Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

10 views819-c-89525-MCQS XI CH 3 (B)

819-c-89525-MCQS XI CH 3 (B)

Uploaded by

ramankantjain07This document contains 17 multiple choice questions about taxation of house property under Chapter 3(b) of the Indian Income Tax Act. The questions cover topics such as the section that deals with chargeability of house property, the basis for chargeability, what types of income are taxable under house property, how to calculate gross annual value, deductions allowed for municipal taxes and interest paid on loans for house property. The document provides the questions, answer options, and identifies the preparer as CA Inderpreet Kaur, who teaches Principles of Taxation.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You might also like

- Print MCQ - CPWD MADE EASY - Upto Works AccountsDocument100 pagesPrint MCQ - CPWD MADE EASY - Upto Works Accountsanon_8757961390% (10)

- Sample TestDocument12 pagesSample TestShara Lyn100% (3)

- Test Bank For Macroeconomics 15th Canadian Edition Christopher T S RaganDocument36 pagesTest Bank For Macroeconomics 15th Canadian Edition Christopher T S Ragangaoleryis.cj8rly100% (44)

- Direct Tax McqsDocument23 pagesDirect Tax McqsShreejith nair100% (1)

- Income Under The Head House PropertyDocument4 pagesIncome Under The Head House PropertySarath KumarNo ratings yet

- Adobe Scan 02 Mar 2022Document17 pagesAdobe Scan 02 Mar 2022Rohit nandiNo ratings yet

- Paper7 Set1 NDocument7 pagesPaper7 Set1 NSanchit ShrivastavaNo ratings yet

- MCQ House PropertyDocument12 pagesMCQ House PropertyKunal KapoorNo ratings yet

- Sample MCQ 3Document8 pagesSample MCQ 3varunendra pandeyNo ratings yet

- HP MCQDocument7 pagesHP MCQ887 shivam guptaNo ratings yet

- DT MCQs Most ExpectedDocument36 pagesDT MCQs Most ExpectedHarriniNo ratings yet

- Paper7 Set1 ADocument15 pagesPaper7 Set1 ASanchit ShrivastavaNo ratings yet

- Paper I ITI Income Tax Law and Computation - 13072009Document15 pagesPaper I ITI Income Tax Law and Computation - 13072009CHANDAN DUTTANo ratings yet

- Direct Tax Law S 2019Document5 pagesDirect Tax Law S 2019jewankarpournimaNo ratings yet

- Salary MCQDocument7 pagesSalary MCQKunal KapoorNo ratings yet

- Test 7 Capital GainDocument11 pagesTest 7 Capital GainA & A AssociatesNo ratings yet

- House PropertyDocument17 pagesHouse PropertySarvar PathanNo ratings yet

- Income Tax Assignment-3Document9 pagesIncome Tax Assignment-3Erohsik KrishNo ratings yet

- Paper7 Set1Document9 pagesPaper7 Set1meswetashaw96No ratings yet

- House PropertyDocument17 pagesHouse PropertydeepaksinghalNo ratings yet

- Paper7 Set2 AnsDocument21 pagesPaper7 Set2 Ansmonukroy1234No ratings yet

- Hours) : - (L) : (Part-lI)Document11 pagesHours) : - (L) : (Part-lI)Sadhik LaluwaleNo ratings yet

- Answer To MTP - Intermediate - Syllabus 2016 - Dec 2019 - Set 1: Paper 7-Direct TaxationDocument15 pagesAnswer To MTP - Intermediate - Syllabus 2016 - Dec 2019 - Set 1: Paper 7-Direct TaxationvijaykumartaxNo ratings yet

- Quiz 1Document4 pagesQuiz 1VarshaNo ratings yet

- Paper 7 CmaDocument16 pagesPaper 7 CmaRama KrishnaNo ratings yet

- 8 Model Test Paper No. 9-10 From Vol 2 & Suggested Answers For Paper No. 1 - 3Document112 pages8 Model Test Paper No. 9-10 From Vol 2 & Suggested Answers For Paper No. 1 - 3atsamitsingh01No ratings yet

