Professional Documents

Culture Documents

Your Annual Mortgage Statement Explained - 10-DeC-23 12030556

Your Annual Mortgage Statement Explained - 10-DeC-23 12030556

Uploaded by

haroonraja579Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Your Annual Mortgage Statement Explained - 10-DeC-23 12030556

Your Annual Mortgage Statement Explained - 10-DeC-23 12030556

Uploaded by

haroonraja579Copyright:

Available Formats

Your annual

mortgage

statement

explained

Illustration only

This brochure is only a guide to help explain your

statement and how our mortgages work.

B0213_BAR0723038772-001_PN7425427_8801372_UK_0923.indd 1 29/08/2023 11:20

About your mortgage

If the Bank of England base rate materially changes

or stops being available

If for any reason the Bank of England base rate

materially changes or stops being available, we’ll

replace it with an alternative rate that we reasonably

consider to be the closest available equivalent.

We’ll give you at least 14 days’ notice before the

alternative rate takes effect.

What happens if I change my address to outside the

United Kingdom?

If you change any address, we have for you to one in a

different country, we might not be able to offer you

certain mortgages.

B0213_BAR0723038772-001_PN7425427_8801372_UK_0923.indd 2 29/08/2023 11:20

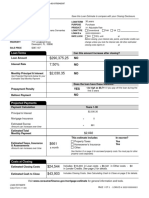

Your statement explained

The descriptions below correspond to the numbered 5. Your mortgage account in more detail

images on the next few pages. We’ve designed them

to help you understand your own statement. The Payment due

items listed in the example will only be shown on your The monthly payment amount due.

statement if they apply to your mortgage.

Credit

1. Your account summary All payments received during the year and any other

credits.

Mortgaged property

The address of the property that the mortgage is Debit

associated with. This might be different from the This could include things like legal costs, administration

postal address we use for you. costs, payments recalled by your bank and unpaid

Direct Debits. It also includes the interest charged for

The repayment terms of your mortgage the month.

Whether your account is interest only, repayment or a

combination of both. Balance carried forward

The balance outstanding on your account at the end of

Remaining term the statement period. The balance on your mortgage

The years and/or months until the end of your year end statement includes all transactions and

mortgage contract based on the original agreed term interest up to the end of your mortgage year. If we told

and doesn’t take into account any overpayments or you your balance previously, this will have been at an

term reduction through offset adjustments. earlier date and may not have reflected all the

payments you’ve made or the interest charged up to

Current interest rate of your mortgage the end of your mortgage year.

The rate that applies to your loan on the date shown.

Viewing all your information online

2. Your payment summary You can see the information on your mortgage

statement in Online Banking. Find out more at

Current monthly payment barclays.co.uk/mortgages

The amount you pay each month.

6. Paying off your mortgage

Previous balance This section gives you an illustration only of how

The balance of your mortgage at the end of your much it could cost you to repay your mortgage in full

previous mortgage year. on the statement date.

This is not a final redemption statement. There may be

Current balance

additional charges that we haven’t applied to your

The balance of your mortgage at the end of your latest mortgage account yet. These will affect the total cost

year. of the repayment shown.

Interest charged this period Q. Can I use the balance outstanding as a redemption

amount?

The amount of interest we applied to the account

during the last mortgage year. It also takes into A. No, the balance shown on your statement was the

account any interest rate changes during this period. amount owed as at the end of your last mortgage year,

as shown in the example on the next page. Since that

time, interest has accrued and you may have made

3. Interest rates

another payment so you’ll need to request a

The interest rates we applied to your account during

redemption statement.

the last mortgage year.

4. Your monthly payments explained

Your new monthly payment from the date detailed in

your annual statement.

B0213_BAR0723038772-001_PN7425427_8801372_UK_0923.indd 3 29/08/2023 11:20

Example of your annual

mortgage statement

Dates and amounts are for illustration only.

