Professional Documents

Culture Documents

Feldstein TaxAvoidanceDeadweight 1999

Feldstein TaxAvoidanceDeadweight 1999

Uploaded by

rq2248k6btCopyright:

Available Formats

You might also like

- IPPIS - Oracle E-Business Suite: Federal Government of NigeriaDocument1 pageIPPIS - Oracle E-Business Suite: Federal Government of NigeriaHalleluyah HalleluyahNo ratings yet

- Chapter 4 - AbelDocument11 pagesChapter 4 - AbelShuvro Kumar Paul75% (4)

- This Study Resource Was: CASTILLO, Lauren Financial Management Mam Barquez BSA-3 Problem 1 (Pro Forma Statements)Document5 pagesThis Study Resource Was: CASTILLO, Lauren Financial Management Mam Barquez BSA-3 Problem 1 (Pro Forma Statements)KATHRYN CLAUDETTE RESENTE100% (2)

- Running Head: The Body Shop CaseDocument19 pagesRunning Head: The Body Shop CaseDominique Meagan LeeNo ratings yet

- Direct Deposit Advice This Is Not A CheckDocument1 pageDirect Deposit Advice This Is Not A CheckAlex RoofNo ratings yet

- Financial Ratio Analysis of Cadburys India and Nestle IndiaDocument11 pagesFinancial Ratio Analysis of Cadburys India and Nestle Indiaankitsaxena8870% (10)

- Tax Reform and Target Saving - Andrew A. SamwickDocument15 pagesTax Reform and Target Saving - Andrew A. Samwickmuitoscaracteres.banNo ratings yet

- The University of Chicago PressDocument28 pagesThe University of Chicago Pressmoha dahmaniNo ratings yet

- Principles of Microeconomics-57375Document15 pagesPrinciples of Microeconomics-57375msfaziah.hartanahNo ratings yet

- Tax ProjectDocument4 pagesTax Projecthritik guptaNo ratings yet

- Inflation and ProfitsDocument6 pagesInflation and ProfitsBelinay jNo ratings yet

- Average Marginal Tax Rates From Social Security and The Individual Income TaxDocument13 pagesAverage Marginal Tax Rates From Social Security and The Individual Income TaxDavid C. SantaNo ratings yet

- Tax Expenditures: Tax Expenditures in The Income Tax Tax Expenditure EstimatesDocument52 pagesTax Expenditures: Tax Expenditures in The Income Tax Tax Expenditure EstimatesSushil JindalNo ratings yet

- Tax IncidenceDocument12 pagesTax IncidenceAnimesh Kr SinghNo ratings yet

- A Trillion Little Subsidies: The Economic Impact of Tax Expenditures in The Federal Income Tax CodeDocument36 pagesA Trillion Little Subsidies: The Economic Impact of Tax Expenditures in The Federal Income Tax CodeMercatus Center at George Mason UniversityNo ratings yet

- Measuring The Effects of Corporate Tax Cuts: Alan J. AuerbachDocument24 pagesMeasuring The Effects of Corporate Tax Cuts: Alan J. Auerbachkarol medinaNo ratings yet

- Saez 2010 Do Taxpayers Bunch at Kink PointsDocument53 pagesSaez 2010 Do Taxpayers Bunch at Kink PointsHemi ShahNo ratings yet

- SAEZ ET AL 2012 Elasticity of Taxable Income Review JELDocument71 pagesSAEZ ET AL 2012 Elasticity of Taxable Income Review JELJuan MVNo ratings yet

- Calijomia Institute of Technology, Pasadena, CA 91125, U.S.ADocument18 pagesCalijomia Institute of Technology, Pasadena, CA 91125, U.S.AhenfaNo ratings yet

- Tax Formula and Tax Determination An Overview of Property TransactionsDocument23 pagesTax Formula and Tax Determination An Overview of Property TransactionsJames Riley Case100% (1)

- Brueggemann 2017Document38 pagesBrueggemann 2017hoangpvrNo ratings yet

- JawapanDocument13 pagesJawapanmsfaziah.hartanahNo ratings yet

- Tax IncidenceDocument87 pagesTax IncidenceandydotfengNo ratings yet

- Alternative TaxDocument33 pagesAlternative Taxjulio_cess2102No ratings yet

- A S M O T S: T, M U: Epartment of ConomicsDocument23 pagesA S M O T S: T, M U: Epartment of ConomicsVeronica_1990No ratings yet

- MNC D, T H B R T: R E: Ividends AX Olidays and The Urden of The Epatriation AX Ecent VidenceDocument22 pagesMNC D, T H B R T: R E: Ividends AX Olidays and The Urden of The Epatriation AX Ecent VidenceromanticthiefNo ratings yet

- Two Cheers For Corporate Tax Base Broadening: AbstractDocument14 pagesTwo Cheers For Corporate Tax Base Broadening: AbstractdaniNo ratings yet

- TaxitionDocument55 pagesTaxitionZakirullah ZakiNo ratings yet

- Macroeconomics Solved PyqDocument19 pagesMacroeconomics Solved Pyqfeyebo8058No ratings yet

- Income Taxes: Agnar Sandmo, Norwegian School of Economics, Bergen, NorwayDocument6 pagesIncome Taxes: Agnar Sandmo, Norwegian School of Economics, Bergen, NorwayAris AmirulNo ratings yet

- Tax Avoidance Versus Tax Evasion On Some PDFDocument14 pagesTax Avoidance Versus Tax Evasion On Some PDFkartikeya gulatiNo ratings yet

- PGD Principles of Taxation LECTURE 2Document7 pagesPGD Principles of Taxation LECTURE 2AbdullahiYauUsmanNo ratings yet

- SSRN Id315985Document48 pagesSSRN Id315985kimseongyun123No ratings yet

- TM 3 PDFDocument6 pagesTM 3 PDFJai VermaNo ratings yet

- AGENCY - Crocker, K.J. and Slemrod, J., 2005. Corporate Tax Evasion With Agency Costs.Document18 pagesAGENCY - Crocker, K.J. and Slemrod, J., 2005. Corporate Tax Evasion With Agency Costs.Ferry FernandesNo ratings yet

- Labor Tax Cuts and Employment: A General Equilibrium Approach For FranceDocument37 pagesLabor Tax Cuts and Employment: A General Equilibrium Approach For FranceAngel Roque EspichanNo ratings yet

- Hard To TaxDocument72 pagesHard To TaxoptoergoNo ratings yet

- Day 2 SlidesDocument24 pagesDay 2 SlidesEyob MogesNo ratings yet

- Chapter #17Document42 pagesChapter #17Sumaira AslamNo ratings yet

- Nber Working Paper SeriesDocument49 pagesNber Working Paper SeriesaytareenNo ratings yet

- The Tax Elasticity of Financial Statement Income: Implications For Current Reform ProposalsDocument19 pagesThe Tax Elasticity of Financial Statement Income: Implications For Current Reform ProposalsthienminhNo ratings yet

- Reply To Grubert DH Feb 05Document5 pagesReply To Grubert DH Feb 05Saina ChuhNo ratings yet

- Solution Manual For Byrd and Chens Canadian Tax Principles 2012 2013 Edition Canadian 1st Edition by Byrd and Chen ISBN 0133115097 9780133115093Document36 pagesSolution Manual For Byrd and Chens Canadian Tax Principles 2012 2013 Edition Canadian 1st Edition by Byrd and Chen ISBN 0133115097 9780133115093juliebeasleywjcygdaisn100% (31)

- Effects Income Tax Changes Economic Growth Gale Samwick PDFDocument16 pagesEffects Income Tax Changes Economic Growth Gale Samwick PDFArpit BorkarNo ratings yet

- Accounting Vs Economic DepreciationDocument15 pagesAccounting Vs Economic DepreciationkonyvviragNo ratings yet

- Joseph E. Stiglitz : Princeton UniversityDocument13 pagesJoseph E. Stiglitz : Princeton UniversityKatia ToledoNo ratings yet

- Wiley, Ohio State University Press Journal of Money, Credit and BankingDocument25 pagesWiley, Ohio State University Press Journal of Money, Credit and BankinganorfirdausNo ratings yet

- Tax Avoidance 1Document27 pagesTax Avoidance 1raya hasibuanNo ratings yet

- The Framework For Assessing Tax Incentives: A Cost-Benefit Analysis ApproachDocument36 pagesThe Framework For Assessing Tax Incentives: A Cost-Benefit Analysis ApproachMCINo ratings yet

