Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

10 viewsOI Losers (Calls) Options Trends and Screener For NSE Contracts Expiring On 28 Dec, 2023

OI Losers (Calls) Options Trends and Screener For NSE Contracts Expiring On 28 Dec, 2023

Uploaded by

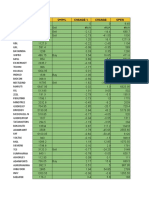

jeyventThe document provides stock information for various companies, including the symbol, type of contract, strike price, daily percentage change in price, volume of contracts, and more. It contains data on call option contracts for over 50 companies traded on the stock market. The highest volumes are for call options on ICICIBANK, INFY, GMRINFRA, HCLTECH and RBLBANK. The largest daily percentage gains are seen in the call options for GMRINFRA, MPHASIS and COFORGE, while the biggest falls are for ADANIENT, COALINDIA and POLYCAB.

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

You might also like

- L4-M1 ProcScope PPT 6-19Document226 pagesL4-M1 ProcScope PPT 6-19Sorna Khan100% (3)

- INSTRUCTION: Answer ALL Questions. PART A: 50 Marks (30 %)Document18 pagesINSTRUCTION: Answer ALL Questions. PART A: 50 Marks (30 %)haslizul hashimNo ratings yet

- Understanding Contract-Law and You WinDocument4 pagesUnderstanding Contract-Law and You WinRhonda Peoples100% (7)

- Ym0654 Tax - PNL 2019 04 01 2020 03 31Document52 pagesYm0654 Tax - PNL 2019 04 01 2020 03 31Jayachandra JcNo ratings yet

- OI Losers (Puts) Options Trends and Screener For NSE Contracts Expiring On 28 Dec, 2023Document15 pagesOI Losers (Puts) Options Trends and Screener For NSE Contracts Expiring On 28 Dec, 2023jeyventNo ratings yet

- Technical Morning - Call - 120922 PDFDocument5 pagesTechnical Morning - Call - 120922 PDFSomeone 4780No ratings yet

- Symbol Open Dayhigh Daylow Lastprice Previousclose ChangeDocument4 pagesSymbol Open Dayhigh Daylow Lastprice Previousclose ChangeVijayNo ratings yet

- Cam PivotDocument30 pagesCam PivotshipdellogNo ratings yet

- DojiDocument11 pagesDojiJaikumar KrishnaNo ratings yet

- Index Movement:: National Stock Exchange of India LimitedDocument37 pagesIndex Movement:: National Stock Exchange of India LimitedJayant SharmaNo ratings yet

- All Bse Share PricesDocument52 pagesAll Bse Share Pricesvishalsharma8522No ratings yet

- Sr. Symbol Price Triangle Breakout TMC PIN BPC BPCDocument6 pagesSr. Symbol Price Triangle Breakout TMC PIN BPC BPCAvinash GaikwadNo ratings yet

- Most Active by Contracts Futures Trends and Screener For NSE Contracts Expiring On 28 Dec, 2023Document8 pagesMost Active by Contracts Futures Trends and Screener For NSE Contracts Expiring On 28 Dec, 2023jeyventNo ratings yet

- NsemarginDocument5 pagesNsemarginBhupesh KumarNo ratings yet

- S&P CNX N Ifty Banknifty: Name Previous Current 5 Day Price Close 5MADocument17 pagesS&P CNX N Ifty Banknifty: Name Previous Current 5 Day Price Close 5MArchawdhry123No ratings yet

- Most Active by Contracts Options Trends and Screener For NSE Contracts Expiring On 10 Nov, 2022Document15 pagesMost Active by Contracts Options Trends and Screener For NSE Contracts Expiring On 10 Nov, 2022chintu_kayNo ratings yet

- Live Nse StocksDocument4 pagesLive Nse StocksP.r.sarmaNo ratings yet

- Bel Lalpathlab Cub L&TFH Maruti: Symbol Open Dayhigh Daylow Lastprice Previousclose Change PchangeDocument8 pagesBel Lalpathlab Cub L&TFH Maruti: Symbol Open Dayhigh Daylow Lastprice Previousclose Change PchangeVijayNo ratings yet

- Doji 6Document51 pagesDoji 6jayakumar krishnaNo ratings yet

- Scripcode LTP Diff Industry TTQ Perc High PreclsDocument4 pagesScripcode LTP Diff Industry TTQ Perc High PreclsshahedNo ratings yet

- Index Movement:: National Stock Exchange of India LimitedDocument27 pagesIndex Movement:: National Stock Exchange of India LimitedjanuianNo ratings yet

- B2Document14 pagesB2marathi techNo ratings yet

- UntitledDocument22 pagesUntitledvineetNo ratings yet

- Daily Stock Check ListDocument7 pagesDaily Stock Check ListvineetksrNo ratings yet

- F&O MarginDocument5 pagesF&O MarginPrashant QuoraNo ratings yet

- Futures Trading Futures Trends - Most Active by ContractsDocument8 pagesFutures Trading Futures Trends - Most Active by ContractssudhakarrrrrrNo ratings yet

- Hasil OasisDocument38 pagesHasil OasisUna MarnainNo ratings yet

- Price Index: Company Name Open High LOW Close Last Company Name Previous Close Total TurnoverDocument50 pagesPrice Index: Company Name Open High LOW Close Last Company Name Previous Close Total Turnovervishalsharma8522No ratings yet

- Shares HIGH LOW SignalDocument10 pagesShares HIGH LOW SignalYASH DOSHINo ratings yet

- Market StructureDocument3 pagesMarket StructurevishwagubbitraderNo ratings yet

- (1953) Mathematical Formula For Market PredictionsDocument32 pages(1953) Mathematical Formula For Market PredictionsRavi VarakalaNo ratings yet

- 18th Expiry DataDocument1,147 pages18th Expiry DatachinnaNo ratings yet

- 13th September DataDocument10 pages13th September DataAceNo ratings yet

- Change in Stocks After Fall in Market Dec-2021Document2 pagesChange in Stocks After Fall in Market Dec-2021Devashish PisalNo ratings yet

- Faisalshafique Tax Information 2018Document60 pagesFaisalshafique Tax Information 2018Zonal AccountantNo ratings yet

- Open High Low LTP CHNG TradeDocument33 pagesOpen High Low LTP CHNG TradeAnand ChineyNo ratings yet

- F & O Margin Dated: November 26, 2010: Symbol Lotsize Spanmargin Exposure Margin Total Margin Span % Exposure Margin%Document10 pagesF & O Margin Dated: November 26, 2010: Symbol Lotsize Spanmargin Exposure Margin Total Margin Span % Exposure Margin%akkhan01No ratings yet

- Skrip Name Tran Quantity: Client Id: N147669 Client Name: Shourya Mohan Asset Class: EquityDocument12 pagesSkrip Name Tran Quantity: Client Id: N147669 Client Name: Shourya Mohan Asset Class: EquityDeepanjaliNo ratings yet

- Equity Report 10 July To 14 JulyDocument6 pagesEquity Report 10 July To 14 JulyzoidresearchNo ratings yet

- Nifty 100 - Expected Returns (Holding Period of 6-8weeks)Document2 pagesNifty 100 - Expected Returns (Holding Period of 6-8weeks)Sathv100% (1)

- Gann Square of 9 CalculatorDocument15 pagesGann Square of 9 CalculatorSantosh ThakurNo ratings yet

- B4 TStock SelectionDocument9 pagesB4 TStock SelectionMunish GuptaNo ratings yet

- Daily F & O StocksDocument7 pagesDaily F & O StocksMantha Devi SuryanarayanaNo ratings yet

- Collected Data ADocument504 pagesCollected Data Aአስምሮ ላቂያዉNo ratings yet

- B4T07STOCKSDocument4 pagesB4T07STOCKSPrakash BatwalNo ratings yet

- Ticker LTP O H L Change % Change OpenDocument22 pagesTicker LTP O H L Change % Change OpenPrasanna PharaohNo ratings yet

- Ipod Tanggal 22 Agustus 2022Document38 pagesIpod Tanggal 22 Agustus 2022baniNo ratings yet

- Zest MotorPriceList 2012Document44 pagesZest MotorPriceList 2012Conrad Hendrik De KockNo ratings yet

- LTE - Requirment 5Mhz10Mhz - 15 - Cities-V2Document41 pagesLTE - Requirment 5Mhz10Mhz - 15 - Cities-V2Osazuwa OmoiguiNo ratings yet

- MGMLDocument2 pagesMGMLkashinath09No ratings yet

- Share Market PricesDocument52 pagesShare Market Pricesvishalsharma8522No ratings yet

- Symbol Open Dayhigh Daylow Lastprice Previousclose ChangeDocument4 pagesSymbol Open Dayhigh Daylow Lastprice Previousclose ChangeVijayNo ratings yet

- Papaf - 2007 Election Projections - 9/21 FridayDocument3 pagesPapaf - 2007 Election Projections - 9/21 Fridaypapaf100% (5)

- 01042010Document9 pages01042010Kishore KunduNo ratings yet

- F&O Daily Margin12Document5 pagesF&O Daily Margin12ayon hazraNo ratings yet

- 1 Month SharpeDocument22 pages1 Month SharpeYadhakishore SiripurapuNo ratings yet