- CommerceDocument6 pagesCommerceshailesh.919613No ratings yet

- INCOME TAX TEST 2 100 MARKS With Answer by CA VIVEK GABADocument16 pagesINCOME TAX TEST 2 100 MARKS With Answer by CA VIVEK GABAAmiya Upadhyay100% (1)

- Tax AnswerDocument22 pagesTax Answer336-Hardik JoisarNo ratings yet

- MCQ - B.com Semester V - Core Course - Bcm5b09 Income Tax Law and AccountsDocument21 pagesMCQ - B.com Semester V - Core Course - Bcm5b09 Income Tax Law and AccountsAfreen FatimaNo ratings yet

- Paper7 Set2Document7 pagesPaper7 Set2ashrant69No ratings yet

- 1 IntroductionDocument10 pages1 Introductionpriyanshu.ryp01No ratings yet

- Jun 2018Document14 pagesJun 2018KONDADASULA PRABHASNo ratings yet

- Direct Taxes Sample Question Paper SEM - VDocument5 pagesDirect Taxes Sample Question Paper SEM - Vparmar manishaNo ratings yet

- CH 11 Income On House PropertyDocument11 pagesCH 11 Income On House PropertyJewelNo ratings yet

- Paper 7-Direct Taxation: Answer To MTP - Intermediate - Syllabus 2016 - June 2020 & December 2020 - Set 1Document21 pagesPaper 7-Direct Taxation: Answer To MTP - Intermediate - Syllabus 2016 - June 2020 & December 2020 - Set 1vikash guptaNo ratings yet

- DT Full MCQ BookDocument209 pagesDT Full MCQ BookPanth BaggaNo ratings yet

- Paper7 Set2 SolutionDocument17 pagesPaper7 Set2 SolutionMayuri KolheNo ratings yet

- Financial Accounting and Reporting - QUIZ 6Document4 pagesFinancial Accounting and Reporting - QUIZ 6JINGLE FULGENCIONo ratings yet

- 2014 SampleTest II-B (200Q) by Willy Segovia NO Answer.Document12 pages2014 SampleTest II-B (200Q) by Willy Segovia NO Answer.cpabygraceNo ratings yet

- Income From House Property Solved Mcq's With PDF Download (Set-1)Document6 pagesIncome From House Property Solved Mcq's With PDF Download (Set-1)DevNo ratings yet

- Chapter 8: Revenue ReceiptsDocument6 pagesChapter 8: Revenue ReceiptsVivek RatanNo ratings yet

- Chapter 1Document4 pagesChapter 1KS JagadishNo ratings yet

- Paper7 Set1 AnsDocument21 pagesPaper7 Set1 AnsPranjal BariNo ratings yet

- DT 2 New Question PaperDocument11 pagesDT 2 New Question Paperneha manglaniNo ratings yet

- Accountancy Model Paper-2-1Document9 pagesAccountancy Model Paper-2-1Hashim SethNo ratings yet

- ElugabaechariDocument12 pagesElugabaecharihitaNo ratings yet

- HPDocument15 pagesHPkhanpattanNo ratings yet

- 21934mtp Cptvolu1 Part2Document194 pages21934mtp Cptvolu1 Part2arshNo ratings yet

- House PropertyDocument18 pagesHouse PropertyNidhi LathNo ratings yet

- PC-16 MCQ Rahi CPWA AllChaptersDocument150 pagesPC-16 MCQ Rahi CPWA AllChaptersVirendra Ramteke100% (1)

- Capital and Revenue Expenditure - QuizizzDocument4 pagesCapital and Revenue Expenditure - Quizizzjane ngNo ratings yet

- Forest Accounts MCQDocument12 pagesForest Accounts MCQAJAY DIMRINo ratings yet

- Screenshot 2022-03-04 at 2.00.46 PMDocument25 pagesScreenshot 2022-03-04 at 2.00.46 PMPragati SrivastavaNo ratings yet

- Basic Concepts MCQs by CA Pranav ChandakDocument11 pagesBasic Concepts MCQs by CA Pranav ChandakJoginder shahNo ratings yet

