Professional Documents

Culture Documents

Questions: Tolley Tax Training Questions For Chapter 3

Questions: Tolley Tax Training Questions For Chapter 3

Uploaded by

behzadji7Copyright:

Available Formats

You might also like

- Tax Melville AnswersDocument58 pagesTax Melville AnswersAmrita Dhasmana25% (4)

- ACC 3013 - FWA - Revision - 202110Document14 pagesACC 3013 - FWA - Revision - 202110falnuaimi001No ratings yet

- Taxation (United Kingdom) : Monday 6 June 2011Document14 pagesTaxation (United Kingdom) : Monday 6 June 2011tayabkhalidNo ratings yet

- MG 3027 TAXATION - Week 2 Introduction To Income TaxDocument39 pagesMG 3027 TAXATION - Week 2 Introduction To Income TaxSyed SafdarNo ratings yet

- PM Rishi Sunak Tax SummaryDocument3 pagesPM Rishi Sunak Tax SummaryCallum JonesNo ratings yet

- MGT 225 Intermediate Accounting IIDocument6 pagesMGT 225 Intermediate Accounting IIchetna sharmaNo ratings yet

- F6uk 2012 Dec QDocument13 pagesF6uk 2012 Dec QSaad HassanNo ratings yet

- Acc 3013 - Fwa Revision AnswersDocument15 pagesAcc 3013 - Fwa Revision Answersfalnuaimi001No ratings yet

- Stanley Sloth Ltd'sDocument9 pagesStanley Sloth Ltd'sZENAB ALINo ratings yet

- 202 2011 2 eDocument36 pages202 2011 2 ePrince McBossmanNo ratings yet

- PIT03 The Taxation of InterestDocument10 pagesPIT03 The Taxation of InterestAlellie Khay D JordanNo ratings yet

- Employment Income TaxDocument20 pagesEmployment Income TaxBizu AtnafuNo ratings yet

- Income Tax Rates, Rebates & DeductionsDocument35 pagesIncome Tax Rates, Rebates & DeductionsMaryam IkhlaqeNo ratings yet

- Your 2013 Income Taxes Have Gone UP Folks!Document2 pagesYour 2013 Income Taxes Have Gone UP Folks!mikerogeroNo ratings yet

- Fabm2 Q2 W4 5Document8 pagesFabm2 Q2 W4 5maeesotoNo ratings yet

- ACC 3013 Taxation RevisionDocument4 pagesACC 3013 Taxation Revisionfalnuaimi001No ratings yet

- Taxtable 2022 23 - FinalDocument3 pagesTaxtable 2022 23 - FinalfmpallabNo ratings yet

- Acc 3013 - Fwa Revision QuestionsDocument12 pagesAcc 3013 - Fwa Revision Questionsfalnuaimi001No ratings yet

- Chapter 8 Solutions Cash Flow Statement: Account ClassificationDocument43 pagesChapter 8 Solutions Cash Flow Statement: Account Classificationmit111217No ratings yet

- Application Level Corporate Laws Practices Nov Dec 2013Document3 pagesApplication Level Corporate Laws Practices Nov Dec 2013Timothy GillespieNo ratings yet

- Solutions To End-Of-Chapter ProblemsDocument22 pagesSolutions To End-Of-Chapter ProblemsKalyani GogoiNo ratings yet

- AdvAcct Chapter04 Solutions 07.13Document35 pagesAdvAcct Chapter04 Solutions 07.13Andrew Gladue100% (1)

- Chapter 2 SolutionsDocument5 pagesChapter 2 SolutionskendozxNo ratings yet

- ACC 3013 - Revision Material - 201920Document34 pagesACC 3013 - Revision Material - 201920falnuaimi001No ratings yet

- Fifth PartDocument17 pagesFifth PartMahsinur RahmanNo ratings yet

- 2021 T2 TPLA601 Final Exam STUDENT v1Document16 pages2021 T2 TPLA601 Final Exam STUDENT v1Anas HassanNo ratings yet

- Principle and Practice of TaxationDocument5 pagesPrinciple and Practice of TaxationAgyeiNo ratings yet

- ASSIGNMENT NO. 3 Chapter 7 Regular Income TaxationDocument4 pagesASSIGNMENT NO. 3 Chapter 7 Regular Income TaxationElaiza Jayne PongaseNo ratings yet

- CH 9 Student Form SolutionDocument1 pageCH 9 Student Form SolutionAddri MaulanaNo ratings yet

- ACC 3013 Taxation Revision - TEST 2Document4 pagesACC 3013 Taxation Revision - TEST 2falnuaimi001No ratings yet

