Professional Documents

Culture Documents

Exam 17 August, Questions and Answers Exam 17 August, Questions and Answers

Exam 17 August, Questions and Answers Exam 17 August, Questions and Answers

Uploaded by

Cường Trần MinhOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Exam 17 August, Questions and Answers Exam 17 August, Questions and Answers

Exam 17 August, Questions and Answers Exam 17 August, Questions and Answers

Uploaded by

Cường Trần MinhCopyright:

Available Formats

lOMoARcPSD|14109898

Exam 17 August, questions and answers

Organisational Planning and Control (Macquarie University)

Studocu is not sponsored or endorsed by any college or university

Downloaded by C??NG TR?N MINH (cuongtran.31211026631@st.ueh.edu.vn)

lOMoARcPSD|14109898

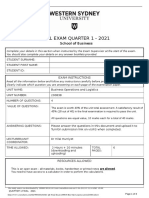

SEAT NUMBER: ……….… ROOM:..……………….

FAMILY NAME:………….....………………………….

This question paper must be returned. OTHER NAMES:……..…….…………………..……..

Candidates are not permitted to remove any

part of it from the examination room. STUDENT NUMBER:…..…….………..……………..

SAMPLE EXAM PAPER ACCG301

Disclaimer

The objective of the sample examination and the revision materials therein is to assist students in their

preparation for the final examination. The sample examination is therefore similar in format to the

final examination. However, questions and topics in the final examination will be different, so students

should also revise all other learning materials, such as, lecture notes and tutorial exercises, and importantly

review the learning outcomes that are stated in the unit guide.

Unit Code: ACCG301

Unit Name: Organisational Planning and Control

Duration of Exam 3 hours plus 10 minutes reading time

(including reading time if applicable):

Total No. of Questions: 8

Total No. of Pages

(including this cover sheet):

GENERAL INSTRUCTIONS TO STUDENTS:

Students are required to follow directions given by the Final Examination Supervisor and must refrain from communicating in any way with another student once they have entered

the final examination venue.

Students may not write or mark the exam materials in any way during reading time.

Students may only access authorised materials during this examination. A list of authorised material is available on this cover sheet.

All watches must be removed and placed at the top of the exam desk and must remain there for the duration of the exam. All alarms, notifications and alerts must be switched off.

Students are not permitted to leave the exam room during the first hour (excluding reading time) and during the last 15 minutes of the examination.

If it is alleged you have breached these rules at any time during the examination, the matter may be reported to a University Discipline Committee for determination.

EXAMINATION INSTRUCTIONS:

All questions are to be answered on this question paper.

AIDS AND MATERIALS PERMITTED/NOT PERMITTED:

Dictionaries: No dictionaries permitted

Calculators: Non-programmable calculators with no text storage/retrieval capacity permitted

Other: Closed book – No notes or textbooks permitted

Value Mark

Question 1 10

Question 2 12

Question 3 14

Question 4 11

Question 5 13

Question 6 18

Question 7 10

Question 8 12

Total 100

Downloaded by C??NG TR?N MINH (cuongtran.31211026631@st.ueh.edu.vn)

lOMoARcPSD|14109898

Question 1 (10 marks)

Allie Haroum is the owner of a small independent café in Sydney. Her café serves the local inner-city,

which has an increasing number of female office workers. She sells high quality European and Middle

Eastern food. A larger food court has just opened across the street from her store. It sells American

and Australian fast food and offers lower prices on its food. It is a no-frills operation and its lower

prices are attracting business away from Allie’s café. Assume you are part of a student team assigned

to do a management accounting class project for Allie. Her question for the team is: “How can I apply

Porter’s generic business strategies to better deal with my strategic planning challenges in this

situation?” How will you reply?

Required:

1 Explain Porter’s three (3) generic (or competitive) business-level strategies to Allie. (4 marks)

2 Advise Allie on how she could apply Porter’s generic business strategies to better deal with

the strategic planning challenges in this situation. (6 marks)

Suggested Solution:

1.

Michael Porter suggests that in order to gain a competitive advantage in their markets, organisations

will pursue one of the following three business-level strategies:

Differentiation:

When using a differentiation strategy, a company focuses effort on providing a unique product

or service to a broad market, setting their offerings apart from competitors. This strategy allows

organisations to charge a premium price to capture market share and earn profits.

Cost Leadership:

When using a cost leadership strategy, a company focuses on gaining competitive advantage

by having the lowest costs and cost structure across their broad industry. There are many ways to

achieve cost leadership such as mass production, mass distribution, economies of scale, technology,

product design, input cost, capacity utilization of resources, and access to raw materials. Profits are

achieved by the high volume of sales rather than by charging premium prices.

Focused Differentiation / Focused Cost Leadership:

When using a focus generic strategy, a firm targets a specific, often narrow segment of the market.

An organization may also choose a combination strategy by mixing one of the generic strategies of

low-cost or differentiation with the focus strategy.

Focused Differentiation: Focus on providing a unique product to a narrow market for which a

premium price may be charged.

Focused Cost Leadership: Focus on having the lowest costs.

Downloaded by C??NG TR?N MINH (cuongtran.31211026631@st.ueh.edu.vn)

lOMoARcPSD|14109898

2.

