Rs. 1 lakh

3. Average salary of last 10 months – Rs. 15 lakh (Rs. 1.5 lakh x 10 months)

4. Salary per day x unutilised leave (considering maximum 30 days leave per year)

for every year of completed service – Rs. 1.5 lakh / 30 days = Rs. 5,000 per day x

20 days = Rs. 1 lakh

Hence, total leave encashment of Rs. 1 lakh would be exempt.

Illustration 2: Mr. Karan retired as Advertisement Officer from PVA Private Limited at

the age of 60 years on 10th December 2021. He worked for the company for 30 years and

9 months. As per services rules he received 25 EL every year. In overall service he

availed 240 Days of Leave. His basic pay was 16,000, D.A 8,000 He received 3,55,000 as

Leave Encashment. Kindly calculate the exemption he can claim.

Solution

1. Amount notified by the Government- Rs 3 lakh

2. Actual leave encashment amount – 3,55,000

3. Average salary of last 10 months – 16,000+8,000 =24,000 x10 = 2,40,000

4. Cash equivalent to Earned Leave in credit of Employee at time of retirement

(should not exceed more than 30 days per year) - 24,000/30= 800 per day x 150 =

300000

25x30= 750

1X25=25

Total = 775 Leaves

Less = 240 Leave Availed

Balance at retirement = 535

Leave Encashment = 4,28,000

Exempted = 2,40,000

Taxable : 1,15,000

You might also like

- Problems On Taxable Salary Income-AdditionalDocument24 pagesProblems On Taxable Salary Income-AdditionalBasappaSarkar82% (49)

- IEEM 666 (Industrial Environmental Audits and Impact Assessment) H.W. #1 (Individual Assignment) Student Name: Reg. NumberDocument2 pagesIEEM 666 (Industrial Environmental Audits and Impact Assessment) H.W. #1 (Individual Assignment) Student Name: Reg. NumberAkramBabonjiNo ratings yet

- Payment of GratuityDocument11 pagesPayment of GratuityHari NaamNo ratings yet

- Retirement Benefits: Taxable Limits and ExemptionsDocument38 pagesRetirement Benefits: Taxable Limits and ExemptionsVineet GargNo ratings yet

- QuestionsDocument16 pagesQuestionsAayush SunejaNo ratings yet

- SCDL - PGDBA - Finance - Sem 4 - TaxationDocument23 pagesSCDL - PGDBA - Finance - Sem 4 - Taxationapi-3762419100% (2)

- Income Tax 05Document17 pagesIncome Tax 05AMJAD ULLA RNo ratings yet

- Income Under The Head Salaries: (Section 15 - 17)Document55 pagesIncome Under The Head Salaries: (Section 15 - 17)leela naga janaki rajitha attiliNo ratings yet

- Enhancement in Gratuity Limit Under Payment of Gratuity ActDocument4 pagesEnhancement in Gratuity Limit Under Payment of Gratuity ActPaymaster ServicesNo ratings yet

- IfsalariesDocument53 pagesIfsalariesSiva SankariNo ratings yet

- GratuityDocument7 pagesGratuitySandeep TakNo ratings yet

- Income From SalaryDocument23 pagesIncome From Salaryparthbajaj2703No ratings yet

- 40 40 Income From Salary BTDocument55 pages40 40 Income From Salary BTkiranshingoteNo ratings yet

- Salaxy Examples (Taxation)Document21 pagesSalaxy Examples (Taxation)PARTH NAIKNo ratings yet

- Meaning of Salary': Condition For Charging Income U/H "Salaries"Document21 pagesMeaning of Salary': Condition For Charging Income U/H "Salaries"kiranshingoteNo ratings yet

- Tax On Leave EncashmentDocument2 pagesTax On Leave EncashmentMZNo ratings yet

- Income From Salary: Ca Pranjal Joshi M/s Pranjal Joshi & Co Chartered AccountantsDocument28 pagesIncome From Salary: Ca Pranjal Joshi M/s Pranjal Joshi & Co Chartered AccountantsPriya AgarwalNo ratings yet

- EFFORTS BY-Ravleen Kaur Roll No-01391101818Document8 pagesEFFORTS BY-Ravleen Kaur Roll No-01391101818Harleen KaurNo ratings yet

- 4.2 Home Assignment Questions - Income From SalaryDocument3 pages4.2 Home Assignment Questions - Income From SalaryAashi Gupta100% (1)

