Professional Documents

Culture Documents

Tax Statement As On Oct 2023: Employee Details

Tax Statement As On Oct 2023: Employee Details

Uploaded by

Parthiban ManiCopyright:

Available Formats

You might also like

- MemoDocument2 pagesMemoa luNo ratings yet

- Quality ManualDocument24 pagesQuality ManualPrateek RastogiNo ratings yet

- Testbank FinancialaccountingDocument7 pagesTestbank FinancialaccountingAxl Gregg Munion100% (1)

- Pharmally Pharmaceutical Corporation Case Study AutorecoveredDocument6 pagesPharmally Pharmaceutical Corporation Case Study AutorecoveredだみNo ratings yet

- Sutherland Global Services Philippines, Inc. - Philippine BranchDocument3 pagesSutherland Global Services Philippines, Inc. - Philippine BranchShunui SonodaNo ratings yet

- Kashato Shirts SolutionsDocument13 pagesKashato Shirts SolutionsJeiger James Huizo100% (1)

- Trade Book TemplateDocument19 pagesTrade Book TemplateCarlos FerreiraNo ratings yet

- Forbes - October 28 2013 USADocument132 pagesForbes - October 28 2013 USAalx_ppscuNo ratings yet

- WL00152 TaxStatement Feb2024Document1 pageWL00152 TaxStatement Feb2024gauthamchentuNo ratings yet

- Tax Statement As On Dec 2021: Employee DetailsDocument1 pageTax Statement As On Dec 2021: Employee DetailsElakkiyaNo ratings yet

- Tax Planner As On Feb 2021: Employee DetailsDocument2 pagesTax Planner As On Feb 2021: Employee DetailsdamallNo ratings yet

- TaxStatement May2022Document1 pageTaxStatement May2022thotada durga prasadNo ratings yet

- TaxStatement Mar2022Document1 pageTaxStatement Mar2022SiddharthNo ratings yet

- Reporte VAN - OkDocument4 pagesReporte VAN - OkEdgar HurtadoNo ratings yet

- Components Earnings: Amounts Are in INRDocument1 pageComponents Earnings: Amounts Are in INRDheeraj KumarNo ratings yet

- Components Earnings: Amounts Are in INRDocument1 pageComponents Earnings: Amounts Are in INRDheeraj KumarNo ratings yet

- GeneratePdftax AspxDocument2 pagesGeneratePdftax AspxShiva KumarNo ratings yet

- Web Payslip 266675 202305Document2 pagesWeb Payslip 266675 202305prabhat.finnproNo ratings yet

- Ejercicio PlanillaDocument17 pagesEjercicio Planillamanfredo pastoraNo ratings yet

- Web Payslip 266675 202304Document2 pagesWeb Payslip 266675 202304prabhat.finnproNo ratings yet

- ProjectionReport 20240331Document3 pagesProjectionReport 20240331IaM Rajesh RajNo ratings yet

- Taxsheet 10007162Document2 pagesTaxsheet 10007162Narender KapoorNo ratings yet

- Ewac Alloys Limited: Uan No Aadhar NoDocument1 pageEwac Alloys Limited: Uan No Aadhar NoNapoleon DasNo ratings yet

- HP & Co. Income ReportDocument6 pagesHP & Co. Income ReportMa Teresa B. CerezoNo ratings yet

- Web Payslip 266675 202306Document2 pagesWeb Payslip 266675 202306prabhat.finnproNo ratings yet

- Appendices To The Business Plan-1Document5 pagesAppendices To The Business Plan-1smile ChristianNo ratings yet

- Tax ComputationDocument2 pagesTax Computationng28No ratings yet

- Devis Charpente MetalliqueDocument1 pageDevis Charpente MetalliqueDamas IaamarNo ratings yet

- File 07092023201232728Document3 pagesFile 07092023201232728dummysold7No ratings yet

- Quikchex 2020 Tax Comparison CalculatorDocument1 pageQuikchex 2020 Tax Comparison CalculatorSankar rajNo ratings yet

