Professional Documents

Culture Documents

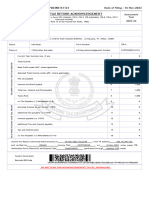

M/S ABC Limited NTN: Cnic: Income Tax Computation Tax Year 20X6

M/S ABC Limited NTN: Cnic: Income Tax Computation Tax Year 20X6

Uploaded by

fergusonaf555Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

M/S ABC Limited NTN: Cnic: Income Tax Computation Tax Year 20X6

M/S ABC Limited NTN: Cnic: Income Tax Computation Tax Year 20X6

Uploaded by

fergusonaf555Copyright:

Available Formats

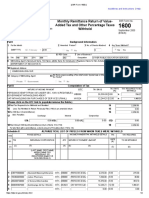

INCOME TAX COMPUTATION

M/S ABC Limited

NTN: TAX YEAR 20X6

CNIC:

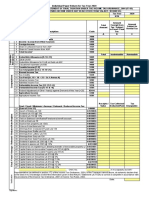

Income from Property TOTAL

Income from Property (Rent) 200,000x12 2,400,000

Gross Rent 2,400,000

Less: Deductions

1/5 Repair & miantainance - - (480,000)

Property tax apid - (100,000)

6% Collection Charges - - (144,000)

Rent charge to Income Tax - - 1,676,000

Capital Gain/Loss

-

FINAL TAX REGIME (FTR)

Tax

PROFIT ON PLS ACCOUNT

Gross Receipt Tax Deducted Deductable Net Receipt

- - -

- - - -

Profit on debt - - - - C

Tax Liability 58,400

Add: Difference of Minimum Tax

NET Tax Liability 58,400

Less: Tax Deducted

Tax on Property Tax 0

Tax On Cell Phone 0

Others -

-

Tax Payable/ Refundable 58,400

58,400

Computation of Tax Liability

As per Property salb

Inocme From Property

Upto 1500,000 1,500,000 32,000

176,000 15% 26,400

1,676,000 58,400

N-1

Tax Slab for TY 2016

Water and salary payment show in Personal Expenses

You might also like

- Work Order Draft For V D Construction-EarthworkDocument4 pagesWork Order Draft For V D Construction-EarthworkPrasad Boni100% (1)

- Exhibit 1 Letters From Respondent Withdrawing Allegations of WrongdoingDocument6 pagesExhibit 1 Letters From Respondent Withdrawing Allegations of WrongdoingRalph Bryant Law FirmNo ratings yet

- Performa Income StatementDocument1 pagePerforma Income StatementAhsan JamalNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruVikash singhNo ratings yet

- Coi 23-24 Lalu YadavDocument2 pagesCoi 23-24 Lalu Yadavtejpalsinghyadav786No ratings yet

- EFPS Home - EFiling and Payment SystemDocument2 pagesEFPS Home - EFiling and Payment SystemJinkieNo ratings yet

- Summer 2010Document9 pagesSummer 2010aleenakhalid001No ratings yet

- Goods and Services Tax - Negative Liablity StatementDocument2 pagesGoods and Services Tax - Negative Liablity StatementANAND AND COMPANYNo ratings yet

- Vikash Mittal Itr-Ay 22-23Document2 pagesVikash Mittal Itr-Ay 22-23Jai BajajNo ratings yet

- FBR Tax FilingDocument48 pagesFBR Tax FilingMuhammad Waqas Hanif100% (1)

- 2020 09 13 10 56 29 221 - 1599974789221 - XXXPR9253X - AcknowledgementDocument1 page2020 09 13 10 56 29 221 - 1599974789221 - XXXPR9253X - Acknowledgementraoanagha27No ratings yet

- Fill in All Applicable Spaces. Mark All Appropriate Boxes With An "X"Document4 pagesFill in All Applicable Spaces. Mark All Appropriate Boxes With An "X"Emelyn Ventura SantosNo ratings yet