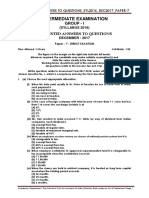

- Intermediate Examination: Suggested Answers To QuestionsDocument15 pagesIntermediate Examination: Suggested Answers To QuestionsSairaj MudhirajNo ratings yet

- LGC Tax BQsDocument4 pagesLGC Tax BQsSGTNo ratings yet

- 21935mtp Cptvolu1 Part3 PDFDocument224 pages21935mtp Cptvolu1 Part3 PDFArun KCNo ratings yet

- MCQ (ICAI Study Material)Document6 pagesMCQ (ICAI Study Material)Sanket Mhetre67% (3)

- Model Test 15 - 20Document206 pagesModel Test 15 - 20theabhishekdahalNo ratings yet

- Chapter 2 - The Global EconomyDocument9 pagesChapter 2 - The Global EconomyMariel OroNo ratings yet

- Neolithic RevolutionDocument33 pagesNeolithic Revolutionapi-304649470No ratings yet

- 1910 Commodity Air Cart Ground Drive IntroductionDocument5 pages1910 Commodity Air Cart Ground Drive IntroductionOleksandr YermolenkoNo ratings yet

- Barclays - Global Economics Weekly PDFDocument44 pagesBarclays - Global Economics Weekly PDFRishabh VakhariaNo ratings yet

- Caltex V COA DigestDocument3 pagesCaltex V COA DigestCarlito HilvanoNo ratings yet

- ECON 460 Assignment 4 Answer KeyDocument5 pagesECON 460 Assignment 4 Answer KeyDivyansh SikharNo ratings yet

- Personal Management: Merit Badge WorkbookDocument23 pagesPersonal Management: Merit Badge WorkbookOri TanzerNo ratings yet

- 67597225eco 24 AlokDocument3 pages67597225eco 24 AlokAlok GoswamiNo ratings yet

- Hoa Phat Group Business EnvironmentDocument22 pagesHoa Phat Group Business EnvironmentTruong Thi Phuong Dung (FGW HN)No ratings yet

- Michael Platt (Financier)Document5 pagesMichael Platt (Financier)evangeliamartini2017No ratings yet

- BankDocument116 pagesBanknravindranathreddyNo ratings yet

- Essay On The Influence of Microfinance On The Business Development of Merchants in The San José International Market in The City of JuliacaDocument4 pagesEssay On The Influence of Microfinance On The Business Development of Merchants in The San José International Market in The City of JuliacaEvelyn CastilloNo ratings yet

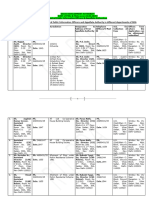

- PIOs - and - FAAs - As - On - 22june 2020Document74 pagesPIOs - and - FAAs - As - On - 22june 2020Ashish Singh bhandariNo ratings yet

- Microeconomics Principles and Policy 13th Edition Baumol Test Bank 1Document70 pagesMicroeconomics Principles and Policy 13th Edition Baumol Test Bank 1lynn100% (62)

- NewBookReleaseInfo-Gann Planets Vol II PDFDocument8 pagesNewBookReleaseInfo-Gann Planets Vol II PDFJim Baxter50% (2)

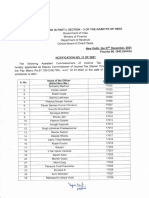

- To Be Published in Part-I, Section - 2 of The Gazette of IndiaDocument6 pagesTo Be Published in Part-I, Section - 2 of The Gazette of Indiajudicial teamworkNo ratings yet

- Final (PPT) A Study On Investors Perception Towards MutualDocument12 pagesFinal (PPT) A Study On Investors Perception Towards MutualAvantika JindalNo ratings yet

- Presantation On Special Economic Zone (Sez) by Rahul Jagtap PGDM 1stsemDocument27 pagesPresantation On Special Economic Zone (Sez) by Rahul Jagtap PGDM 1stsemcimr33No ratings yet