In this case, the large food court seems better positioned to follow the cost leadership strategy. So,

Allie should consider the other two alternatives in order to compete:

Differentiation strategy:

Involve trying to distinguish Allie’s food (European & Middle Eastern) from those of

the larger food court (Australian & American)

May also involve providing better customer service – which may include a “frills

operation” (as opposed to a no-frills operation)

Employing customer-oriented waitresses

Providing a relaxing atmosphere

Focus differentiation strategy:

Might specifically target female office workers & try to respond to their tastes / needs

rather than the larger business community

Could involve special orders (deliveries), other types of individualised services, more

of a customised approach & designing the store to better suit the needs of female

office workers (the target market)

Downloaded by C??NG TR?N MINH (cuongtran.31211026631@st.ueh.edu.vn)

lOMoARcPSD|14109898

Question 2 (12 marks)

Versatile Electrics manufactures electrical instruments for a variety of purposes. The following costs,

related to maintaining product quality, were incurred in May:

Inspection of electrical components purchased from outside suppliers $24 000

Costs of rework on faulty instruments 38 000

Replacement of instruments already sold that were still covered by warranty 85 000

Costs of defective parts that cannot be salvaged 12 200

Training of quality control inspectors 10 000

Tests of instruments before sales 20 000

Required:

1 Prepare a cost of quality report similar to the report shown in Exhibit 16.11. (6 marks)

2 How do you think management should react to the relative size of the four categories of quality

costs? (4 marks)

3 Do you think that Versatile Electrics has identified all of its external failure costs? Explain.

(2 marks)

Suggested Solution:

1

Versatile Electrics

Cost of Quality Report for the month of May

Current month’s Percentage

cost of total

Internal failure costs:

Costs of rework on faulty instruments $38 000

Costs of defective parts that cannot be salvaged 12 200

50 200 26.5

External failure costs:

Replacement of instruments already sold, which

were still covered by warranty 85 000 44.9

85 000

Prevention costs:

Training of quality control inspectors 10 000 5.3

10 000

Appraisal costs:

Inspection of electrical components purchased from

outside suppliers 24 000

Tests of instruments before sales 20 000

44 000 23.3

Total quality costs $189 200 100.0

Downloaded by C??NG TR?N MINH (cuongtran.31211026631@st.ueh.edu.vn)

lOMoARcPSD|14109898

2 Failure costs are 71.4 per cent of the quality costs, with external failure costs accounting for

44.9 per cent of the quality costs. The cause of the high failure costs is the lack of investment in the

prevention of defects (5.3 per cent). The fact that the customers discover a majority of the failures is

due to the low appraisal activity (23.3 per cent). External failure costs are far more costly than

internal scrap or rework as a poor experience by the customer can lead to the loss of customers and

a widespread perception of poor quality outputs when disappointed customers mention this to

others. Hence an underestimated external failure cost results from not including the impact from

losing future sales due to upsetting customers. The company should spend more on prevention to

reduce the failure costs. Perhaps investment on better equipment or higher quality inputs would

reduce defects. Since there can be a lag between investment in prevention and reaping its benefits,

appraisal could be increased to prevent defects from reaching customers. Ultimately, the increased

prevention costs should help to bring down both the internal and external failure costs and, in the

longer term, reduce the need for appraisal.

3 The external failure costs are likely to be underestimated as they do not include the lost

contribution on the goods that had to be replaced, nor the contribution on future sales that are

likely to be lost due to the company’s poor reputation. They also omit the costs of servicing these

customer complaints.

Downloaded by C??NG TR?N MINH (cuongtran.31211026631@st.ueh.edu.vn)

lOMoARcPSD|14109898

Question 3 (14 marks)

Fabulous Enterprises manufactures modular kitchens and bathrooms and the Managing Director,

Alfred Jones, is concerned that the total number of suppliers has increased from 15 to 40 over the

past three years. He is sure that this is inefficient and has asked you as the new management

accountant to investigate this. You have decided to undertake an activity-based analysis of supplier

costs and supplier performance, and will focus initially on the three suppliers of wall and floor tiles.

After much discussion with managers and an analysis of costs and activities over the past year, you

have isolated supplier-related activities, identified activity drivers, and estimated the cost per unit of

activity driver:

Activity Cost per unit of activity driver

Order material $200 per order

Receive order $1500 per delivery

Inspect order $250 per delivery

Return material to supplier $210 per return

Downtime due to late delivery $260 per hour

Rework due to low quality tiles $50 per hour

Pay supplier $190 per invoice

Dispute invoiced amount $480 per dispute

Over the past year, the four suppliers of tiles consumed the following number of activities:

Activity A B C

Order material 20 50 30

Receive order 20 80 10

Inspect order 5 25 5

Return material to supplier 3 8 0

Downtime due to late delivery 20 60 10

Rework due to low quality tiles 11 10 0

Pay supplier 12 48 12

Dispute invoiced amount 2 0 13

A supplier relationship manager is employed to manage a range of suppliers, at a salary of $90 000.

The proportion of her time that she spends managing tiling suppliers is as follows: 10 per cent on

supplier A; 15 per cent on supplier B; 10 per cent on supplier C.

The cost of material purchased from each supplier over the past year was as follows: A $60 000; B

$120 000; and C $70 000.

Downloaded by C??NG TR?N MINH (cuongtran.31211026631@st.ueh.edu.vn)

lOMoARcPSD|14109898

Required:

1 Calculate the total cost of ownership and the supplier performance index for each supplier.

(8 marks)

2 Discuss the relative performance of the suppliers. (3 marks)

3 Suggest three non-financial performance measures that could be used to assess the performance

of the tile suppliers. (3 marks)

Suggested Solution:

Supplier A Supplier B Supplier C

Activity No. of No. of No. of

Activity rate activities $ activities $ activities $

Unit level

Rework due to low quality tiles $50 11 $550 10 $500 0 $0

Downtime: Late delivery 260 20 5 200 60 15 600 10 2 600

Order level

Order components 200 20 4 000 50 10 000 30 6 000

Receive order 1 500 20 30 000 80 120 000 10 15 000

Inspect order 250 5 1 250 25 6 250 5 1 250

Return material to supplier 210 3 630 8 1 680 0 0

Pay supplier 190 12 2 280 48 9 120 12 2 280

Dispute invoice 480 2 960 0 0 13 6 240

Supplier related

Supplier relationship manager $90 000 10% 9 000 15% 13 500 10% 9 000

Total supplier activity costs 53 870 176 650 42 370

Purchase cost 60 000 120 000 70 000

Total cost of ownership $113 870 $296 650 $112 370

Supplier performance index 0.898 1.472 0.605

Downloaded by C??NG TR?N MINH (cuongtran.31211026631@st.ueh.edu.vn)

lOMoARcPSD|14109898

2 Supplier C is clearly a more cost effective supplier to deal with than the other suppliers, with

an SPI of 0.605. Supplier B is the most expensive supplier, with a large number of orders, deliveries

and payments, and an excessive number of late deliveries that have resulted in downtime. There are

many opportunities here for Fabulous Enterprises to negotiate with Supplier B to set up new processes

to decrease the number of individual orders and to improve the quality of tiles delivered. If this is not

possible, assuming that the tiles supplied by the four suppliers are similar, then Fabulous may choose

to direct future orders to Supplier C.

