Professional Documents

Culture Documents

Question 7.1 7.2

Question 7.1 7.2

Uploaded by

AnCopyright:

Available Formats

You might also like

- Varo Bank Statement BankStatementsDocument2 pagesVaro Bank Statement BankStatementsВасилий Горох100% (1)

- Bandhan Bank Statement.Document1 pageBandhan Bank Statement.ssbajajbethua22No ratings yet

- Schaum's Outline of Bookkeeping and Accounting, Fourth EditionFrom EverandSchaum's Outline of Bookkeeping and Accounting, Fourth EditionRating: 5 out of 5 stars5/5 (1)

- Field Report (Udsm)Document22 pagesField Report (Udsm)Farid said89% (18)

- Au Abhi Bank StatementDocument1 pageAu Abhi Bank StatementAjit RawalNo ratings yet

- Coca-Cola (Ticker Symbol KO On NYSE) : Standardized Balance Sheet and Income Statement (Millions)Document6 pagesCoca-Cola (Ticker Symbol KO On NYSE) : Standardized Balance Sheet and Income Statement (Millions)Sayan BiswasNo ratings yet

- Review Questions For Test #1 ACC210Document14 pagesReview Questions For Test #1 ACC210Aaa0% (1)

- Instructions:: Name: Score: Bank Statement ReconciliationDocument3 pagesInstructions:: Name: Score: Bank Statement ReconciliationAlpha JNo ratings yet

- Homework Solutions Week 13Document4 pagesHomework Solutions Week 13JNo ratings yet

- Activity 1Document7 pagesActivity 1Joanah TayamenNo ratings yet

- Exercise On Bank ReconciliationDocument3 pagesExercise On Bank ReconciliationJoshua OtienoNo ratings yet

- Bac 204 - Cat 1Document4 pagesBac 204 - Cat 1duncanmaina204No ratings yet

- Bank StatementDocument3 pagesBank StatementSigei LeonardNo ratings yet

- Ventas a PlazoDocument37 pagesVentas a Plazoxnwshfc sxbwidmaNo ratings yet

- Bank Reconciliation ExampleDocument5 pagesBank Reconciliation ExampleAyushi chauhanNo ratings yet

- 20 Devt Fund PPSBDocument103 pages20 Devt Fund PPSBAljo FernandezNo ratings yet

- Taller 8 - 03 Julián ConciliaciónDocument14 pagesTaller 8 - 03 Julián ConciliaciónJulian SaezNo ratings yet

- Bank ReconnnnDocument5 pagesBank ReconnnnRamm Raven Castillo100% (1)

- General Ledger/ Company Books Bank StatementDocument1 pageGeneral Ledger/ Company Books Bank StatementBazal NasirNo ratings yet

- Ejemplo Tabla de Amortización Finanaciamiento Actividad 2Document2 pagesEjemplo Tabla de Amortización Finanaciamiento Actividad 2Alizz CoRaNo ratings yet

- AKINJISE Fatai (SB14243) : Ondo State Government Staff Matters AccountDocument1 pageAKINJISE Fatai (SB14243) : Ondo State Government Staff Matters AccountScientist Orioye GabrielNo ratings yet

- CheckStubsReport 20240610153828Document22 pagesCheckStubsReport 20240610153828justcallmearbiterNo ratings yet

- Loan Payment Calculator Amortiztion ScheduleDocument2 pagesLoan Payment Calculator Amortiztion Scheduley shNo ratings yet

- Screenshot 2020-03-13 at 4.33.54 PMDocument6 pagesScreenshot 2020-03-13 at 4.33.54 PMJordan Leigh AuriemmaNo ratings yet

- Topic 7: Cash Management and Control, Preparation Bank Reconciliations and Maintaining A Petty Cash System Solutions To Tutorial QuestionsDocument3 pagesTopic 7: Cash Management and Control, Preparation Bank Reconciliations and Maintaining A Petty Cash System Solutions To Tutorial QuestionsMitchell BylartNo ratings yet

- 15 YearstudentloanDocument8 pages15 Yearstudentloanapi-351687679No ratings yet

- WalshDocument6 pagesWalshapi-518242090No ratings yet

- Actual Comparative Income StatementDocument21 pagesActual Comparative Income StatementRichelle PilapilNo ratings yet

- AKINJISE Fatai (SB14243) : Ondo State Government Staff Matters AccountDocument1 pageAKINJISE Fatai (SB14243) : Ondo State Government Staff Matters AccountScientist Orioye GabrielNo ratings yet