- TableOfIncomeTaxable EPF SOCSO EISDocument7 pagesTableOfIncomeTaxable EPF SOCSO EISMohd ShamNo ratings yet

- Jurnal Tinjauan Keselamatan Perlintasan Sebidang Dampak Rencana Operasi Kereta Penumpang Di Lintas Padang-Pauh LimaDocument10 pagesJurnal Tinjauan Keselamatan Perlintasan Sebidang Dampak Rencana Operasi Kereta Penumpang Di Lintas Padang-Pauh Limahead unitNo ratings yet

- New FGE Chapter I and IIDocument18 pagesNew FGE Chapter I and IImubarek kemalNo ratings yet

- Enter The Data Only in The Yellow Cells.: Agg Plan - LevelDocument7 pagesEnter The Data Only in The Yellow Cells.: Agg Plan - LevelJason RobillardNo ratings yet

- Chapters 20, 22 & 24Document59 pagesChapters 20, 22 & 24Manidipa BoseNo ratings yet

- For Point 3Document5 pagesFor Point 3Jigisha SinghNo ratings yet

- GHGGVG Data UploadedDocument3 pagesGHGGVG Data Uploadedshriya shettiwarNo ratings yet

- Unit 5 - Global City, Demography and MigrationDocument8 pagesUnit 5 - Global City, Demography and MigrationNorlyn Esmatao BaladiaNo ratings yet

- DEBENTURES - SolutionsDocument7 pagesDEBENTURES - Solutionssaiteja surabhiNo ratings yet

- Statistical Techniques in Business and Economics 16th Edition Lind Solutions ManualDocument19 pagesStatistical Techniques in Business and Economics 16th Edition Lind Solutions Manualsnuggerytamiliana4h2100% (26)

- Fundamentals of ABMDocument4 pagesFundamentals of ABMMadriñan Wency M.No ratings yet

819-c-89525-MCQS XI CH 3 (B)

819-c-89525-MCQS XI CH 3 (B)

Uploaded by

ramankantjain070 ratings0% found this document useful (0 votes)

10 views1 pageThis document contains 17 multiple choice questions about taxation of house property under Chapter 3(b) of the Indian Income Tax Act. The questions cover topics such as the section that deals with chargeability of house property, the basis for chargeability, what types of income are taxable under house property, how to calculate gross annual value, deductions allowed for municipal taxes and interest paid on loans for house property. The document provides the questions, answer options, and identifies the preparer as CA Inderpreet Kaur, who teaches Principles of Taxation.

Original Description:

Original Title

819-c-89525-MCQS XI CH 3(B)

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document contains 17 multiple choice questions about taxation of house property under Chapter 3(b) of the Indian Income Tax Act. The questions cover topics such as the section that deals with chargeability of house property, the basis for chargeability, what types of income are taxable under house property, how to calculate gross annual value, deductions allowed for municipal taxes and interest paid on loans for house property. The document provides the questions, answer options, and identifies the preparer as CA Inderpreet Kaur, who teaches Principles of Taxation.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

10 views1 page819-c-89525-MCQS XI CH 3 (B)

819-c-89525-MCQS XI CH 3 (B)

Uploaded by

ramankantjain07This document contains 17 multiple choice questions about taxation of house property under Chapter 3(b) of the Indian Income Tax Act. The questions cover topics such as the section that deals with chargeability of house property, the basis for chargeability, what types of income are taxable under house property, how to calculate gross annual value, deductions allowed for municipal taxes and interest paid on loans for house property. The document provides the questions, answer options, and identifies the preparer as CA Inderpreet Kaur, who teaches Principles of Taxation.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 1

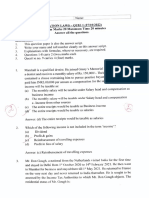

BCM ARYA MODEL SR. SEC SCHOOL.

TAXATION CLASS XI

CHAPTER 3(b)

Assignment TAX-03(b)-2- MCQS

Q1. Chargeability of House Property is given u/s

(a) 15 (b) 22 (c) 20 (d) None of the above

Q2. The basis of chargeability of House Property is ____.