Your annual mortgage statement for 2023

1 Your account summary

Your account number 90-123-45678

Mortgaged property 1 Any Street

Any Town

Any County

AN1 6NY

The repayment terms of your mortgage Repayment

Remaining term 7 years 8 months

Current interest rate of your mortgage as 5.24%

30 September 2023

2 Your payment summary

Current monthly payment £101.02

Previous balance £20,210.34

Current balance £19,222.06

Interest charged this period £229.54

3 Interest rates

The following interest rates were applied to your mortgage during the statement period.

1 October 2022 to 30 September 2023 5.24%

Current interest rate as of 30 September 2023 5.24%

4 Your monthly payments

Commencing from 1 October 2023 your monthly payment will be £99.84

B0213_BAR0723038772-001_PN7425427_8801372_UK_0923.indd 4 29/08/2023 11:20

5 Your mortgage account in more detail

If you made a payment shortly before the mortgage year end and it’s not shown, it’ll be included on your

next annual statement.

Date Description Payment due Debit Credit Balance

1 Oct Balance brought forward £20,210.34

Oct Payment due £101.02

16 Oct Payment – thank you £101.02

Oct Interest charged for Oct £19.42

Nov Payment due £101.02

16 Nov Payment – thank you £101.02

Nov Interest charged for Nov £18.71

Dec Payment due £101.02

16 Dec Payment – thank you £101.02

Dec Interest charged for Dec £19.26

...

...

30 September 2023 Balance carried forward £19,222.06

6 Paying off your mortgage

As this is an illustration only, there may be additional charges and interest which we haven’t yet

applied to your mortgage account. These could affect the total cost of repayment shown below.

Outstanding balance £19,222.06

Early Repayment Charge £1,000.00

Mortgage exit fee £275.00

Total cost of repayment in full £20,497.06

B0213_BAR0723038772-001_PN7425427_8801372_UK_0923.indd 5 29/08/2023 11:20

All about payments and transactions

This section gives you information about how you can Overpayments

change payments to your mortgage and make Q. What are overpayments?

overpayments in Online Banking. It also provides

helpful descriptions of mortgage terminology and A. Any extra money that you pay above your

what they mean for you. contractual monthly payment.

You can make one-off or regular overpayments in

Direct Debits Online Banking or increase your monthly Direct Debit

or standing order.

Q. If I pay by Direct Debit and my payment has

changed, what do I need to do? Q. What’s the definition of an overpayment?

A. You don’t need to do anything – we’ll change your A. An overpayment is any extra payment (other than a

payment amount for you. payment to cover any of our charges or costs) that’s

less than three times your monthly payment amount.

Q. Can I change the date of my Direct Debit?

If you make a payment equal to more than three times

A. We can collect your Direct Debits between the 1st your monthly payment amount, we’ll treat this as an

and 28th, or the last working day of the month. We can ‘early repayment’ (see capital repayments). We can’t

collect offset Direct Debits between the 16th and refund any overpayments.

28th, or the last working day. You can change your

Q. Will overpayments change my monthly

payment date by calling us on 0800 022 4022* –

repayments?

we’re here Monday to Friday, from 7am to 8pm and

weekends from 7am to 5pm. A. No, overpayments will reduce your mortgage

balance (which we charge interest on) but won’t

automatically change your contractual monthly

Standing orders

payment amount. We’ll still apply the overpayment

Q. If I pay by standing order and my payment has amount to reduce the balance, which will also reduce

changed, what do I need to do? the interest charged. You can choose to reduce your

A. You’ll need to change your payment amount. If you monthly payments by asking us to apply the money as

bank with us, you can do this in Online Banking or the a capital repayment (or part redemption) and to

Barclays app, or by calling us on 03457 345 345† we’re recalculate your monthly payment.

here Monday to Friday, from 9am to 5pm. Q. My payment amount is due to be reduced, can I

Q. Can I change the date of my standing order? keep it the same?

A. We accept standing order payments on any day of A. Please find more information on overpayments

the month, but you’ll need to make sure we receive online at barclays.co.uk/overpayments

your payment by the due date.

Q. Do I have to call you or visit a branch to set up or

amend a Direct Debit or standing order?

A. No, you can do this in Online Banking or the

Barclays app. We’ll send you confirmation by post

within 14 working days. If you don’t pay your mortgage

from a Barclays account, you’ll need to contact your

account provider.

