Professional Documents

Culture Documents

22 Momentive TimesofCrisis BusinessReport

22 Momentive TimesofCrisis BusinessReport

Uploaded by

p9wht9wqjnCopyright:

Available Formats

You might also like

- CEO Decision-Making in The Age of AIDocument27 pagesCEO Decision-Making in The Age of AIComunicarSe-Archivo100% (1)

- Succession Management Positioning Your Organizaton Leadership For Business SuccessDocument9 pagesSuccession Management Positioning Your Organizaton Leadership For Business SuccessRight ManagementNo ratings yet

- CEO Outlook 2019Document24 pagesCEO Outlook 2019Anonymous e90uptNo ratings yet

- Organizational Agility in Depth ReportDocument11 pagesOrganizational Agility in Depth Reportahuamaniv100% (1)

- (Whitepaper) The Definitive Guide For Business Continuity Program SuccessDocument19 pages(Whitepaper) The Definitive Guide For Business Continuity Program Successparkinglorca2No ratings yet

- Organizational Effectiveness: Preparing Your Workforce For ChangeDocument6 pagesOrganizational Effectiveness: Preparing Your Workforce For ChangeShabih FatimaNo ratings yet

- Top Insights 2020 FullDocument136 pagesTop Insights 2020 FullKrish Gopalakrishnan100% (1)

- OKR WorkBoard-OKRs-at-Enterprise-ScaleDocument13 pagesOKR WorkBoard-OKRs-at-Enterprise-ScaleDragan MrkajicNo ratings yet

- The Impact of Employee Engagement On PerformanceDocument20 pagesThe Impact of Employee Engagement On PerformanceRajan RahiNo ratings yet

- It Top Insights 2020 PDFDocument18 pagesIt Top Insights 2020 PDFPNG networksNo ratings yet

- Index Report For Web ResillenceDocument20 pagesIndex Report For Web Resillencegilberth araujoNo ratings yet

- Driving Org Perf in Complex Times MKinnich July 2008Document12 pagesDriving Org Perf in Complex Times MKinnich July 2008lspiering3No ratings yet

- BB Winning Turbulence Lessons Gaining Groud TimesDocument4 pagesBB Winning Turbulence Lessons Gaining Groud TimesGustavo MicheliniNo ratings yet

- From Operational Chaos To Business GrowthDocument11 pagesFrom Operational Chaos To Business Growth50interviewsNo ratings yet

- Four Ways To Advance Risk OversightDocument32 pagesFour Ways To Advance Risk OversightMarcos Avello IbarraNo ratings yet

- Communicating Change: Evidence-Based Communications. Inform. Monitor. MeasureDocument9 pagesCommunicating Change: Evidence-Based Communications. Inform. Monitor. MeasurecchaudoitNo ratings yet

- Motivational Matters Report 2009Document8 pagesMotivational Matters Report 2009Lynne BellNo ratings yet

- Buildingawinningsalesforce WP DdiDocument14 pagesBuildingawinningsalesforce WP DdiMawaheb ContractingNo ratings yet

- (2023) The Power of Portfolio Renewal and The Value in Divestitures - GTM Slides May 2023Document19 pages(2023) The Power of Portfolio Renewal and The Value in Divestitures - GTM Slides May 2023Javier UrmenetaNo ratings yet

- Enabling Enterprise Change ManagementDocument8 pagesEnabling Enterprise Change ManagementDemand MetricNo ratings yet

- EZ-Sustainability Survey Report-FinalDocument12 pagesEZ-Sustainability Survey Report-FinalFranklin AntezanaNo ratings yet

- 7A-Balanced ScorecardDocument18 pages7A-Balanced ScorecardBhaskar AnandNo ratings yet

- A Guide To Growth - A Global Analysis of The Defining Characteristics of Leading Midsize CompaniesDocument15 pagesA Guide To Growth - A Global Analysis of The Defining Characteristics of Leading Midsize CompaniesCharith Nilanga WeerasekaraNo ratings yet

- Transform To PerformDocument17 pagesTransform To PerformIgorNo ratings yet

- Bulletin v3 Issue6Document5 pagesBulletin v3 Issue6Rugeyye RashidNo ratings yet

- How Top Companies Close the SЕ GapDocument34 pagesHow Top Companies Close the SЕ GapCecilia BodkNo ratings yet

- Cre3055 HBR Ps Lattice 3Document12 pagesCre3055 HBR Ps Lattice 31210869No ratings yet

- 27th Annual Global Ceo Survey Asia PacificDocument24 pages27th Annual Global Ceo Survey Asia Pacificpt.andalan.mutiaraNo ratings yet

- Business Strategies in Economic Turbulence: Authors Name: V. SUDHA College: MRITS PH: 9000462678Document6 pagesBusiness Strategies in Economic Turbulence: Authors Name: V. SUDHA College: MRITS PH: 9000462678Sudha VemarajuNo ratings yet

