Professional Documents

Culture Documents

B 004561 Doc 201300002017

B 004561 Doc 201300002017

Uploaded by

CloudKitCopyright:

Available Formats

You might also like

- IRS 3949-A American Bankers AssociationDocument2 pagesIRS 3949-A American Bankers Associationrodclassteam100% (4)

- 2010.07.14 HRTO Complaint Carasco v. University of Windsor Et Al. Form 1Document48 pages2010.07.14 HRTO Complaint Carasco v. University of Windsor Et Al. Form 1Omar .HaNo ratings yet

- Senate SAFE Banking ActDocument30 pagesSenate SAFE Banking ActMarijuana MomentNo ratings yet

- BARACK OBAMA FOUNDATION Registration Statement NEW YORK States Purpose As LIBRARYDocument5 pagesBARACK OBAMA FOUNDATION Registration Statement NEW YORK States Purpose As LIBRARYJerome CorsiNo ratings yet

- Voluntary Petition - Case Number - 05 16979 1 RelDocument35 pagesVoluntary Petition - Case Number - 05 16979 1 RelAlec VenturaNo ratings yet

- 2006 07 26 - DR1Document1 page2006 07 26 - DR1Zach EdwardsNo ratings yet

- For Instructions See Back of Form T?' ,, Form DR-1: 1 .L Gar Court 1 1 1 1Document1 pageFor Instructions See Back of Form T?' ,, Form DR-1: 1 .L Gar Court 1 1 1 1Zach EdwardsNo ratings yet

- Frankzen Altoona I-80 12 14 05Document1 pageFrankzen Altoona I-80 12 14 05Zach EdwardsNo ratings yet

- CHAR001-RT: Registration Statement and Notice of Termination of Intervening Interest For Charitable Remainder TrustsDocument1 pageCHAR001-RT: Registration Statement and Notice of Termination of Intervening Interest For Charitable Remainder Trustsفيصل جفارةNo ratings yet

- Clark Waddoups Financial Disclosure Report For 2010Document13 pagesClark Waddoups Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Wright Part-Time Agreement 1998 (GC-18)Document4 pagesWright Part-Time Agreement 1998 (GC-18)Albany Times UnionNo ratings yet

- 2006 05 01 - DR1Document1 page2006 05 01 - DR1Zach EdwardsNo ratings yet

- Cynthia M Rufe Financial Disclosure Report For 2010Document6 pagesCynthia M Rufe Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Information Referral: Department of The Treasury - Internal Revenue Service Form (12-2005) OMB # 1545-1960 (Document2 pagesInformation Referral: Department of The Treasury - Internal Revenue Service Form (12-2005) OMB # 1545-1960 (IRSNo ratings yet

- Cedar Valley Corp - 2005 - Black Hawk - OTCDocument1 pageCedar Valley Corp - 2005 - Black Hawk - OTCZach EdwardsNo ratings yet

- IRS Complaint Against NH District Corporation 11-18-19Document26 pagesIRS Complaint Against NH District Corporation 11-18-19Roberto RoldanNo ratings yet

- 15-7682 Floyd Kephart and New City Development Docs Part 1 PDFDocument17 pages15-7682 Floyd Kephart and New City Development Docs Part 1 PDFRecordTrac - City of OaklandNo ratings yet

- Information Referral: Form (2-2007) Department of The Treasury - Internal Revenue Service OMB # 1545-1960Document2 pagesInformation Referral: Form (2-2007) Department of The Treasury - Internal Revenue Service OMB # 1545-1960diversified1No ratings yet

- CycleBar - 2015-01-31 - FDD - Xponential Fitness BrandDocument214 pagesCycleBar - 2015-01-31 - FDD - Xponential Fitness BrandFuzzy PandaNo ratings yet

- Legacy Bank 12 16 05Document1 pageLegacy Bank 12 16 05Zach EdwardsNo ratings yet

- Danny Clancy CFR 10-25-10Document69 pagesDanny Clancy CFR 10-25-10sam_mertenNo ratings yet

- Aspro - 2005 - Black Hawk - OTCDocument1 pageAspro - 2005 - Black Hawk - OTCZach EdwardsNo ratings yet

- Harry Thomas JR IRS Form 3949aDocument2 pagesHarry Thomas JR IRS Form 3949aWashington City Paper100% (1)

