Professional Documents

Culture Documents

Unit-Iii Bank Reconciliation Statement Debit (+) Credit (-) Credit (-) Debit (+)

Unit-Iii Bank Reconciliation Statement Debit (+) Credit (-) Credit (-) Debit (+)

Uploaded by

aiswarya sCopyright:

Available Formats

You might also like

- Auditing Concept Problems Cash and Cash EquivalentDocument7 pagesAuditing Concept Problems Cash and Cash EquivalentJoanah TayamenNo ratings yet

- Introduction To Investment BankingDocument37 pagesIntroduction To Investment BankingVaidyanathan RavichandranNo ratings yet

- Cash and Cash EquivalentDocument32 pagesCash and Cash EquivalentArbie D. DecimioNo ratings yet

- Reviewer Intacc 1n2Document58 pagesReviewer Intacc 1n2John100% (1)

- FarDocument8 pagesFarnivea gumayagay71% (7)

- Practical - Bank Reconciliation StatementDocument5 pagesPractical - Bank Reconciliation StatementUniversal SoldierNo ratings yet

- BRS ProblemsDocument28 pagesBRS ProblemsKutbuddin JawadwalaNo ratings yet

- Prepare Bank Reconciliation Statement From The Following: (I) Debit Balance As Per The Cash BookDocument10 pagesPrepare Bank Reconciliation Statement From The Following: (I) Debit Balance As Per The Cash BookPragya ShuklaNo ratings yet

- Chapter 9 - Bank Reconciliation StatementDocument15 pagesChapter 9 - Bank Reconciliation StatementSaurabh GohanNo ratings yet

- Bank Reconciliation StatementDocument33 pagesBank Reconciliation StatementMd TahirNo ratings yet

- BRS PDFDocument8 pagesBRS PDFAnshumanNo ratings yet

- CA Foundation June 23 BRS Problem - CTC ClassesDocument2 pagesCA Foundation June 23 BRS Problem - CTC ClassesMohit SharmaNo ratings yet

- Bank Reconcilaition Statement Problems PDF 1 4 PDFDocument4 pagesBank Reconcilaition Statement Problems PDF 1 4 PDFHakim JanNo ratings yet

- BRS 2Document2 pagesBRS 2Aarnav SharmaNo ratings yet

- BRS WorksheetDocument8 pagesBRS WorksheetMayank VermaNo ratings yet

- Bank ReconciliationDocument6 pagesBank Reconciliationnaih marchessaNo ratings yet

- Bank Reconciliation Statement: Gravity 4 CaDocument13 pagesBank Reconciliation Statement: Gravity 4 CaAmit ChaudhryNo ratings yet

- Bank Re-Conciliation QuesDocument3 pagesBank Re-Conciliation QuesGarima GarimaNo ratings yet

- Accounts RTP CA Foundation May 2020Document31 pagesAccounts RTP CA Foundation May 2020YashNo ratings yet

- Account Past Questions Compilation (2009june - 2022 June)Document319 pagesAccount Past Questions Compilation (2009june - 2022 June)Arjun AdhikariNo ratings yet

- Quiz 1Document3 pagesQuiz 1Carmi FeceroNo ratings yet

- Cash and Cash Equivalent Tutorial PDFDocument3 pagesCash and Cash Equivalent Tutorial PDFClara San MiguelNo ratings yet

- Additional Illustrations-13Document5 pagesAdditional Illustrations-13Deepak YadavNo ratings yet

- Unit 8 Bank Reconciliation StatementDocument7 pagesUnit 8 Bank Reconciliation StatementUrja JoshiNo ratings yet

- Bank Reconciliation - SolutionsDocument6 pagesBank Reconciliation - SolutionsNIAZ HUSSAIN100% (1)

- P01. Cash and Cash Equivalents AnswersDocument8 pagesP01. Cash and Cash Equivalents AnswersIosif DzhugasviliNo ratings yet

- Balance: Financial AccountingDocument6 pagesBalance: Financial AccountingravinraghzNo ratings yet

- Paper - 1: Principles & Practice of Accounting Questions True and FalseDocument31 pagesPaper - 1: Principles & Practice of Accounting Questions True and FalseUnknown 1No ratings yet

- FAR 0 Bank Recon and Proof of Cash Drill ProblemsDocument6 pagesFAR 0 Bank Recon and Proof of Cash Drill Problemsyeeaahh56No ratings yet