- Tax LiabilityDocument133 pagesTax LiabilitySebastian Cruz RivasNo ratings yet

- BUSI 1043 Unit 3 ExerciseDocument4 pagesBUSI 1043 Unit 3 ExerciseRichard MamisNo ratings yet

- Bhushan SteelDocument3 pagesBhushan Steelharshad19855457No ratings yet

- MAT-200013 Company Files BinderDocument3 pagesMAT-200013 Company Files BinderDenny Brave NSANZUMUHIRENo ratings yet

- AKINJISE Fatai (SB14243) : Ondo State Government Staff Matters AccountDocument1 pageAKINJISE Fatai (SB14243) : Ondo State Government Staff Matters AccountScientist Orioye GabrielNo ratings yet

- AKINJISE Fatai (SB14243) : Ondo State Government Staff Matters AccountDocument1 pageAKINJISE Fatai (SB14243) : Ondo State Government Staff Matters AccountScientist Orioye GabrielNo ratings yet

- Auditing Problems - 001Document2 pagesAuditing Problems - 001Geoff MacarateNo ratings yet

- Audit Prob Cash AnsDocument7 pagesAudit Prob Cash AnsNoreen BinagNo ratings yet

- Bank Reconciliation L2Document3 pagesBank Reconciliation L2C XNo ratings yet

- Special Journals - Quiz 36Document8 pagesSpecial Journals - Quiz 36Joana TrinidadNo ratings yet

- Balance Sheet of Jet AirwaysDocument2 pagesBalance Sheet of Jet Airwaysakhilesh718No ratings yet

- Tabla de Amortizacion2Document5 pagesTabla de Amortizacion2Maciel DorvilleNo ratings yet

- Tabla de Amortizacion2Document5 pagesTabla de Amortizacion2Heyssy PachecoNo ratings yet

- Task 1: Prepare Budgets Part 1 A (Refer To Spreadsheet) Profit BudgetDocument15 pagesTask 1: Prepare Budgets Part 1 A (Refer To Spreadsheet) Profit BudgetUurka LucyNo ratings yet

- BC 16 02 2023Document10 pagesBC 16 02 2023jhonatan vladimirNo ratings yet

- Matematica Financiera Paso 2Document21 pagesMatematica Financiera Paso 2ana maria gutierrezNo ratings yet

- Mortgage Payment Calculator - TD Canada TrustDocument3 pagesMortgage Payment Calculator - TD Canada TrustTomura ShigarakiNo ratings yet

- Item No. 23 Teresita BuenaflorDocument14 pagesItem No. 23 Teresita BuenaflorXiaoNo ratings yet

- TM 7 Tugas PDF Bank ConsiliationDocument2 pagesTM 7 Tugas PDF Bank ConsiliationNajla Aura KhansaNo ratings yet

- Input Data: Checking Account ReconciliationDocument8 pagesInput Data: Checking Account ReconciliationĐặng Thuỳ HươngNo ratings yet

- Balance Sheet of Ambuja CementsDocument7 pagesBalance Sheet of Ambuja CementsHiren KariyaNo ratings yet

- Instructions: Do Chapter 2 - Problem 6Document18 pagesInstructions: Do Chapter 2 - Problem 6Christopher ColumbusNo ratings yet

- CRJ ModularDocument2 pagesCRJ ModularCarla Sabrina PamajilanNo ratings yet

- Prime It Bank Statement - June 2019Document4 pagesPrime It Bank Statement - June 2019api-306226330No ratings yet

- 1st Practice AccountingDocument7 pages1st Practice AccountingJose AmayaNo ratings yet

- Information Technology (PUNO)Document9 pagesInformation Technology (PUNO)Daniel Gabriel PunoNo ratings yet

- 15 YearmortgageDocument8 pages15 Yearmortgageapi-351687679No ratings yet

- Neraca Februari 2024Document2 pagesNeraca Februari 2024k24isvillNo ratings yet

- Bank Reconsiliasi - Model Soal 7.5Document4 pagesBank Reconsiliasi - Model Soal 7.5William SugiartoNo ratings yet

- Jet AirwaysDocument5 pagesJet AirwaysKarthik SrmNo ratings yet

- 1.2 Assignment Audit of Cash and Cash Equivalents 2Document3 pages1.2 Assignment Audit of Cash and Cash Equivalents 2ORIEL RICKY IGNACIO GALLARDONo ratings yet