- Problems Accouting For Deferred Taxes Webinar ReoDocument7 pagesProblems Accouting For Deferred Taxes Webinar ReocrookshanksNo ratings yet

- ACC 3013 Revision Material..Document22 pagesACC 3013 Revision Material..falnuaimi001No ratings yet

- Hafiz Mahmood Ul Hassan Cash Flow StatementDocument3 pagesHafiz Mahmood Ul Hassan Cash Flow StatementHafiz Mahmood Ul HassanNo ratings yet

- Scenario1 Details 0Document3 pagesScenario1 Details 0Karthik RagupathyNo ratings yet

- Chapter 11 TaxDocument11 pagesChapter 11 Taxkp_popinjNo ratings yet

- F6uk 2011 Dec QDocument12 pagesF6uk 2011 Dec Qmosherif2011No ratings yet

- TA U6 Salaries 4 PA3 PDFDocument5 pagesTA U6 Salaries 4 PA3 PDFRafaelKwongNo ratings yet

- Mock E Exam Pap ERDocument19 pagesMock E Exam Pap ERtim_rattanaNo ratings yet

- BMA Guidance On Restricting Pensions Tax Relief - October 2010Document6 pagesBMA Guidance On Restricting Pensions Tax Relief - October 2010fernandofloridoNo ratings yet

- Week 4 FA Lecture BBDocument24 pagesWeek 4 FA Lecture BBkk23212No ratings yet

- Chapter 3Document4 pagesChapter 3Rosemarie Mae DezaNo ratings yet

- F6UK 2012 Dec AnsDocument9 pagesF6UK 2012 Dec AnsamirahimiNo ratings yet

- 29 Ke-toan-quoc-te-2 201109 Đề-01 Cky3 CLC 13h30 10.09.2021-2Document10 pages29 Ke-toan-quoc-te-2 201109 Đề-01 Cky3 CLC 13h30 10.09.2021-2uthanh2209No ratings yet

- 1TAX 301 SEP DiscussionDocument3 pages1TAX 301 SEP DiscussionChristine Merry AbionNo ratings yet

- What Is Annualized Withholding TaxDocument7 pagesWhat Is Annualized Withholding TaxMarietta Fragata RamiterreNo ratings yet

- Problems On Individual Taxation AY 2020-21 StudentsDocument9 pagesProblems On Individual Taxation AY 2020-21 StudentsAminul Islam RubelNo ratings yet

- Financial Statements, Cash Flow, and TaxesDocument23 pagesFinancial Statements, Cash Flow, and TaxesSaad KhanNo ratings yet

- Assignment1 FTX Team3Document17 pagesAssignment1 FTX Team3Sergelen TurkhuuNo ratings yet

- Lecture Notes Week 1 2022Document26 pagesLecture Notes Week 1 2022Anton BessonovNo ratings yet

- FUNDALES BTAX MidtermsDocument4 pagesFUNDALES BTAX MidtermsE. RobertNo ratings yet

- F6 Mock - Exm - Answers - Dec2012Document17 pagesF6 Mock - Exm - Answers - Dec2012Inga ȚîgaiNo ratings yet

- Topic 1: Accounting For Income TaxesDocument13 pagesTopic 1: Accounting For Income TaxesPillos Jr., ElimarNo ratings yet

- Computation of Taxable IncomeDocument9 pagesComputation of Taxable IncomeVikas WadmareNo ratings yet

- Tax 301 Module 2 Part 2-1Document23 pagesTax 301 Module 2 Part 2-1Christine Merry AbionNo ratings yet

- Activity 2 Income TaxationDocument5 pagesActivity 2 Income TaxationEd HernandezNo ratings yet

- Income Tax Practice Questions 1Document8 pagesIncome Tax Practice Questions 1bamberoNo ratings yet

- The Art of SuccessDocument39 pagesThe Art of Successbehzadji7No ratings yet

- Ism-e-Azam by Khwaja Shamsuddin AzeemiDocument146 pagesIsm-e-Azam by Khwaja Shamsuddin Azeemibehzadji7100% (1)

- Kahan HoDocument47 pagesKahan Hobehzadji7No ratings yet

- The Decisive Debate by Mawlana Muhammad Manzur Ahmad NumaniDocument93 pagesThe Decisive Debate by Mawlana Muhammad Manzur Ahmad Numanibehzadji7No ratings yet

- Sa Jan13 P6uk Travellers PDFDocument9 pagesSa Jan13 P6uk Travellers PDFbehzadji7No ratings yet

