Professional Documents

Culture Documents

ACCN. LOCKDOWN WORKSHEET 2a

ACCN. LOCKDOWN WORKSHEET 2a

Uploaded by

Ryno de BeerOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

ACCN. LOCKDOWN WORKSHEET 2a

ACCN. LOCKDOWN WORKSHEET 2a

Uploaded by

Ryno de BeerCopyright:

Available Formats

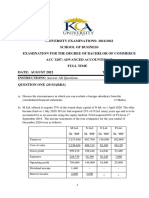

Province of the EASTERN CAPE GRADE 12 ACCOUNTING: TERM 1 REVISION

DEPARTMENT OF EDUCATION WORKSHEET 2

CURRICULUM MANAGEMENT

COMPANIES: CASH FLOW STATEMENT,

FINANCIAL INDICATORS, and INTERPRETATION

--------------------------------------------------------------------------------------------------------------------------------

The following information relates to DUFF LTD for the financial year ended 29 February 2020.

REQUIRED:

1.1 Complete the Cash Flow Statement by filling in all the missing amounts

Show ALL workings. (35)

1.2 Calculate the following financial indicators for 2020:

1.2.1 % operating expenses on sales (3)

1.2.2 Acid test ratio (4)

1.2.3 Debt/equity ratio (3)

1.2.4 % return on average shareholders’ equity (5)

1.2.5 Net asset value per share. (3)

1.3 Comment on the liquidity of the business. Quote TWO financial indicators (with figures). (6)

1.4 Provide TWO reasons why directors decided to change the dividend pay-out policy.

Quote figures to support your opinion. (6)

1.5 Did the company pay a fair price to buy back the shares? Explain. Quote figures. (5)

INFORMATION:

A. Extract from the Income Statement on 29 February 2020:

Sales 6 720 000

Cost of sales 4 200 000

Operating expenses 1 020 000

Depreciation 322 200

Interest expense 156 000

Income tax (30% of taxable income) ?

Net profit after tax 940 800

B. Extract from the Balance Sheet:

29 February 2020 28 February 2019

Fixed assets (carrying value) 8 275 600 7 722 000

Fixed Deposit 100 000 500 000

Current assets 1 121 600 848 000

Inventories 461 000 329 000

Trade and other receivables 635 000 514 000

Cash and cash equivalents 25 600 5 000

Shareholders’ equity 7 844 800 6 472 000

Ordinary share capital 7 182 000 6 200 000

Retained income 662 800 272 000

Loan: Mazu Bank 900 000 1 700 000

Current liabilities 752 400 898 000

Trade and other payables 752 400 852 800

SARS: Income tax 22 400 6 800

Shareholders for dividends 240 000 180 000

Bank overdraft 0 45 200

2

C. Changes to Share capital:

Number of

share

Balance on 1 March 2019 1 000 000

Shares issued on 1 November 2019 200 000

Shares repurchased on 1 January 2020, at R1,00 above the average share price 60 000

Balance on 28 February 2020 1 140 000

D. Total dividends for the year amounted to R490 000.

E. Changes to fixed assets:

Old equipment were sold at carrying value during the financial year, R252 000.

Additional equipment were purchased to upgrade the office section.

Extensions to the office section were also completed during the current financial year.

F. Financial indicators:

29 February 2020 28 February 2019

% mark-up (on cost) 60.0% 60.0%

% operating expenses on sales ? 16,3%

Debt / equity ratio ? 0,3 : 1

Current ratio 1,5 : 1 0,9 : 1

Acid-test ratio ? 0,6 : 1

Stock turnover rate 10,8 times 11,6 times

Earnings per share (cents) 89 cents 78 cents

Dividends per share (cents) 45 cents 60 cents

% return on average shareholders’ equity ? 12,0%

% return on average capital employed 17,7% 15,5%

Interest rate on loans 14% 15%

Net asset value per share (cents) ? 647 cents

Market price of shares (JSE) 660 cents 650 cents

70

P. Govender (BCMD)

You might also like

- Manufacturing Engineering HandbookDocument1,193 pagesManufacturing Engineering Handbookgustavogomezch96% (24)

- ACCN 304 Revision QuestionsDocument11 pagesACCN 304 Revision Questionskelvinmunashenyamutumba100% (1)

- Quiet Title Complaint Template Sample Example FormDocument5 pagesQuiet Title Complaint Template Sample Example FormZionNo ratings yet