- Wells Fargo International Solutions Private Limited: Employee Pay History For The Period JAN-2021 To DEC-2021Document1 pageWells Fargo International Solutions Private Limited: Employee Pay History For The Period JAN-2021 To DEC-2021Sourabh PunshiNo ratings yet

- 10011488Document1 page10011488Anonymous BtiQTJz00% (1)

- Dec 2022Document1 pageDec 2022kumarsanjeevsskNo ratings yet

- Total Cheltuieli Din Care 482,016,993.00 298,821,592.62 288,901,344.34 (460,878.28) 288,440,466.06 193,576,526.94 0.60Document5 pagesTotal Cheltuieli Din Care 482,016,993.00 298,821,592.62 288,901,344.34 (460,878.28) 288,440,466.06 193,576,526.94 0.60CNo ratings yet

- DSHRDocument10 pagesDSHRDIV DOCNo ratings yet

- P Fled German AsDocument1 pageP Fled German AsPrimansu Pritam behera beheraNo ratings yet

- Feb 2007Document38 pagesFeb 2007Larry LeachNo ratings yet

- Hindustan Coca-Cola Beverages PVT LTD B-91 Mayapuri Industrial Area Phase-I New DelhiDocument2 pagesHindustan Coca-Cola Beverages PVT LTD B-91 Mayapuri Industrial Area Phase-I New DelhiUtkarsh KadamNo ratings yet

- Daily Flash BeverageDocument1 pageDaily Flash Beverageulumsaputra1997No ratings yet

- How To Compute Basic Income TaxDocument11 pagesHow To Compute Basic Income Taxkate trishaNo ratings yet

- Financial Work ScheduleDocument1 pageFinancial Work ScheduleSisay chaneNo ratings yet

- Trial BalanceDocument1 pageTrial Balancebhoomika.shah0624No ratings yet

- Ceiling 6.000.00 Ceiling 10,0000 Ceiling 5,000.00: Basic Salary Pera de Minimis BenefitsDocument6 pagesCeiling 6.000.00 Ceiling 10,0000 Ceiling 5,000.00: Basic Salary Pera de Minimis Benefitsjohn frits gerard mombayNo ratings yet

- 920dy-Stock Report 1st April 2024 To 20th April-2024Document9 pages920dy-Stock Report 1st April 2024 To 20th April-2024Rabi TamangNo ratings yet

- Xoriantlive 28051007Document1 pageXoriantlive 28051007susilaNo ratings yet

- Libroma20170526172327 PDFDocument1 pageLibroma20170526172327 PDFSergio GarciaNo ratings yet

- Libroma20170526172327 PDFDocument1 pageLibroma20170526172327 PDFSergio GarciaNo ratings yet

- Salma Saifi May SlipDocument2 pagesSalma Saifi May Slipsalma saifiNo ratings yet

- ControldegokuDocument1 pageControldegokupedroNo ratings yet

- Pirhot JuanDocument2 pagesPirhot Juanmutiya andiniNo ratings yet

- P2385 Nov2023Document2 pagesP2385 Nov2023ManiNo ratings yet

- July, 2008Document2 pagesJuly, 2008dujust_hudesNo ratings yet

- Lic PolicyDocument1 pageLic Policyvisupatel26112004No ratings yet

- FY 2022 Expense ModelDocument15 pagesFY 2022 Expense ModelJomar JordasNo ratings yet

- Manimaran Oct Payslip ShriramDocument2 pagesManimaran Oct Payslip ShriramManiNo ratings yet

- Calculo Rta 5ta 2020Document12 pagesCalculo Rta 5ta 2020CARLOS DANIEL ARELLANO SOLANONo ratings yet

- Manimaran Nov Payslip ShriramDocument2 pagesManimaran Nov Payslip ShriramManiNo ratings yet

