Professional Documents

Culture Documents

Market Report - 17 January 2024

Market Report - 17 January 2024

Uploaded by

kelvinizimburaCopyright:

Available Formats

You might also like

- Operation and Instruction Manual Model DB PumpDocument54 pagesOperation and Instruction Manual Model DB PumpJustin Zimmerman100% (6)

- Portofoliu Tradeville Mai 2023Document2 pagesPortofoliu Tradeville Mai 2023fk6dfdxjkhNo ratings yet

- Boeing Current Market Outlook 2021Document20 pagesBoeing Current Market Outlook 2021VaibhavNo ratings yet

- Gregory Mankiw Ten Economic PrinciplesDocument2 pagesGregory Mankiw Ten Economic PrinciplesKumander AlibasbasNo ratings yet

- DSE. MKT REP 5 May 2016Document6 pagesDSE. MKT REP 5 May 2016Antony KashubeNo ratings yet

- MKT RPT 30 October 2020Document8 pagesMKT RPT 30 October 2020antonyNo ratings yet

- Dar Es Salaam Stock Exchange Market Report Tuesday, 7 March, 2017Document8 pagesDar Es Salaam Stock Exchange Market Report Tuesday, 7 March, 2017FatherNo ratings yet

- Dar Es Salaam Stock Exchange Market Report Monday, 6 March, 2017Document8 pagesDar Es Salaam Stock Exchange Market Report Monday, 6 March, 2017FatherNo ratings yet

- Analisa 1-16Document1 pageAnalisa 1-16KPH BaliNo ratings yet

- DailyPrices 30 06 21Document1 pageDailyPrices 30 06 21emmanuel mtizwaNo ratings yet

- Market Update 25th April 2018Document1 pageMarket Update 25th April 2018Anonymous iFZbkNwNo ratings yet

- Market Update 11th April 2018Document1 pageMarket Update 11th April 2018Anonymous iFZbkNwNo ratings yet

- Analisa 1-25Document1 pageAnalisa 1-25KPH BaliNo ratings yet

- Market Update 8th February 2018Document1 pageMarket Update 8th February 2018Anonymous iFZbkNwNo ratings yet

- Market Update 4th April 2018Document1 pageMarket Update 4th April 2018Anonymous iFZbkNwNo ratings yet

- Market Update 13th March 2018Document1 pageMarket Update 13th March 2018Anonymous iFZbkNwNo ratings yet

- 4.2.2020 Market Daily Report PDFDocument5 pages4.2.2020 Market Daily Report PDFMsuyaNo ratings yet

- Aanugandu - Uwr DredgingDocument1 pageAanugandu - Uwr Dredgingsasikumarcivil1996No ratings yet

- TheSun 2009-09-15 Page19 Energy Giants To Develop Huge Aussie Gas FieldDocument1 pageTheSun 2009-09-15 Page19 Energy Giants To Develop Huge Aussie Gas FieldImpulsive collectorNo ratings yet

- Dar Es Salaam Stock Exchange: Market Report Wednesday, 10 ʰ June 2020Document5 pagesDar Es Salaam Stock Exchange: Market Report Wednesday, 10 ʰ June 2020Hanzuruni RashidiNo ratings yet

- ReinforcementDocument9 pagesReinforcementAnoop VgNo ratings yet

- Thesun 2009-10-21 Page15 Msia Lags Rich Nations in Corporate Remuneration DisclosureDocument1 pageThesun 2009-10-21 Page15 Msia Lags Rich Nations in Corporate Remuneration DisclosureImpulsive collectorNo ratings yet

- The Philippine Stock Exchange, Inc. Daily Quotation Report: January 03, 2022Document11 pagesThe Philippine Stock Exchange, Inc. Daily Quotation Report: January 03, 2022craftersxNo ratings yet

- Client Symbol Series Netqty Netprice MTM Optionty Pe Instrume NT Strikepric E Marketpri CeDocument3 pagesClient Symbol Series Netqty Netprice MTM Optionty Pe Instrume NT Strikepric E Marketpri CeRounak ChowdhuryNo ratings yet

- Market Update 6th February 2018Document1 pageMarket Update 6th February 2018Anonymous iFZbkNwNo ratings yet

- Thesun 2009-06-04 Page13 Eas Leaders Firm Against Protectionist MeasuresDocument1 pageThesun 2009-06-04 Page13 Eas Leaders Firm Against Protectionist MeasuresImpulsive collectorNo ratings yet

- Market Update 31st August 2017Document1 pageMarket Update 31st August 2017Anonymous iFZbkNwNo ratings yet

