Professional Documents

Culture Documents

Guaranteed Income Goal

Guaranteed Income Goal

Uploaded by

diwediakshitaCopyright:

Available Formats

You might also like

- INS21Document110 pagesINS21pav_43675% (12)

- Pru HI 6th Edition (4 Sets of Mock Combined)Document51 pagesPru HI 6th Edition (4 Sets of Mock Combined)thth943No ratings yet

- List of FBI - Interpol ContactsDocument38 pagesList of FBI - Interpol ContactsEyemanProphetNo ratings yet

- Practice QuestionsDocument109 pagesPractice QuestionsDc Maxx37% (19)

- ENGLISH One Pager Sanchay Plus Long Term Income Retail FinalDocument2 pagesENGLISH One Pager Sanchay Plus Long Term Income Retail FinalAbhisek BrahmaNo ratings yet

- A Non-Linked, Non-Participating, Individual Life Insurance Savings PlanDocument6 pagesA Non-Linked, Non-Participating, Individual Life Insurance Savings PlanabcdNo ratings yet

- LifeBooster R17070922080013077Document21 pagesLifeBooster R17070922080013077Rajat SrivastavaNo ratings yet

- New Children's Money Back: Benefits Illustration SummaryDocument2 pagesNew Children's Money Back: Benefits Illustration Summarykrishna-almightyNo ratings yet

- Illustration - 2022-08-26T182831.858Document2 pagesIllustration - 2022-08-26T182831.858Soumen BeraNo ratings yet

- Mr. Tapan Das - Age: 35: Unique Solution Created ForDocument6 pagesMr. Tapan Das - Age: 35: Unique Solution Created Forsunil.bhattacharyaNo ratings yet

- Awg Second Income OnepagerDocument2 pagesAwg Second Income Onepagersjoshi.0024No ratings yet

- Illustration - 2022-12-21T143227.841Document2 pagesIllustration - 2022-12-21T143227.841Ashher UsmaniNo ratings yet

- Product Proposal For Achieving Your Life Goals Product Proposal For Achieving Your Life GoalsDocument5 pagesProduct Proposal For Achieving Your Life Goals Product Proposal For Achieving Your Life Goalsprachididwania13No ratings yet

- 973comboDocument6 pages973comboRahul GoelNo ratings yet

- Sanchy Plus - Long Term Income 1 LDocument2 pagesSanchy Plus - Long Term Income 1 LVen NatNo ratings yet

- Max Life Return PlanDocument6 pagesMax Life Return PlanExcel 4CAsNo ratings yet

- Illustration 4 PDFDocument2 pagesIllustration 4 PDFsusman paulNo ratings yet

- Non Linked Non Participating Endowment Assurance PlanDocument6 pagesNon Linked Non Participating Endowment Assurance PlanJ KrishnaNo ratings yet

- Umang DemoDocument7 pagesUmang DemoAvinash SinghNo ratings yet

- PruCash Double Reward BrochureDocument31 pagesPruCash Double Reward BrochureDavid ChungNo ratings yet

- Jeevan Umang: Benefits Illustration SummaryDocument4 pagesJeevan Umang: Benefits Illustration SummarySelvam RamanathanNo ratings yet

- Age 67 12 PayDocument5 pagesAge 67 12 PayRohit yadavNo ratings yet

- Grip Leaflet LatestDocument14 pagesGrip Leaflet LatestsaurabNo ratings yet

- IllustrationDocument2 pagesIllustrationSoumen BeraNo ratings yet

- Lic Jeevan Umang Plan ExampleDocument3 pagesLic Jeevan Umang Plan ExampleAnil KUMAR H.VNo ratings yet

- IllustrationDocument2 pagesIllustrationNeelamegamBalaji JeyaramanNo ratings yet

- IllustrationDocument2 pagesIllustrationNeerja M GuhathakurtaNo ratings yet

- Jeevan Labh: Benefits Illustration SummaryDocument2 pagesJeevan Labh: Benefits Illustration Summarymr_anilpawarNo ratings yet

- Renewal Premium Notice: Mr. Kishor Kumar Gupta Insured Name: MR - Kishor Kumar GuptaDocument1 pageRenewal Premium Notice: Mr. Kishor Kumar Gupta Insured Name: MR - Kishor Kumar GuptaYT ENTERTAINMENTNo ratings yet