3 Fabulous Enterprises could use the following criteria and non-financial measures to assess

the performance of the tile suppliers:

Criteria Measures

On-time delivery Percentage of orders delivered on schedule

Hours of downtime due to late delivery

Organisational change Adoption of EDI systems at supplier

Improvement in supplier productivity

Quality Percentage of orders rejected

Hours of downtime due to defective material

Downloaded by C??NG TR?N MINH (cuongtran.31211026631@st.ueh.edu.vn)

lOMoARcPSD|14109898

Question 4 (11 marks)

Alfred Wood operates a factory that manufactures bread and cakes. One of the major raw materials

used is organic maize, which he buys for $5 per kilogram. The factory operates for 350 days each year.

The following information has been provided:

Annual usage of maize 80 000 kilograms

Average time between placing and receiving order 4 days

Estimated cost of ordering and receiving inventory (per order) $8

Estimated annual cost of carrying a kilogram of maize in stock $0.50

Required:

1 Use the above data to calculate: (4 marks)

(a) Economic order quantity (EOQ).

(b) Number of orders per year.

2 Wood has recently heard of just-in-time (JIT) purchasing, and wonders if he should use it in his

business. However, he is very concerned that the cost of placing frequent orders will be too high.

Explain the advantages of JIT purchasing and address specifically his concerns about cost.

(3 marks)

3 After a brief analysis of the cost of storing maize, including the cost of wasted space and

inefficiency, you have discovered that the annual carrying cost can be reduced to $0.20 per

kilogram. Wood has asked you to help him to negotiate a JIT purchasing arrangement with a major

supplier. After some discussion you have discovered that the cost of placing an order for maize

can now be reduced to just $2 per order. Calculate: (4 marks)

(a) New EOQ.

(b) New number of orders per year.

Suggested Solution:

1 (a)

(b)

Downloaded by C??NG TR?N MINH (cuongtran.31211026631@st.ueh.edu.vn)

lOMoARcPSD|14109898

2 The advantages of JIT purchasing system include: lower inventory carrying costs; less risk of

inventory obsolescence, spoilage and theft; and elimination of non-value-added activities.

The main advantage of the JIT system is that inventory is not held in stock, but is ordered from

suppliers so that it arrives just when it is needed for production. This will reduce storage costs.

While the number of orders placed with suppliers under JIT increases, the costs per order can be

reduced through ordering inventory online, requiring suppliers to deliver at a specified level of

quality so that fewer inspections of deliveries take place, and allowing electronic ordering of

inventory and payments with suppliers.

3 (a)

(b)

10

Downloaded by C??NG TR?N MINH (cuongtran.31211026631@st.ueh.edu.vn)

lOMoARcPSD|14109898

Question 5 (13 marks)

Pacific Telecommunications has two divisions and operates out of Auckland, New Zealand. The Express

Division manufactures and transfers a range of computer circuit boards to the Harris Division, which

uses those circuits to produce telecommunication equipment for the Asia–Pacific market. The Express

Division is operating at full capacity. One circuit board that it transfers to the Harris Division—Circuit

A569—has variable costs of $32 per 100 units, and it can be sold in the external market to other

companies in the computer industry for $40 per 100 units.

To produce its final product, the Harris Division incurs additional variable manufacturing and selling

costs of $65 per 100 units and sells the final product to the external market for $120 per 100 units.

The Harris Division has just been contacted by a Malaysian-based company that is offering a product

similar to Circuit A569 at the very competitive price of $28 per 100 units. The manager of the Harris

Division is very keen to take up this offer.

Required:

1 Calculate the transfer price for Circuit A569, using the general transfer pricing rule, assuming that

the Express Division has no spare capacity. (3 marks)

2 Recalculate the transfer price assuming the Express Division has spare capacity and has no other

opportunities for that capacity. Explain the likely transfer price if the company policy for transfer

pricing is variable cost plus 20 per cent. (2 marks)

3 Is it in the best interests of the company as a whole if the manager of the Harris Division purchases

its circuits from the Malaysian company rather than from the Express Division? Assume that the

Express Division has spare capacity. (6 marks)

4 As the manager of the Express Division what arguments might you use to encourage the manager

of the Harris Division to continue to source the product from your division rather than from the

Malaysian company? (2 marks)

Suggested Solution:

The $8 opportunity cost is the contribution margin that will be forgone by the Express Division if

Circuit A569 is transferred instead of sold in the external market. In this case the transfer price is

the same as the market price.

The opportunity cost is zero as the Express Division has no alternative use for its spare capacity.

While the minimum transfer price is $32 per unit, the Express Division would want to make a

profit on the transfer. The company policy of variable cost plus 20 per cent will lead to the

following transfer price:

11

Downloaded by C??NG TR?N MINH (cuongtran.31211026631@st.ueh.edu.vn)

lOMoARcPSD|14109898

As the transfer price is less than the market price of $40, the Harris Division will be motivated to

purchase from the Express Division.

3

If the circuits are purchased from the Malaysian company:

Profit to Express Division will be zero.

