Professional Documents

Culture Documents

Econ1313-As2 Sample

Econ1313-As2 Sample

Uploaded by

tloc02032010Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Econ1313-As2 Sample

Econ1313-As2 Sample

Uploaded by

tloc02032010Copyright:

Available Formats

lOMoARcPSD|24382262

ECON1313 Assignment 2 s3879951 Fuoc An Doanh

Basic Econometrics (Royal Melbourne Institute of Technology University Vietnam)

Studocu is not sponsored or endorsed by any college or university

Downloaded by than loc (tloc02032010@gmail.com)

lOMoARcPSD|24382262

Assignment 2: Empirical Project Individual

Report (40%)

ASSIGNMENT COVER PAGE

Course code ECON1313

Course name Basic Econometrics

Assignment 2 - Empirical Project Individual Report

Lecturer Bob Baulch

Student Fuoc An Doanh

sID S3879951

Word count 2713

Part 1. Overview and Data Collection 2

Downloaded by than loc (tloc02032010@gmail.com)

lOMoARcPSD|24382262

1. Overview of topic 2

2. Data Importation and Descriptive Statistics 3

a) Missing values 3

b) Natural logarithm 3

Part 2. Descriptive Statistics and initial estimation 4

1. Descriptive Statistics 4

2. Model 1 5

3. OLS model of Model 1 5

Part 3. Interpretation 6

1. Interpret Goodness-of-Fit - R² 6

2. F-test for Model 1 7

3. t-test for Model 1 7

4. Discussion 8

5. Testing multicollinearity 8

Part 4. Further Estimation 9

1. High DEPRATIO 9

2. Hypothesis t-test for HDP 10

3. Generate interaction term 10

4. Hypothesis t-test for interaction term 10

5. Model 4 11

6. Choosing the best Model 11

Part 5. Conclusion 11

1. Summarizing the findings 11

2. Policy recommendations 12

3. Limitations and suggestions 12

References 12

Appendices 13

Downloaded by than loc (tloc02032010@gmail.com)

lOMoARcPSD|24382262

Part 1. Overview and Data Collection

1. Overview of topic

Access to healthcare is a prominent issue in many countries, as health is a fundamental factor

affecting the growth of not only humans but the country as a whole. In fact, it is the objective

of countries and one of the prime goals of the Sustainable Development Goals to ameliorate

the health conditions. Thus, it is crucial to identify the factors which determine healthcare

expenditures.

In a study in the previous year, researchers examined the determinants of healthcare expenses

in developing and transitional countries. The results showed that, among the examined

factors, Foreign Direct Investment (FDI), personal remittances (PR), urbanization, life

expectancy (LE), population age 65 and above (POP65) and unemployment are some

noteworthy determinants of healthcare spending in developing and transitional countries. In

particular, FDI and PR have negative relationships with wellbeing expenditure in developing

countries, while PR has a significant positive effect among transitional countries.

Additionally, wellbeing spending in transitional countries is also impacted by unemployment

with positive signs. On the other hand, urbanization has a considerably negative effect on

both developing and transitional countries. Meanwhile, LE and POP65 have positive

associations with wellbeing expenses in income-related classified countries (Awais et al.

2021).

Typically, FDI has a major impact on healthcare expenditure due to its ability to raise

awareness of health related goods and services in low-income countries, thus affecting the

stocks of said goods and services. Meanwhile, PR is found to affect healthcare knowledge of

the populace and reduce poverty. Moreover, trade liberalization has great relation with LE

and child fatality rates. LE is proven to be one of the main determinants of wellbeing

expenditure and child mortality rate, as well as having a major effect on FDI (Akca et al.

2017). Furthermore, urbanization helps people to have more access to healthcare. On the

other hand, some studies suggest that the unemployment rate has a negative effect on

healthcare expenditure (Abbas & Hiemenz 2011) while some say otherwise (Braendles &

Colombier 2016). As for population age, specifically population age 65 and above, it is

observed that the variable has an affirmative association with healthcare expenditure (Awais

et al. 2021).