- Non Negotiable - This Is Not A Check - Non NegotiableDocument1 pageNon Negotiable - This Is Not A Check - Non NegotiableAlexa PribisNo ratings yet

- Parcial2 - Actividades de La Semana 4 KevvDocument23 pagesParcial2 - Actividades de La Semana 4 KevvLuis Eduardo Meunier MendezNo ratings yet

- ChaseDocument6 pagesChasepeter hammerNo ratings yet

- Plazo (Meses, Semanas, Días) Saldo InsolutoDocument2 pagesPlazo (Meses, Semanas, Días) Saldo InsolutoFanny Osorio TapiasNo ratings yet

- J.K. Lasser's Small Business Taxes 2007: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2007: Your Complete Guide to a Better Bottom LineNo ratings yet

- Starting A Business in Vietnam and Mexico Can Offer Unique Opportunities and ChallengesDocument3 pagesStarting A Business in Vietnam and Mexico Can Offer Unique Opportunities and ChallengesAnNo ratings yet

- BullyingDocument2 pagesBullyingAnNo ratings yet

- Daft12ePPT Ch09Document19 pagesDaft12ePPT Ch09AnNo ratings yet

- About Vietnamese FiannceDocument13 pagesAbout Vietnamese FiannceAnNo ratings yet

- Daft CH02 FinalDocument40 pagesDaft CH02 FinalAnNo ratings yet

- DA 185 - Application Form - Registration or Licensing of Customs and Excise Clients External FormDocument6 pagesDA 185 - Application Form - Registration or Licensing of Customs and Excise Clients External Formkotu.kgomotsoNo ratings yet

- FIN - BL - EB - 1 - Import and Forward (Automatically) (New) (RELNFIBL - 606 - FINBLEB1 - 01) - ConsolutDocument3 pagesFIN - BL - EB - 1 - Import and Forward (Automatically) (New) (RELNFIBL - 606 - FINBLEB1 - 01) - ConsolutiuriiNo ratings yet

- Auditing Midterm Exam - Attempt ReviewDocument47 pagesAuditing Midterm Exam - Attempt ReviewkielmorganzapietoNo ratings yet

- Grade 11 Provincial Examination Accounting P2 (English) June 2023 Question PaperDocument11 pagesGrade 11 Provincial Examination Accounting P2 (English) June 2023 Question PaperRebotile MashaoNo ratings yet

- Revision Business Studies Paper 1 & 2Document64 pagesRevision Business Studies Paper 1 & 2Utkarsh AgarwalNo ratings yet

- Reconciliation StatementsDocument26 pagesReconciliation StatementsPetrinaNo ratings yet

- Exercises For Bank Reconciliation and Proof of CashDocument2 pagesExercises For Bank Reconciliation and Proof of CashAnnie RapanutNo ratings yet

- MVF Finance ManualDocument17 pagesMVF Finance ManualsaifNo ratings yet

- ACC205 SemProjectDocument4 pagesACC205 SemProjectBernice OrtegaNo ratings yet

- Pak Enings HTDocument15 pagesPak Enings HTVincent SampianoNo ratings yet

- Name - ID. No. - Section - GroupDocument3 pagesName - ID. No. - Section - Groupsamuel debebeNo ratings yet

- Financial Activities of Rastriya Banijya Bank Limited: An Internship ReportDocument45 pagesFinancial Activities of Rastriya Banijya Bank Limited: An Internship ReportPrajwol ThapaNo ratings yet

- Accounting Reviewer Part 2Document14 pagesAccounting Reviewer Part 2yhygyugNo ratings yet

- 2 Notes Lecture Audit of Cash 2021Document1 page2 Notes Lecture Audit of Cash 2021JoyluxxiNo ratings yet

- AACONAPPS2 - Audit of Cash Reviewer (Theories)Document2 pagesAACONAPPS2 - Audit of Cash Reviewer (Theories)Dawson Dela CruzNo ratings yet

- Quiz No. 2Document5 pagesQuiz No. 2VernnNo ratings yet

- Savage Worlds - Realms of Cthulhu - Mythos Tales #2 - Unstill WatersDocument82 pagesSavage Worlds - Realms of Cthulhu - Mythos Tales #2 - Unstill WatersBrandon Harris100% (1)

- Customizing Data Setup Bank Account Management 20160510 PDFDocument68 pagesCustomizing Data Setup Bank Account Management 20160510 PDFDanny NinovaNo ratings yet

