Professional Documents

Culture Documents

Chapter 6 Econ

Chapter 6 Econ

Uploaded by

reynnnnn01Copyright:

Available Formats

You might also like

- wbs14 01 Rms 20240307Document15 pageswbs14 01 Rms 20240307balgacium.marketerNo ratings yet

- International Economics 9th Edition Appleyard Solutions ManualDocument25 pagesInternational Economics 9th Edition Appleyard Solutions ManualMckenzieSmithymcqxwai100% (54)

- Chapter 6 MNGDocument45 pagesChapter 6 MNGMohamed Hassan Mohamed KulmiyeNo ratings yet

- Bodie8ce FormulaSheet PDFDocument24 pagesBodie8ce FormulaSheet PDFSandini Dharmasena PereraNo ratings yet

- Tony Arnold - Inventory Management CH - 09Document9 pagesTony Arnold - Inventory Management CH - 09durlitNo ratings yet

- Report On Salem Telephone CompanyDocument11 pagesReport On Salem Telephone Companyasheesh100% (1)

- Biomimicry An Economic Game Changer InfographicDocument1 pageBiomimicry An Economic Game Changer Infographicrodolfo barbosa100% (1)

- The Organization of The Firm Transaction Costs Variations On Asset SpecificityDocument11 pagesThe Organization of The Firm Transaction Costs Variations On Asset Specificitychizz popcornnNo ratings yet

- The Organization of The FirmDocument4 pagesThe Organization of The Firmbebanco.maryzarianna.olaveNo ratings yet

- Chapter 6 The Organization of The FirmDocument2 pagesChapter 6 The Organization of The FirmChristlyn Joy BaralNo ratings yet

- Derivative LectureDocument11 pagesDerivative LectureRynette FloresNo ratings yet

- Midterm Reviewer - EconDocument10 pagesMidterm Reviewer - EconNikki RunesNo ratings yet

- Ipm To ReviewDocument4 pagesIpm To ReviewgrapeslibanNo ratings yet

- CFA Investment Foundations - Module 1 (CFA Institute) (Z-Library)Document39 pagesCFA Investment Foundations - Module 1 (CFA Institute) (Z-Library)gmofneweraNo ratings yet

- I. Sales: CPA in Transit Reviewer: Law On SalesDocument32 pagesI. Sales: CPA in Transit Reviewer: Law On SalesJoksmer MajorNo ratings yet

- The Organization of The Firm Specialized InvestmentsDocument3 pagesThe Organization of The Firm Specialized Investmentschizz popcornnNo ratings yet

- Glossary: © Canadian Securities Institute (2015)Document32 pagesGlossary: © Canadian Securities Institute (2015)john tinkaNo ratings yet

- Actividad 4 ElectivaDocument22 pagesActividad 4 ElectivaLaura AmayaNo ratings yet

- Finman ReviewerDocument24 pagesFinman ReviewerXeleen Elizabeth ArcaNo ratings yet

- Equity Securities Market 2 PDFDocument14 pagesEquity Securities Market 2 PDFAlmira LozanoNo ratings yet

- Equity Resumen: Reading 44:: Fixed Income Debt Securitues Common Stock Preferred Stock Currencies Mutual FundsDocument12 pagesEquity Resumen: Reading 44:: Fixed Income Debt Securitues Common Stock Preferred Stock Currencies Mutual FundsBetzabe SoriaNo ratings yet

- Accounting Theories (Summary in Intermediate Accounting)Document9 pagesAccounting Theories (Summary in Intermediate Accounting)Leira Ramos DepanteNo ratings yet

- Common Contract TypesDocument7 pagesCommon Contract Typeszubair-scribdNo ratings yet

- AQR Corporate Arbitrage Overview and Benefits of A Dynamic Multistrategy ApproachDocument12 pagesAQR Corporate Arbitrage Overview and Benefits of A Dynamic Multistrategy ApproachJereynierNo ratings yet

- Chapitre 11 - DerivativesDocument6 pagesChapitre 11 - DerivativesAxelNo ratings yet

- Glossterms PDFDocument87 pagesGlossterms PDFecatalanviNo ratings yet

- Annual General Meetings (Agms)Document15 pagesAnnual General Meetings (Agms)Annabella PetroNo ratings yet

