Professional Documents

Culture Documents

Policydownload 230207 000615-43

Policydownload 230207 000615-43

Uploaded by

Anindya SundarCopyright:

Available Formats

You might also like

- Tangerine-eStatement Jul19 PDFDocument2 pagesTangerine-eStatement Jul19 PDFRudyard Martin Cardozo33% (6)

- Premium ReceiptsDocument1 pagePremium Receiptsmanojsh88870% (1)

- Accounting 1 Chapter 4 TestDocument3 pagesAccounting 1 Chapter 4 TestIvy Long33% (3)

- Max Life Total Premium ReceiptDocument1 pageMax Life Total Premium ReceiptBhavik Thaker100% (1)

- Hotel LeadsDocument17 pagesHotel Leadssanakausar.5089No ratings yet

- Life Insurance Premium Receipt: Personal DetailsDocument1 pageLife Insurance Premium Receipt: Personal DetailsRITIKANo ratings yet

- Max Life InsuranceDocument1 pageMax Life InsuranceLohith Labhala100% (1)

- باسم يوسف العاجDocument1 pageباسم يوسف العاجباسم الحاجNo ratings yet

- Life Insurance Premium Receipt: Personal DetailsDocument1 pageLife Insurance Premium Receipt: Personal Detailssatish varmaNo ratings yet

- Health Insurance Premium Receipt: Personal DetailsDocument1 pageHealth Insurance Premium Receipt: Personal DetailsRanjith BNo ratings yet

- Lecture NotesDocument37 pagesLecture NotesGangadhar MamadapurNo ratings yet

- Old LIC PremiumDocument2 pagesOld LIC PremiumVikrantTandelNo ratings yet

- Max Life Term PlanDocument1 pageMax Life Term PlanShreya JadhavNo ratings yet

- Premium Paid Certificate: Personal DetailsDocument1 pagePremium Paid Certificate: Personal Detailsravikumar281287No ratings yet

- Consolidated Premium Receipt (Chosen Policy)Document1 pageConsolidated Premium Receipt (Chosen Policy)sreeleoenterprisesNo ratings yet

- Maxlife SRMDocument1 pageMaxlife SRMnrcagroNo ratings yet

- Consolidated ReceiptDocument1 pageConsolidated ReceiptSaket TiwariNo ratings yet

- Personal Details: Duration For Which The Premium Is Received: 28/07/2021Document1 pagePersonal Details: Duration For Which The Premium Is Received: 28/07/2021ravi kumarNo ratings yet

- Premium ReceiptDocument1 pagePremium Receiptsvruma2No ratings yet

- Saw G Payment ReceiptDocument1 pageSaw G Payment ReceiptrinkukjanNo ratings yet

- Life Insurance Premium Receipt: Duration For Which The Premium Is Received: 12-DEC-2017 To 11-JAN-2018 Personal DetailsDocument2 pagesLife Insurance Premium Receipt: Duration For Which The Premium Is Received: 12-DEC-2017 To 11-JAN-2018 Personal Detailsnitish rohiraNo ratings yet

- Consolidated ReceiptDocument2 pagesConsolidated Receiptdigital.arun999No ratings yet

- Life Insurance Premium Receipt: Personal DetailsDocument1 pageLife Insurance Premium Receipt: Personal DetailsHarsh Gandhi0% (1)

- Life Insurance InvoiceDocument1 pageLife Insurance InvoiceAkash DesaiNo ratings yet

- Personal Details: Duration For Which The Premium Is Received: 01/04/2023Document1 pagePersonal Details: Duration For Which The Premium Is Received: 01/04/2023bbarle69No ratings yet

- Parents Policy Father PDFDocument1 pageParents Policy Father PDFshamsehrNo ratings yet

- Life Insurance 47KDocument1 pageLife Insurance 47KRaghupathi PaindlaNo ratings yet

- Parents Policy Mother PDFDocument1 pageParents Policy Mother PDFshamsehrNo ratings yet

- Official Receipt 1676234863Document1 pageOfficial Receipt 1676234863vasim hatwadkarNo ratings yet

- Medical InsuranceDocument1 pageMedical Insurancesunil dinodiyaNo ratings yet

- UnlockedDocument1 pageUnlockedAshish NaikNo ratings yet

- Premium Receipt: Personal DetailsDocument1 pagePremium Receipt: Personal DetailssunnybisnoiNo ratings yet