- Form Test Log MinMaxDocument4 pagesForm Test Log MinMaxridwaniyasNo ratings yet

- F&OAnalysis 20 May 21Document8 pagesF&OAnalysis 20 May 21Siddharth TripathiNo ratings yet

- 1 Month SharpeDocument49 pages1 Month SharpeYadhakishore SiripurapuNo ratings yet

- Idpel Nama KDDK Tarif Daya FKMKWH SlalwbpDocument2 pagesIdpel Nama KDDK Tarif Daya FKMKWH SlalwbpandialviannorNo ratings yet

- Work Stock Market Sheet LatestDocument4 pagesWork Stock Market Sheet Latestanand kumar chaubeyNo ratings yet

- Equity Report 26 June To 30 JuneDocument6 pagesEquity Report 26 June To 30 JunezoidresearchNo ratings yet

- United States Census Figures Back to 1630From EverandUnited States Census Figures Back to 1630No ratings yet

- OI Gainers (Calls) Options Trends and Screener For NSE Contracts Expiring On 28 Dec, 2023Document15 pagesOI Gainers (Calls) Options Trends and Screener For NSE Contracts Expiring On 28 Dec, 2023jeyventNo ratings yet

- OI Gainers (Puts) Options Trends and Screener For NSE Contracts Expiring On 28 Dec, 2023Document15 pagesOI Gainers (Puts) Options Trends and Screener For NSE Contracts Expiring On 28 Dec, 2023jeyventNo ratings yet

- Exhibition Stand Brief Sheet - Business DevelopmentDocument5 pagesExhibition Stand Brief Sheet - Business DevelopmentjeyventNo ratings yet

- Client Address For ToaGosei Mission Feb'11Document2 pagesClient Address For ToaGosei Mission Feb'11jeyventNo ratings yet

- Arif Chips IndustriesDocument1 pageArif Chips IndustriesjeyventNo ratings yet

- Sekon Principles of Business Agreement 2015Document5 pagesSekon Principles of Business Agreement 2015Ali HajassdolahNo ratings yet

- Cost Acc BBA VDocument3 pagesCost Acc BBA VHamza TariqNo ratings yet

- WP 243Document87 pagesWP 243instt_engNo ratings yet

- ANKIT MEHTA BLACK BOOK Effects of Mergers and Acquisitions With Special Reference To Vodafone and IdeaDocument76 pagesANKIT MEHTA BLACK BOOK Effects of Mergers and Acquisitions With Special Reference To Vodafone and IdeaUjjwal Joseph fernandedNo ratings yet

- Assignment 3Document7 pagesAssignment 3Dat DoanNo ratings yet

- Seven Facets of Modern Category Management: 1. Real Customer Centricity-Walk A Mile in Your Customer's ShoesDocument4 pagesSeven Facets of Modern Category Management: 1. Real Customer Centricity-Walk A Mile in Your Customer's ShoesPriyanshu MishraNo ratings yet

- Accounting Policies, Changes in Accounting Estimates and ErrorsDocument23 pagesAccounting Policies, Changes in Accounting Estimates and ErrorsFery AnnNo ratings yet

- Teresita Gandiongco Oledan For Petitioner. Acaban & Sabado For Private RespondentDocument3 pagesTeresita Gandiongco Oledan For Petitioner. Acaban & Sabado For Private Respondentwenny capplemanNo ratings yet

- COVID 19 S Impact On Globalization and InnovationDocument7 pagesCOVID 19 S Impact On Globalization and InnovationRabiya TungNo ratings yet

- Sapp Balancing Market: Traders and Controllers Training - Day 1Document69 pagesSapp Balancing Market: Traders and Controllers Training - Day 1Addie Hatisari DandaNo ratings yet

- Resource 1 - IndoAust Jaya - CRM Project BriefDocument25 pagesResource 1 - IndoAust Jaya - CRM Project BriefRahmi Can ÖzmenNo ratings yet

- Marketing Management: Business Studies Project - 1 Yashvi Bothra 12413 7891372295Document34 pagesMarketing Management: Business Studies Project - 1 Yashvi Bothra 12413 7891372295Geetika Jain100% (2)

- Executors Guide Digital Will Guide PackDocument6 pagesExecutors Guide Digital Will Guide PackOneNationNo ratings yet

- Forecasting and PurchasingDocument25 pagesForecasting and PurchasingPartha Pratim SenguptaNo ratings yet

- Stucture of Financial Sector of PakistanDocument5 pagesStucture of Financial Sector of PakistanSYEDWASIQABBAS RIZVINo ratings yet

- 467 - Age222-Introduction To Farm Machinery-2unitsDocument8 pages467 - Age222-Introduction To Farm Machinery-2unitsAnonymous 1XBCMXNo ratings yet

- Notre Dame Vs LaguesmaDocument2 pagesNotre Dame Vs LaguesmaClarence ProtacioNo ratings yet

- FAR 4202 Discontinued Operation NCA Held For SaleDocument4 pagesFAR 4202 Discontinued Operation NCA Held For SaleMaximusNo ratings yet

- Fco Oficial Company Brahm Inc...Document9 pagesFco Oficial Company Brahm Inc...Phill BonatoNo ratings yet

- ICAEW - Chapter 6 - Control Accounts Errors and Suspense AccountsDocument21 pagesICAEW - Chapter 6 - Control Accounts Errors and Suspense Accountsvothituongnhi7703No ratings yet

- Project ReportDocument48 pagesProject ReportMalharNo ratings yet

- Paranginan Partners Tax Law FirmDocument5 pagesParanginan Partners Tax Law FirmBram SostenesNo ratings yet

- Tax Invoice - 2555703 - 1686188896465Document1 pageTax Invoice - 2555703 - 1686188896465Ivy GaudicosNo ratings yet

- RMC No. 111-2022 AttachmentDocument1 pageRMC No. 111-2022 AttachmentPaulus PacanaNo ratings yet

- CAPE Communication Studies 2012 P2 PDFDocument6 pagesCAPE Communication Studies 2012 P2 PDFGayatrie BhagalooNo ratings yet

- GR 75037 Tanduay V NLRCDocument2 pagesGR 75037 Tanduay V NLRCKathlene JaoNo ratings yet

- Company Profile - BravoFabsDocument14 pagesCompany Profile - BravoFabssong.anarNo ratings yet

OI Losers (Calls) Options Trends and Screener For NSE Contracts Expiring On 28 Dec, 2023

OI Losers (Calls) Options Trends and Screener For NSE Contracts Expiring On 28 Dec, 2023

Uploaded by

jeyvent0 ratings0% found this document useful (0 votes)

10 views15 pagesThe document provides stock information for various companies, including the symbol, type of contract, strike price, daily percentage change in price, volume of contracts, and more. It contains data on call option contracts for over 50 companies traded on the stock market. The highest volumes are for call options on ICICIBANK, INFY, GMRINFRA, HCLTECH and RBLBANK. The largest daily percentage gains are seen in the call options for GMRINFRA, MPHASIS and COFORGE, while the biggest falls are for ADANIENT, COALINDIA and POLYCAB.

Original Description:

Original Title

OI Losers (Calls) Options Trends and Screener for NSE contracts expiring on 28 Dec, 2023

Copyright

© © All Rights Reserved

Available Formats

XLSX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document provides stock information for various companies, including the symbol, type of contract, strike price, daily percentage change in price, volume of contracts, and more. It contains data on call option contracts for over 50 companies traded on the stock market. The highest volumes are for call options on ICICIBANK, INFY, GMRINFRA, HCLTECH and RBLBANK. The largest daily percentage gains are seen in the call options for GMRINFRA, MPHASIS and COFORGE, while the biggest falls are for ADANIENT, COALINDIA and POLYCAB.

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

Download as xlsx, pdf, or txt

0 ratings0% found this document useful (0 votes)

10 views15 pagesOI Losers (Calls) Options Trends and Screener For NSE Contracts Expiring On 28 Dec, 2023

OI Losers (Calls) Options Trends and Screener For NSE Contracts Expiring On 28 Dec, 2023

Uploaded by

jeyventThe document provides stock information for various companies, including the symbol, type of contract, strike price, daily percentage change in price, volume of contracts, and more. It contains data on call option contracts for over 50 companies traded on the stock market. The highest volumes are for call options on ICICIBANK, INFY, GMRINFRA, HCLTECH and RBLBANK. The largest daily percentage gains are seen in the call options for GMRINFRA, MPHASIS and COFORGE, while the biggest falls are for ADANIENT, COALINDIA and POLYCAB.