- Fabm2 Final Week2Document13 pagesFabm2 Final Week2studentemail0% (1)

- Errors - Discussion ProblemsDocument2 pagesErrors - Discussion ProblemsHaidee Flavier SabidoNo ratings yet

- Advanced Accounting 2CDocument5 pagesAdvanced Accounting 2CHarusiNo ratings yet

- Accounting and Financial Management - Question PaperDocument11 pagesAccounting and Financial Management - Question PaperKim-Rushay WilliamsNo ratings yet

- ACMA Unit 5 Problems - CFS PDFDocument3 pagesACMA Unit 5 Problems - CFS PDFPrabhat SinghNo ratings yet

- FE QUESTION FIN 2224 Sept2021Document6 pagesFE QUESTION FIN 2224 Sept2021Tabish HyderNo ratings yet

- Financial Statement AnalysisDocument4 pagesFinancial Statement AnalysisAsad RehmanNo ratings yet

- © The Institute of Chartered Accountants of IndiaDocument7 pages© The Institute of Chartered Accountants of IndiaSarvesh JoshiNo ratings yet

- A2 Accounting p3 Booklet (2023 - 24)Document208 pagesA2 Accounting p3 Booklet (2023 - 24)Saif UllahNo ratings yet

- April 2022 (Fa4)Document7 pagesApril 2022 (Fa4)Amelia RahmawatiNo ratings yet

- June 2021Document64 pagesJune 2021new yearNo ratings yet

- Socw - 1263543589Document7 pagesSocw - 1263543589dolevov652No ratings yet

- GR 12 March 2022 QPDocument10 pagesGR 12 March 2022 QPjuniorfrankk73No ratings yet

- Instructor Questionaire AccountingDocument4 pagesInstructor Questionaire AccountingjovelioNo ratings yet

- Accounting Grade 12 Test 1Document4 pagesAccounting Grade 12 Test 1Ryno de BeerNo ratings yet

- Jan 2022 BBF20103 Introduction To Financial Management A1QPDocument6 pagesJan 2022 BBF20103 Introduction To Financial Management A1QPJane HoNo ratings yet

- Acct1101 Final Examination SEMESTER 2, 2020Document13 pagesAcct1101 Final Examination SEMESTER 2, 2020Yahya ZafarNo ratings yet

- 15 March Worksheet - Cash FlowDocument7 pages15 March Worksheet - Cash FlowkeithsimphiweNo ratings yet

- © The Institute of Chartered Accountants of IndiaDocument24 pages© The Institute of Chartered Accountants of IndiaAniketNo ratings yet

- Question 6 Chic Homes LTD GroupDocument5 pagesQuestion 6 Chic Homes LTD GroupsavagewolfieNo ratings yet

- Case StudyDocument3 pagesCase Study203560No ratings yet

- Activity 4 Financial Reporting in Hyperinflationary EconomiesDocument5 pagesActivity 4 Financial Reporting in Hyperinflationary Economiesnglc srzNo ratings yet

- P1 - ReviewDocument14 pagesP1 - ReviewEvitaAyneMaliñanaTapit0% (2)

- Jul22 Osa Supp Accounting and Financial Management Question PaperDocument9 pagesJul22 Osa Supp Accounting and Financial Management Question PaperMelokuhle MhlongoNo ratings yet

- QuestionsDocument13 pagesQuestionsAriaNo ratings yet

- 2020 Acc 410 Test 1Document8 pages2020 Acc 410 Test 1Kesa Metsi100% (1)

- MBA731 Class Activity Question 2 CashflowDocument5 pagesMBA731 Class Activity Question 2 CashflowWisdom MandazaNo ratings yet

- 2020 GR 12 Controlled Test 1 QP EnglishDocument7 pages2020 GR 12 Controlled Test 1 QP Englishmbalentledaniso035No ratings yet

- Sem-6 FR & FSA Model paper 1_240608_144233Document5 pagesSem-6 FR & FSA Model paper 1_240608_144233taniashaw200309No ratings yet

- Advanced Financial Reporting Supp 2018Document8 pagesAdvanced Financial Reporting Supp 2018smlingwaNo ratings yet

- 301 AFA II PL III Question CMA June 2021 Exam.Document4 pages301 AFA II PL III Question CMA June 2021 Exam.rumelrashid_seuNo ratings yet