- Balance de Prueba (De 1/ABR/2017 A 30/JUN/2017) : Innovaciones Empresariales E Inmobiliarias S.A.S (Nit: 900.423.362-1)Document3 pagesBalance de Prueba (De 1/ABR/2017 A 30/JUN/2017) : Innovaciones Empresariales E Inmobiliarias S.A.S (Nit: 900.423.362-1)Yury Nayduth MUNOZ GOMEZNo ratings yet

- P2385 Nov2023Document2 pagesP2385 Nov2023ManiNo ratings yet

- Web Payslip 266675 202308Document2 pagesWeb Payslip 266675 202308prabhat.finnproNo ratings yet

- Wa0023.Document2 pagesWa0023.ManiNo ratings yet

- Manimaran Oct Payslip ShriramDocument2 pagesManimaran Oct Payslip ShriramManiNo ratings yet

- Evi14 104947Document1 pageEvi14 104947Al QadriNo ratings yet

- GSTR-1 Report TestingDocument14 pagesGSTR-1 Report TestingSingb BabluNo ratings yet

- IT Certificate 691362233Document1 pageIT Certificate 691362233Parthiban ManiNo ratings yet

- Know About MediaMintDocument1 pageKnow About MediaMintParthiban ManiNo ratings yet

- Rajappah PortfolioDocument2 pagesRajappah PortfolioParthiban ManiNo ratings yet

- DownloadDocument1 pageDownloadParthiban ManiNo ratings yet

- Aravindharaj Ad Ops - 110423Document2 pagesAravindharaj Ad Ops - 110423Parthiban ManiNo ratings yet

- மத்திய அரசு நலத்திட்டங்கள்Document40 pagesமத்திய அரசு நலத்திட்டங்கள்Parthiban ManiNo ratings yet

- House Warming CeremonyDocument3 pagesHouse Warming CeremonyParthiban ManiNo ratings yet

- dd718a03-9310-4175-8d1f-d046354db5d4Document1 pagedd718a03-9310-4175-8d1f-d046354db5d4Parthiban ManiNo ratings yet

- Statement 1674272376205Document19 pagesStatement 1674272376205Parthiban ManiNo ratings yet

- ChennaiDocument6 pagesChennaiParthiban ManiNo ratings yet

- FAQ On RGESS - v1Document6 pagesFAQ On RGESS - v1Parthiban ManiNo ratings yet

- InvoiceDocument1 pageInvoiceParthiban ManiNo ratings yet

- Mfu 7 NDocument6 pagesMfu 7 NParthiban ManiNo ratings yet

- Work Completion Agreement 2010Document1 pageWork Completion Agreement 2010Md Mehdi HasanNo ratings yet

- Lean Six Sigma ToolkitDocument63 pagesLean Six Sigma ToolkitLOLIMNo ratings yet

- D&E - Price - List-w.e.f-15-Nov-23Document1 pageD&E - Price - List-w.e.f-15-Nov-23pawansagar0530No ratings yet

- Risk Management, Strategic PDFDocument380 pagesRisk Management, Strategic PDFCong NguyenNo ratings yet

- Satya Buddharaju: EducationDocument1 pageSatya Buddharaju: EducationVBNo ratings yet

- Role of It in Supply Chain ManagementDocument13 pagesRole of It in Supply Chain ManagementtadashadNo ratings yet

- Why Europe Planned The Great Bank RobberyDocument2 pagesWhy Europe Planned The Great Bank RobberyRakesh SimhaNo ratings yet

- Ontrolling: Source: Management - A Global Perspective by Weihrich and Koontz 11 EditionDocument23 pagesOntrolling: Source: Management - A Global Perspective by Weihrich and Koontz 11 EditionSarah ViscoNo ratings yet

- TCS India (BPS) Policy - Notice PeriodDocument8 pagesTCS India (BPS) Policy - Notice PeriodBharath MadalaNo ratings yet

- Success StoryDocument19 pagesSuccess StoryCrissa BernarteNo ratings yet

- Lulu Enterprises, Inc. v. N-F Newsite, LLC Et Al - Document No. 106Document7 pagesLulu Enterprises, Inc. v. N-F Newsite, LLC Et Al - Document No. 106Justia.comNo ratings yet