- Module 2 - Bank Reconciliation - With Sample ExercisesDocument24 pagesModule 2 - Bank Reconciliation - With Sample ExercisesJudie Ellaine SumandacNo ratings yet

- Loan Account Statement For 4210Cd00035753: DisclaimerDocument1 pageLoan Account Statement For 4210Cd00035753: DisclaimerVicky BossNo ratings yet

- Cash and Cash Equivalents TheoriesDocument5 pagesCash and Cash Equivalents Theoriesjane dillanNo ratings yet

- Electronic Bank Statement - CAMT 054 FormatDocument18 pagesElectronic Bank Statement - CAMT 054 FormatpermendraderivNo ratings yet

- Bank ReconciliationsDocument24 pagesBank ReconciliationsTinoManhangaNo ratings yet

- Cash and Cash Equivalent LatestDocument53 pagesCash and Cash Equivalent LatestxagocipNo ratings yet

- The Effects of The Reconciling ItemDocument16 pagesThe Effects of The Reconciling ItemElla BridgetteNo ratings yet

Question 7.1 7.2

Question 7.1 7.2

Uploaded by

AnOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Question 7.1 7.2

Question 7.1 7.2

Uploaded by

AnCopyright:

Available Formats

Part 7 – Internal Control and Cash

Question 7.1 Preparation of Bank Reconciliation and Recording Adjustments

The bank reconciliation prepared by June Bug Inc on June 30, appeared as follows:

June Bug Inc.

Bank Reconciliation

June 30

$ $

Bank Statement Balance 12,351.18 Book Balance 16,874.59

Add:

Deposit of June 30 in

transit 1,208.51

13,559.69

Deduct: Deduct:

Outstanding cheques: NSF cheque plus

$

#265 $ 455.85 service charge: 5,035.75

Bank service

#276 1,400.00 1,855.85 charge 135.00 5,170.75

$ $

Adjusted bank balance 11,703.84 Adjusted book balance 11,703.84

The Cash account in the general ledger appeared as follows on July 31:

Cash - Acct No 1001

Date Explanation PR Debit Credit Balance

July 1 Balance $11,703.84

$ 10,433.96

1 Cheque # 280 GJ458 1,269.88

1 Cheque # 281 GJ459 1254.32 9,179.64

4 Cheque # 282 GJ460 741.59 8,438.05

6 Cheque # 283 GJ461 455.85 7,982.20

7 Cheque # 284 GJ462 1748.44 6,233.76

8 Deposit GJ463 $ 3,751.56 9,985.32

12 Cheque # 285 GJ464 1375.06 8,610.26

12 Cheque # 286 GJ465 1374.67 7,235.59

14 Cheque # 287 GJ466 647.32 6,588.27

18 Cheque # 288 GJ467 1153.06 5,435.21

19 Deposit GJ468 4,611.27 10,046.48

20 Cheque # 289 GJ469 2386.52 7,659.96

24 Cheque # 290 GJ470 304.05 7,355.91

25 Cheque # 291 GJ471 337.08 7,018.83

31 Deposit GJ472 4,152.36 11,171.19

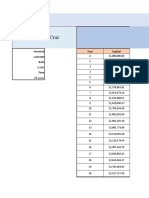

The following bank statement is available for July:

Financial Accounting I by Evan van Dyk is license under a CC BY 4.0 license.

Bank Statement

To: June Big Inc.

July 31

Cheques/Charges Deposits/Credits Balance

July 1 Balance $12,351.18

1 Deposit $1,208.51 13,559.69

6 Cheque # 280 $1,269.88 12,289.81

8 Cheque # 282 741.59 11,548.22

8 Cheque # 265 455.85 11,092.37

9 Cheque # 284 1,748.44 9,343.93

9 Deposit 3,751.56 13,095.49

14 Cheque # 286 1,374.67 11,720.82

15 Cheque # 287 674.32 11,046.50

18 Cheque # 285 1,375.06 9,671.44

20 Deposit 4,611.27 14,282.71

23 Cheque # 289 2,386.52 11,896.19

28 Cheque # 291 337.08 11,559.11

31 Interest 4.50 11,563.61

31 Service Charge 60.00 11,503.61

Prepare a bank reconciliation at July 31 Assume that any errors made were by the bookkeeper (cheque

#287 was for office supplies).

Prepare the necessary entries resulting from the bank reconciliation.

Financial Accounting I by Evan van Dyk is license under a CC BY 4.0 license.

