Professional Documents

Culture Documents

Syska Led-1

Syska Led-1

Uploaded by

Vijay AroraOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Syska Led-1

Syska Led-1

Uploaded by

Vijay AroraCopyright:

Available Formats

Press Release

SYSKA Led Lights Private Limited

July 20, 2022

Rating Reaffirmed & Partly Withdrawn

Quantum (Rs. Short Term

Product Long Term Rating

Cr) Rating

ACUITE A- | Reaffirmed &

Bank Loan Ratings 10.00 -

Withdrawn

ACUITE A- | Stable |

Bank Loan Ratings 210.00 -

Reaffirmed

Total Outstanding Quantum

210.00 - -

(Rs. Cr)

Total Withdrawn Quantum

10.00 - -

(Rs. Cr)

Rating Rationale

Acuité has reaffirmed its long-term rating of ‘ACUITE A-’ (read as ACUITE A minus) on the

Rs. 210.00 crore bank facilities of Syska Led Lights Private Limited (SLLPL). The outlook remains

'Stable'.

Acuité has also withdrawn the rating of 'ACUITE A-' (read as ACUITE A minus) on the Rs.

10 Cr. bank facilities of SLLPL. The withdrawal is on account of a written request received from

the client.

Rationale fo Rating Reaffirmation

The rating reaffirmation considers the decline in FY2021 in SYSKA Group's (SG) performance. Its

revenue declined to Rs. 5235 Cr. in FY2021 against Rs. 9162 Cr. in FY2020. This decline has

continued in FY2022 and revenue for 9M FY2022 (Provisional) stood at Rs. 3000 Cr. This decline

is primarily on account disruptions caused by the spread of Covid 19 and the Group's limited

presence in the online market which has been the preferred mode of electronic shopping

during the pandemic. However, the Group has been able to maintain its operating

profitability which stood at 3.92 percent in 9M FY2022 and 3.09 percent in FY2021. The rating

downgrade also considers the deterioration in the liquidity profile on account of elongation in

its working capital cycle. The Group's GCA days stood at 154 days in FY2021 against 79 days in

FY2020. This has led to higher dependence on working capital limits and the bank limit

utilization stood over 95 percent for March 31, 2022. The rating continues to consider the

established operational track record and position of the Group in the mobile distribution

business, experience of the management and comfortable financial risk profile. Acuite also

notes that the promoters have currently diluted their stake in SLLPL (defined below) up to 30

percent and new investor (Mr. Rakesh Jhunjhunwala) has come in. The promter's stake is

expected to gradually go down to 51 percent in next three years. Acuite expects the Group's

operating and financial risk profile to improve on account of technical expertise and

investment from the new investor over the medium term. The Group’s ability to increase its

scale of operations and improve its working capital cycle will continue to remain a key rating

sensitivity.

Acuité Ratings & Research Limited www.acuite.in

About Company

SLLPL was incorporated in 2012 at Pune by Mr. Rajesh and Mr. Govind Uttamchandani. The

company is engaged in trading and manufacturing of LED Lights, personal grooming products,

irons, fans and home wires under the brand name of ‘SYSKA’. It has its factories in Rabale and

Chakan in Maharashtra.

About the Group

SYSKA Group comprises of 6 companies, namely Shree Sant Kripa Appliances Private Limited

(SSKAPL), Syska E-Retails LLP (SELLP), SYSKA LED Lights Private Limited (SLLPL), Bagh Bahar

Appliances Private Limited (BBAPL), SSK Retails Private Limited (SRPL) and SSK Infotech Private

Limited (SIPL). The group is primarily engaged in mobile distribution business exclusively for

Samsung under its flagship company SSKAPL. The group is also engaged in the manufacturing

and trading of LED lights, home wires, irons, fans and personal care and grooming products

under their own brand name of 'SYSKA'. BBAPL is the exclusive distributor for Samsung mobiles

across Pune and its outskirts, LG home appliances in Pune district and Haier home appliances

in Mumbai region. SRPL currently operates 26 Samsung Smart Phone Cafes across India. SIPL

provides electronic data services and solutions to telecom and multi-national companies;

and printing and mailing activities such as printing of cheques and current/savings account

statements, mainly for banks. SELLP is engaged in the trading of SYSKA Brand Products such as

LED Bulbs, Tube Lights, Panel Lights, Irons, Fans, Extension Boards, Power Banks, Bluetooth,

Speakers, and Personal Care grooming products for both men and women through

ECommerce platforms. SLLPL is engaged in the trading and manufacturing of LED Lights,

grooming and personal care products and home wires, irons and fans under the 'SYSKA' brand

name.

Analytical Approach

Extent of Consolidation

• Full Consolidation

Rationale for Consolidation or Parent / Group / Govt. Support

Acuité has consolidated the business and financial risk profiles of Syska E-Retails LLP (SELLP),

Shree Sant Kripa Appliances Pvt. Ltd. (SSKAPL), SYSKA LED Lights Pvt. Ltd. (SLLPL), Bagh Bahar

Appliances Pvt. Ltd. (BBAPL), SSK Retails Pvt. Ltd. (SRPL), SSK Infotech Pvt. Ltd. (SIPL) together

referred to as the ‘SSK Group’ (SG). The consolidation is in view of the common management,

strong operational & financial linkages between the entities and personal guarantee of Mr.