- Premium ReceiptsDocument1 pagePremium ReceiptsVijay PendurthiNo ratings yet

- 2018032388Document1 page2018032388Vengal reddyNo ratings yet

- Consolidated Premium ReceiptDocument1 pageConsolidated Premium ReceiptBhavik ThakerNo ratings yet

- Official Receipt 1676234862Document1 pageOfficial Receipt 1676234862vasim hatwadkarNo ratings yet

- Term Insurance Premium Receipt: Personal DetailsDocument1 pageTerm Insurance Premium Receipt: Personal DetailsRanjith BNo ratings yet

- Life Insurance Premium ReceiptDocument1 pageLife Insurance Premium ReceiptChandPari AkulNo ratings yet

- Life Insurance Premium Receipt: Personal DetailsDocument1 pageLife Insurance Premium Receipt: Personal Detailsnitish rohiraNo ratings yet

- Consolidatedreceipt PDFDocument1 pageConsolidatedreceipt PDFSuyash MishraNo ratings yet

- 297511794-OctDocument1 page297511794-OctVikash SinghNo ratings yet

- Premium Receipts PDFDocument1 pagePremium Receipts PDFAJAY JAISWALNo ratings yet

- Reliance Premium Receipt y M D GDocument1 pageReliance Premium Receipt y M D Gyadavravindranath57No ratings yet

- Circi: InsuranceDocument1 pageCirci: InsuranceapplerajivNo ratings yet

- Premium ReceiptsDocument1 pagePremium Receiptsani dNo ratings yet

- Consolidated Life Insurence Premium Receipt FY-2022-2023-SujanDocument1 pageConsolidated Life Insurence Premium Receipt FY-2022-2023-SujanSujanNo ratings yet

- Premium ReceiptsDocument1 pagePremium ReceiptsNeeraj TyagiNo ratings yet

- (A) Policy Schedule (Policy Certificate) : Policyall 2 2 1 1Document3 pages(A) Policy Schedule (Policy Certificate) : Policyall 2 2 1 1Vijay VemuriNo ratings yet

- Zprmrnot 23345535 17208239Document1 pageZprmrnot 23345535 17208239bharat4u04No ratings yet

- Premium ReceiptsDocument1 pagePremium ReceiptsAmit KumarNo ratings yet

- Life Insurance Premium ReceiptDocument1 pageLife Insurance Premium ReceiptVijayNo ratings yet

- Zprmrnot 22847670 15676911Document1 pageZprmrnot 22847670 15676911Gulshan GavelNo ratings yet

- Insurance 1premiumDocument1 pageInsurance 1premiumBharathNo ratings yet

- Premium Receipt: ' 50,00,000.00 ' 853.78 13-DEC-2020 To 12-JAN-2021 13-JAN-2021Document1 pagePremium Receipt: ' 50,00,000.00 ' 853.78 13-DEC-2020 To 12-JAN-2021 13-JAN-2021ceogaursNo ratings yet

- Premium ReceiptsDocument1 pagePremium ReceiptsThakur Pranay SinghNo ratings yet

- July 3Document1 pageJuly 3Vikash SinghNo ratings yet

- Medical InsuranceDocument1 pageMedical InsuranceMasood AhmadNo ratings yet

- Consolidated ReceiptDocument1 pageConsolidated ReceiptKhushbu GuptaNo ratings yet

- Zprmrnot 23764103 16031216Document1 pageZprmrnot 23764103 16031216Kiran KumarNo ratings yet

- Zprmrnot - 22303149 - 12926353 2Document1 pageZprmrnot - 22303149 - 12926353 2RKGUPTANo ratings yet

- MCLMDocument13 pagesMCLMcibil scoreNo ratings yet

- Zprmrnot 20927762 24235025 231002 181434Document2 pagesZprmrnot 20927762 24235025 231002 181434aanandaman1098No ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific: 2020 EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: 2020 EditionNo ratings yet

- Bcom 4TH SemDocument6 pagesBcom 4TH SemPrakash RNo ratings yet

- Bharti Airtel - SWAT and PESTAL AnalysisDocument7 pagesBharti Airtel - SWAT and PESTAL AnalysisArchu KamatNo ratings yet

- Press Release: Octopus Healthcare Appoints Sheila Hendy As Clinical Assurance DirectorDocument2 pagesPress Release: Octopus Healthcare Appoints Sheila Hendy As Clinical Assurance Directorapi-291693629No ratings yet