- Illustration Qatkwl5gp3chlDocument2 pagesIllustration Qatkwl5gp3chlRahul DipaliNo ratings yet

- IllustrationDocument2 pagesIllustrationShashikumar RajkumarNo ratings yet

- Illustration - 42Document2 pagesIllustration - 42arvindan ram hariNo ratings yet

- Century Star Leaflet - A5 - Ver - 05Document4 pagesCentury Star Leaflet - A5 - Ver - 05hiramallickNo ratings yet

- KFD New16022024101242313 E28Document19 pagesKFD New16022024101242313 E28Mr ZekeNo ratings yet

- SBI Life - Retire Smart _Single Pager_Ver03Document2 pagesSBI Life - Retire Smart _Single Pager_Ver03athulkp555No ratings yet

- Praveen 8-27-2023 930Document8 pagesPraveen 8-27-2023 930Rajashekar Reddy SamaNo ratings yet

- New Money Back - 921.25.20 - SA 05.00 L - MR Prospect 00Document2 pagesNew Money Back - 921.25.20 - SA 05.00 L - MR Prospect 00RasakNo ratings yet

- IllustrationDocument2 pagesIllustrationShashikumar RajkumarNo ratings yet

- IllustrationDocument2 pagesIllustrationAshfaq hussainNo ratings yet

- Personalised Proposal For Securing Your Guaranteed Income NeedsDocument6 pagesPersonalised Proposal For Securing Your Guaranteed Income NeedsSirshajit SanfuiNo ratings yet

- Unique Life Solution HandbookDocument8 pagesUnique Life Solution HandbookPaluri GowthamNo ratings yet

- Bima ShreeDocument3 pagesBima ShreeDhaval KotakNo ratings yet

- Personalised Proposal For Securing Your Guaranteed Income NeedsDocument6 pagesPersonalised Proposal For Securing Your Guaranteed Income NeedsSirshajit SanfuiNo ratings yet

- Illustration 2Document7 pagesIllustration 2muks.jags.2023No ratings yet

- Smart Platina Assure - One - Pager FinalDocument2 pagesSmart Platina Assure - One - Pager FinalpankajNo ratings yet

- Nishchit Samrudhi Plan BrochureDocument16 pagesNishchit Samrudhi Plan BrochureManish SahuNo ratings yet

- IllustrationDocument2 pagesIllustrationVivek SinghalNo ratings yet

- New Money Back - 921.25.20 - SA 05.00 L - MR Prospect 00Document1 pageNew Money Back - 921.25.20 - SA 05.00 L - MR Prospect 00RasakNo ratings yet

- Smart Swadhan Supreme Brochure - V01 17th Jan 1Document10 pagesSmart Swadhan Supreme Brochure - V01 17th Jan 1Nitin KumarNo ratings yet

- HDFC Illustration-qbmphxhfromvrDocument2 pagesHDFC Illustration-qbmphxhfromvrAditya SinghNo ratings yet

- EndowmentDocument2 pagesEndowmentcryptomaxxtrade4No ratings yet

- KFD New02042023200005221 E32Document5 pagesKFD New02042023200005221 E32SanjeetNo ratings yet

- IllustrationDocument2 pagesIllustrationvishnuNo ratings yet

- IllustrationDocument2 pagesIllustrationCHANDRAKANT RANANo ratings yet

- Mrs Richa 8-1-25 10LDocument2 pagesMrs Richa 8-1-25 10LRaju KaliperumalNo ratings yet

- IllustrationDocument2 pagesIllustrationsarthakNo ratings yet

- MR. DHIREN SADIA-HDFC Jeevan SanchayDocument2 pagesMR. DHIREN SADIA-HDFC Jeevan Sanchaykenichihattori01No ratings yet

- IllustrationDocument2 pagesIllustrationMahesh AgrawalNo ratings yet

- Ananya Sharma 9yDocument1 pageAnanya Sharma 9yraviNo ratings yet

- Illustration Qbuh70x89xxnnDocument2 pagesIllustration Qbuh70x89xxnnKiran JohnNo ratings yet

- Unique Life Solution HandbookDocument5 pagesUnique Life Solution HandbookPaluri GowthamNo ratings yet

- KFD New04122022004727946 E28Document5 pagesKFD New04122022004727946 E28Ashfaq hussainNo ratings yet