- Individual Paper Return For Tax Year 2019: SignatureDocument10 pagesIndividual Paper Return For Tax Year 2019: SignatureEngr Saad Bin SarfrazNo ratings yet

- Vamsi Krishna Velaga - ITDocument1 pageVamsi Krishna Velaga - ITvamsiNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, Bengaluruwar10ckjupiNo ratings yet

- Indian Income Tax Return Acknowledgement 2021-22: Assessment YearDocument1 pageIndian Income Tax Return Acknowledgement 2021-22: Assessment YearTitiksha JoshiNo ratings yet

- 2020 09 29 12 10 23 809 - 1601361623809 - XXXPT4878X - Acknowledgement PDFDocument1 page2020 09 29 12 10 23 809 - 1601361623809 - XXXPT4878X - Acknowledgement PDFpratyush thakurNo ratings yet

- 2020 07 07 09 18 12 832 - 1594093692832 - XXXPC2200X - Acknowledgement PDFDocument1 page2020 07 07 09 18 12 832 - 1594093692832 - XXXPC2200X - Acknowledgement PDFLokeshNo ratings yet

- Naveen 22-23 ComputationDocument2 pagesNaveen 22-23 Computationdeepkaler219No ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruJaydeep WayalNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruAkhil c.kNo ratings yet

- ACFrOgCJ87XweE1ORK13I2yjbAMpCA3F8IcGcpwOM7Zst d62VpOa - XyXN MuGeegYkBFHwEvDzNOO7UyAo3ZaahtGIUUtsLu9puasYbmvQsTO8CMisioK4V7tRmWf MWfXFiQHjT0hWqlhMM4XDocument8 pagesACFrOgCJ87XweE1ORK13I2yjbAMpCA3F8IcGcpwOM7Zst d62VpOa - XyXN MuGeegYkBFHwEvDzNOO7UyAo3ZaahtGIUUtsLu9puasYbmvQsTO8CMisioK4V7tRmWf MWfXFiQHjT0hWqlhMM4XAngelica PagaduanNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruRoshanjit ThakurNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruMithlesh KumarNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruVipin SaxenaNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruCA ANDANI GSTNo ratings yet

- Tutorial 8 - CIT Problems - Sample AnswerDocument13 pagesTutorial 8 - CIT Problems - Sample Answerhien cungNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruNavis AntonyNo ratings yet

- Ivt BS 2021Document53 pagesIvt BS 2021Sujan TripathiNo ratings yet

- Itr 2020-21Document1 pageItr 2020-21saif.siddiqui.ablNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruNANDAN SALESNo ratings yet

- P6MYS 2012 Dec ADocument15 pagesP6MYS 2012 Dec AFakhrul Azman NawiNo ratings yet

- Ack Acmpn8839q 2021-22 187058110250721Document1 pageAck Acmpn8839q 2021-22 187058110250721salveakshay1000No ratings yet

- Individual Paper Return For Tax Year 2020: SignatureDocument26 pagesIndividual Paper Return For Tax Year 2020: SignaturejamalNo ratings yet

- LJ Huf FinancialDocument21 pagesLJ Huf Financialsunil jadhavNo ratings yet

- PDF 268701180200221Document1 pagePDF 268701180200221Rahul RampalNo ratings yet

- ITR Acknowledgement FY 2019-20Document1 pageITR Acknowledgement FY 2019-20taramaNo ratings yet

- Sarath 201-21 NewDocument1 pageSarath 201-21 Newbindu mathaiNo ratings yet

- IT Assessment of Individuals IllustrationDocument5 pagesIT Assessment of Individuals Illustrationsyedfareed596No ratings yet

- Oho Shop CoiDocument5 pagesOho Shop CoiJAY K SHAH & ASSOCIATESNo ratings yet

- Screenshot 2023-10-16 at 11.38.24 AMDocument1 pageScreenshot 2023-10-16 at 11.38.24 AMappurajan51No ratings yet

