Professional Documents

Culture Documents

FinalLetter 88-4282224 PLANTSFORHUMANITYFOUNDATION 01142023 00

FinalLetter 88-4282224 PLANTSFORHUMANITYFOUNDATION 01142023 00

Uploaded by

CloudKitOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

FinalLetter 88-4282224 PLANTSFORHUMANITYFOUNDATION 01142023 00

FinalLetter 88-4282224 PLANTSFORHUMANITYFOUNDATION 01142023 00

Uploaded by

CloudKitCopyright:

Available Formats

Department of the Treasury Date:

Internal Revenue Service 01/24/2023

Tax Exempt and Government Entities Employer ID number:

P.O. Box 2508 75-3249696

Cincinnati, OH 45201 Person to contact:

Name: Customer Service

ID number: 31954

Telephone: 877-829-5500

ANY DOG RESCUE Accounting period ending:

C/O MARTA WOLFE December 31

822 BENICIA RD Public charity status:

VALLEJO, CA 94591 509(a)(2)

Form 990 / 990-EZ / 990-N required:

Yes

Effective date of exemption:

August 10, 2023

Contribution deductibility:

Yes

Addendum applies:

No

DLN:

26053419007283

Dear Applicant:

We're pleased to tell you we determined you're exempt from federal income tax under Internal Revenue Code

(IRC) Section 501(c)(3). Donors can deduct contributions they make to you under IRC Section 170. You're also

qualified to receive tax deductible bequests, devises, transfers or gifts under Section 2055, 2106, or 2522. This

letter could help resolve questions on your exempt status. Please keep it for your records.

Organizations exempt under IRC Section 501(c)(3) are further classified as either public charities or private

foundations. We determined you're a public charity under the IRC Section listed at the top of this letter.

If we indicated at the top of this letter that you're required to file Form 990/990-EZ/990-N, our records show

you're required to file an annual information return (Form 990 or Form 990-EZ) or electronic notice (Form

990-N, the e-Postcard). If you don't file a required return or notice for three consecutive years, your exempt

status will be automatically revoked.

If we indicated at the top of this letter that an addendum applies, the enclosed addendum is an integral part of

this letter.

For important information about your responsibilities as a tax-exempt organization, go to www.irs.gov/charities.

Enter "4221-PC" in the search bar to view Publication 4221-PC, Compliance Guide for 501(c)(3) Public

Charities, which describes your recordkeeping, reporting, and disclosure requirements.

Sincerely,

Stephen A. Martin

Director, Exempt Organizations

Rulings and Agreements

Letter 947 (Rev. 2-2020)

Catalog Number 35152P

You might also like

- Hailey Simpson Tax Return Scenario 9Document29 pagesHailey Simpson Tax Return Scenario 9qypctpnbp8No ratings yet

- Gorin Business Structuring MaterialsDocument1,260 pagesGorin Business Structuring MaterialsJoshua Friel100% (3)

- GST HST Return Notice of Assessment 2022 11 17 00 29 29 773897 PDFDocument4 pagesGST HST Return Notice of Assessment 2022 11 17 00 29 29 773897 PDFalex mac dougallNo ratings yet

- CP575Notice 1605020544606Document2 pagesCP575Notice 1605020544606SMOOVE STOP PLAYIN RECORDS100% (1)

- Classification Election. See Form 8832 and Its Instructions For Additional InformationDocument3 pagesClassification Election. See Form 8832 and Its Instructions For Additional InformationSamuel RodriguezNo ratings yet

- Renters InsuranceDocument1 pageRenters InsuranceQuintina100% (1)

- April 2022Document2 pagesApril 2022abul hasan nayemNo ratings yet

- Chase Name Change 0202Document2 pagesChase Name Change 0202Mason DukeNo ratings yet

- Preliminary Title ReportDocument24 pagesPreliminary Title Reportpournima mohiteNo ratings yet

- New Tax Return Transcript 2222Document7 pagesNew Tax Return Transcript 2222James Franklin67% (3)

- Chorinho Pacoqui o Du SilvaDocument9 pagesChorinho Pacoqui o Du SilvaAlejo GarciaNo ratings yet

