Professional Documents

Culture Documents

Mfe Finals Reviewer

Mfe Finals Reviewer

Uploaded by

Merry Joy SolizaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Mfe Finals Reviewer

Mfe Finals Reviewer

Uploaded by

Merry Joy SolizaCopyright:

Available Formats

THE GOAL OF FINANCIAL MANAGEMENT CORPORATE GOVERNANCE

For public companies: -Specifies the system of rules, practices, and

procedures by which corporations are

maximize current share value of existing managed and controlled

stock

-Good corporate governance helps the

For companies that doesn’t have stocks company to achieve its goal

traded in the public market:

-Shareholders are owners of stock issued by

maximize shareholder/s (owner of the the company. They can be individuals or

company) wealth institutions

-If a value of a company increases, its shares -Majority shareholder = has more than 50%

are also worth more. of the stocks

THE PROBLEM SHAREHOLDER RIGHTS

-Profit is an accounting term and there are -Right to vote on important corporate

various ways to manipulate it issues

-Manipulation can lead to boosting short- -Right to receive dividends

term profit but will harm long-term growth

BOARD OF DIRECTORS

-No consensus on the appropriate time

horizon for profit maximization -Elected by shareholders to represent the

interests of shareholders and make sure

that the company management acts on

-Besides shareholders, stakeholders also their behalf

include: THE AGENCY PROBLEM

1. Employees 4. Suppliers -An agency relationship exists whenever a

2. Customers 5. Society principal hires an agent to represent his/her

interests

3. Creditors

-Agency Problem: conflict of interest b/w

-Yoshimori (1995) surveyed more than 300 firm’s owners and managers

financial managers in different countries

and found: -Corporations suffer from this problem

US and UK, shareholder interest =

priority

Japan, Germany, and France =

stakeholder interest

AGENCY COSTS WHERE TO GET FINANCIAL INFO

-Agency costs = expenses incurred b the 1. PSE Electronic Disclosure Generation

agency problem Technology (EDGE)

-Direct cost = Expenditures that benefit the 2. Company website

company’s management but cost the

shareholders

-Indirect cost = expenses incurred due to Balance sheet – takes a snapshot of a firm’s

the lost opportunities accounting value at a certain time

AGENCY PROBLEM SOLUTIONS Income statement – shows company

revenues, expenses, and income over an

1. Managerial Compensation entire fiscal year

2. Replace management Statement of cash flows

/ Merger and acquisition – if the company’s -fills the gap b/w the balance sheet and

management is underperforming, the income statement by showing how much

company will become a target for other cash is generated or spent, operating,

companies investing, and financing activities for a

specific period of time

3 BASIC FINANCIAL STATEMENTS

FINANCIERS VS ACCOUNTANTS

1. The balance sheet

-Financiers care more about the cash

2. The income statement inflows and outflows b/c they determine

3. The statement of cash flows the value of a business

FINANCIALS -Accountants pay more attention to

accounting the income

-Public traded companies must report their

financial reports to their shareholders and -Difference: noncash items such as

the general public depreciation and amortization

-Financials are official documents that

summarize the financial performance of a

company

-Used by investors, creditors, researchers,

and anyone interested in the company

CASH FLOW ANALYSIS SOLVENCY/LEVERAGE RATIOS

-Depreciation has an impact on how much Solvency ratio =

taxes a company pays to the govt. and

affects the net income Total A / Total L

-Cash flow is a more accurate way to Debt ratio =

capture the company’s financial health b/c Total Debt / Total A

its numbers are hard to manipulate

Debt-to-equity ratio =

-Cash flows is composed of 3 categories:

operating, investment, and financing Total Debt/ Total Shareholder/s Equity

activities

Interes

FINANCIAL RATIOS

ANG UBAN RATIO SA PPT NALANG

-Short-term LIQUIDITY ratios = measure TANAWA KAY KAPOY NAKO

liquidity of a company

-Long-term SOLVENCY ratios = evaluate the

financial leverage of a company

-Asset TURNOVER ratios = tell us the

efficiency of asset management

-PROFITABILITY ratios

-MARKET VALUE ratios

LIQUIDITY RATIOS

-Ability of firm to pay SHORT-TERM

obligations

Current ratio =

Current assets / Current Liabilities

Quick ratio (Acid test ratio) =

Current A- Inventory-Prepayments/

Current L

You might also like

- Principles of Managerial Finance Brief 8th Edition Zutter Solutions ManualDocument35 pagesPrinciples of Managerial Finance Brief 8th Edition Zutter Solutions Manualreniformcalechexcmp100% (27)