- Agri TechDocument1 pageAgri TechUsama FarooqNo ratings yet

- Market Update 7th February 2018Document1 pageMarket Update 7th February 2018Anonymous iFZbkNwNo ratings yet

- Market Update 20th November 2017Document1 pageMarket Update 20th November 2017Anonymous iFZbkNwNo ratings yet

- Personal Loan 2Document14 pagesPersonal Loan 2Naushin SharminNo ratings yet

- Blank Dna FormatDocument15 pagesBlank Dna FormatDhruv AryanNo ratings yet

- Upto PlinthDocument25 pagesUpto PlinthAjayvidyanand SharmaNo ratings yet

- September 2021comparative ReportDocument9 pagesSeptember 2021comparative ReportIts MAESONNo ratings yet

- July 11 - July 27Document12 pagesJuly 11 - July 27April NNo ratings yet

- Client Symbol Series Netqty Netprice MTM Optionty Pe Strikepric E Marketpri Ce Mtmvpo SDocument3 pagesClient Symbol Series Netqty Netprice MTM Optionty Pe Strikepric E Marketpri Ce Mtmvpo SRounak ChowdhuryNo ratings yet

- The Philippine Stock Exchange, Inc. Daily Quotation Report: February 09, 2022Document11 pagesThe Philippine Stock Exchange, Inc. Daily Quotation Report: February 09, 2022craftersxNo ratings yet

- DailyPrices 30 06 22Document1 pageDailyPrices 30 06 22emmanuel mtizwaNo ratings yet

- Thesun 2009-10-14 Page15 Merrill Lynch Upbeat On Asia Pacific EconomiesDocument1 pageThesun 2009-10-14 Page15 Merrill Lynch Upbeat On Asia Pacific EconomiesImpulsive collectorNo ratings yet

- D Lemc: Commercial InvoiceDocument3 pagesD Lemc: Commercial InvoiceAudreyMarieNo ratings yet

- InvoiceDocument3 pagesInvoiceAudreyMarieNo ratings yet

- Closingrates 202431janDocument21 pagesClosingrates 202431janmdcat466No ratings yet

- SMTC 21102021Document24 pagesSMTC 21102021RoshniNo ratings yet

- DailyPrices 26 06 20Document1 pageDailyPrices 26 06 20emmanuel mtizwaNo ratings yet

- 1136 Cost Summary Report Jan 2011Document8 pages1136 Cost Summary Report Jan 2011Vasim ShaikhNo ratings yet

- ErgysDocument1 pageErgysbledxhepa081No ratings yet

- Market Update 27th November 2017Document1 pageMarket Update 27th November 2017Anonymous iFZbkNwNo ratings yet

- DRAFT Sarvay Sea MercyDocument10 pagesDRAFT Sarvay Sea Mercyamino BakirNo ratings yet

- Ero"" "Iltjtia: Kerala Cardamom Marketing Company LimitedDocument25 pagesEro"" "Iltjtia: Kerala Cardamom Marketing Company LimitedRoshniNo ratings yet

- BBS Link OrderDocument4 pagesBBS Link OrderLallamaNo ratings yet

- Closingrates 202313junDocument19 pagesClosingrates 202313junTabrez IrfanNo ratings yet

- BAN000127 - NS Industry Champ - LUMPSUM - SM - 20240221 - 124806Document2 pagesBAN000127 - NS Industry Champ - LUMPSUM - SM - 20240221 - 124806Realm PhangchoNo ratings yet

- Stockquotes 03012023Document13 pagesStockquotes 03012023Jonathan M.No ratings yet

- Alpha Opcost2013Document20 pagesAlpha Opcost2013Mrjunecarlo HazerahnNo ratings yet

- NLI Securities Limited: Direct Trading AccountDocument12 pagesNLI Securities Limited: Direct Trading AccountSaiful IslamNo ratings yet

- PSE May 22 2024 EODDocument14 pagesPSE May 22 2024 EODakiraNo ratings yet

- Stockquotes 02012023Document13 pagesStockquotes 02012023Jonathan M.No ratings yet

- Thesun 2009-06-18 Page17 Obama To Unveil Financial Supervision ReformsDocument1 pageThesun 2009-06-18 Page17 Obama To Unveil Financial Supervision ReformsImpulsive collector100% (1)

- Symbol Value: Date 02-MAR-18 06:20 PMDocument2 pagesSymbol Value: Date 02-MAR-18 06:20 PMHussain AliNo ratings yet

- Dar Es Salaam Stock Exchange: Market Report Tuesday, 30 ʰ June 2020Document5 pagesDar Es Salaam Stock Exchange: Market Report Tuesday, 30 ʰ June 2020Muksin NgakolaNo ratings yet