- Engineering Economics (Coaching)Document2 pagesEngineering Economics (Coaching)Dan Mitchelle CanoNo ratings yet

- LAW ON SALES - ReviewerDocument17 pagesLAW ON SALES - Reviewersofiamallari25No ratings yet

- Module 1 Organization of FirmDocument28 pagesModule 1 Organization of FirmTrúc Ly Cáp thịNo ratings yet

- AS13Document23 pagesAS13RyuK OPNo ratings yet

- JFP463E - Chapter 2Document7 pagesJFP463E - Chapter 2mirajosriNo ratings yet

- BESANKO The Vertical Boundaries of The FirmDocument39 pagesBESANKO The Vertical Boundaries of The FirmyanuarwirandonoNo ratings yet

- CISI - Financial Products, Markets & ServicesDocument9 pagesCISI - Financial Products, Markets & ServicesLenin BorladoNo ratings yet

- Derivatives Analysis & Valuation: Study Session 9Document10 pagesDerivatives Analysis & Valuation: Study Session 9Muskan MittalNo ratings yet

- Financial MarketsDocument24 pagesFinancial MarketsAdonis GaoiranNo ratings yet

- TTS - Acquisition Comps PrimerDocument5 pagesTTS - Acquisition Comps PrimerKrystleNo ratings yet

- BFSI ModuleDocument7 pagesBFSI ModulevijayNo ratings yet

- Eac SMDocument16 pagesEac SMAnupam KumarNo ratings yet

- MATERIALDocument8 pagesMATERIALVatsal ParmarNo ratings yet

- Investment On Banking SectorDocument20 pagesInvestment On Banking SectorÀñshùl RàñgáríNo ratings yet

- Lease Purchase LawDocument4 pagesLease Purchase LawViper VenomNo ratings yet

- Stock Market TerminologyDocument2 pagesStock Market TerminologyErnest NievaNo ratings yet

- Ey tl15859 221us 05 30 2023Document16 pagesEy tl15859 221us 05 30 2023g.dhawal22No ratings yet

- Glossaire Finance InvestissementDocument21 pagesGlossaire Finance InvestissementMireille ZeNo ratings yet

- 1st Real Estate Forum Working With Agency AgreementsDocument24 pages1st Real Estate Forum Working With Agency Agreementsskshimla1No ratings yet

- McCann 23Document44 pagesMcCann 23raum123No ratings yet

- Chapter 8Document12 pagesChapter 8Hannah Pauleen G. LabasaNo ratings yet

- Session 6 - InvestmentDocument13 pagesSession 6 - InvestmentUtkarsh BhalodeNo ratings yet

- Glossary SecuritiesDocument9 pagesGlossary Securitiesparseghianmayda8No ratings yet

- Forward and Futures MarketDocument51 pagesForward and Futures MarketHarsh DaniNo ratings yet

- Introduction To Derivatives: Corporate Finance Institute®Document70 pagesIntroduction To Derivatives: Corporate Finance Institute®SwatiNo ratings yet

- Tutorial 10 Islamic Capital MarketsDocument5 pagesTutorial 10 Islamic Capital MarketsSyed HaiqalNo ratings yet

- Firm Org-Vertical Boundaries G3-G4Document32 pagesFirm Org-Vertical Boundaries G3-G4Aquib RahmanNo ratings yet

- Level I - Derivatives and Alternative Investments: Last Revised: 05/05/2021Document77 pagesLevel I - Derivatives and Alternative Investments: Last Revised: 05/05/2021Harsh JainNo ratings yet

- International Introduction To Securities & Investment Ed15-209-250-3Document1 pageInternational Introduction To Securities & Investment Ed15-209-250-3Vijaykumar HegdeNo ratings yet

- Week 15 Risk ManagementDocument22 pagesWeek 15 Risk ManagementRay MundNo ratings yet

- Pipe PDFDocument2 pagesPipe PDFEliasNo ratings yet

- #16 Investment PropertyDocument4 pages#16 Investment PropertyClaudine DuhapaNo ratings yet