Financial Accounting I by Evan van Dyk is license under a CC BY 4.0 license.

Date Account Titles and Explanation PR Debit Credit

Financial Accounting I by Evan van Dyk is license under a CC BY 4.0 license.

Question 7.2 Preparation of Bank Reconciliation and Recording Adjustments

The bank reconciliation prepared by Chapman Inc. on September 30 appeared as follows:

Chapman Inc.

Bank Reconciliation

September 30

Bank Statement Balance $ 16,518.15 Book Balance $ 34,648.55

Add:

Deposit of Sept 30 in transit 17,351.00

33,869.15

Deduct: Deduct:

$

Outstanding cheques: Interest Payment 450.00

$

#551 $ 2,945.15 Principle Payment 4,500.00

#558 850.45 3,795.60 Bank service charge 75.00 4,575.00

Adjusted bank balance $ 30,073.55 Adjusted book balance $ 30,073.55

The Cash account in the general ledger appeared as follows on October 31:

Cash - Acct No 1001

Date Explanation PR Debit Credit Balance

October 1 Balance $30,073.55

1 Cheque # 565 GJ121 $ 1,235.26 28,838.29

2 Cheque # 566 GJ122 850.07 27,988.22

3 Cheque # 567 GJ123 1,354.71 26,633.51

6 Cheque # 568 GJ124 858.71 25,774.80

6 Cheque # 569 GJ125 1,253.92 24,520.88

8 Deposit GJ126 3,193.93 27,714.81

12 Cheque # 570 GJ127 810.37 26,904.44

12 Cheque # 571 GJ128 1,458.10 25,446.34

14 Cheque # 572 GJ129 816.54 24,629.79

18 Cheque # 573 GJ130 1,014.34 23,615.45

19 Deposit GJ131 1,139.68 24,755.13

20 Cheque # 574 GJ132 2,386.52 22,368.62

24 Cheque # 575 GJ133 780.85 21,587.77

25 Cheque # 576 GJ134 925.60 20,662.16

31 Deposit GJ135 1,264.08 21,926.25

The following bank statement is available for October:

Financial Accounting I by Evan van Dyk is license under a CC BY 4.0 license.

Bank Statement

To: Chapman Inc.

October 31

Cheques/Charges Deposits/Credits Balance

October 1 Balance $16,518.15

1 Deposit $17,351.00 33,869.15

3 Cheque # 551 $2,945.15 30,924.00

8 Cheque # 565 1,235.26 29,688.74

8 Cheque # 568 858.71 28,830.03

9 Cheque # 569 1,253.92 27,576.11

9 Deposit 3,193.93 30,770.04

17 Cheque # 572 816.54 29,953.50

19 Cheque # 558 850.45 29,103.05

21 NSF Cheque 1,284.83 27,818.22

20 Deposit 1,139.68 28,957.90

26 Cheque # 574 2,386.52 26,571.38

28 Cheque # 575 780.85 25,790.53

31 Cheque # 571 1,458.10 24,332.43

31 Principle 4,500.00 19,832.43

31 Interest 440.00 19,392.43

31 Service Charge 60.00 19,332.43

Prepare a bank reconciliation at October 31. The NSF cheque was for a customer payment Jessica

Pearson.

Prepare the necessary entries resulting from the bank reconciliation.

Financial Accounting I by Evan van Dyk is license under a CC BY 4.0 license.

Financial Accounting I by Evan van Dyk is license under a CC BY 4.0 license.

Date Account Titles and Explanation PR Debit Credit

Financial Accounting I by Evan van Dyk is license under a CC BY 4.0 license.

You might also like

- Varo Bank Statement BankStatementsDocument2 pagesVaro Bank Statement BankStatementsВасилий Горох100% (1)

- Bandhan Bank Statement.Document1 pageBandhan Bank Statement.ssbajajbethua22No ratings yet

- Schaum's Outline of Bookkeeping and Accounting, Fourth EditionFrom EverandSchaum's Outline of Bookkeeping and Accounting, Fourth EditionRating: 5 out of 5 stars5/5 (1)

- Field Report (Udsm)Document22 pagesField Report (Udsm)Farid said89% (18)

- Au Abhi Bank StatementDocument1 pageAu Abhi Bank StatementAjit RawalNo ratings yet

- Coca-Cola (Ticker Symbol KO On NYSE) : Standardized Balance Sheet and Income Statement (Millions)Document6 pagesCoca-Cola (Ticker Symbol KO On NYSE) : Standardized Balance Sheet and Income Statement (Millions)Sayan BiswasNo ratings yet