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

Download as xlsx, pdf, or txt

You are on page 1of 15

SYMBOL TYPE STRIKE PRICE %DAY CHANGE VOLUMECONTRACTS

ICICIBANK Call 1000 28.3 29.52 20351

INFY Call 1480 37.85 47.56 18129

GMRINFRA Call 65 6.05 266.67 13569

HCLTECH Call 1350 41.05 90.93 10745

RBLBANK Call 260 17.4 68.12 8548

INFY Call 1470 44.15 44.52 7333

TCS Call 4000 6.35 8.55 7181

JSWSTEEL Call 830 30.4 60.42 6912

GMRINFRA Call 60 10.1 176.71 6703

ADANIENT Call 3300 58.95 -33.31 6386

COALINDIA Call 370 4.35 -16.35 6042

HDFCBANK Call 1630 42.9 53.49 5209

ICICIBANK Call 1005 25.5 31.78 4964

GMRINFRA Call 62 8.4 200 3835

MPHASIS Call 2400 105.5 16.06 3674

POLYCAB Call 6000 27.9 -20.4 3669

COFORGE Call 5700 240.7 14.27 3385

INFY Call 1450 59 39.15 3373

LT Call 3380 71 11.46 3332

GMRINFRA Call 63 7.55 221.28 3055

LICHSGFIN Call 520 24.35 33.06 2896

HDFCBANK Call 1620 51.5 53.05 2878

GMRINFRA Call 64 6.8 240 2822

POLYCAB Call 5450 154.7 -6.1 2762

RBLBANK Call 250 24.25 57.47 2725

AARTIIND Call 580 16.1 -22.97 2682

DABUR Call 550 10.75 3.37 2577

LTIM Call 5600 235.5 30.36 2476

WIPRO Call 410 19.15 18.94 2443

ADANIPORTS Call 1120 21.1 -32.91 2377

CHOLAFIN Call 1140 55.35 55.92 2279

DEEPAKNTR Call 2260 53 -37.57 2228

LTIM Call 5650 206 31 2154

JINDALSTEL Call 680 25.5 1.8 1998

LT Call 3360 82.8 12.12 1967

INDIGO Call 2940 66.3 -3.91 1877

ESCORTS Call 3700 7.4 -60.43 1834

BSOFT Call 650 27.3 -4.04 1816

HCLTECH Call 1330 55.05 78.16 1770

RBLBANK Call 255 20.5 63.35 1711

CROMPTON Call 310 5.65 -32.74 1710

HINDCOPPER Call 180 10.7 0 1642

PERSISTENT Call 6300 282.9 38.85 1635

ADANIPORTS Call 1130 19.75 -31.9 1449

BPCL Call 440 34.65 -14.23 1429

LTIM Call 6100 56 35.76 1422

TATAPOWER Call 310 21.7 -12.32 1414

CANBK Call 445 10.5 -1.41 1408

WIPRO Call 417.5 13.7 19.13 1339

NMDC Call 199 2.4 -20 1251

CONCOR Call 820 40.5 -16.92 1153

HAVELLS Call 1400 16.65 -23.27 1136

BRITANNIA Call 5100 39 -37.6 1129

TITAN Call 3580 96.75 27.05 1100

APOLLOHOSP Call 5450 198 13.24 1081

HAL Call 2650 165 8.23 1030

LICHSGFIN Call 525 21.55 34.69 962

HDFCBANK Call 1610 59.2 47.08 956

IRCTC Call 720 41.5 -18.15 934

LTIM Call 5500 302.35 29.9 920

COALINDIA Call 372.5 3.85 -18.09 914

TORNTPHARM Call 2200 18.95 -47.87 883

TCS Call 3580 93.4 3.15 861

BHARATFORG Call 1250 11.3 -10.32 845

PNB Call 84 4.85 -11.01 821

IEX Call 168 2.5 -45.05 811

BSOFT Call 655 25.5 -1.92 791

MGL Call 1150 43 -24.16 774

LICHSGFIN Call 510 31.4 33.9 743

RECLTD Call 395 23.65 36.71 740

TATAPOWER Call 315 18.55 -13.72 734

TITAN Call 3560 110.95 27.16 715

SBILIFE Call 1480 26.9 0.37 685

INFY Call 1400 102.65 25.95 667

ZEEL Call 270 17 20.14 589

VEDL Call 235 14.7 -18.78 585

LICHSGFIN Call 500 39.2 31.76 559

JINDALSTEL Call 670 31.5 2.44 558

TATACONSUM Call 980 8.25 -24.66 556

INDIGO Call 2880 99.95 6.05 523

ATUL Call 7500 36.5 -44.7 522

APOLLOHOSP Call 5400 230.5 13.05 519

ICICIBANK Call 950 69.55 21.38 501

AARTIIND Call 620 5.25 -32.69 489

NATIONALUM Call 100 2.45 -35.53 474

RECLTD Call 397.5 22.1 35.58 467

HCLTECH Call 1320 62.85 72.19 445

COALINDIA Call 352.25 9.6 -15.04 435

INDIACEM Call 250 27.5 36.48 429

LTIM Call 5550 269.25 31.31 425

KOTAKBANK Call 1810 57.95 28.07 424

INDIGO Call 2800 149.65 7.31 422

HCLTECH Call 1490 4.55 175.76 421

TATAPOWER Call 317.5 17.2 -14.64 420

PNB Call 83 5.45 -9.92 406

LT Call 3320 110.45 12.99 394

IDFCFIRSTB Call 97 0.75 0 381

IRCTC Call 795 10.7 -37.97 375

SBIN Call 550 67.8 3.2 352

MRF Call 119000 1950 -1.54 347

LICHSGFIN Call 515 27.8 33.98 344

HINDCOPPER Call 175 14.3 6.32 343

POWERGRID Call 215 15.55 -9.86 342

BALRAMCHIN Call 420 9 -46.9 315

ACC Call 2220 46.6 -18.03 307

CANBK Call 410 33.1 2.8 299

COFORGE Call 5600 301.85 14.27 298

JKCEMENT Call 4000 65 -6.47 290

DEEPAKNTR Call 2320 35.9 -38.79 277

TATASTEEL Call 144 0.55 -8.33 274

MPHASIS Call 2380 118 17.06 270

MPHASIS Call 2360 126.65 13.69 264

HINDCOPPER Call 170 18.6 12.05 263

TATACHEM Call 960 49.8 -24.14 251

HINDCOPPER Call 182.5 9.8 3.7 249

TATAMOTORS Call 640 79.5 -11.67 246

ULTRACEMCO Call 10200 23.8 -12.18 237

TCS Call 3920 8.45 3.05 236

AARTIIND Call 585 14 -24.73 224

HAVELLS Call 1300 60.5 -13.76 224

LICHSGFIN Call 505 35.9 34.96 191

BPCL Call 435 39.3 -11.09 188

BALRAMCHIN Call 430 6.5 -51.13 186

LTTS Call 4850 202.05 -3.76 184

BAJFINANCE Call 8150 11.6 -20.82 178

BALRAMCHIN Call 470 2.1 -56.25 173

AXISBANK Call 1090 56.25 19.94 172

TATAPOWER Call 270 55.25 -4.82 165

CANFINHOME Call 870 8 -33.05 164

TATAPOWER Call 295 33.1 -8.31 160

POLYCAB Call 5000 469.2 -2.87 158

DRREDDY Call 6050 43.75 -25.85 158

LTTS Call 5050 111.25 -6.83 143

TATAPOWER Call 302.5 27 -10.6 111

RAMCOCEM Call 1000 47.1 -7.74 107

ACC Call 2320 27.5 -18.76 107

TATAPOWER Call 307.5 22.8 -13.8 97

BANDHANBNK Call 252.5 3.3 -12 96

MRF Call 121000 1064.55 -19.71 96

GAIL Call 132 10.3 -13.45 94

HCLTECH Call 1310 69.25 62.56 91

HAVELLS Call 1460 7.25 -27.86 88

IDFC Call 129 1.35 -3.57 87

BALRAMCHIN Call 410 12.15 -42.96 85

BALRAMCHIN Call 400 13.35 -50.92 85

HINDCOPPER Call 177.5 13.3 16.16 84

TVSMOTOR Call 1840 85.6 -16.89 76

DABUR Call 610 1.05 5 71

DIVISLAB Call 4150 10.15 -33 71

GRASIM Call 1980 103.8 -12.48 69

TECHM Call 1390 2.95 7.27 69

BSOFT Call 715 5.05 -32.21 62

LAURUSLABS Call 375 19.8 -16.81 56

JUBLFOOD Call 625 1.85 -30.19 55

PVRINOX Call 1860 17.25 -11.54 48

BALRAMCHIN Call 425 8 -46.67 45

POLYCAB Call 5150 358.85 1.97 45

BHARTIARTL Call 960 48.85 -4.31 43

IGL Call 465 1.7 -39.29 41

CANBK Call 380 62.15 5.43 38

ONGC Call 212 1.05 -38.24 35

BANDHANBNK Call 277.5 0.75 0 33

ABFRL Call 225 12.9 -31.56 33

ASHOKLEY Call 160 16.8 -6.67 30

HINDPETRO Call 372.5 17.95 -22.8 30

BALRAMCHIN Call 415 8.75 -55.01 28

MCDOWELL-N Call 1250 0.7 -68.89 26

TORNTPHARM Call 2120 39 -40.73 25

ASTRAL Call 2300 3 -38.78 25

NATIONALUM Call 111 0.5 -58.33 24

INDUSTOWER Call 172.5 20.4 -9.13 23

GAIL Call 159 1 -25.93 20

INDIACEM Call 285 9.35 139.74 19

BPCL Call 502.5 4.3 -36.76 18

SBICARD Call 710 54.55 -19.36 18

OBEROIRLTY Call 1430 56 -21.46 17

EXIDEIND Call 282.5 13.05 -26.27 15

BIOCON Call 227.5 14.9 -17.45 14

ADANIPORTS Call 750 276 -6.28 12

ALKEM Call 5250 20.1 -55.92 12

BALRAMCHIN Call 405 11.55 -51.77 11

MOTHERSON Call 89 7.25 16.94 9

EXIDEIND Call 312.5 2.35 -42.68 9

BIOCON Call 225 15.9 -21.29 8

ICICIPRULI Call 520 29 -17.14 8

TRENT Call 3040 19.55 -40.67 8

PETRONET Call 237.5 0.6 -53.85 7

GUJGASLTD Call 510 0.9 -53.85 7

INDIGO Call 2780 164.2 20.16 7

GRANULES Call 365 29.45 -24.39 6

NMDC Call 174 12.05 -13.62 5

BPCL Call 512.5 4.7 0 5

ABCAPITAL Call 192.5 0.5 -16.67 5

GUJGASLTD Call 410 35.95 -3.36 5

LAURUSLABS Call 365 30.45 -4.09 4

MCX Call 3080 220 3.38 4

AUBANK Call 690 57.8 0 4

M&MFIN Call 235 36.9 17.89 3

CHOLAFIN Call 1080 86.5 13.59 3

METROPOLIS Call 1660 62 -4.62 2

OI Losers (Calls) Options Trends and Screener for NSE contracts expiring on 28 Dec, 2023