- CFA Level 3 Book 5Document11 pagesCFA Level 3 Book 5sasasNo ratings yet

- Specialized Investments - g5Document15 pagesSpecialized Investments - g5KaonashiNo ratings yet

- FAR.111 - INVESTMENT IN EQUITY SECURITIES AND DEBT SECURITIES With AnswerDocument12 pagesFAR.111 - INVESTMENT IN EQUITY SECURITIES AND DEBT SECURITIES With AnswerMae100% (2)

- Clearing and Settlement - DTCC - Following How A Trade Gets ClearedDocument8 pagesClearing and Settlement - DTCC - Following How A Trade Gets ClearedAsha Pagdiwalla100% (1)

- INVESTMENT PROJECTS TO GENERATE POSITIVE RATES OF RETURN in CONDITIONS OF NEAR ZERO or NEGATIVE INTEREST RATESFrom EverandINVESTMENT PROJECTS TO GENERATE POSITIVE RATES OF RETURN in CONDITIONS OF NEAR ZERO or NEGATIVE INTEREST RATESNo ratings yet

- VN Cuts From DollarDocument4 pagesVN Cuts From DollarThanh NguyenNo ratings yet

- SM Cycle 7 Session 4Document76 pagesSM Cycle 7 Session 4OttilieNo ratings yet

- Cae 9.2: Solidaire Infrastructure Company: Cement Fertiliser Power (Rs in Million)Document2 pagesCae 9.2: Solidaire Infrastructure Company: Cement Fertiliser Power (Rs in Million)Mukul KadyanNo ratings yet

- 1 AstudyonportfolioevaluationandinvestmentDocument10 pages1 AstudyonportfolioevaluationandinvestmentVedant JainabadkarNo ratings yet

- Individual Activity SWOT AnalysisDocument3 pagesIndividual Activity SWOT AnalysisNoor Azizah Binti JakariaNo ratings yet

- 11-Term - 2-SyllabusDocument7 pages11-Term - 2-SyllabussaumyayayNo ratings yet

- Business Management: Chapter 9Document2 pagesBusiness Management: Chapter 9Javier BallesterosNo ratings yet

- Social Science Research in IndiaDocument6 pagesSocial Science Research in IndiaHelly ParikhNo ratings yet

- Managerial Economics: Introduction, Nature, Scope & SignificanceDocument13 pagesManagerial Economics: Introduction, Nature, Scope & SignificanceRamya NairNo ratings yet

- What Is The Difference Between Socialism and Communism?Document2 pagesWhat Is The Difference Between Socialism and Communism?Muhammad AhmadNo ratings yet

- Homework 1 CIVL 300Document6 pagesHomework 1 CIVL 300mohamed mohsenNo ratings yet

- IR Notes (Part I & II)Document362 pagesIR Notes (Part I & II)Ameer HamzaNo ratings yet

- Economics of Copyright Collecting SocietiesDocument19 pagesEconomics of Copyright Collecting SocietiesStephanie YoungNo ratings yet

- Chapter 1 211Document13 pagesChapter 1 211Nazirul SafwatNo ratings yet

- Econ2 4A v2 Feb15Document13 pagesEcon2 4A v2 Feb15boston.morganNo ratings yet

- Managerial Economics L4: Dr. Rashmi AhujaDocument38 pagesManagerial Economics L4: Dr. Rashmi AhujaPrakhar SahayNo ratings yet

- East Asian Financial Crisis: Group MembersDocument17 pagesEast Asian Financial Crisis: Group MembersAnika VarkeyNo ratings yet

- 12 Economics-Indian Economy 1950-1990 - AssignmentDocument2 pages12 Economics-Indian Economy 1950-1990 - AssignmentSiddharthNo ratings yet

- MCQDocument3 pagesMCQPeng GuinNo ratings yet

- Customer-Led Strategies: (Group 9) Tejas Gosavi Rishi Raheja Ankita SinghDocument9 pagesCustomer-Led Strategies: (Group 9) Tejas Gosavi Rishi Raheja Ankita SinghTejas GosaviNo ratings yet

- The Dynamic Environment of International TradeDocument9 pagesThe Dynamic Environment of International TradeKhairunnisa HandayaniNo ratings yet