B0213_BAR0723038772-001_PN7425427_8801372_UK_0923.indd 6 29/08/2023 11:20

Capital repayments (part redemption) Maintaining my mortgage payment

Q. What are capital repayments? Q. What if I’m having difficulty keeping up with my

A. A lump sum payment to reduce your mortgage mortgage payments?

balance. You might need to pay an Early Repayment A. We’re always here to help, so if you’re having trouble

Charge (see your offer for details). We’ll also adjust paying your mortgage or think you might in the future,

your monthly payment amount to take the lump sum please call us on 0800 022 4022*.

payment into account.

Q. Will I be charged when you apply a capital repayment Other charges

to my mortgage? We don’t charge for unpaid or returned Direct Debits

A. You might need to pay an Early Repayment Charge or cheques. This means you won’t need to pay any

when you make a capital repayment. It’s important you additional charges when you’re first in arrears. Other

check your mortgage offer and terms and conditions, charges may apply later in the process, for example,

or call 0800 022 4022* for more details. if we have to start the repossession process. These

charges will depend on your circumstances.

B0213_BAR0723038772-001_PN7425427_8801372_UK_0923.indd 7 29/08/2023 11:20

Useful information

Here are some descriptions of other mortgage terms How rebalancing works

you might see on letters we send you. This means your mortgage reserve limit automatically

goes up as your main mortgage balance goes down.

Mortgage Current Account Rebalancing provides flexibility when managing your

Your Mortgage Current Account (MCA) finances, but you’ll still need to repay any outstanding

balance at the same time as the mortgage.

This works like any normal current account, which you

can use for your everyday banking needs. You may It’s important you have a plan in place to repay any

have received a chequebook and debit card from us outstanding mortgage reserve balance on or before

when you took out your mortgage. your mortgage is repaid.

Depending on your repayment plans, you might find it

The Mortgage Current Account Reserve or reserve easier to manage your finances by removing the

facility rebalancing feature and keeping your mortgage

This is a secured overdraft facility on a Mortgage reserve at the limit agreed.

Current Account (or an OpenPlan Reserve). We no

longer offer a reserve facility with new mortgage Repaying your reserve facility

applications, but some existing customers will have a Any funds drawn from the reserve facility are secured

reserve facility on their Mortgage Current Account (or against your property and you’ll need to repay them by

an OpenPlan Reserve). the end of your mortgage term or on redemption of

We originally charged interest on extra borrowing your main mortgage, whichever is sooner. This means

drawn down from the Mortgage Current Account you’ll need to put additional arrangements in place to

Reserve at our Standard Variable Rate (SVR), except repay your reserve facility, as your contractual monthly

offset mortgages where we charge interest at the mortgage repayments don’t cover the additional

offset mortgage rate. The rate for non-offset tracks borrowing.

the Bank of England base rate (BEBR) +3.49%. The rate If you’re concerned about repaying your reserve

we charge on your mortgage will change within one facility, you might want to set up a standing order

month of any change to the BEBR. to help you manage repayments over a period that

On any overdrawn reserve facility balance, interest will suits you.

accrue and the reserve facility balance will increase If you bank with us, the easiest way to do this is in

because of this. Interest on offset mortgages will be Online Banking or the Barclays app.

debited from your mortgage account.

To make sure your mortgage reserve limit is set at an

appropriate level, we regularly review mortgage

reserve limits for all our customers. This takes into

account things like how regularly you use your

mortgage reserve, how much you’ve borrowed, and

(where necessary) credit reference agency

information.

B0213_BAR0723038772-001_PN7425427_8801372_UK_0923.indd 8 29/08/2023 11:20

Porting your mortgage Interest rates

This is when you transfer your existing mortgage

interest rate on your current property to a newly Our Standard Variable Rate (SVR)

purchased property. Our Standard Variable Rate is a variable interest rate

set by Barclays Bank UK PLC that tracks the Bank of

You can’t port to a property you’d already purchased

England base rate +3.49%. As the rate is linked to a

before you redeemed the existing mortgage on your

variable rate, your monthly repayments could increase

current property.

or decrease. The rate we charge on your mortgage will

change within one month of any change to the BEBR.

