Professional Documents

Culture Documents

Audit Risk

Audit Risk

Uploaded by

Roisu De KuriOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Audit Risk

Audit Risk

Uploaded by

Roisu De KuriCopyright:

Available Formats

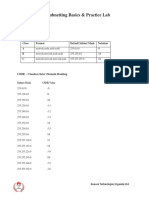

4.1 Define audit risk.

Audit risk is the probability that an audit team will express an inappropriate audit

opinion when the financial statements are materially misstated (i.e., provide an

unmodified opinion on financial statements that are misleading due to material

misstatements that the auditors failed to discover). Such a risk always exists, even

when audits are well-planned and carefully performed. Naturally, the risk is

significantly higher in poorly planned and carelessly executed audits. The auditing

profession does not have an official standard for an acceptable level of overall audit

risk, except that it should be "appropriately" low.

4.2 What are the components of the risk of material misstatement (RMM)? What are the

components of audit risk model?

Audit Risk = (Inherent Risk x Control Risk) x Detection Risk

RMM = Inherent Risk x Control Risk

4.3 How is audit risk model used to plan the audit?

The audit risk model, outlined in the provided text, is a conceptual framework that

guides auditors in planning and executing audits effectively. Beginning with the

assessment of inherent risk and control risk, the model calculates the overall risk of

material misstatement. By setting a predetermined audit risk tolerance, auditors

determine the acceptable level of error in their opinions. The calculated detection

risk then informs the adjustment of the nature, timing, and extent of audit

procedures, allowing auditors to tailor their approach based on assessed risks. This

dynamic process ensures that the audit is conducted with a clear understanding of

inherent and control risks, managing detection risk within acceptable limits. The

audit risk model, therefore, plays a crucial role in risk assessment, procedure

planning, and overall risk management throughout the audit process.

4.4 What is meant by the terms nature, timing, and extent of further audit procedures?

Nature – refers to the type and characteristics of audit tests, determining the specific

methods used to gather relevant and effective evidence, such as inspection,

observation, or confirmation.

Timing – involves deciding when audit tests are conducted, with auditors choosing

between interim dates or closer to the reporting period end to maximize the

effectiveness of substantive procedures.

Extent – encompasses determining the quantity or scope of audit testing, specifying

the number of items or transactions to be examined and the depth of scrutiny

applied to each, influenced by risk assessments and materiality considerations.

You might also like

- Standard Operating Procedure Pharmaceutical Quality Risk Management ToolsDocument15 pagesStandard Operating Procedure Pharmaceutical Quality Risk Management ToolsPharma Life-cycle Consultancy100% (1)

- Multi-Function Electronic Warfare - Air (MFEW Air)Document5 pagesMulti-Function Electronic Warfare - Air (MFEW Air)Zh YunNo ratings yet

- Chapter 11 A Risk Based Audit Approach - PPT 302925165Document12 pagesChapter 11 A Risk Based Audit Approach - PPT 302925165Clar Aaron Bautista50% (2)

- Chapter 2 ReviewDocument3 pagesChapter 2 ReviewTed Amachree80% (5)

- Audit PlanningDocument22 pagesAudit Planningdomenick sadamaNo ratings yet

- Risk Assessment & Statistical Sampling in AuditDocument21 pagesRisk Assessment & Statistical Sampling in Auditaymen marzoukiNo ratings yet

- AT 4 Audit Risk and MaterialityDocument6 pagesAT 4 Audit Risk and MaterialityLhea ClomaNo ratings yet

- Audit RisksDocument4 pagesAudit RisksAliAwaisNo ratings yet

- Lesson 8 Identifying and Assessing The ROMMDocument5 pagesLesson 8 Identifying and Assessing The ROMMMark TaysonNo ratings yet

- Risk Analysis and Statistical Sampling in Audit - Methodology - Comptroller and Auditor General of IndiaDocument13 pagesRisk Analysis and Statistical Sampling in Audit - Methodology - Comptroller and Auditor General of IndiaIsmailNo ratings yet

- Definition and Meaning of Risk-Based Auditing: Chapter One: Introduction and Over-All ViewDocument13 pagesDefinition and Meaning of Risk-Based Auditing: Chapter One: Introduction and Over-All ViewWally AranasNo ratings yet

- CO4 - AUOPE Handouts - Risk AssessmentDocument6 pagesCO4 - AUOPE Handouts - Risk AssessmentTin CorderoNo ratings yet