- Market - Structure, Output - Profit MaximisationDocument26 pagesMarket - Structure, Output - Profit MaximisationMayank PriayadarshiNo ratings yet

- Questions On PPC 1.Document3 pagesQuestions On PPC 1.Mahimaa HoodaNo ratings yet

- 6 Money SupplyDocument6 pages6 Money SupplySaroj LamichhaneNo ratings yet

- Trial and ErrorDocument34 pagesTrial and ErrorZerohedge100% (1)

Chapter 6 Econ

Chapter 6 Econ

Uploaded by

reynnnnn01Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Chapter 6 Econ

Chapter 6 Econ

Uploaded by

reynnnnn01Copyright:

Available Formats

CHAPTER 6: Cost of negotiating a price.

THE ORGANIZATION OF THE Investments and expenditures required to facilitate

exchange.

FIRM

Types of “Hidden” Transaction Costs

Specialized investment

an investment in a particular exchange that cannot be

recovered in another trading relationship.

expenditure that must be made to allow two parties to

exchange but has little or no value in any alternative

use.

Relationship-specific exchange

occurs when the parties to a transaction have made

specialized investments.

the two parties are “tied together” because of the

specific investments made to facilitate exchange

between them

Types of Specialized Investments

Site specificity

Determine whether the following transactions involve spot when the buyer and the seller of an input must locate

exchange, a contract, or vertical integration: their plants close to each other to be able to engage in

1. Clone 1 PC is legally obligated to purchase 300 computer exchange

chips each year for the next three Physical-asset specificity

years from AMI. The price paid in the first year is $200 per a situation where the capital equipment needed to

chip, and the price rises during produce an input is designed to meet the needs of a

the second and third years by the same percentage by which the particular buyer and cannot be readily adapted to

wholesale price index rises produce inputs needed by other buyers.

during those years. Dedicated assets

2. Clone 2 PC purchased 300 computer chips from a firm that general investments made by a firm that allows it to

ran an advertisement in the exchange with a particular buyer.

back of a computer magazine. Human capital

3. Clone 3 PC manufactures its own motherboards and In many employment relationships, workers must learn

computer chips for its personal specific skills to work for a particular firm.

computers. If these skills are not useful or transferable to other

ANSWER: employers, they represent a specialized investment.

1. Clone 1 PC is using a contract to purchase its computer Implications of Specialized Investments

chips. Costly bargaining

2. Clone 2 PC used spot exchange to acquire its chips. where transaction costs are low and the desired input is

3. Clone 3 PC uses vertical integration to obtain its chips and of uniform quality and sold by many firms, the price of

motherboards the input is determined by the forces of supply and

Methods of Procuring Inputs demand.

Spot exchange required to obtain the input.

o An informal relationship between a buyer and no “market price” for the input; the two parties in

seller in which neither party is obligated to the relationship-specific exchange bargain with

adhere to specific terms for exchange. each other over a price at which the input will be

o when the buyer and seller of an input meet, bought and sold.

exchange, and then go their separate ways. bargaining process generally is costly, as each side

Contract employs negotiators to obtain a more favorable

o A formal relationship between a buyer and seller price.

that obligates the buyer and seller to exchange at Underinvestment

terms specified in a legal document. required to facilitate exchange, the level of the

o a legal document that creates an extended specialized investment often is lower than the

relationship between a particular buyer and seller optimal level.

of an input. lower than optimal, resulting in higher transaction

Produce inputs internally (vertical integration) costs because the input produced is of inferior

o A situation where a firm produces the inputs quality.

required to Opportunism and the “hold-up problem”

vertical integration When a specialized investment must be made to

o When a firm shuns other suppliers and chooses to acquire an input, the buyer or seller may

produce an input internally attempt to capitalize on the “sunk” nature of the

investment by engaging in opportunism.

Transaction Costs Optimal Input Procurement

Cost associated with acquiring an input that is in excess of How should a manager acquire inputs to minimize

the amount paid to the input supplier. costs?

Types of “obvious” transaction costs o Depends on the extent of the relationship-

Cost of searching for a supplier. specific exchange.