- Cost Control Spreadsheet - Piling WorksDocument2 pagesCost Control Spreadsheet - Piling WorksFaiz AhmadNo ratings yet

- Market Update 30th August 2017Document1 pageMarket Update 30th August 2017Anonymous iFZbkNwNo ratings yet

- Komunikasi Krisis Perusahaan TelekomunikasiDocument8 pagesKomunikasi Krisis Perusahaan TelekomunikasiDelia NurusyifaNo ratings yet

- Gold Prices During and After RecessionDocument8 pagesGold Prices During and After RecessionShakinah ShirinNo ratings yet

- Elevator and Escalator Installation Progress of WaterFront ProjectDocument7 pagesElevator and Escalator Installation Progress of WaterFront ProjectLakshan FonsekaNo ratings yet

- Test Bank Chapter 15 Investment BodieDocument42 pagesTest Bank Chapter 15 Investment BodieTami DoanNo ratings yet

- Chapter 2Document7 pagesChapter 2IanNo ratings yet

- G Ferrero - Az Ókor Civilizáció Bukása 4Document80 pagesG Ferrero - Az Ókor Civilizáció Bukása 4Anton KhimNo ratings yet

- CA Final SFM New Syllabus Full Chalisa Book by Aaditya Jain SirDocument48 pagesCA Final SFM New Syllabus Full Chalisa Book by Aaditya Jain SirYedu KrishnanNo ratings yet

- .TFFL:: Lls4Lxj - It:IisjfifDocument1 page.TFFL:: Lls4Lxj - It:IisjfifPANDILAKSHMINo ratings yet

- Course Ouline Financial InstitutionsDocument5 pagesCourse Ouline Financial InstitutionsSherif ElSheemyNo ratings yet

- AssignmentDocument5 pagesAssignmentpankajjaiswal60No ratings yet

- Test of Relationship Between Exchange Rate and Inflation in South Sudan: Granger-Causality ApproachDocument7 pagesTest of Relationship Between Exchange Rate and Inflation in South Sudan: Granger-Causality ApproachlukeniaNo ratings yet

- A.Haque, B.Rahm - Traffic AnalysisDocument5 pagesA.Haque, B.Rahm - Traffic AnalysisDhaabar SalaaxNo ratings yet

- COMPETING SCHOOLS OF THOGHT IN MACROECNOMICS Gerrard1996Document20 pagesCOMPETING SCHOOLS OF THOGHT IN MACROECNOMICS Gerrard1996dawitNo ratings yet

- Nang CaoDocument5 pagesNang CaoLinh ChuNo ratings yet

- Alpha C&S and Thematic PortfolioDocument24 pagesAlpha C&S and Thematic PortfolioSaurabh KothariNo ratings yet

- Shava & Masuku - Living Currency - The Multiple Roles of Livestock in Livelihood Sustenance and Exchange in The Context of Rural Indigenous Communities in Southern AfricaDocument13 pagesShava & Masuku - Living Currency - The Multiple Roles of Livestock in Livelihood Sustenance and Exchange in The Context of Rural Indigenous Communities in Southern AfricachazunguzaNo ratings yet

- Solved Problems and Exercises-DepreciationDocument7 pagesSolved Problems and Exercises-DepreciationKaranNo ratings yet

- Cashback Offer T&C Feb 15th To March1stDocument8 pagesCashback Offer T&C Feb 15th To March1stShubham PalNo ratings yet

- 13 Nilufer-CaliskanDocument7 pages13 Nilufer-Caliskanab theproNo ratings yet

- Booking Invoice M06ai23i01024843Document2 pagesBooking Invoice M06ai23i01024843AkshayMilmileNo ratings yet

- Basel II PresentationDocument21 pagesBasel II PresentationMuhammad SaqibNo ratings yet

- A Basic Description of The Crude PropertiesDocument6 pagesA Basic Description of The Crude PropertiesPriya NarayanNo ratings yet

- Activity Based Costing-A Tool To Aid Decision MakingDocument54 pagesActivity Based Costing-A Tool To Aid Decision MakingSederiku KabaruzaNo ratings yet

- Bank of Tanzania: TZS '000 TZS '000Document1 pageBank of Tanzania: TZS '000 TZS '000MKUTA PTBLDNo ratings yet

- Acronyms and AbbreviationsDocument1 pageAcronyms and AbbreviationsSabrina CarriónNo ratings yet

- Special Permit To TransferDocument4 pagesSpecial Permit To TransferMonique Lab-you100% (1)