- Accounting 1Document3 pagesAccounting 1Carmina Dongcayan100% (1)

- Corporate Finance: A Beginner's Guide: Investment series, #1From EverandCorporate Finance: A Beginner's Guide: Investment series, #1No ratings yet

- Bus 312Document8 pagesBus 312Goop BoopNo ratings yet

- Fin Reviewer - 1Document7 pagesFin Reviewer - 1anne grace escapeNo ratings yet

- Xfinmar - PrelimsDocument22 pagesXfinmar - PrelimsAndrea CuiNo ratings yet

- Financial Management Notes SummaryDocument6 pagesFinancial Management Notes SummaryAeris StrongNo ratings yet

- FINANCIAL MANAGEMENT MidtermsDocument10 pagesFINANCIAL MANAGEMENT MidtermsErwin Louis CaoNo ratings yet

- Financial Management Prelim ReviewerDocument3 pagesFinancial Management Prelim RevieweryenismeeeNo ratings yet

- Accounting Is The Art of RecordingDocument10 pagesAccounting Is The Art of RecordingChristine ChuaNo ratings yet

- 3.4 Business IbDocument11 pages3.4 Business IbsamaraarrobaNo ratings yet

- Chapter 1. Finance and The FirmDocument40 pagesChapter 1. Finance and The FirmThùy DươngNo ratings yet

- Introduction To Financial ManagementDocument37 pagesIntroduction To Financial ManagementEftakharul Haque BappyNo ratings yet

- Fundamentals of Accounting Notes Types of Businesses and UsesDocument4 pagesFundamentals of Accounting Notes Types of Businesses and UsesSALENE WHYTENo ratings yet

- BF BinderDocument7 pagesBF BinderShane VeiraNo ratings yet

- Buss1030 Notes: 1.1 Factors Affecting The Complexity of A Changing Business EnvironmentDocument56 pagesBuss1030 Notes: 1.1 Factors Affecting The Complexity of A Changing Business EnvironmentTINo ratings yet

- Reviewer FinanceDocument9 pagesReviewer FinanceChristine Marie RamirezNo ratings yet

- Chapter 1 The Role and Environment of Managerial FinanceDocument27 pagesChapter 1 The Role and Environment of Managerial FinanceSteph BorinagaNo ratings yet

- Complete Business Revision NotesDocument100 pagesComplete Business Revision NotesAndrea CasseyNo ratings yet

- Introduction To Financial Statement AnalysisDocument2 pagesIntroduction To Financial Statement AnalysisTričiaStypayhørliksønNo ratings yet

- Chapter One - Introduction To Corporate FinanceDocument8 pagesChapter One - Introduction To Corporate FinanceSH1970No ratings yet

- Questions Mba - MidtermDocument6 pagesQuestions Mba - Midtermاماني محمدNo ratings yet

- Finance Lesson 1Document7 pagesFinance Lesson 1Mark AnthonyNo ratings yet

- Business Finance NotesDocument6 pagesBusiness Finance Notesclaire juarezNo ratings yet

- Topic 1 Overview of Financial ManagementDocument37 pagesTopic 1 Overview of Financial ManagementFenrirNo ratings yet

- FinMan ReviewerDocument10 pagesFinMan ReviewerJahz Aira GamboaNo ratings yet

- UntitledDocument6 pagesUntitledLucinta LunaNo ratings yet

- The Role and Environment of Corporate Finance: Dr. Doaa AymanDocument30 pagesThe Role and Environment of Corporate Finance: Dr. Doaa AymanMohamed HosnyNo ratings yet

- Chapter 1 Bus FinDocument12 pagesChapter 1 Bus FinMickaella DukaNo ratings yet

- Chapter 1 Notes: Created Tags UpdatedDocument6 pagesChapter 1 Notes: Created Tags UpdatedTristan RamosNo ratings yet

- Business-Finance ReviewerDocument7 pagesBusiness-Finance ReviewerRed TigerNo ratings yet