- MPhil 2013 BatchDocument8 pagesMPhil 2013 BatchabcdefghijkNo ratings yet

- YU V CADocument1 pageYU V CANicoleNo ratings yet

- Recruiters Sites TetenDocument20 pagesRecruiters Sites Tetensandeep kNo ratings yet

- Issue 31Document186 pagesIssue 31lcristy12No ratings yet

- Six Sigma Quiz (30-9-2020) - 1Document4 pagesSix Sigma Quiz (30-9-2020) - 1Hemant ChaudharyNo ratings yet

- RLP - Campus PlacementDocument16 pagesRLP - Campus PlacementB Rahul100% (1)

- Chart Petterns Ebook EnglishDocument48 pagesChart Petterns Ebook Englishharshmevada81150% (4)

- Sec Cert - Cms Products Treasury and BorrowingDocument3 pagesSec Cert - Cms Products Treasury and Borrowingevelyn deeNo ratings yet

- 407 - Answer Key Engleza 2 AP - 2015-2016Document11 pages407 - Answer Key Engleza 2 AP - 2015-2016Lavinia ConstandaNo ratings yet

- A Lessons-Learned Knowledge Management System For EngineersDocument3 pagesA Lessons-Learned Knowledge Management System For EngineersHarshavardhan D. GorakhNo ratings yet

- ListDocument4 pagesListSplashy BabyNo ratings yet

- Chapter 1 - Types of Market DayDocument5 pagesChapter 1 - Types of Market DayAngkan SarmaNo ratings yet

- Should Air India Go PrivateDocument5 pagesShould Air India Go PrivateNikhil Reddy LingalaNo ratings yet

Tax Statement As On Oct 2023: Employee Details

Tax Statement As On Oct 2023: Employee Details

Uploaded by

Parthiban ManiOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Tax Statement As On Oct 2023: Employee Details

Tax Statement As On Oct 2023: Employee Details

Uploaded by

Parthiban ManiCopyright:

Available Formats

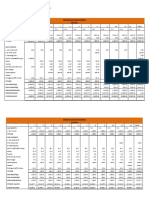

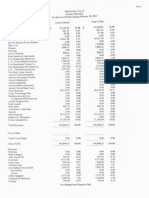

Employee Details

Company Name : RateGain Travel Technologies Pvt. Ltd

Employee Name : Parthiban S

Employee Code : 4856

Tax Statement as on Oct 2023

Sl. Description Apr May Jun Jul Aug Sep Oct Nov Dec Jan Feb Mar TOTAL

1 TAX STRUCTURE NEW NEW NEW NEW NEW NEW OLD OLD OLD OLD OLD OLD

2 TELEPHONE REIM 0.00 0.00 0.00 0.00 0.00 0.00 3,600.00 3,000.00 3,000.00 3,000.00 3,000.00 3,000.00 18,600.00

3 TELEPHONE REIM EXEMPTION -18,600.00

4 FUEL REIM 0.00 0.00 0.00 0.00 0.00 0.00 3,960.00 3,300.00 3,300.00 3,300.00 3,300.00 3,300.00 20,460.00

5 FUEL REIM EXEMPTION -20,460.00

6 BOOKS AND PERIODICAL REIM 0.00 0.00 0.00 0.00 0.00 0.00 2,400.00 2,000.00 2,000.00 2,000.00 2,000.00 2,000.00 12,400.00

7 BOOKS AND PERIODICAL REIM EXEMPTION -12,400.00

8 LTA REIM 0.00 0.00 0.00 0.00 0.00 0.00 2,800.00 2,333.00 2,333.00 2,333.00 2,333.00 2,333.00 14,465.00

9 BASIC PAY 0.00 0.00 0.00 0.00 0.00 8,633.00 43,166.67 43,166.67 43,166.67 43,166.67 43,166.67 43,166.67 2,67,634.00

10 HOUSE RENT ALLOW 0.00 0.00 0.00 0.00 0.00 4,317.00 21,583.00 21,583.00 21,583.00 21,583.00 21,583.00 21,583.00 1,33,815.00