- Vat ZNZDocument6 pagesVat ZNZAndrey PavlovskiyNo ratings yet

Market Report - 17 January 2024

Market Report - 17 January 2024

Uploaded by

kelvinizimburaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Market Report - 17 January 2024

Market Report - 17 January 2024

Uploaded by

kelvinizimburaCopyright:

Available Formats

SOLOMON Stockbrokers Limited

Member of Dar es Salaam Stock Exchange

Authorized Dealer of Government Securities

www.solomon.co.tz

e-Market Report

Reach | Access | Invest™ Thursday, January 18, 2024

Market Report for Wednesday, 17 January 2024

DSE recorded a total turnover of TZS 760.12 Mln from 1,669,700 shares traded in 187 deals; and TZS 1.53 Bln from bond traded in 22

deals.

On Pre-Arranged Market board, CRDB counter had 847,230 shares traded at TZS 460 per share in 8 deals. CRDB counter had 710,473

shares traded at a weighted average price of TZS 460 per share in 150 deals. DCB counter had 100 shares traded at a weighted average

price of TZS 135 per share in 2 deals. DSE counter had 348 shares traded at a weighted average price of TZS 1,800 per share in 3 deals.

NMB counter had 1,696 shares traded at a weighted average price of TZS 4,500 per share in 8 deals. TCCL counter had 1,512 shares

traded at a weighted average price of TZS 2,260 per share in 2 deals. TICL counter had 101,140 shares traded at a weighted average price

of TZS 190 per share in 14 deals. TOL counter had 5,070 shares traded at a weighted average price of TZS 660 per share in 2 deals. TPCC

counter had 2,131 shares traded at a weighted average price of TZS 4,340 per share in 4 deals.

On the Government Bonds Board, a 20-year bond with a coupon rate of 15.49% and a face value of TZS 0.23 Bln was traded at prices of

101.0000%, 108.5528%, 110.0000%, 112.5405% and 114.0230% in 6 deals, while a 25-year bond with a coupon rate of 12.56% and a

face value of TZS 1.36 Bln was traded at prices of 89.0000%, 89.0001%, 89.2310%, 89.7344%, 90.0000%, 90.0432%, 90.5000%,

91.9818%, 93.0000%, 95.0874% and 99.2502% in 16 deals.

On the Corporate Bonds Board, a 3-year bond with a coupon rate of 8.50% and a face value of TZS 5.00 Mln was traded at prices of

84.4000 %and 90.0000% in 1 deal, while a 3-year bond with a coupon rate of 9.50% and a face value of TZS 15.00 Mln was traded at

prices of 84.4000% and 90.0000% in 1 deal. The market also traded a 5-year bond with a coupon rate of 10.00% and a face value of TZS

2.00 Mln at a price of 80.0000% in 1 deal.

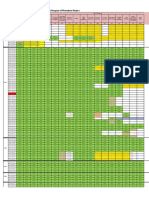

BIDS OFFERS TRADED

Market

Shares Turnover Cap Last

Company Outstanding Price Outstanding Price

Traded (TZS) (Bln) Price

CRDB 2,050 460 12,491 465 1,557,703 716,588,415 1,201.52 460

DCB 5,938 130 250 135 100 13,500 13.18 135

DSE 1,278 1,800 - - 348 626,400 42.88 1,800

JATU - - 5,652 240 - - 5.81 265

MBP - - 200 320 - - 8.06 305

MCB - - 5,610 310 - - 19.17 310

MKCB - - 93 630 - - 18.37 630

MUCOBA - - - - - - 13.07 400

NICO 3,668 510 8,000 540 - - 35.28 510

NMB 10 4,400 4,817 4,500 1,696 7,632,800 2,250.24 4,500

PAL - - 15,093 360 - - 57.77 360

SWALA - - - - - - 47.79 450

SWISS - - - - - - 48.96 1,360

TBL - - 21,894 10,400 - - 3,216.11 10,400

TCC - 20,360 16,200 - - 1,700.00 17,000

TCCL 1,058 2,260 1,950 2,300 1,512 3,419,120 143.90 2,260

TICL 624 195 189,613 200 101,140 19,248,750 13.91 190

TOL - - 10,545 660 5,070 3,346,200 39.06 660

TPCC 4 4,300 36,447 4,340 2,131 9,245,680 780.87 4,340

TTP - - - - - - 11.41 120

VODA - - 140,612 740 - - 1,724.80 740

MARKET SUMMARY GAINERS & LOSERS

Indices 17 January 2024 Company Price Change

TSI 4,283.46 0.00 JHL 2,820 -9.03

DSEI 1,741.21 -7.88 KCB 330 -4.35

NMG 315 -1.56

TRADING STATISTICS TOP MOVERS

Market Cap (Bln) 14,532.89 Company Price Volume

Equity Turnover 760,120,865.00 CRDB 460 1,557,703

Total Volume 1,669,700 TICL 190 101,140

Total Deals 187 TOL 660 5,070

EXCHANGE RATE

CURRENCY BUYING SELLING

KES 15.6234 15.7304

USD 2,495.0594 2,520.0100

ZAR 132.1151 133.391

CORPORATE BONDS

Maturity

Coupon Rate Due Date Remarks

(Years)