Profit to the company as a whole = $27 per 100 units

If the circuits are transferred from the Express Division to the Harris Division:

Profit to company as a whole = $23 per 100 units

If Harris Division was to purchase the circuits from the Malaysian company, rather than from the

Express Division, its profits would increase by $10.40 per 100 units ($27 − 16.60). Overall the

company would be better off by $4 per 100 units ($27 − 23).

4 The issues that you might discuss could include the following.

(a) Will the supply from Malaysia will be of the right quality and be delivered on time?

(b) How long will the price remain at the low level?

(c) Will the Malaysian company be flexible enough to be able to respond quickly to last minute

orders or to changes in order quantity and timings, especially given their distant location.

(d) Will the Malaysian company be able to accommodate changes in product specifications

when they arise?

12

Downloaded by C??NG TR?N MINH (cuongtran.31211026631@st.ueh.edu.vn)

lOMoARcPSD|14109898

Question 6 (18 marks)

Youngblood International has its head office in Brisbane, and operates throughout Australia, New

Zealand and parts of Asia. There are two main divisions: Newspaper Division, which owns leading

tabloid newspapers in several cities, and Brewing Divisions, which operates major breweries in Perth

and Brisbane.

Each division is headed by a managing director who has been given a high level of decision-making

authority. Each managing director effectively runs his or her division as a stand-alone business within

the general policy guidelines provided by the board of directors in the head office. Each managing

director agrees to achieve a series of targets: return on investment (ROI), market share and sales

growth. These targets are developed each year as part of the annual budget-setting process. Intense

lobbying takes place between each managing director and the board of directors to determine the

most suitable targets.

Each managing director receives an annual cash bonus based on achieving the target divisional ROI.

The company defines ROI as operating profit, before interest and taxes, divided by divisional assets

(measured at original cost less accumulated depreciation). If the ROI target is not reached, there are

no bonuses, and the managing director has to provide convincing reasons for the poor performance.

As a consequence of the performance measurement and reward system, the managing directors are

highly motivated to achieve—and exceed—their ROI targets.

Janice Cookson has just been appointed as the new management accountant in the head office,

charged with redesigning the performance measurement system. As her first task, she has obtained

the financial data for the last year and the latest forecast for the current year, for each division, in

thousands of dollars, as follows:

Operating profit Sales revenue Divisional assets

Last Current Last Current Last Current

year year year year year year

Newspaper 440 539 2588 2600 4400 4900

Brewing 950 1100 4750 4500 5000 6471

Leonard Smith, the managing director of the Brewing Division, is concerned that his ROI is likely to

suffer next year, as his main competitor has recently purchased new brewing technology. While his

own brewing equipment is only 10 years old, it is unable to produce the new variety of beers that

customers are demanding, and maintenance and operating costs are increasing.

Smith is considering a proposal to invest $10 million in new equipment. This will probably increase

next year's operating profit for his division by $1 million. Smith has analysed the future cash flows of

this proposal, and the new acquisition will easily satisfy the minimum required rate of return of 10%

for all new investments that is set for the Youngblood Group. Without this acquisition, Smith expects

his divisional profit ROI to be 14% next year.

Required:

1 Calculate the ROI for each division for last year and the current year, as well as the two

components of ROI: profit margin and return on assets. (6 marks)

13

Downloaded by C??NG TR?N MINH (cuongtran.31211026631@st.ueh.edu.vn)

lOMoARcPSD|14109898

2 Explain why Leonard Smith is reluctant to invest in the new brewing equipment. Provide

calculations to back up your answer. (4 marks)

3 Janice Cookson is considering expanding the divisional targets to include a range of non-financial

measures. She is interested in developing a scorecard for each division. For the Newspaper

Division:

(a) Formulate objectives for each of the four perspectives: financial, customer, internal business

process and learning and growth. (4 marks)

(b) Suggest lag and lead indicators for these perspectives. (4 marks)

Suggested Solution:

1 Calculation of ROI (target):

Last year Current year

Newspaper 440 2588 539 2600

´ ´

2588 4400 2600 4900

17% 0.59 = 10.0% 20.7% 0.53 = 11.0%

Brewing 950 4750 1100 4500

´ ´

4750 5000 4500 6471

20% 0.95 = 19.0% 24.4% 0.70 = 17.1%

2 Leonard Smith is the managing director of the Brewing Division, which earned an ROI of 19%

last year and 17.1% for the current year. The new brewing equipment is needed for competitive

reasons. Without the equipment, the division’s ROI may drop to 14 per cent next year. However, if the

new equipment is acquired, it will also decrease the division’s ROI next year. The incremental ROI on

the equipment in year one is 10% (see calculations below). This is why Smith is reluctant to invest in

the new equipment. The effect on next year’s ROI from investing in the new equipment may be lower

than the 14% ROI expected if the equipment is not purchased. Smith should realise that in the longer

term it will be important to invest in the new equipment to prevent any loss of competitive position.

$1 000 000

Incremental ROI in year one: = = 10%

$10 000 000

If the new equipment is purchased and if we assume that profit and other assets are unchanged,

then the ROI for next year could be as low as 12.75 per cent:

$1 100 000 $1 000 000 $2 100 000

Next year ROI: = = = 12.75%

$6 471 000 $10 000 $16 471 000

14

Downloaded by C??NG TR?N MINH (cuongtran.31211026631@st.ueh.edu.vn)

lOMoARcPSD|14109898

3 A variety of answers are possible, and it is important that the scorecards are tailored

specifically to the particular divisions.