- Polk County Employees AFSCME Local 1868 - 09-22-04 - ContributionDocument1 pagePolk County Employees AFSCME Local 1868 - 09-22-04 - ContributionZach EdwardsNo ratings yet

- Statement of Interests FormDocument4 pagesStatement of Interests FormJoe BowenNo ratings yet

- Clarence Thomas Financial Disclosure Report For 2010Document7 pagesClarence Thomas Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Reena Raggi Financial Disclosure Report For 2010Document23 pagesReena Raggi Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Combined Application Form For Incorporation Ammended 2017Document4 pagesCombined Application Form For Incorporation Ammended 2017Gold MindsNo ratings yet

- Aronson AffidavitDocument18 pagesAronson AffidavitNorthDecoder2No ratings yet

- Qwest 11-02-05Document1 pageQwest 11-02-05Zach EdwardsNo ratings yet

- V%Oulnth: For Instructions, See Back of Form I Ugi L U Form Dr-1Document2 pagesV%Oulnth: For Instructions, See Back of Form I Ugi L U Form Dr-1Zach EdwardsNo ratings yet

- Garland E Burrell JR Financial Disclosure Report For 2009Document6 pagesGarland E Burrell JR Financial Disclosure Report For 2009Judicial Watch, Inc.No ratings yet

- Palmer Candy 07 25 05Document1 pagePalmer Candy 07 25 05Zach EdwardsNo ratings yet

- Lawrence P Zatkoff Financial Disclosure Report For 2010Document6 pagesLawrence P Zatkoff Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- SIKANU Form 56Document4 pagesSIKANU Form 56sikanubeyel100% (3)

- Community State Bank 12 21 05Document1 pageCommunity State Bank 12 21 05Zach EdwardsNo ratings yet

- For Instructions, See Back Form Reset L Form DR-1Document2 pagesFor Instructions, See Back Form Reset L Form DR-1Zach EdwardsNo ratings yet

- Knupp For Mayor: For Instructions, See Back of Form LDocument1 pageKnupp For Mayor: For Instructions, See Back of Form LZach EdwardsNo ratings yet

- United States Securities and Exchange Commission Form D Notice of Exempt Offering of SecuritiesDocument7 pagesUnited States Securities and Exchange Commission Form D Notice of Exempt Offering of SecuritiesWilliam HarrisNo ratings yet

- State Steel Supply 07 05 05Document1 pageState Steel Supply 07 05 05Zach EdwardsNo ratings yet

- 2006 03 07 - DR1Document1 page2006 03 07 - DR1Zach EdwardsNo ratings yet

- Robert H McWilliams Financial Disclosure Report For 2010Document6 pagesRobert H McWilliams Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Chesterman Company 07 08 05Document1 pageChesterman Company 07 08 05Zach EdwardsNo ratings yet

- Filled 139092Document2 pagesFilled 139092doomcomplexNo ratings yet

- Ralph R Beistline Financial Disclosure Report For 2010Document6 pagesRalph R Beistline Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- California Tax Power of Attorney Form 3520 PitDocument5 pagesCalifornia Tax Power of Attorney Form 3520 Pitjohn rossiNo ratings yet

- IRS Form F3949ADocument2 pagesIRS Form F3949APolarikNo ratings yet

- Scott O Wright Financial Disclosure Report For 2010Document6 pagesScott O Wright Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Nikola July 22, 2021 SEC FORM S-1 Defendant Trevor MiltonDocument250 pagesNikola July 22, 2021 SEC FORM S-1 Defendant Trevor MiltonFile 411No ratings yet

- Harold L Murphy Financial Disclosure Report For 2010Document7 pagesHarold L Murphy Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Received E-Mail: For Instructions, See Back of Form Form DR-1Document1 pageReceived E-Mail: For Instructions, See Back of Form Form DR-1Zach EdwardsNo ratings yet

- Carolyn R Dimmick Financial Disclosure Report For 2010Document6 pagesCarolyn R Dimmick Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- 2005 02 28 - DR1Document1 page2005 02 28 - DR1Zach EdwardsNo ratings yet

- For Instructions, See Back of Form Form DR-1: Porte 342-3977 1 1 342-3378 Indicate PurposeDocument1 pageFor Instructions, See Back of Form Form DR-1: Porte 342-3977 1 1 342-3378 Indicate PurposeZach EdwardsNo ratings yet