Spot Exchange

A most straightforward way for a firm to obtain inputs for

a production process is to use spot exchange

Characteristics of the spot exchange:

No relationship-specific investment.

The absence of transaction costs, and many buyers

and sellers, imply that the market price is

determined by the intersection of demand and

supply.

Opportunism

Underinvestment in specialized investments

.

Disadvantages:

o Managers must create an internal regulatory

mechanism

Contracts o Bear the cost of setting up production facilities

Characteristics of contracts: o No longer specialized in producing its output

Use when inputs require a substantial specialized

investment

Typically requires substantial up-front expenditures.

Specifies prices of inputs prior to making specialized

investments.

o Reduces likelihood of opportunism.

o Reduces likelihood to skimp on specialized

investment.

Requires decision on optimal contract length.

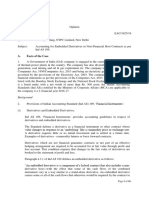

OPTIMAL CONTRACT LENGTH

Vertical Integration

Produce inputs internally

Use when inputs require

SPECIALIZED INVESTMENT AND CONTRACT o a substantial specialized investment.

LENGTH o generate significant transaction cost.

o complex contracting or uncertain economic

environments.

Advantages:

o “Skips the middleman”

o Reduces opportunism

o Mitigates transaction costs

Managerial Compensation and the

Principal-Agent Problem

The primary obstacle is the separation of ownership and

control.

CONTRACTING ENVIRONMENT AND CONTRACT o Principal-agent (P-A) problem: if the owner is

LENGTH

not present to monitor the manager, how can she

get the manager to do what is in her best interest?

o Owners have to incent managers since they are

not present to monitor.

Managers’ Compensation Mechanisms

Manager’s economic trade-off

o Leisure.

o Labor

Fixed salary

o Receives wage independent of labor hours and show up, they will put forth more effort than they would

effort. otherwise since getting caught “goofing off” may lead

No strong incentive to monitor other to dismissal or a reduction in pay.

employees labor hours and effort. Disadvantage of spot checks

Adversely impacts firm performance. occur frequently enough to induce workers not to risk

Incentive contract getting caught shirking

o Tie manager wage to firm performance (like entail some penalty for workers caught shirking.

profits). in effect, through threat.

o Manager makes labor-leisure choice and is Performance bonuses - work through a promise of

accordingly compensated. reward.

Incentive Contracts These characteristics can have different psychological

chief executive officer of a corporation receives stock effects on workers

options and other bonuses directly related to profits.

A way to align owners’ interests with that of the actions

of its manager.

Examples include:

o Stock option

o Other bonuses directly related to profits.

External Incentives

Outside forces can provide manages with the incentive

to maximize profits, and include:

o Reputation

o Takeover threat

The Manager-Worker

Principal-Agent Problem

The owner-manager, principal-agent problem is not

unique.

o A similar problem exists between the firm’s

managers and the employees he or she

supervises.

Solutions to the Manager-Worker Principal-Agent Problem

Manager-worker principal-agent problem solutions:

Profit sharing

Mechanism used to

enhance workers’ efforts

that involves tying

compensation to the

underlying profitability of

the firm.

Revenue sharing

enhance workers’ efforts

that involves linking

compensation to the

underlying revenues of

the firm

effective when worker productivity is related to

revenues rather than costs

TIP AND SALES COMMISSION

Piece rates

pay workers based on a piece rate rather than on a

fixed hourly wage.

effort must be expended in quality control

Time clocks and spot checks

assist managers in monitoring workers

Spot checks

o allow the manager to verify not only that workers

are physically present but also that worker effort

and the quality of the work are satisfactory

Advantage of spot checks

reduce the cost of monitoring workers.