- NCAs PracticeDocument3 pagesNCAs Practicebehzadji7No ratings yet

- Basis PeriodDocument26 pagesBasis Periodbehzadji7No ratings yet

- Lecture 1 - Seminar QuestionsDocument5 pagesLecture 1 - Seminar Questionsbehzadji7No ratings yet

- To What Extent Is The Labour Party Still Committed To Its Traditional Principles?Document1 pageTo What Extent Is The Labour Party Still Committed To Its Traditional Principles?behzadji7No ratings yet

- Kahan Ho Tum by Farhat Abbas ShahDocument47 pagesKahan Ho Tum by Farhat Abbas Shahbehzadji7No ratings yet

Questions: Tolley Tax Training Questions For Chapter 3

Questions: Tolley Tax Training Questions For Chapter 3

Uploaded by

behzadji7Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Questions: Tolley Tax Training Questions For Chapter 3

Questions: Tolley Tax Training Questions For Chapter 3

Uploaded by

behzadji7Copyright:

Available Formats

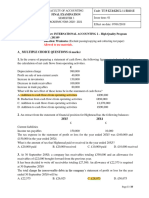

Tolley Tax Training

Questions for Chapter 3

QUESTIONS

3.1

Evelyn has the following income in 2010/11: 16,330 310 275 560

Salary from part time job (PAYE deducted 2,000) Interest received on NS&I investment account Interest received on her ISA Interest received on her Egg current account Calculate her tax due/repayable for the year.

3.2

Frank has the following income in 2010/11: 42,600 2,000 1,200

Salary (before PAYE deducted 6,630) Interest received on RBS deposit account Interest received on NS&I income bonds Calculate his tax due/repayable for the year. 3.3 Gretchen has the following income in 2010/11:

Rental income from house in Leeds Interest on government stocks Interest on loan to work colleague Calculate her tax due/repayable for the year.

5,000 25,000 100

3.4

Hayley has the following income in 2010/11: 140,000 20,000

Salary (before PAYE deducted 48,205) Interest received on Nationwide account Calculate her tax due/repayable for the year.

Reed Elsevier UK Ltd 2010

3.1

FA 2010

Tolley Tax Training

Questions for Chapter 3

Reed Elsevier UK Ltd 2010

3.2

FA 2010

Tolley Tax Training

Questions for Chapter 3

ANSWERS

3.1 Interest on an ISA is exempt from tax.

Non savings

Salary Interest (gross) Taxed income 100 560 x 80 Less: Personal Allowance Taxable income

16,330

Interest

310

(6,475) 9,855

700 ____ 1,010 1,971 202 2,173 (2,000) (140) 33

9,855 @ 20% 1,010 @ 20% Tax liability Less: PAYE Tax on interest (700 @ 20%) Tax payable

Tax

3.2

Non Savings

Salary RBS Interest 100 (2,000 x ) 80 NS&I income bonds Net income Less: Personal Allowance Taxable income 42,600

Interest

2,500 _____ 42,600 (6,475) 36,125 1,200 3,700 _____ 3,700

36,125 @ 20% 1,275 @ 20% 37,400 2,425 @ 40% Tax liability Less: PAYE deducted Tax deducted on interest (2,500 @ 20%) Tax due

Reed Elsevier UK Ltd 2010 3.3

Tax

7,225 255 970 8,450 (6,630) (500) 1,320

FA 2010

Tolley Tax Training

Questions for Chapter 3

3.3

Non Savings

Rental income Government stock interest Interest from colleague Net income Less: Personal Allowance Taxable Income

5,000

Interest

_____ 5,000 (5,000) NIL

25,000 100 25,100 (1,475) 23,625

2,440 @ 10% 21,185 @ 20% Tax liability = tax due

Tax

244 4,237 4,481

3.4

Non savings

Salary Nationwide interest 100 (20,000 x ) 80 Net income Less: Personal Allowance (reduced to nil) Taxable income

140,000

Interest

_____ 140,000 140,000

25,000 25,000 25,000

37,400 @ 20% 102,600 @ 40% 140,000 10,000 @ 40% 150,000 15,000 @ 50% Tax liability Less: PAYE Tax on interest (25,000 @ 20%) Tax due

Tax

7,480 41,040 4,000 7,500 60,020 (48,205) (5,000) 6,815

Reed Elsevier UK Ltd 2010

3.4

FA 2010

You might also like

- Tax Melville AnswersDocument58 pagesTax Melville AnswersAmrita Dhasmana25% (4)

- ACC 3013 - FWA - Revision - 202110Document14 pagesACC 3013 - FWA - Revision - 202110falnuaimi001No ratings yet