Downloaded by than loc (tloc02032010@gmail.com)

lOMoARcPSD|24382262

2. Data Importation and Descriptive Statistics

The data provided of countries from 2012 is extracted from the World Bank. The variables

used in determining the healthcare expenditures are displayed in Appendix 1.

a) Missing values

In the dataset given, there are missing values for Niger and South Sudan in 2012. To solve the

issue, the value missing for Niger is replaced by the average of the two nearest years, 2011

and 2013. Regarding South Sudan, since there are many values missing and there are no

nearest values possible, the country is removed from the dataset.

b) Natural logarithm

In the suggested model, natural logarithm of current healthcare expenditure per capita

(PCHE), crude birth rate (per 1000 people) (CBR), gross domestic product per capita (current

US$) (GDPPC), and net official development assistance received (current US$) (NETODA)

will be used. The main reasons are that natural logarithm is useful for multiple linear

regression models in the sense that it helps the data be more skewed and normally distributed.

In addition, in the process of deriving the descriptive statistics of the variables, outliers are

found; natural logarithm plays a role in minimizing the impact of the outliers to the dataset.

Another benefit of natural logarithm is that it eradicates heteroscedasticity, which causes OLS

ceases to be the minimum variance estimator, as well as nullify F-test and t-test. Thus, it is in

best interest to take the natural logarithm of the variables.

Part 2. Descriptive Statistics and initial estimation

1. Descriptive Statistics

The descriptive statistics of the variables are demonstrated as below.

PCHE CBR URBAN DEPRATIO GDPPC NETODA

Mean 192.63 29.00 48.12 31.85 3845.64 708.84

Standard Error 29.47 1.71 3.16 3.23 680.15 191.32

Median 120.01 28.08 51.41 32.02 2590.14 420.24

Standard 176.81 10.23 18.94 19.41 4080.89 1147.93

Deviation

Downloaded by than loc (tloc02032010@gmail.com)

lOMoARcPSD|24382262

Sample 31260.77 104.68 358.88 376.73 16653665.36 1317733.16

Variance

Minimum 19.81 11.17 11.19 1.86 252.36 -181.95

Maximum 604.21 48.93 88.19 63.35 21711.15 6666.32

IQR -247.46 -16.53 -28.01 -35.34 -5034.45 -690.40

CoV(%) 0.92 0.35 0.39 0.61 1.06 1.62

Table 1. Descriptive Statistics of the variables (Note: for the convenience of display, NETODA has

been divided by 1 million compared to original data)

- PCHE: In general, the values of the variable are fairly spreaded; the sample variance

is observed to be relatively high, but the CoV of the variable is below 1, thus, the data

is rather low-variance.

- CBR: It can be seen that both the SD and CoV is considerably low, which indicates

that the values concentrated around the mean, hence, the dataset is stable.

- URBAN: As observed in Table 1, with the SD value of 3.16 and CoV of 0.39, the

dataset of URBAN is remarkably concentrated, which indicates that the dataset of this

variable is consistent.

- DEPRATIO: Regarding DEPRATIO, the descriptive statistics suggest that the dataset

is rather centralized; the CoV is less than 1, which means that the data is nonvolatile.

- GDPPC: In the dataset of this variable, it is clearly seen that there are signs of

volatility. In particular, SV is remarkably high, along with a CoV more than 1. The

dataset is risky to use.

- NETODA: Similar to GDPPC, data points in this dataset are fairly distant from the

mean; the minimum and maximum value have immense difference, causing the data

to be dispersed.

2. Model 1

The population multiple linear regression Model 1 is as demonstrated as below:

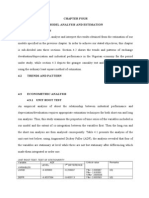

3. OLS model of Model 1

In order for Model 1 to be estimated by the Ordinary Least Square (OLS) model, at least 4

out 6 assumptions of OLS need to be satisfied.

MLR.1: The relationship between dependent and independent variables is linear. This

assumption is satisfied.

Downloaded by than loc (tloc02032010@gmail.com)

lOMoARcPSD|24382262

MLR.2: Random sampling is met. The dataset given consists of 36 countries from different

continents and income classes.

MLR.3: this is the assumption that the independent variables in the Model 1 have no perfect

collinearity relationship. This assumption is applied for Model 1.

MLR.4: In this assumption, zero conditional mean, implying that there should be no

information regarding the explanatory variables contained in the mean of error. The residual

means is figured out to be nearly zero, thus, MLR.4 is satisfied.