- Ayoe,+1 +Agung+Endika+Satyadini+ (1-26) +even+smallerDocument26 pagesAyoe,+1 +Agung+Endika+Satyadini+ (1-26) +even+smallerturnitinku 02No ratings yet

- Chapter One SolutionsDocument9 pagesChapter One Solutionsapi-3705855100% (1)

- Tax Policy Tax-Credit and Subtraction Methods of Calculating A Value-Added TaxDocument59 pagesTax Policy Tax-Credit and Subtraction Methods of Calculating A Value-Added TaxTai Lieu On Thi Cong ChucNo ratings yet

- wp2003 10 01Document39 pageswp2003 10 01جمال جفات شاطيNo ratings yet

- Who Bears The Corporate Tax?: A Review of What We KnowDocument52 pagesWho Bears The Corporate Tax?: A Review of What We Knowarmagg1245No ratings yet

- Income Tax Policy: Is A Single Rate Tax Optimum For Long-Term Economic Growth?Document9 pagesIncome Tax Policy: Is A Single Rate Tax Optimum For Long-Term Economic Growth?RebeccaChuaNo ratings yet

- 1464349978ECO P7 M32 E-TextDocument15 pages1464349978ECO P7 M32 E-TextAshin AnishNo ratings yet

- Economics AssignmentDocument10 pagesEconomics Assignmentabdi reta100% (1)

- F3 - Individual Income TaxationDocument43 pagesF3 - Individual Income TaxationmultaneNo ratings yet

- Lecture 2 - Income TaxDocument13 pagesLecture 2 - Income TaxMasitala PhiriNo ratings yet

- American Finance Association, Wiley The Journal of FinanceDocument4 pagesAmerican Finance Association, Wiley The Journal of FinanceLavinia LazărNo ratings yet

- Developing Consistent Tax Bases For Broad-Based Reform: Fiscal Associates, IncDocument10 pagesDeveloping Consistent Tax Bases For Broad-Based Reform: Fiscal Associates, IncThe Washington PostNo ratings yet

- Myth of Ownership - Tax Base - Chapter-5Document42 pagesMyth of Ownership - Tax Base - Chapter-5Edgars EihmanisNo ratings yet

- Progressive Varela Feb 2016 Complete PDFDocument10 pagesProgressive Varela Feb 2016 Complete PDFRenelyn Esteban ClementeNo ratings yet

- T Tax E Expen Nditu Ure: Ann Nex - 2Document3 pagesT Tax E Expen Nditu Ure: Ann Nex - 2BilalNumanNo ratings yet

- ACTBFAR - Exercise Set #1Document7 pagesACTBFAR - Exercise Set #1Cha PampolinaNo ratings yet

- Revisiting Kenneth Brown's "10-Point Test"Document6 pagesRevisiting Kenneth Brown's "10-Point Test"DEDY KURNIAWANNo ratings yet

- 48 Salary ProcessDocument33 pages48 Salary ProcessbapigangNo ratings yet

- MAS 03 CVP AnalysisDocument6 pagesMAS 03 CVP AnalysisJericho G. BariringNo ratings yet

- Review Material - ACCE 411Document5 pagesReview Material - ACCE 411zee abadillaNo ratings yet

- The Financial Statements of Banks and Their Principal CompetitorsDocument6 pagesThe Financial Statements of Banks and Their Principal Competitorsandiswandie2No ratings yet

- MTP 12 17 Questions 1696512917Document11 pagesMTP 12 17 Questions 1696512917harshallahotNo ratings yet

- Financial Statement Analysis: 17-5 The Dividend Yield Is TheDocument51 pagesFinancial Statement Analysis: 17-5 The Dividend Yield Is TheMafi De LeonNo ratings yet

- Why Is Europe More Equal Than The United States? Online AppendixDocument678 pagesWhy Is Europe More Equal Than The United States? Online AppendixBhaskkar SinhaNo ratings yet

- International Transfer PricingDocument60 pagesInternational Transfer Pricingeconomic life - الحياة الاقتصاديةNo ratings yet

- CHAPTER 9 To CHAPTER 15 ANSWERSDocument38 pagesCHAPTER 9 To CHAPTER 15 ANSWERSryanmartintaanNo ratings yet

- Buckwold 25ePPT Ch11Document39 pagesBuckwold 25ePPT Ch11SanjayNo ratings yet

- PT - Cash and Cash Equivalents Period Ended - Audit ObjectivesDocument32 pagesPT - Cash and Cash Equivalents Period Ended - Audit ObjectivesVera Magdalena HutaurukNo ratings yet

- Income From HPDocument17 pagesIncome From HPaKSHAT sHARMANo ratings yet

- FN 200 - Financial Forecasting Seminar QuestionsDocument7 pagesFN 200 - Financial Forecasting Seminar QuestionskelvinizimburaNo ratings yet

- Pay Slip July 2021Document1 pagePay Slip July 2021Chiranjibi BiswalNo ratings yet

- A222 - Individual Assignment #2 - Topic 1-4Document9 pagesA222 - Individual Assignment #2 - Topic 1-4IzadNo ratings yet

- Senior Citizen LawDocument7 pagesSenior Citizen Lawkim cheNo ratings yet

- Week 5 - Sept 26-30 - AcctgDocument13 pagesWeek 5 - Sept 26-30 - Acctgmaria teresa aparreNo ratings yet

- Tax RemediesDocument22 pagesTax RemediesJezreel CastañagaNo ratings yet

- Tutorial 7 - 2024Document4 pagesTutorial 7 - 2024Giang Dương HươngNo ratings yet

- MC1404 - Unit 2Document111 pagesMC1404 - Unit 2Senthil KumarNo ratings yet

- Vitrox q22015Document12 pagesVitrox q22015Dennis AngNo ratings yet

- Draft: The Return Should Reach Mra Electronicallt at Latest On 15 October 2021Document7 pagesDraft: The Return Should Reach Mra Electronicallt at Latest On 15 October 2021DstormNo ratings yet

- Financial Management Economics For Finance 1679035282Document135 pagesFinancial Management Economics For Finance 1679035282Alaka BelkudeNo ratings yet

Feldstein TaxAvoidanceDeadweight 1999

Feldstein TaxAvoidanceDeadweight 1999

Uploaded by

rq2248k6btOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Feldstein TaxAvoidanceDeadweight 1999

Feldstein TaxAvoidanceDeadweight 1999

Uploaded by

rq2248k6btCopyright:

Available Formats

Tax Avoidance and the Deadweight Loss of the Income Tax

Author(s): Martin Feldstein

Source: The Review of Economics and Statistics , Nov., 1999, Vol. 81, No. 4 (Nov., 1999),

pp. 674-680

Published by: The MIT Press

Stable URL: https://www.jstor.org/stable/2646716

JSTOR is a not-for-profit service that helps scholars, researchers, and students discover, use, and build upon a wide

range of content in a trusted digital archive. We use information technology and tools to increase productivity and

facilitate new forms of scholarship. For more information about JSTOR, please contact support@jstor.org.