Newspaper Division

Objectives Lag indicators Lead indicators

1 Financial

Improve returns to ROI Sales revenue growth

shareholders

Market share

Increase advertising Advertising revenue growth Number of regular

revenue advertisers

2 Customer

Increase customer Sales revenue growth Customer complaints

satisfaction

Market share Delivery on time

Increase circulation Number of new customers Regular newspaper

promotions

3 Internal business

processes

Improve efficiency of Cycle time Number of printing press

production processes breakdowns

Printing press downtime

Regular maintenance of

Delivery times

equipment

Number of delivery

complaints

Wastage of material

Reduce litigation Number of pending cases Number of legal complaints

4 Learning and growth

Improve skills levels of Number of ‘exclusives’ Employee days spent in

journalists training

Improve skills levels of Number of legal complaints New, more highly-skilled

legal department employees engaged

15

Downloaded by C??NG TR?N MINH (cuongtran.31211026631@st.ueh.edu.vn)

lOMoARcPSD|14109898

Question 7 (10 marks)

Stamford Office Supplies is a small retailing business that sells stationery to businesses and consumers

in its local area. It has a Sales Office, a Warehouse and an Accounts Office, and employs around 10

workers.

Sales staff are paid a base wage and do not receive any performance-based bonuses.

Orders for stationery supplies are received from customers by the Sales Office via phone, fax or email

and are printed off throughout the day and filed in a tray on Jenny’s desk. At the end of each day Jenny

collects the printed sales orders, enters them into the computerised sales system, then delivers them

to the Warehouse so they can be filled and delivered to the customers.

Often the Warehouse boys are busy with receiving deliveries or packing shelves when Jenny delivers

the orders, so she helps out by picking the ordered goods off the warehouse shelves and packing them

in boxes ready for them to be delivered to the customers. The Warehousing staff appreciate her help

& in the past, when she has offered to update their system with the orders she’s filled for them, they

share their username and passwords with her to give her access to the inventory records.

Once the orders have been boxed, they sit in the dock until the courier arrives to deliver them to

Stamford’s customers. The dock is an open space so the couriers can back up their van, check the

paperwork stuck to boxes waiting in the dock and grab the delivery without needing to waste time

waiting for the Warehousing staff to sign the consignment notes.

Required:

1. Identify five lapses in control and explain why they would pose a risk for the business.

(5 marks)

2. Suggest an internal control for each risk, and classify each control as preventive or detective.

(5 marks)

Suggested Solution:

1.

a) Sales staff are not motivated to maximise sales since there are no incentive rewards – risk is

that revenues achieved are less than what could be generated;

b) No restriction of access to warehouse and inventory – employees from Accounts and Sales

have access – risk of theft of inventory;

c) Jenny can update both Sales and Inventory computerised systems – no segregation of

duties, may lead to theft of inventory or fraud;

d) Sharing of credentials – risk of fraud or theft of inventory;

e) No security over customer orders in the dock – couriers and any staff member could access

orders – risk of theft of inventory;

16

Downloaded by C??NG TR?N MINH (cuongtran.31211026631@st.ueh.edu.vn)

lOMoARcPSD|14109898

2.

a) Produce a performance-based incentive programme to encourage and monitor

improvement in performance. Preventive (attempting to prevent poor performance),

detective (attempting to identify gaps between expected level of performance and actual

level).

b) Restrict access to Warehouse to authorised staff only – locked doors and swipe lock access.

Preventive (attempting to prevent theft of inventory or fraud).

c) Enforce segregation of duties – sales staff only have access to sales system, warehouse staff

only allowed access to inventory records. Preventive (attempting to prevent theft or fraud).

d) Enforce privacy of credentials – require passwords to be changed every month – preventive

(attempting to prevent unauthorised access to systems and fraud/theft); regular audits on

levels of access – detective (attempting to find instances of unauthorised access and

fraud/theft); provide training for those who continue to share credentials – preventive

(attempting to prevent future instances of credential sharing).

17

Downloaded by C??NG TR?N MINH (cuongtran.31211026631@st.ueh.edu.vn)

lOMoARcPSD|14109898

Question 8 (12 marks)

Assume you are the newly appointed internal auditor for the Foleo Group. The Chief Executive Office

has asked you to assist her in assessing the organisation’s staff motivation levels and incentive

programs currently in place for the Foleo Head Office Marketing Department. As a result of your

investigations into the Department, you have uncovered a number of concerning personnel issues and

reported your findings as follows:

I met last week, with the Marketing Manager, to review the operations of the newly updated

internal controls across Head Office (H.O.). Included in this review were the mechanisms in place

that address and encourage employee performance, i.e. the various employee reward systems. In

addition to discussing the incentive scheme currently in place, we also identified some underlying

issues that I believe, are directly related to the poor levels of staff motivation at H.O., but more

specifically, within the Marketing Department. The Manager noted that in recent years,

absenteeism has been steadily increasing, as has staff turnover in his Department, which is

concerning. The introduction of new internal controls have effectively reduced the opportunities

for the theft (and subsequent sale) of customer data as well as supplier fraud, however, I believe

that these types of dysfunctional behaviours have been directly influenced by poor levels of job

satisfaction and motivation within the Marketing workforce. The Department Manager notes that

he has received a vast number of complaints over the years, from staff regarding their working

space, remuneration and career path opportunities. I read a selection of these emails which

suggest that the Marketing employees are concerned with the lack of opportunities for

advancement and bonuses offered to them in comparison with those offered to other Foleo

departments and business units. Those marketing employees who are directly involved with the

campaigns and promotions are offered bonuses on the basis of the sales that are generated from

their specific campaigns. This scheme has not been well-received by staff, since they feel that the

sales generated from marketing campaigns are not a true measure of the value of the campaigns.

They argue that the sales are dependent on many other factors outside the control of the

Marketing Department and typically, bonuses payments are rarely paid to the Marketing

employees. They feel that this is unfair, since many of the other departments and business units of

the Foleo Group receive regular bonuses. Also apparent from the emails, was the dissatisfaction at

the opportunities offered to Marketing employees for training and advancement, compared to

other areas within the organisation. Consequently, many of the staff believe that they need to look

outside Foleo to further their career, as is evident from the staff turnover statistics for the

Department over the last few years. For example, both the Finance and R&D Departments hold

monthly in-house training workshops to develop & update employee skills, while the Foleo Skills

employees are sent to annual external training courses to enhance their communication & teaching

skills. The staff are also highly critical of their workspace, arguing that they are “creative people

who need a workspace that inspires them”. Evidently, the Marketing employees align themselves

with the R&D Department and Foleo Scapps programmers in terms of the type of work they

undertake & feel that in comparison, their working conditions are far less conducive to creativity.