MLR.5: Homoscedasticity. This assumption is tested using the Breusch-Pagan test. The

result given provided that the p-value (0.666) is larger than 0.05. Hence, we reject the

hypothesis that there is the presence of heteroscedasticity in the data, and MLR.5 is met.

Since 4 out of 6 OLS assumptions are satisfied as mentioned above, OLS can be applied to

Model 1 as below.

Coefficient Standard Error t value P-value

Intercept 9.491e-01 2.242e+00 0.423 0.675074

log(CBR) -5.379e-01 5.539e-01 -0.971 0.339248

URBAN 3.709e-03 7.835e-03 0.473 0.639391

DEPRATIO 4.989e-03 1.217e-02 0.410 0.684826

log(GDPPC) 6.739e-01 1.569e-01 4.295 0.000169

NETODA 4.818e-05 7.707e-05 0.625 0.536621

Table 2. Regression of Model 1 using the OLS method

Part 3. Interpretation

1. Interpret Goodness-of-Fit - R²

Using the results given, Model 1 is written as below in standard regression format:

The adjusted R-squared is 0.81, which means that approximately 81% of the variations in

Downloaded by than loc (tloc02032010@gmail.com)

lOMoARcPSD|24382262

log(PCHE) is demonstrated by the variations of log(CBR), URBAN, DEPRATIO,

log(GDPPC), and NETODA. The remaining 19% is explained by further factors unmentioned

in this paper.

Because adding more variables to the Model can increase the R-squared value, despite

whether the variable has any relationship with the Model, the adjusted R-squared penalizes

the addition of new variables. If the gap between multiple and adjusted R-squared is great,

then it indicates overfitting. The multiple R-squared of Model 1 is 0.839, so the difference

between multiple and adjusted R-squared is approximately 0.029; this implies that the

variables are mostly significant to the Model.

2. F-test for Model 1

In order for the F-test to be done, at least 4 OLS assumptions need to be held. As discussed in

part 2, the condition is fulfilled.

The hypotheses of F-test state:

Null hypothesis: , all regression coefficients are equal to 0 (The variables are not at all useful

in determining healthcare expenditure).

Alternative: , reject null hypothesis (At least one variable has an impact on healthcare

expenditure).

Using R, we were able to derive that F-statistics is 31.204 and p-value of 5.002e-11. At the

significance level of , we reject the null hypothesis as the p-value is significantly smaller than

the significance level.

Thus, as the result of the F-test, at least one variable in the data has an impact on healthcare

expenditure.

3. t-test for Model 1

T-test is applicable as OLS assumptions are met as demonstrated in part 2. Hypotheses of t-

test state:

Null hypothesis: , The explanatory variables have no effect on healthcare expenditure.

Alternative: , reject null hypothesis (At least one variable is the determinants of healthcare

expenditure).

Downloaded by than loc (tloc02032010@gmail.com)

lOMoARcPSD|24382262

With , we derive the results as below:

Variables p-value >,<,= α Reject null hypothesis?

log(CBR) 0.3392 > No

URBAN 0.6394 > No

DEPRATIO 0.6848 > No

log(GDPPC) 0.000 < Yes

NETODA 0.5366 > No

Table 3. T-test for variables

Thus, according to Table 3, log(CBR), URBAN, DEPRATIO, and NETODA are not

statistically significant. log(GDPPC) is the only statistically significant variable.

Interpretation:

Coefficient of log(GDPPC) = 0.673904599 indicates that if GDP per capita increases by 1%,

healthcare expenditure will increase by 0.674%, holding other factors constant.

4. Discussion

From the analysis above and the research article in part 1, the findings are somewhat

expected. The relationship between urbanization and healthcare expenditure is found to be

negatively correlated in developing and transitional countries. On the other hand, in the

author’s findings, the relationships between GDP with developing and transitional countries

are negative, with the coefficients of -0.09 and -0.02 (Awais et al. 2021). However, since the

coefficients are not significantly low, the negative relationships are weak.

5. Testing multicollinearity

Using the variance inflation factor (VIF) method, multicollinearity is tested between the

variables.

VIF

log(CBR) 7.351083

URBAN 3.446012

DEPRATIO 8.733128

Downloaded by than loc (tloc02032010@gmail.com)

lOMoARcPSD|24382262

log(GDPPC) 4.548462

NETODA 1.224260

Table 4. Variance inflation factor of variables

It can be seen in Table 4, the VIF of log(CBR) and DEPRATIO are relatively high. However,

the values are below 10, so the correlation result is acceptable and no potential

multicollinearity is detected in the Model.