What happens if you move house

If you buy another property, you can port your current Bank of England base rate (BEBR)

mortgage interest rate to the newly purchased

The Bank of England base rate is a variable rate set by

property, as long as the ported amount isn’t more than

the Bank of England, which can go up or down.

your outstanding mortgage balance.

Some of our variable rate products have a minimum

Porting will always be subject to eligibility and provided

rate, also known as the floor rate. If there’s a minimum

you still meet our lending criteria. You won’t be able to

rate on your product, we won’t make any changes to

use your existing mortgage interest rate on your

track the BEBR if it’s less than zero.

current property to get any additional borrowing –

you’ll need to apply for one of our current products.

What happens if you sell my house but I don't have

one to move into straight away

If you redeem the mortgage you intend to port before

you purchase another property, you’ll have 90 days

from the date you redeem your current mortgage to

complete on the new purchase to keep the existing

mortgage interest rate. After that, you’ll need to select

a product from the current mortgage product range

available at that time.

B0213_BAR0723038772-001_PN7425427_8801372_UK_0923.indd 9 29/08/2023 11:20

Check you’re on track to repay

your mortgage

This section provides a guide to familiarise yourself Other repayment plans

with the key mortgage repayment types and useful If you have any other type of repayment plan, you’ll

contact numbers if you need to discuss your need to check with your product provider to make sure

repayment arrangements. it’s on track to repay your mortgage.

We can’t give you information to assess whether you

Repayment mortgages have a potential shortfall, but we may be able to help

Your monthly payments gradually pay off your you with options.

mortgage as well as the interest charged. This means If you have a mortgage and/or repayment plan that will

that the amount borrowed will normally be repaid by continue beyond your retirement date, it’s important

the end of the mortgage term (assuming you’ve made you make sure you’ll be able to meet your regular

all repayments on time and in full). payments when you retire, if you’ve identified a

potential shortfall.

Interest-only mortgages

Your monthly payments only pay off the mortgage Keeping up with your mortgage payments

interest. This means that at the end of the mortgage If you ever find you can’t make your monthly mortgage

term, assuming you’ve made all the interest payments, payments, or you have any concerns about your

you’ll owe the same amount that you borrowed at the repayment plan being on track to pay your mortgage

beginning, plus any fees you may have chosen to add off at the end of the term, please call us on

to your mortgage during the term. 0800 022 4022* as soon as possible.

We’re here to help. The earlier you contact us the more

Part interest, part repayment mortgages likely it is that we’ll be able to come to an arrangement

Simply, this is a mixture of a repayment and an about your payments and guide you through any

interest-only mortgage. You choose how much of your charges you might have to pay.

mortgage you’d like to be on a repayment basis and

how much on interest-only. Queries

If you need to query the payment or balance shown on

Make sure you can repay your interest-only, the statement, please call us on 0800 022 4022*

part interest, part repayment mortgages

or write to:

If you have an interest-only, part interest, part

Barclays Mortgages

repayment mortgage or Mortgage Current Account

PO Box 8575

reserve drawn balance, it’s your responsibility to make

Leicester

sure you have a repayment plan in place. You’ll need to

LE18 9AW

check it regularly to make sure it’s on track to repay the

mortgage at the end of the term, otherwise you could Please check and keep all statements for future

lose your home. reference.

Endowment policies

If you have an endowment policy, your insurer will tell

you whether the policy is on target. If it indicates a

potential shortfall, you have a number of choices to

consider depending on your individual events.

You can contact the Money Helper Service which is a

free independent service set up by the government by

visiting moneyhelper.org.uk for more information.

10

B0213_BAR0723038772-001_PN7425427_8801372_UK_0923.indd 10 29/08/2023 11:20

Your personal information What else can you do with Online

We're committed to protecting your

Banking?

personal data. Make regular overpayments

We’ll use your information for a number of different You can set up to make regular overpayments online.

purposes, like to manage your account, to provide our

products and services to you and others and to meet Make underpayments

our legal and regulatory obligations.

Depending on your circumstances, you may be able to

We may also share your information with our trusted set up regular underpayments online.

third parties for these purposes.