- ,4.,4/ 442'tdy, Et, Aft Iibt'Ti, 2"L, F,0,47.:,F?A '"C N 'KDocument38 pages,4.,4/ 442'tdy, Et, Aft Iibt'Ti, 2"L, F,0,47.:,F?A '"C N 'KMelissa MontalvoNo ratings yet

- Master Builders 07 20 05Document1 pageMaster Builders 07 20 05Zach EdwardsNo ratings yet

- Imt 02 21 2005Document1 pageImt 02 21 2005Zach EdwardsNo ratings yet

- Lacey A Collier Financial Disclosure Report For 2010Document6 pagesLacey A Collier Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Bankruptcy QuestionnaireDocument36 pagesBankruptcy QuestionnaireJody SomersNo ratings yet

- James C Turk Financial Disclosure Report For 2010Document7 pagesJames C Turk Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- GR No. 206510Document3 pagesGR No. 206510Juvial Guevarra BostonNo ratings yet

- The Rational Basis of Trademark ProtectionDocument2 pagesThe Rational Basis of Trademark Protectionmarikit.maritNo ratings yet

- Flores Vs Drilon 223 Scra 568 (1993)Document1 pageFlores Vs Drilon 223 Scra 568 (1993)Maica MahusayNo ratings yet

- Murrel McQueen Individually and as Administrator of the Estate of Ivory Virginia McQueen Deceased v. Morris Bedsole, as Sheriff of Cumberland County, North Carolina Bob Clark, Individually and as Lieutenant, Cumberland County Sheriff's Department Regina Robertson, Individually and as Deputy, Cumberland County Sheriff's Department Cumberland County, North Carolina, 81 F.3d 150, 4th Cir. (1996)Document2 pagesMurrel McQueen Individually and as Administrator of the Estate of Ivory Virginia McQueen Deceased v. Morris Bedsole, as Sheriff of Cumberland County, North Carolina Bob Clark, Individually and as Lieutenant, Cumberland County Sheriff's Department Regina Robertson, Individually and as Deputy, Cumberland County Sheriff's Department Cumberland County, North Carolina, 81 F.3d 150, 4th Cir. (1996)Scribd Government DocsNo ratings yet

- LOPF TAKE HOME TEST 2 (Mbalenhle Ndlovu 22215465)Document7 pagesLOPF TAKE HOME TEST 2 (Mbalenhle Ndlovu 22215465)Mbalenhle NdlovuNo ratings yet

- 2017 RCDSO Annual Report PDFDocument28 pages2017 RCDSO Annual Report PDFMatias salasNo ratings yet

- 2019 Ra PromptDocument1 page2019 Ra Promptapi-438316167No ratings yet

- Dar 12162019Document5 pagesDar 12162019Fauquier NowNo ratings yet

- (U) Daily Activity Report: Marshall DistrictDocument5 pages(U) Daily Activity Report: Marshall DistrictFauquier NowNo ratings yet

- Type Approval Certificate: Rittal GMBH & Co. KGDocument2 pagesType Approval Certificate: Rittal GMBH & Co. KGLorena OrtizNo ratings yet

- Legal Research Paper SampleDocument6 pagesLegal Research Paper Samplefzpabew4100% (1)

- Deed of Sale Saguday, QuirinoDocument2 pagesDeed of Sale Saguday, QuirinoCali BuganNo ratings yet

- LNS 2018 1 277 Ag02Document111 pagesLNS 2018 1 277 Ag02Eusoff AbdullahNo ratings yet

- Criminal Case - People v. Guillermo Rodriguez - Illegal Traffic StopDocument20 pagesCriminal Case - People v. Guillermo Rodriguez - Illegal Traffic StopAdonis HamptonNo ratings yet

- Manabang vs. Lopez Vito 73 Phil 1 G.R. No. L-1123Document55 pagesManabang vs. Lopez Vito 73 Phil 1 G.R. No. L-1123EriyunaNo ratings yet

- CRM100 W7 CH7Document10 pagesCRM100 W7 CH7manmeetNo ratings yet

- Module 5Document23 pagesModule 5Haruto WatanabeNo ratings yet

- Role of HEC Under Provincial AutonomyDocument6 pagesRole of HEC Under Provincial AutonomyFootball ForceNo ratings yet

- People vs. BadriagoDocument12 pagesPeople vs. BadriagoMariz D.R.No ratings yet

- Shelton Scanlon DocsDocument24 pagesShelton Scanlon DocsThe Valley Indy100% (1)