- State of Product Excellence - Product BoardDocument32 pagesState of Product Excellence - Product BoardRahulSharma100% (1)

- Ey Mena Faas From Value Protection To Long Term Value Creation How Can Cfos Reframe FinanceDocument36 pagesEy Mena Faas From Value Protection To Long Term Value Creation How Can Cfos Reframe Financejangan opo? jangan sayurNo ratings yet

- Business Partnering e BookDocument20 pagesBusiness Partnering e BookjohnkwashanaiNo ratings yet

- Mckinsey On Finance: Managing Through Covid-19Document48 pagesMckinsey On Finance: Managing Through Covid-19nvpstudy279No ratings yet

- Accelerate or Get Left Behind - ENGDocument8 pagesAccelerate or Get Left Behind - ENGSara-QMNo ratings yet

- The New Decision Makers: Equipping Frontline Workers For SuccessDocument15 pagesThe New Decision Makers: Equipping Frontline Workers For SuccessMDanNo ratings yet

- Implementing The: Project PortfolioDocument20 pagesImplementing The: Project PortfolioGriselda Meza GutierrezNo ratings yet

- Performance Management COVIDDocument15 pagesPerformance Management COVIDrogerNo ratings yet

- Deloitte Insightful Management ReportingDocument20 pagesDeloitte Insightful Management ReportingДавид АрноNo ratings yet

- Healthcare Trends - 2011: Healthcare Leadership White PaperDocument4 pagesHealthcare Trends - 2011: Healthcare Leadership White PaperBESmithIncNo ratings yet

- Severance Practices Around The WorldDocument34 pagesSeverance Practices Around The WorldRight ManagementNo ratings yet

- The Flux Report Building A Resilient Workforce in The Face of FluxDocument17 pagesThe Flux Report Building A Resilient Workforce in The Face of FluxManpowerGroupFrNo ratings yet

- Strategy For PRESENTATION Riskdjustedforecastingandplanning DeloitteIreland EnergyResourcesDocument16 pagesStrategy For PRESENTATION Riskdjustedforecastingandplanning DeloitteIreland EnergyResourcessergio.assuncao9711No ratings yet

- How To Approach Your Business Transformation: Tips For SuccessDocument12 pagesHow To Approach Your Business Transformation: Tips For SuccessJg ZhouNo ratings yet

- Fp&A Trends: Cfo Guide ToDocument15 pagesFp&A Trends: Cfo Guide ToaasifmmNo ratings yet

- Reassessing Value PDFDocument16 pagesReassessing Value PDFanushanNo ratings yet

- How Companies Approcah Innovation MKZ PDFDocument13 pagesHow Companies Approcah Innovation MKZ PDFLucusNo ratings yet

- Aberdeen Managing Risk in Your Sales and Operations Planning Process November 2017Document12 pagesAberdeen Managing Risk in Your Sales and Operations Planning Process November 2017AhmadNo ratings yet

- LOS 2021 Execution InsightsDocument22 pagesLOS 2021 Execution InsightsOluwaseun AlausaNo ratings yet

- Management Accounting Opportunities in ChinaDocument11 pagesManagement Accounting Opportunities in Chinafurong.hsuNo ratings yet

- Chapter No. 2 Crisis and Crisis ManagementDocument48 pagesChapter No. 2 Crisis and Crisis ManagementmohitNo ratings yet

- Audit Plan 8Document13 pagesAudit Plan 8Harold Dan AcebedoNo ratings yet

- Delloite - Journey Resilient LeadershipDocument16 pagesDelloite - Journey Resilient LeadershiptammymdNo ratings yet

- Report OnSolve Failing To Plan Is Planning To FailDocument19 pagesReport OnSolve Failing To Plan Is Planning To FailibrahimNo ratings yet

- Driving Sustainability Strategy Home 1707595711Document20 pagesDriving Sustainability Strategy Home 1707595711Senem KayakıranNo ratings yet

- Five Key Asset Management StrategiesDocument6 pagesFive Key Asset Management StrategiesFemi ObiomahNo ratings yet

- How Can Bold CFO Reframe Their Role EYDocument32 pagesHow Can Bold CFO Reframe Their Role EYSaurabh MehrotraNo ratings yet

- The Success Case Method: Find Out Quickly What's Working and What's NotFrom EverandThe Success Case Method: Find Out Quickly What's Working and What's NotRating: 5 out of 5 stars5/5 (4)

- The Business Forecasting Deal: Exposing Myths, Eliminating Bad Practices, Providing Practical SolutionsFrom EverandThe Business Forecasting Deal: Exposing Myths, Eliminating Bad Practices, Providing Practical SolutionsNo ratings yet

- Cosmopolitan Managers: Executive Development that WorksFrom EverandCosmopolitan Managers: Executive Development that WorksNo ratings yet