- AP - Quiz 01 (UCP)Document8 pagesAP - Quiz 01 (UCP)CrestinaNo ratings yet

- 4.CA Foundation Test 4Document6 pages4.CA Foundation Test 4Nived Narayan PNo ratings yet

- Assignment BRSDocument2 pagesAssignment BRSveydantsharma42No ratings yet

- MOD 01 - Cash and Cash EquivalentsDocument3 pagesMOD 01 - Cash and Cash EquivalentsIrish VargasNo ratings yet

- FAR103 - FAR - 203 (A) - Cash and Cash EquivalentsDocument3 pagesFAR103 - FAR - 203 (A) - Cash and Cash EquivalentsDan Andrei BongoNo ratings yet

- Adobe Scan 05 Jan 2024Document2 pagesAdobe Scan 05 Jan 2024Harshit GargNo ratings yet

- Cce Board WorkDocument3 pagesCce Board WorkNicole VinaraoNo ratings yet

- Assessment Task 1-1Document10 pagesAssessment Task 1-1hahahahaNo ratings yet

- Bank Reconciliation StatementDocument3 pagesBank Reconciliation StatementKritika HarlalkaNo ratings yet

- Financial AssetsDocument127 pagesFinancial Assetscherry blossomNo ratings yet

- Tsgrewal BRSDocument11 pagesTsgrewal BRSDhruvNo ratings yet

- Cash Cash Equivalent Bank ReconDocument4 pagesCash Cash Equivalent Bank Reconmavie arellanoNo ratings yet

- Mock Prelim - Intermediate AcctDocument9 pagesMock Prelim - Intermediate AcctNikki LabialNo ratings yet

- Bank Reconciliation StatementDocument12 pagesBank Reconciliation StatementBhuvan PrajapatiNo ratings yet

- FAR - CASH ProbDocument2 pagesFAR - CASH Prob2216391No ratings yet

- AACONAPPS2 Quiz No. 01 - Audit of Cash Problem Questions (2022)Document4 pagesAACONAPPS2 Quiz No. 01 - Audit of Cash Problem Questions (2022)Dawson Dela CruzNo ratings yet

- Cash and Cash Equivalents Quizzer 1Document5 pagesCash and Cash Equivalents Quizzer 1yna kyleneNo ratings yet

- Cash and Cash EquivalentsDocument3 pagesCash and Cash EquivalentsBeat KarbNo ratings yet

- Submitted To: Submitted byDocument33 pagesSubmitted To: Submitted byaanaughtyNo ratings yet

- CCE Bank Recon DISCUSSION EXERCISESDocument2 pagesCCE Bank Recon DISCUSSION EXERCISESGlance Piscasio CruzNo ratings yet

- Cash and Cash EquivalentsDocument3 pagesCash and Cash EquivalentsShiela Mae SangidNo ratings yet

- ACCTG 102 Practice Sets Quizzes ExamsDocument25 pagesACCTG 102 Practice Sets Quizzes ExamsheythereitsclaireNo ratings yet

- CashDocument6 pagesCashrosemariesollegue888No ratings yet

- FINANCIAL ACCOUNTING - Cash To Receivables Problems and SolutionsDocument8 pagesFINANCIAL ACCOUNTING - Cash To Receivables Problems and Solutionsstan iKONNo ratings yet

- Paper - 1: Principles & Practice of Accounting Questions True and FalseDocument32 pagesPaper - 1: Principles & Practice of Accounting Questions True and FalseShaindra SinghNo ratings yet

- Proof+of+Cash ProblemsDocument2 pagesProof+of+Cash ProblemshelaihjsNo ratings yet

- Proof of Cash ProblemsDocument2 pagesProof of Cash ProblemsSamantha Marie Arevalo100% (1)

- BA3 M KIT Chapter 16Document4 pagesBA3 M KIT Chapter 16Nivneth PeirisNo ratings yet

- Bank Reconciliation StatementDocument4 pagesBank Reconciliation StatementProttasha AsifNo ratings yet

- Bank Reconciliation Statement August 17Document10 pagesBank Reconciliation Statement August 17NO NAMENo ratings yet

- FM Quiz Set ADocument3 pagesFM Quiz Set AShaira Mae TomasNo ratings yet

- BCom Second Year Assignments PDFDocument2 pagesBCom Second Year Assignments PDFKotaiah Avula75% (8)

- AGNPO The Budget ProcessDocument57 pagesAGNPO The Budget ProcessJassyNo ratings yet

- CC Two-Wheeler-LoansDocument29 pagesCC Two-Wheeler-LoansRight ClickNo ratings yet