Your use of the JSTOR archive indicates your acceptance of the Terms & Conditions of Use, available at

https://about.jstor.org/terms

The MIT Press is collaborating with JSTOR to digitize, preserve and extend access to The

Review of Economics and Statistics

This content downloaded from

163.178.171.71 on Thu, 16 Nov 2023 22:03:06 +00:00

All use subject to https://about.jstor.org/terms

TAX AVOIDANCE AND THE DEADWEIGHT LOSS OF THE INCOME TAX

Martin Feldstein*

Abstract-Traditional analyses of the income tax greatly underestimate ing that the income tax does not change the relative -prices of

deadweight losses by ignoring its effect on forms of compensation and

leisure and of the tax-favored forms of consumption that

patterns of consumption. The full deadweight loss is easily calculated

using the compensated elasticity of taxable income to changes in tax rates give rise to exclusions and deductions. Because the relative

because leisure, excludable income, and deductible consumption are a prices of leisure, excludable income, and deductible consump-

Hicksian composite good. Microeconomic estimates imply a deadweight

tion are fixed, all of these can be treated as a single Hicksian

loss of as much as 30% of revenue or more than ten times Harberger's

classic 1964 estimate. The relative deadweight loss caused by increasing composite good. The analysis in this paper shows that, even

existing tax rates is substantially greater and may exceed $2 per $1 of though the magnitude of the exclusions cannot be measured

revenue.

directly, the compensated change in taxable income induced

by changes in tax rates provides all of the information that is

I. Introduction

needed to evaluate the deadweight loss of the income tax.2

T he traditional method of analyzing the distorting effects Section II of this paper presents a formal analysis that

of the income tax greatly underestimates its total incorporates tax avoidance into the measurement of the

deadweight loss as well as the incremental deadweight loss deadweight loss of the income tax. Section III reviews

of an increase in income tax rates. Ever since Harberger's evidence on the magnitude of the key elasticity. Section IV

classic 1964 paper, economists have focused on the effects uses the NBER's microeconomic TAXSIM model to evalu-

of the income tax on the supply of labor and the rate of ate the deadweight loss of the income tax as well as of a

capital accumulation. The relatively low estimated elastici- proportional rise in income tax rates and of the increased

ties of labor supply and of saving have led analysts to progressivity exemplified by the 1993 tax law. There is a

calculate a correspondingly small deadweight loss of the brief concluding section that discusses some of the implica-

income tax. In Harberger's own analysis, the deadweight tions of this work and directions for further analysis.

loss of using a tax on labor income instead of a lump-sum

tax was only about 2.5% of the revenue raised (Harberger,

1964).' II. Tax Avoidance and Deadweight Loss

The true deadweight losses are substantially greater than

The traditional Harberger analysis of the deadweight loss

these conventional estimates because the traditional frame-

of a labor income tax specifies the individual's decision

work ignores the effect of higher income tax rates on tax

problem as a choice between leisure (L) and consumption

avoidance through changes in the form of compensation

(C) subject to a budget constraint in which consumption

(e.g., employer-paid health insurance) and through changes

equals labor earnings minus the tax on those earnings:3

in the patterns of consumption (e.g., owner-occupied hous-

ing). The present paper shows that, when these forms of tax

max U (L, C) subject to C = (1 -t)w(l -L) (1)

avoidance are taken into account, the deadweight losses of

the income tax and of changes in income tax rates may be

where t is the proportional rate of income tax and w is the

more than ten times as large as the traditional Harberger

individual's pretax wage rate.

calculations imply.

In reality, the individual's income tax liability is not based

The deadweight loss due to the increased use of exclu-

on total labor income. Some forms of compensation are

sions and deductions is easily calculated even when the

excluded in the calculation of taxable income even though

exclusions cannot be explicitly measured (e.g., improved

they enter the individual's utility function (e.g., health

working conditions). The key to the calculation is recogniz-

benefits, pleasant working conditions), and some forms of

consumption are deducted by taxpayers (e.g., mortgage

interest) who use the itemized deduction method of calculat-

Received for publication July 23, 1996. Revision accepted for publica- ing taxable income. If we denote the exclusions by E and the

tion January 22, 1999.

* Harvard University and National Bureau of Economic Research

deductions by D, the individual's decision problem can be

I am grateful to Daniel Feenberg for the TAXSIM estimates in section IV

and to him, Jim Hines, Jeff Liebman, other members of the Harvard-MIT

Public Economics Seminar and the NBER Public Economics program, and 2 Tax avoidance through deductible spending and excludable income is

referees of this journal for comments on an earlier draft. For a more very different from illegal tax evasion because evasion generally reduces

complete version of this paper, see NBER Working Paper 5055 at spendable income in a nonlinear way, i.e., it is not part of a Hicksian

www.nber.org. compensated good. See Slemrod (1994) for a very interesting discussion of

I More-recent analyses using this same framework include Auerbach illegal evasion in this context. Similarly, changes in the timing of taxable

(1985), Ballard et al. (1985), Browning (1987), Hausman (1981, 1985), income raise issues not dealt with in the current analysis. Triest (1992)

and Stuart (1984). Even within this framework, existing analyses may incorporates deductible expenses in a model of labor supply but does not

underestimate the deadweight loss because they define the nature of the analyze the welfare implications or note that the deadweight loss depends

labor-supply response too narrowly (in terms of just hours and participa- on changes in taxable income rather than changes in labor supply.

tion) and therefore understate the magnitude of the labor-supply elasticity; 3The current analysis does not deal with the issues of saving and

see Feldstein (1995b). deferred consumption.

The Review of Economics and Statistics, November 1999, 81(4): 674-680

? 1999 by the President and Fellows of Harvard College and the Massachusetts Institute of Technology

This content downloaded from

163.178.171.71 on Thu, 16 Nov 2023 22:03:06 +00:00

All use subject to https://about.jstor.org/terms

INCOME TAX AVOIDANCE AND THE DEADWEIGHT LOSS 675

written: The deadweight loss of the income tax can therefore be

evaluated as the deadweight loss of an excise tax on ordinary

max U = U(L, C, E, D) (2) consumption at rate T. Measuring the change in the dead-

weight loss that would result from a change in the income

subject to the budget constraint tax therefore only requires estimating the change in ordinary

consumption that the tax change would induce. More

C = (1-t)[w(l-L)-E-D] (3) precisely, because the equivalent excise tax applies only to C

as a whole and no taxes distort the relative prices of L, E and

where C now refers to all general consumption that is not D, it is not necessary to know the substitution elasticities

tax-favored through exclusion or deduction and w(l - L) - among C, L, E, and D in order to measure the deadweight

E - D is taxable income (TI). loss of the tax. To see this explicitly, note that the traditional

An indication of the order of magnitude of the exclusions Hicks-Harberger approximation of the deadweight loss due

and deductions is suggested by the Treasury Department's to price distortions is 0.5VS1jdpjdpj, where Sij is the

estimates of tax expenditures in the personal income tax. compensated substitution term between goods i andj and dpi

These tax expenditures are defined as the revenue losses that is the change in the price of good i. If ordinary consumption,

result from reductions in taxable income due to certain C, is the first good, equation (4) implies that dp1 = dT and

exclusions and deductions. For 1993, the Treasury estimates that dpj = 0 for j = 2, 3, and 4. The deadweight loss

that the total of all such individual income tax revenue losses therefore collapses to 0.5S1l(dpl)2. The text that follows

is $388 billion.4 This estimated revenue loss corresponds to shows that this is equivalent in the current case to the

deductions and exclusions that are approximately four times product of the square of the tax rate and the elasticity of

larger, i.e., larger by a factor equal to the inverse of the taxable income with respect to one minus the tax rate.

average of the individual marginal tax rates, or approxi- The calculation of the deadweight loss of the income tax

mately $1,500 billion. To put this number in perspective, is illustrated with the help of figure 1. The DD curve is the

$1,500 billion is more than 60% of the estimated taxable compensated demand for ordinary consumption relative to

income for 1993. Even this large amount understates the the alternatives of leisure and tax-favored consumption. The

complete sum of exclusions and deductions, because the excise tax equivalent of the income tax raises the price of

official tax expenditure list does not include a wide range of ordinary consumption from 1 to 1 + T. The deadweight loss

behavior that reduces taxable income, e.g., the choice of more- is the shaded area equal to 0.5 T dC. Thus,

pleasant working conditions (larger offices, better furniture, air

conditioning, location, etc.) instead of higher cash income. DWL - -0.5TdC

Since the budget constraint of equation (3) can be

- -0.5T[dCId(l + T)]d-

rewritten as

- -0.5(T/(1 + T))[(1 + T)IC][dCld(l + T)]TC (5)

(1+T)C=w-wL-E-D (4) -0.5(T/(l + r))EcITC

where 1 + T = (1 -t) , it is clear that the income tax is Note that (1 + T)-1 = (1 - t) implies that (T/(1 + T)) = t

equivalent to an excise tax on ordinary consumption (i.e., on and T = tI(l - t). Equation (5) therefore implies

consumption that is not tax-favored).5 The income tax

therefore changes the relative prices of leisure and ordinary DWL =-0.5t2ECCI(l - t). (6)

(i.e., not tax-favored) consumption, raising the price of

ordinary consumption by a factor of 1 + T (or, equivalently, In the remainder of this section, I show that this can be

reducing the price of leisure in terms of foregone ordinary stated in terms of the elasticity of taxable income with

consumption from w per unit of leisure to (1 - t)w, but does respect to the net of tax share.6 More specifically, I now

not change the relative prices of leisure, excludable compen- show that equation (6) is equivalent to

sation, and deductible consumption. The key conclusion that

the relative prices of L, E, and D remain unchanged is DWL = 0.5t2(1 -t)-1ETT,

unaffected if the proportional income tax of equation (3) is

replaced by a linear but not proportional tax or by a the traditional Harberger-Browning formula (Hfarberger,

nonlinear income tax. 1964; Browning, 1987) for the deadweight loss of a tax

system but with the usual compensated labor supply elastic-

4The largest tax expenditure for an exclusion is the $51 billion for

ity replaced by the compensated elasticity of taxable income

employer contributions to health insurance plans. The largest tax expendi-

ture for a deduction is the $51 billion for mortgage-interest deductions. The

total of the individual tax expenditures is only an approximation because 6 In the special case in which there is no excludable income or deductible

eliminating any single tax expenditure would change the revenue loss of consumption, this analysis is equivalent to the traditional deadweight loss

the others. calculation, because changes in the demand for ordinary consumption are

5 Recall that the analysis excludes saving and deferred consumption. equivalent under those conditions to changes in labor supply.