- Examiner's Report: MA1 Management Information Based On Exams From January To June 2019Document6 pagesExaminer's Report: MA1 Management Information Based On Exams From January To June 2019Zohair HumayunNo ratings yet

- Jazz Weekly SMS PackageDocument2 pagesJazz Weekly SMS Packageaimenmubashar111No ratings yet

- Auditing Dan AtestasiDocument7 pagesAuditing Dan AtestasiYudiantoNo ratings yet

- Master Budget: Sales ForecastDocument61 pagesMaster Budget: Sales ForecastLay TekchhayNo ratings yet

- Preparation of Final AccountsDocument13 pagesPreparation of Final AccountsDr Sarbesh MishraNo ratings yet

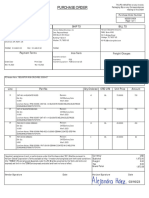

- Purchase Order: Ship To Vendor Bill ToDocument1 pagePurchase Order: Ship To Vendor Bill Toeduardo patricioNo ratings yet

- Spell Bee Reg. Form - Excel Version 2020-21Document26 pagesSpell Bee Reg. Form - Excel Version 2020-21Itismita PriyadarshiNo ratings yet

- Investor.: Amcham Celebrates July 4ThDocument80 pagesInvestor.: Amcham Celebrates July 4Thmihaii3No ratings yet

- Accounting Principles 8th Edition - Exercises Chapter07Document9 pagesAccounting Principles 8th Edition - Exercises Chapter07kimkov119No ratings yet

- What Benefits Have CEMEX and The Other Global Competitors in Cement Derived From GlobalizationDocument2 pagesWhat Benefits Have CEMEX and The Other Global Competitors in Cement Derived From GlobalizationEmmanuelNo ratings yet

- 01 & 02 Week POMDocument51 pages01 & 02 Week POMfakhar alamgirNo ratings yet

- Organization Culture-Nikhil Peshawaria - Mohit WattsDocument32 pagesOrganization Culture-Nikhil Peshawaria - Mohit WattsAmit Anand KumarNo ratings yet

- Parent DeclarationDocument2 pagesParent DeclarationshajuNo ratings yet

- Chapter 4 Market Force@Document77 pagesChapter 4 Market Force@sơn trầnNo ratings yet

- A Study On Financial Ratio Analysis of Tata MotorsDocument68 pagesA Study On Financial Ratio Analysis of Tata MotorsSushree SmitaNo ratings yet

- Draft BL RASHAD v. 0918 - ASM PDFDocument1 pageDraft BL RASHAD v. 0918 - ASM PDFFerry ChandraNo ratings yet

- Strategy FormulationDocument27 pagesStrategy Formulationanju antonyNo ratings yet

- Afm 5Document2 pagesAfm 5helpevery7No ratings yet

- Datta Et Al 2018Document18 pagesDatta Et Al 2018Integrante TreceNo ratings yet

- Lecture 3: Entrepreneurship Process & Importance of EntrepreneurshipDocument8 pagesLecture 3: Entrepreneurship Process & Importance of EntrepreneurshipKalidasNo ratings yet

- Quant Checklist 184 PDF 2022 by Aashish AroraDocument74 pagesQuant Checklist 184 PDF 2022 by Aashish AroraRajnish SharmaNo ratings yet

- Macroeconomics Canadian 15th Edition Mcconnell Test BankDocument50 pagesMacroeconomics Canadian 15th Edition Mcconnell Test Bankadeleiolanthe6zr1100% (27)

- j544 Mabr Strategic Recommendation ProjectDocument20 pagesj544 Mabr Strategic Recommendation Projectapi-399251828No ratings yet

- BCG - Senior Knowledge Analyst - TMT - The Boston Consulting GroupDocument4 pagesBCG - Senior Knowledge Analyst - TMT - The Boston Consulting GroupRishiNo ratings yet

- Shariah Stock Screening Final ReportDocument16 pagesShariah Stock Screening Final ReportOsama Ali RizwanNo ratings yet

- Long Test Midterm Coverage - QDocument6 pagesLong Test Midterm Coverage - QMark IlanoNo ratings yet

- Department of Business Administration, Faculty of Arts, Brandon University, Manitoba, CanadaDocument8 pagesDepartment of Business Administration, Faculty of Arts, Brandon University, Manitoba, CanadavithuNo ratings yet

- A Guide To Risk Assessment in Ship OperationsDocument6 pagesA Guide To Risk Assessment in Ship OperationsDmytro OparivskyNo ratings yet

- Amoya Mcbean Family and Resource Mangement PortfolioDocument108 pagesAmoya Mcbean Family and Resource Mangement PortfolioJahiem BenjaminNo ratings yet

- Class 12 Business Studies Chapter 11Document30 pagesClass 12 Business Studies Chapter 11Ayush JainNo ratings yet

22 Momentive TimesofCrisis BusinessReport

22 Momentive TimesofCrisis BusinessReport

Uploaded by

p9wht9wqjnOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

22 Momentive TimesofCrisis BusinessReport

22 Momentive TimesofCrisis BusinessReport

Uploaded by

p9wht9wqjnCopyright:

Available Formats

TIMES OF CRISIS BUSINESS REPORT

How business leaders

confidently navigate

times of crisis

Current research and strategies for thriving

in an economic downturn

TIMES OF CRISIS BUSINESS REPORT | 1

OVE R VI EW

Introduction

It may feel too soon to talk about the next global crisis, but

companies are bracing for impact. From inflation and

supply chain issues, to political and social unrest in the U.S.

and abroad, the probability of an economic downturn has

gotten real.