Part 4. Further Estimation

1. High DEPRATIO

The median of DEPRATIO is estimated at 32.0195. The new dummy variable, High

DEPRATIO (HDP) is generated and receives 1 with the condition of if DEPRATIO is higher

than its mean and 0 if otherwise. The new Model 2 is created by replacing the DEPRATIO

variable with the HDP variable. The population multiple linear regression of Model 2 is

demonstrated below.

Coefficients Standard Error t value P-value

Intercept 4.383e-01 1.795e+00 0.244 0.809

lCBR -4.090e-01 3.781e-01 -1.082 0.288

URBAN 3.448e-03 7.503e-03 0.460 0.649

HDP 3.224e-01 2.705e-01 1.192 0.243

lGDPPC 6.864e-01 1.433e-01 4.790 4.21e-05

NETODA 4.741e-05 7.340e-05 0.646 0.523

Table 5. Regression of Model 2 using the OLS method

With the above information, we can derive the sample multiple linear regression of Model 2

as below.

Downloaded by than loc (tloc02032010@gmail.com)

lOMoARcPSD|24382262

2. Hypothesis t-test for HDP

Null hypothesis: healthcare expenditure is not impacted by HDP.

Alternative: HDP has an influence on healthcare expenditure.

The p-value HDP is higher than the level of significance (0.243 > 0.05). As a result, the

alternative hypothesis is rejected, meaning that HDP does not affect the healthcare

expenditure per capita.

3. Generate interaction term

An interaction term between two variables, log(GDPPC) and HDP, is generated to evaluate

the impact of these two variables on healthcare expenditure. Adding the interaction term into

Model 2, we have the new Model 3:

Coefficients Standard Error t value P-value

Intercept 4.473e-01 1.847e+00 0.242 0.810

lCBR -4.138e-01 4.125e-01 -1.003 0.324

URBAN 3.456e-03 7.635e-03 0.453 0.654

HDP 3.768e-01 1.709e+00 0.220 0.827

lGDPPC 6.875e-01 1.499e-01 4.585 8.02e-05

NETODA 4.739e-05 7.465e-05 0.635 0.531

GDPPC×HDP -7.072e-03 2.194e-01 -0.032 0.975

Table 6. Regression of Model 3 using OLS method

Using the given data above, the sample multiple linear regression of Model 3 is as below.

4. Hypothesis t-test for interaction term

Null hypothesis: the interaction term does not affect healthcare expenditure.

Alternative: healthcare expenditure is influenced by the interaction term.

At a significance level of 0.05, the p-value of the interaction term is 0.975. Thus, the

Downloaded by than loc (tloc02032010@gmail.com)

lOMoARcPSD|24382262

alternative hypothesis is rejected, which indicates that the effect of GDPPC is not influenced

by HDP.

5. Model 4

Throughout re-working the Model, we found out that the data of NETODA is extremely

volatile due to a huge outlier. To eliminate the problem as well as secure homoscedasticity,

Model 4 could use the natural logarithm of NETODA (log(NETODA)). The estimating

equation for Model 4 would be:

However, the major problem of the dataset was the appearance of negative numbers (there are

two). Because of that, natural logarithm cannot be applied to NETODA. Hence, Model 4 is

not the best of choice.

6. Choosing the best Model

After considering the 4 models above, Model 1 is the final preferable choice. In Model 2 and

3, the p-values given of the two added variables, HDP and GDPPC×HDP, are higher than the

significance level α=0.05 (even if changing the significance level to 0.1, the p-values are still

larger), indicating that these two variables are statistically insignificant. As for Model 4, the

attempt of using natural logarithm for NETODA has failed, causing the Model to best be

avoided. The assumptions and interpretations of coefficients in Model 1 have been done

before in this paper.

Part 5. Conclusion

1. Summarizing the findings

To sum up my findings, among the variables, GDP per capita and NETODA were two

considerably volatile datasets to begin with. GDP per capita is the only factor found to have a

significant impact on healthcare expenditure in this research, despite the research paper used

for reference said otherwise. Meanwhile, some other factors, including later added ones, do

not play any role in defining healthcare expenditure. There is no potential multicollinearity in

Model 1. The best Model out of 4 models suggested is Model 1.