For more detailed information on how and why we use Setup and manage direct debits

your information, including the rights in relation to Set up a new Direct Debit or manage an existing one.

your personal data, and our legal grounds for using it,

please go to barclays.co.uk/control-your-data or you Manage your offset mortgage

can ask us for a copy. Add or remove the accounts linked to your offset

mortgage.

How you can manage your mortgage in

the Barclays app or in Online Banking. How to register for the Barclays app

It’s important to us that you feel in control of your To get registered, first download the Barclays app from

mortgage. If you’re registered for the Barclays app or your app store. You can also scan the QR code on this

Online Banking, you can access all the important page to take you directly to it.

details of your mortgage including:

• Your balance

• Your mortgage year end statement

• Monthly statements for offset customers

• Monthly payment amount

• When your mortgage product rate ends

• Mortgage transactions

• Current interest rate. If you also have a Barclays current account, or a

Mortgage Current Account, you can easily register for

What can you do in the Barclays app? the app using your debit card by selecting that option

and following the instructions you see on your device

Make overpayments: screen.

Make a one-off overpayment using your Barclays If you only have a mortgage with us, select the

savings or current account, or by debit card. Just 'Register another way' option instead. To complete

check your mortgage offer and terms and conditions registration, you’ll need:

first to see if you'll have to pay any early repayment 1. To enter your mobile number - this will need to

charges. match what we have for you on record

Switch your mortgage rate 2. Photo ID to securely complete registration.

Secure your rate quickly and easily in the app up to You may also need your 10-digit mortgage account

180 days before your current rate ends. number (this will start with a 9).

Apply for additional borrowing

You can apply for additional borrowing in the

Barclays app.

11

B0213_BAR0723038772-001_PN7425427_8801372_UK_0923.indd 11 29/08/2023 11:20

How to register for Online Banking Having difficulty registering or

Just visit barclays.co.uk/onlinebanking and select logging in?

‘Register’ in the top right corner of the page. From

here, you’ll need either your: The Barclays app

• Barclays debit card and sort code, or If you only hold a mortgage with us, you may have

difficulty registering to the app if we don’t have your

• Mortgage account number, which you can find on

up-to-date mobile number on our records. Please call

your annual mortgage statement or on your original

us on 0333 202 7578 to update it or if you need any

mortgage paperwork

help registering. We’re here Monday to Friday, from

After you’ve registered, your membership and 7am to 8pm, and from 7am to 5pm at the weekend.

passcode details will be with you within seven working

days. Online Banking

If you hold a Barclays current or savings account as well If you've forgotten your login details, call us on 0345

as a mortgage with us, please register using your 600 2323† (outside the UK +44 247 684 2063) to get a

current or savings account details – you’ll need to reminder of your membership number, or for a

select ‘current/savings account’ under the account replacement online banking passcode. We’re here

type option. If you only hold a mortgage, please Monday to Friday, from 9am to 5pm.

register using your mortgage account number.

Your home may be repossessed if you don’t keep up repayments on your mortgage.

Your buy to let property may be repossessed or a receiver of rent appointed if you

don’t keep up repayments on your mortgage.

You can request this in Braille, large print or audio. For information

about all of our accessibility services or ways to contact us, visit

barclays.co.uk/accessibility

Call monitoring and charges information

*Calls to 0800 numbers are free if made from a UK landline and international calls are charged at local rate,

mobile costs may vary – please check with your telecoms provider for other phone numbers.† Calls may be

recorded so that we can monitor the quality of our service and for security purposes.

Barclays Bank UK PLC. Authorised by the Prudential Regulation Authority and regulated by the Financial Conduct Authority and the Prudential

Regulation Authority (Financial Services Register No. 759676). Registered in England. Registered No. 9740322. Registered Office: 1 Churchill

Place, London E14 5HP. Most buy-to-let mortgages are not regulated by the Financial Conduct Authority.

