Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

9 viewsAnnex 249 Au3367

Annex 249 Au3367

Uploaded by

Welt GeistThe Reserve Bank of India is being given more powers to regulate non-banking financial companies through amendments in the Finance Bill 2019. The amendments would allow RBI to supersede NBFC boards, remove directors, amalgamate or reconstruct NBFCs in the public interest, impose higher penalties, and raise net owned fund requirements. RBI has also taken steps to strengthen NBFCs and maintain financial stability by aligning regulations with banks, setting capital and deposit norms, appointing chief risk officers, and conducting on-site and off-site supervision. Measures have also been taken to provide temporary support to NBFCs through relaxed securitization rules and increased single borrower exposure limits.

Copyright:

© All Rights Reserved

Available Formats

Download as DOC, PDF, TXT or read online from Scribd

You might also like

- Finastra CapabilitiesDocument12 pagesFinastra CapabilitiesAlan Zhang100% (1)

- Ahm 810Document45 pagesAhm 810FERRACHI SamiraNo ratings yet

- Volume XV - Issue 2 - AUGUST 2019: I. RBI Central Board Approves Surplus Transfer To The GovernmentDocument4 pagesVolume XV - Issue 2 - AUGUST 2019: I. RBI Central Board Approves Surplus Transfer To The GovernmentAnonymous Ax5bwAHvNo ratings yet

- GK Power Capsule NICL AO Assistant 2015Document45 pagesGK Power Capsule NICL AO Assistant 2015Abbie HudsonNo ratings yet

- IBPS SO Marketing Mains Current Affairs CapsuleDocument41 pagesIBPS SO Marketing Mains Current Affairs CapsuleAP ABHILASHNo ratings yet

- PIB 2-14 MarchDocument122 pagesPIB 2-14 MarchgaganNo ratings yet

- Module V Recent Trends & DevelopmentsDocument18 pagesModule V Recent Trends & DevelopmentsItisha SinghNo ratings yet

- Sample Phase I Ga NotesDocument8 pagesSample Phase I Ga NotesSAI CHARAN VNo ratings yet

- GK Tornado Ibps RRB Officer Asst Main 2020 Exam Eng 68 PDFDocument154 pagesGK Tornado Ibps RRB Officer Asst Main 2020 Exam Eng 68 PDFDeepaNo ratings yet

- Adv RTP 20Document38 pagesAdv RTP 20Pawan AgrawalNo ratings yet

- Monetary Management REPORTDocument12 pagesMonetary Management REPORTRajat MishraNo ratings yet

- © The Institute of Chartered Accountants of IndiaDocument48 pages© The Institute of Chartered Accountants of IndiaIndhuNo ratings yet

- Last Six Months Current Affairs For NTPC ExamDocument190 pagesLast Six Months Current Affairs For NTPC ExamMujassamNazarKhanNo ratings yet

- Affairscloud April 2024 Banking & Economy English PDF WatermarkDocument142 pagesAffairscloud April 2024 Banking & Economy English PDF Watermarkbipasha.deyNo ratings yet

- RBI Measures PDFDocument11 pagesRBI Measures PDFJaldeep MangawaNo ratings yet

- Intermediate Advance Accounting RTP May 20Document48 pagesIntermediate Advance Accounting RTP May 20BAZINGANo ratings yet

- Thousands Small Steps 3rd Edition - FinalDocument44 pagesThousands Small Steps 3rd Edition - FinaljayeshbhandariNo ratings yet

- 1 Narasimhan Cvommittee ReportDocument4 pages1 Narasimhan Cvommittee ReportAbhishek KhandelwalNo ratings yet

- GK Tornado Rbi Assistant 2020 Mains Exam Eng 40Document180 pagesGK Tornado Rbi Assistant 2020 Mains Exam Eng 40AKHIL RAJ SNo ratings yet

- (English) Last 6 Months Current Affairs 2020 PDF (WWW - Examstocks.com)Document188 pages(English) Last 6 Months Current Affairs 2020 PDF (WWW - Examstocks.com)1ECE B 089 THARUN K SNo ratings yet

- Vidyadeepam Dec 2019 FinalDocument46 pagesVidyadeepam Dec 2019 FinalAjit kumarNo ratings yet

- NBFC23022018Document17 pagesNBFC23022018RAMANAN MAGESHNo ratings yet

- CBM Assignment 2Document3 pagesCBM Assignment 2Abhishek ChopraNo ratings yet

- GK Tornado Sbi Clerk Main 2020 Exam 15 Sep To 21st Oct 2020 12Document56 pagesGK Tornado Sbi Clerk Main 2020 Exam 15 Sep To 21st Oct 2020 12Divya Kishore BollaNo ratings yet