- 4 Audit RiskDocument10 pages4 Audit RiskHussain MustunNo ratings yet

- Tema EnglezaDocument7 pagesTema EnglezaLupitu Aura DanielaNo ratings yet

- Questionnaire Tally SheetDocument19 pagesQuestionnaire Tally SheetJester Ten-ten BermejoNo ratings yet

- Manjares - AUDIT RISKDocument2 pagesManjares - AUDIT RISKApril ManjaresNo ratings yet

- Major Phases of AuditDocument8 pagesMajor Phases of AuditCamille SantosNo ratings yet

- Lecture - 10Document2 pagesLecture - 10Md Joinal AbedinNo ratings yet

- Assessing The Risk of Material MisstatementDocument2 pagesAssessing The Risk of Material MisstatementAri PrtmaNo ratings yet

- Chapter 11 To 29Document114 pagesChapter 11 To 29JadeNo ratings yet

- Brain Teaser Questions Chapter 6Document4 pagesBrain Teaser Questions Chapter 6ainmazni officialNo ratings yet

- The Risk of Material Misstatement (RMM) Audit Procedures - Response To Risks & Evaluating The Audit Verification Obtained.Document4 pagesThe Risk of Material Misstatement (RMM) Audit Procedures - Response To Risks & Evaluating The Audit Verification Obtained.Dr.Mohammad Wahid Abdullah KhanNo ratings yet

- Risk-Based Approach To Conducting A Quality AuditDocument55 pagesRisk-Based Approach To Conducting A Quality AuditKyla Marie MojicoNo ratings yet

- Quality Risk Management Plan: ApprovalsDocument8 pagesQuality Risk Management Plan: Approvalsnsk79in@gmail.comNo ratings yet

- Quality Risk Management PlanDocument9 pagesQuality Risk Management Plansakib445No ratings yet

- 15JF Brady PDFDocument8 pages15JF Brady PDFitung23No ratings yet

- Aud339 Audit Planning Part 2Document26 pagesAud339 Audit Planning Part 2Nur IzzahNo ratings yet

- Study and Evaluation of Internal ControlDocument10 pagesStudy and Evaluation of Internal Controlsethdrea officialNo ratings yet

- 1 - Audit PlanningDocument15 pages1 - Audit PlanningWaynie Jane OsingNo ratings yet

- Chapter 11 AnsDocument7 pagesChapter 11 AnsDave Manalo0% (1)

- F8-Risk Based Approach To AuditingDocument2 pagesF8-Risk Based Approach To AuditingMoe AungNo ratings yet

- What Is A Risk-Based Audit Approach?Document4 pagesWhat Is A Risk-Based Audit Approach?migraneNo ratings yet

- 3.1. Bra Procedure With MethodologyDocument4 pages3.1. Bra Procedure With MethodologyaceNo ratings yet

- Risk Based ApproachDocument1 pageRisk Based Approachriefa isMeNo ratings yet

- Risk Assessment: ChallengeDocument8 pagesRisk Assessment: ChallengeApoloTrevinoNo ratings yet

- The Risk Based AuditDocument6 pagesThe Risk Based AuditHana AlmiraNo ratings yet

- QMS-135 Quality Risk Management Techniques SampleDocument14 pagesQMS-135 Quality Risk Management Techniques Samplefaisal abbas100% (1)

- Risk Management PolicyDocument4 pagesRisk Management Policyoleksandr.jobNo ratings yet

- Activity 2 - Audit Planning and Internal Control SENIDODocument3 pagesActivity 2 - Audit Planning and Internal Control SENIDOSarah Jane SeñidoNo ratings yet

- S11: Risk Based Audit ApproachDocument16 pagesS11: Risk Based Audit ApproachGodfrey JathoNo ratings yet

- Quality Risk Management ISO 9001-2015Document9 pagesQuality Risk Management ISO 9001-2015dhir.ankurNo ratings yet

- Task 1 UsmanDocument11 pagesTask 1 Usmansweet sweetNo ratings yet

- Lecture 3-Risk Materiality-Jan 2020Document99 pagesLecture 3-Risk Materiality-Jan 2020Ching XueNo ratings yet

- Overview of Risk Based Audit ProcessDocument17 pagesOverview of Risk Based Audit ProcessAira Nhaira Mecate100% (1)

- S11: Risk Based Audit ApproachDocument16 pagesS11: Risk Based Audit ApproachLuthfie Wahyu WidodoNo ratings yet