Business leaders are taking cues from pandemic learnings

and preparing their companies to act quickly. The ability to

pivot, establish a strategic plan, and motivate the workforce

are high priorities for companies moving forward.

We took a pulse on business leaders’ —including managers,

directors, and VP/C-suite executives— priorities as they

considered the probability of an economic crisis. In a July

study by Momentive* using SurveyMonkey Enterprise,

we asked 500 U.S. business leaders about their concerns,

challenges and strategies for the upcoming year. Read on to

find out what we learned.

TIMES OF CRISIS BUSINESS REPORT | 2

OVE R VI EW

Key findings

• Over a quarter of leaders predicted that their

companies would respond with a lack of

action, overreaction, or chaos in the event of

an economic downturn

• 62% of leaders will prioritize optimizing

existing products and services during a

downturn vs. launching something new

• 65% of business leaders will prioritize gathering

fresh insights on their market and customers

during an economic downturn

• Almost half of business leaders say that access

to in-the-moment feedback is the most

important thing they can provide to their

teams during a crisis

• 57% of insights and marketing VPs/C-suite

believe that reducing research during a crisis is

very or extremely risky

• Almost half of business leaders say they

conduct MORE research during a time of crisis

TIMES OF CRISIS BUSINESS REPORT | 3

OVE R VI EW

What’s keeping business

leaders up at night?

Over two-thirds of business leaders said Leaders are split in their confidence in

an economic downturn would have their company’s ability to adapt and

the biggest negative impact on their thrive in a crisis, with 44% stating they

company, the #1 response over a global are only somewhat or not confident,

pandemic, product recall or corporate and 55% saying they are very confident.

scandal. VP and C-suite executives Middle management was less

were even more concerned, with 78% optimistic than executives—only 49%

ranking an economic downturn as the of directors are confident, compared to

most damaging event. 64% of VP+.

Leaders are split in their confidence that

their company will adapt & thrive during

times of disruption

44% Not or only somewhat

confident 56% Very or extremely

confident

TIMES OF CRISIS BUSINESS REPORT | 4

OVE R VI EW

The main concern? Giving teams what

they need to meet their goals. That

includes clear priorities, access to current

feedback, and the tools and solutions that

provide teams the autonomy to make

decisions and take action.

48%

say access to current feedback

is the most important thing

they can provide teams

Top priorities to provide teams during

a crisis

A clear strategy & set of priorities 62%

Access to current feedback 48%

Expertise to act quickly 45%

Decision-making tools & systems 42%

Data & insights to take action 38%

Well-integrated systems 30%

TIMES OF CRISIS BUSINESS REPORT | 5

OVE R VI EW

How would your company fare?

If an economic downturn were to hit, over a All of these steps rely on the same thing:

quarter of business leaders predicted there collecting current, accurate data to fuel

would be a lack of action, overreaction, or decisions. When asked what their company

43%

chaos at their company. The remaining 72% would likely do to adapt during a time of

state they will be able to quickly execute on crisis, gathering insights was high on

a clear strategy that aligns teams across the list.

the company.

Most leaders plan to lean in on existing

strengths and internal abilities. Just over

half, or 52%, believe an established brand

reputation gives them confidence to

survive, while 48% said it was a strong

of business leaders prioritized

customer experience. Last on the list? gathering insights to understand

Reliance on a team of outside experts,

at 13%. how their industry will shift

Leaders that have confidence in their

company’s ability to survive are more

inclined to use data-driven decisions as a

strategic advantage.

Confident leaders rank the

importance of using research

to drive strategies higher

than their less-confident

counterparts

Agility might be the most common

element of surviving an economic

turndown. Confident leaders put more

emphasis on their ability to make fast

decisions, align behind strategies, execute

quickly, and give teams clear direction.

TIMES OF CRISIS BUSINESS REPORT | 6

OVE R VI EW

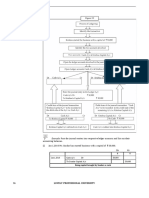

Playbook for surviving

1

an economic crisis

2

Invest in what’s working

3

Empower teams with

clear strategies

4

Plan to pivot

Tap into your strengths

TIMES OF CRISIS BUSINESS REPORT | 7

1

PL AYB OOK FOR SU R VIVIN G A N ECON OMIC CR IS IS

Invest in what’s working

The majority of business leaders agree that an economic downturn may not be the

best time to go out on a limb with unproven initiatives. Instead, the top priorities focus

on optimizing existing initiatives rather than launching new, untested strategies.