- IllustrationDocument2 pagesIllustrationNiranjan LenkaNo ratings yet

- Section 80cca Deduction in Respect of Deposits Under National Savings Scheme or Payment To A Deferred Annuity PlanDocument3 pagesSection 80cca Deduction in Respect of Deposits Under National Savings Scheme or Payment To A Deferred Annuity PlanParul NayakNo ratings yet

- Consumer Awareness Regarding PNB MetlifeDocument51 pagesConsumer Awareness Regarding PNB MetlifeKirti Jindal100% (1)

- Donors Tax CasesDocument29 pagesDonors Tax Caseskirsten_bri16No ratings yet

- HDFC MarketingDocument85 pagesHDFC MarketingDeeptimaan Dutta100% (2)

- 1905 The - India - List - and - India - Office - ListDocument813 pages1905 The - India - List - and - India - Office - ListSundarNo ratings yet

- Alex Dy Comm Law Review OutlineDocument246 pagesAlex Dy Comm Law Review OutlineMelvin Banzon100% (1)

- Lic Leaflet Jeevan Anand 4 5x8 Inches WXH DEC 2020Document16 pagesLic Leaflet Jeevan Anand 4 5x8 Inches WXH DEC 2020bantwal_venkateshNo ratings yet

- HSC Business Studies FinanceDocument30 pagesHSC Business Studies FinanceUttkarsh AroraNo ratings yet

- Insurance Law NotesDocument24 pagesInsurance Law NotesMaristela RegidorNo ratings yet

- Final Thesis Of: Premium Collection and Investment Pattern of Nepalese Life Insurance Companies (Madan Raj Pandey) .Document97 pagesFinal Thesis Of: Premium Collection and Investment Pattern of Nepalese Life Insurance Companies (Madan Raj Pandey) .Madan Raj Pndey84% (19)

- P L I Premium ReceiptDocument4 pagesP L I Premium Receiptapi-3810632No ratings yet

- Neeraj Bahrani Winter ResearchDocument20 pagesNeeraj Bahrani Winter ResearchNeeraj KumarNo ratings yet

- Agenda158SLBC PDFDocument44 pagesAgenda158SLBC PDFSandeep KumarNo ratings yet

- ASOP 54 Pricing of Life and Annuity ProductsDocument27 pagesASOP 54 Pricing of Life and Annuity ProductsNoura ShamseddineNo ratings yet

- Phased Retirement FAQsDocument5 pagesPhased Retirement FAQsFedSmith Inc.No ratings yet

- Vul Set A Set B Set C With KeywordsDocument24 pagesVul Set A Set B Set C With KeywordsKenneth QuiranteNo ratings yet

- Claimant's Statement FormDocument2 pagesClaimant's Statement FormRiza Zausa CuarteroNo ratings yet

- Presenting .: UTI - Unit Linked Insurance PlanDocument21 pagesPresenting .: UTI - Unit Linked Insurance PlanSudipto MajumderNo ratings yet

- Bajaj Allianz Life Insurance Co. LTD.: Date:09-01-2024Document2 pagesBajaj Allianz Life Insurance Co. LTD.: Date:09-01-2024dipeshraghav67No ratings yet

- Taxation System: A Comparison Between Thailand and PhilippinesDocument2 pagesTaxation System: A Comparison Between Thailand and PhilippinesBeberlie LapingNo ratings yet

- Fraud in InsuranceDocument54 pagesFraud in Insurance9220501752No ratings yet

- Principles & Practice of Life Revised)Document78 pagesPrinciples & Practice of Life Revised)Riya_Biswas_8955No ratings yet

- AIA Medical Card - Benefit SummaryDocument1 pageAIA Medical Card - Benefit SummaryLimKangNo ratings yet

- LIST OF IGNOU MBA Marketing Project TopicsbbDocument2 pagesLIST OF IGNOU MBA Marketing Project TopicsbbSivaji VarkalaNo ratings yet

- Insurance: Commission 1071 United Nations Avenue Manila (Nbape) CompaniesDocument1 pageInsurance: Commission 1071 United Nations Avenue Manila (Nbape) CompaniesClarisse InaoNo ratings yet

- Labour Welfare Its Purpose, Scope AND Importance of The StudyDocument20 pagesLabour Welfare Its Purpose, Scope AND Importance of The StudyNadeem KhanNo ratings yet

Guaranteed Income Goal

Guaranteed Income Goal

Uploaded by

diwediakshitaOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Guaranteed Income Goal

Guaranteed Income Goal

Uploaded by

diwediakshitaCopyright:

Available Formats

9

TAX FREE

INCOME Early retirement ke baad family

ke sath duniya dekhna.