- NBFCDocument5 pagesNBFCNiket SharmaNo ratings yet

- Downloadfile 1Document43 pagesDownloadfile 1muhilanNo ratings yet

- Master Circular - Bank Finance To Non-Banking Financial Companies (NBFCS)Document10 pagesMaster Circular - Bank Finance To Non-Banking Financial Companies (NBFCS)yogendrachat4057No ratings yet

- GK Tornado Sbi Po Main Exam 2019-68Document119 pagesGK Tornado Sbi Po Main Exam 2019-68sasNo ratings yet

- Ruti RajeshwariDocument17 pagesRuti RajeshwariAmit KumarNo ratings yet

- RBI - Dividend by NBFCs 24062021Document8 pagesRBI - Dividend by NBFCs 24062021Nimesh KumarNo ratings yet

- Jan19 PDFDocument20 pagesJan19 PDFJatin ValechaNo ratings yet

- GK Powercapsule For Ibps Po - Iv 2014 ExamDocument45 pagesGK Powercapsule For Ibps Po - Iv 2014 ExamJayapalNo ratings yet

- GK Tornado Final - pdf-87Document54 pagesGK Tornado Final - pdf-87Sourav SenNo ratings yet

- Oscb Banking Assistant Previous Paper With Solutions PDFDocument62 pagesOscb Banking Assistant Previous Paper With Solutions PDFRupeshNo ratings yet

- Adv RTP 19Document34 pagesAdv RTP 19Pawan AgrawalNo ratings yet

- GK Tornado Ibps RRB Po Clerk Mains Exam 2023 Eng 881708655428681Document197 pagesGK Tornado Ibps RRB Po Clerk Mains Exam 2023 Eng 881708655428681applogin27No ratings yet

- 4163IIBF Vision March 2015Document8 pages4163IIBF Vision March 2015Madhumita PandeyNo ratings yet

- Commercial Bank Management: Assignment-2Document4 pagesCommercial Bank Management: Assignment-2Prash SNo ratings yet

- Weekly Economic Round Up 39Document14 pagesWeekly Economic Round Up 39Mana PlanetNo ratings yet

- RBI Master CircularDocument13 pagesRBI Master Circularnaina.kim2427No ratings yet

- Classroom 0 BANKINGDocument19 pagesClassroom 0 BANKINGSimbaBabduNo ratings yet

- Gradestack Clerk Mains CapsuleDocument51 pagesGradestack Clerk Mains CapsuleunikxocizmNo ratings yet

- Enhanced Regulatory Power To Supersede Board of DirectorsDocument6 pagesEnhanced Regulatory Power To Supersede Board of DirectorsAnonymous uurrtSaNo ratings yet

- Rbi Guidelines For Nbfcs by Mayuri MandotDocument23 pagesRbi Guidelines For Nbfcs by Mayuri Mandotmailhot16No ratings yet

- Nov 19 Group 2 RTPDocument113 pagesNov 19 Group 2 RTPYash KediaNo ratings yet

- Asso PDFDocument54 pagesAsso PDFneeta chandNo ratings yet

- Roll No. 286, 378 - Assignment 2Document5 pagesRoll No. 286, 378 - Assignment 2Kathiravan RajendranNo ratings yet

- What Is The Policy Action Taken by RBI To Counter The Impact of Covid 19 Pandemic?Document2 pagesWhat Is The Policy Action Taken by RBI To Counter The Impact of Covid 19 Pandemic?nickcrokNo ratings yet

- Project Report: Banking ReformsDocument9 pagesProject Report: Banking ReformsS.S.Rules100% (1)

- Q 1 Discuss The Evolution of IFS Post GFC Also Explain The FunctionDocument2 pagesQ 1 Discuss The Evolution of IFS Post GFC Also Explain The FunctionjatinNo ratings yet

- Key Highlights of 7 Bi-Monthly Monetary Policy 2019-20: IIBF Vision April 2020Document9 pagesKey Highlights of 7 Bi-Monthly Monetary Policy 2019-20: IIBF Vision April 2020go4ibibo 15No ratings yet

- Weekly Economic Round Up 37Document11 pagesWeekly Economic Round Up 37Mana PlanetNo ratings yet

- Growth and Performance of Non-Banking Financial Institute in IndiaDocument19 pagesGrowth and Performance of Non-Banking Financial Institute in IndiaSreenivasa Murthy KotaNo ratings yet

- Professional Knowledge Questions For Indian Bank So (Credit)Document28 pagesProfessional Knowledge Questions For Indian Bank So (Credit)hermandeep5No ratings yet

- Non-Banking Finance CompnaiesDocument19 pagesNon-Banking Finance CompnaiesAnonymous ZVyShhiNo ratings yet

- NK Singh Committee On FRBMDocument5 pagesNK Singh Committee On FRBMvikashchoudhary22082002No ratings yet

- Banking & Economy PDF - December 2022 by AffairsCloud 1Document119 pagesBanking & Economy PDF - December 2022 by AffairsCloud 1Maahi ThakorNo ratings yet