- Taxation (United Kingdom) : Monday 6 June 2011Document14 pagesTaxation (United Kingdom) : Monday 6 June 2011tayabkhalidNo ratings yet

- MG 3027 TAXATION - Week 2 Introduction To Income TaxDocument39 pagesMG 3027 TAXATION - Week 2 Introduction To Income TaxSyed SafdarNo ratings yet

- PM Rishi Sunak Tax SummaryDocument3 pagesPM Rishi Sunak Tax SummaryCallum JonesNo ratings yet

- MGT 225 Intermediate Accounting IIDocument6 pagesMGT 225 Intermediate Accounting IIchetna sharmaNo ratings yet

- F6uk 2012 Dec QDocument13 pagesF6uk 2012 Dec QSaad HassanNo ratings yet

- Acc 3013 - Fwa Revision AnswersDocument15 pagesAcc 3013 - Fwa Revision Answersfalnuaimi001No ratings yet

- Stanley Sloth Ltd'sDocument9 pagesStanley Sloth Ltd'sZENAB ALINo ratings yet

- 202 2011 2 eDocument36 pages202 2011 2 ePrince McBossmanNo ratings yet

- PIT03 The Taxation of InterestDocument10 pagesPIT03 The Taxation of InterestAlellie Khay D JordanNo ratings yet

- Employment Income TaxDocument20 pagesEmployment Income TaxBizu AtnafuNo ratings yet

- Income Tax Rates, Rebates & DeductionsDocument35 pagesIncome Tax Rates, Rebates & DeductionsMaryam IkhlaqeNo ratings yet

- Your 2013 Income Taxes Have Gone UP Folks!Document2 pagesYour 2013 Income Taxes Have Gone UP Folks!mikerogeroNo ratings yet

- Fabm2 Q2 W4 5Document8 pagesFabm2 Q2 W4 5maeesotoNo ratings yet

- ACC 3013 Taxation RevisionDocument4 pagesACC 3013 Taxation Revisionfalnuaimi001No ratings yet

- Taxtable 2022 23 - FinalDocument3 pagesTaxtable 2022 23 - FinalfmpallabNo ratings yet

- Acc 3013 - Fwa Revision QuestionsDocument12 pagesAcc 3013 - Fwa Revision Questionsfalnuaimi001No ratings yet

- Chapter 8 Solutions Cash Flow Statement: Account ClassificationDocument43 pagesChapter 8 Solutions Cash Flow Statement: Account Classificationmit111217No ratings yet

- Application Level Corporate Laws Practices Nov Dec 2013Document3 pagesApplication Level Corporate Laws Practices Nov Dec 2013Timothy GillespieNo ratings yet

- Solutions To End-Of-Chapter ProblemsDocument22 pagesSolutions To End-Of-Chapter ProblemsKalyani GogoiNo ratings yet

- AdvAcct Chapter04 Solutions 07.13Document35 pagesAdvAcct Chapter04 Solutions 07.13Andrew Gladue100% (1)

- Chapter 2 SolutionsDocument5 pagesChapter 2 SolutionskendozxNo ratings yet

- ACC 3013 - Revision Material - 201920Document34 pagesACC 3013 - Revision Material - 201920falnuaimi001No ratings yet

- Fifth PartDocument17 pagesFifth PartMahsinur RahmanNo ratings yet

- 2021 T2 TPLA601 Final Exam STUDENT v1Document16 pages2021 T2 TPLA601 Final Exam STUDENT v1Anas HassanNo ratings yet

- Principle and Practice of TaxationDocument5 pagesPrinciple and Practice of TaxationAgyeiNo ratings yet

- ASSIGNMENT NO. 3 Chapter 7 Regular Income TaxationDocument4 pagesASSIGNMENT NO. 3 Chapter 7 Regular Income TaxationElaiza Jayne PongaseNo ratings yet

- CH 9 Student Form SolutionDocument1 pageCH 9 Student Form SolutionAddri MaulanaNo ratings yet

- ACC 3013 Taxation Revision - TEST 2Document4 pagesACC 3013 Taxation Revision - TEST 2falnuaimi001No ratings yet

- Problems Accouting For Deferred Taxes Webinar ReoDocument7 pagesProblems Accouting For Deferred Taxes Webinar ReocrookshanksNo ratings yet

- ACC 3013 Revision Material..Document22 pagesACC 3013 Revision Material..falnuaimi001No ratings yet

- Hafiz Mahmood Ul Hassan Cash Flow StatementDocument3 pagesHafiz Mahmood Ul Hassan Cash Flow StatementHafiz Mahmood Ul HassanNo ratings yet

- Scenario1 Details 0Document3 pagesScenario1 Details 0Karthik RagupathyNo ratings yet