- MSME Definition by RBIDocument8 pagesMSME Definition by RBIRahul YadavNo ratings yet

- A Study On Brand Awareness of Financial Products With Special Reference To Agile Capital ServicesDocument71 pagesA Study On Brand Awareness of Financial Products With Special Reference To Agile Capital Servicesjassi nishadNo ratings yet

- VOPAK Jaarverslag2010 PDFDocument180 pagesVOPAK Jaarverslag2010 PDFJasper Laarmans Teixeira de MattosNo ratings yet

- Match Each Annual Report Section With Its Description Annual ReportDocument1 pageMatch Each Annual Report Section With Its Description Annual ReportLet's Talk With HassanNo ratings yet

- 10 - Borrowing Costs PS 12edDocument15 pages10 - Borrowing Costs PS 12edbusiness docNo ratings yet

- Notes LAW OF TAXATIONDocument266 pagesNotes LAW OF TAXATIONsadia zaahirNo ratings yet

- Infographic Bank Issue Fin360Document1 pageInfographic Bank Issue Fin360NUR SYAFIQAH DAYANA MOHD SUFFIANNo ratings yet

- Absorption CostingDocument32 pagesAbsorption Costingsknco50% (2)

- Research Report Bajaj Finance LTDDocument8 pagesResearch Report Bajaj Finance LTDvivekNo ratings yet

- Apr 2023Document1 pageApr 2023saurabhjaNo ratings yet

- Oman Oil Balance SheetDocument27 pagesOman Oil Balance Sheeta.hasan670100% (1)

- Accounts Mock Test May 2019Document18 pagesAccounts Mock Test May 2019poojitha reddyNo ratings yet

- Vol 5-1 and 2..akram Khan..Performance Auditing For Islamic Banks..DpDocument15 pagesVol 5-1 and 2..akram Khan..Performance Auditing For Islamic Banks..Dpbabak1897No ratings yet

- QuizDocument4 pagesQuizPraveer BoseNo ratings yet

- Chapter 10Document26 pagesChapter 10Minh Ánh NguyênNo ratings yet

- Accounting 21 Financial Accounting and Reporting Part 1Document5 pagesAccounting 21 Financial Accounting and Reporting Part 1Faith BariasNo ratings yet

- MBFS Unit 1Document48 pagesMBFS Unit 1pearlksrNo ratings yet

- Securities Laws in IndiaDocument19 pagesSecurities Laws in IndiaBhawna Pamnani100% (1)

- Risk Management For MBA StudentsDocument28 pagesRisk Management For MBA StudentsMuneeb Sada50% (2)

- AOi XTIANDocument4 pagesAOi XTIANArste GimoNo ratings yet

- Risk & Return: Chapte RDocument52 pagesRisk & Return: Chapte RMohammad Salim HossainNo ratings yet

- Trade Indicator Handbook FINAL 2013Document138 pagesTrade Indicator Handbook FINAL 2013Santiago.VRNo ratings yet

- Tax Chapter 3 SummaryDocument4 pagesTax Chapter 3 SummaryishaNo ratings yet

- Roosevelt DEcision of Bank HolidayDocument12 pagesRoosevelt DEcision of Bank HolidaySheetal ChauhanNo ratings yet

- CF Industries Presentation May 2016Document23 pagesCF Industries Presentation May 2016red cornerNo ratings yet

- 6 Enano-Bote v. Alvarez, G.R. No. 223572, (November 10, 2020)Document13 pages6 Enano-Bote v. Alvarez, G.R. No. 223572, (November 10, 2020)Marlito Joshua AmistosoNo ratings yet

Unit-Iii Bank Reconciliation Statement Debit (+) Credit (-) Credit (-) Debit (+)

Unit-Iii Bank Reconciliation Statement Debit (+) Credit (-) Credit (-) Debit (+)

Uploaded by

aiswarya sOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Unit-Iii Bank Reconciliation Statement Debit (+) Credit (-) Credit (-) Debit (+)

Unit-Iii Bank Reconciliation Statement Debit (+) Credit (-) Credit (-) Debit (+)

Uploaded by

aiswarya sCopyright:

Available Formats

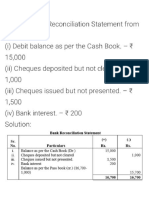

UNIT-III

BANK RECONCILIATION STATEMENT

Note:

Cash book Debit (+) Credit (-)

Pass book Credit (-) Debit (+)