- Audit Risk Isa 400Document2 pagesAudit Risk Isa 400dennychiwarahNo ratings yet

- Procurement 3 PDFDocument33 pagesProcurement 3 PDFShabnam ShahNo ratings yet

- The Risk Management ProcessDocument14 pagesThe Risk Management ProcessPeri RosewellNo ratings yet

- Advanced Auditing Chapter FourDocument52 pagesAdvanced Auditing Chapter FourmirogNo ratings yet

- Group 1 Auditing RISK AUDITDocument24 pagesGroup 1 Auditing RISK AUDITFlamive VongNo ratings yet

- Members' Handbook: Statement of Auditing Standards 330 The Auditor'S Procedures in Response To Assessed RisksDocument17 pagesMembers' Handbook: Statement of Auditing Standards 330 The Auditor'S Procedures in Response To Assessed RisksAngeline SahagunNo ratings yet

- School of Business, Economics and Management Bps430: Audit Practice and Performance Review Chapter 4: The Theory of AuditingDocument73 pagesSchool of Business, Economics and Management Bps430: Audit Practice and Performance Review Chapter 4: The Theory of AuditingChibwe ChinyamaNo ratings yet

- The Risk of Material MisstatementDocument4 pagesThe Risk of Material Misstatementlkt11152No ratings yet

- 5 Risk Based AuditDocument93 pages5 Risk Based AuditAnonymous jlLBRMAr3ONo ratings yet

- Management Reserves: Differences Between Risk MGT Planning and Risk RegisterDocument5 pagesManagement Reserves: Differences Between Risk MGT Planning and Risk RegisterPurva RaneNo ratings yet

- Balanced ScorecardDocument14 pagesBalanced ScorecardHenryNo ratings yet

- Qualitative, Semi-Quantitative And, Quantitative Methods For Risk Assessment: Case of The Financial AuditDocument15 pagesQualitative, Semi-Quantitative And, Quantitative Methods For Risk Assessment: Case of The Financial AuditAnonymous tTAMJ4RNo ratings yet

- AUD339 (NOTES CP5) - Audit Planning & Fieldwork 2Document28 pagesAUD339 (NOTES CP5) - Audit Planning & Fieldwork 2pinocchiooNo ratings yet

- Audit PlanningDocument15 pagesAudit PlanningClaudette GarciaNo ratings yet

- Adventurer's Guide to Risk Management: Fictional Tales about Risk ManagementFrom EverandAdventurer's Guide to Risk Management: Fictional Tales about Risk ManagementNo ratings yet

- Audit Engagement Strategy (Driving Audit Value, Vol. III): The Best Practice Strategy Guide for Maximising the Added Value of the Internal Audit EngagementsFrom EverandAudit Engagement Strategy (Driving Audit Value, Vol. III): The Best Practice Strategy Guide for Maximising the Added Value of the Internal Audit EngagementsNo ratings yet

- De Vera - CYBERSECURITY AND OS ActivitiesDocument4 pagesDe Vera - CYBERSECURITY AND OS ActivitiesRoisu De KuriNo ratings yet

- FedexDocument2 pagesFedexRoisu De KuriNo ratings yet

- Unof Cis Chapter1 Test PrelimDocument6 pagesUnof Cis Chapter1 Test PrelimRoisu De KuriNo ratings yet

- De Vera - Cis-Assign4Document1 pageDe Vera - Cis-Assign4Roisu De KuriNo ratings yet

- CIS Assign2Document2 pagesCIS Assign2Roisu De KuriNo ratings yet

- 3RD Year Diagnostic ExamDocument30 pages3RD Year Diagnostic ExamRoisu De KuriNo ratings yet

- De Vera-Exercise1 5-Problem1Document3 pagesDe Vera-Exercise1 5-Problem1Roisu De KuriNo ratings yet

- Grp-3 Case Study 2 Comparative Eco. Devt. Pakistan and BangladeshDocument2 pagesGrp-3 Case Study 2 Comparative Eco. Devt. Pakistan and BangladeshRoisu De KuriNo ratings yet

- Grp-3 Case Study 10 HaitiDocument4 pagesGrp-3 Case Study 10 HaitiRoisu De KuriNo ratings yet

- Grp-3 Case Study 5 Ghan and CIVDocument4 pagesGrp-3 Case Study 5 Ghan and CIVRoisu De KuriNo ratings yet