NMB JASIRI BOND 3 8.5% March 2025 Interest is quarterly

FURSA SUKUK BOND 3 8.75% December 2025 Interest is quarterly

NMB JAMII BOND 3 9.50% October 2026 Interest is quarterly

NBC TWIGA BOND 5 10% December 2027 Interest is semi-annual

TMRC BOND 5 10.20% May 2028 Interest is semi-annual

CRDB KIJANI BOND 5 10.25% October 2028 Interest is semi-annual

GOVERNMENT BONDS

Maturity Current Previous

Remarks

(Years) Yield % Yield %

2 0.0000 11.6412 7.60% - 2024/26 Issue No.341 held 10.01.2024

5 10.0922 9.6670 8.60% - 2023/28 Issue No.86 held 03.08.2023

7 9.4633 9.3348 9.48% - 2022/29 Issue No.83 held 30.03.2022

10 11.8775 11.5067 11.44% - 2023/33 Issue No.342 held 04.10.2023

15 12.7525 12.3436 11.15% - 2023/38 Issue No.54 held 29.11.2023

20 13.5125 13.0770 12.10% - 2023/43 Issue No.270 held 01.11.2023

25 14.3854 13.8115 12.56% - 2023/48 Issue No.14 held 27.12.2023

[http://www.bot.go.tz]

Treasury Bills Auction Results Summary 17 January 2024

35 days 91 days 182 days 364 days

Offered (000,000) 900.0000 1,900.0000 2,900.0000 72,670.0000

Tendered (000,000) 0.0000 0.0000 0.0000 141,537.5000

Over (-) / Under (+) (000,000) 0.0000 0.0000 0.0000 68,867.5000

Successful (000,000) 0.0000 0.0000 0.0000 126,532.5000

Current (WAY) %: 17.01.2024 0.0000 0.0000 0.0000 11.8074

Previous (WAY) %: 03.01.2024 0.0000 0.0000 0.0000 11.4119

[The auction is usually conducted bi-weekly on Wednesdays. Information thereof will be updated once results are made available]

UPCOMING TREASURY BOND & TREASURY BILLS AUCTION

1. Treasury Bond 10 Years Fixed Rate

Amount Interest Payment Coupon Redemption Trading

(Bln) Auction Date Date

TZS

July 10.25%

- 24 January 2024 25 January 2034 24 January 2024

January

2. Treasury Bills – 17 January 2023

Amount (Mln) Maturities Remarks

TZS

900 35 days

1,900 91 days All maturities will be sold on behalf of the Union Government of

2,900 182 days Tanzania in this auction.

72,670 364 days

[Interest income is subject to 10% withholding tax]

UNIT TRUST OF TANZANIA – ASSET MANAGEMENT & INVESTOR SERVICES: 16 January 2023

FUND TYPE

Sale Price per Unit Repurchase Price per Unit

UMOJA 984.6391 974.7927

WEKEZA 868.6269 851.2544

WATOTO 636.3970 630.0330

JIKIMU 167.8274 164.4709

LIQUID 384.9485 384.9485

BOND 116.1877 116.1877

[http://www.uttamis.co.tz]

WATUMISHI HOUSING INVESTMENT: 17 January 2024

FUND TYPE Sale Price per Unit Repurchase Price per Unit

FAIDA 110.8204 110.8204

[https://www.whi.go.tz/]

For further information please contact: SOLOMON Stockbrokers Limited: 2124495 /2112874 /0764269090 /0714 269090

[All care has been taken in preparing this commercial document, and the information contained therein has been derived from sources believed to be accurate and reliable.