This content downloaded from

163.178.171.71 on Thu, 16 Nov 2023 22:03:06 +00:00

All use subject to https://about.jstor.org/terms

676 THE REVIEW OF ECONOMICS AND STATISTICS

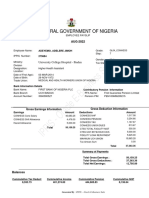

FIGURE 1 {dTIld(1- 0}coMP. It follows that - CEc = (1 - t) X

{dCld(1 -t)CoMp = (1 - t){dTI/d(1 - t)ICOMp = TIET. This

establishes the equivalence of equations (6) and (7) as

D measures of the deadweight loss.

price

III. The Elasticity of Taxable Income with Respect

to the Net of Tax Share

(1+t)\

In an earlier paper (Feldstein, 1995a), I estimated the

1a value of ET on the basis of taxpayers' responses to the 1986

tax-rate reductions. That analysis used a panel of individual

tax returns created by the Treasury Department that allows a

D

comparison of each taxpayer's return for 1985 with the same

taxpayer's return for 1988. I focused on married taxpayers

dC C who were under age 65 in 1988. Taxable income was

adjusted for changes in the law in 1986 and was modified to

exclude the portion of taxable income due to capital gains

with respect to the net-of-tax share (ET) and with labor

and to gross partnership losses. These adjustments permit

income replaced by taxable income (i.e., TI, the labor

the estimated change in taxable income to reflect the change

income net of deductions and exclusions).7

in marginal tax rates rather than other changes in tax rules.8

The notion of an income-compensated elasticity of TI

To estimate the elasticity, taxpayers were grouped accord-

with respect to the net of tax share needs some further

ing to their 1985 marginal tax rate and the adjusted taxable

explanation. An increase in the net of tax share of money

incomes were compared for 1988 and 1985. Comparing the

wages that the taxpayer can keep (i.e., 1 - t) has both an

changes in taxable incomes to the changes in the net of tax

income effect and a substitution effect. The compensated or

shares in different marginal tax-rate groups provides alterna-

substitution effect of an increase in 1 - t is to induce the tive estimates of the elasticity of taxable income with respect

taxpayer to consume less leisure and less of the tax-favored to the net of tax share. This differences-in-differences approach

forms of consumption and therefore more of the ordinary

avoids the identification problems of traditional regression esti-

consumption. The compensated effect of an increase in 1 - t

mates and the assumption that demographic and other

is therefore to increase Tl. However, a rise in the after-tax

factors affect taxable income in a linear additive way.

share causes an increase in disposable income at the initial

An example will indicate the nature of the differences-in-

levels of leisure and tax-favored consumption. This, in turn,

differences calculation. Taxpayers who were in the highest

causes the individual to want more leisure and more of the

marginal tax rate class in 1985 (with marginal tax rates of

tax-favored consumption (i.e., less taxable income). This 49% and 50%) had average marginal tax rates of approxi-

response to the increase in disposable income is the income

mately 28% in 1988, a 42.2% rise in the net of tax share.

effect of the change in the net of tax share. If dy is the

Taxpayers in the next group, with marginal tax rates of 42%

increase in disposable income with no behavioral response,

to 45% in 1985, experienced a 25.6% rise in the net of tax

the income effect is the decrease in taxable income at a rate

share. The corresponding increases in the adjusted taxable

equal to dTI/dy. If there were no excludable income or income for the two groups were 44.8% and 20.3%. The

deductible consumption, -dTI/dy = wdL/dy > 0, the value

comparison of changes in TI and in 1 - t implies an

of the increase in leisure demanded per incremental dollar of

elasticity of 1.48. Similar comparisons between the taxpay-

lump sum income. More generally, an increase in exogenous

ers in the highest 1985 marginal tax-rate groups and those in

income will induce an increase in excludable income (i.e.,

the medium marginal tax-rate range (with 1985 marginal tax

more fringe benefits) and an increase in deductible consump- rates of 22% to 38%) implies an elasticity of 1.25. Finally, a

tion. Thus, dTI/dy = d[w - wL - E - D]/dy < 0. comparison of the TI changes for those who started with

With this concept in mind, note that equations (6) and (7)

marginal tax rates of 42% to 45% and those who started with

are equivalent if - ECC = ETTI. Since EC (1 + T)C-1 X marginal tax rates of 22% to 38% implies an elasticity of

{dC/d(1 + T)}cOMp and (1 + T) = (1 - t)-, it follows that 1.04. The simple average of these three elasticities was thus

EC= -(1 - t)C-{dC/d(1 - t)}coMp. By definition, ET =1.26.

(1 - t)(TI)-1{dTId(1 - t)}coMp. Since the uncompensated Gerald Auten and Robert Carroll (1994) of the Treasury

change in TI with respect to a tax change differs from the

Department's Office of Tax Analysis subsequently reesti-

change in consumption only by the amount of the tax paid,

mated the same elasticity using the much larger panel of tax

the compensated effects are equal: {dC/d(1 - t)}COMp =

7 Note that this measures the deadweight loss due to changes in the 8 The sample also excluded taxpayers who created a subchapter S

income tax rate and not the deadweight loss that results from changes in the corporation between 1985 and 1988. The specific reasons for excluding

list of deductions and exclusions or other changes in the structure of the gross partnership losses and taxpayers who created subchapter S corpora-

income tax. tions are discussed in Feldstein (1995a).

This content downloaded from

163.178.171.71 on Thu, 16 Nov 2023 22:03:06 +00:00

All use subject to https://about.jstor.org/terms

INCOME TAX AVOIDANCE AND THE DEADWEIGHT LOSS 677

returns for 1985 and 1989 that is available inside the working less hard per hour (including not only the amount of

Treasury but not available for outside use. Their sample of effort per hour but also such dimensions as the amount of

more than 14,000 returns includes more than 5,000 taxpay- travel, employee location, responsibility accepted, and so

ers with 1985 marginal tax rates of 50%. They report an on), receiving compensation in ways other than cash that are

estimated elasticity of 1.33 with a standard error of 0.15. The excluded from taxable income (such as fringe benefits, office

Feldstein (1995a) and Auten-Carroll (1994) estimates are amenities, first-class travel, corporate health and fitness

broadly consistent with earlier elasticity estimates by Lind- facilities, and subsidized corporate day-care for children),

sey (1987) based on comparing cross-sections of ranked and spending money in ways that are deductible in the

taxpayers before and after the 1981 tax-rate reductions and calculation of taxable income.11

with Navratil's (1994) estimates based on panel data of It is not surprising therefore that the estimate of ET iS

taxable incomes for individuals before and after the rate substantially larger than the traditional estimates of the

reductions. compensated labor-supply elasticity. The much broader

A more recent study by Auten and Carroll (1999) esti- range of responses implied by the change in TI than by the

mates the response of taxable income to the net-of-tax rate to change in labor supply (or leisure) implies a substantially

be 1.19 with a standard error of 0.16 in their basic two-stage larger deadweight loss.12

least-squares specification. That result is very robust to

expanding the set of regressors to include a variety of nontax IV. Microeconomic Estimates with the TAXSIM Model

factors (a coefficient of 1.10 with a standard error of 0.17)