SAMJHO HO GAYA.

Bajaj Allianz Life

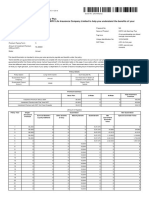

Guaranteed Income Goal

A Non-Linked Non-Participating Endowment Life Insurance Plan

Scan to watch

Non-Par Savings Plan

simplified video

Get

`1,30,728

Pay th

on 13 year increasing to

#

`1,00,000 p.a.

` 2,61,457 th

till 24 year.

over the premium @

payment term

of 12 years

Total = ` 23,53,111

Key Advantages-

Get Guaranteed^ increasing Income$ Tax Benefit9

Option to Extend your Life Cover Choice of 2 Variants - Income

beyond Policy Term Benefit & Lump-sum Benefit

@

Above illustration is considering male age 30 years, Policy term – 12 years, Standard Life, Premium payment term - 12 years, Income Benefit, Sum assured of ` 2,37,688 and Annualized premium of

th

` 1,00,000. Extended Life Cover is not opted. Incase of unfortunate death during the 10 year death benefit will be ` 10,50,000. The premiums mentioned above are after High Sum Assured Rebate

# st th

(HSAR) and exclusive of any extra premium loading and Goods & Service Tax. The 1 Guaranteed Maturity Instalment (GMI) of ` 1,30,728 will be paid on 13 policy year which is 55% of Sum Assured.

st th

Each subsequent installment after the 1 installment will be increased by 5% of Sum Assured. The last GMI of `2,61,457 will be paid on 24 policy year which is 110% of Sum Assured.

^

Conditions apply. The Guaranteed benefits are dependant on the policy term, premium payment term availed along with other variable factors. For details please refer to sales brochure (Also available

$

on www.bajajallianzlife.com). Available with Income Benefit.

%

Sum Assured on Death is the higher of (i) 10 times Annualized Premium*, (ii) 105% of Total Premiums* paid as on date of death, (iii) Sum Assured

*Annualized Premium is exclusive of extra premium, rider premiums, and GST/any other applicable tax levied, subject to changes in tax laws, if any, and Total Premiums paid is equal to (Annualized

Premium * number of years for which premiums have been paid).

Total Premium is exclusive of extra premium, rider premiums and GST/any other applicable tax levied, subject to changes in tax laws, if any. Please note that GST/any other applicable tax levied, subject

to changes in tax laws will be collected over and above the premium under the Policy.

EXTENDED LIFE COVER (ELC)

At the inception of the policy, you will have the option to choose the Extended Life Cover (ELC) under the policy .

(i) The amount of risk cover during the ELC Period is equal to the Sum Assured on Death %.

(ii) The ELC will start from the Maturity Date and will continue for an ELC Period equal to the duration of the PPT

(in years), starting from the Maturity Date.

For more details and terms & conditions, please refer sales literature available on www .bajajallianzlife.com.

GUARANTEED MATURITY BENEFIT

Lump-sum Benefit - Guaranteed Maturity Benefit payable as lumpsum will be an enhanced percentage of your Sum

Assured, provided all due premiums are paid. This is called as Guaranteed Enhancer (GE) and is payable as per the below table:

Policy Term (years) Premium Payment Term (years) Guaranteed Enhancer (GE) % Guaranteed Maturity Benefit

10 5 310% 310% of Sum Assured

10 7 410% 410% of Sum Assured

12 5 375% 375% of Sum Assured

12 7 450% 450% of Sum Assured

12 8 490% 490% of Sum Assured

10 10 520% 520% of Sum Assured

1800 209 4040 | bajajallianzlife.com

Policy Term Premium Payment Guaranteed Guaranteed Maturity

(years) Term (years) Enhancer (GE) % Benefit

12 12 600% 600% of Sum Assured

15 5 380% 380% of Sum Assured

Scan to watch Policy

15 7 455% 455% of Sum Assured Term & Premium Payment

Term simplified video

15 8 495% 495% of Sum Assured

15 10 545% 545% of Sum Assured

15 12 605% 605% of Sum Assured

20 5 385% 385% of Sum Assured

20 7 460% 460% of Sum Assured

20 8 500% 500% of Sum Assured

20 10 550% 550% of Sum Assured

20 12 610% 610% of Sum Assured

Income Benefit - If all premiums are paid, Guaranteed Maturity Benefit will be paid in yearly, half-yearly, quarterly or monthly installments