1) From the following information, extract a bank reconciliation statement as on

31stDecember, 2008

1. The balance as per Cash book on 31-12.2008 Rs.12000/-

2. Cheque issued but not presented in the bank Rs.1600/-

3. Cheque paid into bank but not cleared before 31st Dec,08 Rs.2000/-

4. Interest on investment Rs.300/-

5. Bank Charges made by the bank Rs.30/-

Solution:

Bank Reconciliation Statement as on 31st December 2008

Particulars Amount in Rs. Debit Amount in Rs. Credit

(+) (-)

Balance as per Cash book 12000

Cheque issued but not presented in the bank 1600

st

Cheque paid into bank but not cleared before 31 2000

Dec,08

Interest on investment 300

Bank Charges made by the bank 30

TOTAL 13900 (2030)

Debit balance as per Pass Book 11870

2) Prepare a bank reconciliation statement from the following on 28th Feb, 2009. Cash book

showed a bank balance Rs.11000.

1. A cheque issued but not presented for payment Rs.900/-

2. A post-dated cheque if RS.1000 has be debited in the bank column of the cash book but it was not

possible to present.

3. Three cheque of Rs.1500 sent for collection but not cleared so far by the bank

4. A cheque for rs.500 deposited in the bank has been dishonored.

5. Trade subscription directly paid by the bank Rs.200

6. The bank debit for Rs.100 in respect of bank charges and credit Rs.200 for dividend collected by the

bank.

Solution:

Bank Reconciliation Statement as on 28th February 2009

Particulars Amount in Rs. Debit Amount in Rs. Credit

(+) (-)

Balance as per Cash book 11000

A cheque issued but not presented for payment 900

A post-dated cheque has be debited in the bank 1000

column of the cash book but it was not possible

to present

Three cheque of Rs.1500 sent for collection but 4500

not cleared so far by the bank [1500*3]

A cheque deposited in the bank has been 500

dishonored.

Trade subscription directly paid by the bank 200

Bank charges 100

Dividend credited collected by bank 200

TOTAL 12100 (6300)

Debit balance as per Pass Book 5800

3) From the following particulars a Bank Reconciliation Statement for the year ending on

31st March 2011

(i) Bank balance as per Cash Book Rs 8,600

(ii) Cheques of Rs 4,000 issued but not presented for payment

(iii) Bank debited bank charges Rs 200

(iv) Cheque of Rs 2,800 deposited into the Bank but not Credited by Bank

(v)Bank paid Insurance Premium on our behalf directly Rs 2,500 not recorded in the Cash

Book.

(vi) Bank Credited interest on investment Rs 1,900 but not recorded in the Cash Book.

Solution:

Bank Reconciliation Statement as on 31st March 2011

Particulars Amount in Rs. Debit Amount in Rs. Credit

(+) (-)

Balance as per Cash book 8600

Cheque issued but not presented for payment 4000

Bank charges 200

Cheque deposited into the Bank but not Credited 2800

by Bank

Bank paid Insurance Premium on our behalf 2500

directly not recorded in the Cash Book

Bank Credited interest on investment but not 1900

recorded in the Cash Book

TOTAL 14500 (5500)

Debit balance as per Pass Book 9000

4) From the following particulars, you are required to find out the errors in cash book and bank

statement by using missing method and prepare Bank Reconciliation Statement as on 31-

12-2016, for Chandran.

(i) Bank balance overdraft as per cash book 80,000

(ii) Cheque recorded for collection but not sent to the bank - 10,000

(iii) Credit side of the cash book cast short - 1,000

(iv) Premium on proprietor’s Life Insurance Policy (LIP) paid on standing order-5,000

(v) Bank Charges recorded twice in the cash book -100

(vi) Customer’s cheque returned by the bank as dishonoured -4,000

(vii) Bill Receivable collected by the bank directly on the behalf of company-20,000

(viii) Cheque received entered twice in the cash book -6,000

(ix) Cheque issued but dishonoured on technical grounds -3,000

(x) A Cheque deposited into the bank of worth Rs. 45,000 but Rs. 8,000 cheque was not collected

by bank

Solution:

Bank Reconciliation Statement as on 31st December 2016

Particulars Amount in Rs. Debit Amount in Rs. Credit

(+) (-)

Overdraft balance as per Cash book 80000

Cheque recorded for collection but not sent to the 10000

bank

Credit side of the cash book cast short 1000

Premium on proprietor’s Life Insurance Policy 5000

(LIP) paid

Bank Charges recorded twice in the cash book 100

Customer’s cheque returned by the bank as 4000

dishonored

Bill Receivable collected by the bank directly on 20000

the behalf of company

Cheque received entered twice in the cash book 6000

Cheque issued but dishonoured on technical 3000

grounds

A Cheque deposited into the bank of worth 8000

Rs. 45,000 but Rs. 8,000 cheque was not

collected by bank

TOTAL 23100 (114000)

Debit balance as per Pass Book 90900

5) Prepare Bank Reconciliation Statement as on 31st January 2011 from the following details.