This section presents estimates of deadweight losses

and adding variables that indicate the taxpayer's occupation

calculated with the NBER's TAXSIM model, a microsimula-

(a coefficient of 0.97 with a standard error of 0.17). Auten

tion model based on a stratified random sample of more than

and Carroll also repeat their estimates with weights propor-

100,000 individual tax returns provided by the Internal

tional to the sample selection probability, a procedure that

Revenue Service. The estimates include the reduction in the

gives greater weight to lower-income taxpayers and that

deadweight loss associated with eliminating the personal tax

reduces the estimated tax parameter from 1.19 to 0.75 in the

completely and the changes in the deadweight loss and in tax

basic regression and to 0.55 when all of the additional

revenue of a 10% increase in all marginal tax rates and of a

regressors are added. This reweighting has two effects: It

repeal of the 1993 increase in tax-rate progressivity.

corrects a potential panel-sampling bias, and it also produces

Because the deadweight loss is directly proportional to the

a weighted average of the elasticities at different income

elasticity of taxable income with respect to the net of tax

levels if the true elastiticies differ by income. Such an

share, readers can easily modify the estimates presented here

overall elasticity estimate that gives equal weight to all

if they believe that the true elasticity is different from the

taxpayers would underestimate the effect of a proportional

estimate of ET = 1.04 used. An assumed alternative value of

tax change if low-income individuals have lower behavioral

ET = 0.5 would cut the implied deadweight losses approxi-

responses than high-income individuals.9

mately in half, while assuming the value of ET = 1.33 (as

Because the 1986 tax reforms were designed to be

estimated by Auten and Carroll (1994)) would raise the

revenue neutral and distributionally neutral (on the assump-

implied deadweight losses by about one-third.

tion of no change in economic behavior), the behavioral

The TAXSIM calculations are based on tax returns for

response should in principle be an estimate of ET, the

1991, the most recent data available when this study was

income-compensated elasticity of taxable income with re-

done. These have been adjusted at the NBER to estimated

spect to the net of tax share.10 This is of course only an

1994 income levels. The TAXSIM model incorporates the

approximation. Determining the extent to which the tax

legislation was revenue neutral and distributionally neutral

11 Some reductions in taxable income of the individual represent a

is complicated by, among other things, the uncertain inci- transfer of taxable income from the individual to the corporate employer.

dence of the corporate tax changes that were part of the 1986 Deferred compensation is a very clear example of this. Such intertemporal

aspects are beyond the scope of this paper but are reflected in the

tax reform act.

empirically estimated elasticity of TI with respect to the 1 - t tax share.

It is important to emphasize that the elasticity of TI with 12 The estimated elasticity ET, as reported in Feldstein (1995a) and in

respect to the net of tax share is conceptually very different Auten and Carroll (1994, 1999), is based on the experience of taxpayers

with 1985 marginal tax rates over 20%. It is not clear a priori whether the

from the more familiar elasticities of labor supply with

elasticity would be lower or higher for taxpayers with lower marginal tax

respect to the net of tax share. A taxpayer can respond to a rates and lower incomes. Because such taxpayers may have less discretion

higher marginal tax rate not only by working fewer hours about the form of compensation and are less likely to itemize deductions,

the elasticity could be lower. However, even a small change in wages could

(the traditional labor-supply response) but also in a variety imply a proportionately very large change in taxable income for lower-

of other ways that reduce taxable income. These include income taxpayers; for example, a couple with wage income of $25,000 and

two children who use the standard deduction now has a taxable income of

9 Footnote 17 notes that the overall revenue effect and deadweight loss of less than $9,000, so a 5% decrease in earnings translates into a 14% decline

a proportional tax change depend almost completely on the elasticity of the in taxable income. The analysis of a proportional change in all tax rates

higher-income taxpayers. (reported in section IV) shows that the revenue and dead loss effects are

10 Determining the extent to which the tax legislation was revenue neutral almost unchanged if it is assumed that lower-income taxpayers (the 31

and distributionally neutral is complicated by the uncertain incidence of million taxpayers with adjusted gross income less than $25,000) do not

the corporate income tax changes that were part of the 1986 tax reform act. respond at all to changes in marginal tax rates.

This content downloaded from

163.178.171.71 on Thu, 16 Nov 2023 22:03:06 +00:00

All use subject to https://about.jstor.org/terms

678 THE REVIEW OF ECONOMICS AND STATISTICS

income tax rates and rules as of 1994. The initial marginal marginal tax rate in each adjusted gross income class instead

personal income tax rate is estimated for each individual on of separate marginal rates for each individual.15

the basis of that individual's taxable income and the 1994 The TAXSIM estimate of a $181 billion deadweight loss

schedule of marginal tax rates. For individuals who are ignores the effect of the Social Security payroll tax on the

eligible for the earned-income tax credit, the marginal tax deadweight loss of the income tax. An alternative calcula-

rate includes the increase or decrease in the credit per dollar tion takes each individual's net Social Security marginal tax

of additional income. To capture the full complexity of the rate as given and calculates the total deadweight loss with

tax rules, the marginal tax rate for each taxpayer is calcu- and without the personal income tax. Treating the personal

lated by comparing that taxpayer's liability with the initial income tax as incremental in this way implies a substantially

taxable income to that individual's tax liability if his income larger deadweight loss of $284 billion or 52% of the

rises by $100. personal income tax revenue.

Because the 15.3% Social Security payroll tax is an

important part of the marginal tax rate that most individuals B. A 10% Increase in All Marginal Tax Rates

face, we generally include the payroll tax as well as the

The TAXSIM calculation indicates that increasing all

income tax in our calculations. To calculate marginal tax

personal income tax rates by 10% creates a deadweight loss

rates for Social Security net of the present actuarial value of

of $43 billion.16 Since a 10% increase in all tax rates would

future benefits, the analysis divides the wage and salaiy

raise $56 billion if there were no induced change in taxpayer

income reported on each tax return into separate earnings of

behavior, this $43 billion represents a very high deadweight

husbands and wives using a method described in Feldstein

loss of $0.78 per $1 of potential additional revenue. More-

and Feenberg (1996). Married women are classified as

over, since the higher tax rate causes a decline in taxable

potential retired workers (rather than potential dependent

incomne, the increase in revenue is substantially smaller than

spouses) if their current wage and salary places them at a

10% of the original personal income tax revenue. The

point in the earnings distribution at which their individual

TAXSIM analysis implies that the personal income tax rises

benefits would exceed the benefits to which they would be

by $26 billion instead of the $56 billion with no behavioral

entitled as a dependent spouse.13 The Feldstein and Samwick

response. The reduced labor supply and the shift away from

(1992) estimates of the net present value of future Social

taxable cash income to other types of compensation also

Security retirement benefits are then used to adjust the

reduces the payroll tax revenue by an estimated $4.1 billion,

15.3% employer-employee payroll tax rate based on im-

so that the total revenue gain from a 10% rise in all personal

puted assumptions about ages and incomes.

income tax rates is only $21.4 billion. Comparing the $44

billion deadweight loss to this additional revenue indicates

A. The Deadweight Loss of the Personal Incomne Tax

that the incremental deadweight loss per dollar of additional

Consider first the deadweight loss of the personal income revenue is $2.06.

tax as a whole if there were no Social Security payroll tax. Since the effects on deadweight loss and revenue are

Applying equation (7) with E7 = 1.04 to each individual symmetric for small increases and decreases in tax rates, a

return and then using the sample weights to find a national 10% across-the-board reduction in all tax rates would be

aggregate implies a deadweight loss of the income tax in expected to lose only about $21 billion in revenue and to

1994 of $181 billion or 32.2% of the TAXSIM estimate of reduce the deadweight loss of the existing tax system by $44

the corresponding personal income tax revenue of $543 billion. Real disposable household incomes (net of the value

billion.14 This 32% ratio of deadweight loss to revenue is of foregone leisure) would rise by $65 billion or about $3 per

about twelve times as large as the original Harberger $1 of revenue lost by the government.17

estimate despite the decrease in the level of tax rates since

the time when Harberger made his estimates. The primary 15 The deadweight loss for each individual depends on the square of that

reason for the difference is the current use of the taxable individual's marginal tax rate. Since the weighted mean of the squares of

the individual marginal tax rates exceeds the square of the mean marginal

income elasticity of 1.04 instead of the much lower elasticity

tax rate, the use of the average marginal rate in each AGI class causes a

of labor supply (0.125) used by Harberger. The Harberger downward bias in the estimated deadweight loss. See Feldstein (1996,

estimate was also biased downward by using an average section 6).