Top priorities during an economic downturn

Gather fresh insights on 65% 35% Use “what’s worked

market & customers before” findings

Optimize exising 62% 38% Innnovate/launch new

products & services products & services

Retain & grow existing

66% 34% Acquire new customers

customers

Optimize existing 51% 49% Launch new campaigns

campaigns

75% 25% Cut benefits &

Invest in our workforce

employees costs

65%

of business leaders will gather

fresh insights on their market

and customers

During times of crisis, leaders were clear on

the need to collect current data rather than

rely on past success. This was an even higher

priority amongst confident leaders, who

ranked gathering insights at 69%.

TIMES OF CRISIS BUSINESS REPORT | 8

2

PL AYB OOK FOR SU R VIVIN G A N ECON OMIC CR IS IS

Empower teams with

clear strategies

52%

The keys to success start with a solid plan The second most important thing? Giving

but include quick execution. According teams access to current feedback that

to our study, over half of executives chose identifies what’s working.

adapting to a new strategy quickly as their

top response.

Gathering insights to

understand industry shifts of confident leaders rank giving

ranked high, with 43% of leaders teams the ability to access

rating it a priority.” current feedback as the most

important thing they can do

As far as what teams need to meet their

goals, 62% of leaders said providing teams

with a clear strategy and set of priorities was

the most important step they could take

during an economic downturn.

Top priorities during an 53% Adapt to a new strategy

quickly

economic downturn

52% Prioritize delivering a great

customer experience

43% Gather insights to

understand how our

industry will shift

TIMES OF CRISIS BUSINESS REPORT | 9

3

PL AYB OOK FOR SU R VIVIN G A N ECON OMIC CR IS IS

Plan to pivot

Agility was an underlying theme in the Pivoting, quick decision making, and

responses from business leaders. Changing big-picture thinking all rely on accurate

course, fast execution, good decision insights. When we asked leaders about the

making ranked high across the board. importance of research during a crisis, the

response was overwhelming.

In fact, 64% said an ability to pivot was the

most important leadership quality during a Eighty-five percent of leaders believe that

crisis, the number one answer. Big picture eliminating research during a crisis is risky.

thinking ranked next, followed by quick Only 15% believe there’s no risk to reducing

decision making. Risk taking came in last research.

at 22%.

Business leaders weigh the risk:

eliminating research during an economic downturn

85% The downside of not acting on

insights? The outcomes are clear.

15%

85% said it would be Only 15% said it would not

somewhat, very or be very risky or not risky

extremelly risky at all

What if you didn’t have current data to make decisions during a crisis?

49% 44% 49% 42%

Putting effort into the Missed sales

Slower growth wrong things Delayed decisions opportunities

TIMES OF CRISIS BUSINESS REPORT | 10

4

PL AYB OOK FOR SU R VIVIN G A N ECON OMIC CR IS IS

Tap into your strengths

Business leaders plan to lean on different Over half chose market & competitive

areas of their company to weather a storm. intelligence research, the top response.

Whether it’s a brand tracking initiative, a Campaign development research (ad/

workforce study, or a CSAT or NPS survey, message testing) came in second at 43%

it’s critical to do the homework and buyer behavior ranked third at 31%.

to understand your company’s areas

of resilience.

We asked our marketing and insights

leaders what kind of research and

marketing programs would be the most

important during an economic downturn.

Top research initiatives during an economic downturn

Market & competitive intelligence 55%

Campaign development research 43%

Buyer behavior research 31%

Customer experience 27%

Product development research 27%

Brand health tracking 25%

Top marketing initiatives during an economic downturn

Brand awareness campaigns 53%

Organic channels 47%

Performance campaigns 39%

PR and communications 37%

Content marketing 27%

Events 22%

TIMES OF CRISIS BUSINESS REPORT | 11

What’s your game plan?

Leaders may be concerned about an economic downturn, but the most confident are

also prepared.

From collecting insights to giving teams clear, strategic direction, the business

leaders that prioritize, optimize and catalyze their teams to act will be the companies

that thrive.

Learn more about how your company

can get the insights it needs to survive.

Brand Tracking

Usage & Attitudes

Consumer Segmentation

Concept Testing

Customer Experience

Industry Tracking

About Momentive

Momentive is a leader in agile experience management, delivering powerful,

purpose-built solutions that bring together the best parts of humanity and

technology to redefine AI. Momentive products, including GetFeedback,

SurveyMonkey, and its brand and market insights solutions, empower

decision-makers at 345,000 organizations worldwide to shape exceptional

experiences. More than 20 million active users rely on Momentive for market

insights, brand insights, employee experience, customer experience, and

product experience. Ultimately, the company’s vision is to raise the bar for

human experiences by amplifying individual voices.