- Salary SimplifiedDocument16 pagesSalary SimplifiedaruunstalinNo ratings yet

- Leave EncashmentDocument8 pagesLeave Encashmentcooldude690No ratings yet

- Income From Salary QUESTIONSDocument20 pagesIncome From Salary QUESTIONSSiva SankariNo ratings yet

- Income Tax Salary NotesDocument48 pagesIncome Tax Salary NotesTanya AntilNo ratings yet

- Taxation of Leave SalaryDocument1 pageTaxation of Leave SalaryJPNo ratings yet

- Income From SalaryDocument54 pagesIncome From SalaryMohsin ShaikhNo ratings yet

- Income From SalaryDocument54 pagesIncome From SalaryJyoti Kalotra70% (10)

- Income From SalaryDocument10 pagesIncome From SalaryShubham BajajNo ratings yet

- GratuityDocument3 pagesGratuityTariq MahmoodNo ratings yet

- Salary HeadDocument34 pagesSalary Headrathnamano186No ratings yet

- Incomes On RetirementDocument11 pagesIncomes On RetirementShabnam HabeebNo ratings yet

- Benefits of Government EmployeesDocument2 pagesBenefits of Government EmployeesBitta Saha HridoyNo ratings yet

- Template - Restructuring-Tax Computation-BER-Salary Tracker For FY 2015-16 - CKDocument9 pagesTemplate - Restructuring-Tax Computation-BER-Salary Tracker For FY 2015-16 - CKajaykrsinghpintuNo ratings yet

- Salary IllustrationDocument10 pagesSalary IllustrationSarvar Pathan100% (1)

- Salaries PresentationDocument21 pagesSalaries PresentationDipika PandaNo ratings yet

- Numericals of SalaryDocument7 pagesNumericals of SalaryAnas ShaikhNo ratings yet

- Chapter 4 Income From Salaries: (Sec.15 To 17)Document32 pagesChapter 4 Income From Salaries: (Sec.15 To 17)kiranshingoteNo ratings yet

- Chapter 4 Income From Salaries: (Sec.15 To 17)Document32 pagesChapter 4 Income From Salaries: (Sec.15 To 17)kiranshingoteNo ratings yet

- Retirement Benefits (Theoretical)Document62 pagesRetirement Benefits (Theoretical)Venkatasubbu MadhavanNo ratings yet

- Problems On Income From Salaries: Tax SupplementDocument20 pagesProblems On Income From Salaries: Tax SupplementJkNo ratings yet

- Tax Treatment of Gratuity and Leave Encashment Write UpDocument3 pagesTax Treatment of Gratuity and Leave Encashment Write UpAvinash RajuNo ratings yet

- Lecture 11 GratuityDocument16 pagesLecture 11 GratuityVikas WadmareNo ratings yet

- RIGHT ACCOUTNANCY - Tax Law MCQ Income From Salary QUESTION 06.02.16Document7 pagesRIGHT ACCOUTNANCY - Tax Law MCQ Income From Salary QUESTION 06.02.16Sangeetha AchyuthNo ratings yet

- Retirement Workbook 1Document27 pagesRetirement Workbook 1Pankaj Mathpal100% (1)

- Retirement Workbook 3.2Document31 pagesRetirement Workbook 3.2Tejas Shah83% (6)

- Welcome!: Income Under Head - SalariesDocument66 pagesWelcome!: Income Under Head - SalariesKalpana ChoudharyNo ratings yet

- ITLP (Unit 3) 09-11-2021Document86 pagesITLP (Unit 3) 09-11-2021anushkaNo ratings yet

- 80.deductions or Allowances Allowed To Salaried EmployeeDocument11 pages80.deductions or Allowances Allowed To Salaried Employeehustlerstupid737No ratings yet

- Income Tax LawDocument7 pagesIncome Tax LawPrableen KaurNo ratings yet

- Salary IncomeDocument47 pagesSalary Incomearchana_anuragiNo ratings yet

- Head Salary PDFDocument48 pagesHead Salary PDFRvi MahayNo ratings yet

- Problems On Business/Profession Income: SEM It AssignmentDocument9 pagesProblems On Business/Profession Income: SEM It AssignmentNikhilNo ratings yet

- Lecture 11 Income From Salary - Till Leave SalaryDocument19 pagesLecture 11 Income From Salary - Till Leave Salarynileshshengule12No ratings yet