- Review Questions For Test #1 ACC210Document14 pagesReview Questions For Test #1 ACC210Aaa0% (1)

- Instructions:: Name: Score: Bank Statement ReconciliationDocument3 pagesInstructions:: Name: Score: Bank Statement ReconciliationAlpha JNo ratings yet

- Homework Solutions Week 13Document4 pagesHomework Solutions Week 13JNo ratings yet

- Activity 1Document7 pagesActivity 1Joanah TayamenNo ratings yet

- Exercise On Bank ReconciliationDocument3 pagesExercise On Bank ReconciliationJoshua OtienoNo ratings yet

- Bac 204 - Cat 1Document4 pagesBac 204 - Cat 1duncanmaina204No ratings yet

- Bank StatementDocument3 pagesBank StatementSigei LeonardNo ratings yet

- Ventas a PlazoDocument37 pagesVentas a Plazoxnwshfc sxbwidmaNo ratings yet

- Bank Reconciliation ExampleDocument5 pagesBank Reconciliation ExampleAyushi chauhanNo ratings yet

- 20 Devt Fund PPSBDocument103 pages20 Devt Fund PPSBAljo FernandezNo ratings yet

- Taller 8 - 03 Julián ConciliaciónDocument14 pagesTaller 8 - 03 Julián ConciliaciónJulian SaezNo ratings yet

- Bank ReconnnnDocument5 pagesBank ReconnnnRamm Raven Castillo100% (1)

- General Ledger/ Company Books Bank StatementDocument1 pageGeneral Ledger/ Company Books Bank StatementBazal NasirNo ratings yet

- Ejemplo Tabla de Amortización Finanaciamiento Actividad 2Document2 pagesEjemplo Tabla de Amortización Finanaciamiento Actividad 2Alizz CoRaNo ratings yet

- AKINJISE Fatai (SB14243) : Ondo State Government Staff Matters AccountDocument1 pageAKINJISE Fatai (SB14243) : Ondo State Government Staff Matters AccountScientist Orioye GabrielNo ratings yet

- CheckStubsReport 20240610153828Document22 pagesCheckStubsReport 20240610153828justcallmearbiterNo ratings yet

- Loan Payment Calculator Amortiztion ScheduleDocument2 pagesLoan Payment Calculator Amortiztion Scheduley shNo ratings yet

- Screenshot 2020-03-13 at 4.33.54 PMDocument6 pagesScreenshot 2020-03-13 at 4.33.54 PMJordan Leigh AuriemmaNo ratings yet

- Topic 7: Cash Management and Control, Preparation Bank Reconciliations and Maintaining A Petty Cash System Solutions To Tutorial QuestionsDocument3 pagesTopic 7: Cash Management and Control, Preparation Bank Reconciliations and Maintaining A Petty Cash System Solutions To Tutorial QuestionsMitchell BylartNo ratings yet

- 15 YearstudentloanDocument8 pages15 Yearstudentloanapi-351687679No ratings yet

- WalshDocument6 pagesWalshapi-518242090No ratings yet

- Actual Comparative Income StatementDocument21 pagesActual Comparative Income StatementRichelle PilapilNo ratings yet

- AKINJISE Fatai (SB14243) : Ondo State Government Staff Matters AccountDocument1 pageAKINJISE Fatai (SB14243) : Ondo State Government Staff Matters AccountScientist Orioye GabrielNo ratings yet

- Tax LiabilityDocument133 pagesTax LiabilitySebastian Cruz RivasNo ratings yet

- BUSI 1043 Unit 3 ExerciseDocument4 pagesBUSI 1043 Unit 3 ExerciseRichard MamisNo ratings yet

- Bhushan SteelDocument3 pagesBhushan Steelharshad19855457No ratings yet

- MAT-200013 Company Files BinderDocument3 pagesMAT-200013 Company Files BinderDenny Brave NSANZUMUHIRENo ratings yet

- AKINJISE Fatai (SB14243) : Ondo State Government Staff Matters AccountDocument1 pageAKINJISE Fatai (SB14243) : Ondo State Government Staff Matters AccountScientist Orioye GabrielNo ratings yet

- AKINJISE Fatai (SB14243) : Ondo State Government Staff Matters AccountDocument1 pageAKINJISE Fatai (SB14243) : Ondo State Government Staff Matters AccountScientist Orioye GabrielNo ratings yet