*July 26, 2022 Momentive study conducted of 410 business leaders in the U.S. Data collected overnight. Respondents for

this survey were selected from the more than 2 million people who take surveys on the using SurveyMonkey platform

each day.

TIMES OF CRISIS BUSINESS REPORT | 12

You might also like

- CEO Decision-Making in The Age of AIDocument27 pagesCEO Decision-Making in The Age of AIComunicarSe-Archivo100% (1)

- Succession Management Positioning Your Organizaton Leadership For Business SuccessDocument9 pagesSuccession Management Positioning Your Organizaton Leadership For Business SuccessRight ManagementNo ratings yet

- CEO Outlook 2019Document24 pagesCEO Outlook 2019Anonymous e90uptNo ratings yet

- Organizational Agility in Depth ReportDocument11 pagesOrganizational Agility in Depth Reportahuamaniv100% (1)

- (Whitepaper) The Definitive Guide For Business Continuity Program SuccessDocument19 pages(Whitepaper) The Definitive Guide For Business Continuity Program Successparkinglorca2No ratings yet

- Organizational Effectiveness: Preparing Your Workforce For ChangeDocument6 pagesOrganizational Effectiveness: Preparing Your Workforce For ChangeShabih FatimaNo ratings yet

- Top Insights 2020 FullDocument136 pagesTop Insights 2020 FullKrish Gopalakrishnan100% (1)

- OKR WorkBoard-OKRs-at-Enterprise-ScaleDocument13 pagesOKR WorkBoard-OKRs-at-Enterprise-ScaleDragan MrkajicNo ratings yet

- The Impact of Employee Engagement On PerformanceDocument20 pagesThe Impact of Employee Engagement On PerformanceRajan RahiNo ratings yet

- It Top Insights 2020 PDFDocument18 pagesIt Top Insights 2020 PDFPNG networksNo ratings yet

- Index Report For Web ResillenceDocument20 pagesIndex Report For Web Resillencegilberth araujoNo ratings yet

- Driving Org Perf in Complex Times MKinnich July 2008Document12 pagesDriving Org Perf in Complex Times MKinnich July 2008lspiering3No ratings yet

- BB Winning Turbulence Lessons Gaining Groud TimesDocument4 pagesBB Winning Turbulence Lessons Gaining Groud TimesGustavo MicheliniNo ratings yet

- From Operational Chaos To Business GrowthDocument11 pagesFrom Operational Chaos To Business Growth50interviewsNo ratings yet

- Four Ways To Advance Risk OversightDocument32 pagesFour Ways To Advance Risk OversightMarcos Avello IbarraNo ratings yet

- Communicating Change: Evidence-Based Communications. Inform. Monitor. MeasureDocument9 pagesCommunicating Change: Evidence-Based Communications. Inform. Monitor. MeasurecchaudoitNo ratings yet

- Motivational Matters Report 2009Document8 pagesMotivational Matters Report 2009Lynne BellNo ratings yet

- Buildingawinningsalesforce WP DdiDocument14 pagesBuildingawinningsalesforce WP DdiMawaheb ContractingNo ratings yet

- (2023) The Power of Portfolio Renewal and The Value in Divestitures - GTM Slides May 2023Document19 pages(2023) The Power of Portfolio Renewal and The Value in Divestitures - GTM Slides May 2023Javier UrmenetaNo ratings yet

- Enabling Enterprise Change ManagementDocument8 pagesEnabling Enterprise Change ManagementDemand MetricNo ratings yet

- EZ-Sustainability Survey Report-FinalDocument12 pagesEZ-Sustainability Survey Report-FinalFranklin AntezanaNo ratings yet

- 7A-Balanced ScorecardDocument18 pages7A-Balanced ScorecardBhaskar AnandNo ratings yet

- A Guide To Growth - A Global Analysis of The Defining Characteristics of Leading Midsize CompaniesDocument15 pagesA Guide To Growth - A Global Analysis of The Defining Characteristics of Leading Midsize CompaniesCharith Nilanga WeerasekaraNo ratings yet

- Transform To PerformDocument17 pagesTransform To PerformIgorNo ratings yet

- Bulletin v3 Issue6Document5 pagesBulletin v3 Issue6Rugeyye RashidNo ratings yet

- How Top Companies Close the SЕ GapDocument34 pagesHow Top Companies Close the SЕ GapCecilia BodkNo ratings yet

- Cre3055 HBR Ps Lattice 3Document12 pagesCre3055 HBR Ps Lattice 31210869No ratings yet

- 27th Annual Global Ceo Survey Asia PacificDocument24 pages27th Annual Global Ceo Survey Asia Pacificpt.andalan.mutiaraNo ratings yet