Govind Uttamchandani and Mr. Rajesh Uttamchandani for the bank facilities of SELLP.

Key Rating Drivers

Strengths

Strong support from the SYSKA Group and established position in the mobile

distribution business

SYSKA Group (SG) is promoted by Mr. Govind Uttamchandani and Mr. Rajesh

Uttamchandani. The promoters of the group have an extensive experience of over three

decades in various industries like distribution business and manufacturing segment. The group

is engaged in the distribution of Samsung products, manufacturing and trading of LED lights,

grooming & personal care products, irons, fans and home wires under the brand name of

'SYSKA'. The promoters in the past have demonstrated the ability to quickly reorient their

business models based on changes in market conditions. Earlier, the promoters were engaged

in the distribution business for T -Series cassettes and Nokia mobile phones. However, with

entry of new players like SAMSUNG with newer technologies and stronger product pipelines,

the promoters switched over from their earlier distributorships so as to maintain their revenue

growth. SSKAPL, the flagship company of SYSKA Group, was established as a partnership firm

in 2002. Later the constitution was changed to private limited in 2006. SSKAPL has established

their brand position and a widespread distribution network in the mobile distribution business.

Acuité believes the established brand position of 'SYSKA' and wide network along with long

standing relations with distributors and dealers will help the group in establishing the presence

Acuité Ratings & Research Limited www.acuite.in

of 'SYSKA' brand of products across India. In the future, revenue from trading and

manufacturing business of 'SYSKA' brand of products is expected to partly de-risk the over

dependence of the company on the distribution business of Samsung products. Acuité

believes that large scale of operations of the group is well supported by the extensive

experience of the promoters and a stable and well experienced management team.

Long standing association with a st rong principal and a widespread distribution

network

SSKAPL is the exclusive distributors of 'Samsung' brand for distribution of mobile handsets,

accessories and tablets. Samsung is a multi-national conglomerate which is the world's largest

information technology company, consumer electronics maker and chip maker under its

industrial affiliate 'Samsung Electronics'. Samsung is present as a leading brand of consumer

electronics in almost every major country of the world. Samsung is one of the global leaders in

technology driven products and enjoys a huge customer base and a good brand image in

India as well as abroad. Samsung is among the top 5 mobile handset selling companies in

India since the last 10 years. SSKAPL has been associated with 'Samsung' since 2008 and has

established a strong relationship with the brand. The SYSKA group of companies have varied

line of businesses which include being the sole distributor of 'Samsung' mobiles and

accessories. Further, the other companies in the group are engaged in the trading and

manufacturing of LED lights, personal and grooming products, irons, fans and home wires.

Having said that, the group has been in distribution business for over three decades. The

group has long standing relation with its wide based distribution network. Previously the group

was associated in the distribution business with 'T-Series' and 'Nokia'. The group has a strong

pan India presence with more than 1000 distributors and over 1,00,000 dealers across the

country. Acuité believes the long-standing relation with its wide based distributors and

dealers will help the company distribute its own products under 'SYSKA' brand such as LED

lights, mobile accessories and other products.

Comfortable financial risk profile

The rating also derives comfort from the healthy financial risk profile marked by stable gearing

and comfortable debt protection metrics. The financial risk profile of the group has been

healthy marked by net worth of Rs. 604.08 crore as on 31 March 2021 as against Rs. 582.76

crore as on 31 March 2020. The gearing marginally increased to 2.27 times as on 31 March 2021

as against 2.23 times as on 31 March 2020 increase in debt. The total debt of Rs. 1369.66 crore

outstanding as on 31 March 2021 comprises long term debt of Rs. 220 crore, unsecured loans

from promoters and directors of Rs. 31 crore and working capital facility of Rs. 1119 crore from

the bank. The increase in long term debt in FY2021 is on account of additional debt raised for

a project which was later cancelled, and the debt was later paid off in FY2022. There has

been a moderation in the coverage indicators on account of decline in operating

performance. The Interest Coverage Ratio (ICR) declined to 1.24 times in FY2021 from 1.43

times in FY2020. For 9M FY2021 financial risk profile has remained stable. Gearing stood at 1.76

times and interest coverage ratio at 1.47 times. In FY2022 SG's promoters have diluted its

stake in SLLPL and a new investor (Mr. Rakesh Jhunjhunwala) has come in. Mr. Jhunjhunwala

has brought in technical expertise though his advisors to the promoters and has invested

almost Rs. 500 Cr. in FY2022 with further investment of Rs. 250 Cr. over the next three year. This

is expected to improve SG's financial risk profile as the proceeds will be used to reduce debt

burden and for expanding scale of 'SYSKA' branded products. Going forward the gearing is

expected to be in the range 0.50-1 times and interest coverage is expected to be increase in

the range 1.3- 2.50 over the medium term. Acuite expects SG's financial risk profile to improve

on account of expected improvement in its operating performance and investment by the

new investors.