Item ref: 8801372_UK 09/23

B0213_BAR0723038772-001_PN7425427_8801372_UK_0923.indd 12 29/08/2023 11:20

You might also like

- Accounting Gov ReviewerDocument19 pagesAccounting Gov ReviewerAira Jaimee GonzalesNo ratings yet

- International Contract For Sale of Goods PDFDocument28 pagesInternational Contract For Sale of Goods PDFtienma19890% (1)

- FInal Task Performance TNT ExpressDocument6 pagesFInal Task Performance TNT ExpressBea Catherine LaguitaoNo ratings yet

- Economic Environment of Business Mini ProjectDocument19 pagesEconomic Environment of Business Mini Projectpankajkapse67% (3)

- Mortgage IllustrationDocument7 pagesMortgage IllustrationMark JacksonNo ratings yet

- Consumer Credit Contract ScheduleDocument10 pagesConsumer Credit Contract ScheduleFarhan MohaimenNo ratings yet

- Essential InformationDocument14 pagesEssential InformationdavemuncNo ratings yet

- Essential InformationDocument14 pagesEssential InformationALEXANDRANo ratings yet

- Loan Documentation - 20231215065004Document13 pagesLoan Documentation - 20231215065004souljarsmile7No ratings yet

- Loan Modification Agreement (5-1 ARM 10 Year IO)Document4 pagesLoan Modification Agreement (5-1 ARM 10 Year IO)TaylorMortgageLawNo ratings yet

- Loan AmortizationDocument28 pagesLoan AmortizationMarilyn Perez OlañoNo ratings yet

- Credit Card Terms 04 19Document11 pagesCredit Card Terms 04 19THNo ratings yet

- Loan Agreement PDFDocument9 pagesLoan Agreement PDFHengki YonoNo ratings yet

- CreditCardCreditAgreement 1323-28042013Document7 pagesCreditCardCreditAgreement 1323-28042013Fabian DeeNo ratings yet

- Module 1 3 Notes PayableDocument8 pagesModule 1 3 Notes PayableFujoshi BeeNo ratings yet

- PERSONAL LOAN AGREEMENT - OlanDocument4 pagesPERSONAL LOAN AGREEMENT - OlanJerson ArinqueNo ratings yet

- Zpsagreementshowtranid ZMP20201207110122 BC 17 FD 44Document12 pagesZpsagreementshowtranid ZMP20201207110122 BC 17 FD 44Licia BeezNo ratings yet

- Module 13 Notes PayableDocument9 pagesModule 13 Notes PayableLilyNo ratings yet

- Financial Terminology Jargon Buster A - EDocument5 pagesFinancial Terminology Jargon Buster A - Embarty2010No ratings yet

- 0 - Loan EstimateDocument3 pages0 - Loan EstimateSophia AlvaradNo ratings yet

- Proposaldoc0 Doc183Document9 pagesProposaldoc0 Doc183Asuncion Blanque AlcaideNo ratings yet

- Loan Terms & ConditionsDocument10 pagesLoan Terms & ConditionsTesting100% (1)

- Tenants GuideDocument13 pagesTenants GuideShashi Shekhar MahajanNo ratings yet

- Agreement in PrincipleDocument10 pagesAgreement in PrincipleAnonymous Y7iconnNo ratings yet

- Monthly Fixed Sum Loan Agreement 2Document4 pagesMonthly Fixed Sum Loan Agreement 2karenfergieNo ratings yet

- Term Loan Hong LeongDocument5 pagesTerm Loan Hong LeongYap HSNo ratings yet

- Credit Agreement - Iinitial Advance Into The Bank Account Whose Details You Have Provided To Us at The Time You Made Your ApplicationDocument10 pagesCredit Agreement - Iinitial Advance Into The Bank Account Whose Details You Have Provided To Us at The Time You Made Your ApplicationTestingNo ratings yet

- Agreements Loan Agreement 6393151316115339 1669014522591Document4 pagesAgreements Loan Agreement 6393151316115339 1669014522591Krishna aryalNo ratings yet

- Mrs Xhilda Kapo Loan AgreementDocument5 pagesMrs Xhilda Kapo Loan Agreement8zcjft96dgNo ratings yet

- 41w 5.25% 2250:mo 30yr 7yr2mo 25wDocument3 pages41w 5.25% 2250:mo 30yr 7yr2mo 25w俞悅No ratings yet