11 SPECIAL ALLOWANCE 0.00 0.00 0.00 0.00 0.00 5,056.00 25,278.68 25,278.68 25,278.68 25,278.68 25,278.68 25,278.68 1,56,729.00

12 GROSS INCOME FROM SALARY 5,72,643.00

13 GROSS SALARY INCLUDING PERQ 5,72,643.00

14 LTA EXEMPTION -14,465.00

15 SALARY FOR HRA EXEMPTION(10%) 0.00 0.00 0.00 0.00 0.00 863.00 4,317.00 4,317.00 4,317.00 4,317.00 4,317.00 4,317.00 26,763.00

16 SALARY FOR HRA EXEMPTION(40%/50%)(B) 0.00 0.00 0.00 0.00 0.00 4,317.00 21,583.00 21,583.00 21,583.00 21,583.00 21,583.00 21,583.00 1,33,815.00

17 ACTUAL HRA RECEIVED (C) 0.00 0.00 0.00 0.00 0.00 4,317.00 21,583.00 21,583.00 21,583.00 21,583.00 21,583.00 21,583.00 1,33,815.00

18 TOTAL EXEMPTION -14,465.00

19 INCOME AFTER SECTION(10) 5,58,178.00

20 STANDARD DEDUCTION -50,000.00

21 INCOME AFTER SECTION (16) 5,08,178.00

22 GROSS TOTAL INCOME 5,08,178.00

23 PF CONTRIBUTION 0.00 0.00 0.00 0.00 0.00 1,036.00 5,180.00 5,180.00 5,180.00 5,180.00 5,180.00 5,180.00 32,116.00

24 TOTAL INVESTMENTS 32,116.00

25 DEDUCTION U/S 80CCCE 32,116.00

26 TOTAL INVESTMENTS DEDUCTABLE -32,116.00

27 TOTAL CHAPTER VI(A) DEDUCTIONS -32,116.00

28 NET TAXABLE INCOME 4,76,062.00

29 TAX SLAB RATE 0.00 0.00 0.00 0.00 0.00 0.00 5.00 0.00 0.00 0.00 0.00 0.00 5.00

30 TAX ON TOTAL INCOME 11,303.10

31 TAX INCLUDING SURCHARGE 11,303.10

32 TAX REBATE U/S 87A -11,303.10

33 EMPLOYER PF 32,116.00

34 TOTAL EMPLOYER NPS, PF SUPER ANNUATION 32,116.00

This is a computer generated document, hence no signature is required.

You might also like

- MemoDocument2 pagesMemoa luNo ratings yet

- Quality ManualDocument24 pagesQuality ManualPrateek RastogiNo ratings yet

- Testbank FinancialaccountingDocument7 pagesTestbank FinancialaccountingAxl Gregg Munion100% (1)

- Pharmally Pharmaceutical Corporation Case Study AutorecoveredDocument6 pagesPharmally Pharmaceutical Corporation Case Study AutorecoveredだみNo ratings yet

- Sutherland Global Services Philippines, Inc. - Philippine BranchDocument3 pagesSutherland Global Services Philippines, Inc. - Philippine BranchShunui SonodaNo ratings yet

- Kashato Shirts SolutionsDocument13 pagesKashato Shirts SolutionsJeiger James Huizo100% (1)

- Trade Book TemplateDocument19 pagesTrade Book TemplateCarlos FerreiraNo ratings yet

- Forbes - October 28 2013 USADocument132 pagesForbes - October 28 2013 USAalx_ppscuNo ratings yet

- WL00152 TaxStatement Feb2024Document1 pageWL00152 TaxStatement Feb2024gauthamchentuNo ratings yet

- Tax Statement As On Dec 2021: Employee DetailsDocument1 pageTax Statement As On Dec 2021: Employee DetailsElakkiyaNo ratings yet

- Tax Planner As On Feb 2021: Employee DetailsDocument2 pagesTax Planner As On Feb 2021: Employee DetailsdamallNo ratings yet