- Financial AccountingDocument19 pagesFinancial AccountingObed AsamoahNo ratings yet

- Accountancy - Holiday Homework-Class12Document8 pagesAccountancy - Holiday Homework-Class12Ahill sudershanNo ratings yet

- University of Bradford Financial Accounting, Afe5008-B Final ExaminationDocument9 pagesUniversity of Bradford Financial Accounting, Afe5008-B Final ExaminationDiana TuckerNo ratings yet

- Financila Statements 2023 FinalDocument17 pagesFinancila Statements 2023 Finallesleymohlala7No ratings yet

- Fm2quizb4 QoDocument10 pagesFm2quizb4 QoYe YongshiNo ratings yet

- Chapter 21 - QB - Q1 - SolutionDocument4 pagesChapter 21 - QB - Q1 - SolutionRichard SibekoNo ratings yet

- ACC 401-2023 GA 2-EvenDocument3 pagesACC 401-2023 GA 2-EvenOhene Asare PogastyNo ratings yet

- Advanced Accounting 2eDocument3 pagesAdvanced Accounting 2eHarusiNo ratings yet

- Mba ZC415 Ec-3r First Sem 2022-2023Document4 pagesMba ZC415 Ec-3r First Sem 2022-2023Ravi KaviNo ratings yet

- DorexDocument2 pagesDorexSonal SuryawanshiNo ratings yet

- FM Eco Q Mtp2 Inter Nov21Document7 pagesFM Eco Q Mtp2 Inter Nov21rridhigolchha15No ratings yet

- Revision Pack QuestionsDocument12 pagesRevision Pack QuestionsAmmaarah PatelNo ratings yet

- FAR - Final Preboard CPAR 92Document14 pagesFAR - Final Preboard CPAR 92joyhhazelNo ratings yet

- Financial Analysis TestDocument11 pagesFinancial Analysis TestAlaitz GNo ratings yet

- Control Test 1 - March 2022Document4 pagesControl Test 1 - March 2022yandisaNo ratings yet

- I1.2-Financial Reporting QPDocument8 pagesI1.2-Financial Reporting QPConstantin NdahimanaNo ratings yet

- B.B.A., Sem.-IV CC-213: Corporate Financial StatementsDocument4 pagesB.B.A., Sem.-IV CC-213: Corporate Financial StatementsJJ NayakNo ratings yet

- Far670 Tutorial Basis of AnalysisDocument3 pagesFar670 Tutorial Basis of Analysis2020482736No ratings yet

- Financial Ratio Questions 1Document7 pagesFinancial Ratio Questions 1Afnan QusyairiNo ratings yet

- FS Analysis Horizontal Vertical ExerciseDocument5 pagesFS Analysis Horizontal Vertical ExerciseCarla Noreen CasianoNo ratings yet

- H and V Anal ExerciseDocument3 pagesH and V Anal ExerciseSummer ClaronNo ratings yet

- QP CODE: 22100973: Reg No: NameDocument6 pagesQP CODE: 22100973: Reg No: NameSajithaNo ratings yet

- FABVDocument10 pagesFABVdivyayella024No ratings yet

- What Are The Advantages To A Business of Being Formed As A Company? What Are The Disadvantages?Document12 pagesWhat Are The Advantages To A Business of Being Formed As A Company? What Are The Disadvantages?Nguyễn HoàngNo ratings yet

- Classroom Exerisises On Presentation of Financial Statements PDFDocument2 pagesClassroom Exerisises On Presentation of Financial Statements PDFalyssaNo ratings yet

- KZN 2020 June P1 Answer Book 2Document7 pagesKZN 2020 June P1 Answer Book 2shandren19No ratings yet

- 69587bos55533-P1.pdf 2Document46 pages69587bos55533-P1.pdf 2pittujb2002No ratings yet

- Management Accounitng - 104 (I)Document4 pagesManagement Accounitng - 104 (I)Rudraksh PareyNo ratings yet

- 2023 Accounting Grade 12 Baseline Assessment - QP-1Document12 pages2023 Accounting Grade 12 Baseline Assessment - QP-1Ryno de BeerNo ratings yet

- Accounting Grade 12 Test 1Document4 pagesAccounting Grade 12 Test 1Ryno de BeerNo ratings yet

- 11 Acc P2 Memo Nov 2011Document6 pages11 Acc P2 Memo Nov 2011Ryno de BeerNo ratings yet