16 In order to look at the pure effect of a 10% rise in marginal tax rates,

the TAXSIM calculation of this tax change is based on a modified 1994 tax

13 A married woman is entitled to the higher of her own benefit and 50% law that omits the alternative minimum tax, the earned-income tax credit,

of her retired husband's benefit. The choice is complicated by such things and the credits for child care and for the elderly. These features of the tax

as the ability of women to claim benefits earlier than their husbands on law are included in the analysis of repealing the 1993 tax-rate increases.

their own and then shift to the status of dependent beneficiary when their 17 As a test of the sensitivity of the results to using the estimated elasticity

husbands retire. Even those who do not ever claim benefits as a dependent of taxable income of 1.04 for low-income groups as well as high-income

spouse are likely to take the benefit based on husband's income after his groups, I have evaluated the effects of the 10% increase in all personal

death. income tax rates with the compensated and uncompensated elasticities set

14 Since the deadweight loss is proportional to the elasticity of taxable equal to zero for the 31 million taxpayers with incomes of $25,000 or less.

income with respect to the net of tax share, assuming any value of ET Doing so has almost no effect on both tax revenue and the deadweight loss.

different from 1.04 changes this deadweight loss estimate in the same The tax revenue rises by $23.6 billion instead of $21.4 billion, and the

proportion. deadweight loss is $41.4 billion instead of $42.8 billion.

This content downloaded from

163.178.171.71 on Thu, 16 Nov 2023 22:03:06 +00:00

All use subject to https://about.jstor.org/terms

INCOME TAX AVOIDANCE AND THE DEADWEIGHT LOSS 679

C. The Effect of Increases in Tax Progressivity loss of $4,248. Since half of all taxpayers affected by the

1993 tax-rate increase had initial taxable incomes below

An increase in tax progressivity raises the deadweight loss

$180,000, the majority of those affected by the 1993 tax-rate

per dollar of tax revenue. This can be seen intuitively by

increases experienced a substantially increased deadweight

noting that the deadweight loss of the tax depends on the

loss while paying a reduced amount of tax.

weighted average of the squared marginal tax rates while

For taxpayers with high-enough income, the $140,000

the revenue depends on the same weighted average of the

threshold becomes relatively less important, and the tax

marginal tax rates themselves. The greater convexity of the

liability actually rises. Consider for example a married

more progressive marginal rate schedule raises the mean of

couple filing jointly with initial taxable income of $500,000.

the squared marginal rates proportionately more than it

Their marginal tax rate rose from 0.31 to 0.425, raising the

raises the mean of the rates themselves.

deadweight loss by $31,867 and the revenue by $8,468, an

This is well illustrated by the 1993 tax legislation which

incremental deadweight loss of $3.76 for every $1 of

raised the top marginal rate of personal income tax from

revenue.20

31% to 36% for married taxpayers with taxable incomes

between $140,000 and $250,000 and from 31% to 39.6% for

V Concluding Comments

married taxpayers with taxable incomes over $250,000. In

addition, the $135,000 income ceiling for the 2.9% health This paper has emphasized that the deadweight loss of the

insurance payroll tax was eliminated, bringing the total personal income tax on labor income reflects the induced

marginal tax rates to 38.9% and 42.5% from the previous changes in itemized deductions and in income exclusions as

31%.18 well as a broader than usual measure of changes ini labor

Before looking at the TAXSIM estimates, it is useful to supply. Although the effects of taxes on all of these aspects

study a few representative high-income taxpayers to see why of behavior cannot be estimated separately, the analysis

the increased progressivity implies a very high ratio of shows that the deadweight loss of the labor income tax can

incremental deadweight loss to incremental revenue. be calculated in terms of the elasticity of taxable income

Consider first a taxpayer with $180,000 of taxable in- with respect to the net of tax share. Because the response of

come, the median income level among those whose tax rates taxable income involves much broader behavior than the

were increased in 1993. Since the taxpayer is above the traditional elasticity of labor supply, the taxable-income

maximum taxable income for the Social Security payroll elasticity is larger than the traditional labor-supply elasticity

tax, the rise in the marginal income tax rate from t1 = 0.31 and

to the resulting deadweight loss is correspondingly greater.

t2 = 0.389 increased the individual taxpayer's deadweight This is borne out by the statistical estimates of the elasticity

loss by ADWL = O.5ET [t2 - t2](1 - t1)-1TI = $7461. of taxable income based on the 1986 tax-rate reductions.

Because the increased tax rate applies only to income in These estimates imply that the deadweight loss per dollar of

excess of $140,000, the increased revenue would be 7.9% of revenue of using a labor income tax rather than a lump-sum

the income between $140,000 and $180,000, or $3,160 if the tax is more than twelve times as large as Harberger's classic

taxpayer does not change his $180,000 income. However, estimate. If the existing Social Security tax and benefit

the 7.9% rise in the marginal tax rate reduces the individual's structure is taken into account, the deadweight loss per

net-of-tax share of income from 0.69 to 0.611, a fall of dollar of personal income tax revenue is even greater.

11.4%. The resulting compensated decline in taxable income The analysis implies that a marginal increase in tax

would be TIET[d(l - t)I(1 - t)] = -21340. Against this revenue achieved by a proportional rise in all personal

must be offset the income effect on taxable income, (dTII dy) income tax rates involves a deadweight loss of two dollars

$3160 = 1264, assuming an income effect of 0.4.19 The net per incremental dollar of revenue. This has important

decline in taxable income is therefore $20,076, implying a implications for the cost of financing incremental govern-

loss of personal income tax revenue at t = 0.36 of ment spending. The relative cost of incremental revenue is

$7,227. There is also a decline of payroll tax revenue of even greater when it is achieved by a tax change that

$181. The net revenue effect is therefore the difference increases the progressivity of the rate structure, as the

between the $3,160 additional revenue that would be analysis of the 1993 tax changes showed.

collected with no behavioral response and the combined The calculations could be improved in a variety of ways.

revenue loss of $7227 + $181 = 7408, a net revenue loss of The analysis deals only with a single period of time,

$4,248. ignoring both ordinary saving and tax-favored saving.

In short, for a taxpayer with initial taxable income of Similarly, there is no attempt to deal with the deadweight

$180,000, the rise in the marginal tax rate from 31% to losses that arise from the rules governing the taxation of

38.9% implies a deadweight loss of $7,461 and a revenue investments in portfolio assets. Although state income and

consumption taxes raise marginal tax rates, they have not

been incorporated. It is clear, however, from the current

18 Since half of the 2.9% is paid by employers, the marginal tax rate on

full pretax income is 38.9/1.0145 = 38.3%. I ignore this distinction in the analysis that the deadweight losses are of a substantial

current section.

19 See Feldstein (1996, section 4) for a discussion of this income effect. 20 See Feldstein (1996, section 5) for details of this calculation.

This content downloaded from

163.178.171.71 on Thu, 16 Nov 2023 22:03:06 +00:00

All use subject to https://about.jstor.org/terms

680 THE REVIEW OF ECONOMICS AND STATISTICS

enough magnitude to make further research on these issues a Feldstein, M., and D. Feenberg, "The Tax Treatment of Two Earner

Families," in M. Feldstein and J. Poterba (eds.), Empirical Founda-

high priority.

tions of Household Taxation (Chicago: University of Chicago Press,

1996).

References Feldstein, M., and A. Samwick, "Social Security Rules and Marginal Tax

Rates," National Tax Journal 45:1 (March, 1992), 1-22.

Atkinson, A. B., and J. Stiglitz, Lectures in Public Economics (New York

Harberger, A., "Taxation, Resource Allocation, and Welfare," in J. Due

and London: McGraw-Hill Book Company, 1980).

(ed.), The Role of Direct and Indirect Taxes in the Federal Revenue

Auerbach, A., "The Theory of Excess Burden and Optimal Taxation," in

System (Princeton, NJ: Princeton University Press, 1964).