(a) Annual Value (b) Municipal Value (c) Standard Rent (d) Fair Rent

Q3. Under the head of house property, ____ is taxable.

(a) Income from building (b) Income from land

(c) Income from building &/or land attached to building (d) None of the above

Q4. House property means _____.

(a) Residential Houses (b) Shops or godowns

(c) Cinema or hotel building (d) All of the above

Q5. Mr. PC is having a plot of land. He has let out this to earn some extra income. Rent of such plot is taxable u/h

(a) PGBP (b) Income from house property

(c) IFOS (d) Any head at the choice of Mr. PC.

Q6. Mr. PC has taken a house on rent & sublet it to Mr. A. Income of Mr. PC from such house property is taxed u/h __.

(a) Income from house property (b) IFOS

(c) Income from salary (d) Not taxed at all

Q7. For any income from house property to be assessed u/h “Income from house property”, Assessee must such house property

for any purpose other than _____.

(a) his business.profession (b) his personal use

(c) Doing Illegal things (d) Gambling

Q8. Mr. PC is the owner of a house property covered under the Rent Control Act. Municipal value ₹ 30,000, actual rent ₹ 25,000;

fair rent ₹ 36,000 & standard rent is ₹ 28,000. GAV will be.

(a) ₹ 30,000 (b) ₹ 36,000 (c) ₹ 25,000 (d) ₹ 28,000

Q9. In case of SO HP, deduction of municipal taxes is ___

(a) available if paid by the owner (b) not available if paid by the tenant

(c) available if tax is deducted at source (d) No deduction of Municipal taxes paid.

Q10. Unrealized rent is allowed as a deduction from ___.

(a) GAV (b) NAV (c) Income from HP (d) Actual rent

Q11. Municipal Taxes are deducted from ____.

(a) NAV on payment basis (b) GAV on accrual basis

(c) GAV on payment basis (d) not deductible

Q12. Municipal taxes to be deducted from GAV should be

(a) Paid by tenant during PY (b) Paid by owner during PY

(c) Accrued during PY (d) None of the above

Q13. Deduction u/s 24(a) of statutory deduction under the head House Property is ____ % of NAV.

(a) 35% (b) 30% (c) 25% (d) 40%

Q14. Any person who has taken loan before 1.4.1999 for purchase or construction of the house which is self occupied, maximum

deduction for the interest shall be.

(a) ₹ 2 lacs (b) ₹ 30,000 (c) ₹ 3 lacs (d) Nil

Q15. Mr. PC received ₹ 30,000 as arrears of rent during AY 2021-22. Amount taxable u/s 25A:

(a) ₹ 30,000 (b) ₹ 21,000 (c) ₹ 20,000 (d) ₹ 15,000

Q16. If an assessee has borrowed money for purchase of a house & interest is payable outside India. Such interest shall be ____.

(a) Allowed as deduction (b) not allowed as deduction

(c) be allowed as deduction if tax is deducted at source (d) None of these

Q17. Which out of the following is not a case of deemed ownership of house property?

(a) Transfer of house property to a spouse for inadequate consideration

(b) Transfer of house property to a minor child for inadequate consideration

(c) Individual who is holder of an impartible estate

(d) Co-owner of a house property

Prepared By:

CA Inderpreet Kaur

(PGT FMM)

You might also like

- Print MCQ - CPWD MADE EASY - Upto Works AccountsDocument100 pagesPrint MCQ - CPWD MADE EASY - Upto Works Accountsanon_8757961390% (10)

- Sample TestDocument12 pagesSample TestShara Lyn100% (3)

- Test Bank For Macroeconomics 15th Canadian Edition Christopher T S RaganDocument36 pagesTest Bank For Macroeconomics 15th Canadian Edition Christopher T S Ragangaoleryis.cj8rly100% (44)

- Direct Tax McqsDocument23 pagesDirect Tax McqsShreejith nair100% (1)

- Income Under The Head House PropertyDocument4 pagesIncome Under The Head House PropertySarath KumarNo ratings yet

- Adobe Scan 02 Mar 2022Document17 pagesAdobe Scan 02 Mar 2022Rohit nandiNo ratings yet