- Sample - Hindu Marriage Act: The Best Study Material For Judicial ServicesDocument27 pagesSample - Hindu Marriage Act: The Best Study Material For Judicial ServicesZainul AbedeenNo ratings yet

- Guru Content Manager Release NotesDocument10 pagesGuru Content Manager Release NotesMarkus LandingtonNo ratings yet

- United States v. Tejada, 481 F.3d 44, 1st Cir. (2007)Document19 pagesUnited States v. Tejada, 481 F.3d 44, 1st Cir. (2007)Scribd Government DocsNo ratings yet

- Adminstrative Contract Law Lecture Note by YohananDocument129 pagesAdminstrative Contract Law Lecture Note by YohananEsku LuluNo ratings yet

- KARIS ENCHELMAYER - (Template) Six Big Ideas OutlineDocument2 pagesKARIS ENCHELMAYER - (Template) Six Big Ideas OutlineKARIS ENCHELMAYERNo ratings yet

- BTP PDFDocument64 pagesBTP PDFsaloni bungNo ratings yet

- R.M.D.C (Mysore) Pvt. LTD v. State of MysoreDocument19 pagesR.M.D.C (Mysore) Pvt. LTD v. State of MysoreRandall WilliamsNo ratings yet

- PIO SAN MELIZZA Vs CITY OF ILOILO Case DigestDocument10 pagesPIO SAN MELIZZA Vs CITY OF ILOILO Case DigestIAN MARK S. VEGANo ratings yet

- Pestle AnalysisDocument3 pagesPestle AnalysisShreeniwasNo ratings yet

B 004561 Doc 201300002017

B 004561 Doc 201300002017

Uploaded by

CloudKitOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

B 004561 Doc 201300002017

B 004561 Doc 201300002017

Uploaded by

CloudKitCopyright:

Available Formats

^ ?1 -.

50 -

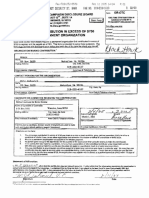

Registration Statement for Charitable Organizations

Form CHAR4I New York State Department of Law (Office of the Attorney General)

Charities Bureau - Registration Section

For new registrants only 120 Broadway

(Amending use CHAR410-A, New York, NY 10271

Re-registering use CHAR410-R) www.charitiesnys.com/

PtA 4ltton f

1. Full name of organization (exactly as it appears In your organizing document) 5. Fed. employer ID no. (EIN)

The "We Are Many " Foundation Inc. 4 5 -t12 3-

2. do Name (if applicable) 6. Organization's website

www.wearemanyfoundation.org

3. Mailing address (Number and street) Room/suite 7. Primary contact

P0 Box 5313 Rich Byllott

City or town, state or country and ZIP+4 Title

Hauppauge, NY 11788 President

4. Principal NYS address (Number and street) Room/suite Phone Fax

516 635 1399

City or town, state or country and ZIP+4 Email

Attach all of the following documents to this Registration Statement, even if you are claiming an exemption from registration:

• Certificate of incorporation, trust agreement or other organizing document, and any amendments; and

• Bylaws or other organizational rules, and any amendments; and

• IRS Form 1023 or 1024 Application for Recognition of Exemption (if applicable); and

• IRS tax exemption determination letter (if applicable)

ttor Efl?tor

Is the organization requesting exemption from registration under either or both Article 7-A or the EPTL? ......................... 0 Yes* No

* If "Yes", complete Schedule E.

Page 1 of 3 Form CHAR4IO (2010)

1. Incorporation /formation

a. Type of organization: b. Type of corporation if New York not-for-profit corporation

Corporation ..........................................AD

BX C D D

Limited liability company (LLC) .........................

Partnership ........................................0 c. Date incorporated if a corporation or formed if other than a corporation

Sole proprietorship

Trust :::::::::: .Q.. a. '24' 20_1_1_

Unincorporated association ............................0 d. State in which incorporated or formed

Other *0

* If Other, describe:

2. List all chapters, branches and affiliates of your organization (attach additional sheets if necessary)

Mailing address (number and street, room/suite,

Name Relationship City or town, state or country and zip+4)

None

3. List all officers, directors, trustees and key employees

Mailing address (number and street, roomlsuite, End of term

Name Title city or town, state or country and zip+4) (if applicable)

President, P0 Box 5313

Rich Byllott Trustee Hauppauge, NY 11788

Treasurer, /o Grassi & Co.