Managers needn’t be in several places at the same time

because workers do not know when the manager will

You might also like

- wbs14 01 Rms 20240307Document15 pageswbs14 01 Rms 20240307balgacium.marketerNo ratings yet

- International Economics 9th Edition Appleyard Solutions ManualDocument25 pagesInternational Economics 9th Edition Appleyard Solutions ManualMckenzieSmithymcqxwai100% (54)

- Chapter 6 MNGDocument45 pagesChapter 6 MNGMohamed Hassan Mohamed KulmiyeNo ratings yet

- Bodie8ce FormulaSheet PDFDocument24 pagesBodie8ce FormulaSheet PDFSandini Dharmasena PereraNo ratings yet

- Tony Arnold - Inventory Management CH - 09Document9 pagesTony Arnold - Inventory Management CH - 09durlitNo ratings yet

- Report On Salem Telephone CompanyDocument11 pagesReport On Salem Telephone Companyasheesh100% (1)

- Biomimicry An Economic Game Changer InfographicDocument1 pageBiomimicry An Economic Game Changer Infographicrodolfo barbosa100% (1)

- The Organization of The Firm Transaction Costs Variations On Asset SpecificityDocument11 pagesThe Organization of The Firm Transaction Costs Variations On Asset Specificitychizz popcornnNo ratings yet

- The Organization of The FirmDocument4 pagesThe Organization of The Firmbebanco.maryzarianna.olaveNo ratings yet

- Chapter 6 The Organization of The FirmDocument2 pagesChapter 6 The Organization of The FirmChristlyn Joy BaralNo ratings yet

- Derivative LectureDocument11 pagesDerivative LectureRynette FloresNo ratings yet

- Midterm Reviewer - EconDocument10 pagesMidterm Reviewer - EconNikki RunesNo ratings yet

- Ipm To ReviewDocument4 pagesIpm To ReviewgrapeslibanNo ratings yet

- CFA Investment Foundations - Module 1 (CFA Institute) (Z-Library)Document39 pagesCFA Investment Foundations - Module 1 (CFA Institute) (Z-Library)gmofneweraNo ratings yet

- I. Sales: CPA in Transit Reviewer: Law On SalesDocument32 pagesI. Sales: CPA in Transit Reviewer: Law On SalesJoksmer MajorNo ratings yet

- The Organization of The Firm Specialized InvestmentsDocument3 pagesThe Organization of The Firm Specialized Investmentschizz popcornnNo ratings yet

- Glossary: © Canadian Securities Institute (2015)Document32 pagesGlossary: © Canadian Securities Institute (2015)john tinkaNo ratings yet

- Actividad 4 ElectivaDocument22 pagesActividad 4 ElectivaLaura AmayaNo ratings yet

- Finman ReviewerDocument24 pagesFinman ReviewerXeleen Elizabeth ArcaNo ratings yet

- Equity Securities Market 2 PDFDocument14 pagesEquity Securities Market 2 PDFAlmira LozanoNo ratings yet

- Equity Resumen: Reading 44:: Fixed Income Debt Securitues Common Stock Preferred Stock Currencies Mutual FundsDocument12 pagesEquity Resumen: Reading 44:: Fixed Income Debt Securitues Common Stock Preferred Stock Currencies Mutual FundsBetzabe SoriaNo ratings yet

- Accounting Theories (Summary in Intermediate Accounting)Document9 pagesAccounting Theories (Summary in Intermediate Accounting)Leira Ramos DepanteNo ratings yet

- Common Contract TypesDocument7 pagesCommon Contract Typeszubair-scribdNo ratings yet

- AQR Corporate Arbitrage Overview and Benefits of A Dynamic Multistrategy ApproachDocument12 pagesAQR Corporate Arbitrage Overview and Benefits of A Dynamic Multistrategy ApproachJereynierNo ratings yet

- Chapitre 11 - DerivativesDocument6 pagesChapitre 11 - DerivativesAxelNo ratings yet

- Glossterms PDFDocument87 pagesGlossterms PDFecatalanviNo ratings yet

- Annual General Meetings (Agms)Document15 pagesAnnual General Meetings (Agms)Annabella PetroNo ratings yet

- Engineering Economics (Coaching)Document2 pagesEngineering Economics (Coaching)Dan Mitchelle CanoNo ratings yet

- LAW ON SALES - ReviewerDocument17 pagesLAW ON SALES - Reviewersofiamallari25No ratings yet

- Module 1 Organization of FirmDocument28 pagesModule 1 Organization of FirmTrúc Ly Cáp thịNo ratings yet