- Paper7 Set1 NDocument7 pagesPaper7 Set1 NSanchit ShrivastavaNo ratings yet

- MCQ House PropertyDocument12 pagesMCQ House PropertyKunal KapoorNo ratings yet

- Sample MCQ 3Document8 pagesSample MCQ 3varunendra pandeyNo ratings yet

- HP MCQDocument7 pagesHP MCQ887 shivam guptaNo ratings yet

- DT MCQs Most ExpectedDocument36 pagesDT MCQs Most ExpectedHarriniNo ratings yet

- Paper7 Set1 ADocument15 pagesPaper7 Set1 ASanchit ShrivastavaNo ratings yet

- Paper I ITI Income Tax Law and Computation - 13072009Document15 pagesPaper I ITI Income Tax Law and Computation - 13072009CHANDAN DUTTANo ratings yet

- Direct Tax Law S 2019Document5 pagesDirect Tax Law S 2019jewankarpournimaNo ratings yet

- Salary MCQDocument7 pagesSalary MCQKunal KapoorNo ratings yet

- Test 7 Capital GainDocument11 pagesTest 7 Capital GainA & A AssociatesNo ratings yet

- House PropertyDocument17 pagesHouse PropertySarvar PathanNo ratings yet

- Income Tax Assignment-3Document9 pagesIncome Tax Assignment-3Erohsik KrishNo ratings yet

- Paper7 Set1Document9 pagesPaper7 Set1meswetashaw96No ratings yet

- House PropertyDocument17 pagesHouse PropertydeepaksinghalNo ratings yet

- Paper7 Set2 AnsDocument21 pagesPaper7 Set2 Ansmonukroy1234No ratings yet

- Hours) : - (L) : (Part-lI)Document11 pagesHours) : - (L) : (Part-lI)Sadhik LaluwaleNo ratings yet

- Answer To MTP - Intermediate - Syllabus 2016 - Dec 2019 - Set 1: Paper 7-Direct TaxationDocument15 pagesAnswer To MTP - Intermediate - Syllabus 2016 - Dec 2019 - Set 1: Paper 7-Direct TaxationvijaykumartaxNo ratings yet

- Quiz 1Document4 pagesQuiz 1VarshaNo ratings yet

- Paper 7 CmaDocument16 pagesPaper 7 CmaRama KrishnaNo ratings yet

- 8 Model Test Paper No. 9-10 From Vol 2 & Suggested Answers For Paper No. 1 - 3Document112 pages8 Model Test Paper No. 9-10 From Vol 2 & Suggested Answers For Paper No. 1 - 3atsamitsingh01No ratings yet

- CommerceDocument6 pagesCommerceshailesh.919613No ratings yet

- INCOME TAX TEST 2 100 MARKS With Answer by CA VIVEK GABADocument16 pagesINCOME TAX TEST 2 100 MARKS With Answer by CA VIVEK GABAAmiya Upadhyay100% (1)

- Tax AnswerDocument22 pagesTax Answer336-Hardik JoisarNo ratings yet

- MCQ - B.com Semester V - Core Course - Bcm5b09 Income Tax Law and AccountsDocument21 pagesMCQ - B.com Semester V - Core Course - Bcm5b09 Income Tax Law and AccountsAfreen FatimaNo ratings yet

- Paper7 Set2Document7 pagesPaper7 Set2ashrant69No ratings yet

- 1 IntroductionDocument10 pages1 Introductionpriyanshu.ryp01No ratings yet

- Jun 2018Document14 pagesJun 2018KONDADASULA PRABHASNo ratings yet

- Direct Taxes Sample Question Paper SEM - VDocument5 pagesDirect Taxes Sample Question Paper SEM - Vparmar manishaNo ratings yet

- CH 11 Income On House PropertyDocument11 pagesCH 11 Income On House PropertyJewelNo ratings yet

- Paper 7-Direct Taxation: Answer To MTP - Intermediate - Syllabus 2016 - June 2020 & December 2020 - Set 1Document21 pagesPaper 7-Direct Taxation: Answer To MTP - Intermediate - Syllabus 2016 - June 2020 & December 2020 - Set 1vikash guptaNo ratings yet