%VOLUMECONTRACTS TTV OI OI Change %OI IV %IV

57.85 333206923 3458700 -1292900 -27.21 21.57 0.86

219.74 231833652 713200 -408800 -36.43 20.8 -1.49

397.03 653347350 12813750 -4398750 -25.56 58.03 19.52

762.36 260093470 420000 -148400 -26.11 24.19 5.98

-0.86 324610300 1970000 -2115000 -51.77 51.4 7.7

59.27 107853764 516000 -473600 -47.86 20.98 -1.3

40.61 7841652 606025 -241850 -28.52 26.35 1.64

403.06 150698880 304425 -198450 -39.46 30.49 6.13

1235.26 508254975 6390000 -3926250 -38.06 66.61 50.2

-5.71 122400462 663900 -239400 -26.5 76.47 -5.15

97.52 72703386 2956800 -1020600 -25.66 32.81 -3.48

-34.09 103682540.5 856900 -358050 -29.47 16.77 6.9

95.82 70538440 373800 -132300 -26.14 21.7 1.66

243.02 213130125 3510000 -3735000 -51.55 62.93 30.88

9.77 109218835 177100 -101200 -36.36 38.49 -0.27

-16.99 13483575 100200 -41200 -29.14 34.4 -7.82

60.2 133187902.5 62700 -56250 -47.29 34.46 -6.05

48.46 68067140 387600 -262400 -40.37 22.04 0.72

37.29 80557764 65700 -64200 -49.42 20.78 -3.6

200.39 164970000 2801250 -3960000 -58.57 60.48 26

-64.3 146421760 766000 -1404000 -64.7 33.22 -8.44

-44.12 68634544 711150 -238150 -25.09 18.07 15.06

262.26 142546275 1395000 -2137500 -60.51 59.55 22.25

-29.56 49456372 45400 -32300 -41.57 28.84 -11.77

-47.61 142381250 2405000 -1525000 -38.8 53.42 11.97

75.64 43636140 1183000 -415000 -25.97 37.57 -6.44

308.4 42488287.5 900000 -263750 -22.66 21.5 -1.54

121.86 85061742 73050 -29850 -29.01 30.92 -11.69

71.8 60281025 2253000 -754500 -25.09 27.44 3.65

-4.77 40047696 338400 -376800 -52.68 55.98 -7.66

132.79 58114500 233125 -111250 -32.3 35.37 10.66

79.1 44749380 205500 -78000 -27.51 33.51 -10.47

221.49 65602224 21750 -28950 -57.1 30.88 -11.42

133.41 72427500 616250 -321250 -34.27 32.78 -1.29

-15.4 53705001 97500 -69000 -41.44 21.11 -2.71

-56.99 47187780 107400 -58800 -35.38 29.82 -10.18

109.12 4352540.5 120450 -97625 -44.77 42.01 -1.08

-33.67 51501760 727000 -338000 -31.74 35.94 -8.15

95.58 58517970 203700 -174300 -46.11 25.35 9.63

-56.92 76053950 1027500 -985000 -48.94 51.53 9.46

-38.38 25085700 1053000 -327600 -23.73 34.01 -14.71

14.66 118007256 1743700 -985800 -36.12 39.45 -21.93

240.62 71425383.75 37975 -22750 -37.46 29.13 -6.28

42.62 20158488 281600 -122400 -30.3 57.11 -6.35

1300.98 91956150 826200 -882000 -51.63 29.76 -19.07

239.38 13892229 39600 -25800 -39.45 33.68 -7.15

-95.12 111097980 2487375 -745875 -23.07 44.34 -8.81

32.83 37369728 788400 -302400 -27.72 31.07 -8.03

-28.89 24041745 345000 -190500 -35.57 25.65 -0.55

751.02 20716560 202500 -337500 -62.5 42.69 -5.2

-80.74 53960400 264000 -278000 -51.29 32.63 -25.15

-43.31 10610240 254500 -85000 -25.04 28.97 -5.92

44.37 12694476 54800 -15000 -21.49 19.77 4.69

-36.82 36712500 39375 -30375 -43.55 16.77 -13.27

39.48 24392765 13000 -13250 -50.48 24.47 -19.54

-44.68 52795740 93300 -34200 -26.82 44.82 -9.53

-31.97 43059120 206000 -272000 -56.9 33.6 -7.54

12.74 27536146 249150 -159500 -39.03 18.4 15.65

-33.95 36620972.5 733250 -259875 -26.17 31.72 -12.1

145.33 39916500 42600 -16500 -27.92 31.22 -11.13

134.96 9021180 96600 -48300 -33.33 33.14 -3.94

-47.35 10467965 158000 -66000 -29.46 33.64 -5.68

-45.98 14161943.25 61775 -20650 -25.05 17.45 -5.19

34.98 5196750 189000 -96000 -33.68 31.45 -11.78

-9.38 33825200 2320000 -656000 -22.04 40.61 -10.24

-71.91 10188187.5 1095000 -577500 -34.53 51.89 -5.51

11.1 20170500 175000 -97000 -35.66 37.4 -4.9

-82.67 29207664 202400 -57600 -22.15 35.25 -14.48

-74.54 47566860 510000 -204000 -28.57 34.18 -4.86

3.79 31686800 318000 -234000 -42.39 45.8 2.87

-95.02 48628417.5 1208250 -428625 -26.19 44.23 -8.35

-77.08 26788368.75 60375 -25125 -29.39 16.83 -12.81

-71.58 13717125 221250 -97500 -30.59 22.88 -9.35

148.88 24879100 345600 -123600 -26.34 26.3 3.41

242.44 29614920 3603000 -1023000 -22.11 44.44 -10.42

54.76 20978100 742000 -262000 -26.1 37.18 -2.87

-65.47 45044220 652000 -204000 -23.83 35.21 -2.55

365 24572925 227500 -86250 -27.49 32.99 -0.75

33.98 5609484 173700 -80100 -31.56 21.94 6.18

0 16546674 28200 -12900 -31.39 31.59 -3.12

-60.57 1821649.5 11700 -7350 -38.58 37.2 -3.39

16.89 13702248.75 22750 -7500 -24.79 24.21 -21.4

86.25 22476363 506100 -154700 -23.41 27.75 20.98

65.2 2567250 160000 -53000 -24.88 38.43 -5.1

-83.16 9989550 11115000 -3405000 -23.45 37.39 -13.09

76.23 18904160 138000 -48000 -25.81 45.5 1.04

28.24 16151275 50400 -43400 -46.27 26.15 11.96

13.58 10578330 228900 -73500 -24.31 29.28 -8.75

725 30455568 1038200 -342200 -24.79 56.93 18.95

165.62 16473000 14250 -5700 -28.57 31.37 -10.27

-42.47 7883008 81200 -25200 -23.68 22.25 21.05

-71.35 20359812 96600 -34800 -26.48 31.95 -1.46

347.87 1175853 46900 -25200 -34.95 28.46 4.32

-89.77 25033050 256500 -114750 -30.91 44.57 -8.45

-24.68 17831520 1272000 -368000 -22.44 40 -10.74

10.67 14104806 40800 -13200 -24.44 22.25 -0.07

34.15 2171700 1995000 -675000 -25.28 40.57 -0.29

-27.04 4183593.75 64750 -21875 -25.25 37.3 -12.29

528.57 32862720 517500 -388500 -42.88 34.09 1.32

-0.29 3468421.15 440 -125 -22.12 20.34 -8.58

-72.59 19917600 204000 -56000 -21.54 33.76 -6.44

69.8 31685997 477000 -164300 -25.62 40.46 -18.03

-20.47 20844216 2354400 -889200 -27.41 27.39 -10.11

-95.04 6400800 793600 -502400 -38.77 50.87 -6.7

-6.4 4222785 57900 -24300 -29.56 38.57 -8.4

54.92 24461190 918000 -275400 -23.08 32.48 -11.56

30.13 14712111 15900 -6600 -29.33 34.41 -6

-77.08 4225300 60000 -16750 -21.82 38.38 -1.97

78.71 3774402 37500 -10800 -22.36 35.27 -5.92

179.59 979550 687500 -225500 -24.7 35.45 4.68

-23.51 8695417.5 11550 -12100 -51.16 39.04 1.49

-66.02 9468492 20900 -8250 -28.3 37.44 -2.35

143.52 29773704 503500 -270300 -34.93 44.06 -7.22

253.52 6705088.5 166650 -91850 -35.53 26.85 14.96

162.11 16826175 137800 -249100 -64.38 43.24 -14.9

12200 26424459 95475 -312075 -76.57 36.95 -23.1