- RepaymentSchedule 2Document2 pagesRepaymentSchedule 2Mae Ann GonzalesNo ratings yet

- Promissory Note Promissory Note Number: PN761443 - 347310Document4 pagesPromissory Note Promissory Note Number: PN761443 - 347310Joseph TolentinoNo ratings yet

- CBA HomeLoan Key Fact SheetDocument2 pagesCBA HomeLoan Key Fact Sheet3zarez14No ratings yet

- Signature-1Document6 pagesSignature-1Phumi PhumiNo ratings yet

- Halifax Personal Loan CCADocument10 pagesHalifax Personal Loan CCAGabriel TalosNo ratings yet

- SignatureDocument13 pagesSignatureVee-kay Vicky KatekaniNo ratings yet

- Creditcard PCC IDocument8 pagesCreditcard PCC IJason MatthewsNo ratings yet

- SecciCcaPdf 2 JKDocument10 pagesSecciCcaPdf 2 JKmohitulislamNo ratings yet

- Lending Against Turnover - Key Facts Statement Oct 2022Document3 pagesLending Against Turnover - Key Facts Statement Oct 2022Sunday DavidNo ratings yet

- Mortgage CalculatorDocument4 pagesMortgage Calculatorapi-246390576No ratings yet

- Loans Notes and ExamplesDocument7 pagesLoans Notes and ExamplesJennifer PitterleNo ratings yet

- Uni Flex 120922Document12 pagesUni Flex 120922wilsonNo ratings yet

- Example Amortization ScheduleDocument3 pagesExample Amortization SchedulePankil R ShahNo ratings yet

- Aggr EmentDocument46 pagesAggr EmentMihir PanchalNo ratings yet

- Spring Financial - The FoundationDocument8 pagesSpring Financial - The FoundationJustin GordonNo ratings yet

- 3cb6023e-e475-4cd7-807d-7d47845e15d5Document21 pages3cb6023e-e475-4cd7-807d-7d47845e15d5Joseph MoranNo ratings yet

- Chap 008Document5 pagesChap 008hasnat sakibNo ratings yet

- BAR ResidentialAffordability 2023 09 01 0336Document3 pagesBAR ResidentialAffordability 2023 09 01 0336adeel.a.bhattiNo ratings yet

- Group3 Corporate Finance Rent Vs Buy ExplanationDocument4 pagesGroup3 Corporate Finance Rent Vs Buy ExplanationShashwat JhaNo ratings yet

- Indigo Platinum MC Cardholder Agreement No Annual FeeDocument3 pagesIndigo Platinum MC Cardholder Agreement No Annual Feemichaelwhitaker420No ratings yet

- Loan Documentation - 20210905100946Document13 pagesLoan Documentation - 20210905100946598dqczrn6No ratings yet

- Sunshine ContractDocument13 pagesSunshine Contractnick wilkinsonNo ratings yet

- Most Important Document: CustomerDocument8 pagesMost Important Document: CustomermasumsojibNo ratings yet

- Legal Kit - Home Loan: 1. Facility Advice Letter (FAL) 2. Demand Promissory Note 3. Agreement For Home LoanDocument21 pagesLegal Kit - Home Loan: 1. Facility Advice Letter (FAL) 2. Demand Promissory Note 3. Agreement For Home LoanRajNo ratings yet

- REVIEW QUESTIONS Notes Payable StudentDocument2 pagesREVIEW QUESTIONS Notes Payable Studentangelo eleazarNo ratings yet

- Repayment ScheduleDocument2 pagesRepayment ScheduleCharina MiclatNo ratings yet

- Chapters 12B and 12CDocument42 pagesChapters 12B and 12CCarlos VillanuevaNo ratings yet

- Personal Loan Agreement - Rio Buendia ReoladaDocument2 pagesPersonal Loan Agreement - Rio Buendia ReoladaJerson Arinque100% (1)

- PDS 20040121-155717Document16 pagesPDS 20040121-155717kasugagNo ratings yet

- 5056896e-6bc1-404a-9a03-d464a2c2b647Document21 pages5056896e-6bc1-404a-9a03-d464a2c2b647sherrieNo ratings yet