- Financial MGT - 07.05.2014Document3 pagesFinancial MGT - 07.05.2014JERRALYN ALVANo ratings yet

- Summary BASICS OF BUSINESS FINANCINGDocument3 pagesSummary BASICS OF BUSINESS FINANCINGScribdTranslationsNo ratings yet

- FINMAN Notes - April 14, 2021Document10 pagesFINMAN Notes - April 14, 2021Nicole Andrea TuazonNo ratings yet

- Topic 1: Financial Manager (3 Fundamental Questions)Document8 pagesTopic 1: Financial Manager (3 Fundamental Questions)KHAkadsbdhsg100% (1)

- Accounting Midterms ReviwerDocument5 pagesAccounting Midterms ReviwermariaNo ratings yet

- Tổng hợp kiến thứcDocument17 pagesTổng hợp kiến thức9zrwj8rbgdNo ratings yet

- CH1 - Financial ManagementDocument10 pagesCH1 - Financial ManagementJohn LiamNo ratings yet

- Finance CompilationDocument14 pagesFinance CompilationNo NameNo ratings yet

- 1st Prelim Reviewer in FinanceDocument7 pages1st Prelim Reviewer in FinancemarieNo ratings yet

- Assignment of Financial AccountingDocument9 pagesAssignment of Financial Accountingsavi vermaNo ratings yet

- Financial Management ReviewerDocument7 pagesFinancial Management ReviewerCecilia VillarinoNo ratings yet

- Unit 1 - Introduction To Principles of AccountingDocument100 pagesUnit 1 - Introduction To Principles of AccountingNgonga FumbeloNo ratings yet

- Accounting Unit 1 NotesDocument13 pagesAccounting Unit 1 NotesLeon BurresNo ratings yet

- Fin Acc TextbookDocument520 pagesFin Acc TextbookjrjhvbydfnNo ratings yet

- Credit Crunch-Decline in Lending Activity by Financial Institutions Brought On by A SuddenDocument5 pagesCredit Crunch-Decline in Lending Activity by Financial Institutions Brought On by A Suddenseungwan sonNo ratings yet

- Newton Media Supplies LTDDocument2 pagesNewton Media Supplies LTDYashmi BhanderiNo ratings yet

- Topic OneDocument15 pagesTopic OnechelseaNo ratings yet

- Overview of Financial ManagementDocument55 pagesOverview of Financial ManagementCenelyn PajarillaNo ratings yet

- The Definition of FinanceDocument9 pagesThe Definition of FinanceJan Mae EstaresNo ratings yet

- Chapter 1: Forms of Business Ownership 1.1 Sole TraderDocument15 pagesChapter 1: Forms of Business Ownership 1.1 Sole TraderBrandon LuuNo ratings yet

- 9.) Chapter 17 (Financial Management)Document10 pages9.) Chapter 17 (Financial Management)John AustinNo ratings yet

- Fundamentals of AccountingDocument7 pagesFundamentals of AccountingMichelleNo ratings yet

- FINMAR - Introduction To Financial Management and Financial MarketsDocument8 pagesFINMAR - Introduction To Financial Management and Financial MarketsLagcao Claire Ann M.No ratings yet

- Accounting 101Document4 pagesAccounting 101Cheche AmpoanNo ratings yet

- Advanced Financial Management: Chapter 1: Corporate GovernanceDocument30 pagesAdvanced Financial Management: Chapter 1: Corporate Governancearmando.chappell1005No ratings yet

- Fabm MidtermDocument7 pagesFabm MidtermSamantha LiberatoNo ratings yet

- Principles of Managerial Finance Brief 8th Edition Zutter Solutions ManualDocument4 pagesPrinciples of Managerial Finance Brief 8th Edition Zutter Solutions ManualBrianCoxbtqeo100% (13)

- "The Language of Business: How Accounting Tells Your Story" "A Comprehensive Guide to Understanding, Interpreting, and Leveraging Financial Statements for Personal and Professional Success"From Everand"The Language of Business: How Accounting Tells Your Story" "A Comprehensive Guide to Understanding, Interpreting, and Leveraging Financial Statements for Personal and Professional Success"No ratings yet