Jeff Cohen Trustee _

c/o Ruskin Moscou Faltischek, P.C., East Tower

Jonathan Bodner Trustee -- '-- '-.---

15th Floor, 1425 RXR Plaza, Uniondale, NY 1155E

c/o Sterling & Sterling, Inc.

Tom Clementi Trustee --'--'----

311 Latham Road

Karen Signoracci Suero Trustee

Mineola, NY 11501

---'--'----

do Wells Fargo Advisors

Michael Stern Trustee ---'--'----

401 Broadhollow Road, 1st Floor, Melville, NY 11 47

I /

I /

4. Other Names and Registration Numbers

a. List all other names used by your organization, including any prior names

b. List all prior New York State charities registration numbers for the organization, including those from the New York State Attorney General's

Charities Bureau or the New York State Department of State's Office of Charities Registration

Page 2 of 3 Form CHAR4I0 (2010)

Q#aa*Atthes

1. Month the annual accounting period ends (01-12) 2 NTEE code

12 F60,173

3. Date organization began doing each of following in New York State:

a. conducting activity ............................................................................

b. maintaining assets ............................................................................

c. soliciting contributions (including from residents, foundations, corporations, government agencies, etc.) ......... Q .9.. / .Q. .t '2.. Q.. l..Z..

4. Describe the purposes of your organization

See attached copy of Article THIRD of Certificate of Incorporation.

5. Has your organization or any of your officers, directors, trustees or key employees been:

a. enjoined or otherwise prohibited by a government agency or court from soliciting contributions? ......................... 0 Yes* X No

* If "Yes", describe:

b. found to have engaged In unlawful practices in connection with the solicitation or administration of charitable assets? ........ 0 Yes" No

* If "Yes", describe:

6. Has your organization's registration or license been suspended by any government agency? .............................. 0 Yes* No

* If "Yes", describe:

7. Does your organization solicit or intend to solicit contributions (including from residents, foundations, corporations, government

agencies, etc.) in New York State? ............................................................................ Yes 0 No

* If "Yes", describe the purposes for which contributions are or will be solicited:

Contributions are and will be solicited to help finance the Organization's operations.

8. List all fund raising professionals (FRP) that your organization has engaged for fund raising activity in NY State (attach additional sheets if

necessary)

Type of FRP Mailing address (number and street, room/suite,

Name (see instructions for definitions) city or town, state or country and zip+4) Dates of contract

Start date:

PFR ................0

None FRC ................o

CCV 0

End date:

Start date:

0

FRC................0 .-----------------------------------

0 End date:

Start date:

PFR 0

FRC ..................

End date:

If applicable, list the date your organization:

a. applied for tax exempt status .................................................................... 1 2 / 1 3 / 2012

b. was granted tax exempt status ..................................................................

c. was denied tax exempt status ...................................................................

d. had its tax exempt status revoked ................................................................

2. Provide Internal Revenue Code provision: 501(c)(_)

Page 3013 Form CHAR4IO (2010)

You might also like

- IRS 3949-A American Bankers AssociationDocument2 pagesIRS 3949-A American Bankers Associationrodclassteam100% (4)

- 2010.07.14 HRTO Complaint Carasco v. University of Windsor Et Al. Form 1Document48 pages2010.07.14 HRTO Complaint Carasco v. University of Windsor Et Al. Form 1Omar .HaNo ratings yet

- Senate SAFE Banking ActDocument30 pagesSenate SAFE Banking ActMarijuana MomentNo ratings yet

- BARACK OBAMA FOUNDATION Registration Statement NEW YORK States Purpose As LIBRARYDocument5 pagesBARACK OBAMA FOUNDATION Registration Statement NEW YORK States Purpose As LIBRARYJerome CorsiNo ratings yet

- Voluntary Petition - Case Number - 05 16979 1 RelDocument35 pagesVoluntary Petition - Case Number - 05 16979 1 RelAlec VenturaNo ratings yet

- 2006 07 26 - DR1Document1 page2006 07 26 - DR1Zach EdwardsNo ratings yet

- For Instructions See Back of Form T?' ,, Form DR-1: 1 .L Gar Court 1 1 1 1Document1 pageFor Instructions See Back of Form T?' ,, Form DR-1: 1 .L Gar Court 1 1 1 1Zach EdwardsNo ratings yet