Weaknesses

Decline in scale of operations and elongation in working capital cycle

There has been a significant decline in SG's scale of operations for the three-year period

ended FY2021. Its revenue declined to Rs. 5235 Cr. in FY2021 against Rs. 9162 Cr. in FY2021 and

Rs. 11004 Cr. in FY2020. This has further continued to decline in FY2022 and revenue for 9M

FY2022 (Provisional) for Rs. 3000 Cr. This decline is primarily on account of disruptions caused by

Covid 19 induced lockdowns, shift of consumer preference towards online shopping where SG

has a limited presence and moderation in Samsung's market share in FY2022. There has also

Acuité Ratings & Research Limited www.acuite.in

been decline in SG's SYSKA branded products. However, the SG has been able to maintain its

operating profitability which stood in the range of 2-3 percent for three year period

ended FY2021. Further, elongation has been also observed in SG's working capital cycle

reflected in the GCA days of 114 days in FY2021 against 67 days in FY2020. This has been

primarily on account of stretch in SG's elongation receivable and inventory days. Its

receivable and inventory days stood at 80 days and 61 days in FY2021 against 44 days and 33

days in FY2020 respectively. SG has not been able to collect from its channel partners on time

as its channel partners have also faced challenges on account of Covid 19 induced

lockdowns. This has continued in FY2022 as well and its receivable and inventory days stood

at 81 and 98 days respectively for 9M FY2022. This has led to deterioration in SG's liquidity

profile. Its dependency on bank limits has increased and average bank limit utilization stood

over 95 percent for 6 month ended March 2022. Acuite believes SG's ability to improve its

scale of operations and ability to improve its working capital cycle will continue to remain key

rating sensitivities.

Susceptibility of SG’s revenue profile to change in consumer preferences amidst

intense competition

SG's revenue profile is linked primarily to Samsung's ability to maintain a strong competitive

position in India's intensely competitive mobile handset market. Although SG revenues from

Samsung distributorship have declined over the past two years, however they still comprise

around 80 percent of its overall revenues. Hence, its revenue trajectory is linked to Samsung's

ability to continuously develop and introduce new models at various price points keeping in

mind the ever changing consumer preferences. The Indian market has witnessed significant

turbulence in the past wherein certain players like Nokia had to relinquish their leadership

positions to other players on account of their relative inability to react to technological and

market related changes. Samsung has been facing competitive pressures with respect to its

market share in the mobile segment especially over the last 2 years. The advent of other

companies like Xiaomi, Oppo, Vivo and Oneplus have proved to be intensely competitive in

terms of features and value. The ability of these companies to continuously churn out newer

models with a strong value proposition for the consumer has helped these other companies

gain a significant share in the mobile market at the expense of larger players like Samsung.

Samsung is still among the top 5 players in the Indian mobile market for the past 10 years.

Since the SYSKA Group generates around 80 percent of their revenue through the sale of

Samsung products, it has been highly dependent on the market share of Samsung India in the

mobile market. Further, Samsung's ability to maintain its market share by adapting , and

reinventing itself from time to time according to the changes in consumer preference will

remain a key monitorable over the near to medium term. The revenue and margin profile of

SG will also be influenced by Samsung's distribution policies and Samsung's strategy with

regard to the Indian market. SSKAPL generally maintains inventory up to 20-25 days and

hence the risk of technological obsolescence for Samsung mobile phones is significantly

mitigated. The risk of facing a loss due to reduced selling price is mitigated as dealers/

distributors are compensated by Samsung for any loss suffered due to reduction in selling price

by a pre-agreed policy. Besides the revenues from Samsung distributorship, the group also

derives revenues from sale of products under SYSKA brand where they are able to generate

higher margins. The revenue from the own branded products has been increasing over the

past 2 - 3 years however it still remains around 20 percent of the overall revenue. The Group

has plans to scale up this business with augmentation of product profile and infusion of

additional funds to be raised from private equity. The ongoing COVID 19 pandemic has also

had a significant impact on consumer preferences. It has led to higher adoption of online

shopping as social distancing and stay at home were adopted. SG’s has sales through online

portal form a small percentage of its overall revenue. SG’s limited presence in the online

segment will impact their scale of operations to some extent going ahead e-commerce in

India is expected grow. It is expected to reach USD 111 billion by 2024. Acuité believes the

group's ability to improve scale of operations for their ‘SYSKA’ branded products will remain a

key rating sensitivity over the medium term.