(i) Cash Book shows debit balance of Rs 5000 as on 31st January, 2011.

(ii)Out of cheques of Rs 8,000 issued, cheques of Rs 4,000 has not been presented for payment

till 31st January, 2011.

(iii) Bank commission Rs 75 debited in the Pass Book only.

(iv) Transferred Rs 2,000 from Fixed deposit account to Current account, but not recorded.

(v)A cheque of Rs 4,500 deposited into Bank but not cleared by Bank.

(vi) Divided collected by Bank, though recorded in the Pass Book, failed to be recorded in the

Cash Book Rs. 650.

Solution:

Bank Reconciliation Statement as on 31st January 2011

Particulars Amount in Rs. Debit Amount in Rs. Credit

(+) (-)

Balance as per Cash book 5000

Out of cheque of Rs. 8,000 issued, cheque of Rs. 4000

4,000 has not been presented for payment till 31st

January, 2011.

Bank commission debited in the Pass Book only 75

Transferred Rs. 2,000 from Fixed deposit account 2000

to Current account, but not recorded.

Cheque deposited into Bank but not cleared by 4500

Bank.

Divided collected by Bank failed to be recorded 650

in the Cash Book

TOTAL 11650 (4575)

Debit balance as per Pass Book 7075

6) Pass Book showed the balance of Rs 3,500 as on 30th September 2011. On the same date Cash

Book showed the balance of Rs 3,170.

The following Points were noted.

(i) Bank collected Dividend on shares Rs 400, but not entered in the Cash

Book

ii) Cheques paid into Bank but not Credited by Bank Rs 570

iii) Discounted Bill dishonoured Rs. 750 debited by Bank, but no intimation was

received from the Bank

iv) Cheques of Rs 1,250 was issued on 29th September 2011 but not presented to

the Bank for payment till 30th sept. 2011

Prepare Bank Reconciliation Statement as on 30th September, 2011

Solution:

Bank Reconciliation Statement as on 30st September 2011

Particulars Amount in Rs. Debit Amount in Rs. Credit

(+) (-)

Balance as per Cash book 3170

Bank collected Dividend but not entered in the 400

Cash Book

Cheques paid into Bank but not Credited by Bank 570

Discounted Bill dishonoured debited by Bank, 750

but no intimation was received from the Bank

Cheques issued on 29th September 2011 but not 1250

presented to the Bank for payment till 30th sept.

2011

TOTAL 4820 (1320)

Debit balance as per Pass Book 7075

7) From the following particulars prepare a Bank Reconciliation Statement to find out the

causes of difference in two balances as on August 31st, 2016 for Four Star Ltd.

(i) Bank Overdraft as per Bank Statement -17,000

(ii) Cheque issued but not encased during the August -2,200

(iii) Dividends on shares collected by banker - 2,300

(iv) Interest charged by the bank recorded twice in the Cash Book -500

(v) Cheque deposited as per Bank Statement not entered in Cash Book-3,400

(vi) Credit side of the Bank column in Cash Book cast short -1,000

(vii) Clubs dues paid by bank as per standing instruction not recorded in Cash Book … 1,200

(viii) Uncredited cheque due to outstation- 3,900

Solution:

Bank Reconciliation Statement as on 31st August 2016

Particulars Amount in Rs. Debit Amount in Rs. Credit

(+) (-)

Overdraft balance as per Bank book 17000

Cheque issued but not encased during the August 2200

Dividends on shares collected by banker 2300

Interest charged by the bank recorded twice in 500

the Cash Book

Cheque deposited as per Bank Statement not 3400

entered in Cash Book

Credit side of the Bank column in Cash Book 1000

cast short

Clubs dues paid by bank as per standing 1200

instruction not recorded in Cash Book

Uncredited cheque due to outstation 3900

TOTAL 25400 (6100)

Credit balance as per Cash Book 19300

8) From the following particulars, find out the errors in cash book and bank statement and

prepare Bank Reconciliation Statement as on 31-05-2016 for Sugar Mill Ltd

(i) Balance as per bank statement overdraft of Rs. 2,118.