- Personal Loans: Standard Chartered Bank Zimbabwe LimitedDocument8 pagesPersonal Loans: Standard Chartered Bank Zimbabwe LimitedkarthickjothiNo ratings yet

- What The Banks Ask & Why: Everything You Need to Know before Applying for a Mortgage If You're Self-Employed or Have a Complex IncomeFrom EverandWhat The Banks Ask & Why: Everything You Need to Know before Applying for a Mortgage If You're Self-Employed or Have a Complex IncomeNo ratings yet

- Techno-Commercial Proposal - DR - 2302241933-UpdatedDocument2 pagesTechno-Commercial Proposal - DR - 2302241933-UpdatedVirendra PatelNo ratings yet

- Unep - 24 Cleaner Production - ReferenciaDocument96 pagesUnep - 24 Cleaner Production - ReferenciaAxelVanBrsNo ratings yet

- Royals NegotiationsDocument2 pagesRoyals NegotiationsKCTV5No ratings yet

- Risk and Rates of ReturnsDocument2 pagesRisk and Rates of Returnskyle GNo ratings yet

- Key Issues in Industry in PakistanDocument13 pagesKey Issues in Industry in PakistanRahim NayaniNo ratings yet

- Tilak Mehta EntrepreneurDocument8 pagesTilak Mehta EntrepreneurVishnu SaiNo ratings yet

- Ali Sec17a 2020Document376 pagesAli Sec17a 2020Phoeza Espinosa VillanuevaNo ratings yet

- Rural Marketing Stategies of Asian PaintsDocument10 pagesRural Marketing Stategies of Asian PaintsSaiPhaniNo ratings yet

- 7.export Promotion Measures PDFDocument47 pages7.export Promotion Measures PDFNitu BhattaraiNo ratings yet

- Deposit Mix of Dee Nationalized Bank of BangladeshDocument7 pagesDeposit Mix of Dee Nationalized Bank of Bangladeshratul JiaNo ratings yet

- Ayushi PDFDocument61 pagesAyushi PDFayushi kanoujiaNo ratings yet

- ENSR InternationalDocument9 pagesENSR Internationalashwin100% (1)

- Submitted To MS: NechituDocument16 pagesSubmitted To MS: NechituAbenezer SisayNo ratings yet

- Tax Year 2013 DeskReferenceGuideDocument8 pagesTax Year 2013 DeskReferenceGuideMia JacksonNo ratings yet

- Working Capital Management of L&TDocument18 pagesWorking Capital Management of L&TDeepak Jaiswal0% (1)

- Salari Traders General Order SuppliersDocument2 pagesSalari Traders General Order SuppliersKarachi computersNo ratings yet

- TechnopreneurshipDocument7 pagesTechnopreneurshipSummer AutumnNo ratings yet

- Chapter 6 - Brief Exercises - SolutionsDocument4 pagesChapter 6 - Brief Exercises - SolutionsQuynh Nguyen Huong100% (1)

- Determinants of ElasticityDocument1 pageDeterminants of ElasticityTARSEHSNo ratings yet

- RashmiRathi 22221065 Case RMDocument3 pagesRashmiRathi 22221065 Case RMRashmi RNo ratings yet

- Unit 4 Social SecurityDocument16 pagesUnit 4 Social SecurityKanwaljeet SinghNo ratings yet

- Problems Faced by Cotton Ginning Industries in PakistanDocument5 pagesProblems Faced by Cotton Ginning Industries in PakistanSahaab AkbarNo ratings yet

- Correction of Accounting Errors: Sanjaya JayasundaraDocument22 pagesCorrection of Accounting Errors: Sanjaya JayasundaraNerissa BanguiNo ratings yet

- Assignment Semester 1 Cycle 6 ( (Fa) )Document135 pagesAssignment Semester 1 Cycle 6 ( (Fa) )Sumaya100% (1)

- Income and Business TaxationDocument1 pageIncome and Business TaxationTomo Euryl San JuanNo ratings yet

- Standar Mutu Pangan Asal HewanDocument27 pagesStandar Mutu Pangan Asal HewanHasan AshariNo ratings yet