- (Final) Quiz Statement of Changes in Equity and Cash Flows Word FileDocument3 pages(Final) Quiz Statement of Changes in Equity and Cash Flows Word FileAyanna CameroNo ratings yet

- Unit III-PROBLEMSDocument6 pagesUnit III-PROBLEMSPranav GaikwadNo ratings yet

- TT10 QuestionDocument1 pageTT10 QuestionUyển Nhi TrầnNo ratings yet

- Business Taxation NotesDocument2 pagesBusiness Taxation NotesSelene DimlaNo ratings yet

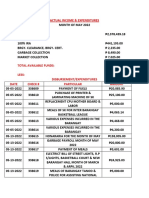

- Actual Income & ExpendituresDocument5 pagesActual Income & Expendituressan nicolas 2nd betis guagua pampangaNo ratings yet

- AQ - 20230226212627 - Aquila SA EN Consolidated Financial Results Preliminary 2022Document6 pagesAQ - 20230226212627 - Aquila SA EN Consolidated Financial Results Preliminary 2022teoxysNo ratings yet

- Re CumberDocument21 pagesRe CumberAshok NagpalNo ratings yet

- Case 11 Tipton Ice CreamDocument10 pagesCase 11 Tipton Ice CreamFD ReynosoNo ratings yet

- Top 35 GST Interview Questions and Answers in 2022 GST Blogs - 62039eb8Document14 pagesTop 35 GST Interview Questions and Answers in 2022 GST Blogs - 62039eb8UmeshNo ratings yet

- Adjusting Entries: Problem 1Document9 pagesAdjusting Entries: Problem 1Wholehearted LayoutsNo ratings yet

- Khushi Pandey Report 1Document35 pagesKhushi Pandey Report 1Rahul KumarNo ratings yet

- FABM 2 M2 Activity 2 My AnsDocument3 pagesFABM 2 M2 Activity 2 My AnsLeny Glyn B. CabreraNo ratings yet

- CAF 5 FAR2 Autumn 2022Document7 pagesCAF 5 FAR2 Autumn 2022Zeeshan AqeelNo ratings yet

- August Salary SlipDocument1 pageAugust Salary SlipVipul TyagiNo ratings yet

- AFM Unit 1Document12 pagesAFM Unit 1anushkabokkasamNo ratings yet

- Diluted EPS Excel Template: Visit: EmailDocument5 pagesDiluted EPS Excel Template: Visit: Emailroneldo asasNo ratings yet

- Time Value of Money (Problems)Document4 pagesTime Value of Money (Problems)Mohammad RashidNo ratings yet

- ACE PP11MSTP1 ExamDocument18 pagesACE PP11MSTP1 Examgrayce limNo ratings yet

- A Guide To International Estate Planning For Cross-Border FamiliesDocument20 pagesA Guide To International Estate Planning For Cross-Border FamiliesYaquifoxNo ratings yet

- Ingles Infografia - EE - FF - Samuel ToctoDocument2 pagesIngles Infografia - EE - FF - Samuel Toctosamuel denilson tocto peñaNo ratings yet

- New York Department of Tax and Finance W-2G Tax FormDocument8 pagesNew York Department of Tax and Finance W-2G Tax FormStingah VelliNo ratings yet

- Chap 2Document10 pagesChap 2Houn Pisey100% (1)

- Module 7 - The Need For Adjusting Journal Entries, Part IDocument12 pagesModule 7 - The Need For Adjusting Journal Entries, Part INina AlexineNo ratings yet

- RRC Part 2 Sample ExamDocument11 pagesRRC Part 2 Sample Examantonytrigger66No ratings yet

- MAF CH 5Document20 pagesMAF CH 5Asegid H/meskelNo ratings yet

- Chap 22Document13 pagesChap 22Hemant GhugeNo ratings yet

- Problem IntxDocument7 pagesProblem IntxSophia KeratinNo ratings yet

- Prelim Assignment 3 - Quiz 1Document1 pagePrelim Assignment 3 - Quiz 1ANGELO JUSTINE CATALANNo ratings yet

- Objectives of AuditDocument11 pagesObjectives of AuditpoojaNo ratings yet

- IB Economics Real-Life ExamplesDocument7 pagesIB Economics Real-Life ExamplesKRISHANG MAHAJANNo ratings yet