10

Downloaded by than loc (tloc02032010@gmail.com)

lOMoARcPSD|24382262

2. Policy recommendations

Based on my analysis, the policy recommendation for the governments of my assigned group

of countries would be to focus on factors which induce economic growth. As the economy is

more stable, this will attract FDI to invest in healthcare related systems. Another note is that

GDP per capita remarkably affects healthcare expenditure, which can explain in the way that

as income increases, people are more willing to access healthcare, which might be expensive

in some places.

3. Limitations and suggestions

One limitation of this report is that one of the countries in the dataset, South Sudan, is

eliminated because of insufficient data, causing the dataset to shrink. Another limitation is

that although the NETODA can be used best if natural logarithm can be applied, but the

appearance of negative values has prevented NETODA from being taken in the most suitable

functional forms. To improve the estimations in my models, considering variables is

suggested.

References

Abbas F and Hiemenz U (2011) 'Determinants of Public Health expenditures in Pakistan',

ZEF-Discussion Papers on Development Policy No. 158, 1 November 2011, accessed 6

December 2022, <https://papers.ssrn.com/sol3/papers.cfm?abstract_id=1967070>.

Akca N, Sönmez S and Yılmaz A (2017) 'Determinants of health expenditure in OECD

countries: A decision tree model', Pak J Med Sci, 2017, 33(6) : 1490-1494, doi:

https://doi.org/10.12669/pjms.336.13300, accessed 9 December 2022,

<https://pjms.com.pk/index.php/pjms/article/view/13300>.

Awais M, Khan A and Ahmad SM (2021) 'Determinants of health expenditure from global

perspective: A panel data analysis', Liberal Arts &Social Sciences International Journal, 29

June 2021, 5(1) : 481-496, doi: https://doi.org/10.47264/idea.lassij/5.1.31, accessed 9

December 2022, <https://ideapublishers.org/index.php/lassij/article/view/306/177>.

Braendle T and Colombier C (2016) 'What drives public health care expenditure growth?

Evidence from Swiss cantons, 1970–2012', Health Policy, September 2016, 120(9) : 1051-

1060, doi: https://doi.org/10.1016/j.healthpol.2016.07.009, accessed 10 December 2022,

11

Downloaded by than loc (tloc02032010@gmail.com)

lOMoARcPSD|24382262

<https://www.sciencedirect.com/science/article/abs/pii/S0168851016301816?via%3Dihub>.

Appendices

Dependent/Independent

Variables Unit Abbreviation

Variables

Current health

expenditure per Current US$ PCHE Dependent variable

capita

Birth rate, crude per 1000 people CBR Independent variable

urban population, %

Urbanization of the total Urban Independent variable

population

Share of the

population that is

under 15 years of

age or above 65 DepRatio Independent variable

years of age as a

percentage of the

population

GDP per capita current US$ GDPPC Independent variable

Net official

development current US$ NETODA Independent variable

assistance received

Appendix 1. Variables used in estimating multiple regression of healthcare expenditure

12

Downloaded by than loc (tloc02032010@gmail.com)

You might also like

- AGA Report No. 9 Measurement of Gas by Multipath Ultrasonic Meters 3rd Ed. 2017 PDFDocument74 pagesAGA Report No. 9 Measurement of Gas by Multipath Ultrasonic Meters 3rd Ed. 2017 PDFMiguel Moreno100% (1)

- IPMVP StatisticsUncertainty 2014Document26 pagesIPMVP StatisticsUncertainty 2014Marcelo100% (1)

- Deferred and Supplementary Final Exam ECON339 2022Document8 pagesDeferred and Supplementary Final Exam ECON339 2022Jahanzaib AhmedNo ratings yet

- Controllership Case StudyDocument50 pagesControllership Case StudyMark CentenoNo ratings yet

- Characterization of Geotechnical Variability PDFDocument18 pagesCharacterization of Geotechnical Variability PDFTrần Quang Huy100% (1)

- Selection, Verification and Validation of MethodsDocument47 pagesSelection, Verification and Validation of MethodsaloediyahNo ratings yet