- Initiatives To Improve The Conditions of Government BanksDocument2 pagesInitiatives To Improve The Conditions of Government BanksKartik AhirNo ratings yet

- Statement by Governor - First Bi-Monthly Monetary Policy, 2019-20, April 4, 2019Document8 pagesStatement by Governor - First Bi-Monthly Monetary Policy, 2019-20, April 4, 2019Valter SilveiraNo ratings yet

- RBI/2008-09/193 DNBS (PD) CC No. 129/03. 02.82/ 2008-09 September 23, 2008Document7 pagesRBI/2008-09/193 DNBS (PD) CC No. 129/03. 02.82/ 2008-09 September 23, 2008grover_deepak18No ratings yet

- Securitization in India: Managing Capital Constraints and Creating Liquidity to Fund Infrastructure AssetsFrom EverandSecuritization in India: Managing Capital Constraints and Creating Liquidity to Fund Infrastructure AssetsNo ratings yet

- Emerging Issues in Finance Sector Inclusion, Deepening, and Development in the People's Republic of ChinaFrom EverandEmerging Issues in Finance Sector Inclusion, Deepening, and Development in the People's Republic of ChinaNo ratings yet

- Tred RubDocument1 pageTred RubWelt GeistNo ratings yet

- Polm PrceDocument1 pagePolm PrceWelt GeistNo ratings yet

- VRTCLDocument1 pageVRTCLWelt GeistNo ratings yet

- ConvyrDocument1 pageConvyrWelt GeistNo ratings yet

- FinxjbDocument1 pageFinxjbWelt GeistNo ratings yet

- FxdastDocument1 pageFxdastWelt GeistNo ratings yet

- Metal ProcrDocument1 pageMetal ProcrWelt GeistNo ratings yet

- InstwbDocument1 pageInstwbWelt GeistNo ratings yet

- MetuclslDocument1 pageMetuclslWelt GeistNo ratings yet

- JRNL GRNFLDocument1 pageJRNL GRNFLWelt GeistNo ratings yet

- NoisecovrDocument1 pageNoisecovrWelt GeistNo ratings yet

- JRNL MNTLDocument1 pageJRNL MNTLWelt GeistNo ratings yet

- Mark JDDocument1 pageMark JDWelt GeistNo ratings yet

- WishtelDocument1 pageWishtelWelt GeistNo ratings yet

- LapiDocument1 pageLapiWelt GeistNo ratings yet

- Digital Marketing JDDocument1 pageDigital Marketing JDWelt GeistNo ratings yet

- ItsaleDocument1 pageItsaleWelt GeistNo ratings yet

- AspireDocument1 pageAspireWelt GeistNo ratings yet

- Wa0001Document1 pageWa0001Welt GeistNo ratings yet

- JD 2Document1 pageJD 2Welt GeistNo ratings yet

- Wa0007Document1 pageWa0007Welt GeistNo ratings yet

- 05 Wa0003Document1 page05 Wa0003Welt GeistNo ratings yet

- Wa0002Document1 pageWa0002Welt GeistNo ratings yet

- Factors Determining Profitability of Commercial Banks: Evidence From Nepali Banking SectorDocument14 pagesFactors Determining Profitability of Commercial Banks: Evidence From Nepali Banking Sectorshresthanikhil078No ratings yet

- Servicedesk Plus MSP OverviewDocument71 pagesServicedesk Plus MSP Overviewsupport lantai5No ratings yet

- Decision TreesDocument10 pagesDecision TreesMarketing ExpertNo ratings yet

- Class 6 Innovation Adoption 2020Document26 pagesClass 6 Innovation Adoption 2020jshen5No ratings yet

- A Major Project Presentation ON "A Study On Brand Preference of Different Mobile Phones"Document62 pagesA Major Project Presentation ON "A Study On Brand Preference of Different Mobile Phones"aksrinivasNo ratings yet

- 56 Cebu Institute of Medicine v. CIM Employee's UnionDocument3 pages56 Cebu Institute of Medicine v. CIM Employee's UnionRuab PlosNo ratings yet

- Income Indirect Taxes VAT Slides ICPAK Presentation Gideon RotichDocument26 pagesIncome Indirect Taxes VAT Slides ICPAK Presentation Gideon RotichREJAY89No ratings yet

- Esgci DbaDocument18 pagesEsgci DbaSterowany DanymiNo ratings yet

- PmiDocument10 pagesPmiparaneetharanNo ratings yet

- At Home Real Estate Media Kit FY22Document23 pagesAt Home Real Estate Media Kit FY22tronicspackNo ratings yet

- MobiliseYourCity Global Monitor 2021Document192 pagesMobiliseYourCity Global Monitor 2021krupalbhavsarNo ratings yet