72.99 608379 7000 -2000 -22.22 24.6 -6.53

42.17 372526 10150 -4900 -32.56 23.51 0.07

79.2 3295040 118000 -40000 -25.32 37.34 -6.69

-62.1 7118720 84500 -23500 -21.76 25.09 -13.39

-63.55 14076700 108000 -32000 -22.86 36.48 0.6

6166.67 13749192 199800 -180000 -47.39 31.52 -11.3

-97.27 2654592 878400 -296000 -25.2 50.65 -7.21

-79.23 7750080 10000 -7600 -43.18 31.23 -7.81

122.5 313725 7000 -2125 -23.29 28.14 6.73

-91.37 700304 748800 -268800 -26.42 54.72 -2.9

23.74 4807400 155625 -56875 -26.76 27.08 1.87

-69.1 31441162.5 1042875 -452250 -30.25 47.93 -11.69

-62.12 1512654 70200 -23400 -25 42.9 -7.48

-96.17 18824400 789750 -226125 -22.26 46.47 -8.63

-14.13 7412886 13300 -5600 -29.63 21.15 -43.69

-68.77 870185 12500 -4375 -25.93 24.98 -6.07

-25.13 3467750 7800 -2200 -22 32.95 -5.87

-94.77 10392097.5 259875 -151875 -36.89 44.75 -10.01

46.58 3999981 86700 -34000 -28.17 36.83 -2.78

-15.75 824328 22500 -12600 -35.9 42.78 -5.13

-96.82 7762061.25 236250 -84375 -26.32 42.1 -13.65

17.07 768000 127500 -35000 -21.54 38.27 0.56

-63.91 564537.6 150 -245 -62.03 19.04 -16.64

224.14 4365007.5 905850 -338550 -27.21 36.21 -3.79

-27.2 4026477 32900 -16800 -33.8 25.15 6.73

-66.92 341440 37500 -10500 -21.88 31.51 -4.22

102.33 700350 140000 -90000 -39.13 31.25 0.44

-96.26 2264400 398400 -132800 -25 51.01 -6.36

-95.98 2880480 302400 -131200 -30.26 43.7 -22.72

104.88 6940668 127200 -254400 -66.67 45.78 -1.53

245.45 2172688 49350 -14000 -22.1 24.09 -7.96

491.67 115375 43750 -31250 -41.67 29.08 1.26

7000 132202 12000 -7000 -36.84 34.22 2.37

46.81 3483982.5 16625 -12825 -43.55 18.96 -15.75

-33.65 145728 16200 -8400 -34.15 34.56 3.03

169.57 474920 28000 -26000 -48.15 35.46 -13.91

16.67 2217208 23800 -20400 -46.15 40.33 4.73

37.5 155375 33750 -10000 -22.86 33.58 -5.35

20 352234.08 13024 -6105 -31.91 33.05 -3.64

-96.33 758160 156800 -70400 -30.99 51.82 -4.83

200 1717200 5300 -2000 -27.4 30.69 -8.41

-14 1931388 38000 -15200 -28.57 21.48 -11.95

-26.79 116132.5 45375 -20625 -31.25 44.62 -1.6

-9.52 6163182 299700 -86400 -22.38 48.9 10.42

118.75 123970 69300 -84700 -55 30.16 -0.45

1000 80025 65000 -35000 -35 43.72 5.03

3.12 1293864 106600 -33800 -24.07 32.5 -23.74

900 2620500 105000 -145000 -58 39.84

100 1584360 48600 -18900 -28 41.71 -9.28

-95.49 602560 142400 -40000 -21.93 45.79 -17.59

-58.73 26026 14700 -9800 -40 36.45 -7.57

13.64 571000 7000 -3000 -30 33.07 -6.79

47.06 37892.75 2936 -1835 -38.46 41.37 3.52

-64.18 99000 217500 -165000 -43.14 42.66 -14.48

27.78 1578076 13600 -27200 -66.67 46.45 35.8

-45.95 106140 96075 -27450 -22.22 45.48 0.09

533.33 484329 116000 -31900 -21.57 57.73 32.42

-53.85 186300 18000 -18000 -50 32.6 -8.87

0 899280 7200 -3200 -30.77 23.89 -39.28

1600 727447 14000 -7000 -33.33 32.7 -9.36

400 737640 36000 -10800 -23.08 30.57 -11.51

0 550200 5000 -5000 -50 32.62 -7.41

500 2559936 16800 -7200 -30 53.36 -27.96

100 53784 3000 -1200 -28.57 30.88 -8.03

-96.01 308000 57600 -16000 -21.74 44.23 -19.51

50 418545 78100 -35500 -31.25 36.37 -5.44

-73.53 93960 25200 -14400 -36.36 33.76 -5.32

-38.46 366200 27500 -12500 -31.25 26.01 -28.61

-11.11 385200 10500 -4500 -30 24.77 -23.01

-33.33 71520 2000 -1200 -37.5 29.66 -15.79

133.33 13020 9000 -6000 -40 35.26 -8.9

-56.25 7087.5 6250 -2500 -28.57 37.68 -11.06

357672 3300 -900 -21.43 32.23 20.76

500 350040 4000 -2000 -33.33 38.81 -26.98

150 312075 27000 -9000 -25 32.85 -23.68

150 42390 21600 -7200 -25 39.73 10.32

25 14580 10800 -5400 -33.33 45.02 9.52

0 231625 3750 -1250 -25 37.8 15.35

-33.33 209100 3400 -3400 -50 54.01 30.06

371200 2400 -1200 -33.33 54.02 6.83

33.33 226600 3000 -1000 -25 32.56

231600 4000 -2000 -33.33

200 158550 1250 -625 -33.33

100 51440 800 -400 -33.33 40.32 11.82

23

SPOT DELTA GAMMARHO THETA VEGA Build Up

1010.85 0.61 0.01 0.32 -0.66 0.9 Short Covering

1491.15 0.58 0 0.45 -1.12 1.36 Short Covering

68.9 0.75 0.05 0.03 -0.06 0.05 Short Covering

1364.1 0.6 0 0.42 -0.95 1.23 Short Covering

267.7 0.63 0.01 0.08 -0.35 0.24 Short Covering

1491.15 0.62 0 0.47 -1.1 1.32 Short Covering

3626.7 0.04 0 0.08 -0.47 0.76 Short Covering

839.35 0.6 0.01 0.26 -0.68 0.76 Short Covering

68.9 0.93 0.02 0.03 -0.03 0.02 Short Covering

2822.15 0.21 0 0.3 -3.66 1.91 Long Unwinding

351 0.27 0.01 0.05 -0.23 0.27 Long Unwinding

1653.2 0.64 0 0.55 -1.03 1.44 Short Covering

1010.85 0.58 0.01 0.3 -0.66 0.92 Short Covering

68.9 0.88 0.03 0.03 -0.04 0.03 Short Covering

2427.05 0.59 0 0.72 -2.31 2.21 Short Covering

5446.65 0.14 0 0.39 -2.58 2.77 Long Unwinding

5783 0.6 0 1.73 -5.87 5.22 Short Covering

1491.15 0.7 0 0.53 -1.04 1.21 Short Covering

3378.45 0.53 0 0.93 -2.38 3.13 Short Covering

68.9 0.84 0.04 0.03 -0.05 0.04 Short Covering

532.3 0.64 0.01 0.17 -0.48 0.46 Short Covering

1653.2 0.68 0 0.58 -1 1.37 Short Covering

68.9 0.8 0.04 0.03 -0.06 0.04 Short Covering

5446.65 0.53 0 1.47 -4.97 5.05 Long Unwinding

267.7 0.74 0.01 0.09 -0.31 0.2 Short Covering

569.35 0.45 0.01 0.13 -0.54 0.53 Long Unwinding

547.5 0.51 0.01 0.14 -0.35 0.51 Short Covering

5708.7 0.63 0 1.82 -4.95 5.03 Short Covering

422.6 0.72 0.01 0.16 -0.27 0.33 Short Covering

1022.95 0.25 0 0.13 -0.99 0.75 Long Unwinding

1166.65 0.64 0 0.37 -1.11 1.02 Short Covering

2215.25 0.44 0 0.5 -2.08 2.04 Long Unwinding

5708.7 0.59 0 1.7 -5.04 5.19 Short Covering

686.25 0.57 0.01 0.2 -0.75 0.63 Short Covering

3378.45 0.57 0 1 -2.38 3.09 Short Covering

2897.95 0.46 0 0.69 -2.54 2.68 Long Unwinding

3145.3 0.03 0 0.05 -0.44 0.48 Long Unwinding

657.75 0.58 0.01 0.19 -0.7 0.6 Long Unwinding

1364.1 0.7 0 0.49 -0.9 1.11 Short Covering

267.7 0.68 0.01 0.09 -0.33 0.22 Short Covering

299.45 0.36 0.02 0.06 -0.24 0.26 Long Unwinding

186.2 0.65 0.02 0.06 -0.23 0.16

6464.5 0.65 0 2.11 -5.95 5.58 Short Covering

1022.95 0.22 0 0.12 -0.94 0.71 Long Unwinding