- QF 2 PP 2017Document8 pagesQF 2 PP 2017Revatee HurilNo ratings yet

- Universiti Kuala Lumpur Malaysian Institute of Chemical & Bioengineering TechnologyDocument15 pagesUniversiti Kuala Lumpur Malaysian Institute of Chemical & Bioengineering Technologynn bbNo ratings yet

- Chapter Fou1Document11 pagesChapter Fou1sue patrickNo ratings yet

- Ardl Analysis Chapter Four FinalDocument9 pagesArdl Analysis Chapter Four Finalsadiqmedical160No ratings yet

- Test Question BSD4643Document6 pagesTest Question BSD4643durantNo ratings yet

- Report Group 7Document33 pagesReport Group 7park jihoonNo ratings yet

- Final Wo FormatDocument42 pagesFinal Wo FormatGehanNo ratings yet

- Rahul Pandey ,: Submitted byDocument23 pagesRahul Pandey ,: Submitted bySAURABH DIXITNo ratings yet

- WalenkampmasterDocument58 pagesWalenkampmasterKamel RamtanNo ratings yet

- Impact of Foreign Direct Investment On Living StandardDocument13 pagesImpact of Foreign Direct Investment On Living StandardNwigwe Promise ChukwuebukaNo ratings yet

- 2005 JEEG Sheehan Et AlDocument15 pages2005 JEEG Sheehan Et AlGUILHERME VILLANOVANo ratings yet

- Econometrics IIDocument4 pagesEconometrics IINia Hania SolihatNo ratings yet

- Econometrics IIDocument4 pagesEconometrics IINia Hania SolihatNo ratings yet

- Solar Radiation Prediction: Dr. Himani BansalDocument43 pagesSolar Radiation Prediction: Dr. Himani BansalHimanshu KesarwaniNo ratings yet

- ##Some Known Facts About Financial DataDocument13 pages##Some Known Facts About Financial DataLooseNo ratings yet

- SLH Chapter FourDocument8 pagesSLH Chapter Foursadiqmedical160No ratings yet

- Janfeb 16 Solution Ecs4863Document14 pagesJanfeb 16 Solution Ecs4863thobejanekellyNo ratings yet

- 2013 - REEN3001 - Catalytic Processes - December2013Document6 pages2013 - REEN3001 - Catalytic Processes - December2013sharon khanNo ratings yet

- Analysis 2005Document107 pagesAnalysis 2005EscríNo ratings yet

- Book Ics Part-I 2019Document70 pagesBook Ics Part-I 2019Rajput Prince50% (2)

- COMT Group09 2 PDFDocument9 pagesCOMT Group09 2 PDFAdil0kNo ratings yet

- An Empirical Study On The Factors Affecting Job Satisfaction.Document73 pagesAn Empirical Study On The Factors Affecting Job Satisfaction.Fariha KabirNo ratings yet

- Designand Implementationof Fast Fourier Transform FFTusing VHDLCodeDocument7 pagesDesignand Implementationof Fast Fourier Transform FFTusing VHDLCodeEstevão De Freitas Ferreira PrinceNo ratings yet

- 19MA217 Random Processes and StatisticsDocument3 pages19MA217 Random Processes and StatisticsMukesh MugiNo ratings yet

- 2nd Year SyllabusDocument43 pages2nd Year SyllabusKarthikeyan RVNo ratings yet

- Artificial Intelligence Techniques and Their Application in Oil and Gas IndustryDocument19 pagesArtificial Intelligence Techniques and Their Application in Oil and Gas Industryhatemfarouk24No ratings yet

- Medical Expenses PredictionDocument51 pagesMedical Expenses PredictionSai GskNo ratings yet

- Chapter Four Model Analysis and Estimation 4.1Document8 pagesChapter Four Model Analysis and Estimation 4.1Oladipupo Mayowa PaulNo ratings yet

- Principles of Business Forecasting 1St Edition Ord Solutions Manual Full Chapter PDFDocument27 pagesPrinciples of Business Forecasting 1St Edition Ord Solutions Manual Full Chapter PDFyuyen1ty6100% (11)

- Eee Semester V SyllabusDocument22 pagesEee Semester V SyllabusRanjitNo ratings yet

- Nguyen-Thi-Thuy-Ngan MA 2020 21 ECD DD UEHDocument55 pagesNguyen-Thi-Thuy-Ngan MA 2020 21 ECD DD UEHNinhDuongNo ratings yet