- TaxStatement May2022Document1 pageTaxStatement May2022thotada durga prasadNo ratings yet

- TaxStatement Mar2022Document1 pageTaxStatement Mar2022SiddharthNo ratings yet

- Reporte VAN - OkDocument4 pagesReporte VAN - OkEdgar HurtadoNo ratings yet

- Components Earnings: Amounts Are in INRDocument1 pageComponents Earnings: Amounts Are in INRDheeraj KumarNo ratings yet

- Components Earnings: Amounts Are in INRDocument1 pageComponents Earnings: Amounts Are in INRDheeraj KumarNo ratings yet

- GeneratePdftax AspxDocument2 pagesGeneratePdftax AspxShiva KumarNo ratings yet

- Web Payslip 266675 202305Document2 pagesWeb Payslip 266675 202305prabhat.finnproNo ratings yet

- Ejercicio PlanillaDocument17 pagesEjercicio Planillamanfredo pastoraNo ratings yet

- Web Payslip 266675 202304Document2 pagesWeb Payslip 266675 202304prabhat.finnproNo ratings yet

- ProjectionReport 20240331Document3 pagesProjectionReport 20240331IaM Rajesh RajNo ratings yet

- Taxsheet 10007162Document2 pagesTaxsheet 10007162Narender KapoorNo ratings yet

- Ewac Alloys Limited: Uan No Aadhar NoDocument1 pageEwac Alloys Limited: Uan No Aadhar NoNapoleon DasNo ratings yet

- HP & Co. Income ReportDocument6 pagesHP & Co. Income ReportMa Teresa B. CerezoNo ratings yet

- Web Payslip 266675 202306Document2 pagesWeb Payslip 266675 202306prabhat.finnproNo ratings yet

- Appendices To The Business Plan-1Document5 pagesAppendices To The Business Plan-1smile ChristianNo ratings yet

- Tax ComputationDocument2 pagesTax Computationng28No ratings yet

- Devis Charpente MetalliqueDocument1 pageDevis Charpente MetalliqueDamas IaamarNo ratings yet

- File 07092023201232728Document3 pagesFile 07092023201232728dummysold7No ratings yet

- Quikchex 2020 Tax Comparison CalculatorDocument1 pageQuikchex 2020 Tax Comparison CalculatorSankar rajNo ratings yet

- Wells Fargo International Solutions Private Limited: Employee Pay History For The Period JAN-2021 To DEC-2021Document1 pageWells Fargo International Solutions Private Limited: Employee Pay History For The Period JAN-2021 To DEC-2021Sourabh PunshiNo ratings yet

- 10011488Document1 page10011488Anonymous BtiQTJz00% (1)

- Dec 2022Document1 pageDec 2022kumarsanjeevsskNo ratings yet

- Total Cheltuieli Din Care 482,016,993.00 298,821,592.62 288,901,344.34 (460,878.28) 288,440,466.06 193,576,526.94 0.60Document5 pagesTotal Cheltuieli Din Care 482,016,993.00 298,821,592.62 288,901,344.34 (460,878.28) 288,440,466.06 193,576,526.94 0.60CNo ratings yet

- DSHRDocument10 pagesDSHRDIV DOCNo ratings yet

- P Fled German AsDocument1 pageP Fled German AsPrimansu Pritam behera beheraNo ratings yet

- Feb 2007Document38 pagesFeb 2007Larry LeachNo ratings yet

- Hindustan Coca-Cola Beverages PVT LTD B-91 Mayapuri Industrial Area Phase-I New DelhiDocument2 pagesHindustan Coca-Cola Beverages PVT LTD B-91 Mayapuri Industrial Area Phase-I New DelhiUtkarsh KadamNo ratings yet

- Daily Flash BeverageDocument1 pageDaily Flash Beverageulumsaputra1997No ratings yet

- How To Compute Basic Income TaxDocument11 pagesHow To Compute Basic Income Taxkate trishaNo ratings yet