- Voice and AccountabilityDocument2 pagesVoice and AccountabilityHammad AHMEDNo ratings yet

- Carrefour Offer Today QatarDocument19 pagesCarrefour Offer Today QatarqabbasNo ratings yet

- AdmissionDocument22 pagesAdmissionAccounting HelpNo ratings yet

- Enabling Mechanisms GOVERNANCEDocument36 pagesEnabling Mechanisms GOVERNANCEJUNE QUIZA100% (1)

- SMAW-Basics DEMODocument24 pagesSMAW-Basics DEMOKentDemeterioNo ratings yet

- Educational Wooden Toys 2018Document118 pagesEducational Wooden Toys 2018jagadish NNo ratings yet

- The Impact of Technology On MarketingDocument12 pagesThe Impact of Technology On MarketingGabrielaNo ratings yet

- Best Practices of VMIDocument54 pagesBest Practices of VMIMuhammad Younas100% (1)

- Project NameDocument20 pagesProject NameAlice WongNo ratings yet

- A Project On "Study of BSE and NASDAQ - A Comparision of Two Stock Exchanges"Document12 pagesA Project On "Study of BSE and NASDAQ - A Comparision of Two Stock Exchanges"Kshitij ThakurNo ratings yet

- Totok Ismanto 424366380Document7 pagesTotok Ismanto 424366380Green Sustain EnergyNo ratings yet

- Ancra: Container Parts CatalogueDocument31 pagesAncra: Container Parts CatalogueGarryNo ratings yet

- Report Writing in EnvironmentDocument8 pagesReport Writing in EnvironmentFred Raphael IlomoNo ratings yet

- CAD Tech PackDocument14 pagesCAD Tech PackAbenu Kasim67% (3)

- Basics: How Does GPRS Work?Document3 pagesBasics: How Does GPRS Work?Sopno GhuriNo ratings yet

- A Micro-Project Report ON: "Currency Convertor"Document7 pagesA Micro-Project Report ON: "Currency Convertor"Aniket BokeNo ratings yet

- Textbook Ebook Introduction To Management Accounting Global Edition 17Th Edition Charles Horngren All Chapter PDFDocument43 pagesTextbook Ebook Introduction To Management Accounting Global Edition 17Th Edition Charles Horngren All Chapter PDFkim.reyes855100% (9)

Annex 249 Au3367

Annex 249 Au3367

Uploaded by

Welt Geist0 ratings0% found this document useful (0 votes)

9 views2 pagesThe Reserve Bank of India is being given more powers to regulate non-banking financial companies through amendments in the Finance Bill 2019. The amendments would allow RBI to supersede NBFC boards, remove directors, amalgamate or reconstruct NBFCs in the public interest, impose higher penalties, and raise net owned fund requirements. RBI has also taken steps to strengthen NBFCs and maintain financial stability by aligning regulations with banks, setting capital and deposit norms, appointing chief risk officers, and conducting on-site and off-site supervision. Measures have also been taken to provide temporary support to NBFCs through relaxed securitization rules and increased single borrower exposure limits.

Original Description:

Original Title

_annex_249_Au3367

Copyright

© © All Rights Reserved

Available Formats

DOC, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe Reserve Bank of India is being given more powers to regulate non-banking financial companies through amendments in the Finance Bill 2019. The amendments would allow RBI to supersede NBFC boards, remove directors, amalgamate or reconstruct NBFCs in the public interest, impose higher penalties, and raise net owned fund requirements. RBI has also taken steps to strengthen NBFCs and maintain financial stability by aligning regulations with banks, setting capital and deposit norms, appointing chief risk officers, and conducting on-site and off-site supervision. Measures have also been taken to provide temporary support to NBFCs through relaxed securitization rules and increased single borrower exposure limits.

Copyright:

© All Rights Reserved

Available Formats

Download as DOC, PDF, TXT or read online from Scribd

Download as doc, pdf, or txt

0 ratings0% found this document useful (0 votes)

9 views2 pagesAnnex 249 Au3367

Annex 249 Au3367

Uploaded by

Welt GeistThe Reserve Bank of India is being given more powers to regulate non-banking financial companies through amendments in the Finance Bill 2019. The amendments would allow RBI to supersede NBFC boards, remove directors, amalgamate or reconstruct NBFCs in the public interest, impose higher penalties, and raise net owned fund requirements. RBI has also taken steps to strengthen NBFCs and maintain financial stability by aligning regulations with banks, setting capital and deposit norms, appointing chief risk officers, and conducting on-site and off-site supervision. Measures have also been taken to provide temporary support to NBFCs through relaxed securitization rules and increased single borrower exposure limits.