- UFCW Local 1262 - Redacted Bates HWDocument13 pagesUFCW Local 1262 - Redacted Bates HWAnonymous kprzCiZNo ratings yet

- Yield If y Fashion e Book 2015Document25 pagesYield If y Fashion e Book 2015crristtinaaNo ratings yet

- BashaDocument2 pagesBashahispeed internetNo ratings yet

- College Resource Planning Money Receipt Receipt No. 00366/2022-23Document1 pageCollege Resource Planning Money Receipt Receipt No. 00366/2022-23Divyansh SachdevNo ratings yet

- My Insurance PolicyDocument7 pagesMy Insurance PolicyMuntaj BegumNo ratings yet

- Mgt101 PApers With SolutionDocument13 pagesMgt101 PApers With Solutioncs619finalproject.com100% (7)

- BJT - Tugas 1 Bahasa Inggris NiagaDocument2 pagesBJT - Tugas 1 Bahasa Inggris NiagaKhidatul AyatullohNo ratings yet

- Report 20230604125900Document8 pagesReport 20230604125900AbhimanyuNo ratings yet

- Ecdm T1Document49 pagesEcdm T1spam ashishNo ratings yet

- Problem-2 3 1Document6 pagesProblem-2 3 1Alexis KingNo ratings yet

- Business Transactions and Their Analysis BSAIS 1A Group2Document25 pagesBusiness Transactions and Their Analysis BSAIS 1A Group2Marydelle De Austria-De GuiaNo ratings yet

- The Full Truth About FastracksDocument24 pagesThe Full Truth About FastracksIndependence InstituteNo ratings yet

- Introduction To Hotel Rooms DivisionDocument21 pagesIntroduction To Hotel Rooms DivisionKatrina SanchezNo ratings yet

- Sa Puregold, Always Panalo!: N R D C I NDocument7 pagesSa Puregold, Always Panalo!: N R D C I NTumamudtamud, JenaNo ratings yet

- Techinfo56 DatadictionaryDocument264 pagesTechinfo56 DatadictionaryPhanithStar Triple HNo ratings yet

- HAC - Pentest Solutions Brief HackerOne - L1R7 RGBDocument2 pagesHAC - Pentest Solutions Brief HackerOne - L1R7 RGBRykiel KameniNo ratings yet

- Exercises 2b SolutionsDocument8 pagesExercises 2b SolutionsDionisius TriNo ratings yet

- SCM Module - 2Document64 pagesSCM Module - 2SREEVISAKH V SNo ratings yet

- Fintech Chapter 1Document30 pagesFintech Chapter 1shamira haqueNo ratings yet

- Unit 4&5 (CN) NotesDocument58 pagesUnit 4&5 (CN) Notesvasundhara kaleNo ratings yet

- Closure FormDocument3 pagesClosure FormSriteja JosyulaNo ratings yet

- Statement Mar 21 XXXXXXXX3935Document1 pageStatement Mar 21 XXXXXXXX3935Raja SekharNo ratings yet

Policydownload 230207 000615-43

Policydownload 230207 000615-43

Uploaded by

Anindya SundarOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Policydownload 230207 000615-43

Policydownload 230207 000615-43

Uploaded by

Anindya SundarCopyright:

Available Formats

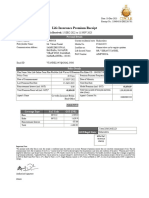

Date: 18-Jan-2024

Receipt No.: 538991008JUN2301

Life Insurance Premium Receipt

Duration For Which the Premium is Received: 01-APR-2023 to 31-MAR-2024

Personal Details

Policy Number: 324693142 Current residential state: West Bengal

Policyholder Name: Mr. Anindya Sundar Sinha Mobile No. 9163640262

Commuinication Address: 88/4/1 Landline no. Please inform us for regular updates

PATHAK PARA ROAD, Life Insured Name: Mr. Anindya Sundar Sinha

PARNASREE PALLY PAN Number: CTIPS5640F

Kolkata - 700060

Email ID: SUNDAR.SINHAANINDYA@GMAIL.COM

Policy Details

Plan Name: Max Life Online Term Plan Plus - 104N082V03

Policy Term 47 Years Premium Payment Frequency Monthly

Date of Commencement 26-JUN-2019 Date of Maturity 26-JUN-2066

Last Premium Due Date 26-JUN-2023 Next Due Date 26-JUL-2024

Reinstatement Interest (incl. GST) 0.00 Model Premium (incl. GST) 17721.69

Total Premium Received (incl. GST)* 17721.69 Total Sum Assured of base plan and term 50,00,000.00

rider (if any)

Agent's Name Policybazaar Ins Web Aggr Agent's Contact No.