(as chosen at the inception of the policy). These are called as Guaranteed Maturity Instalments (GMI), and will be paid at the end of the GMI

year for a period equal to your Premium Payment Term (PPT). For yearly frequency the GMI will be payable as per the below table –

Guaranteed Maturity Instalment (as % of Sum Assured)

GMI Year Policy Term / Premium Payment Term

(Post the Policy Term) 05-05 10-05 12-05 07-07 10-07 12-07 10-10 12-12

1 40% 40% 50% 45% 45% 55% 50% 55%

2 45% 45% 55% 50% 50% 60% 55% 60%

3 50% 50% 60% 55% 55% 65% 60% 65%

4 55% 55% 65% 60% 60% 70% 65% 70%

5 60% 60% 70% 65% 65% 75% 70% 75%

6 - - - 70% 70% 80% 75% 80%

7 - - - 75% 75% 85% 80% 85%

8 - - - - - - 85% 90%

9 - - - - - - 90% 95%

10 - - - - - - 95% 100%

11 - - - - - - - 105%

12 - - - - - - - 110%

For more details and terms & conditions, please refer Sales Literature available on www.bajajallianzlife.com.

DEATH BENEFIT - LUMP-SUM BENEFIT

If all due premiums have been paid : Scan to watch Sum

% Assured simplified video

I. Death Benefit during the Policy Term is the, Sum Assured on Death , as on the date of death. The policy will

terminate on payment of the Death Benefit.

ii. Death Benefit during the ELC Period (only if chosen) (ELC Period is after the policy term) is the Sum Assured on

Death% as on the date of death. The policy will terminate on payment of the Death Benefit

DEATH BENEFIT - INCOME BENEFIT

If all due premiums have been paid:

I. Death Benefit during the Policy Term is the Sum Assured on Death% as on the date of death. The policy will terminate on

payment of the Death Benefit.

ii. Death Benefit during payout period i.e. after the Policy Term is -

%

If ELC is chosen then the Sum Assured on Death will be paid. The risk cover will terminate immediately and the Policy

will terminate on payment of last GMI.

If ELC is not chosen, then the remaining GMI will be paid. The policy will terminate on payment of last GMI

BEWARE OF SPURIOUS PHONE CALLS AND FICTITIOUS / FRAUDULENT OFFERS - IRDAI is not involved in activities like selling insurance policies, announcing bonus or investment of premiums. Public

receiving such phone calls are requested to lodge a police complaint.

Risk Factors and Warning Statements: Bajaj Allianz Life Insurance Company Limited and Bajaj Allianz Life Guaranteed Income Goal are the names of the company and the product respectively and do not in

any way indicate the quality of the product and its future prospects or returns. For more details on risk factors, terms and conditions please read sales brochure & policy document (available on

www.bajajallianzlife.com) carefully before concluding a sale. Bajaj Allianz Life Guaranteed Income Goal - A Non-Linked Non-Participating Endowment Life Insurance Plan. Regd. Office Address: Bajaj Allianz

House, Airport Road, Yerawada, Pune - 411006. Reg. No.: 116. CIN : U66010PN2001PLC015959 | Mail us : customercare@bajajallianz.co.in | Call on : Toll free no. 1800 209 7272 | Fax No: 02066026789. Bajaj

Allianz Life Guaranteed Income Goal (UIN: 116N157V06), The Logo of Bajaj Allianz Life Insurance Co. Ltd. is provided on the basis of license given by Bajaj Finserv Ltd. to use its “Bajaj” Logo and Allianz SE to use

its “Allianz” logo. All charges/ taxes, as applicable, will be borne by the Policyholder.

9

Tax benefits as per prevailing Income tax laws shall apply. You are requested to consult your tax consultant and obtain independent advice for eligibility before claiming any benefit under the policy.