- Auditing Problems - 001Document2 pagesAuditing Problems - 001Geoff MacarateNo ratings yet

- Audit Prob Cash AnsDocument7 pagesAudit Prob Cash AnsNoreen BinagNo ratings yet

- Bank Reconciliation L2Document3 pagesBank Reconciliation L2C XNo ratings yet

- Special Journals - Quiz 36Document8 pagesSpecial Journals - Quiz 36Joana TrinidadNo ratings yet

- Balance Sheet of Jet AirwaysDocument2 pagesBalance Sheet of Jet Airwaysakhilesh718No ratings yet

- Tabla de Amortizacion2Document5 pagesTabla de Amortizacion2Maciel DorvilleNo ratings yet

- Tabla de Amortizacion2Document5 pagesTabla de Amortizacion2Heyssy PachecoNo ratings yet

- Task 1: Prepare Budgets Part 1 A (Refer To Spreadsheet) Profit BudgetDocument15 pagesTask 1: Prepare Budgets Part 1 A (Refer To Spreadsheet) Profit BudgetUurka LucyNo ratings yet

- BC 16 02 2023Document10 pagesBC 16 02 2023jhonatan vladimirNo ratings yet

- Matematica Financiera Paso 2Document21 pagesMatematica Financiera Paso 2ana maria gutierrezNo ratings yet

- Mortgage Payment Calculator - TD Canada TrustDocument3 pagesMortgage Payment Calculator - TD Canada TrustTomura ShigarakiNo ratings yet

- Item No. 23 Teresita BuenaflorDocument14 pagesItem No. 23 Teresita BuenaflorXiaoNo ratings yet

- TM 7 Tugas PDF Bank ConsiliationDocument2 pagesTM 7 Tugas PDF Bank ConsiliationNajla Aura KhansaNo ratings yet

- Input Data: Checking Account ReconciliationDocument8 pagesInput Data: Checking Account ReconciliationĐặng Thuỳ HươngNo ratings yet

- Balance Sheet of Ambuja CementsDocument7 pagesBalance Sheet of Ambuja CementsHiren KariyaNo ratings yet

- Instructions: Do Chapter 2 - Problem 6Document18 pagesInstructions: Do Chapter 2 - Problem 6Christopher ColumbusNo ratings yet

- CRJ ModularDocument2 pagesCRJ ModularCarla Sabrina PamajilanNo ratings yet

- Prime It Bank Statement - June 2019Document4 pagesPrime It Bank Statement - June 2019api-306226330No ratings yet

- 1st Practice AccountingDocument7 pages1st Practice AccountingJose AmayaNo ratings yet

- Information Technology (PUNO)Document9 pagesInformation Technology (PUNO)Daniel Gabriel PunoNo ratings yet

- 15 YearmortgageDocument8 pages15 Yearmortgageapi-351687679No ratings yet

- Neraca Februari 2024Document2 pagesNeraca Februari 2024k24isvillNo ratings yet

- Bank Reconsiliasi - Model Soal 7.5Document4 pagesBank Reconsiliasi - Model Soal 7.5William SugiartoNo ratings yet

- Jet AirwaysDocument5 pagesJet AirwaysKarthik SrmNo ratings yet

- 1.2 Assignment Audit of Cash and Cash Equivalents 2Document3 pages1.2 Assignment Audit of Cash and Cash Equivalents 2ORIEL RICKY IGNACIO GALLARDONo ratings yet

- Non Negotiable - This Is Not A Check - Non NegotiableDocument1 pageNon Negotiable - This Is Not A Check - Non NegotiableAlexa PribisNo ratings yet

- Parcial2 - Actividades de La Semana 4 KevvDocument23 pagesParcial2 - Actividades de La Semana 4 KevvLuis Eduardo Meunier MendezNo ratings yet

- ChaseDocument6 pagesChasepeter hammerNo ratings yet

- Plazo (Meses, Semanas, Días) Saldo InsolutoDocument2 pagesPlazo (Meses, Semanas, Días) Saldo InsolutoFanny Osorio TapiasNo ratings yet

- J.K. Lasser's Small Business Taxes 2007: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2007: Your Complete Guide to a Better Bottom LineNo ratings yet

- Starting A Business in Vietnam and Mexico Can Offer Unique Opportunities and ChallengesDocument3 pagesStarting A Business in Vietnam and Mexico Can Offer Unique Opportunities and ChallengesAnNo ratings yet