8826272750

Head Office

GST Details

Coverage Type SAC Code IGST (INR) GSTIN 06AACCM3201E1Z7

Base 997132 2722.69 GST Regd. State Haryana

Rider 997132 Affix

Reinstatement Interest 0.00 Re1

revenue

Total 2722.69 stamp

Important Note:

*For payment mode other than in cash, this receipt is conditional upon the credit in our account. Payment of premium amount does not constitute commencement of risk. The risk

commencement starts after acceptance of risk by us. *Amount received would be adjusted against the due premium as per terms and conditions of the policy. *Premiums may be

eligible for tax benefits under section 80C/80CCC/80D/37(1) of the Income Tax Act 1961. Kindly consult your tax advisor for more information. Tax benefits are liable to change due

to changes in legislation or government notification. *Applicable Taxes, Cesses and Levies, as per prevailing laws, shall be borne by you. *For GST purposes,this premium receipt is

Tax Invoice.Assessable Value in GST for Endowment First Year is 25%, Renewal Year is 12.5%; Single Premium Annuity is 10%; Term and Health is 100%.

Authorised signatory

PRM20

39 of 40

You might also like

- Tangerine-eStatement Jul19 PDFDocument2 pagesTangerine-eStatement Jul19 PDFRudyard Martin Cardozo33% (6)

- Premium ReceiptsDocument1 pagePremium Receiptsmanojsh88870% (1)

- Accounting 1 Chapter 4 TestDocument3 pagesAccounting 1 Chapter 4 TestIvy Long33% (3)

- Max Life Total Premium ReceiptDocument1 pageMax Life Total Premium ReceiptBhavik Thaker100% (1)

- Hotel LeadsDocument17 pagesHotel Leadssanakausar.5089No ratings yet

- Life Insurance Premium Receipt: Personal DetailsDocument1 pageLife Insurance Premium Receipt: Personal DetailsRITIKANo ratings yet

- Max Life InsuranceDocument1 pageMax Life InsuranceLohith Labhala100% (1)

- باسم يوسف العاجDocument1 pageباسم يوسف العاجباسم الحاجNo ratings yet

- Life Insurance Premium Receipt: Personal DetailsDocument1 pageLife Insurance Premium Receipt: Personal Detailssatish varmaNo ratings yet

- Health Insurance Premium Receipt: Personal DetailsDocument1 pageHealth Insurance Premium Receipt: Personal DetailsRanjith BNo ratings yet

- Lecture NotesDocument37 pagesLecture NotesGangadhar MamadapurNo ratings yet

- Old LIC PremiumDocument2 pagesOld LIC PremiumVikrantTandelNo ratings yet

- Max Life Term PlanDocument1 pageMax Life Term PlanShreya JadhavNo ratings yet

- Premium Paid Certificate: Personal DetailsDocument1 pagePremium Paid Certificate: Personal Detailsravikumar281287No ratings yet

- Consolidated Premium Receipt (Chosen Policy)Document1 pageConsolidated Premium Receipt (Chosen Policy)sreeleoenterprisesNo ratings yet

- Maxlife SRMDocument1 pageMaxlife SRMnrcagroNo ratings yet

- Consolidated ReceiptDocument1 pageConsolidated ReceiptSaket TiwariNo ratings yet

- Personal Details: Duration For Which The Premium Is Received: 28/07/2021Document1 pagePersonal Details: Duration For Which The Premium Is Received: 28/07/2021ravi kumarNo ratings yet

- Premium ReceiptDocument1 pagePremium Receiptsvruma2No ratings yet

- Saw G Payment ReceiptDocument1 pageSaw G Payment ReceiptrinkukjanNo ratings yet

- Life Insurance Premium Receipt: Duration For Which The Premium Is Received: 12-DEC-2017 To 11-JAN-2018 Personal DetailsDocument2 pagesLife Insurance Premium Receipt: Duration For Which The Premium Is Received: 12-DEC-2017 To 11-JAN-2018 Personal Detailsnitish rohiraNo ratings yet