Many emails cite “Space Time” and “My Time” offered to the Scapps employees and the free-

flowing work environment of the R&D Department as innovations that would also be beneficial to

Marketing. When asked how he managed this level of dissatisfaction amongst his staff, the

Marketing Manager responded by pointing out the “Suggestion Box” in a corner of his office and

handing me a flyer containing information on the next Marketing Department’s Family Picnic.

These initiatives are a good start, however I’m not sure they have been all that effective to date.

18

Downloaded by C??NG TR?N MINH (cuongtran.31211026631@st.ueh.edu.vn)

lOMoARcPSD|14109898

Required:

1. Using Herzberg’s Two-Factor theory, explain the low level of motivation in the Foleo H.O. Marketing

Department. (4 marks)

2. Using Expectancy theory, explain the low level of motivation in the Marketing Department.

(4 marks)

3. Using Equity theory, explain the low level of motivation in the Marketing Department. (4 marks)

Suggested Solution:

1.

It could be argued that Foleo Marketing have not provided their employees with sufficient hygiene

(or maintenance) factors, since the staff believe “their working conditions are far less conducive to

creativity” than others – this has increased employees’ dissatisfaction levels. Furthermore,

Marketing has not provided sufficient motivating factors, such as recognition through bonuses,

potential for advancement and opportunities for training (growth), all of which have negatively

impacted the employees’ satisfaction levels. Since Foleo Marketing have not provided adequate

hygiene and motivation factors, Herzberg suggests that the employees are poorly motivated in the

workplace and unfulfilled with their job.

2.

The Marketing employees do not believe that if they work hard and produce a quality marketing

campaign, that they will be able to achieve the required level of performance of them (i.e. the

required sales target, which is outside of their control), so the E-P expectancy will be broken. There

is no evidence to suggest that Foleo has withheld bonuses in the past once the sales targets have

been met, so employees would believe that bonuses would be paid if the sales target is met, so the

instrumentality or P-O expectancy will be positive. There is sufficient evidence to suggest that the

Marketing staff value the outcome or the bonuses offered, so the valence is positive. Since all 3 of

these links are not positive, i.e. the E-P expectancy is broken, Expectancy theory suggests that

motivation levels have been negatively affected, which supports the assessment that motivation is

low in the Marketing Department.

3.

There is sufficient evidence to suggest that the Marketing employees do not feel equally treated,

since they have not been offered the same opportunities (for achieving bonuses, furthering their

careers or creative workspaces) as staff from other areas of the business. Using Equity theory, this

perceived inequity has unfortunately, resulted in Marketing staff becoming demotivated which has

resulted in poor performance, high staff turnover and absenteeism and some staff attempting to

equalise the situation by committing theft/fraud.

19

Downloaded by C??NG TR?N MINH (cuongtran.31211026631@st.ueh.edu.vn)

You might also like

- C6 Student Assessment Booklet Final 2012Document22 pagesC6 Student Assessment Booklet Final 2012dharul khair0% (2)

- Unemployment Class Action LawsuitDocument36 pagesUnemployment Class Action LawsuitMallory Sofastaii100% (2)

- Econ 101 - Sample ExamDocument14 pagesEcon 101 - Sample ExamjasonwheelinNo ratings yet

- COMM314 - 2021W - Syllabus and Reading ListDocument9 pagesCOMM314 - 2021W - Syllabus and Reading ListchilleralexNo ratings yet

- MKC1200 - Practice Exam PaperDocument3 pagesMKC1200 - Practice Exam PaperAltovistaNo ratings yet

- Bmo 6511 SMDocument17 pagesBmo 6511 SMcj_yohji100% (1)

- Amazon Carding Method by @x0tich4ck3rDocument2 pagesAmazon Carding Method by @x0tich4ck3rBosse Meyer50% (2)

- Micro EconomicsDocument11 pagesMicro Economicsanurag anandNo ratings yet

- Unit Outline MGMT3000 Engineering Management Semester 2 2016 Bentley Campus INT (Published)Document11 pagesUnit Outline MGMT3000 Engineering Management Semester 2 2016 Bentley Campus INT (Published)Sudeepa HerathNo ratings yet

- SAP HR Interview Questions and Answers - SAP Training TutorialsDocument3 pagesSAP HR Interview Questions and Answers - SAP Training TutorialsPradeep KumarNo ratings yet

- QB57 Air Rifle Operator's Manual and Parts DiagramDocument8 pagesQB57 Air Rifle Operator's Manual and Parts DiagramStephen Archer100% (1)

- ECON101.602 Spring 2023 - Syllabus - Aamina AjazDocument5 pagesECON101.602 Spring 2023 - Syllabus - Aamina AjazAdam MahfouzNo ratings yet

- Final Exam - II421 (IM430) - 3 - 4 - 20Document3 pagesFinal Exam - II421 (IM430) - 3 - 4 - 20chelhwar.christineNo ratings yet

- Lecture 0 - Microeconomics Updated 18 June 2023Document32 pagesLecture 0 - Microeconomics Updated 18 June 2023vanshikaNo ratings yet

- VMBE2014 Managerial Economics Unit Guide Sept2019Document12 pagesVMBE2014 Managerial Economics Unit Guide Sept2019Prateek GehlotNo ratings yet

- INE1050 Microeconomics - SyllabusDocument4 pagesINE1050 Microeconomics - SyllabusLinh VũNo ratings yet

- Economics 380 - Intermediate Microeconomics: Instructor TADocument4 pagesEconomics 380 - Intermediate Microeconomics: Instructor TAEdmund ZinNo ratings yet

- 5.industrial EconomicsDocument11 pages5.industrial Economicsram jrpsNo ratings yet