- AssignmentDocument1 pageAssignmentVivek SharmaNo ratings yet

- GRATUITY BY Pooja MiglaniDocument9 pagesGRATUITY BY Pooja MiglaniBrahamdeep KaurNo ratings yet

- Salaries 3Document2 pagesSalaries 3soumyajeetkundu123No ratings yet

- Questions Case StudyDocument4 pagesQuestions Case StudyKrupa VoraNo ratings yet

- Salary Presentation 1Document56 pagesSalary Presentation 1NIRAVNo ratings yet

- Incone From Salary Ppts - pdf348Document48 pagesIncone From Salary Ppts - pdf348saloniagarwalagarwal3No ratings yet

- How to Reverse Recession and Remove Poverty in India: Prove Me Wrong & Win 10 Million Dollar Challenge Within 60 DaysFrom EverandHow to Reverse Recession and Remove Poverty in India: Prove Me Wrong & Win 10 Million Dollar Challenge Within 60 DaysNo ratings yet

- A Haven on Earth: Singapore Economy Without Duties and TaxesFrom EverandA Haven on Earth: Singapore Economy Without Duties and TaxesNo ratings yet

- The Incentive Plan for Efficiency in Government Operations: A Program to Eliminate Government DeficitsFrom EverandThe Incentive Plan for Efficiency in Government Operations: A Program to Eliminate Government DeficitsNo ratings yet

- PaymentDocument2 pagesPaymentChinmay HarshNo ratings yet

- Regulating Transnational Dissident Cyber EspionageDocument16 pagesRegulating Transnational Dissident Cyber EspionageChinmay HarshNo ratings yet

- Law 9780199231690 E830Document30 pagesLaw 9780199231690 E830Chinmay HarshNo ratings yet

- Ihls Article p331 - 331Document17 pagesIhls Article p331 - 331Chinmay HarshNo ratings yet

- Cyber Attacks MootDocument25 pagesCyber Attacks MootChinmay HarshNo ratings yet

- J 2018 SCC OnLine Tri 112 Devaiah Mdtpartnerscom 20240111 205112 1 6Document6 pagesJ 2018 SCC OnLine Tri 112 Devaiah Mdtpartnerscom 20240111 205112 1 6Chinmay HarshNo ratings yet

- 1666013226Document17 pages1666013226Chinmay HarshNo ratings yet

- UNIT-II - Env Law PrinciplesDocument41 pagesUNIT-II - Env Law PrinciplesChinmay HarshNo ratings yet

- UNIT-I Env Law and Policy Int Developments - All PptsDocument150 pagesUNIT-I Env Law and Policy Int Developments - All PptsChinmay HarshNo ratings yet

- PA INAMDAR CaseDocument3 pagesPA INAMDAR CaseChinmay HarshNo ratings yet

- Final SECULARISM CONCEPT, ORIGIN AND ITS IMPORTANCEDocument18 pagesFinal SECULARISM CONCEPT, ORIGIN AND ITS IMPORTANCEChinmay HarshNo ratings yet

- Issue 3 IismrrDocument7 pagesIssue 3 IismrrChinmay HarshNo ratings yet

- The Subject of Bettale Seve (Nude Worship) at Chandragutti, South IndiaDocument9 pagesThe Subject of Bettale Seve (Nude Worship) at Chandragutti, South IndiapankajdharmadhikariNo ratings yet

- Tamil Nadu Rera (General) Regulations, 2018Document7 pagesTamil Nadu Rera (General) Regulations, 2018Chinmay HarshNo ratings yet

- NCWA I To XIDocument1 pageNCWA I To XIRohit GoswamiNo ratings yet

- CC-308 Industrial Law 2022Document2 pagesCC-308 Industrial Law 2022Prem BhojwaniNo ratings yet

- Labor Law in Pakistan Is Broad and Contains Several OrdinancesDocument9 pagesLabor Law in Pakistan Is Broad and Contains Several OrdinancesQueen CancerianNo ratings yet

- Safety Data Sheet: TR Requisition NR: 0856417013 Doc. Number: FAC10005-CHI-000-PCS-DTS-0001 Rev: Sheet 7 of 23Document5 pagesSafety Data Sheet: TR Requisition NR: 0856417013 Doc. Number: FAC10005-CHI-000-PCS-DTS-0001 Rev: Sheet 7 of 23Bn BnNo ratings yet