- AS13Document23 pagesAS13RyuK OPNo ratings yet

- JFP463E - Chapter 2Document7 pagesJFP463E - Chapter 2mirajosriNo ratings yet

- BESANKO The Vertical Boundaries of The FirmDocument39 pagesBESANKO The Vertical Boundaries of The FirmyanuarwirandonoNo ratings yet

- CISI - Financial Products, Markets & ServicesDocument9 pagesCISI - Financial Products, Markets & ServicesLenin BorladoNo ratings yet

- Derivatives Analysis & Valuation: Study Session 9Document10 pagesDerivatives Analysis & Valuation: Study Session 9Muskan MittalNo ratings yet

- Financial MarketsDocument24 pagesFinancial MarketsAdonis GaoiranNo ratings yet

- TTS - Acquisition Comps PrimerDocument5 pagesTTS - Acquisition Comps PrimerKrystleNo ratings yet

- BFSI ModuleDocument7 pagesBFSI ModulevijayNo ratings yet

- Eac SMDocument16 pagesEac SMAnupam KumarNo ratings yet

- MATERIALDocument8 pagesMATERIALVatsal ParmarNo ratings yet

- Investment On Banking SectorDocument20 pagesInvestment On Banking SectorÀñshùl RàñgáríNo ratings yet

- Lease Purchase LawDocument4 pagesLease Purchase LawViper VenomNo ratings yet

- Stock Market TerminologyDocument2 pagesStock Market TerminologyErnest NievaNo ratings yet

- Ey tl15859 221us 05 30 2023Document16 pagesEy tl15859 221us 05 30 2023g.dhawal22No ratings yet

- Glossaire Finance InvestissementDocument21 pagesGlossaire Finance InvestissementMireille ZeNo ratings yet

- 1st Real Estate Forum Working With Agency AgreementsDocument24 pages1st Real Estate Forum Working With Agency Agreementsskshimla1No ratings yet

- McCann 23Document44 pagesMcCann 23raum123No ratings yet

- Chapter 8Document12 pagesChapter 8Hannah Pauleen G. LabasaNo ratings yet

- Session 6 - InvestmentDocument13 pagesSession 6 - InvestmentUtkarsh BhalodeNo ratings yet

- Glossary SecuritiesDocument9 pagesGlossary Securitiesparseghianmayda8No ratings yet

- Forward and Futures MarketDocument51 pagesForward and Futures MarketHarsh DaniNo ratings yet

- Introduction To Derivatives: Corporate Finance Institute®Document70 pagesIntroduction To Derivatives: Corporate Finance Institute®SwatiNo ratings yet

- Tutorial 10 Islamic Capital MarketsDocument5 pagesTutorial 10 Islamic Capital MarketsSyed HaiqalNo ratings yet

- Firm Org-Vertical Boundaries G3-G4Document32 pagesFirm Org-Vertical Boundaries G3-G4Aquib RahmanNo ratings yet

- Level I - Derivatives and Alternative Investments: Last Revised: 05/05/2021Document77 pagesLevel I - Derivatives and Alternative Investments: Last Revised: 05/05/2021Harsh JainNo ratings yet

- International Introduction To Securities & Investment Ed15-209-250-3Document1 pageInternational Introduction To Securities & Investment Ed15-209-250-3Vijaykumar HegdeNo ratings yet

- Week 15 Risk ManagementDocument22 pagesWeek 15 Risk ManagementRay MundNo ratings yet

- Pipe PDFDocument2 pagesPipe PDFEliasNo ratings yet

- #16 Investment PropertyDocument4 pages#16 Investment PropertyClaudine DuhapaNo ratings yet

- CFA Level 3 Book 5Document11 pagesCFA Level 3 Book 5sasasNo ratings yet

- Specialized Investments - g5Document15 pagesSpecialized Investments - g5KaonashiNo ratings yet

- FAR.111 - INVESTMENT IN EQUITY SECURITIES AND DEBT SECURITIES With AnswerDocument12 pagesFAR.111 - INVESTMENT IN EQUITY SECURITIES AND DEBT SECURITIES With AnswerMae100% (2)