ESG Factors Relevant for Rating

The industry’s exposure to environmental risks is lower than its social and governance risks. The

Acuité Ratings & Research Limited www.acuite.in

primary material issues for the industry include efficient use of energy, putting environmental

management structures in places, GHG emissions, development of green products and

services and emitting air pollutant emissions. Since the industry has a large amount of e-waste

generation in manufacturing process as well as end use, waste management is also a key

material issue. Material efficiency is also important for the industry. For the computer &

electronics manufacturing industry the quality of the product and the safety of the

employeesare important material issues. The community support and development

initiatives taken by the companies in the industry are also a significant factor. Responsible

procurement and supply chain transparency are crucial for evaluating the performance of

the industry players. For the computer & electronics manufacturing industry, upholding

fundamental business ethics is the most pertinent material issue. Factors such as

management compensation, board independence, compensation and diversity are

relevant to the industry. Audit committee functioning, financial audit and control, takeover

defense mechanisms and shareholder rights are also important key issues.

Rating Sensitivities

Ability to improve scale of operations while maintaining profitability

Ability to improve working capital cycle

Material Covenants

None

Liquidity Position: Adequate

The Group generated cash accruals of Rs. 27-50 crore during the last three years through

2021, while its maturing debt obligations were in the range of Rs. 19-31 crore over the same

period. The cash accruals of the group are estimated to remain around Rs. 23 crore – Rs. 84

Cr. during 2021-23 while its repayment obligation is estimated to be around Rs. 16.00 crore –

Rs.25.00 crore. The net cash accruals are expected to decline further in FY2022 on account of

impact of COVID. However, SG is still expected to maintain adequate net cash accruals to

its maturing debt obligations The Group has seen an elongation in its working capital cycle.

This has led to high reliance on working capital borrowings, the cash credit limit in the group

remains utilized over 95 percent during the last 6 months period ended March 2022. The group

has maintained unencumbered cash and bank balances of Rs. 31.65 crore as on March 31,

2021. Acuite expects SG's liquidity to remain adequate on account of adequate buffer

between net cash accruals and repayment obligation constrained to some extent due to

low unutilized bank limits.

Outlook: Stable

Acuité believes that SG will continue to maintain a 'Stable' outlook over the medium term

owing to the extensive experience of the management and established presence in the

industry. The outlook may be revised to 'Positive' if the SG reports higher than expected

increase scale of operations while maintaining profitability. Conversely, the outlook may be

revised to 'Negative' in case of further deterioration in operating performance or working

capital management leading to decline in liquidity profile of the Group.

Other Factors affecting Rating

None

Key Financials

Particulars Unit FY 21 (Actual) FY 20 (Actual)

Operating Income Rs. Cr. 5235.20 9162.50

PAT Rs. Cr. 20.33 36.27

PAT Margin (%) 0.39 0.40

Total Debt/Tangible Net Worth Times 2.27 2.23

PBDIT/Interest Times 1.24 1.43

Acuité Ratings & Research Limited www.acuite.in

Status of non-cooperation with previous CRA (if applicable)

Not Applicable

Any Other Information

None

Applicable Criteria

• Application Of Financial Ratios And Adjustments: https://www.acuite.in/view-rating-criteria-

53.htm

• Consolidation Of Companies: https://www.acuite.in/view-rating-criteria-60.htm

• Default Recognition: https://www.acuite.in/view-rating-criteria-52.htm

• Manufacturing Entities: https://www.acuite.in/view-rating-criteria-59.htm

• Trading Entitie: https://www.acuite.in/view-rating-criteria-61.htm

Note on Complexity Levels of the Rated Instrument

https://www.acuite.in/view-rating-criteria-55.htm

Rating History

Name of Amount

Date Instruments/Facilities Term (Rs. Cr) Rating/Outlook

Long ACUITE A- | Stable (Downgraded from

Cash Credit Term 20.00 ACUITE A | Stable)

Long ACUITE A- | Stable (Downgraded from

Cash Credit Term 50.00 ACUITE A | Stable)

Long ACUITE A- | Stable (Downgraded from

11 Jul Cash Credit Term 40.00 ACUITE A | Stable)

2022 Long ACUITE A- | Stable (Downgraded from

Cash Credit Term 70.00 ACUITE A | Stable)

Long ACUITE A- | Stable (Downgraded from

Cash Credit Term 30.00 ACUITE A | Stable)

Long ACUITE A- | Stable (Downgraded from

Proposed Bank Facility Term 10.00 ACUITE A | Stable)

Long

Cash Credit Term 50.00 ACUITE A | Stable (Reaffirmed)

Long

Cash Credit Term 20.00 ACUITE A | Stable (Reaffirmed)

Long

Cash Credit Term 20.00 ACUITE A | Stable (Reaffirmed)

Working Capital Term Long

12 Apr Loan Term 5.00 ACUITE A | Stable (Assigned)

2021 Long

Cash Credit Term 30.00 ACUITE A | Stable (Reaffirmed)

Working Capital Term Long

Loan Term 5.00 ACUITE A | Stable (Assigned)

Long

Cash Credit Term 40.00 ACUITE A | Stable (Reaffirmed)

Long

Cash Credit Term 50.00 ACUITE A | Stable (Reaffirmed)

Long

Cash Credit Term 50.00 ACUITE A | Stable (Reaffirmed)