470.45 0.85 0.01 0.2 -0.26 0.25 Long Unwinding

5708.7 0.23 0 0.67 -3.68 4.01 Short Covering

323.55 0.72 0.01 0.12 -0.27 0.25 Long Unwinding

438.55 0.47 0.01 0.11 -0.46 0.41 Long Unwinding

422.6 0.62 0.01 0.13 -0.29 0.38 Short Covering

183.6 0.22 0.02 0.02 -0.13 0.13 Long Unwinding

843.2 0.68 0.01 0.29 -0.67 0.7 Long Unwinding

1343 0.3 0 0.21 -0.87 1.09 Long Unwinding

4942.2 0.31 0 0.81 -2.65 4.08 Long Unwinding

3634.65 0.63 0 1.19 -2.51 3.19 Short Covering

5555.35 0.64 0 1.8 -4.43 4.85 Short Covering

2733.65 0.67 0 0.92 -2.47 2.3 Short Covering

532.3 0.6 0.01 0.16 -0.49 0.48 Short Covering

1653.2 0.72 0 0.61 -0.96 1.29 Short Covering

749.55 0.72 0.01 0.27 -0.61 0.59 Long Unwinding

5708.7 0.71 0 2.04 -4.61 4.55 Short Covering

351 0.24 0.01 0.04 -0.22 0.25 Long Unwinding

2053.45 0.16 0 0.17 -0.85 1.15 Long Unwinding

3626.7 0.63 0 1.19 -2.26 3.18 Short Covering

1177.15 0.24 0 0.15 -0.77 0.86 Long Unwinding

86.55 0.65 0.04 0.03 -0.09 0.07 Long Unwinding

152.7 0.17 0.02 0.01 -0.1 0.09 Long Unwinding

657.75 0.55 0.01 0.18 -0.71 0.61 Long Unwinding

1155.75 0.56 0 0.33 -1.08 1.06 Long Unwinding

532.3 0.72 0.01 0.19 -0.44 0.41 Short Covering

405.45 0.64 0.01 0.13 -0.42 0.35 Short Covering

323.55 0.66 0.01 0.11 -0.29 0.28 Long Unwinding

3634.65 0.67 0 1.25 -2.45 3.08 Short Covering

1465.2 0.47 0 0.36 -1.05 1.36 Short Covering

1491.15 0.85 0 0.64 -0.78 0.79 Short Covering

278.95 0.64 0.01 0.09 -0.34 0.24 Short Covering

244.8 0.69 0.01 0.08 -0.24 0.2 Long Unwinding

532.3 0.8 0.01 0.21 -0.39 0.35 Short Covering

686.25 0.63 0.01 0.21 -0.73 0.61 Short Covering

946.6 0.31 0.01 0.15 -0.54 0.78 Long Unwinding

2897.95 0.57 0 0.83 -2.57 2.66 Short Covering

6748.7 0.09 0 0.3 -2.02 2.45 Long Unwinding

5555.35 0.68 0 1.93 -4.27 4.6 Short Covering

1010.85 0.89 0 0.45 -0.43 0.45 Short Covering

569.35 0.18 0.01 0.05 -0.35 0.35 Long Unwinding

97.45 0.43 0.04 0.02 -0.1 0.09 Long Unwinding

405.45 0.61 0.01 0.12 -0.43 0.36 Short Covering

1364.1 0.74 0 0.51 -0.86 1.04 Short Covering

351 0.52 0.02 0.09 -0.3 0.33 Long Unwinding

271.1 0.78 0.01 0.1 -0.27 0.19 Short Covering

5708.7 0.67 0 1.93 -4.8 4.81 Short Covering

1838.45 0.65 0 0.61 -1.18 1.59 Short Covering

2897.95 0.7 0 1.02 -2.37 2.35 Short Covering

1364.1 0.09 0 0.06 -0.35 0.5 Short Covering

323.55 0.62 0.01 0.1 -0.3 0.29 Long Unwinding

86.55 0.69 0.04 0.03 -0.09 0.07 Long Unwinding

3378.45 0.65 0 1.12 -2.31 2.92 Short Covering

88.05 0.15 0.03 0.01 -0.05 0.05

749.55 0.26 0.01 0.1 -0.54 0.57 Long Unwinding

614.15 0.96 0 0.29 -0.18 0.12 Short Covering

117949.4 0.48 0 29.31 -82.11 109.56 Long Unwinding

532.3 0.68 0.01 0.18 -0.46 0.44 Short Covering

186.2 0.73 0.01 0.07 -0.21 0.14 Short Covering

228.6 0.85 0.02 0.1 -0.12 0.13 Long Unwinding

392.7 0.28 0.01 0.06 -0.35 0.31 Long Unwinding

2137.8 0.36 0 0.39 -1.83 1.86 Long Unwinding

438.55 0.79 0.01 0.17 -0.37 0.3 Short Covering

5783 0.67 0 1.92 -5.62 4.9 Short Covering

3798.05 0.29 0 0.57 -2.88 3.04 Long Unwinding

2215.25 0.33 0 0.37 -1.87 1.86 Long Unwinding

129.2 0.1 0.02 0.01 -0.05 0.05 Long Unwinding

2427.05 0.62 0 0.76 -2.27 2.15 Short Covering

2427.05 0.66 0 0.8 -2.22 2.07 Short Covering

186.2 0.8 0.01 0.07 -0.18 0.12 Short Covering

996.85 0.71 0 0.36 -0.8 0.79 Long Unwinding

186.2 0.6 0.02 0.05 -0.23 0.17 Short Covering

714.55 0.92 0 0.32 -0.32 0.24 Long Unwinding

9413.55 0.1 0 0.5 -2.6 3.85 Long Unwinding

3626.7 0.09 0 0.17 -0.84 1.35 Short Covering

569.35 0.41 0.01 0.12 -0.52 0.52 Long Unwinding

1343 0.72 0 0.49 -0.95 1.06 Long Unwinding

532.3 0.76 0.01 0.2 -0.42 0.38 Short Covering

470.45 0.89 0.01 0.21 -0.23 0.21 Long Unwinding

392.7 0.21 0.01 0.04 -0.3 0.26 Long Unwinding

4939.05 0.62 0 1.53 -4.64 4.39 Long Unwinding

7307.6 0.08 0 0.33 -2.25 2.65 Long Unwinding

392.7 0.04 0 0.01 -0.1 0.09 Long Unwinding

1131.2 0.75 0 0.43 -0.75 0.85 Short Covering

323.55 0.99 0 0.14 -0.07 0.02 Long Unwinding

790.45 0.18 0 0.07 -0.53 0.48 Long Unwinding

323.55 0.88 0.01 0.14 -0.18 0.15 Long Unwinding

5446.65 0.87 0 2.31 -3.16 2.66 Long Unwinding

5763.9 0.22 0 0.67 -2.65 3.99 Long Unwinding

4939.05 0.43 0 1.09 -4.61 4.53 Long Unwinding

323.55 0.81 0.01 0.13 -0.23 0.2 Long Unwinding

1019 0.64 0.01 0.33 -0.81 0.89 Long Unwinding

2137.8 0.19 0 0.21 -1.29 1.34 Long Unwinding

323.55 0.76 0.01 0.12 -0.26 0.24 Long Unwinding

237.05 0.28 0.02 0.03 -0.2 0.19 Long Unwinding

117949.4 0.37 0 22.85 -76.17 103.97 Long Unwinding

140.35 0.82 0.03 0.06 -0.09 0.09 Long Unwinding

1364.1 0.78 0 0.54 -0.81 0.95 Short Covering

1343 0.13 0 0.09 -0.51 0.65 Long Unwinding

122.3 0.31 0.03 0.02 -0.11 0.1 Long Unwinding

392.7 0.37 0.01 0.07 -0.4 0.34 Long Unwinding

392.7 0.46 0.01 0.09 -0.43 0.36 Long Unwinding

186.2 0.69 0.02 0.06 -0.22 0.15 Short Covering

1902.7 0.71 0 0.68 -1.43 1.52 Long Unwinding

547.5 0.03 0 0.01 -0.05 0.08 Short Covering

3681.75 0.06 0 0.13 -0.92 1.08 Long Unwinding

2070.05 0.8 0 0.84 -1.14 1.33 Long Unwinding

1225.3 0.05 0 0.03 -0.24 0.29 Short Covering

657.75 0.22 0 0.08 -0.51 0.46 Long Unwinding

383.65 0.63 0.01 0.12 -0.37 0.34 Long Unwinding

559.75 0.1 0 0.03 -0.22 0.23 Long Unwinding

1744.85 0.24 0 0.21 -1.15 1.25 Long Unwinding

392.7 0.24 0.01 0.05 -0.33 0.29 Long Unwinding

5446.65 0.78 0 2.11 -4.06 3.76 Short Covering

1000.25 0.8 0.01 0.41 -0.54 0.66 Long Unwinding

401.1 0.05 0 0.01 -0.09 0.09 Long Unwinding

438.55 0.94 0 0.19 -0.19 0.12 Short Covering

195.95 0.17 0.02 0.02 -0.1 0.11 Long Unwinding

237.05 0.05 0.01 0.01 -0.06 0.06

233.95 0.7 0.02 0.08 -0.21 0.19 Long Unwinding

174.9 0.9 0.01 0.08 -0.08 0.07 Long Unwinding

377.5 0.59 0.01 0.11 -0.39 0.34 Long Unwinding

392.7 0.32 0.01 0.06 -0.38 0.33 Long Unwinding

1045.25 0.01 0 0 -0.04 0.05 Long Unwinding

2053.45 0.34 0 0.36 -1.32 1.75 Long Unwinding

1928.75 0.02 0 0.02 -0.16 0.18 Long Unwinding