- DT Full MCQ BookDocument209 pagesDT Full MCQ BookPanth BaggaNo ratings yet

- Paper7 Set2 SolutionDocument17 pagesPaper7 Set2 SolutionMayuri KolheNo ratings yet

- Financial Accounting and Reporting - QUIZ 6Document4 pagesFinancial Accounting and Reporting - QUIZ 6JINGLE FULGENCIONo ratings yet

- 2014 SampleTest II-B (200Q) by Willy Segovia NO Answer.Document12 pages2014 SampleTest II-B (200Q) by Willy Segovia NO Answer.cpabygraceNo ratings yet

- Income From House Property Solved Mcq's With PDF Download (Set-1)Document6 pagesIncome From House Property Solved Mcq's With PDF Download (Set-1)DevNo ratings yet

- Chapter 8: Revenue ReceiptsDocument6 pagesChapter 8: Revenue ReceiptsVivek RatanNo ratings yet

- Chapter 1Document4 pagesChapter 1KS JagadishNo ratings yet

- Paper7 Set1 AnsDocument21 pagesPaper7 Set1 AnsPranjal BariNo ratings yet

- DT 2 New Question PaperDocument11 pagesDT 2 New Question Paperneha manglaniNo ratings yet

- Accountancy Model Paper-2-1Document9 pagesAccountancy Model Paper-2-1Hashim SethNo ratings yet

- ElugabaechariDocument12 pagesElugabaecharihitaNo ratings yet

- HPDocument15 pagesHPkhanpattanNo ratings yet

- 21934mtp Cptvolu1 Part2Document194 pages21934mtp Cptvolu1 Part2arshNo ratings yet

- House PropertyDocument18 pagesHouse PropertyNidhi LathNo ratings yet

- PC-16 MCQ Rahi CPWA AllChaptersDocument150 pagesPC-16 MCQ Rahi CPWA AllChaptersVirendra Ramteke100% (1)

- Capital and Revenue Expenditure - QuizizzDocument4 pagesCapital and Revenue Expenditure - Quizizzjane ngNo ratings yet

- Forest Accounts MCQDocument12 pagesForest Accounts MCQAJAY DIMRINo ratings yet

- Screenshot 2022-03-04 at 2.00.46 PMDocument25 pagesScreenshot 2022-03-04 at 2.00.46 PMPragati SrivastavaNo ratings yet

- Basic Concepts MCQs by CA Pranav ChandakDocument11 pagesBasic Concepts MCQs by CA Pranav ChandakJoginder shahNo ratings yet

- Intermediate Examination: Suggested Answers To QuestionsDocument15 pagesIntermediate Examination: Suggested Answers To QuestionsSairaj MudhirajNo ratings yet

- LGC Tax BQsDocument4 pagesLGC Tax BQsSGTNo ratings yet

- 21935mtp Cptvolu1 Part3 PDFDocument224 pages21935mtp Cptvolu1 Part3 PDFArun KCNo ratings yet

- MCQ (ICAI Study Material)Document6 pagesMCQ (ICAI Study Material)Sanket Mhetre67% (3)

- Model Test 15 - 20Document206 pagesModel Test 15 - 20theabhishekdahalNo ratings yet

- Chapter 2 - The Global EconomyDocument9 pagesChapter 2 - The Global EconomyMariel OroNo ratings yet

- Neolithic RevolutionDocument33 pagesNeolithic Revolutionapi-304649470No ratings yet

- 1910 Commodity Air Cart Ground Drive IntroductionDocument5 pages1910 Commodity Air Cart Ground Drive IntroductionOleksandr YermolenkoNo ratings yet

- Barclays - Global Economics Weekly PDFDocument44 pagesBarclays - Global Economics Weekly PDFRishabh VakhariaNo ratings yet

- Caltex V COA DigestDocument3 pagesCaltex V COA DigestCarlito HilvanoNo ratings yet