If you are in any doubt about the contents of this document, do not hesitate to contact those mentioned above. SOLOMON Stockbrokers Ltd does not assume responsibility

for any error, omission, or opinion expressed. Anyone acting on the information or opinion does so at his own risk. This information has been sent to you for your information

and may not be reproduced. Unauthorized use or disclosure of this document is strictly prohibited. © Copyright 2023 SOLOMON Stockbrokers Ltd. All rights reserved]

You might also like

- Operation and Instruction Manual Model DB PumpDocument54 pagesOperation and Instruction Manual Model DB PumpJustin Zimmerman100% (6)

- Portofoliu Tradeville Mai 2023Document2 pagesPortofoliu Tradeville Mai 2023fk6dfdxjkhNo ratings yet

- Boeing Current Market Outlook 2021Document20 pagesBoeing Current Market Outlook 2021VaibhavNo ratings yet

- Gregory Mankiw Ten Economic PrinciplesDocument2 pagesGregory Mankiw Ten Economic PrinciplesKumander AlibasbasNo ratings yet

- DSE. MKT REP 5 May 2016Document6 pagesDSE. MKT REP 5 May 2016Antony KashubeNo ratings yet

- MKT RPT 30 October 2020Document8 pagesMKT RPT 30 October 2020antonyNo ratings yet

- Dar Es Salaam Stock Exchange Market Report Tuesday, 7 March, 2017Document8 pagesDar Es Salaam Stock Exchange Market Report Tuesday, 7 March, 2017FatherNo ratings yet

- Dar Es Salaam Stock Exchange Market Report Monday, 6 March, 2017Document8 pagesDar Es Salaam Stock Exchange Market Report Monday, 6 March, 2017FatherNo ratings yet

- Analisa 1-16Document1 pageAnalisa 1-16KPH BaliNo ratings yet

- DailyPrices 30 06 21Document1 pageDailyPrices 30 06 21emmanuel mtizwaNo ratings yet

- Market Update 25th April 2018Document1 pageMarket Update 25th April 2018Anonymous iFZbkNwNo ratings yet

- Market Update 11th April 2018Document1 pageMarket Update 11th April 2018Anonymous iFZbkNwNo ratings yet

- Analisa 1-25Document1 pageAnalisa 1-25KPH BaliNo ratings yet

- Market Update 8th February 2018Document1 pageMarket Update 8th February 2018Anonymous iFZbkNwNo ratings yet

- Market Update 4th April 2018Document1 pageMarket Update 4th April 2018Anonymous iFZbkNwNo ratings yet

- Market Update 13th March 2018Document1 pageMarket Update 13th March 2018Anonymous iFZbkNwNo ratings yet

- 4.2.2020 Market Daily Report PDFDocument5 pages4.2.2020 Market Daily Report PDFMsuyaNo ratings yet

- Aanugandu - Uwr DredgingDocument1 pageAanugandu - Uwr Dredgingsasikumarcivil1996No ratings yet

- TheSun 2009-09-15 Page19 Energy Giants To Develop Huge Aussie Gas FieldDocument1 pageTheSun 2009-09-15 Page19 Energy Giants To Develop Huge Aussie Gas FieldImpulsive collectorNo ratings yet

- Dar Es Salaam Stock Exchange: Market Report Wednesday, 10 ʰ June 2020Document5 pagesDar Es Salaam Stock Exchange: Market Report Wednesday, 10 ʰ June 2020Hanzuruni RashidiNo ratings yet

- ReinforcementDocument9 pagesReinforcementAnoop VgNo ratings yet

- Thesun 2009-10-21 Page15 Msia Lags Rich Nations in Corporate Remuneration DisclosureDocument1 pageThesun 2009-10-21 Page15 Msia Lags Rich Nations in Corporate Remuneration DisclosureImpulsive collectorNo ratings yet

- The Philippine Stock Exchange, Inc. Daily Quotation Report: January 03, 2022Document11 pagesThe Philippine Stock Exchange, Inc. Daily Quotation Report: January 03, 2022craftersxNo ratings yet

- Client Symbol Series Netqty Netprice MTM Optionty Pe Instrume NT Strikepric E Marketpri CeDocument3 pagesClient Symbol Series Netqty Netprice MTM Optionty Pe Instrume NT Strikepric E Marketpri CeRounak ChowdhuryNo ratings yet

- Market Update 6th February 2018Document1 pageMarket Update 6th February 2018Anonymous iFZbkNwNo ratings yet

- Thesun 2009-06-04 Page13 Eas Leaders Firm Against Protectionist MeasuresDocument1 pageThesun 2009-06-04 Page13 Eas Leaders Firm Against Protectionist MeasuresImpulsive collectorNo ratings yet

- Market Update 31st August 2017Document1 pageMarket Update 31st August 2017Anonymous iFZbkNwNo ratings yet

- Agri TechDocument1 pageAgri TechUsama FarooqNo ratings yet

- Market Update 7th February 2018Document1 pageMarket Update 7th February 2018Anonymous iFZbkNwNo ratings yet