- Clearing and Settlement - DTCC - Following How A Trade Gets ClearedDocument8 pagesClearing and Settlement - DTCC - Following How A Trade Gets ClearedAsha Pagdiwalla100% (1)

- INVESTMENT PROJECTS TO GENERATE POSITIVE RATES OF RETURN in CONDITIONS OF NEAR ZERO or NEGATIVE INTEREST RATESFrom EverandINVESTMENT PROJECTS TO GENERATE POSITIVE RATES OF RETURN in CONDITIONS OF NEAR ZERO or NEGATIVE INTEREST RATESNo ratings yet

- VN Cuts From DollarDocument4 pagesVN Cuts From DollarThanh NguyenNo ratings yet

- SM Cycle 7 Session 4Document76 pagesSM Cycle 7 Session 4OttilieNo ratings yet

- Cae 9.2: Solidaire Infrastructure Company: Cement Fertiliser Power (Rs in Million)Document2 pagesCae 9.2: Solidaire Infrastructure Company: Cement Fertiliser Power (Rs in Million)Mukul KadyanNo ratings yet

- 1 AstudyonportfolioevaluationandinvestmentDocument10 pages1 AstudyonportfolioevaluationandinvestmentVedant JainabadkarNo ratings yet

- Individual Activity SWOT AnalysisDocument3 pagesIndividual Activity SWOT AnalysisNoor Azizah Binti JakariaNo ratings yet

- 11-Term - 2-SyllabusDocument7 pages11-Term - 2-SyllabussaumyayayNo ratings yet

- Business Management: Chapter 9Document2 pagesBusiness Management: Chapter 9Javier BallesterosNo ratings yet

- Social Science Research in IndiaDocument6 pagesSocial Science Research in IndiaHelly ParikhNo ratings yet

- Managerial Economics: Introduction, Nature, Scope & SignificanceDocument13 pagesManagerial Economics: Introduction, Nature, Scope & SignificanceRamya NairNo ratings yet

- What Is The Difference Between Socialism and Communism?Document2 pagesWhat Is The Difference Between Socialism and Communism?Muhammad AhmadNo ratings yet

- Homework 1 CIVL 300Document6 pagesHomework 1 CIVL 300mohamed mohsenNo ratings yet

- IR Notes (Part I & II)Document362 pagesIR Notes (Part I & II)Ameer HamzaNo ratings yet

- Economics of Copyright Collecting SocietiesDocument19 pagesEconomics of Copyright Collecting SocietiesStephanie YoungNo ratings yet

- Chapter 1 211Document13 pagesChapter 1 211Nazirul SafwatNo ratings yet

- Econ2 4A v2 Feb15Document13 pagesEcon2 4A v2 Feb15boston.morganNo ratings yet

- Managerial Economics L4: Dr. Rashmi AhujaDocument38 pagesManagerial Economics L4: Dr. Rashmi AhujaPrakhar SahayNo ratings yet

- East Asian Financial Crisis: Group MembersDocument17 pagesEast Asian Financial Crisis: Group MembersAnika VarkeyNo ratings yet

- 12 Economics-Indian Economy 1950-1990 - AssignmentDocument2 pages12 Economics-Indian Economy 1950-1990 - AssignmentSiddharthNo ratings yet

- MCQDocument3 pagesMCQPeng GuinNo ratings yet

- Customer-Led Strategies: (Group 9) Tejas Gosavi Rishi Raheja Ankita SinghDocument9 pagesCustomer-Led Strategies: (Group 9) Tejas Gosavi Rishi Raheja Ankita SinghTejas GosaviNo ratings yet

- The Dynamic Environment of International TradeDocument9 pagesThe Dynamic Environment of International TradeKhairunnisa HandayaniNo ratings yet

- Market - Structure, Output - Profit MaximisationDocument26 pagesMarket - Structure, Output - Profit MaximisationMayank PriayadarshiNo ratings yet

- Questions On PPC 1.Document3 pagesQuestions On PPC 1.Mahimaa HoodaNo ratings yet

- 6 Money SupplyDocument6 pages6 Money SupplySaroj LamichhaneNo ratings yet

- Trial and ErrorDocument34 pagesTrial and ErrorZerohedge100% (1)