- Chapter 11 TaxDocument11 pagesChapter 11 Taxkp_popinjNo ratings yet

- F6uk 2011 Dec QDocument12 pagesF6uk 2011 Dec Qmosherif2011No ratings yet

- TA U6 Salaries 4 PA3 PDFDocument5 pagesTA U6 Salaries 4 PA3 PDFRafaelKwongNo ratings yet

- Mock E Exam Pap ERDocument19 pagesMock E Exam Pap ERtim_rattanaNo ratings yet

- BMA Guidance On Restricting Pensions Tax Relief - October 2010Document6 pagesBMA Guidance On Restricting Pensions Tax Relief - October 2010fernandofloridoNo ratings yet

- Week 4 FA Lecture BBDocument24 pagesWeek 4 FA Lecture BBkk23212No ratings yet

- Chapter 3Document4 pagesChapter 3Rosemarie Mae DezaNo ratings yet

- F6UK 2012 Dec AnsDocument9 pagesF6UK 2012 Dec AnsamirahimiNo ratings yet

- 29 Ke-toan-quoc-te-2 201109 Đề-01 Cky3 CLC 13h30 10.09.2021-2Document10 pages29 Ke-toan-quoc-te-2 201109 Đề-01 Cky3 CLC 13h30 10.09.2021-2uthanh2209No ratings yet

- 1TAX 301 SEP DiscussionDocument3 pages1TAX 301 SEP DiscussionChristine Merry AbionNo ratings yet

- What Is Annualized Withholding TaxDocument7 pagesWhat Is Annualized Withholding TaxMarietta Fragata RamiterreNo ratings yet

- Problems On Individual Taxation AY 2020-21 StudentsDocument9 pagesProblems On Individual Taxation AY 2020-21 StudentsAminul Islam RubelNo ratings yet

- Financial Statements, Cash Flow, and TaxesDocument23 pagesFinancial Statements, Cash Flow, and TaxesSaad KhanNo ratings yet

- Assignment1 FTX Team3Document17 pagesAssignment1 FTX Team3Sergelen TurkhuuNo ratings yet

- Lecture Notes Week 1 2022Document26 pagesLecture Notes Week 1 2022Anton BessonovNo ratings yet

- FUNDALES BTAX MidtermsDocument4 pagesFUNDALES BTAX MidtermsE. RobertNo ratings yet

- F6 Mock - Exm - Answers - Dec2012Document17 pagesF6 Mock - Exm - Answers - Dec2012Inga ȚîgaiNo ratings yet

- Topic 1: Accounting For Income TaxesDocument13 pagesTopic 1: Accounting For Income TaxesPillos Jr., ElimarNo ratings yet

- Computation of Taxable IncomeDocument9 pagesComputation of Taxable IncomeVikas WadmareNo ratings yet

- Tax 301 Module 2 Part 2-1Document23 pagesTax 301 Module 2 Part 2-1Christine Merry AbionNo ratings yet

- Activity 2 Income TaxationDocument5 pagesActivity 2 Income TaxationEd HernandezNo ratings yet

- Income Tax Practice Questions 1Document8 pagesIncome Tax Practice Questions 1bamberoNo ratings yet

- The Art of SuccessDocument39 pagesThe Art of Successbehzadji7No ratings yet

- Ism-e-Azam by Khwaja Shamsuddin AzeemiDocument146 pagesIsm-e-Azam by Khwaja Shamsuddin Azeemibehzadji7100% (1)

- Kahan HoDocument47 pagesKahan Hobehzadji7No ratings yet

- The Decisive Debate by Mawlana Muhammad Manzur Ahmad NumaniDocument93 pagesThe Decisive Debate by Mawlana Muhammad Manzur Ahmad Numanibehzadji7No ratings yet

- Sa Jan13 P6uk Travellers PDFDocument9 pagesSa Jan13 P6uk Travellers PDFbehzadji7No ratings yet

- NCAs PracticeDocument3 pagesNCAs Practicebehzadji7No ratings yet

- Basis PeriodDocument26 pagesBasis Periodbehzadji7No ratings yet

- Lecture 1 - Seminar QuestionsDocument5 pagesLecture 1 - Seminar Questionsbehzadji7No ratings yet

- To What Extent Is The Labour Party Still Committed To Its Traditional Principles?Document1 pageTo What Extent Is The Labour Party Still Committed To Its Traditional Principles?behzadji7No ratings yet

- Kahan Ho Tum by Farhat Abbas ShahDocument47 pagesKahan Ho Tum by Farhat Abbas Shahbehzadji7No ratings yet