- Frankzen Altoona I-80 12 14 05Document1 pageFrankzen Altoona I-80 12 14 05Zach EdwardsNo ratings yet

- CHAR001-RT: Registration Statement and Notice of Termination of Intervening Interest For Charitable Remainder TrustsDocument1 pageCHAR001-RT: Registration Statement and Notice of Termination of Intervening Interest For Charitable Remainder Trustsفيصل جفارةNo ratings yet

- Clark Waddoups Financial Disclosure Report For 2010Document13 pagesClark Waddoups Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Wright Part-Time Agreement 1998 (GC-18)Document4 pagesWright Part-Time Agreement 1998 (GC-18)Albany Times UnionNo ratings yet

- 2006 05 01 - DR1Document1 page2006 05 01 - DR1Zach EdwardsNo ratings yet

- Cynthia M Rufe Financial Disclosure Report For 2010Document6 pagesCynthia M Rufe Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Information Referral: Department of The Treasury - Internal Revenue Service Form (12-2005) OMB # 1545-1960 (Document2 pagesInformation Referral: Department of The Treasury - Internal Revenue Service Form (12-2005) OMB # 1545-1960 (IRSNo ratings yet

- Cedar Valley Corp - 2005 - Black Hawk - OTCDocument1 pageCedar Valley Corp - 2005 - Black Hawk - OTCZach EdwardsNo ratings yet

- IRS Complaint Against NH District Corporation 11-18-19Document26 pagesIRS Complaint Against NH District Corporation 11-18-19Roberto RoldanNo ratings yet

- 15-7682 Floyd Kephart and New City Development Docs Part 1 PDFDocument17 pages15-7682 Floyd Kephart and New City Development Docs Part 1 PDFRecordTrac - City of OaklandNo ratings yet

- Information Referral: Form (2-2007) Department of The Treasury - Internal Revenue Service OMB # 1545-1960Document2 pagesInformation Referral: Form (2-2007) Department of The Treasury - Internal Revenue Service OMB # 1545-1960diversified1No ratings yet

- CycleBar - 2015-01-31 - FDD - Xponential Fitness BrandDocument214 pagesCycleBar - 2015-01-31 - FDD - Xponential Fitness BrandFuzzy PandaNo ratings yet

- Legacy Bank 12 16 05Document1 pageLegacy Bank 12 16 05Zach EdwardsNo ratings yet

- Danny Clancy CFR 10-25-10Document69 pagesDanny Clancy CFR 10-25-10sam_mertenNo ratings yet

- Aspro - 2005 - Black Hawk - OTCDocument1 pageAspro - 2005 - Black Hawk - OTCZach EdwardsNo ratings yet

- Harry Thomas JR IRS Form 3949aDocument2 pagesHarry Thomas JR IRS Form 3949aWashington City Paper100% (1)

- Polk County Employees AFSCME Local 1868 - 09-22-04 - ContributionDocument1 pagePolk County Employees AFSCME Local 1868 - 09-22-04 - ContributionZach EdwardsNo ratings yet

- Statement of Interests FormDocument4 pagesStatement of Interests FormJoe BowenNo ratings yet

- Clarence Thomas Financial Disclosure Report For 2010Document7 pagesClarence Thomas Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Reena Raggi Financial Disclosure Report For 2010Document23 pagesReena Raggi Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Combined Application Form For Incorporation Ammended 2017Document4 pagesCombined Application Form For Incorporation Ammended 2017Gold MindsNo ratings yet

- Aronson AffidavitDocument18 pagesAronson AffidavitNorthDecoder2No ratings yet

- Qwest 11-02-05Document1 pageQwest 11-02-05Zach EdwardsNo ratings yet

- V%Oulnth: For Instructions, See Back of Form I Ugi L U Form Dr-1Document2 pagesV%Oulnth: For Instructions, See Back of Form I Ugi L U Form Dr-1Zach EdwardsNo ratings yet

- Garland E Burrell JR Financial Disclosure Report For 2009Document6 pagesGarland E Burrell JR Financial Disclosure Report For 2009Judicial Watch, Inc.No ratings yet

- Palmer Candy 07 25 05Document1 pagePalmer Candy 07 25 05Zach EdwardsNo ratings yet

- Lawrence P Zatkoff Financial Disclosure Report For 2010Document6 pagesLawrence P Zatkoff Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- SIKANU Form 56Document4 pagesSIKANU Form 56sikanubeyel100% (3)