- ECON 460 Assignment 4 Answer KeyDocument5 pagesECON 460 Assignment 4 Answer KeyDivyansh SikharNo ratings yet

- Personal Management: Merit Badge WorkbookDocument23 pagesPersonal Management: Merit Badge WorkbookOri TanzerNo ratings yet

- 67597225eco 24 AlokDocument3 pages67597225eco 24 AlokAlok GoswamiNo ratings yet

- Hoa Phat Group Business EnvironmentDocument22 pagesHoa Phat Group Business EnvironmentTruong Thi Phuong Dung (FGW HN)No ratings yet

- Michael Platt (Financier)Document5 pagesMichael Platt (Financier)evangeliamartini2017No ratings yet

- BankDocument116 pagesBanknravindranathreddyNo ratings yet

- Essay On The Influence of Microfinance On The Business Development of Merchants in The San José International Market in The City of JuliacaDocument4 pagesEssay On The Influence of Microfinance On The Business Development of Merchants in The San José International Market in The City of JuliacaEvelyn CastilloNo ratings yet

- PIOs - and - FAAs - As - On - 22june 2020Document74 pagesPIOs - and - FAAs - As - On - 22june 2020Ashish Singh bhandariNo ratings yet

- Microeconomics Principles and Policy 13th Edition Baumol Test Bank 1Document70 pagesMicroeconomics Principles and Policy 13th Edition Baumol Test Bank 1lynn100% (62)

- NewBookReleaseInfo-Gann Planets Vol II PDFDocument8 pagesNewBookReleaseInfo-Gann Planets Vol II PDFJim Baxter50% (2)

- To Be Published in Part-I, Section - 2 of The Gazette of IndiaDocument6 pagesTo Be Published in Part-I, Section - 2 of The Gazette of Indiajudicial teamworkNo ratings yet

- Final (PPT) A Study On Investors Perception Towards MutualDocument12 pagesFinal (PPT) A Study On Investors Perception Towards MutualAvantika JindalNo ratings yet

- Presantation On Special Economic Zone (Sez) by Rahul Jagtap PGDM 1stsemDocument27 pagesPresantation On Special Economic Zone (Sez) by Rahul Jagtap PGDM 1stsemcimr33No ratings yet

- TableOfIncomeTaxable EPF SOCSO EISDocument7 pagesTableOfIncomeTaxable EPF SOCSO EISMohd ShamNo ratings yet

- Jurnal Tinjauan Keselamatan Perlintasan Sebidang Dampak Rencana Operasi Kereta Penumpang Di Lintas Padang-Pauh LimaDocument10 pagesJurnal Tinjauan Keselamatan Perlintasan Sebidang Dampak Rencana Operasi Kereta Penumpang Di Lintas Padang-Pauh Limahead unitNo ratings yet

- New FGE Chapter I and IIDocument18 pagesNew FGE Chapter I and IImubarek kemalNo ratings yet

- Enter The Data Only in The Yellow Cells.: Agg Plan - LevelDocument7 pagesEnter The Data Only in The Yellow Cells.: Agg Plan - LevelJason RobillardNo ratings yet

- Chapters 20, 22 & 24Document59 pagesChapters 20, 22 & 24Manidipa BoseNo ratings yet

- For Point 3Document5 pagesFor Point 3Jigisha SinghNo ratings yet

- GHGGVG Data UploadedDocument3 pagesGHGGVG Data Uploadedshriya shettiwarNo ratings yet

- Unit 5 - Global City, Demography and MigrationDocument8 pagesUnit 5 - Global City, Demography and MigrationNorlyn Esmatao BaladiaNo ratings yet

- DEBENTURES - SolutionsDocument7 pagesDEBENTURES - Solutionssaiteja surabhiNo ratings yet

- Statistical Techniques in Business and Economics 16th Edition Lind Solutions ManualDocument19 pagesStatistical Techniques in Business and Economics 16th Edition Lind Solutions Manualsnuggerytamiliana4h2100% (26)

- Fundamentals of ABMDocument4 pagesFundamentals of ABMMadriñan Wency M.No ratings yet