Long

Cash Credit Term 50.00 ACUITE A | Stable (Reaffirmed)

Long

27 Feb Cash Credit Term 20.00 ACUITE A | Stable (Reaffirmed)

Acuité Ratings & Research Limited www.acuite.in

2020 Long

Cash Credit Term 40.00 ACUITE A | Stable (Reaffirmed)

Long

Cash Credit Term 30.00 ACUITE A | Stable (Reaffirmed)

Long

Cash Credit Term 20.00 ACUITE A | Stable (Reaffirmed)

Long

Cash Credit Term 50.00 ACUITE A | Stable (Assigned)

Long

Cash Credit Term 50.00 ACUITE A | Stable (Assigned)

Long

30 Jan Proposed Bank Facility Term 30.00 ACUITE A | Stable (Assigned)

2019 Long

Cash Credit Term 30.00 ACUITE A | Stable (Assigned)

Long

Cash Credit Term 20.00 ACUITE A | Stable (Assigned)

Long

Cash Credit Term 30.00 ACUITE A | Stable (Assigned)

Acuité Ratings & Research Limited www.acuite.in

Annexure - Details of instruments rated

Lender’s Date Of Coupon Maturity Quantum

ISIN Facilities Rating

Name Issuance Rate Date (Rs. Cr.)

ACUITE A-

State Bank Not Not Not Not

Cash Credit 70.00 | Stable |

of India Applicable Applicable Applicable Applicable

Reaffirmed

ACUITE A-

HDFC Bank Not Not Not Not

Cash Credit 40.00 | Stable |

Ltd Applicable Applicable Applicable Applicable

Reaffirmed

ACUITE A-

Union Bank Not Not Not Not

Cash Credit 50.00 | Stable |

of India Applicable Applicable Applicable Applicable

Reaffirmed

ACUITE A-

Indusind Not Not Not Not

Cash Credit 30.00 | Stable |

Bank Ltd Applicable Applicable Applicable Applicable

Reaffirmed

IDFC First ACUITE A-

Not Not Not Not

Bank Cash Credit 20.00 | Stable |

Applicable Applicable Applicable Applicable

Limited Reaffirmed

ACUITE A-

Proposed |

Not Not Not Not Not

Long Term 10.00 Reaffirmed

Applicable Applicable Applicable Applicable Applicable

Bank Facility &

Withdrawn

Acuité Ratings & Research Limited www.acuite.in

Contacts

Analytical Rating Desk

Aditya Gupta Varsha Bist

Vice President-Rating Operations Senior Manager-Rating Operations

Tel: 022-49294041 Tel: 022-49294011

aditya.gupta@acuite.in rating.desk@acuite.in

Parth Pandit

Assistant Manager-Rating Operations

Tel: 022-49294065

parth.pandit@acuite.in

About Acuité Ratings & Research

Acuité is a full-service Credit Rating Agency registered with the Securities & Exchange Board

of India (SEBI). The company received RBI Accreditation as an External Credit Assessment

Institution (ECAI) for Bank Loan Ratings under BASEL-II norms in the year 2012. Acuité has

assigned ratings to various securities, debt instruments and bank facilities of entities spread

across the country and across a wide cross section of industries. It has its Registered and

Head Office in Kanjurmarg, Mumbai.

Disclaimer: An Acuité rating does not constitute an audit of the rated entity and should not

be treated as a recommendation or opinion that is intended to substitute for a financial

adviser's or investor's independent assessment of whether to buy, sell or hold any security.

Ratings assigned by Acuité are based on the data and information provided by the issuer

and obtained from other reliable sources. Although reasonable care has been taken to

ensure that the data and information is true, Acuité, in particular, makes no representation or

warranty, expressed or implied with respect to the adequacy, accuracy or completeness of

the information relied upon. Acuité is not responsible for any errors or omissions and especially

states that it has no financial liability whatsoever for any direct, indirect or consequential loss

of any kind, arising from the use of its ratings. Ratings assigned by Acuité are subject to a

process of surveillance which may lead to a revision in ratings as and when the circumstances

so warrant. Please visit our website (www.acuite.in) for the latest information on any

instrument rated by Acuité.

Acuité Ratings & Research Limited www.acuite.in

You might also like

- Principles of Economics 7th Edition Frank Solutions ManualDocument18 pagesPrinciples of Economics 7th Edition Frank Solutions ManualEdwardBishopacsy100% (42)

- Managerial Accounting Quiz 3 - 1Document8 pagesManagerial Accounting Quiz 3 - 1Christian De LeonNo ratings yet

- Chapter 18 - Test BankDocument50 pagesChapter 18 - Test Bankjdiaz_64624780% (5)

- Funnels 101 FrameworksDocument14 pagesFunnels 101 FrameworksAaron I Ang100% (6)

- Starbucks PDFDocument28 pagesStarbucks PDFDerry Pandita Pangestu100% (1)