- Business Strategies in Economic Turbulence: Authors Name: V. SUDHA College: MRITS PH: 9000462678Document6 pagesBusiness Strategies in Economic Turbulence: Authors Name: V. SUDHA College: MRITS PH: 9000462678Sudha VemarajuNo ratings yet

- State of Product Excellence - Product BoardDocument32 pagesState of Product Excellence - Product BoardRahulSharma100% (1)

- Ey Mena Faas From Value Protection To Long Term Value Creation How Can Cfos Reframe FinanceDocument36 pagesEy Mena Faas From Value Protection To Long Term Value Creation How Can Cfos Reframe Financejangan opo? jangan sayurNo ratings yet

- Business Partnering e BookDocument20 pagesBusiness Partnering e BookjohnkwashanaiNo ratings yet

- Mckinsey On Finance: Managing Through Covid-19Document48 pagesMckinsey On Finance: Managing Through Covid-19nvpstudy279No ratings yet

- Accelerate or Get Left Behind - ENGDocument8 pagesAccelerate or Get Left Behind - ENGSara-QMNo ratings yet

- The New Decision Makers: Equipping Frontline Workers For SuccessDocument15 pagesThe New Decision Makers: Equipping Frontline Workers For SuccessMDanNo ratings yet

- Implementing The: Project PortfolioDocument20 pagesImplementing The: Project PortfolioGriselda Meza GutierrezNo ratings yet

- Performance Management COVIDDocument15 pagesPerformance Management COVIDrogerNo ratings yet

- Deloitte Insightful Management ReportingDocument20 pagesDeloitte Insightful Management ReportingДавид АрноNo ratings yet

- Healthcare Trends - 2011: Healthcare Leadership White PaperDocument4 pagesHealthcare Trends - 2011: Healthcare Leadership White PaperBESmithIncNo ratings yet

- Severance Practices Around The WorldDocument34 pagesSeverance Practices Around The WorldRight ManagementNo ratings yet

- The Flux Report Building A Resilient Workforce in The Face of FluxDocument17 pagesThe Flux Report Building A Resilient Workforce in The Face of FluxManpowerGroupFrNo ratings yet

- Strategy For PRESENTATION Riskdjustedforecastingandplanning DeloitteIreland EnergyResourcesDocument16 pagesStrategy For PRESENTATION Riskdjustedforecastingandplanning DeloitteIreland EnergyResourcessergio.assuncao9711No ratings yet

- How To Approach Your Business Transformation: Tips For SuccessDocument12 pagesHow To Approach Your Business Transformation: Tips For SuccessJg ZhouNo ratings yet

- Fp&A Trends: Cfo Guide ToDocument15 pagesFp&A Trends: Cfo Guide ToaasifmmNo ratings yet

- Reassessing Value PDFDocument16 pagesReassessing Value PDFanushanNo ratings yet

- How Companies Approcah Innovation MKZ PDFDocument13 pagesHow Companies Approcah Innovation MKZ PDFLucusNo ratings yet

- Aberdeen Managing Risk in Your Sales and Operations Planning Process November 2017Document12 pagesAberdeen Managing Risk in Your Sales and Operations Planning Process November 2017AhmadNo ratings yet

- LOS 2021 Execution InsightsDocument22 pagesLOS 2021 Execution InsightsOluwaseun AlausaNo ratings yet

- Management Accounting Opportunities in ChinaDocument11 pagesManagement Accounting Opportunities in Chinafurong.hsuNo ratings yet

- Chapter No. 2 Crisis and Crisis ManagementDocument48 pagesChapter No. 2 Crisis and Crisis ManagementmohitNo ratings yet

- Audit Plan 8Document13 pagesAudit Plan 8Harold Dan AcebedoNo ratings yet

- Delloite - Journey Resilient LeadershipDocument16 pagesDelloite - Journey Resilient LeadershiptammymdNo ratings yet

- Report OnSolve Failing To Plan Is Planning To FailDocument19 pagesReport OnSolve Failing To Plan Is Planning To FailibrahimNo ratings yet

- Driving Sustainability Strategy Home 1707595711Document20 pagesDriving Sustainability Strategy Home 1707595711Senem KayakıranNo ratings yet

- Five Key Asset Management StrategiesDocument6 pagesFive Key Asset Management StrategiesFemi ObiomahNo ratings yet

- How Can Bold CFO Reframe Their Role EYDocument32 pagesHow Can Bold CFO Reframe Their Role EYSaurabh MehrotraNo ratings yet

- The Success Case Method: Find Out Quickly What's Working and What's NotFrom EverandThe Success Case Method: Find Out Quickly What's Working and What's NotRating: 5 out of 5 stars5/5 (4)

- The Business Forecasting Deal: Exposing Myths, Eliminating Bad Practices, Providing Practical SolutionsFrom EverandThe Business Forecasting Deal: Exposing Myths, Eliminating Bad Practices, Providing Practical SolutionsNo ratings yet