A. Auerbach and M. Feldstein (eds.), Handbook of Public Econom-

Hausman, J., "Labor Supply," in H. Aaron and J. Pechman (eds.), How

ics, Vol. 1 (Amsterdam: North-Holland, 1985).

Taxes Affect Economic Behavior (Washington, D.C.: The Brook-

Auten, G., and R. Carroll, "Taxpayer Behavior and the 1986 Tax Reform

ings Institution, 1981).

Act," Treasury Department, Office of Tax Analysis (July, 1994).

"Taxes and Labor Supply," in A. Auerbach and M. Feldstein

"The Effect of Income Tax on Household Income," this REVIEW

(eds.), Handbook of Public Economics, Vol. 1 (Amsterdam: North-

81(4) (1999).

Holland, 1985).

Ballard, C., J. Shoven, and J. Whalley, "General Equilibrium Computa-

Lindsey, L., "Individual Taxpayer Response to Tax Cuts: 1982-1984, with

tions of the Marginal Welfare Costs of Taxes in the United States,"

American Economic Review 77 (March, 1985), 128-138. Implications for the Revenue Maximizing Tax Rate," Journal of

Browning, E., "On the Marginal Welfare Cost of Taxation," American Public Economics 33 (1987), 173-206.

Economic Review 77 (March, 1987), 11-23. Navratil, J., "Evidence on Individual Taxpayer Behavior for Panel Tax

Feldstein, M., "The Effect of Marginal Tax Rates on Taxable Income: A Return Data," mimeograph (1994).

Panel Study of the 1986 Tax Reform Act," Journal of Political Slemrod, J., "A General Model of the Behavioral Responses to Taxation,"

Economy 103 (1995a), 551-572. mimeograph (1994).

"Behavioral Responses to Tax Rates: Evidence from TRA86," Stuart, C., "Welfare Costs per Dollar of Additional Revenue in the United

American Economic Review 85 (May, 1995b), 170-174. States," American Economic Review 74 (June, 1984), 352-363.

"Tax Avoidance and the Deadweight Loss of the Income Tax," Triest, R., "The Effect of Income Taxation on Labor Supply when

working paper 5055, NBER (1996). Deductions are Endogenous," this REVIEW 74 (1992), 91-99.

This content downloaded from

163.178.171.71 on Thu, 16 Nov 2023 22:03:06 +00:00

All use subject to https://about.jstor.org/terms

You might also like

- IPPIS - Oracle E-Business Suite: Federal Government of NigeriaDocument1 pageIPPIS - Oracle E-Business Suite: Federal Government of NigeriaHalleluyah HalleluyahNo ratings yet

- Chapter 4 - AbelDocument11 pagesChapter 4 - AbelShuvro Kumar Paul75% (4)

- This Study Resource Was: CASTILLO, Lauren Financial Management Mam Barquez BSA-3 Problem 1 (Pro Forma Statements)Document5 pagesThis Study Resource Was: CASTILLO, Lauren Financial Management Mam Barquez BSA-3 Problem 1 (Pro Forma Statements)KATHRYN CLAUDETTE RESENTE100% (2)

- Running Head: The Body Shop CaseDocument19 pagesRunning Head: The Body Shop CaseDominique Meagan LeeNo ratings yet

- Direct Deposit Advice This Is Not A CheckDocument1 pageDirect Deposit Advice This Is Not A CheckAlex RoofNo ratings yet

- Financial Ratio Analysis of Cadburys India and Nestle IndiaDocument11 pagesFinancial Ratio Analysis of Cadburys India and Nestle Indiaankitsaxena8870% (10)

- Tax Reform and Target Saving - Andrew A. SamwickDocument15 pagesTax Reform and Target Saving - Andrew A. Samwickmuitoscaracteres.banNo ratings yet

- The University of Chicago PressDocument28 pagesThe University of Chicago Pressmoha dahmaniNo ratings yet

- Principles of Microeconomics-57375Document15 pagesPrinciples of Microeconomics-57375msfaziah.hartanahNo ratings yet

- Tax ProjectDocument4 pagesTax Projecthritik guptaNo ratings yet

- Inflation and ProfitsDocument6 pagesInflation and ProfitsBelinay jNo ratings yet

- Average Marginal Tax Rates From Social Security and The Individual Income TaxDocument13 pagesAverage Marginal Tax Rates From Social Security and The Individual Income TaxDavid C. SantaNo ratings yet

- Tax Expenditures: Tax Expenditures in The Income Tax Tax Expenditure EstimatesDocument52 pagesTax Expenditures: Tax Expenditures in The Income Tax Tax Expenditure EstimatesSushil JindalNo ratings yet

- Tax IncidenceDocument12 pagesTax IncidenceAnimesh Kr SinghNo ratings yet

- A Trillion Little Subsidies: The Economic Impact of Tax Expenditures in The Federal Income Tax CodeDocument36 pagesA Trillion Little Subsidies: The Economic Impact of Tax Expenditures in The Federal Income Tax CodeMercatus Center at George Mason UniversityNo ratings yet

- Measuring The Effects of Corporate Tax Cuts: Alan J. AuerbachDocument24 pagesMeasuring The Effects of Corporate Tax Cuts: Alan J. Auerbachkarol medinaNo ratings yet

- Saez 2010 Do Taxpayers Bunch at Kink PointsDocument53 pagesSaez 2010 Do Taxpayers Bunch at Kink PointsHemi ShahNo ratings yet

- SAEZ ET AL 2012 Elasticity of Taxable Income Review JELDocument71 pagesSAEZ ET AL 2012 Elasticity of Taxable Income Review JELJuan MVNo ratings yet

- Calijomia Institute of Technology, Pasadena, CA 91125, U.S.ADocument18 pagesCalijomia Institute of Technology, Pasadena, CA 91125, U.S.AhenfaNo ratings yet

- Tax Formula and Tax Determination An Overview of Property TransactionsDocument23 pagesTax Formula and Tax Determination An Overview of Property TransactionsJames Riley Case100% (1)

- Brueggemann 2017Document38 pagesBrueggemann 2017hoangpvrNo ratings yet

- JawapanDocument13 pagesJawapanmsfaziah.hartanahNo ratings yet

- Tax IncidenceDocument87 pagesTax IncidenceandydotfengNo ratings yet

- Alternative TaxDocument33 pagesAlternative Taxjulio_cess2102No ratings yet

- A S M O T S: T, M U: Epartment of ConomicsDocument23 pagesA S M O T S: T, M U: Epartment of ConomicsVeronica_1990No ratings yet

- MNC D, T H B R T: R E: Ividends AX Olidays and The Urden of The Epatriation AX Ecent VidenceDocument22 pagesMNC D, T H B R T: R E: Ividends AX Olidays and The Urden of The Epatriation AX Ecent VidenceromanticthiefNo ratings yet

- Two Cheers For Corporate Tax Base Broadening: AbstractDocument14 pagesTwo Cheers For Corporate Tax Base Broadening: AbstractdaniNo ratings yet

- TaxitionDocument55 pagesTaxitionZakirullah ZakiNo ratings yet

- Macroeconomics Solved PyqDocument19 pagesMacroeconomics Solved Pyqfeyebo8058No ratings yet

- Income Taxes: Agnar Sandmo, Norwegian School of Economics, Bergen, NorwayDocument6 pagesIncome Taxes: Agnar Sandmo, Norwegian School of Economics, Bergen, NorwayAris AmirulNo ratings yet

- Tax Avoidance Versus Tax Evasion On Some PDFDocument14 pagesTax Avoidance Versus Tax Evasion On Some PDFkartikeya gulatiNo ratings yet

- PGD Principles of Taxation LECTURE 2Document7 pagesPGD Principles of Taxation LECTURE 2AbdullahiYauUsmanNo ratings yet

- SSRN Id315985Document48 pagesSSRN Id315985kimseongyun123No ratings yet

- TM 3 PDFDocument6 pagesTM 3 PDFJai VermaNo ratings yet

- AGENCY - Crocker, K.J. and Slemrod, J., 2005. Corporate Tax Evasion With Agency Costs.Document18 pagesAGENCY - Crocker, K.J. and Slemrod, J., 2005. Corporate Tax Evasion With Agency Costs.Ferry FernandesNo ratings yet

- Labor Tax Cuts and Employment: A General Equilibrium Approach For FranceDocument37 pagesLabor Tax Cuts and Employment: A General Equilibrium Approach For FranceAngel Roque EspichanNo ratings yet