- Consolidated ReceiptDocument2 pagesConsolidated Receiptdigital.arun999No ratings yet

- Life Insurance Premium Receipt: Personal DetailsDocument1 pageLife Insurance Premium Receipt: Personal DetailsHarsh Gandhi0% (1)

- Life Insurance InvoiceDocument1 pageLife Insurance InvoiceAkash DesaiNo ratings yet

- Personal Details: Duration For Which The Premium Is Received: 01/04/2023Document1 pagePersonal Details: Duration For Which The Premium Is Received: 01/04/2023bbarle69No ratings yet

- Parents Policy Father PDFDocument1 pageParents Policy Father PDFshamsehrNo ratings yet

- Life Insurance 47KDocument1 pageLife Insurance 47KRaghupathi PaindlaNo ratings yet

- Parents Policy Mother PDFDocument1 pageParents Policy Mother PDFshamsehrNo ratings yet

- Official Receipt 1676234863Document1 pageOfficial Receipt 1676234863vasim hatwadkarNo ratings yet

- Medical InsuranceDocument1 pageMedical Insurancesunil dinodiyaNo ratings yet

- UnlockedDocument1 pageUnlockedAshish NaikNo ratings yet

- Premium Receipt: Personal DetailsDocument1 pagePremium Receipt: Personal DetailssunnybisnoiNo ratings yet

- Premium ReceiptsDocument1 pagePremium ReceiptsVijay PendurthiNo ratings yet

- 2018032388Document1 page2018032388Vengal reddyNo ratings yet

- Consolidated Premium ReceiptDocument1 pageConsolidated Premium ReceiptBhavik ThakerNo ratings yet

- Official Receipt 1676234862Document1 pageOfficial Receipt 1676234862vasim hatwadkarNo ratings yet

- Term Insurance Premium Receipt: Personal DetailsDocument1 pageTerm Insurance Premium Receipt: Personal DetailsRanjith BNo ratings yet

- Life Insurance Premium ReceiptDocument1 pageLife Insurance Premium ReceiptChandPari AkulNo ratings yet

- Life Insurance Premium Receipt: Personal DetailsDocument1 pageLife Insurance Premium Receipt: Personal Detailsnitish rohiraNo ratings yet

- Consolidatedreceipt PDFDocument1 pageConsolidatedreceipt PDFSuyash MishraNo ratings yet

- 297511794-OctDocument1 page297511794-OctVikash SinghNo ratings yet

- Premium Receipts PDFDocument1 pagePremium Receipts PDFAJAY JAISWALNo ratings yet

- Reliance Premium Receipt y M D GDocument1 pageReliance Premium Receipt y M D Gyadavravindranath57No ratings yet

- Circi: InsuranceDocument1 pageCirci: InsuranceapplerajivNo ratings yet

- Premium ReceiptsDocument1 pagePremium Receiptsani dNo ratings yet

- Consolidated Life Insurence Premium Receipt FY-2022-2023-SujanDocument1 pageConsolidated Life Insurence Premium Receipt FY-2022-2023-SujanSujanNo ratings yet

- Premium ReceiptsDocument1 pagePremium ReceiptsNeeraj TyagiNo ratings yet

- (A) Policy Schedule (Policy Certificate) : Policyall 2 2 1 1Document3 pages(A) Policy Schedule (Policy Certificate) : Policyall 2 2 1 1Vijay VemuriNo ratings yet

- Zprmrnot 23345535 17208239Document1 pageZprmrnot 23345535 17208239bharat4u04No ratings yet

- Premium ReceiptsDocument1 pagePremium ReceiptsAmit KumarNo ratings yet

- Life Insurance Premium ReceiptDocument1 pageLife Insurance Premium ReceiptVijayNo ratings yet

- Zprmrnot 22847670 15676911Document1 pageZprmrnot 22847670 15676911Gulshan GavelNo ratings yet

- Insurance 1premiumDocument1 pageInsurance 1premiumBharathNo ratings yet

- Premium Receipt: ' 50,00,000.00 ' 853.78 13-DEC-2020 To 12-JAN-2021 13-JAN-2021Document1 pagePremium Receipt: ' 50,00,000.00 ' 853.78 13-DEC-2020 To 12-JAN-2021 13-JAN-2021ceogaursNo ratings yet

- Premium ReceiptsDocument1 pagePremium ReceiptsThakur Pranay SinghNo ratings yet