Copyright:

© All Rights Reserved

Available Formats

Download as DOC, PDF, TXT or read online from Scribd

Download as doc, pdf, or txt

You are on page 1of 2

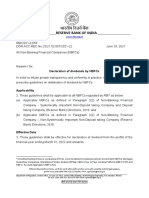

GOVERNMENT OF INDIA

MINISTRY OF FINANCE

RAJYA SABHA

UNSTARRED QUESTION NO-3367

ANSWERED ON-23.07.2019

REGULATION OF NBFCs BY RBI

3367. SHRI T. RATHINAVEL:

Will the Minister of FINANCE be pleased to state:

(a) whether it is a fact that Government is considering to give more powers to Reserve

Bank of India (RBI) to regulate Non-Banking Financial Companies (NBFCs);

(b) if so, the details thereof;

(c) whether it is also a fact that the RBI has been taking necessary regulatory and

supervisory steps to strengthen the NBFCs and maintain stability of the financial

system; and

(d) if so, the details thereof?

ANSWER

THE MINISTER OF STATE IN THE MINISTRY OF FINANCE

(SHRI ANURAG SINGH THAKUR)

(a) and (b): Amendments to give more powers to RBI to regulate NBFCs form part of

Finance Bill, 2019, which has been introduced in the ongoing Budget Session 2019 of

Parliament. The proposed amendments would empower RBI to supersede the Board of

an NBFC or remove its director(s), amalgamate or reconstruct or split an NBFC in

public interest or for financial stability, remove and debar auditors, direct the

inspection and audit of any group company of an NBFC, raise the Net Owned Fund

requirement for NBFCs, and impose higher penalties in case of legal contraventions.

(c) and (d): With regard to taking of necessary regulatory and supervisory steps to

strengthen NBFCs and maintain stability of the financial system, RBI has stated that it

has taken a number of measures to strengthen NBFCs and maintain stability of the

financial system including the following:

1. To remove the regulatory arbitrage between banks and non-banks, regulatory and

supervisory frameworks for NBFCs are being aligned with that of Scheduled

Commercial Banks.

2. Minimum capital adequacy norms have been prescribed for different categories of

NBFCs, and for deposit-taking NBFCs, the deposit amount has been limited to 1.5

times of net owned fund.

3. Net owned fund requirement for Asset Reconstruction Companies (ARCs) has

been fixed at Rs. 100 crore on an ongoing basis.

4. With a view to extend temporary support to NBFCs and maintain stability of the

financial system, RBI has been taking the following regulatory measures to

alleviate stress in the NBFC sector in the near-term:

(i) To encourage NBFCs to securitise/assign their eligible assets, the minimum

holding period requirement for originating NBFCs was relaxed till

December 2019.

(ii) The single-borrower exposure limit for NBFCs that do not finance

infrastructure was increased from 10 percent to 15 percent of capital funds,

up to 31st March 2019.

(iii) Banks were permitted to provide partial credit-enhancement for non-deposit

accepting systematically-important NBFCs registered with RBI and housing

finance companies (HFCs) registered with the National Housing Board

(NHB) as per guidelines.

(iv) RBI permitted special dispensation to banks till 31 st March 2019, whereby

their incremental credit to NBFCs and HFCs after 19 th October 2018 could

be treated as high-quality liquid assets for calculation of liquidity coverage

ratios.

(v) NBFCs with assets over Rs. 5,000 crore have been asked to appoint a Chief

Risk Officer to improve the standards of risk management.

5. Supervision of NBFCs is carried out through on-site surveillance, off-site

surveillance, market intelligence, and reports received annually from statutory

auditors.

*****

You might also like

- Finastra CapabilitiesDocument12 pagesFinastra CapabilitiesAlan Zhang100% (1)

- Ahm 810Document45 pagesAhm 810FERRACHI SamiraNo ratings yet

- Volume XV - Issue 2 - AUGUST 2019: I. RBI Central Board Approves Surplus Transfer To The GovernmentDocument4 pagesVolume XV - Issue 2 - AUGUST 2019: I. RBI Central Board Approves Surplus Transfer To The GovernmentAnonymous Ax5bwAHvNo ratings yet

- GK Power Capsule NICL AO Assistant 2015Document45 pagesGK Power Capsule NICL AO Assistant 2015Abbie HudsonNo ratings yet

- IBPS SO Marketing Mains Current Affairs CapsuleDocument41 pagesIBPS SO Marketing Mains Current Affairs CapsuleAP ABHILASHNo ratings yet

- PIB 2-14 MarchDocument122 pagesPIB 2-14 MarchgaganNo ratings yet

- Module V Recent Trends & DevelopmentsDocument18 pagesModule V Recent Trends & DevelopmentsItisha SinghNo ratings yet

- Sample Phase I Ga NotesDocument8 pagesSample Phase I Ga NotesSAI CHARAN VNo ratings yet

- GK Tornado Ibps RRB Officer Asst Main 2020 Exam Eng 68 PDFDocument154 pagesGK Tornado Ibps RRB Officer Asst Main 2020 Exam Eng 68 PDFDeepaNo ratings yet