- Saskia FalkenDocument3 pagesSaskia FalkenRyno de BeerNo ratings yet

- Cell C Social Weekly Competition TCs BelieveInTheImpossible 27 Jan 2014 FINALDocument4 pagesCell C Social Weekly Competition TCs BelieveInTheImpossible 27 Jan 2014 FINALRyno de BeerNo ratings yet

- Berg River Trust It638/97 T/A Berg River Resort: No. of PersonsDocument3 pagesBerg River Trust It638/97 T/A Berg River Resort: No. of PersonsRyno de BeerNo ratings yet

- Value Relevance of Accounting Information of Listed New Economy Firms in Nigeria-An Empirical Investigation Using Ohlson ModelDocument18 pagesValue Relevance of Accounting Information of Listed New Economy Firms in Nigeria-An Empirical Investigation Using Ohlson ModelNguyễn Hữu QuyNo ratings yet

- Trend Micro Apex One: Endpoint Security RedefinedDocument2 pagesTrend Micro Apex One: Endpoint Security RedefinedtestNo ratings yet

- Mobile Application Development UnitDocument24 pagesMobile Application Development Unitjango navi100% (1)

- Chapter 5 Health Information SystemDocument36 pagesChapter 5 Health Information SystemAirishNo ratings yet

- Design Frameworks: Past, Present and FuturesDocument53 pagesDesign Frameworks: Past, Present and FuturesJames Piers Taylor100% (2)

- Chemistry Project On Coin AnalysisDocument13 pagesChemistry Project On Coin AnalysisArnav GajbhiyeNo ratings yet

- Guy Huynh-Ba 2018Document15 pagesGuy Huynh-Ba 2018IsmaelNo ratings yet

- Exercise Chapters 1-5 No SolutionDocument7 pagesExercise Chapters 1-5 No SolutionTrâm Lê Ngọc BảoNo ratings yet

- University of KarachiDocument53 pagesUniversity of KarachiWaqasBakaliNo ratings yet

- Time and Distance Handwritten NotesDocument26 pagesTime and Distance Handwritten Notes20-20 online junctionNo ratings yet

- REVA University PGD MTech in Cyber Security Brochure FinalDocument4 pagesREVA University PGD MTech in Cyber Security Brochure Finalhemant mohiteNo ratings yet

- Media ProjectDocument8 pagesMedia Projectruchika singhNo ratings yet

- Underwater ChaosDocument2 pagesUnderwater ChaosHack mau5100% (1)

- Đề HSG 9 Tiếng Anh Phù Ninh 2017Document8 pagesĐề HSG 9 Tiếng Anh Phù Ninh 2017Quỳnh Anh DươngNo ratings yet

- CWC Handbook Fo Desisgn of FC - AE Works - CompressedDocument104 pagesCWC Handbook Fo Desisgn of FC - AE Works - Compressedglh karunaNo ratings yet

- University of Cagayan Valley: College Freshmen Program (CFP)Document13 pagesUniversity of Cagayan Valley: College Freshmen Program (CFP)Turingan, Ranz Gabriel, D.No ratings yet

- Spiral Model Phases PlanningDocument3 pagesSpiral Model Phases PlanningshahbazNo ratings yet

- Manual de Usuario Holiday PcwiDocument12 pagesManual de Usuario Holiday PcwijerrymcflyNo ratings yet

- The Black Horse (Capitalism)Document4 pagesThe Black Horse (Capitalism)acts2and38No ratings yet

- Letters of Credit: Need and ScopeDocument22 pagesLetters of Credit: Need and ScopeSidhant NaikNo ratings yet

- Practical Skin Cancer Surgery by Mileham HayesDocument327 pagesPractical Skin Cancer Surgery by Mileham HayesDaniella TruffelloNo ratings yet

- Oracle: 1Z0-819 ExamDocument9 pagesOracle: 1Z0-819 ExamdspNo ratings yet

- Electric Cars and EnviroDocument5 pagesElectric Cars and EnviroC VNo ratings yet

- Guide To GRE Awa PDFDocument33 pagesGuide To GRE Awa PDFAbdul KareemNo ratings yet

- MPLUN-DSC User ManualDocument5 pagesMPLUN-DSC User ManualAccounts DepartmentNo ratings yet

- POS 205 GroupDocument5 pagesPOS 205 GroupnathanharyehrinNo ratings yet