- July 3Document1 pageJuly 3Vikash SinghNo ratings yet

- Medical InsuranceDocument1 pageMedical InsuranceMasood AhmadNo ratings yet

- Consolidated ReceiptDocument1 pageConsolidated ReceiptKhushbu GuptaNo ratings yet

- Zprmrnot 23764103 16031216Document1 pageZprmrnot 23764103 16031216Kiran KumarNo ratings yet

- Zprmrnot - 22303149 - 12926353 2Document1 pageZprmrnot - 22303149 - 12926353 2RKGUPTANo ratings yet

- MCLMDocument13 pagesMCLMcibil scoreNo ratings yet

- Zprmrnot 20927762 24235025 231002 181434Document2 pagesZprmrnot 20927762 24235025 231002 181434aanandaman1098No ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific: 2020 EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: 2020 EditionNo ratings yet

- Bcom 4TH SemDocument6 pagesBcom 4TH SemPrakash RNo ratings yet

- Bharti Airtel - SWAT and PESTAL AnalysisDocument7 pagesBharti Airtel - SWAT and PESTAL AnalysisArchu KamatNo ratings yet

- Press Release: Octopus Healthcare Appoints Sheila Hendy As Clinical Assurance DirectorDocument2 pagesPress Release: Octopus Healthcare Appoints Sheila Hendy As Clinical Assurance Directorapi-291693629No ratings yet

- UFCW Local 1262 - Redacted Bates HWDocument13 pagesUFCW Local 1262 - Redacted Bates HWAnonymous kprzCiZNo ratings yet

- Yield If y Fashion e Book 2015Document25 pagesYield If y Fashion e Book 2015crristtinaaNo ratings yet

- BashaDocument2 pagesBashahispeed internetNo ratings yet

- College Resource Planning Money Receipt Receipt No. 00366/2022-23Document1 pageCollege Resource Planning Money Receipt Receipt No. 00366/2022-23Divyansh SachdevNo ratings yet

- My Insurance PolicyDocument7 pagesMy Insurance PolicyMuntaj BegumNo ratings yet

- Mgt101 PApers With SolutionDocument13 pagesMgt101 PApers With Solutioncs619finalproject.com100% (7)

- BJT - Tugas 1 Bahasa Inggris NiagaDocument2 pagesBJT - Tugas 1 Bahasa Inggris NiagaKhidatul AyatullohNo ratings yet

- Report 20230604125900Document8 pagesReport 20230604125900AbhimanyuNo ratings yet

- Ecdm T1Document49 pagesEcdm T1spam ashishNo ratings yet

- Problem-2 3 1Document6 pagesProblem-2 3 1Alexis KingNo ratings yet

- Business Transactions and Their Analysis BSAIS 1A Group2Document25 pagesBusiness Transactions and Their Analysis BSAIS 1A Group2Marydelle De Austria-De GuiaNo ratings yet

- The Full Truth About FastracksDocument24 pagesThe Full Truth About FastracksIndependence InstituteNo ratings yet

- Introduction To Hotel Rooms DivisionDocument21 pagesIntroduction To Hotel Rooms DivisionKatrina SanchezNo ratings yet

- Sa Puregold, Always Panalo!: N R D C I NDocument7 pagesSa Puregold, Always Panalo!: N R D C I NTumamudtamud, JenaNo ratings yet

- Techinfo56 DatadictionaryDocument264 pagesTechinfo56 DatadictionaryPhanithStar Triple HNo ratings yet

- HAC - Pentest Solutions Brief HackerOne - L1R7 RGBDocument2 pagesHAC - Pentest Solutions Brief HackerOne - L1R7 RGBRykiel KameniNo ratings yet

- Exercises 2b SolutionsDocument8 pagesExercises 2b SolutionsDionisius TriNo ratings yet

- SCM Module - 2Document64 pagesSCM Module - 2SREEVISAKH V SNo ratings yet

- Fintech Chapter 1Document30 pagesFintech Chapter 1shamira haqueNo ratings yet

- Unit 4&5 (CN) NotesDocument58 pagesUnit 4&5 (CN) Notesvasundhara kaleNo ratings yet

- Closure FormDocument3 pagesClosure FormSriteja JosyulaNo ratings yet

- Statement Mar 21 XXXXXXXX3935Document1 pageStatement Mar 21 XXXXXXXX3935Raja SekharNo ratings yet