BJAZ-OP-EC-01203/22

You might also like

- INS21Document110 pagesINS21pav_43675% (12)

- Pru HI 6th Edition (4 Sets of Mock Combined)Document51 pagesPru HI 6th Edition (4 Sets of Mock Combined)thth943No ratings yet

- List of FBI - Interpol ContactsDocument38 pagesList of FBI - Interpol ContactsEyemanProphetNo ratings yet

- Practice QuestionsDocument109 pagesPractice QuestionsDc Maxx37% (19)

- ENGLISH One Pager Sanchay Plus Long Term Income Retail FinalDocument2 pagesENGLISH One Pager Sanchay Plus Long Term Income Retail FinalAbhisek BrahmaNo ratings yet

- A Non-Linked, Non-Participating, Individual Life Insurance Savings PlanDocument6 pagesA Non-Linked, Non-Participating, Individual Life Insurance Savings PlanabcdNo ratings yet

- LifeBooster R17070922080013077Document21 pagesLifeBooster R17070922080013077Rajat SrivastavaNo ratings yet

- New Children's Money Back: Benefits Illustration SummaryDocument2 pagesNew Children's Money Back: Benefits Illustration Summarykrishna-almightyNo ratings yet

- Illustration - 2022-08-26T182831.858Document2 pagesIllustration - 2022-08-26T182831.858Soumen BeraNo ratings yet

- Mr. Tapan Das - Age: 35: Unique Solution Created ForDocument6 pagesMr. Tapan Das - Age: 35: Unique Solution Created Forsunil.bhattacharyaNo ratings yet

- Awg Second Income OnepagerDocument2 pagesAwg Second Income Onepagersjoshi.0024No ratings yet

- Illustration - 2022-12-21T143227.841Document2 pagesIllustration - 2022-12-21T143227.841Ashher UsmaniNo ratings yet

- Product Proposal For Achieving Your Life Goals Product Proposal For Achieving Your Life GoalsDocument5 pagesProduct Proposal For Achieving Your Life Goals Product Proposal For Achieving Your Life Goalsprachididwania13No ratings yet

- 973comboDocument6 pages973comboRahul GoelNo ratings yet

- Sanchy Plus - Long Term Income 1 LDocument2 pagesSanchy Plus - Long Term Income 1 LVen NatNo ratings yet

- Max Life Return PlanDocument6 pagesMax Life Return PlanExcel 4CAsNo ratings yet

- Illustration 4 PDFDocument2 pagesIllustration 4 PDFsusman paulNo ratings yet

- Non Linked Non Participating Endowment Assurance PlanDocument6 pagesNon Linked Non Participating Endowment Assurance PlanJ KrishnaNo ratings yet

- Umang DemoDocument7 pagesUmang DemoAvinash SinghNo ratings yet

- PruCash Double Reward BrochureDocument31 pagesPruCash Double Reward BrochureDavid ChungNo ratings yet

- Jeevan Umang: Benefits Illustration SummaryDocument4 pagesJeevan Umang: Benefits Illustration SummarySelvam RamanathanNo ratings yet

- Age 67 12 PayDocument5 pagesAge 67 12 PayRohit yadavNo ratings yet

- Grip Leaflet LatestDocument14 pagesGrip Leaflet LatestsaurabNo ratings yet

- IllustrationDocument2 pagesIllustrationSoumen BeraNo ratings yet

- Lic Jeevan Umang Plan ExampleDocument3 pagesLic Jeevan Umang Plan ExampleAnil KUMAR H.VNo ratings yet

- IllustrationDocument2 pagesIllustrationNeelamegamBalaji JeyaramanNo ratings yet

- IllustrationDocument2 pagesIllustrationNeerja M GuhathakurtaNo ratings yet

- Jeevan Labh: Benefits Illustration SummaryDocument2 pagesJeevan Labh: Benefits Illustration Summarymr_anilpawarNo ratings yet

- Renewal Premium Notice: Mr. Kishor Kumar Gupta Insured Name: MR - Kishor Kumar GuptaDocument1 pageRenewal Premium Notice: Mr. Kishor Kumar Gupta Insured Name: MR - Kishor Kumar GuptaYT ENTERTAINMENTNo ratings yet