- RR 20220720Document9 pagesRR 20220720a76296419No ratings yet

- Syska Led Lights PVT LTDDocument8 pagesSyska Led Lights PVT LTDLiquidNo ratings yet

- SJS Enterprises LimitedDocument7 pagesSJS Enterprises LimitedCA Ankur BariaNo ratings yet

- PickoftheWeek 31122022Document3 pagesPickoftheWeek 31122022yasar jawaidNo ratings yet

- Suprajit Engineering LimitedDocument6 pagesSuprajit Engineering LimitedHarinath ReddyNo ratings yet

- Century LED LimitedDocument7 pagesCentury LED Limitedankityad129No ratings yet

- Stove Kraft LimitedDocument7 pagesStove Kraft LimitedSiddharth Rai SuranaNo ratings yet

- Tube Investments of India LimitedDocument8 pagesTube Investments of India Limitedpraveen kumarNo ratings yet

- Luxor Writing Instruments Pvt. LTDDocument7 pagesLuxor Writing Instruments Pvt. LTDbookdekho.ytNo ratings yet

- Munjal Kiriu Industries Private LimitedDocument8 pagesMunjal Kiriu Industries Private Limitedankityad129No ratings yet

- RR 20211213Document9 pagesRR 20211213Balakrishnan IyerNo ratings yet

- Polycab India - Pick of The WeekDocument3 pagesPolycab India - Pick of The WeekS.Sharique HassanNo ratings yet

- Syska Led-2Document7 pagesSyska Led-2Vijay AroraNo ratings yet

- Stove Kraft LimitedDocument8 pagesStove Kraft Limitedflying400No ratings yet

- Uno Minda Ivestors PresentationDocument26 pagesUno Minda Ivestors Presentationdeepak pareekNo ratings yet

- Prateek Wires (P) LTD - R - 08102020Document6 pagesPrateek Wires (P) LTD - R - 08102020DarshanNo ratings yet

- Padget Electronics Pvt. LTDDocument9 pagesPadget Electronics Pvt. LTDvenkyniyerNo ratings yet

- R. K. Marble Private Limited-12!30!2020Document6 pagesR. K. Marble Private Limited-12!30!2020Brajpal JhalaNo ratings yet

- Rockman Industries Limited: Summary of Rated Instruments Instrument Rated Amount (Rs. Crore) Rating ActionDocument7 pagesRockman Industries Limited: Summary of Rated Instruments Instrument Rated Amount (Rs. Crore) Rating ActionVirender RawatNo ratings yet

- Ashley Alteams India LimitedDocument7 pagesAshley Alteams India Limitedkrishnansarathy2006No ratings yet

- 202309140910_Vindhya_Telelinks_LimitedDocument7 pages202309140910_Vindhya_Telelinks_Limitedadhyan kashyapNo ratings yet

- Kalyan Jewellers India LimitedDocument8 pagesKalyan Jewellers India LimitedArunachalamNo ratings yet

- Sundaram Alternate Assets LimitedDocument7 pagesSundaram Alternate Assets LimitedSabSab MukNo ratings yet

- Enrich Hair and Skin Solutions PVT LTDDocument6 pagesEnrich Hair and Skin Solutions PVT LTDAbhishek BajoriaNo ratings yet

- Nuvama Wealth Management LimitedDocument8 pagesNuvama Wealth Management LimitedjayeshNo ratings yet

- Press Release: Raichur Power Corporation LimitedDocument3 pagesPress Release: Raichur Power Corporation LimitedPrasanna Kumar KNo ratings yet

- CTR Manufacturing Industries Private LimitedDocument7 pagesCTR Manufacturing Industries Private Limitedkrushna.maneNo ratings yet

- INEOS Styrolution India LimitedDocument5 pagesINEOS Styrolution India LimitedLAVKUSH YADAVNo ratings yet

- Sona BLW Precision Forgings - Nomura - 070622Document6 pagesSona BLW Precision Forgings - Nomura - 070622naman makkarNo ratings yet

- 82 - Amber ReportDocument5 pages82 - Amber ReportSaloniPatilNo ratings yet

- MSL Driveline Systems - R - 16102020Document8 pagesMSL Driveline Systems - R - 16102020DarshanNo ratings yet

- BAXY LimitedDocument8 pagesBAXY LimitedcareerNo ratings yet

- Silver Crest Clothing Private LimitedDocument7 pagesSilver Crest Clothing Private Limitedsyedyaseenpasha9292No ratings yet

- Gna Gears LimitedDocument7 pagesGna Gears Limitedankityad129No ratings yet

- Jeevaka Industries PVT R 06042020Document7 pagesJeevaka Industries PVT R 06042020saikiran reddyNo ratings yet

- K-Electric - ICP-11: Rating ReportDocument6 pagesK-Electric - ICP-11: Rating ReportAli RazaNo ratings yet

- Jupiter International LimitedDocument6 pagesJupiter International LimitedRahul syalNo ratings yet

- EKI Energy Services LimitedDocument8 pagesEKI Energy Services LimitedTarun 199No ratings yet