- Entitlement to Benefits Language/ भाषाDocument2 pagesEntitlement to Benefits Language/ भाषाinfoprincemachinesNo ratings yet

- Chapter 8 IR MALAYSIADocument25 pagesChapter 8 IR MALAYSIAadibaumairahNo ratings yet

- 2020 Calendar PDFDocument12 pages2020 Calendar PDFHaneef ShaikNo ratings yet

- Standard Bank Chartered Employees Union v. Confesor, G.R. No. 114974 (2004)Document2 pagesStandard Bank Chartered Employees Union v. Confesor, G.R. No. 114974 (2004)rudilyn.palero9No ratings yet

- Method Statement and HIRAC Guide Ao 061024Document12 pagesMethod Statement and HIRAC Guide Ao 061024Kim Ryan PomarNo ratings yet

- SDS PS Afff A3f1hec - Msa3f1%Document8 pagesSDS PS Afff A3f1hec - Msa3f1%Cristobal HernandezNo ratings yet

- Job Safety Analysis (Jsa) and Risk Assessment FormDocument2 pagesJob Safety Analysis (Jsa) and Risk Assessment FormHery KurniawanNo ratings yet

- Trade Union Case StudyDocument2 pagesTrade Union Case Studysananda_sikdar100% (3)

- The Differences and Similarities Between IHRM and HRMDocument16 pagesThe Differences and Similarities Between IHRM and HRMMohamed SobahNo ratings yet

- Practice Occupational Health and Safety Procedures (Dressmaking)Document47 pagesPractice Occupational Health and Safety Procedures (Dressmaking)Arjerene Gador Dela Cruz100% (5)

- Resource Manager Resource Manager: EconomicsDocument16 pagesResource Manager Resource Manager: EconomicsPLAYVONo ratings yet

- Strikes and Lockouts (Labor Review)Document6 pagesStrikes and Lockouts (Labor Review)Lois DNo ratings yet

- 04 - Labour Law Health and SafetyDocument2 pages04 - Labour Law Health and SafetyBhavya RayalaNo ratings yet

- 4 Billboard PDFDocument1 page4 Billboard PDFIvan BaracNo ratings yet

- Collective Bargaining and Labour Relations: Lecture-9Document75 pagesCollective Bargaining and Labour Relations: Lecture-9Promiti SarkerNo ratings yet

- Test OhsDocument1 pageTest OhsTracy Faye A. SalinasNo ratings yet

- Employee Movement Form.v01 - Recg - Mohamed Adam Izhar Bin Mohamed RidzwanDocument1 pageEmployee Movement Form.v01 - Recg - Mohamed Adam Izhar Bin Mohamed RidzwanXiao Minn NeohNo ratings yet

- Commercial Proposal - Hans HR - 05.12 (UAE)Document3 pagesCommercial Proposal - Hans HR - 05.12 (UAE)JOhnNo ratings yet

- Night Shift Differential: Article 86Document12 pagesNight Shift Differential: Article 86jeongchaeng no jam brotherNo ratings yet

- Job Hazard Analysis: OSHA 3071 2002 (Revised)Document50 pagesJob Hazard Analysis: OSHA 3071 2002 (Revised)slamet suryantoNo ratings yet

- Question Paper MIR PDFDocument2 pagesQuestion Paper MIR PDFManoj KumarNo ratings yet

- FORM 10 - Government Safety Engineer's Accident Investigation ReportDocument1 pageFORM 10 - Government Safety Engineer's Accident Investigation ReportTomas del RosarioNo ratings yet

- Employee'S Daily Time Record Employee'S Daily Time Record: Reynaldo Dinglasan Reynaldo DinglasanDocument1 pageEmployee'S Daily Time Record Employee'S Daily Time Record: Reynaldo Dinglasan Reynaldo DinglasanIstib Adriatico AlcanciaNo ratings yet

- Chapter 10 Understanding Labour Relations and Collective Bargaining PDFDocument24 pagesChapter 10 Understanding Labour Relations and Collective Bargaining PDFSung-il LeeNo ratings yet

- Santa Rosa Coca Cola Plant Employee Union Vs Coca Cola BottlersDocument3 pagesSanta Rosa Coca Cola Plant Employee Union Vs Coca Cola BottlersRuth Hazel GalangNo ratings yet