- Adv RTP 20Document38 pagesAdv RTP 20Pawan AgrawalNo ratings yet

- Monetary Management REPORTDocument12 pagesMonetary Management REPORTRajat MishraNo ratings yet

- © The Institute of Chartered Accountants of IndiaDocument48 pages© The Institute of Chartered Accountants of IndiaIndhuNo ratings yet

- Last Six Months Current Affairs For NTPC ExamDocument190 pagesLast Six Months Current Affairs For NTPC ExamMujassamNazarKhanNo ratings yet

- Affairscloud April 2024 Banking & Economy English PDF WatermarkDocument142 pagesAffairscloud April 2024 Banking & Economy English PDF Watermarkbipasha.deyNo ratings yet

- RBI Measures PDFDocument11 pagesRBI Measures PDFJaldeep MangawaNo ratings yet

- Intermediate Advance Accounting RTP May 20Document48 pagesIntermediate Advance Accounting RTP May 20BAZINGANo ratings yet

- Thousands Small Steps 3rd Edition - FinalDocument44 pagesThousands Small Steps 3rd Edition - FinaljayeshbhandariNo ratings yet

- 1 Narasimhan Cvommittee ReportDocument4 pages1 Narasimhan Cvommittee ReportAbhishek KhandelwalNo ratings yet

- GK Tornado Rbi Assistant 2020 Mains Exam Eng 40Document180 pagesGK Tornado Rbi Assistant 2020 Mains Exam Eng 40AKHIL RAJ SNo ratings yet

- (English) Last 6 Months Current Affairs 2020 PDF (WWW - Examstocks.com)Document188 pages(English) Last 6 Months Current Affairs 2020 PDF (WWW - Examstocks.com)1ECE B 089 THARUN K SNo ratings yet

- Vidyadeepam Dec 2019 FinalDocument46 pagesVidyadeepam Dec 2019 FinalAjit kumarNo ratings yet

- NBFC23022018Document17 pagesNBFC23022018RAMANAN MAGESHNo ratings yet

- CBM Assignment 2Document3 pagesCBM Assignment 2Abhishek ChopraNo ratings yet

- GK Tornado Sbi Clerk Main 2020 Exam 15 Sep To 21st Oct 2020 12Document56 pagesGK Tornado Sbi Clerk Main 2020 Exam 15 Sep To 21st Oct 2020 12Divya Kishore BollaNo ratings yet

- NBFCDocument5 pagesNBFCNiket SharmaNo ratings yet

- Downloadfile 1Document43 pagesDownloadfile 1muhilanNo ratings yet

- Master Circular - Bank Finance To Non-Banking Financial Companies (NBFCS)Document10 pagesMaster Circular - Bank Finance To Non-Banking Financial Companies (NBFCS)yogendrachat4057No ratings yet

- GK Tornado Sbi Po Main Exam 2019-68Document119 pagesGK Tornado Sbi Po Main Exam 2019-68sasNo ratings yet

- Ruti RajeshwariDocument17 pagesRuti RajeshwariAmit KumarNo ratings yet

- RBI - Dividend by NBFCs 24062021Document8 pagesRBI - Dividend by NBFCs 24062021Nimesh KumarNo ratings yet

- Jan19 PDFDocument20 pagesJan19 PDFJatin ValechaNo ratings yet

- GK Powercapsule For Ibps Po - Iv 2014 ExamDocument45 pagesGK Powercapsule For Ibps Po - Iv 2014 ExamJayapalNo ratings yet

- GK Tornado Final - pdf-87Document54 pagesGK Tornado Final - pdf-87Sourav SenNo ratings yet

- Oscb Banking Assistant Previous Paper With Solutions PDFDocument62 pagesOscb Banking Assistant Previous Paper With Solutions PDFRupeshNo ratings yet

- Adv RTP 19Document34 pagesAdv RTP 19Pawan AgrawalNo ratings yet

- GK Tornado Ibps RRB Po Clerk Mains Exam 2023 Eng 881708655428681Document197 pagesGK Tornado Ibps RRB Po Clerk Mains Exam 2023 Eng 881708655428681applogin27No ratings yet

- 4163IIBF Vision March 2015Document8 pages4163IIBF Vision March 2015Madhumita PandeyNo ratings yet

- Commercial Bank Management: Assignment-2Document4 pagesCommercial Bank Management: Assignment-2Prash SNo ratings yet

- Weekly Economic Round Up 39Document14 pagesWeekly Economic Round Up 39Mana PlanetNo ratings yet

- RBI Master CircularDocument13 pagesRBI Master Circularnaina.kim2427No ratings yet

- Classroom 0 BANKINGDocument19 pagesClassroom 0 BANKINGSimbaBabduNo ratings yet

- Gradestack Clerk Mains CapsuleDocument51 pagesGradestack Clerk Mains CapsuleunikxocizmNo ratings yet