- Financial Work ScheduleDocument1 pageFinancial Work ScheduleSisay chaneNo ratings yet

- Trial BalanceDocument1 pageTrial Balancebhoomika.shah0624No ratings yet

- Ceiling 6.000.00 Ceiling 10,0000 Ceiling 5,000.00: Basic Salary Pera de Minimis BenefitsDocument6 pagesCeiling 6.000.00 Ceiling 10,0000 Ceiling 5,000.00: Basic Salary Pera de Minimis Benefitsjohn frits gerard mombayNo ratings yet

- 920dy-Stock Report 1st April 2024 To 20th April-2024Document9 pages920dy-Stock Report 1st April 2024 To 20th April-2024Rabi TamangNo ratings yet

- Xoriantlive 28051007Document1 pageXoriantlive 28051007susilaNo ratings yet

- Libroma20170526172327 PDFDocument1 pageLibroma20170526172327 PDFSergio GarciaNo ratings yet

- Libroma20170526172327 PDFDocument1 pageLibroma20170526172327 PDFSergio GarciaNo ratings yet

- Salma Saifi May SlipDocument2 pagesSalma Saifi May Slipsalma saifiNo ratings yet

- ControldegokuDocument1 pageControldegokupedroNo ratings yet

- Pirhot JuanDocument2 pagesPirhot Juanmutiya andiniNo ratings yet

- P2385 Nov2023Document2 pagesP2385 Nov2023ManiNo ratings yet

- July, 2008Document2 pagesJuly, 2008dujust_hudesNo ratings yet

- Lic PolicyDocument1 pageLic Policyvisupatel26112004No ratings yet

- FY 2022 Expense ModelDocument15 pagesFY 2022 Expense ModelJomar JordasNo ratings yet

- Manimaran Oct Payslip ShriramDocument2 pagesManimaran Oct Payslip ShriramManiNo ratings yet

- Calculo Rta 5ta 2020Document12 pagesCalculo Rta 5ta 2020CARLOS DANIEL ARELLANO SOLANONo ratings yet

- Manimaran Nov Payslip ShriramDocument2 pagesManimaran Nov Payslip ShriramManiNo ratings yet

- Balance de Prueba (De 1/ABR/2017 A 30/JUN/2017) : Innovaciones Empresariales E Inmobiliarias S.A.S (Nit: 900.423.362-1)Document3 pagesBalance de Prueba (De 1/ABR/2017 A 30/JUN/2017) : Innovaciones Empresariales E Inmobiliarias S.A.S (Nit: 900.423.362-1)Yury Nayduth MUNOZ GOMEZNo ratings yet

- P2385 Nov2023Document2 pagesP2385 Nov2023ManiNo ratings yet

- Web Payslip 266675 202308Document2 pagesWeb Payslip 266675 202308prabhat.finnproNo ratings yet

- Wa0023.Document2 pagesWa0023.ManiNo ratings yet

- Manimaran Oct Payslip ShriramDocument2 pagesManimaran Oct Payslip ShriramManiNo ratings yet

- Evi14 104947Document1 pageEvi14 104947Al QadriNo ratings yet

- GSTR-1 Report TestingDocument14 pagesGSTR-1 Report TestingSingb BabluNo ratings yet

- IT Certificate 691362233Document1 pageIT Certificate 691362233Parthiban ManiNo ratings yet

- Know About MediaMintDocument1 pageKnow About MediaMintParthiban ManiNo ratings yet

- Rajappah PortfolioDocument2 pagesRajappah PortfolioParthiban ManiNo ratings yet

- DownloadDocument1 pageDownloadParthiban ManiNo ratings yet

- Aravindharaj Ad Ops - 110423Document2 pagesAravindharaj Ad Ops - 110423Parthiban ManiNo ratings yet

- மத்திய அரசு நலத்திட்டங்கள்Document40 pagesமத்திய அரசு நலத்திட்டங்கள்Parthiban ManiNo ratings yet

- House Warming CeremonyDocument3 pagesHouse Warming CeremonyParthiban ManiNo ratings yet