- Illustration Qatkwl5gp3chlDocument2 pagesIllustration Qatkwl5gp3chlRahul DipaliNo ratings yet

- IllustrationDocument2 pagesIllustrationShashikumar RajkumarNo ratings yet

- Illustration - 42Document2 pagesIllustration - 42arvindan ram hariNo ratings yet

- Century Star Leaflet - A5 - Ver - 05Document4 pagesCentury Star Leaflet - A5 - Ver - 05hiramallickNo ratings yet

- KFD New16022024101242313 E28Document19 pagesKFD New16022024101242313 E28Mr ZekeNo ratings yet

- SBI Life - Retire Smart _Single Pager_Ver03Document2 pagesSBI Life - Retire Smart _Single Pager_Ver03athulkp555No ratings yet

- Praveen 8-27-2023 930Document8 pagesPraveen 8-27-2023 930Rajashekar Reddy SamaNo ratings yet

- New Money Back - 921.25.20 - SA 05.00 L - MR Prospect 00Document2 pagesNew Money Back - 921.25.20 - SA 05.00 L - MR Prospect 00RasakNo ratings yet

- IllustrationDocument2 pagesIllustrationShashikumar RajkumarNo ratings yet

- IllustrationDocument2 pagesIllustrationAshfaq hussainNo ratings yet

- Personalised Proposal For Securing Your Guaranteed Income NeedsDocument6 pagesPersonalised Proposal For Securing Your Guaranteed Income NeedsSirshajit SanfuiNo ratings yet

- Unique Life Solution HandbookDocument8 pagesUnique Life Solution HandbookPaluri GowthamNo ratings yet

- Bima ShreeDocument3 pagesBima ShreeDhaval KotakNo ratings yet

- Personalised Proposal For Securing Your Guaranteed Income NeedsDocument6 pagesPersonalised Proposal For Securing Your Guaranteed Income NeedsSirshajit SanfuiNo ratings yet

- Illustration 2Document7 pagesIllustration 2muks.jags.2023No ratings yet

- Smart Platina Assure - One - Pager FinalDocument2 pagesSmart Platina Assure - One - Pager FinalpankajNo ratings yet

- Nishchit Samrudhi Plan BrochureDocument16 pagesNishchit Samrudhi Plan BrochureManish SahuNo ratings yet

- IllustrationDocument2 pagesIllustrationVivek SinghalNo ratings yet

- New Money Back - 921.25.20 - SA 05.00 L - MR Prospect 00Document1 pageNew Money Back - 921.25.20 - SA 05.00 L - MR Prospect 00RasakNo ratings yet

- Smart Swadhan Supreme Brochure - V01 17th Jan 1Document10 pagesSmart Swadhan Supreme Brochure - V01 17th Jan 1Nitin KumarNo ratings yet

- HDFC Illustration-qbmphxhfromvrDocument2 pagesHDFC Illustration-qbmphxhfromvrAditya SinghNo ratings yet

- EndowmentDocument2 pagesEndowmentcryptomaxxtrade4No ratings yet

- KFD New02042023200005221 E32Document5 pagesKFD New02042023200005221 E32SanjeetNo ratings yet

- IllustrationDocument2 pagesIllustrationvishnuNo ratings yet

- IllustrationDocument2 pagesIllustrationCHANDRAKANT RANANo ratings yet

- Mrs Richa 8-1-25 10LDocument2 pagesMrs Richa 8-1-25 10LRaju KaliperumalNo ratings yet

- IllustrationDocument2 pagesIllustrationsarthakNo ratings yet

- MR. DHIREN SADIA-HDFC Jeevan SanchayDocument2 pagesMR. DHIREN SADIA-HDFC Jeevan Sanchaykenichihattori01No ratings yet

- IllustrationDocument2 pagesIllustrationMahesh AgrawalNo ratings yet

- Ananya Sharma 9yDocument1 pageAnanya Sharma 9yraviNo ratings yet

- Illustration Qbuh70x89xxnnDocument2 pagesIllustration Qbuh70x89xxnnKiran JohnNo ratings yet

- Unique Life Solution HandbookDocument5 pagesUnique Life Solution HandbookPaluri GowthamNo ratings yet

- KFD New04122022004727946 E28Document5 pagesKFD New04122022004727946 E28Ashfaq hussainNo ratings yet