97.45 0.11 0.02 0.01 -0.05 0.04 Long Unwinding

190.45 0.86 0.01 0.08 -0.14 0.1 Long Unwinding

140.35 0.06 0.01 0 -0.03 0.04 Long Unwinding

271.1 0.37 0.01 0.05 -0.32 0.24 Short Covering

470.45 0.2 0.01 0.05 -0.25 0.3 Long Unwinding

759.95 0.86 0 0.32 -0.42 0.4 Long Unwinding

1447.35 0.59 0 0.43 -1.38 1.31 Long Unwinding

289.9 0.68 0.02 0.1 -0.22 0.24 Long Unwinding

239 0.76 0.02 0.09 -0.18 0.17 Long Unwinding

1022.95 1 0 0.4 -0.17 0.02 Long Unwinding

4796.05 0.09 0 0.23 -1.31 1.81 Long Unwinding

392.7 0.41 0.01 0.08 -0.42 0.36 Long Unwinding

95 0.79 0.03 0.04 -0.07 0.06 Short Covering

289.9 0.16 0.01 0.02 -0.13 0.17 Long Unwinding

239 0.8 0.01 0.09 -0.17 0.16 Long Unwinding

543.55 0.74 0.01 0.2 -0.42 0.41 Long Unwinding

2841.3 0.23 0 0.34 -1.89 2.01 Long Unwinding

210 0.05 0.01 0.01 -0.04 0.05 Long Unwinding

440.3 0.03 0 0.01 -0.05 0.06 Long Unwinding

2897.95 0.73 0 1.06 -2.29 2.24 Short Covering

388.45 0.79 0.01 0.15 -0.31 0.26 Long Unwinding

183.6 0.75 0.02 0.07 -0.16 0.14 Long Unwinding

470.45 0.13 0.01 0.03 -0.18 0.23

163.2 0.04 0.01 0 -0.03 0.03 Long Unwinding

440.3 0.86 0.01 0.19 -0.25 0.23 Long Unwinding

383.65 0.74 0.01 0.14 -0.33 0.29 Long Unwinding

3181.55 0.65 0 1.02 -3.54 2.74 Short Covering

740.5 0.82 0 0.3 -0.53 0.46

273.25 0.94 0 0.12 -0.13 0.08 Short Covering

1166.65 0.83 0 0.47 -0.82 0.69 Short Covering

1653.7 0.52 0 0.43 -1.7 1.54 Long Unwinding

You might also like

- L4-M1 ProcScope PPT 6-19Document226 pagesL4-M1 ProcScope PPT 6-19Sorna Khan100% (3)

- INSTRUCTION: Answer ALL Questions. PART A: 50 Marks (30 %)Document18 pagesINSTRUCTION: Answer ALL Questions. PART A: 50 Marks (30 %)haslizul hashimNo ratings yet

- Understanding Contract-Law and You WinDocument4 pagesUnderstanding Contract-Law and You WinRhonda Peoples100% (7)

- Ym0654 Tax - PNL 2019 04 01 2020 03 31Document52 pagesYm0654 Tax - PNL 2019 04 01 2020 03 31Jayachandra JcNo ratings yet

- OI Losers (Puts) Options Trends and Screener For NSE Contracts Expiring On 28 Dec, 2023Document15 pagesOI Losers (Puts) Options Trends and Screener For NSE Contracts Expiring On 28 Dec, 2023jeyventNo ratings yet

- Technical Morning - Call - 120922 PDFDocument5 pagesTechnical Morning - Call - 120922 PDFSomeone 4780No ratings yet

- Symbol Open Dayhigh Daylow Lastprice Previousclose ChangeDocument4 pagesSymbol Open Dayhigh Daylow Lastprice Previousclose ChangeVijayNo ratings yet

- Cam PivotDocument30 pagesCam PivotshipdellogNo ratings yet

- DojiDocument11 pagesDojiJaikumar KrishnaNo ratings yet

- Index Movement:: National Stock Exchange of India LimitedDocument37 pagesIndex Movement:: National Stock Exchange of India LimitedJayant SharmaNo ratings yet

- All Bse Share PricesDocument52 pagesAll Bse Share Pricesvishalsharma8522No ratings yet

- Sr. Symbol Price Triangle Breakout TMC PIN BPC BPCDocument6 pagesSr. Symbol Price Triangle Breakout TMC PIN BPC BPCAvinash GaikwadNo ratings yet

- Most Active by Contracts Futures Trends and Screener For NSE Contracts Expiring On 28 Dec, 2023Document8 pagesMost Active by Contracts Futures Trends and Screener For NSE Contracts Expiring On 28 Dec, 2023jeyventNo ratings yet

- NsemarginDocument5 pagesNsemarginBhupesh KumarNo ratings yet

- S&P CNX N Ifty Banknifty: Name Previous Current 5 Day Price Close 5MADocument17 pagesS&P CNX N Ifty Banknifty: Name Previous Current 5 Day Price Close 5MArchawdhry123No ratings yet

- Most Active by Contracts Options Trends and Screener For NSE Contracts Expiring On 10 Nov, 2022Document15 pagesMost Active by Contracts Options Trends and Screener For NSE Contracts Expiring On 10 Nov, 2022chintu_kayNo ratings yet

- Live Nse StocksDocument4 pagesLive Nse StocksP.r.sarmaNo ratings yet

- Bel Lalpathlab Cub L&TFH Maruti: Symbol Open Dayhigh Daylow Lastprice Previousclose Change PchangeDocument8 pagesBel Lalpathlab Cub L&TFH Maruti: Symbol Open Dayhigh Daylow Lastprice Previousclose Change PchangeVijayNo ratings yet

- Doji 6Document51 pagesDoji 6jayakumar krishnaNo ratings yet

- Scripcode LTP Diff Industry TTQ Perc High PreclsDocument4 pagesScripcode LTP Diff Industry TTQ Perc High PreclsshahedNo ratings yet

- Index Movement:: National Stock Exchange of India LimitedDocument27 pagesIndex Movement:: National Stock Exchange of India LimitedjanuianNo ratings yet

- B2Document14 pagesB2marathi techNo ratings yet

- UntitledDocument22 pagesUntitledvineetNo ratings yet

- Daily Stock Check ListDocument7 pagesDaily Stock Check ListvineetksrNo ratings yet

- F&O MarginDocument5 pagesF&O MarginPrashant QuoraNo ratings yet

- Futures Trading Futures Trends - Most Active by ContractsDocument8 pagesFutures Trading Futures Trends - Most Active by ContractssudhakarrrrrrNo ratings yet

- Hasil OasisDocument38 pagesHasil OasisUna MarnainNo ratings yet

- Price Index: Company Name Open High LOW Close Last Company Name Previous Close Total TurnoverDocument50 pagesPrice Index: Company Name Open High LOW Close Last Company Name Previous Close Total Turnovervishalsharma8522No ratings yet

- Shares HIGH LOW SignalDocument10 pagesShares HIGH LOW SignalYASH DOSHINo ratings yet

- Market StructureDocument3 pagesMarket StructurevishwagubbitraderNo ratings yet

- (1953) Mathematical Formula For Market PredictionsDocument32 pages(1953) Mathematical Formula For Market PredictionsRavi VarakalaNo ratings yet

- 18th Expiry DataDocument1,147 pages18th Expiry DatachinnaNo ratings yet

- 13th September DataDocument10 pages13th September DataAceNo ratings yet

- Change in Stocks After Fall in Market Dec-2021Document2 pagesChange in Stocks After Fall in Market Dec-2021Devashish PisalNo ratings yet

- Faisalshafique Tax Information 2018Document60 pagesFaisalshafique Tax Information 2018Zonal AccountantNo ratings yet

- Open High Low LTP CHNG TradeDocument33 pagesOpen High Low LTP CHNG TradeAnand ChineyNo ratings yet