- FinalLetter 93-4356006 MEAMOANANUI 11102023 00Document1 pageFinalLetter 93-4356006 MEAMOANANUI 11102023 00lummyylummyyNo ratings yet

- FinalLetter 99-1144423 2SUBJECTSYOUTHANDFAMILIES 03082024 00Document1 pageFinalLetter 99-1144423 2SUBJECTSYOUTHANDFAMILIES 03082024 00amatobertrumNo ratings yet

- Ein Letter Tma of CookDocument1 pageEin Letter Tma of CookamatobertrumNo ratings yet

- Ein Letter Mountainside HospitalDocument1 pageEin Letter Mountainside HospitalamatobertrumNo ratings yet

- Project Veritas Tax Exemption ApplicationDocument22 pagesProject Veritas Tax Exemption ApplicationLachlan MarkayNo ratings yet

- Fowlis, Jesse - T183Document2 pagesFowlis, Jesse - T183End UserNo ratings yet

- TY2020 - Fair Fight Action - Form 990-PDocument78 pagesTY2020 - Fair Fight Action - Form 990-PWashington ExaminerNo ratings yet

- Reporting Agent Authorization: Sign HereDocument1 pageReporting Agent Authorization: Sign HereSam OziegbeNo ratings yet

- Mission Economic Development Agency 990 2016Document46 pagesMission Economic Development Agency 990 2016auweia1No ratings yet

- 6.30.23 Federal Form 990Document60 pages6.30.23 Federal Form 990araciaa16No ratings yet

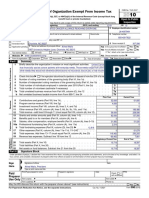

- Return of Organization Exempt From Income Tax: Open To Public InspectionDocument21 pagesReturn of Organization Exempt From Income Tax: Open To Public Inspectiontamiller866No ratings yet

- Additional Credits and Payments: Schedule 3Document1 pageAdditional Credits and Payments: Schedule 3Betty Ann LegerNo ratings yet

- Robinhood Crypto LLC 85 Willow Road Menlo Park, Ca 94025Document4 pagesRobinhood Crypto LLC 85 Willow Road Menlo Park, Ca 94025Jack BotNo ratings yet

- Jhonathan Zambrano Claim 1075395Document51 pagesJhonathan Zambrano Claim 1075395alvaradojarisNo ratings yet

- Fy 2018 FinancialsDocument68 pagesFy 2018 FinancialsAnonymous UH3nIimNo ratings yet

- Shared Temp ELA0Request For Transcript of Tax Ret B 2 11 OutputDocument1 pageShared Temp ELA0Request For Transcript of Tax Ret B 2 11 OutputBlessing Nel GuillaumeNo ratings yet

- Original DocumentDocument45 pagesOriginal Documentalbert anonuevoNo ratings yet

- SignedApplication 9511954983-01 Angela MartinDocument12 pagesSignedApplication 9511954983-01 Angela Martinangelalynnmartin4No ratings yet

- Welrp 2010 990Document38 pagesWelrp 2010 990WELRPNo ratings yet

- 2021 Berger Form 990 - Public InspectionDocument33 pages2021 Berger Form 990 - Public InspectionGabe KaminskyNo ratings yet

- F4506 - LOAN - KY - 3324213673 - 406782704 - 1040 - 12312019 - Kevin Maguire - 40601Document1 pageF4506 - LOAN - KY - 3324213673 - 406782704 - 1040 - 12312019 - Kevin Maguire - 40601myworldiadoreNo ratings yet

- Protecting Ohio Inc.Document18 pagesProtecting Ohio Inc.Jessie BalmertNo ratings yet

- ST Ending:: CincinnatiDocument3 pagesST Ending:: CincinnatiMassiNo ratings yet

- Internal Revenue Service Notice 1382: Department of The TreasuryDocument30 pagesInternal Revenue Service Notice 1382: Department of The TreasuryWahrhaftigNo ratings yet