- dd718a03-9310-4175-8d1f-d046354db5d4Document1 pagedd718a03-9310-4175-8d1f-d046354db5d4Parthiban ManiNo ratings yet

- Statement 1674272376205Document19 pagesStatement 1674272376205Parthiban ManiNo ratings yet

- ChennaiDocument6 pagesChennaiParthiban ManiNo ratings yet

- FAQ On RGESS - v1Document6 pagesFAQ On RGESS - v1Parthiban ManiNo ratings yet

- InvoiceDocument1 pageInvoiceParthiban ManiNo ratings yet

- Mfu 7 NDocument6 pagesMfu 7 NParthiban ManiNo ratings yet

- Work Completion Agreement 2010Document1 pageWork Completion Agreement 2010Md Mehdi HasanNo ratings yet

- Lean Six Sigma ToolkitDocument63 pagesLean Six Sigma ToolkitLOLIMNo ratings yet

- D&E - Price - List-w.e.f-15-Nov-23Document1 pageD&E - Price - List-w.e.f-15-Nov-23pawansagar0530No ratings yet

- Risk Management, Strategic PDFDocument380 pagesRisk Management, Strategic PDFCong NguyenNo ratings yet

- Satya Buddharaju: EducationDocument1 pageSatya Buddharaju: EducationVBNo ratings yet

- Role of It in Supply Chain ManagementDocument13 pagesRole of It in Supply Chain ManagementtadashadNo ratings yet

- Why Europe Planned The Great Bank RobberyDocument2 pagesWhy Europe Planned The Great Bank RobberyRakesh SimhaNo ratings yet

- Ontrolling: Source: Management - A Global Perspective by Weihrich and Koontz 11 EditionDocument23 pagesOntrolling: Source: Management - A Global Perspective by Weihrich and Koontz 11 EditionSarah ViscoNo ratings yet

- TCS India (BPS) Policy - Notice PeriodDocument8 pagesTCS India (BPS) Policy - Notice PeriodBharath MadalaNo ratings yet

- Success StoryDocument19 pagesSuccess StoryCrissa BernarteNo ratings yet

- Lulu Enterprises, Inc. v. N-F Newsite, LLC Et Al - Document No. 106Document7 pagesLulu Enterprises, Inc. v. N-F Newsite, LLC Et Al - Document No. 106Justia.comNo ratings yet

- MPhil 2013 BatchDocument8 pagesMPhil 2013 BatchabcdefghijkNo ratings yet

- YU V CADocument1 pageYU V CANicoleNo ratings yet

- Recruiters Sites TetenDocument20 pagesRecruiters Sites Tetensandeep kNo ratings yet

- Issue 31Document186 pagesIssue 31lcristy12No ratings yet

- Six Sigma Quiz (30-9-2020) - 1Document4 pagesSix Sigma Quiz (30-9-2020) - 1Hemant ChaudharyNo ratings yet

- RLP - Campus PlacementDocument16 pagesRLP - Campus PlacementB Rahul100% (1)

- Chart Petterns Ebook EnglishDocument48 pagesChart Petterns Ebook Englishharshmevada81150% (4)

- Sec Cert - Cms Products Treasury and BorrowingDocument3 pagesSec Cert - Cms Products Treasury and Borrowingevelyn deeNo ratings yet

- 407 - Answer Key Engleza 2 AP - 2015-2016Document11 pages407 - Answer Key Engleza 2 AP - 2015-2016Lavinia ConstandaNo ratings yet

- A Lessons-Learned Knowledge Management System For EngineersDocument3 pagesA Lessons-Learned Knowledge Management System For EngineersHarshavardhan D. GorakhNo ratings yet

- ListDocument4 pagesListSplashy BabyNo ratings yet

- Chapter 1 - Types of Market DayDocument5 pagesChapter 1 - Types of Market DayAngkan SarmaNo ratings yet

- Should Air India Go PrivateDocument5 pagesShould Air India Go PrivateNikhil Reddy LingalaNo ratings yet