- F & O Margin Dated: November 26, 2010: Symbol Lotsize Spanmargin Exposure Margin Total Margin Span % Exposure Margin%Document10 pagesF & O Margin Dated: November 26, 2010: Symbol Lotsize Spanmargin Exposure Margin Total Margin Span % Exposure Margin%akkhan01No ratings yet

- Skrip Name Tran Quantity: Client Id: N147669 Client Name: Shourya Mohan Asset Class: EquityDocument12 pagesSkrip Name Tran Quantity: Client Id: N147669 Client Name: Shourya Mohan Asset Class: EquityDeepanjaliNo ratings yet

- Equity Report 10 July To 14 JulyDocument6 pagesEquity Report 10 July To 14 JulyzoidresearchNo ratings yet

- Nifty 100 - Expected Returns (Holding Period of 6-8weeks)Document2 pagesNifty 100 - Expected Returns (Holding Period of 6-8weeks)Sathv100% (1)

- Gann Square of 9 CalculatorDocument15 pagesGann Square of 9 CalculatorSantosh ThakurNo ratings yet

- B4 TStock SelectionDocument9 pagesB4 TStock SelectionMunish GuptaNo ratings yet

- Daily F & O StocksDocument7 pagesDaily F & O StocksMantha Devi SuryanarayanaNo ratings yet

- Collected Data ADocument504 pagesCollected Data Aአስምሮ ላቂያዉNo ratings yet

- B4T07STOCKSDocument4 pagesB4T07STOCKSPrakash BatwalNo ratings yet

- Ticker LTP O H L Change % Change OpenDocument22 pagesTicker LTP O H L Change % Change OpenPrasanna PharaohNo ratings yet

- Ipod Tanggal 22 Agustus 2022Document38 pagesIpod Tanggal 22 Agustus 2022baniNo ratings yet

- Zest MotorPriceList 2012Document44 pagesZest MotorPriceList 2012Conrad Hendrik De KockNo ratings yet

- LTE - Requirment 5Mhz10Mhz - 15 - Cities-V2Document41 pagesLTE - Requirment 5Mhz10Mhz - 15 - Cities-V2Osazuwa OmoiguiNo ratings yet

- MGMLDocument2 pagesMGMLkashinath09No ratings yet

- Share Market PricesDocument52 pagesShare Market Pricesvishalsharma8522No ratings yet

- Symbol Open Dayhigh Daylow Lastprice Previousclose ChangeDocument4 pagesSymbol Open Dayhigh Daylow Lastprice Previousclose ChangeVijayNo ratings yet

- Papaf - 2007 Election Projections - 9/21 FridayDocument3 pagesPapaf - 2007 Election Projections - 9/21 Fridaypapaf100% (5)

- 01042010Document9 pages01042010Kishore KunduNo ratings yet

- F&O Daily Margin12Document5 pagesF&O Daily Margin12ayon hazraNo ratings yet

- 1 Month SharpeDocument22 pages1 Month SharpeYadhakishore SiripurapuNo ratings yet

- Form Test Log MinMaxDocument4 pagesForm Test Log MinMaxridwaniyasNo ratings yet

- F&OAnalysis 20 May 21Document8 pagesF&OAnalysis 20 May 21Siddharth TripathiNo ratings yet

- 1 Month SharpeDocument49 pages1 Month SharpeYadhakishore SiripurapuNo ratings yet

- Idpel Nama KDDK Tarif Daya FKMKWH SlalwbpDocument2 pagesIdpel Nama KDDK Tarif Daya FKMKWH SlalwbpandialviannorNo ratings yet

- Work Stock Market Sheet LatestDocument4 pagesWork Stock Market Sheet Latestanand kumar chaubeyNo ratings yet

- Equity Report 26 June To 30 JuneDocument6 pagesEquity Report 26 June To 30 JunezoidresearchNo ratings yet

- United States Census Figures Back to 1630From EverandUnited States Census Figures Back to 1630No ratings yet

- OI Gainers (Calls) Options Trends and Screener For NSE Contracts Expiring On 28 Dec, 2023Document15 pagesOI Gainers (Calls) Options Trends and Screener For NSE Contracts Expiring On 28 Dec, 2023jeyventNo ratings yet

- OI Gainers (Puts) Options Trends and Screener For NSE Contracts Expiring On 28 Dec, 2023Document15 pagesOI Gainers (Puts) Options Trends and Screener For NSE Contracts Expiring On 28 Dec, 2023jeyventNo ratings yet

- Exhibition Stand Brief Sheet - Business DevelopmentDocument5 pagesExhibition Stand Brief Sheet - Business DevelopmentjeyventNo ratings yet

- Client Address For ToaGosei Mission Feb'11Document2 pagesClient Address For ToaGosei Mission Feb'11jeyventNo ratings yet

- Arif Chips IndustriesDocument1 pageArif Chips IndustriesjeyventNo ratings yet

- Sekon Principles of Business Agreement 2015Document5 pagesSekon Principles of Business Agreement 2015Ali HajassdolahNo ratings yet

- Cost Acc BBA VDocument3 pagesCost Acc BBA VHamza TariqNo ratings yet

- WP 243Document87 pagesWP 243instt_engNo ratings yet

- ANKIT MEHTA BLACK BOOK Effects of Mergers and Acquisitions With Special Reference To Vodafone and IdeaDocument76 pagesANKIT MEHTA BLACK BOOK Effects of Mergers and Acquisitions With Special Reference To Vodafone and IdeaUjjwal Joseph fernandedNo ratings yet

- Assignment 3Document7 pagesAssignment 3Dat DoanNo ratings yet

- Seven Facets of Modern Category Management: 1. Real Customer Centricity-Walk A Mile in Your Customer's ShoesDocument4 pagesSeven Facets of Modern Category Management: 1. Real Customer Centricity-Walk A Mile in Your Customer's ShoesPriyanshu MishraNo ratings yet

- Accounting Policies, Changes in Accounting Estimates and ErrorsDocument23 pagesAccounting Policies, Changes in Accounting Estimates and ErrorsFery AnnNo ratings yet

- Teresita Gandiongco Oledan For Petitioner. Acaban & Sabado For Private RespondentDocument3 pagesTeresita Gandiongco Oledan For Petitioner. Acaban & Sabado For Private Respondentwenny capplemanNo ratings yet

- COVID 19 S Impact On Globalization and InnovationDocument7 pagesCOVID 19 S Impact On Globalization and InnovationRabiya TungNo ratings yet

- Sapp Balancing Market: Traders and Controllers Training - Day 1Document69 pagesSapp Balancing Market: Traders and Controllers Training - Day 1Addie Hatisari DandaNo ratings yet

- Resource 1 - IndoAust Jaya - CRM Project BriefDocument25 pagesResource 1 - IndoAust Jaya - CRM Project BriefRahmi Can ÖzmenNo ratings yet

- Marketing Management: Business Studies Project - 1 Yashvi Bothra 12413 7891372295Document34 pagesMarketing Management: Business Studies Project - 1 Yashvi Bothra 12413 7891372295Geetika Jain100% (2)

- Executors Guide Digital Will Guide PackDocument6 pagesExecutors Guide Digital Will Guide PackOneNationNo ratings yet

- Forecasting and PurchasingDocument25 pagesForecasting and PurchasingPartha Pratim SenguptaNo ratings yet

- Stucture of Financial Sector of PakistanDocument5 pagesStucture of Financial Sector of PakistanSYEDWASIQABBAS RIZVINo ratings yet

- 467 - Age222-Introduction To Farm Machinery-2unitsDocument8 pages467 - Age222-Introduction To Farm Machinery-2unitsAnonymous 1XBCMXNo ratings yet

- Notre Dame Vs LaguesmaDocument2 pagesNotre Dame Vs LaguesmaClarence ProtacioNo ratings yet

- FAR 4202 Discontinued Operation NCA Held For SaleDocument4 pagesFAR 4202 Discontinued Operation NCA Held For SaleMaximusNo ratings yet

- Fco Oficial Company Brahm Inc...Document9 pagesFco Oficial Company Brahm Inc...Phill BonatoNo ratings yet

- ICAEW - Chapter 6 - Control Accounts Errors and Suspense AccountsDocument21 pagesICAEW - Chapter 6 - Control Accounts Errors and Suspense Accountsvothituongnhi7703No ratings yet

- Project ReportDocument48 pagesProject ReportMalharNo ratings yet

- Paranginan Partners Tax Law FirmDocument5 pagesParanginan Partners Tax Law FirmBram SostenesNo ratings yet

- Tax Invoice - 2555703 - 1686188896465Document1 pageTax Invoice - 2555703 - 1686188896465Ivy GaudicosNo ratings yet

- RMC No. 111-2022 AttachmentDocument1 pageRMC No. 111-2022 AttachmentPaulus PacanaNo ratings yet

- CAPE Communication Studies 2012 P2 PDFDocument6 pagesCAPE Communication Studies 2012 P2 PDFGayatrie BhagalooNo ratings yet

- GR 75037 Tanduay V NLRCDocument2 pagesGR 75037 Tanduay V NLRCKathlene JaoNo ratings yet

- Company Profile - BravoFabsDocument14 pagesCompany Profile - BravoFabssong.anarNo ratings yet