- Market Update 20th November 2017Document1 pageMarket Update 20th November 2017Anonymous iFZbkNwNo ratings yet

- Personal Loan 2Document14 pagesPersonal Loan 2Naushin SharminNo ratings yet

- Blank Dna FormatDocument15 pagesBlank Dna FormatDhruv AryanNo ratings yet

- Upto PlinthDocument25 pagesUpto PlinthAjayvidyanand SharmaNo ratings yet

- September 2021comparative ReportDocument9 pagesSeptember 2021comparative ReportIts MAESONNo ratings yet

- July 11 - July 27Document12 pagesJuly 11 - July 27April NNo ratings yet

- Client Symbol Series Netqty Netprice MTM Optionty Pe Strikepric E Marketpri Ce Mtmvpo SDocument3 pagesClient Symbol Series Netqty Netprice MTM Optionty Pe Strikepric E Marketpri Ce Mtmvpo SRounak ChowdhuryNo ratings yet

- The Philippine Stock Exchange, Inc. Daily Quotation Report: February 09, 2022Document11 pagesThe Philippine Stock Exchange, Inc. Daily Quotation Report: February 09, 2022craftersxNo ratings yet

- DailyPrices 30 06 22Document1 pageDailyPrices 30 06 22emmanuel mtizwaNo ratings yet

- Thesun 2009-10-14 Page15 Merrill Lynch Upbeat On Asia Pacific EconomiesDocument1 pageThesun 2009-10-14 Page15 Merrill Lynch Upbeat On Asia Pacific EconomiesImpulsive collectorNo ratings yet

- D Lemc: Commercial InvoiceDocument3 pagesD Lemc: Commercial InvoiceAudreyMarieNo ratings yet

- InvoiceDocument3 pagesInvoiceAudreyMarieNo ratings yet

- Closingrates 202431janDocument21 pagesClosingrates 202431janmdcat466No ratings yet

- SMTC 21102021Document24 pagesSMTC 21102021RoshniNo ratings yet

- DailyPrices 26 06 20Document1 pageDailyPrices 26 06 20emmanuel mtizwaNo ratings yet

- 1136 Cost Summary Report Jan 2011Document8 pages1136 Cost Summary Report Jan 2011Vasim ShaikhNo ratings yet

- ErgysDocument1 pageErgysbledxhepa081No ratings yet

- Market Update 27th November 2017Document1 pageMarket Update 27th November 2017Anonymous iFZbkNwNo ratings yet

- DRAFT Sarvay Sea MercyDocument10 pagesDRAFT Sarvay Sea Mercyamino BakirNo ratings yet

- Ero"" "Iltjtia: Kerala Cardamom Marketing Company LimitedDocument25 pagesEro"" "Iltjtia: Kerala Cardamom Marketing Company LimitedRoshniNo ratings yet

- BBS Link OrderDocument4 pagesBBS Link OrderLallamaNo ratings yet

- Closingrates 202313junDocument19 pagesClosingrates 202313junTabrez IrfanNo ratings yet

- BAN000127 - NS Industry Champ - LUMPSUM - SM - 20240221 - 124806Document2 pagesBAN000127 - NS Industry Champ - LUMPSUM - SM - 20240221 - 124806Realm PhangchoNo ratings yet

- Stockquotes 03012023Document13 pagesStockquotes 03012023Jonathan M.No ratings yet

- Alpha Opcost2013Document20 pagesAlpha Opcost2013Mrjunecarlo HazerahnNo ratings yet

- NLI Securities Limited: Direct Trading AccountDocument12 pagesNLI Securities Limited: Direct Trading AccountSaiful IslamNo ratings yet

- PSE May 22 2024 EODDocument14 pagesPSE May 22 2024 EODakiraNo ratings yet

- Stockquotes 02012023Document13 pagesStockquotes 02012023Jonathan M.No ratings yet

- Thesun 2009-06-18 Page17 Obama To Unveil Financial Supervision ReformsDocument1 pageThesun 2009-06-18 Page17 Obama To Unveil Financial Supervision ReformsImpulsive collector100% (1)

- Symbol Value: Date 02-MAR-18 06:20 PMDocument2 pagesSymbol Value: Date 02-MAR-18 06:20 PMHussain AliNo ratings yet

- Dar Es Salaam Stock Exchange: Market Report Tuesday, 30 ʰ June 2020Document5 pagesDar Es Salaam Stock Exchange: Market Report Tuesday, 30 ʰ June 2020Muksin NgakolaNo ratings yet