- Enhanced Regulatory Power To Supersede Board of DirectorsDocument6 pagesEnhanced Regulatory Power To Supersede Board of DirectorsAnonymous uurrtSaNo ratings yet

- Rbi Guidelines For Nbfcs by Mayuri MandotDocument23 pagesRbi Guidelines For Nbfcs by Mayuri Mandotmailhot16No ratings yet

- Nov 19 Group 2 RTPDocument113 pagesNov 19 Group 2 RTPYash KediaNo ratings yet

- Asso PDFDocument54 pagesAsso PDFneeta chandNo ratings yet

- Roll No. 286, 378 - Assignment 2Document5 pagesRoll No. 286, 378 - Assignment 2Kathiravan RajendranNo ratings yet

- What Is The Policy Action Taken by RBI To Counter The Impact of Covid 19 Pandemic?Document2 pagesWhat Is The Policy Action Taken by RBI To Counter The Impact of Covid 19 Pandemic?nickcrokNo ratings yet

- Project Report: Banking ReformsDocument9 pagesProject Report: Banking ReformsS.S.Rules100% (1)

- Q 1 Discuss The Evolution of IFS Post GFC Also Explain The FunctionDocument2 pagesQ 1 Discuss The Evolution of IFS Post GFC Also Explain The FunctionjatinNo ratings yet

- Key Highlights of 7 Bi-Monthly Monetary Policy 2019-20: IIBF Vision April 2020Document9 pagesKey Highlights of 7 Bi-Monthly Monetary Policy 2019-20: IIBF Vision April 2020go4ibibo 15No ratings yet

- Weekly Economic Round Up 37Document11 pagesWeekly Economic Round Up 37Mana PlanetNo ratings yet

- Growth and Performance of Non-Banking Financial Institute in IndiaDocument19 pagesGrowth and Performance of Non-Banking Financial Institute in IndiaSreenivasa Murthy KotaNo ratings yet

- Professional Knowledge Questions For Indian Bank So (Credit)Document28 pagesProfessional Knowledge Questions For Indian Bank So (Credit)hermandeep5No ratings yet

- Non-Banking Finance CompnaiesDocument19 pagesNon-Banking Finance CompnaiesAnonymous ZVyShhiNo ratings yet

- NK Singh Committee On FRBMDocument5 pagesNK Singh Committee On FRBMvikashchoudhary22082002No ratings yet

- Banking & Economy PDF - December 2022 by AffairsCloud 1Document119 pagesBanking & Economy PDF - December 2022 by AffairsCloud 1Maahi ThakorNo ratings yet

- Initiatives To Improve The Conditions of Government BanksDocument2 pagesInitiatives To Improve The Conditions of Government BanksKartik AhirNo ratings yet

- Statement by Governor - First Bi-Monthly Monetary Policy, 2019-20, April 4, 2019Document8 pagesStatement by Governor - First Bi-Monthly Monetary Policy, 2019-20, April 4, 2019Valter SilveiraNo ratings yet

- RBI/2008-09/193 DNBS (PD) CC No. 129/03. 02.82/ 2008-09 September 23, 2008Document7 pagesRBI/2008-09/193 DNBS (PD) CC No. 129/03. 02.82/ 2008-09 September 23, 2008grover_deepak18No ratings yet

- Securitization in India: Managing Capital Constraints and Creating Liquidity to Fund Infrastructure AssetsFrom EverandSecuritization in India: Managing Capital Constraints and Creating Liquidity to Fund Infrastructure AssetsNo ratings yet

- Emerging Issues in Finance Sector Inclusion, Deepening, and Development in the People's Republic of ChinaFrom EverandEmerging Issues in Finance Sector Inclusion, Deepening, and Development in the People's Republic of ChinaNo ratings yet