- Hina, Presentation For Conference, Pollution Haven HypothesisDocument22 pagesHina, Presentation For Conference, Pollution Haven HypothesisArshad AfridiNo ratings yet

- Term Paper On: "Telecommunication Industries Performance & Comparison Among Countries"Document52 pagesTerm Paper On: "Telecommunication Industries Performance & Comparison Among Countries"Rifat AnjanNo ratings yet

- Module of Introduction To StatisticsDocument108 pagesModule of Introduction To Statisticssamiteze2012No ratings yet

- Esaet2023 131 137Document7 pagesEsaet2023 131 137baotramlehuynh2k4No ratings yet

- Applied - Statistics - Theory - CSBA 2010Document3 pagesApplied - Statistics - Theory - CSBA 2010testbabaNo ratings yet

- Covid 19 Research Paper Part 1Document17 pagesCovid 19 Research Paper Part 1xgentusNo ratings yet

- Research Discussion Paper: A Multi-Sector Model of The Australian EconomyDocument73 pagesResearch Discussion Paper: A Multi-Sector Model of The Australian EconomyfpttmmNo ratings yet

- Exp 3Document7 pagesExp 3amin shukriNo ratings yet

- Project On Core MVCDocument8 pagesProject On Core MVCsajolNo ratings yet

- Chapter 7. Software ApplicationDocument43 pagesChapter 7. Software Applicationberhanu seyoumNo ratings yet

- Volume6 PSSE Study Final PDFDocument183 pagesVolume6 PSSE Study Final PDFSuterm Seccion100% (1)

- Asset Manaegement of Power TransformersDocument23 pagesAsset Manaegement of Power TransformersSAURABH DIXITNo ratings yet

- Content: Title Page NoDocument28 pagesContent: Title Page NoNawaz AhmedNo ratings yet

- Power Transformer Efficiency - Survey Results and Assessment of Efficiency ImplementationDocument7 pagesPower Transformer Efficiency - Survey Results and Assessment of Efficiency ImplementationsergeykrustevNo ratings yet

- Aapm 2012Document3 pagesAapm 2012Peter HaseNo ratings yet

- Bcse2370 DCN LabDocument27 pagesBcse2370 DCN LabJATIN KUMAR SHARMA 22SCSE1012203No ratings yet

- RPL Thesis Chapter1Document11 pagesRPL Thesis Chapter1Alex AliNo ratings yet

- Admm Distr Stats PDFDocument125 pagesAdmm Distr Stats PDFIlsen LeónNo ratings yet

- (THESIS) The Analysis of Supply Chain Uncertainties in Thai Medium-Size Textile EnterprisesDocument34 pages(THESIS) The Analysis of Supply Chain Uncertainties in Thai Medium-Size Textile EnterprisesTaemee IssaranukulthamNo ratings yet

- 4.1 Analyse Oil Exprt To GDPDocument19 pages4.1 Analyse Oil Exprt To GDPshahzad ahmedNo ratings yet

- Rabjot Capstone ReportDocument42 pagesRabjot Capstone ReportRabjot Singh SidharNo ratings yet

- Demonstrating The Use of Vector Error Correction Models Using Simulated DataDocument17 pagesDemonstrating The Use of Vector Error Correction Models Using Simulated DataChetan KumarNo ratings yet

- Temporal Disaggregation of Time Series DataDocument8 pagesTemporal Disaggregation of Time Series DataAlexander DeckerNo ratings yet

- Germany22 LuedickeDocument39 pagesGermany22 Luedickethaonhi0018No ratings yet

- Delay AnalysisDocument2 pagesDelay AnalysisInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- CFD Gap Analysis - 08032010Document68 pagesCFD Gap Analysis - 08032010Alexei KotchourkoNo ratings yet

- University of Engineering and Technology Peshawar Jalozai CampusDocument17 pagesUniversity of Engineering and Technology Peshawar Jalozai CampusShafi UllahNo ratings yet

- Theory of Particulate Processes: Analysis and Techniques of Continuous CrystallizationFrom EverandTheory of Particulate Processes: Analysis and Techniques of Continuous CrystallizationNo ratings yet

- Solubility of Formaldehyde and Trioxane in Aqueous Solutions PDFDocument5 pagesSolubility of Formaldehyde and Trioxane in Aqueous Solutions PDFLior AbadiNo ratings yet