- Tax Information Authorization: Form (Rev. January 2021) Department of The Treasury Internal Revenue ServiceDocument1 pageTax Information Authorization: Form (Rev. January 2021) Department of The Treasury Internal Revenue ServiceJohnArbNo ratings yet

- Goodlett Quail 2019 Form 1065 SC SignedDocument19 pagesGoodlett Quail 2019 Form 1065 SC SignedSue StevenNo ratings yet

- Intertech Fluid Power 2019Document38 pagesIntertech Fluid Power 2019Sue StevenNo ratings yet

- P Neupane CPA 407R Mystic Avenue Suite 26 Medford, MA 02155 (617) 717-8108Document37 pagesP Neupane CPA 407R Mystic Avenue Suite 26 Medford, MA 02155 (617) 717-8108GOODS AND SERVICES TAXNo ratings yet

- This Is The Trial Version. Click Here To Get The Full Calc VersionDocument16 pagesThis Is The Trial Version. Click Here To Get The Full Calc VersionMounesh KumarNo ratings yet

- CBA ContractDocument3 pagesCBA ContractjackazizoskiNo ratings yet

- Client Benefit Retainer AgreementDocument4 pagesClient Benefit Retainer AgreementHarvey BenderNo ratings yet

- BDSMDocument2 pagesBDSMmathewshallom77No ratings yet

- 1099k Document ExampleDocument65 pages1099k Document ExamplemuchromadhooniNo ratings yet

- Singh, Jashanpreet Tax PDF 2020 SignedDocument20 pagesSingh, Jashanpreet Tax PDF 2020 SignedJashan Dere AalaNo ratings yet

- Form 4506-T (Rev. 11-2021)Document1 pageForm 4506-T (Rev. 11-2021)keyNo ratings yet

- Six LLC (EIN - 84-4408052) - Form 1099-NEC - 2023Document1 pageSix LLC (EIN - 84-4408052) - Form 1099-NEC - 2023nansolokoNo ratings yet

- Building International Bridges BIB Articles of Incorporation Page 19 BY LAWSDocument32 pagesBuilding International Bridges BIB Articles of Incorporation Page 19 BY LAWSJk McCreaNo ratings yet

- Sharmin Sultana: Tax Information AuthorizationDocument1 pageSharmin Sultana: Tax Information AuthorizationIam GalactorNo ratings yet

- Department of The Treasury Internal Revenue Service Notice 1382Document30 pagesDepartment of The Treasury Internal Revenue Service Notice 1382peterjohannes100% (1)

- Ashley Dixon-Harrison 293 Whittenton ST Apt 1Ft TAUNTON MA 02780-1305Document2 pagesAshley Dixon-Harrison 293 Whittenton ST Apt 1Ft TAUNTON MA 02780-1305ashcat227 DNo ratings yet

- FY20 990 YouthServiceAmericaDocument37 pagesFY20 990 YouthServiceAmericaTOSSOU BerangerNo ratings yet

- Return Checklist Form 1040 ShortDocument13 pagesReturn Checklist Form 1040 ShortMalathi accountsNo ratings yet

- Notice of Assessment 2021 03 18 13 33 09 783841Document4 pagesNotice of Assessment 2021 03 18 13 33 09 783841Maria Fe CeleciosNo ratings yet

- T3 Adjustment Request: A. IdentificationDocument2 pagesT3 Adjustment Request: A. Identificationchosu_riki7316No ratings yet

- Irs Form 1023Document30 pagesIrs Form 1023Steve Majerus-Collins0% (1)

- 2010 Form 990 PDFDocument48 pages2010 Form 990 PDFMark ReinhardtNo ratings yet

- Antonio Morales Reyes T183 2023-03-30Document1 pageAntonio Morales Reyes T183 2023-03-30Antonio MoralesNo ratings yet

- F 843Document1 pageF 843Manjula.bsNo ratings yet

- Everytown Gun Safety Action Fund - 990 Tax FormDocument118 pagesEverytown Gun Safety Action Fund - 990 Tax FormCNBC.comNo ratings yet

- 501c3 IRS Affirmation LetterDocument3 pages501c3 IRS Affirmation LetterDjibzlaeNo ratings yet