- Gabriel India Annual Report 2020 21Document180 pagesGabriel India Annual Report 2020 21pandyasamiksha503No ratings yet

- Oriental Rubber Industries Pvt. LTDDocument7 pagesOriental Rubber Industries Pvt. LTDPriya VijiNo ratings yet

- Khadim India Limited - ICRA Feb 2020 PDFDocument7 pagesKhadim India Limited - ICRA Feb 2020 PDFPuneet367No ratings yet

- MPlastics Toys and Engineering Private LimitedDocument9 pagesMPlastics Toys and Engineering Private Limitedshihabshibu105No ratings yet

- Airvision India Private Limited - R - 25082020Document7 pagesAirvision India Private Limited - R - 25082020DarshanNo ratings yet

- Majesco Software and Solutions India Private Limited: Summary of Rated InstrumentsDocument7 pagesMajesco Software and Solutions India Private Limited: Summary of Rated InstrumentsJatin SoniNo ratings yet

- Joy Ebikes IPDocument85 pagesJoy Ebikes IPdipesh.shopNo ratings yet

- HK Weekly Summary 20230718Document2 pagesHK Weekly Summary 20230718Nabil JazliNo ratings yet

- Skoda Auto India - R-21122018Document7 pagesSkoda Auto India - R-21122018Wasim Ahamad KhanNo ratings yet

- 06 - Aditi Jhanwar MFS Presentation PDFDocument21 pages06 - Aditi Jhanwar MFS Presentation PDFAditi JhanwarNo ratings yet

- Pragnes H Darji: Digitally Signed by Pragnesh Darji Date: 2022.12.27 15:56:44 +05'30'Document104 pagesPragnes H Darji: Digitally Signed by Pragnesh Darji Date: 2022.12.27 15:56:44 +05'30'virupakshudu kodiyalaNo ratings yet

- Final Internship Project - Doc1Document57 pagesFinal Internship Project - Doc1rohitkg2121No ratings yet

- Waaree Energies LimitedDocument6 pagesWaaree Energies LimitedHasik JainNo ratings yet

- Press Release Udaipur Cement Works LimitedDocument6 pagesPress Release Udaipur Cement Works Limitedflying400No ratings yet

- Nelcast Limited: Long-Term Rating Re-Affirmed and Outlook Revised To Negative Short-Term Rating Downgraded To (ICRA) A1 Summary of Rating ActionDocument7 pagesNelcast Limited: Long-Term Rating Re-Affirmed and Outlook Revised To Negative Short-Term Rating Downgraded To (ICRA) A1 Summary of Rating ActionPuneet367No ratings yet

- JSW Paints Private LimitedDocument8 pagesJSW Paints Private LimitedvineminaiNo ratings yet

- NCL Veka - RPDocument7 pagesNCL Veka - RPNargis KhanNo ratings yet

- Group Project: The Arabian Contracting Services CoDocument17 pagesGroup Project: The Arabian Contracting Services CoAdi ArifNo ratings yet

- Press Release: YFC Projects Private LimitedDocument5 pagesPress Release: YFC Projects Private Limitedlalit rawatNo ratings yet

- Guidebook for Utilities-Led Business Models: Way Forward for Rooftop Solar in IndiaFrom EverandGuidebook for Utilities-Led Business Models: Way Forward for Rooftop Solar in IndiaNo ratings yet

- Asia Small and Medium-Sized Enterprise Monitor 2020: Volume I: Country and Regional ReviewsFrom EverandAsia Small and Medium-Sized Enterprise Monitor 2020: Volume I: Country and Regional ReviewsNo ratings yet

- Reforms, Opportunities, and Challenges for State-Owned EnterprisesFrom EverandReforms, Opportunities, and Challenges for State-Owned EnterprisesNo ratings yet

- Final NavkhandbabaDocument75 pagesFinal NavkhandbabaVijay AroraNo ratings yet

- Sickle Cell Anemia ProgDocument3 pagesSickle Cell Anemia ProgVijay AroraNo ratings yet

- Drumstick ReportDocument15 pagesDrumstick ReportVijay AroraNo ratings yet

- Sickle Cell GujaratDocument4 pagesSickle Cell GujaratVijay AroraNo ratings yet

- Nagpur TataDocument13 pagesNagpur TataVijay AroraNo ratings yet

- Urban Bodies ProblemDocument19 pagesUrban Bodies ProblemVijay AroraNo ratings yet

- V23N24-1986-Vetal-Vetal Kunj Ka Rahassya - 2Document32 pagesV23N24-1986-Vetal-Vetal Kunj Ka Rahassya - 2Vijay AroraNo ratings yet

- Ten Indian Global Finance StalwartsDocument4 pagesTen Indian Global Finance StalwartsVijay AroraNo ratings yet

- Bain CapitalDocument13 pagesBain CapitalVijay AroraNo ratings yet

- Homeo My ListDocument2 pagesHomeo My ListVijay AroraNo ratings yet

- Nutan Comics - Bhootnath Arab Mein - RDXDocument36 pagesNutan Comics - Bhootnath Arab Mein - RDXVijay AroraNo ratings yet