- International College of Business and Technology Btec HND in Business Management Assignment Cover Sheet 2014/2015Document9 pagesInternational College of Business and Technology Btec HND in Business Management Assignment Cover Sheet 2014/2015nileshdilushanNo ratings yet

- ECO101 POE - UEH-ISB - 3 2020 - Unit Guide - DR Anh NguyenDocument11 pagesECO101 POE - UEH-ISB - 3 2020 - Unit Guide - DR Anh NguyenKhanh Ngan PhanNo ratings yet

- INF113 Jul2020Document4 pagesINF113 Jul2020AmmarNo ratings yet

- International Academy of Management and EconomicsDocument6 pagesInternational Academy of Management and EconomicsPed SalvadorNo ratings yet

- Jaipuria Institute of Management PGDM Trimester I Academic Year 2019-21Document14 pagesJaipuria Institute of Management PGDM Trimester I Academic Year 2019-21Utkarsh padiyarNo ratings yet

- UT Dallas Syllabus For Ba3365.021 06u Taught by Seungwon Jeon (sxj019500)Document6 pagesUT Dallas Syllabus For Ba3365.021 06u Taught by Seungwon Jeon (sxj019500)UT Dallas Provost's Technology GroupNo ratings yet

- INE1050 MicroeconomicsDocument5 pagesINE1050 MicroeconomicsYến Nhi LêNo ratings yet

- Global Business Assignment 1Document23 pagesGlobal Business Assignment 1Sang T. LamNo ratings yet

- Course Outline: MKTG2031 Consumer Behaviour Semester 1, 2012Document10 pagesCourse Outline: MKTG2031 Consumer Behaviour Semester 1, 2012Younusul Haque ShiponNo ratings yet

- MKTG 1301 - Intro To MarketingDocument5 pagesMKTG 1301 - Intro To Marketingchamp1909No ratings yet

- MAR201 Consumer Behavior - UEH-ISB - Unit Guide - Thu NguyenDocument15 pagesMAR201 Consumer Behavior - UEH-ISB - Unit Guide - Thu NguyenMyNo ratings yet

- Mecsyll PDFDocument43 pagesMecsyll PDFabhishekmakkalageri0No ratings yet

- POM SyllabusDocument4 pagesPOM SyllabusBasavaraj EswarappaNo ratings yet

- Unit GuideDocument15 pagesUnit GuidedieuauuyenphuongNo ratings yet

- ECO101 POE - UEH-ISB - T1 2022 - Unit Guide T222Document10 pagesECO101 POE - UEH-ISB - T1 2022 - Unit Guide T222nguyenthienthanh1207No ratings yet

- MGT 3329-02 Spring 2020 Syllabus Cravens UpdatedDocument4 pagesMGT 3329-02 Spring 2020 Syllabus Cravens UpdatedSteve CurreyNo ratings yet

- Unit Guide: Mat102 Statistics For Business Trimester 3 2021Document12 pagesUnit Guide: Mat102 Statistics For Business Trimester 3 2021JeremyNo ratings yet

- Economics WorksDocument2 pagesEconomics WorksAishe SarkarNo ratings yet

- MR5 Part A Proposal Group 2 KIDODocument26 pagesMR5 Part A Proposal Group 2 KIDOThu NguyenNo ratings yet

- Ass-1-WPG2102-8220 Econ and Quan AnalysDocument6 pagesAss-1-WPG2102-8220 Econ and Quan AnalysRanvir SinghNo ratings yet

- 4940 - Technology ManagementDocument9 pages4940 - Technology ManagementJasmin GloriaNo ratings yet

- UT Dallas Syllabus For Ba3365.005.07s Taught by Andrei Strijnev (Axs050300)Document5 pagesUT Dallas Syllabus For Ba3365.005.07s Taught by Andrei Strijnev (Axs050300)UT Dallas Provost's Technology GroupNo ratings yet

- W12 OMS311 SyllabusDocument15 pagesW12 OMS311 SyllabusYoung H. ChoNo ratings yet

- ACC131Y - SyllabusDocument4 pagesACC131Y - SyllabusRobert JohnsonNo ratings yet

- Best Green Idea - Green Goblins, ACDCDocument5 pagesBest Green Idea - Green Goblins, ACDCSamaranth LeeNo ratings yet

- Marketing Management by Philip KotlerDocument6 pagesMarketing Management by Philip KotlerSpandana AlapatiNo ratings yet

- CFE - Cfe 1111115 CFE - CfeDocument21 pagesCFE - Cfe 1111115 CFE - CfeVitany Gyn Cabalfin TraifalgarNo ratings yet

- Eco201 Managerial Economics - T3 2022Document14 pagesEco201 Managerial Economics - T3 2022Anh TranNo ratings yet

- MAT102 - Statistics For Business - UEH-ISB - T3 2022 - Unit Guide - DR Chon LeDocument12 pagesMAT102 - Statistics For Business - UEH-ISB - T3 2022 - Unit Guide - DR Chon LeVĩnh Khánh HoàngNo ratings yet

- Managerial Economics MGCR 293-005 (Fall 2016) : Course DescriptionDocument6 pagesManagerial Economics MGCR 293-005 (Fall 2016) : Course DescriptionTimothy SungNo ratings yet

- Tndte M Scheme Ece BookDocument194 pagesTndte M Scheme Ece Booksmagendiran100% (2)

- Sobe - Econ608.syllsp09Document5 pagesSobe - Econ608.syllsp09ammueast9290No ratings yet

- rsm427h1f 20129Document8 pagesrsm427h1f 20129nnoumanNo ratings yet

- Eastern Mediterranean University Department of Industrial Engineering IENG484/MANE484 Quality Engineering Spring 2019-2020 Course OutlineDocument3 pagesEastern Mediterranean University Department of Industrial Engineering IENG484/MANE484 Quality Engineering Spring 2019-2020 Course OutlineIlkin JafarovNo ratings yet