- 1999 Anselin Spatial Eonometrics PDFDocument31 pages1999 Anselin Spatial Eonometrics PDFArv1ndNo ratings yet

- Academic Qualifications: Curriculum Vitae DR (MRS) Madhulika DubeDocument18 pagesAcademic Qualifications: Curriculum Vitae DR (MRS) Madhulika DubeGopal Krishna TiwariNo ratings yet

- Analysis of The Economic Factors Affecting Household Consumption Expenditures in AzerbaijanDocument8 pagesAnalysis of The Economic Factors Affecting Household Consumption Expenditures in AzerbaijanFidan ZeynalovaNo ratings yet

- SASprimerDocument125 pagesSASprimerLibyaFlowerNo ratings yet

- MGMT 222 Ch. IVDocument30 pagesMGMT 222 Ch. IVzedingel50% (2)

- Introduction To Correlationand Regression Analysis BY Farzad Javidanrad PDFDocument52 pagesIntroduction To Correlationand Regression Analysis BY Farzad Javidanrad PDFgulafshanNo ratings yet

- Ciss 21Document21 pagesCiss 21paquiccNo ratings yet

- Germany22 LuedickeDocument39 pagesGermany22 Luedickethaonhi0018No ratings yet

- Social Pressure and Voter Turnout PDFDocument16 pagesSocial Pressure and Voter Turnout PDFAndreea DobritaNo ratings yet

- Quiz1 Answer FINC Stats SASIN EmbaDocument2 pagesQuiz1 Answer FINC Stats SASIN EmbaPeak ChindapolNo ratings yet

- Rao Et Al. 2012 Corporate Governance and Environmental Reporting An Australian StudyDocument21 pagesRao Et Al. 2012 Corporate Governance and Environmental Reporting An Australian StudyHientnNo ratings yet

- Eco No Metrics 1Document299 pagesEco No Metrics 1Benard OderoNo ratings yet

- Econometrics I Lecture NotesDocument74 pagesEconometrics I Lecture NotesMahamad Foos AhmadNo ratings yet

- Academic Achievement Among Upper Primary School Students in Relation To Their Mental Pressure After Kedarnath DisasterDocument9 pagesAcademic Achievement Among Upper Primary School Students in Relation To Their Mental Pressure After Kedarnath DisasterAnonymous CwJeBCAXpNo ratings yet

- Urtec 3723045 MsDocument12 pagesUrtec 3723045 MsCavidan IbrahimliNo ratings yet

- Fit Indices Accepted Value Absolute Fit MeasuresDocument4 pagesFit Indices Accepted Value Absolute Fit MeasureshermancxNo ratings yet

- CCI Revenue FunctionDocument21 pagesCCI Revenue FunctionanifNo ratings yet

- CH 15Document31 pagesCH 15Adam KhaleelNo ratings yet

- Formulation of A Relation For Pullout Load of Inlclined Square Anchor Plates For Unreinforced and Reinforced Soft Clay Under Static LoadingDocument44 pagesFormulation of A Relation For Pullout Load of Inlclined Square Anchor Plates For Unreinforced and Reinforced Soft Clay Under Static LoadingLazar is LiveNo ratings yet

- Pengaruh Lingkungan Kerja Dan Stres Kerja Terhadap Work Life Balance Di PT - Pos Indonesia (Persero) BandungDocument7 pagesPengaruh Lingkungan Kerja Dan Stres Kerja Terhadap Work Life Balance Di PT - Pos Indonesia (Persero) Bandungdevana anishaNo ratings yet

- 5.3. Statistical Analysis of Results of Biological Assays and TestsDocument29 pages5.3. Statistical Analysis of Results of Biological Assays and TestslauramariaalvarezmoronNo ratings yet

- Cost Estimation of Structures in Commercial Buildings by Surinder Singh PDFDocument196 pagesCost Estimation of Structures in Commercial Buildings by Surinder Singh PDFkiikale WaayeNo ratings yet

- 3.2.6 PracticeDocument8 pages3.2.6 PracticeLucy ZhangNo ratings yet

- EE2201 Measurement and Instrumentation Lecture NotesDocument73 pagesEE2201 Measurement and Instrumentation Lecture NotesDeepa Dhilip100% (1)