(ii) The debit side of the cash book had been under cast by Rs. 300.

(iii) A Cheque for Rs. 182 drawn for the payment of telephone bill had been entered in the cash

book as Rs. 281 but was shown correctly in the bank statement.

(iv) A Cheque for Rs. 210 by the customer having been deposited into bank was dishonoured by

the bank cheque was credited twice in Cash Book for worth Rs. 3,000.

(v) A Dividend of worth Rs. 90 had been collected by the bank but not recorded in the cash book.

Solution:

Bank Reconciliation Statement as on 31st May 2016

Particulars Amount in Rs. Debit Amount in Rs. Credit

(+) (-)

Overdraft balance as per Bank book 2118

The debit side of the cash book had been under 300

cast

A Cheque for Rs. 182 drawn for the payment 99

of telephone bill had been entered in the cash

book as Rs. 281 but was shown correctly in

the bank statement. [281-182=99]

A Cheque for Rs. 210 by the customer having 210

been deposited into bank was dishonoured by the

bank

Cheque was credited twice in Cash Book 3000

Dividend had been collected by the bank but not 90

recorded in the cash book.

TOTAL 3489 (210)

Credit balance as per Cash Book 5397

You might also like

- Auditing Concept Problems Cash and Cash EquivalentDocument7 pagesAuditing Concept Problems Cash and Cash EquivalentJoanah TayamenNo ratings yet

- Introduction To Investment BankingDocument37 pagesIntroduction To Investment BankingVaidyanathan RavichandranNo ratings yet

- Cash and Cash EquivalentDocument32 pagesCash and Cash EquivalentArbie D. DecimioNo ratings yet

- Reviewer Intacc 1n2Document58 pagesReviewer Intacc 1n2John100% (1)

- FarDocument8 pagesFarnivea gumayagay71% (7)

- Practical - Bank Reconciliation StatementDocument5 pagesPractical - Bank Reconciliation StatementUniversal SoldierNo ratings yet

- BRS ProblemsDocument28 pagesBRS ProblemsKutbuddin JawadwalaNo ratings yet

- Prepare Bank Reconciliation Statement From The Following: (I) Debit Balance As Per The Cash BookDocument10 pagesPrepare Bank Reconciliation Statement From The Following: (I) Debit Balance As Per The Cash BookPragya ShuklaNo ratings yet

- Chapter 9 - Bank Reconciliation StatementDocument15 pagesChapter 9 - Bank Reconciliation StatementSaurabh GohanNo ratings yet

- Bank Reconciliation StatementDocument33 pagesBank Reconciliation StatementMd TahirNo ratings yet

- BRS PDFDocument8 pagesBRS PDFAnshumanNo ratings yet

- CA Foundation June 23 BRS Problem - CTC ClassesDocument2 pagesCA Foundation June 23 BRS Problem - CTC ClassesMohit SharmaNo ratings yet

- Bank Reconcilaition Statement Problems PDF 1 4 PDFDocument4 pagesBank Reconcilaition Statement Problems PDF 1 4 PDFHakim JanNo ratings yet

- BRS 2Document2 pagesBRS 2Aarnav SharmaNo ratings yet

- BRS WorksheetDocument8 pagesBRS WorksheetMayank VermaNo ratings yet

- Bank ReconciliationDocument6 pagesBank Reconciliationnaih marchessaNo ratings yet

- Bank Reconciliation Statement: Gravity 4 CaDocument13 pagesBank Reconciliation Statement: Gravity 4 CaAmit ChaudhryNo ratings yet

- Bank Re-Conciliation QuesDocument3 pagesBank Re-Conciliation QuesGarima GarimaNo ratings yet

- Accounts RTP CA Foundation May 2020Document31 pagesAccounts RTP CA Foundation May 2020YashNo ratings yet

- Account Past Questions Compilation (2009june - 2022 June)Document319 pagesAccount Past Questions Compilation (2009june - 2022 June)Arjun AdhikariNo ratings yet

- Quiz 1Document3 pagesQuiz 1Carmi FeceroNo ratings yet

- Cash and Cash Equivalent Tutorial PDFDocument3 pagesCash and Cash Equivalent Tutorial PDFClara San MiguelNo ratings yet

- Additional Illustrations-13Document5 pagesAdditional Illustrations-13Deepak YadavNo ratings yet

- Unit 8 Bank Reconciliation StatementDocument7 pagesUnit 8 Bank Reconciliation StatementUrja JoshiNo ratings yet