- Korean Artificial SunDocument2 pagesKorean Artificial SunVijay AroraNo ratings yet

- BiracDocument2 pagesBiracVijay AroraNo ratings yet

- V23N43-1986-Vetal-Zaalim Daanav I - EditedDocument32 pagesV23N43-1986-Vetal-Zaalim Daanav I - EditedVijay AroraNo ratings yet

- V23N17-1986-Vetal-Katha Teesre Vetal Ki IDocument31 pagesV23N17-1986-Vetal-Katha Teesre Vetal Ki IVijay AroraNo ratings yet

- V24N19-1987-Badale Ki AagDocument32 pagesV24N19-1987-Badale Ki AagVijay AroraNo ratings yet

- AIIMS Regn For Cancer Treatment-2021Document1 pageAIIMS Regn For Cancer Treatment-2021Vijay AroraNo ratings yet

- Meenu ChitraKatha - 008 - Tilismi Danav - RDXDocument36 pagesMeenu ChitraKatha - 008 - Tilismi Danav - RDXVijay AroraNo ratings yet

- Adverse Effect of Traditional Korean MedicinesDocument7 pagesAdverse Effect of Traditional Korean MedicinesVijay AroraNo ratings yet

- 3-ch05 and 06Document61 pages3-ch05 and 06herueuxNo ratings yet

- Eureka Forbes LTDDocument13 pagesEureka Forbes LTDMridul SinhaNo ratings yet

- Difference Between Partnership and CompanyDocument3 pagesDifference Between Partnership and CompanyNusrat JahanNo ratings yet

- Ad Effectiveness by KrutiDocument29 pagesAd Effectiveness by KrutiKruti ShahNo ratings yet

- Chapter 8 Question Review PDFDocument13 pagesChapter 8 Question Review PDFCris ComisarioNo ratings yet

- How To Value A Business - Presentation For Sustainable Business Network of Philadelphia - February 25, 2014Document36 pagesHow To Value A Business - Presentation For Sustainable Business Network of Philadelphia - February 25, 2014Michael CunninghamNo ratings yet

- Group Assignment Auditing BA IT2Document3 pagesGroup Assignment Auditing BA IT2EVER ROBERT HENRYNo ratings yet

- Economics 2013 U1 P2Document6 pagesEconomics 2013 U1 P2Nicola DavisNo ratings yet

- Financial Accounting and Reporting Ii Final Quiz 2/3Document7 pagesFinancial Accounting and Reporting Ii Final Quiz 2/3jemsNo ratings yet

- Junal Analisis HPP Pada UMKM Teh Kita Bojonegoro Tahun 2023Document8 pagesJunal Analisis HPP Pada UMKM Teh Kita Bojonegoro Tahun 202307Arya Bayu ArdanaNo ratings yet

- Caitlin Tolley - CVDocument2 pagesCaitlin Tolley - CVapi-384477076No ratings yet

- Accounting Basics 1Document75 pagesAccounting Basics 1allangreslyNo ratings yet

- Career Test Result - Free Career Test Taking Online at 123testDocument5 pagesCareer Test Result - Free Career Test Taking Online at 123testapi-266265727No ratings yet

- Adjustments Financial Accounting IOBMDocument46 pagesAdjustments Financial Accounting IOBMWahaj noor SiddiqueNo ratings yet

- Accounting II SyllabusDocument4 pagesAccounting II SyllabusRyan Busch100% (2)

- Books of Prime Entry: Accounting 9706Document12 pagesBooks of Prime Entry: Accounting 9706Chirag JogiNo ratings yet

- Setting Product StrategyDocument19 pagesSetting Product StrategyNoora ZulfiqarNo ratings yet

- Chapter 11: The Capital MarketDocument5 pagesChapter 11: The Capital MarketMike RajasNo ratings yet

- Retained EarningsDocument72 pagesRetained EarningsItronix MohaliNo ratings yet

- A. The Importance of Capital BudgetingDocument16 pagesA. The Importance of Capital BudgetingManish ChaturvediNo ratings yet

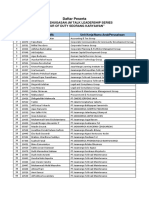

- Daftar Peserta JM Talk Leadership Series2Document8 pagesDaftar Peserta JM Talk Leadership Series2Doddy LombardoNo ratings yet

- FINS 3616 Tutorial Questions-Week 3 - AnswersDocument5 pagesFINS 3616 Tutorial Questions-Week 3 - AnswersJethro Eros PerezNo ratings yet

- E CommerceDocument2 pagesE Commerceevansmokua976No ratings yet

- ORourke Hyatt Services OverviewDocument12 pagesORourke Hyatt Services OverviewAaryan SedhainNo ratings yet

- ANA Email Marketing Solution Maturity ModelDocument2 pagesANA Email Marketing Solution Maturity ModelDemand MetricNo ratings yet