- Community State Bank 12 21 05Document1 pageCommunity State Bank 12 21 05Zach EdwardsNo ratings yet

- For Instructions, See Back Form Reset L Form DR-1Document2 pagesFor Instructions, See Back Form Reset L Form DR-1Zach EdwardsNo ratings yet

- Knupp For Mayor: For Instructions, See Back of Form LDocument1 pageKnupp For Mayor: For Instructions, See Back of Form LZach EdwardsNo ratings yet

- United States Securities and Exchange Commission Form D Notice of Exempt Offering of SecuritiesDocument7 pagesUnited States Securities and Exchange Commission Form D Notice of Exempt Offering of SecuritiesWilliam HarrisNo ratings yet

- State Steel Supply 07 05 05Document1 pageState Steel Supply 07 05 05Zach EdwardsNo ratings yet

- 2006 03 07 - DR1Document1 page2006 03 07 - DR1Zach EdwardsNo ratings yet

- Robert H McWilliams Financial Disclosure Report For 2010Document6 pagesRobert H McWilliams Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Chesterman Company 07 08 05Document1 pageChesterman Company 07 08 05Zach EdwardsNo ratings yet

- Filled 139092Document2 pagesFilled 139092doomcomplexNo ratings yet

- Ralph R Beistline Financial Disclosure Report For 2010Document6 pagesRalph R Beistline Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- California Tax Power of Attorney Form 3520 PitDocument5 pagesCalifornia Tax Power of Attorney Form 3520 Pitjohn rossiNo ratings yet

- IRS Form F3949ADocument2 pagesIRS Form F3949APolarikNo ratings yet

- Scott O Wright Financial Disclosure Report For 2010Document6 pagesScott O Wright Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Nikola July 22, 2021 SEC FORM S-1 Defendant Trevor MiltonDocument250 pagesNikola July 22, 2021 SEC FORM S-1 Defendant Trevor MiltonFile 411No ratings yet

- Harold L Murphy Financial Disclosure Report For 2010Document7 pagesHarold L Murphy Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Received E-Mail: For Instructions, See Back of Form Form DR-1Document1 pageReceived E-Mail: For Instructions, See Back of Form Form DR-1Zach EdwardsNo ratings yet

- Carolyn R Dimmick Financial Disclosure Report For 2010Document6 pagesCarolyn R Dimmick Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- 2005 02 28 - DR1Document1 page2005 02 28 - DR1Zach EdwardsNo ratings yet

- For Instructions, See Back of Form Form DR-1: Porte 342-3977 1 1 342-3378 Indicate PurposeDocument1 pageFor Instructions, See Back of Form Form DR-1: Porte 342-3977 1 1 342-3378 Indicate PurposeZach EdwardsNo ratings yet

- ,4.,4/ 442'tdy, Et, Aft Iibt'Ti, 2"L, F,0,47.:,F?A '"C N 'KDocument38 pages,4.,4/ 442'tdy, Et, Aft Iibt'Ti, 2"L, F,0,47.:,F?A '"C N 'KMelissa MontalvoNo ratings yet

- Master Builders 07 20 05Document1 pageMaster Builders 07 20 05Zach EdwardsNo ratings yet

- Imt 02 21 2005Document1 pageImt 02 21 2005Zach EdwardsNo ratings yet

- Lacey A Collier Financial Disclosure Report For 2010Document6 pagesLacey A Collier Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Bankruptcy QuestionnaireDocument36 pagesBankruptcy QuestionnaireJody SomersNo ratings yet

- James C Turk Financial Disclosure Report For 2010Document7 pagesJames C Turk Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- GR No. 206510Document3 pagesGR No. 206510Juvial Guevarra BostonNo ratings yet

- The Rational Basis of Trademark ProtectionDocument2 pagesThe Rational Basis of Trademark Protectionmarikit.maritNo ratings yet

- Flores Vs Drilon 223 Scra 568 (1993)Document1 pageFlores Vs Drilon 223 Scra 568 (1993)Maica MahusayNo ratings yet