- Tred RubDocument1 pageTred RubWelt GeistNo ratings yet

- Polm PrceDocument1 pagePolm PrceWelt GeistNo ratings yet

- VRTCLDocument1 pageVRTCLWelt GeistNo ratings yet

- ConvyrDocument1 pageConvyrWelt GeistNo ratings yet

- FinxjbDocument1 pageFinxjbWelt GeistNo ratings yet

- FxdastDocument1 pageFxdastWelt GeistNo ratings yet

- Metal ProcrDocument1 pageMetal ProcrWelt GeistNo ratings yet

- InstwbDocument1 pageInstwbWelt GeistNo ratings yet

- MetuclslDocument1 pageMetuclslWelt GeistNo ratings yet

- JRNL GRNFLDocument1 pageJRNL GRNFLWelt GeistNo ratings yet

- NoisecovrDocument1 pageNoisecovrWelt GeistNo ratings yet

- JRNL MNTLDocument1 pageJRNL MNTLWelt GeistNo ratings yet

- Mark JDDocument1 pageMark JDWelt GeistNo ratings yet

- WishtelDocument1 pageWishtelWelt GeistNo ratings yet

- LapiDocument1 pageLapiWelt GeistNo ratings yet

- Digital Marketing JDDocument1 pageDigital Marketing JDWelt GeistNo ratings yet

- ItsaleDocument1 pageItsaleWelt GeistNo ratings yet

- AspireDocument1 pageAspireWelt GeistNo ratings yet

- Wa0001Document1 pageWa0001Welt GeistNo ratings yet

- JD 2Document1 pageJD 2Welt GeistNo ratings yet

- Wa0007Document1 pageWa0007Welt GeistNo ratings yet

- 05 Wa0003Document1 page05 Wa0003Welt GeistNo ratings yet

- Wa0002Document1 pageWa0002Welt GeistNo ratings yet

- Factors Determining Profitability of Commercial Banks: Evidence From Nepali Banking SectorDocument14 pagesFactors Determining Profitability of Commercial Banks: Evidence From Nepali Banking Sectorshresthanikhil078No ratings yet

- Servicedesk Plus MSP OverviewDocument71 pagesServicedesk Plus MSP Overviewsupport lantai5No ratings yet

- Decision TreesDocument10 pagesDecision TreesMarketing ExpertNo ratings yet

- Class 6 Innovation Adoption 2020Document26 pagesClass 6 Innovation Adoption 2020jshen5No ratings yet

- A Major Project Presentation ON "A Study On Brand Preference of Different Mobile Phones"Document62 pagesA Major Project Presentation ON "A Study On Brand Preference of Different Mobile Phones"aksrinivasNo ratings yet

- 56 Cebu Institute of Medicine v. CIM Employee's UnionDocument3 pages56 Cebu Institute of Medicine v. CIM Employee's UnionRuab PlosNo ratings yet

- Income Indirect Taxes VAT Slides ICPAK Presentation Gideon RotichDocument26 pagesIncome Indirect Taxes VAT Slides ICPAK Presentation Gideon RotichREJAY89No ratings yet

- Esgci DbaDocument18 pagesEsgci DbaSterowany DanymiNo ratings yet

- PmiDocument10 pagesPmiparaneetharanNo ratings yet

- At Home Real Estate Media Kit FY22Document23 pagesAt Home Real Estate Media Kit FY22tronicspackNo ratings yet

- MobiliseYourCity Global Monitor 2021Document192 pagesMobiliseYourCity Global Monitor 2021krupalbhavsarNo ratings yet

- Voice and AccountabilityDocument2 pagesVoice and AccountabilityHammad AHMEDNo ratings yet

- Carrefour Offer Today QatarDocument19 pagesCarrefour Offer Today QatarqabbasNo ratings yet

- AdmissionDocument22 pagesAdmissionAccounting HelpNo ratings yet

- Enabling Mechanisms GOVERNANCEDocument36 pagesEnabling Mechanisms GOVERNANCEJUNE QUIZA100% (1)

- SMAW-Basics DEMODocument24 pagesSMAW-Basics DEMOKentDemeterioNo ratings yet

- Educational Wooden Toys 2018Document118 pagesEducational Wooden Toys 2018jagadish NNo ratings yet

- The Impact of Technology On MarketingDocument12 pagesThe Impact of Technology On MarketingGabrielaNo ratings yet

- Best Practices of VMIDocument54 pagesBest Practices of VMIMuhammad Younas100% (1)

- Project NameDocument20 pagesProject NameAlice WongNo ratings yet

- A Project On "Study of BSE and NASDAQ - A Comparision of Two Stock Exchanges"Document12 pagesA Project On "Study of BSE and NASDAQ - A Comparision of Two Stock Exchanges"Kshitij ThakurNo ratings yet

- Totok Ismanto 424366380Document7 pagesTotok Ismanto 424366380Green Sustain EnergyNo ratings yet

- Ancra: Container Parts CatalogueDocument31 pagesAncra: Container Parts CatalogueGarryNo ratings yet

- Report Writing in EnvironmentDocument8 pagesReport Writing in EnvironmentFred Raphael IlomoNo ratings yet

- CAD Tech PackDocument14 pagesCAD Tech PackAbenu Kasim67% (3)

- Basics: How Does GPRS Work?Document3 pagesBasics: How Does GPRS Work?Sopno GhuriNo ratings yet

- A Micro-Project Report ON: "Currency Convertor"Document7 pagesA Micro-Project Report ON: "Currency Convertor"Aniket BokeNo ratings yet

- Textbook Ebook Introduction To Management Accounting Global Edition 17Th Edition Charles Horngren All Chapter PDFDocument43 pagesTextbook Ebook Introduction To Management Accounting Global Edition 17Th Edition Charles Horngren All Chapter PDFkim.reyes855100% (9)