- IllustrationDocument2 pagesIllustrationNiranjan LenkaNo ratings yet

- Section 80cca Deduction in Respect of Deposits Under National Savings Scheme or Payment To A Deferred Annuity PlanDocument3 pagesSection 80cca Deduction in Respect of Deposits Under National Savings Scheme or Payment To A Deferred Annuity PlanParul NayakNo ratings yet

- Consumer Awareness Regarding PNB MetlifeDocument51 pagesConsumer Awareness Regarding PNB MetlifeKirti Jindal100% (1)

- Donors Tax CasesDocument29 pagesDonors Tax Caseskirsten_bri16No ratings yet

- HDFC MarketingDocument85 pagesHDFC MarketingDeeptimaan Dutta100% (2)

- 1905 The - India - List - and - India - Office - ListDocument813 pages1905 The - India - List - and - India - Office - ListSundarNo ratings yet

- Alex Dy Comm Law Review OutlineDocument246 pagesAlex Dy Comm Law Review OutlineMelvin Banzon100% (1)

- Lic Leaflet Jeevan Anand 4 5x8 Inches WXH DEC 2020Document16 pagesLic Leaflet Jeevan Anand 4 5x8 Inches WXH DEC 2020bantwal_venkateshNo ratings yet

- HSC Business Studies FinanceDocument30 pagesHSC Business Studies FinanceUttkarsh AroraNo ratings yet

- Insurance Law NotesDocument24 pagesInsurance Law NotesMaristela RegidorNo ratings yet

- Final Thesis Of: Premium Collection and Investment Pattern of Nepalese Life Insurance Companies (Madan Raj Pandey) .Document97 pagesFinal Thesis Of: Premium Collection and Investment Pattern of Nepalese Life Insurance Companies (Madan Raj Pandey) .Madan Raj Pndey84% (19)

- P L I Premium ReceiptDocument4 pagesP L I Premium Receiptapi-3810632No ratings yet

- Neeraj Bahrani Winter ResearchDocument20 pagesNeeraj Bahrani Winter ResearchNeeraj KumarNo ratings yet

- Agenda158SLBC PDFDocument44 pagesAgenda158SLBC PDFSandeep KumarNo ratings yet

- ASOP 54 Pricing of Life and Annuity ProductsDocument27 pagesASOP 54 Pricing of Life and Annuity ProductsNoura ShamseddineNo ratings yet

- Phased Retirement FAQsDocument5 pagesPhased Retirement FAQsFedSmith Inc.No ratings yet

- Vul Set A Set B Set C With KeywordsDocument24 pagesVul Set A Set B Set C With KeywordsKenneth QuiranteNo ratings yet

- Claimant's Statement FormDocument2 pagesClaimant's Statement FormRiza Zausa CuarteroNo ratings yet

- Presenting .: UTI - Unit Linked Insurance PlanDocument21 pagesPresenting .: UTI - Unit Linked Insurance PlanSudipto MajumderNo ratings yet

- Bajaj Allianz Life Insurance Co. LTD.: Date:09-01-2024Document2 pagesBajaj Allianz Life Insurance Co. LTD.: Date:09-01-2024dipeshraghav67No ratings yet

- Taxation System: A Comparison Between Thailand and PhilippinesDocument2 pagesTaxation System: A Comparison Between Thailand and PhilippinesBeberlie LapingNo ratings yet

- Fraud in InsuranceDocument54 pagesFraud in Insurance9220501752No ratings yet

- Principles & Practice of Life Revised)Document78 pagesPrinciples & Practice of Life Revised)Riya_Biswas_8955No ratings yet

- AIA Medical Card - Benefit SummaryDocument1 pageAIA Medical Card - Benefit SummaryLimKangNo ratings yet

- LIST OF IGNOU MBA Marketing Project TopicsbbDocument2 pagesLIST OF IGNOU MBA Marketing Project TopicsbbSivaji VarkalaNo ratings yet

- Insurance: Commission 1071 United Nations Avenue Manila (Nbape) CompaniesDocument1 pageInsurance: Commission 1071 United Nations Avenue Manila (Nbape) CompaniesClarisse InaoNo ratings yet

- Labour Welfare Its Purpose, Scope AND Importance of The StudyDocument20 pagesLabour Welfare Its Purpose, Scope AND Importance of The StudyNadeem KhanNo ratings yet