- BullyingDocument2 pagesBullyingAnNo ratings yet

- Daft12ePPT Ch09Document19 pagesDaft12ePPT Ch09AnNo ratings yet

- About Vietnamese FiannceDocument13 pagesAbout Vietnamese FiannceAnNo ratings yet

- Daft CH02 FinalDocument40 pagesDaft CH02 FinalAnNo ratings yet

- DA 185 - Application Form - Registration or Licensing of Customs and Excise Clients External FormDocument6 pagesDA 185 - Application Form - Registration or Licensing of Customs and Excise Clients External Formkotu.kgomotsoNo ratings yet

- FIN - BL - EB - 1 - Import and Forward (Automatically) (New) (RELNFIBL - 606 - FINBLEB1 - 01) - ConsolutDocument3 pagesFIN - BL - EB - 1 - Import and Forward (Automatically) (New) (RELNFIBL - 606 - FINBLEB1 - 01) - ConsolutiuriiNo ratings yet

- Auditing Midterm Exam - Attempt ReviewDocument47 pagesAuditing Midterm Exam - Attempt ReviewkielmorganzapietoNo ratings yet

- Grade 11 Provincial Examination Accounting P2 (English) June 2023 Question PaperDocument11 pagesGrade 11 Provincial Examination Accounting P2 (English) June 2023 Question PaperRebotile MashaoNo ratings yet

- Revision Business Studies Paper 1 & 2Document64 pagesRevision Business Studies Paper 1 & 2Utkarsh AgarwalNo ratings yet

- Reconciliation StatementsDocument26 pagesReconciliation StatementsPetrinaNo ratings yet

- Exercises For Bank Reconciliation and Proof of CashDocument2 pagesExercises For Bank Reconciliation and Proof of CashAnnie RapanutNo ratings yet

- MVF Finance ManualDocument17 pagesMVF Finance ManualsaifNo ratings yet

- ACC205 SemProjectDocument4 pagesACC205 SemProjectBernice OrtegaNo ratings yet

- Pak Enings HTDocument15 pagesPak Enings HTVincent SampianoNo ratings yet

- Name - ID. No. - Section - GroupDocument3 pagesName - ID. No. - Section - Groupsamuel debebeNo ratings yet

- Financial Activities of Rastriya Banijya Bank Limited: An Internship ReportDocument45 pagesFinancial Activities of Rastriya Banijya Bank Limited: An Internship ReportPrajwol ThapaNo ratings yet

- Accounting Reviewer Part 2Document14 pagesAccounting Reviewer Part 2yhygyugNo ratings yet

- 2 Notes Lecture Audit of Cash 2021Document1 page2 Notes Lecture Audit of Cash 2021JoyluxxiNo ratings yet

- AACONAPPS2 - Audit of Cash Reviewer (Theories)Document2 pagesAACONAPPS2 - Audit of Cash Reviewer (Theories)Dawson Dela CruzNo ratings yet

- Quiz No. 2Document5 pagesQuiz No. 2VernnNo ratings yet

- Savage Worlds - Realms of Cthulhu - Mythos Tales #2 - Unstill WatersDocument82 pagesSavage Worlds - Realms of Cthulhu - Mythos Tales #2 - Unstill WatersBrandon Harris100% (1)

- Customizing Data Setup Bank Account Management 20160510 PDFDocument68 pagesCustomizing Data Setup Bank Account Management 20160510 PDFDanny NinovaNo ratings yet

- Module 2 - Bank Reconciliation - With Sample ExercisesDocument24 pagesModule 2 - Bank Reconciliation - With Sample ExercisesJudie Ellaine SumandacNo ratings yet

- Loan Account Statement For 4210Cd00035753: DisclaimerDocument1 pageLoan Account Statement For 4210Cd00035753: DisclaimerVicky BossNo ratings yet

- Cash and Cash Equivalents TheoriesDocument5 pagesCash and Cash Equivalents Theoriesjane dillanNo ratings yet

- Electronic Bank Statement - CAMT 054 FormatDocument18 pagesElectronic Bank Statement - CAMT 054 FormatpermendraderivNo ratings yet

- Bank ReconciliationsDocument24 pagesBank ReconciliationsTinoManhangaNo ratings yet

- Cash and Cash Equivalent LatestDocument53 pagesCash and Cash Equivalent LatestxagocipNo ratings yet

- The Effects of The Reconciling ItemDocument16 pagesThe Effects of The Reconciling ItemElla BridgetteNo ratings yet