- Cost Control Spreadsheet - Piling WorksDocument2 pagesCost Control Spreadsheet - Piling WorksFaiz AhmadNo ratings yet

- Market Update 30th August 2017Document1 pageMarket Update 30th August 2017Anonymous iFZbkNwNo ratings yet

- Komunikasi Krisis Perusahaan TelekomunikasiDocument8 pagesKomunikasi Krisis Perusahaan TelekomunikasiDelia NurusyifaNo ratings yet

- Gold Prices During and After RecessionDocument8 pagesGold Prices During and After RecessionShakinah ShirinNo ratings yet

- Elevator and Escalator Installation Progress of WaterFront ProjectDocument7 pagesElevator and Escalator Installation Progress of WaterFront ProjectLakshan FonsekaNo ratings yet

- Test Bank Chapter 15 Investment BodieDocument42 pagesTest Bank Chapter 15 Investment BodieTami DoanNo ratings yet

- Chapter 2Document7 pagesChapter 2IanNo ratings yet

- G Ferrero - Az Ókor Civilizáció Bukása 4Document80 pagesG Ferrero - Az Ókor Civilizáció Bukása 4Anton KhimNo ratings yet

- CA Final SFM New Syllabus Full Chalisa Book by Aaditya Jain SirDocument48 pagesCA Final SFM New Syllabus Full Chalisa Book by Aaditya Jain SirYedu KrishnanNo ratings yet

- .TFFL:: Lls4Lxj - It:IisjfifDocument1 page.TFFL:: Lls4Lxj - It:IisjfifPANDILAKSHMINo ratings yet

- Course Ouline Financial InstitutionsDocument5 pagesCourse Ouline Financial InstitutionsSherif ElSheemyNo ratings yet

- AssignmentDocument5 pagesAssignmentpankajjaiswal60No ratings yet

- Test of Relationship Between Exchange Rate and Inflation in South Sudan: Granger-Causality ApproachDocument7 pagesTest of Relationship Between Exchange Rate and Inflation in South Sudan: Granger-Causality ApproachlukeniaNo ratings yet

- A.Haque, B.Rahm - Traffic AnalysisDocument5 pagesA.Haque, B.Rahm - Traffic AnalysisDhaabar SalaaxNo ratings yet

- COMPETING SCHOOLS OF THOGHT IN MACROECNOMICS Gerrard1996Document20 pagesCOMPETING SCHOOLS OF THOGHT IN MACROECNOMICS Gerrard1996dawitNo ratings yet

- Nang CaoDocument5 pagesNang CaoLinh ChuNo ratings yet

- Alpha C&S and Thematic PortfolioDocument24 pagesAlpha C&S and Thematic PortfolioSaurabh KothariNo ratings yet

- Shava & Masuku - Living Currency - The Multiple Roles of Livestock in Livelihood Sustenance and Exchange in The Context of Rural Indigenous Communities in Southern AfricaDocument13 pagesShava & Masuku - Living Currency - The Multiple Roles of Livestock in Livelihood Sustenance and Exchange in The Context of Rural Indigenous Communities in Southern AfricachazunguzaNo ratings yet

- Solved Problems and Exercises-DepreciationDocument7 pagesSolved Problems and Exercises-DepreciationKaranNo ratings yet

- Cashback Offer T&C Feb 15th To March1stDocument8 pagesCashback Offer T&C Feb 15th To March1stShubham PalNo ratings yet

- 13 Nilufer-CaliskanDocument7 pages13 Nilufer-Caliskanab theproNo ratings yet

- Booking Invoice M06ai23i01024843Document2 pagesBooking Invoice M06ai23i01024843AkshayMilmileNo ratings yet

- Basel II PresentationDocument21 pagesBasel II PresentationMuhammad SaqibNo ratings yet

- A Basic Description of The Crude PropertiesDocument6 pagesA Basic Description of The Crude PropertiesPriya NarayanNo ratings yet

- Activity Based Costing-A Tool To Aid Decision MakingDocument54 pagesActivity Based Costing-A Tool To Aid Decision MakingSederiku KabaruzaNo ratings yet

- Bank of Tanzania: TZS '000 TZS '000Document1 pageBank of Tanzania: TZS '000 TZS '000MKUTA PTBLDNo ratings yet

- Acronyms and AbbreviationsDocument1 pageAcronyms and AbbreviationsSabrina CarriónNo ratings yet

- Special Permit To TransferDocument4 pagesSpecial Permit To TransferMonique Lab-you100% (1)

- Vat ZNZDocument6 pagesVat ZNZAndrey PavlovskiyNo ratings yet