- Bank Reconciliation - SolutionsDocument6 pagesBank Reconciliation - SolutionsNIAZ HUSSAIN100% (1)

- P01. Cash and Cash Equivalents AnswersDocument8 pagesP01. Cash and Cash Equivalents AnswersIosif DzhugasviliNo ratings yet

- Balance: Financial AccountingDocument6 pagesBalance: Financial AccountingravinraghzNo ratings yet

- Paper - 1: Principles & Practice of Accounting Questions True and FalseDocument31 pagesPaper - 1: Principles & Practice of Accounting Questions True and FalseUnknown 1No ratings yet

- FAR 0 Bank Recon and Proof of Cash Drill ProblemsDocument6 pagesFAR 0 Bank Recon and Proof of Cash Drill Problemsyeeaahh56No ratings yet

- AP - Quiz 01 (UCP)Document8 pagesAP - Quiz 01 (UCP)CrestinaNo ratings yet

- 4.CA Foundation Test 4Document6 pages4.CA Foundation Test 4Nived Narayan PNo ratings yet

- Assignment BRSDocument2 pagesAssignment BRSveydantsharma42No ratings yet

- MOD 01 - Cash and Cash EquivalentsDocument3 pagesMOD 01 - Cash and Cash EquivalentsIrish VargasNo ratings yet

- FAR103 - FAR - 203 (A) - Cash and Cash EquivalentsDocument3 pagesFAR103 - FAR - 203 (A) - Cash and Cash EquivalentsDan Andrei BongoNo ratings yet

- Adobe Scan 05 Jan 2024Document2 pagesAdobe Scan 05 Jan 2024Harshit GargNo ratings yet

- Cce Board WorkDocument3 pagesCce Board WorkNicole VinaraoNo ratings yet

- Assessment Task 1-1Document10 pagesAssessment Task 1-1hahahahaNo ratings yet

- Bank Reconciliation StatementDocument3 pagesBank Reconciliation StatementKritika HarlalkaNo ratings yet

- Financial AssetsDocument127 pagesFinancial Assetscherry blossomNo ratings yet

- Tsgrewal BRSDocument11 pagesTsgrewal BRSDhruvNo ratings yet

- Cash Cash Equivalent Bank ReconDocument4 pagesCash Cash Equivalent Bank Reconmavie arellanoNo ratings yet

- Mock Prelim - Intermediate AcctDocument9 pagesMock Prelim - Intermediate AcctNikki LabialNo ratings yet

- Bank Reconciliation StatementDocument12 pagesBank Reconciliation StatementBhuvan PrajapatiNo ratings yet

- FAR - CASH ProbDocument2 pagesFAR - CASH Prob2216391No ratings yet

- AACONAPPS2 Quiz No. 01 - Audit of Cash Problem Questions (2022)Document4 pagesAACONAPPS2 Quiz No. 01 - Audit of Cash Problem Questions (2022)Dawson Dela CruzNo ratings yet

- Cash and Cash Equivalents Quizzer 1Document5 pagesCash and Cash Equivalents Quizzer 1yna kyleneNo ratings yet

- Cash and Cash EquivalentsDocument3 pagesCash and Cash EquivalentsBeat KarbNo ratings yet

- Submitted To: Submitted byDocument33 pagesSubmitted To: Submitted byaanaughtyNo ratings yet

- CCE Bank Recon DISCUSSION EXERCISESDocument2 pagesCCE Bank Recon DISCUSSION EXERCISESGlance Piscasio CruzNo ratings yet

- Cash and Cash EquivalentsDocument3 pagesCash and Cash EquivalentsShiela Mae SangidNo ratings yet

- ACCTG 102 Practice Sets Quizzes ExamsDocument25 pagesACCTG 102 Practice Sets Quizzes ExamsheythereitsclaireNo ratings yet

- CashDocument6 pagesCashrosemariesollegue888No ratings yet

- FINANCIAL ACCOUNTING - Cash To Receivables Problems and SolutionsDocument8 pagesFINANCIAL ACCOUNTING - Cash To Receivables Problems and Solutionsstan iKONNo ratings yet

- Paper - 1: Principles & Practice of Accounting Questions True and FalseDocument32 pagesPaper - 1: Principles & Practice of Accounting Questions True and FalseShaindra SinghNo ratings yet

- Proof+of+Cash ProblemsDocument2 pagesProof+of+Cash ProblemshelaihjsNo ratings yet

- Proof of Cash ProblemsDocument2 pagesProof of Cash ProblemsSamantha Marie Arevalo100% (1)