- 2019 CorporateDocument32 pages2019 Corporateapi-167637329No ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- How to Do a 1031 Exchange of Real Estate: Using a 1031 Qualified Intermediary (Qi) 2Nd EditionFrom EverandHow to Do a 1031 Exchange of Real Estate: Using a 1031 Qualified Intermediary (Qi) 2Nd EditionNo ratings yet

- 1040 Exam Prep: Module I: The Form 1040 FormulaFrom Everand1040 Exam Prep: Module I: The Form 1040 FormulaRating: 1 out of 5 stars1/5 (3)

- Tax Exemption Rules in The PhilippinesDocument1 pageTax Exemption Rules in The PhilippinesEllen Glae DaquipilNo ratings yet

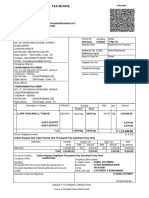

- Tax ReceiptDocument1 pageTax ReceiptCHRISNo ratings yet

- MonthlyPaySlip 2023 02 20T07 04 10Document1 pageMonthlyPaySlip 2023 02 20T07 04 10Prashank ShandilyaNo ratings yet

- 2022 Tax ComputationDocument7 pages2022 Tax ComputationGeo Mosaic Diaz (Jiyu)No ratings yet

- 12.2 Patches Released After RUP 10 Released On 20-Aug-2017Document12 pages12.2 Patches Released After RUP 10 Released On 20-Aug-2017Srinivas GirnalaNo ratings yet

- Corporation TRAIN and CREATE LawDocument8 pagesCorporation TRAIN and CREATE LawdgdeguzmanNo ratings yet

- Payslip Matrimony PDFDocument2 pagesPayslip Matrimony PDFPuneeth KumarNo ratings yet

- Tax InvoiceDocument2 pagesTax InvoiceTechnetNo ratings yet

- F 211Document2 pagesF 211Bogdan PraščevićNo ratings yet

- A Government of West Bengal EnterpriseDocument1 pageA Government of West Bengal EnterprisetanmoyNo ratings yet

- InvoiceDocument1 pageInvoiceManish KumarNo ratings yet

- Pss Silks & Sarees-Shs00923-24-25 Apr 23Document1 pagePss Silks & Sarees-Shs00923-24-25 Apr 23DEVRAJU SNo ratings yet

- RPH FinalsDocument2 pagesRPH FinalsHagia CanapiNo ratings yet

- Celestine 5Document1 pageCelestine 5Nicole Caruther0% (1)

- Estate Under Administration-Tax2Document15 pagesEstate Under Administration-Tax2onet88No ratings yet

- T1Q Introduction & RSDocument9 pagesT1Q Introduction & RS吕仙姿No ratings yet

- CT Tax267 Ss Oct2019 PDFDocument3 pagesCT Tax267 Ss Oct2019 PDFSyazryna AzlanNo ratings yet

- Abft1024 T8 - LtyDocument2 pagesAbft1024 T8 - Ltylfc778No ratings yet

- RR 34-2020 DigestDocument2 pagesRR 34-2020 DigestJejomarNo ratings yet

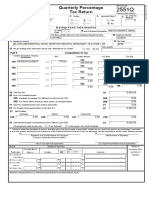

- Quarterly Percentage Tax Return: 12 - DecemberDocument1 pageQuarterly Percentage Tax Return: 12 - DecemberralphalonzoNo ratings yet

- 4515512273482Document1 page4515512273482VermaNo ratings yet

- Cir V Cta & Smith KlineDocument6 pagesCir V Cta & Smith KlinePamela GuiangNo ratings yet

- Wa0005.Document1 pageWa0005.sidd.jane11No ratings yet

- Certificate of Creditable Tax Withheld at Source: Kawanihan NG Rentas InternasDocument1 pageCertificate of Creditable Tax Withheld at Source: Kawanihan NG Rentas InternasMARJONNo ratings yet

- Integrated Goods and Service Tax (IGST)Document21 pagesIntegrated Goods and Service Tax (IGST)Avinash As AviNo ratings yet