- Aksum University College of Business and Economics Department of Logistics and Supply Chain ManagementDocument9 pagesAksum University College of Business and Economics Department of Logistics and Supply Chain ManagementbezawitwubshetNo ratings yet

- Assignment 3 Structure Conduct Performance Analysis 1Document10 pagesAssignment 3 Structure Conduct Performance Analysis 1Đinh HạnhNo ratings yet

- Group 4 Needs AnalysisDocument23 pagesGroup 4 Needs AnalysisTrúc Nguyễn XuânNo ratings yet

- ECO101 - Principles of Economics - Trimester 2 2021Document12 pagesECO101 - Principles of Economics - Trimester 2 2021Vũ Hồng PhươngNo ratings yet

- Standards Guide 2011 Applied Information Technology Stage 3Document94 pagesStandards Guide 2011 Applied Information Technology Stage 3Brent CohenNo ratings yet

- AssignmentDocument2 pagesAssignmentAli Husnain HashmiNo ratings yet

- INST263 Sec2Document147 pagesINST263 Sec2aricanNo ratings yet

- 2021 Q1 Final Exam 200838 Bus Ops Logistics Posted HHv2Document8 pages2021 Q1 Final Exam 200838 Bus Ops Logistics Posted HHv2barcodeNo ratings yet

- Unit Guide - Principles of EconomicsDocument10 pagesUnit Guide - Principles of EconomicsAn Pham ThuyNo ratings yet

- WTW 382 Study Guide 2024Document27 pagesWTW 382 Study Guide 2024tototapzNo ratings yet

- AQA Psychology A Level – Research Methods: Practice QuestionsFrom EverandAQA Psychology A Level – Research Methods: Practice QuestionsNo ratings yet

- ECON 101 Notes + Study Guide - Gold Version: Introduction to Microeconomics at the University of AlbertaFrom EverandECON 101 Notes + Study Guide - Gold Version: Introduction to Microeconomics at the University of AlbertaNo ratings yet

- OECD Comparison of Technology TransferDocument32 pagesOECD Comparison of Technology Transfercdh1001No ratings yet

- n23n-Cr09-0090299s n23n-Cr09-0090300s State of Connecticut v. Blair DawsonDocument11 pagesn23n-Cr09-0090299s n23n-Cr09-0090300s State of Connecticut v. Blair DawsonWebNHRNo ratings yet

- Valves - Schlumberger FTCDocument25 pagesValves - Schlumberger FTCMarwenNo ratings yet

- The International Journal of Advanced Manufacturing TechnologyDocument8 pagesThe International Journal of Advanced Manufacturing TechnologyonepunchogreNo ratings yet

- Chammas PlasmaDocument64 pagesChammas PlasmaSylvain EkaniNo ratings yet

- Supplies Ledger Card: Appendix 57Document4 pagesSupplies Ledger Card: Appendix 57Eduardo AceroNo ratings yet

- Vhe Economizer For Deodorization and Physical Refining of Fats and OilsDocument2 pagesVhe Economizer For Deodorization and Physical Refining of Fats and Oilsmostafizur rahmanNo ratings yet

- 5.1PUNNF Brochure 2Document10 pages5.1PUNNF Brochure 2Darlington EzeNo ratings yet

- Siemens Power Engineering Guide 7E 54Document1 pageSiemens Power Engineering Guide 7E 54mydearteacherNo ratings yet

- DP Printer 15021 DriversdDocument3,747 pagesDP Printer 15021 DriversdRajesh1146No ratings yet

- Height ProjectDocument9 pagesHeight ProjectAnvi bNo ratings yet

- Casting Its TypesDocument84 pagesCasting Its Typesanmanjunath086No ratings yet

- Addcrete Safety Data Sheet P Bond PVADocument4 pagesAddcrete Safety Data Sheet P Bond PVAjessicaNo ratings yet

- Belgrade To Rome Google FlightsDocument1 pageBelgrade To Rome Google FlightsjasminaNo ratings yet

- Gas Metal Arc Welding (GMAW)Document16 pagesGas Metal Arc Welding (GMAW)Akmal Bin Saipul AnuarNo ratings yet

- Chocho Language - WikipediaDocument2 pagesChocho Language - Wikipediajjlajom0% (1)

- Brochure Crosshole Sonic Logging Test BBDocument1 pageBrochure Crosshole Sonic Logging Test BBDilhara WickramaarachchiNo ratings yet

- CYFIRMA Introduction March2022Document35 pagesCYFIRMA Introduction March2022hin PeterNo ratings yet

- Deposit Slip Template 01Document1 pageDeposit Slip Template 01Green DevilNo ratings yet

- Iaea Safety Guide No. Gs-g-1.4Document50 pagesIaea Safety Guide No. Gs-g-1.4FortunatoNo ratings yet

- Process Specification: Docmaster: Uncontrolled Copy When PrintedDocument6 pagesProcess Specification: Docmaster: Uncontrolled Copy When PrintedCemre BağbozanNo ratings yet

- PSCAD Essential Tutorials - Getting Started and Basic FeaturesDocument5 pagesPSCAD Essential Tutorials - Getting Started and Basic FeaturesGabriel Vinicios Moreira FernandesNo ratings yet

- The Morning Calm Korea Weekly - Dec. 22, 2006Document32 pagesThe Morning Calm Korea Weekly - Dec. 22, 2006Morning Calm Weekly NewspaperNo ratings yet

- The Impact of Inequality To Governance and Politics in The PhilippinesDocument14 pagesThe Impact of Inequality To Governance and Politics in The PhilippinesElson Ballena RelentlessTriathleteNo ratings yet

- R Air Packers C 071360014 EngDocument7 pagesR Air Packers C 071360014 Enganon_462570989No ratings yet

- 0 - Pratiti Palit Corporate Governance AssignmentDocument3 pages0 - Pratiti Palit Corporate Governance Assignmentraj vardhan agarwalNo ratings yet