- BA3 M KIT Chapter 16Document4 pagesBA3 M KIT Chapter 16Nivneth PeirisNo ratings yet

- Bank Reconciliation StatementDocument4 pagesBank Reconciliation StatementProttasha AsifNo ratings yet

- Bank Reconciliation Statement August 17Document10 pagesBank Reconciliation Statement August 17NO NAMENo ratings yet

- FM Quiz Set ADocument3 pagesFM Quiz Set AShaira Mae TomasNo ratings yet

- BCom Second Year Assignments PDFDocument2 pagesBCom Second Year Assignments PDFKotaiah Avula75% (8)

- AGNPO The Budget ProcessDocument57 pagesAGNPO The Budget ProcessJassyNo ratings yet

- CC Two-Wheeler-LoansDocument29 pagesCC Two-Wheeler-LoansRight ClickNo ratings yet

- MSME Definition by RBIDocument8 pagesMSME Definition by RBIRahul YadavNo ratings yet

- A Study On Brand Awareness of Financial Products With Special Reference To Agile Capital ServicesDocument71 pagesA Study On Brand Awareness of Financial Products With Special Reference To Agile Capital Servicesjassi nishadNo ratings yet

- VOPAK Jaarverslag2010 PDFDocument180 pagesVOPAK Jaarverslag2010 PDFJasper Laarmans Teixeira de MattosNo ratings yet

- Match Each Annual Report Section With Its Description Annual ReportDocument1 pageMatch Each Annual Report Section With Its Description Annual ReportLet's Talk With HassanNo ratings yet

- 10 - Borrowing Costs PS 12edDocument15 pages10 - Borrowing Costs PS 12edbusiness docNo ratings yet

- Notes LAW OF TAXATIONDocument266 pagesNotes LAW OF TAXATIONsadia zaahirNo ratings yet

- Infographic Bank Issue Fin360Document1 pageInfographic Bank Issue Fin360NUR SYAFIQAH DAYANA MOHD SUFFIANNo ratings yet

- Absorption CostingDocument32 pagesAbsorption Costingsknco50% (2)

- Research Report Bajaj Finance LTDDocument8 pagesResearch Report Bajaj Finance LTDvivekNo ratings yet

- Apr 2023Document1 pageApr 2023saurabhjaNo ratings yet

- Oman Oil Balance SheetDocument27 pagesOman Oil Balance Sheeta.hasan670100% (1)

- Accounts Mock Test May 2019Document18 pagesAccounts Mock Test May 2019poojitha reddyNo ratings yet

- Vol 5-1 and 2..akram Khan..Performance Auditing For Islamic Banks..DpDocument15 pagesVol 5-1 and 2..akram Khan..Performance Auditing For Islamic Banks..Dpbabak1897No ratings yet

- QuizDocument4 pagesQuizPraveer BoseNo ratings yet

- Chapter 10Document26 pagesChapter 10Minh Ánh NguyênNo ratings yet

- Accounting 21 Financial Accounting and Reporting Part 1Document5 pagesAccounting 21 Financial Accounting and Reporting Part 1Faith BariasNo ratings yet

- MBFS Unit 1Document48 pagesMBFS Unit 1pearlksrNo ratings yet

- Securities Laws in IndiaDocument19 pagesSecurities Laws in IndiaBhawna Pamnani100% (1)

- Risk Management For MBA StudentsDocument28 pagesRisk Management For MBA StudentsMuneeb Sada50% (2)

- AOi XTIANDocument4 pagesAOi XTIANArste GimoNo ratings yet

- Risk & Return: Chapte RDocument52 pagesRisk & Return: Chapte RMohammad Salim HossainNo ratings yet

- Trade Indicator Handbook FINAL 2013Document138 pagesTrade Indicator Handbook FINAL 2013Santiago.VRNo ratings yet

- Tax Chapter 3 SummaryDocument4 pagesTax Chapter 3 SummaryishaNo ratings yet

- Roosevelt DEcision of Bank HolidayDocument12 pagesRoosevelt DEcision of Bank HolidaySheetal ChauhanNo ratings yet

- CF Industries Presentation May 2016Document23 pagesCF Industries Presentation May 2016red cornerNo ratings yet

- 6 Enano-Bote v. Alvarez, G.R. No. 223572, (November 10, 2020)Document13 pages6 Enano-Bote v. Alvarez, G.R. No. 223572, (November 10, 2020)Marlito Joshua AmistosoNo ratings yet