- Hard To TaxDocument72 pagesHard To TaxoptoergoNo ratings yet

- Day 2 SlidesDocument24 pagesDay 2 SlidesEyob MogesNo ratings yet

- Chapter #17Document42 pagesChapter #17Sumaira AslamNo ratings yet

- Nber Working Paper SeriesDocument49 pagesNber Working Paper SeriesaytareenNo ratings yet

- The Tax Elasticity of Financial Statement Income: Implications For Current Reform ProposalsDocument19 pagesThe Tax Elasticity of Financial Statement Income: Implications For Current Reform ProposalsthienminhNo ratings yet

- Reply To Grubert DH Feb 05Document5 pagesReply To Grubert DH Feb 05Saina ChuhNo ratings yet

- Solution Manual For Byrd and Chens Canadian Tax Principles 2012 2013 Edition Canadian 1st Edition by Byrd and Chen ISBN 0133115097 9780133115093Document36 pagesSolution Manual For Byrd and Chens Canadian Tax Principles 2012 2013 Edition Canadian 1st Edition by Byrd and Chen ISBN 0133115097 9780133115093juliebeasleywjcygdaisn100% (31)

- Effects Income Tax Changes Economic Growth Gale Samwick PDFDocument16 pagesEffects Income Tax Changes Economic Growth Gale Samwick PDFArpit BorkarNo ratings yet

- Accounting Vs Economic DepreciationDocument15 pagesAccounting Vs Economic DepreciationkonyvviragNo ratings yet

- Joseph E. Stiglitz : Princeton UniversityDocument13 pagesJoseph E. Stiglitz : Princeton UniversityKatia ToledoNo ratings yet

- Wiley, Ohio State University Press Journal of Money, Credit and BankingDocument25 pagesWiley, Ohio State University Press Journal of Money, Credit and BankinganorfirdausNo ratings yet

- Tax Avoidance 1Document27 pagesTax Avoidance 1raya hasibuanNo ratings yet

- The Framework For Assessing Tax Incentives: A Cost-Benefit Analysis ApproachDocument36 pagesThe Framework For Assessing Tax Incentives: A Cost-Benefit Analysis ApproachMCINo ratings yet

- Ayoe,+1 +Agung+Endika+Satyadini+ (1-26) +even+smallerDocument26 pagesAyoe,+1 +Agung+Endika+Satyadini+ (1-26) +even+smallerturnitinku 02No ratings yet

- Chapter One SolutionsDocument9 pagesChapter One Solutionsapi-3705855100% (1)

- Tax Policy Tax-Credit and Subtraction Methods of Calculating A Value-Added TaxDocument59 pagesTax Policy Tax-Credit and Subtraction Methods of Calculating A Value-Added TaxTai Lieu On Thi Cong ChucNo ratings yet

- wp2003 10 01Document39 pageswp2003 10 01جمال جفات شاطيNo ratings yet

- Who Bears The Corporate Tax?: A Review of What We KnowDocument52 pagesWho Bears The Corporate Tax?: A Review of What We Knowarmagg1245No ratings yet

- Income Tax Policy: Is A Single Rate Tax Optimum For Long-Term Economic Growth?Document9 pagesIncome Tax Policy: Is A Single Rate Tax Optimum For Long-Term Economic Growth?RebeccaChuaNo ratings yet

- 1464349978ECO P7 M32 E-TextDocument15 pages1464349978ECO P7 M32 E-TextAshin AnishNo ratings yet

- Economics AssignmentDocument10 pagesEconomics Assignmentabdi reta100% (1)

- F3 - Individual Income TaxationDocument43 pagesF3 - Individual Income TaxationmultaneNo ratings yet

- Lecture 2 - Income TaxDocument13 pagesLecture 2 - Income TaxMasitala PhiriNo ratings yet

- American Finance Association, Wiley The Journal of FinanceDocument4 pagesAmerican Finance Association, Wiley The Journal of FinanceLavinia LazărNo ratings yet

- Developing Consistent Tax Bases For Broad-Based Reform: Fiscal Associates, IncDocument10 pagesDeveloping Consistent Tax Bases For Broad-Based Reform: Fiscal Associates, IncThe Washington PostNo ratings yet

- Myth of Ownership - Tax Base - Chapter-5Document42 pagesMyth of Ownership - Tax Base - Chapter-5Edgars EihmanisNo ratings yet

- Progressive Varela Feb 2016 Complete PDFDocument10 pagesProgressive Varela Feb 2016 Complete PDFRenelyn Esteban ClementeNo ratings yet

- T Tax E Expen Nditu Ure: Ann Nex - 2Document3 pagesT Tax E Expen Nditu Ure: Ann Nex - 2BilalNumanNo ratings yet

- ACTBFAR - Exercise Set #1Document7 pagesACTBFAR - Exercise Set #1Cha PampolinaNo ratings yet

- Revisiting Kenneth Brown's "10-Point Test"Document6 pagesRevisiting Kenneth Brown's "10-Point Test"DEDY KURNIAWANNo ratings yet

- 48 Salary ProcessDocument33 pages48 Salary ProcessbapigangNo ratings yet

- MAS 03 CVP AnalysisDocument6 pagesMAS 03 CVP AnalysisJericho G. BariringNo ratings yet

- Review Material - ACCE 411Document5 pagesReview Material - ACCE 411zee abadillaNo ratings yet

- The Financial Statements of Banks and Their Principal CompetitorsDocument6 pagesThe Financial Statements of Banks and Their Principal Competitorsandiswandie2No ratings yet

- MTP 12 17 Questions 1696512917Document11 pagesMTP 12 17 Questions 1696512917harshallahotNo ratings yet

- Financial Statement Analysis: 17-5 The Dividend Yield Is TheDocument51 pagesFinancial Statement Analysis: 17-5 The Dividend Yield Is TheMafi De LeonNo ratings yet

- Why Is Europe More Equal Than The United States? Online AppendixDocument678 pagesWhy Is Europe More Equal Than The United States? Online AppendixBhaskkar SinhaNo ratings yet

- International Transfer PricingDocument60 pagesInternational Transfer Pricingeconomic life - الحياة الاقتصاديةNo ratings yet

- CHAPTER 9 To CHAPTER 15 ANSWERSDocument38 pagesCHAPTER 9 To CHAPTER 15 ANSWERSryanmartintaanNo ratings yet

- Buckwold 25ePPT Ch11Document39 pagesBuckwold 25ePPT Ch11SanjayNo ratings yet

- PT - Cash and Cash Equivalents Period Ended - Audit ObjectivesDocument32 pagesPT - Cash and Cash Equivalents Period Ended - Audit ObjectivesVera Magdalena HutaurukNo ratings yet

- Income From HPDocument17 pagesIncome From HPaKSHAT sHARMANo ratings yet

- FN 200 - Financial Forecasting Seminar QuestionsDocument7 pagesFN 200 - Financial Forecasting Seminar QuestionskelvinizimburaNo ratings yet

- Pay Slip July 2021Document1 pagePay Slip July 2021Chiranjibi BiswalNo ratings yet

- A222 - Individual Assignment #2 - Topic 1-4Document9 pagesA222 - Individual Assignment #2 - Topic 1-4IzadNo ratings yet

- Senior Citizen LawDocument7 pagesSenior Citizen Lawkim cheNo ratings yet

- Week 5 - Sept 26-30 - AcctgDocument13 pagesWeek 5 - Sept 26-30 - Acctgmaria teresa aparreNo ratings yet

- Tax RemediesDocument22 pagesTax RemediesJezreel CastañagaNo ratings yet

- Tutorial 7 - 2024Document4 pagesTutorial 7 - 2024Giang Dương HươngNo ratings yet

- MC1404 - Unit 2Document111 pagesMC1404 - Unit 2Senthil KumarNo ratings yet

- Vitrox q22015Document12 pagesVitrox q22015Dennis AngNo ratings yet

- Draft: The Return Should Reach Mra Electronicallt at Latest On 15 October 2021Document7 pagesDraft: The Return Should Reach Mra Electronicallt at Latest On 15 October 2021DstormNo ratings yet

- Financial Management Economics For Finance 1679035282Document135 pagesFinancial Management Economics For Finance 1679035282Alaka BelkudeNo ratings yet