- Grp-3 Case Study 6 China-IndiaDocument3 pagesGrp-3 Case Study 6 China-IndiaRoisu De KuriNo ratings yet

- Grp-3 Case Study 9 KenyaDocument5 pagesGrp-3 Case Study 9 KenyaRoisu De KuriNo ratings yet

- 6AYE Trouble Shooting Manual - Unlocked (OCR)Document248 pages6AYE Trouble Shooting Manual - Unlocked (OCR)이리재100% (1)

- Facebook & WhatsAppDocument10 pagesFacebook & WhatsAppSaqib UsmanNo ratings yet

- End-Of-life - Notice For 6500 Sup2Document16 pagesEnd-Of-life - Notice For 6500 Sup2Gazawino1No ratings yet

- System Guide PDFDocument1,841 pagesSystem Guide PDFsolomonNo ratings yet

- Placement Management System For Campus RecruitmentDocument6 pagesPlacement Management System For Campus RecruitmentInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Afosi Exp22 Word Ch04 ML1 DesignDocument5 pagesAfosi Exp22 Word Ch04 ML1 Designw215019229No ratings yet

- Chapter 6: Data CommunicationDocument19 pagesChapter 6: Data CommunicationGökhan DemirNo ratings yet

- (FIX) (Guide) Unbrick Hard Bricked LG G3 (VS9 - Verizon LG G3Document17 pages(FIX) (Guide) Unbrick Hard Bricked LG G3 (VS9 - Verizon LG G3robert hallsteinNo ratings yet

- App Module 2,3,4 NotesDocument38 pagesApp Module 2,3,4 NotesNikhil SekharanNo ratings yet

- The Everyday Life of An Algorithm: Daniel NeylandDocument154 pagesThe Everyday Life of An Algorithm: Daniel NeylandJefry 0816No ratings yet

- SubNetting Practice LabDocument3 pagesSubNetting Practice LabOdoch HerbertNo ratings yet

- Stuvia 1099148 csc1015f Summary Notes of Whole Course 1 PDFDocument40 pagesStuvia 1099148 csc1015f Summary Notes of Whole Course 1 PDFRendani TshikovhiNo ratings yet

- UM1720 User Manual: STM32Cube USB Host LibraryDocument43 pagesUM1720 User Manual: STM32Cube USB Host LibraryDali JliziNo ratings yet

- Tutorial Gibbscam PDFDocument20 pagesTutorial Gibbscam PDFpauloNo ratings yet

- CoC2 Isaac 351Document6 pagesCoC2 Isaac 351aaaaaaaaNo ratings yet

- ADR823En112 PDFDocument7 pagesADR823En112 PDFJoseph BoshehNo ratings yet

- Pertemuan 8: Dasar Query Basis Data Dengan SqliteDocument22 pagesPertemuan 8: Dasar Query Basis Data Dengan SqliteIrma Permata SariNo ratings yet

- Int 082 PD 0001Document85 pagesInt 082 PD 0001Jessica RodriguezNo ratings yet

- Revista Astro RoobotDocument51 pagesRevista Astro RoobotjavierNo ratings yet

- Introduction To Research and Title ProposalDocument34 pagesIntroduction To Research and Title ProposalDave Matthew Campillos (Vilgacs)No ratings yet

- On "IOT Smart Bulb": Mini Project ReportDocument7 pagesOn "IOT Smart Bulb": Mini Project ReportRanveer RotwalNo ratings yet

- SE Tools and Practices Lab 2Document7 pagesSE Tools and Practices Lab 2Hiziki TareNo ratings yet

- TDWI CBIP Brochure 2013 WebDocument6 pagesTDWI CBIP Brochure 2013 Webmr_driveNo ratings yet

- Personal Intelligent Assistance: Doniya Antony M.Tech Csis RET19CSCY07Document43 pagesPersonal Intelligent Assistance: Doniya Antony M.Tech Csis RET19CSCY07doniya antonyNo ratings yet

- Palumbo HW1Document8 pagesPalumbo HW1Sophia PalumboNo ratings yet

- DS 2df8236i AelDocument4 pagesDS 2df8236i Aelcctv 911No ratings yet

- Cover Letter PDF DownloadDocument8 pagesCover Letter PDF Downloadf5b2q8e3100% (2)

- Usage of Control Structure: Message Even Number'Document9 pagesUsage of Control Structure: Message Even Number'KARTHIK MNo ratings yet