- Cosmopolitan Managers: Executive Development that WorksFrom EverandCosmopolitan Managers: Executive Development that WorksNo ratings yet

- Examiner's Report: MA1 Management Information Based On Exams From January To June 2019Document6 pagesExaminer's Report: MA1 Management Information Based On Exams From January To June 2019Zohair HumayunNo ratings yet

- Jazz Weekly SMS PackageDocument2 pagesJazz Weekly SMS Packageaimenmubashar111No ratings yet

- Auditing Dan AtestasiDocument7 pagesAuditing Dan AtestasiYudiantoNo ratings yet

- Master Budget: Sales ForecastDocument61 pagesMaster Budget: Sales ForecastLay TekchhayNo ratings yet

- Preparation of Final AccountsDocument13 pagesPreparation of Final AccountsDr Sarbesh MishraNo ratings yet

- Purchase Order: Ship To Vendor Bill ToDocument1 pagePurchase Order: Ship To Vendor Bill Toeduardo patricioNo ratings yet

- Spell Bee Reg. Form - Excel Version 2020-21Document26 pagesSpell Bee Reg. Form - Excel Version 2020-21Itismita PriyadarshiNo ratings yet

- Investor.: Amcham Celebrates July 4ThDocument80 pagesInvestor.: Amcham Celebrates July 4Thmihaii3No ratings yet

- Accounting Principles 8th Edition - Exercises Chapter07Document9 pagesAccounting Principles 8th Edition - Exercises Chapter07kimkov119No ratings yet

- What Benefits Have CEMEX and The Other Global Competitors in Cement Derived From GlobalizationDocument2 pagesWhat Benefits Have CEMEX and The Other Global Competitors in Cement Derived From GlobalizationEmmanuelNo ratings yet

- 01 & 02 Week POMDocument51 pages01 & 02 Week POMfakhar alamgirNo ratings yet

- Organization Culture-Nikhil Peshawaria - Mohit WattsDocument32 pagesOrganization Culture-Nikhil Peshawaria - Mohit WattsAmit Anand KumarNo ratings yet

- Parent DeclarationDocument2 pagesParent DeclarationshajuNo ratings yet

- Chapter 4 Market Force@Document77 pagesChapter 4 Market Force@sơn trầnNo ratings yet

- A Study On Financial Ratio Analysis of Tata MotorsDocument68 pagesA Study On Financial Ratio Analysis of Tata MotorsSushree SmitaNo ratings yet

- Draft BL RASHAD v. 0918 - ASM PDFDocument1 pageDraft BL RASHAD v. 0918 - ASM PDFFerry ChandraNo ratings yet

- Strategy FormulationDocument27 pagesStrategy Formulationanju antonyNo ratings yet

- Afm 5Document2 pagesAfm 5helpevery7No ratings yet

- Datta Et Al 2018Document18 pagesDatta Et Al 2018Integrante TreceNo ratings yet

- Lecture 3: Entrepreneurship Process & Importance of EntrepreneurshipDocument8 pagesLecture 3: Entrepreneurship Process & Importance of EntrepreneurshipKalidasNo ratings yet

- Quant Checklist 184 PDF 2022 by Aashish AroraDocument74 pagesQuant Checklist 184 PDF 2022 by Aashish AroraRajnish SharmaNo ratings yet

- Macroeconomics Canadian 15th Edition Mcconnell Test BankDocument50 pagesMacroeconomics Canadian 15th Edition Mcconnell Test Bankadeleiolanthe6zr1100% (27)

- j544 Mabr Strategic Recommendation ProjectDocument20 pagesj544 Mabr Strategic Recommendation Projectapi-399251828No ratings yet

- BCG - Senior Knowledge Analyst - TMT - The Boston Consulting GroupDocument4 pagesBCG - Senior Knowledge Analyst - TMT - The Boston Consulting GroupRishiNo ratings yet

- Shariah Stock Screening Final ReportDocument16 pagesShariah Stock Screening Final ReportOsama Ali RizwanNo ratings yet

- Long Test Midterm Coverage - QDocument6 pagesLong Test Midterm Coverage - QMark IlanoNo ratings yet

- Department of Business Administration, Faculty of Arts, Brandon University, Manitoba, CanadaDocument8 pagesDepartment of Business Administration, Faculty of Arts, Brandon University, Manitoba, CanadavithuNo ratings yet

- A Guide To Risk Assessment in Ship OperationsDocument6 pagesA Guide To Risk Assessment in Ship OperationsDmytro OparivskyNo ratings yet

- Amoya Mcbean Family and Resource Mangement PortfolioDocument108 pagesAmoya Mcbean Family and Resource Mangement PortfolioJahiem BenjaminNo ratings yet

- Class 12 Business Studies Chapter 11Document30 pagesClass 12 Business Studies Chapter 11Ayush JainNo ratings yet