- Murrel McQueen Individually and as Administrator of the Estate of Ivory Virginia McQueen Deceased v. Morris Bedsole, as Sheriff of Cumberland County, North Carolina Bob Clark, Individually and as Lieutenant, Cumberland County Sheriff's Department Regina Robertson, Individually and as Deputy, Cumberland County Sheriff's Department Cumberland County, North Carolina, 81 F.3d 150, 4th Cir. (1996)Document2 pagesMurrel McQueen Individually and as Administrator of the Estate of Ivory Virginia McQueen Deceased v. Morris Bedsole, as Sheriff of Cumberland County, North Carolina Bob Clark, Individually and as Lieutenant, Cumberland County Sheriff's Department Regina Robertson, Individually and as Deputy, Cumberland County Sheriff's Department Cumberland County, North Carolina, 81 F.3d 150, 4th Cir. (1996)Scribd Government DocsNo ratings yet

- LOPF TAKE HOME TEST 2 (Mbalenhle Ndlovu 22215465)Document7 pagesLOPF TAKE HOME TEST 2 (Mbalenhle Ndlovu 22215465)Mbalenhle NdlovuNo ratings yet

- 2017 RCDSO Annual Report PDFDocument28 pages2017 RCDSO Annual Report PDFMatias salasNo ratings yet

- 2019 Ra PromptDocument1 page2019 Ra Promptapi-438316167No ratings yet

- Dar 12162019Document5 pagesDar 12162019Fauquier NowNo ratings yet

- (U) Daily Activity Report: Marshall DistrictDocument5 pages(U) Daily Activity Report: Marshall DistrictFauquier NowNo ratings yet

- Type Approval Certificate: Rittal GMBH & Co. KGDocument2 pagesType Approval Certificate: Rittal GMBH & Co. KGLorena OrtizNo ratings yet

- Legal Research Paper SampleDocument6 pagesLegal Research Paper Samplefzpabew4100% (1)

- Deed of Sale Saguday, QuirinoDocument2 pagesDeed of Sale Saguday, QuirinoCali BuganNo ratings yet

- LNS 2018 1 277 Ag02Document111 pagesLNS 2018 1 277 Ag02Eusoff AbdullahNo ratings yet

- Criminal Case - People v. Guillermo Rodriguez - Illegal Traffic StopDocument20 pagesCriminal Case - People v. Guillermo Rodriguez - Illegal Traffic StopAdonis HamptonNo ratings yet

- Manabang vs. Lopez Vito 73 Phil 1 G.R. No. L-1123Document55 pagesManabang vs. Lopez Vito 73 Phil 1 G.R. No. L-1123EriyunaNo ratings yet

- CRM100 W7 CH7Document10 pagesCRM100 W7 CH7manmeetNo ratings yet

- Module 5Document23 pagesModule 5Haruto WatanabeNo ratings yet

- Role of HEC Under Provincial AutonomyDocument6 pagesRole of HEC Under Provincial AutonomyFootball ForceNo ratings yet

- People vs. BadriagoDocument12 pagesPeople vs. BadriagoMariz D.R.No ratings yet

- Shelton Scanlon DocsDocument24 pagesShelton Scanlon DocsThe Valley Indy100% (1)

- Sample - Hindu Marriage Act: The Best Study Material For Judicial ServicesDocument27 pagesSample - Hindu Marriage Act: The Best Study Material For Judicial ServicesZainul AbedeenNo ratings yet

- Guru Content Manager Release NotesDocument10 pagesGuru Content Manager Release NotesMarkus LandingtonNo ratings yet

- United States v. Tejada, 481 F.3d 44, 1st Cir. (2007)Document19 pagesUnited States v. Tejada, 481 F.3d 44, 1st Cir. (2007)Scribd Government DocsNo ratings yet

- Adminstrative Contract Law Lecture Note by YohananDocument129 pagesAdminstrative Contract Law Lecture Note by YohananEsku LuluNo ratings yet

- KARIS ENCHELMAYER - (Template) Six Big Ideas OutlineDocument2 pagesKARIS ENCHELMAYER - (Template) Six Big Ideas OutlineKARIS ENCHELMAYERNo ratings yet

- BTP PDFDocument64 pagesBTP PDFsaloni bungNo ratings yet

- R.M.D.C (Mysore) Pvt. LTD v. State of MysoreDocument19 pagesR.M.D.C (Mysore) Pvt. LTD v. State of MysoreRandall WilliamsNo ratings yet

- PIO SAN MELIZZA Vs CITY OF ILOILO Case DigestDocument10 pagesPIO SAN MELIZZA Vs CITY OF ILOILO Case DigestIAN MARK S. VEGANo ratings yet

- Pestle AnalysisDocument3 pagesPestle AnalysisShreeniwasNo ratings yet