- Indian Income Tax Return Acknowledgement 2021-22: Assessment YearDocument1 pageIndian Income Tax Return Acknowledgement 2021-22: Assessment YearGURJEET SINGHNo ratings yet

- LJ Huf 21-22Document1 pageLJ Huf 21-22sunil jadhavNo ratings yet

- Itr-V Derpk2934d 2020-21 642243430121020Document1 pageItr-V Derpk2934d 2020-21 642243430121020Ambati Madhava ReddyNo ratings yet

- Indian Income Tax Return Acknowledgement 2021-22: Assessment YearDocument1 pageIndian Income Tax Return Acknowledgement 2021-22: Assessment YearHarjot SinghNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruAbhishek SaxenaNo ratings yet

- In Come Tax Return Form 2019Document48 pagesIn Come Tax Return Form 2019Mirza Naseer AbbasNo ratings yet

- 2021 03 21 19 20 27 091 - 1616334627091 - XXXPG9371X - AcknowledgementDocument1 page2021 03 21 19 20 27 091 - 1616334627091 - XXXPG9371X - Acknowledgementgangabhavani kNo ratings yet

- Desktop K99iurj101Document1 pageDesktop K99iurj101r66125082No ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruBANDARU SRINUNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruYogesh SainiNo ratings yet

- Indian Income Tax Return Acknowledgement 2021-22: Assessment YearDocument1 pageIndian Income Tax Return Acknowledgement 2021-22: Assessment YearRaveendra MoodithayaNo ratings yet

- Chandra Kant PDFDocument1 pageChandra Kant PDFSujan SamantaNo ratings yet

- Vikash Mittal Itr-Ay 21-22Document1 pageVikash Mittal Itr-Ay 21-22Jai BajajNo ratings yet

- 2020 07 31 16 05 55 486 - 1596191755486 - XXXPK8367X - AcknowledgementDocument1 page2020 07 31 16 05 55 486 - 1596191755486 - XXXPK8367X - AcknowledgementSiva Jyothi KNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDeepak PathakNo ratings yet

- Ack - Acmpn8839q - 2021-22 - 187058110250721 Year 21Document2 pagesAck - Acmpn8839q - 2021-22 - 187058110250721 Year 21salveakshay1000No ratings yet

- Itr (1234)Document1 pageItr (1234)Ashish SehrawatNo ratings yet

- PDF 796371500091220Document1 pagePDF 796371500091220dimplevats1982No ratings yet

- CASE OF ILIE AND OTHERS v. ROMANIADocument14 pagesCASE OF ILIE AND OTHERS v. ROMANIAJHON EDWIN JAIME PAUCARNo ratings yet

- Menzon vs. Petilla Menzon vs. PetillaDocument2 pagesMenzon vs. Petilla Menzon vs. PetillaJulie Ann Joy GarciaNo ratings yet

- Concept of Contempt of Court: Civil Contempt and Criminal ContemptDocument11 pagesConcept of Contempt of Court: Civil Contempt and Criminal Contemptvirat singhNo ratings yet

- Toms River Fair Share Housing AgreementDocument120 pagesToms River Fair Share Housing AgreementRise Up Ocean CountyNo ratings yet

- CatDocument3 pagesCatShannara21No ratings yet

- Center & State LegislativeDocument12 pagesCenter & State LegislativeRajaNo ratings yet

- Jan Paulsson Universal Arbitration - What We Gain What We LoseDocument23 pagesJan Paulsson Universal Arbitration - What We Gain What We Losechitu1992No ratings yet

- 11-29-2022 Actionable Items & Result of The Oversight Committee On AIDDocument2 pages11-29-2022 Actionable Items & Result of The Oversight Committee On AIDGuihulngan PulisNo ratings yet

- Nabunturan National Comprehensive High SchoolDocument3 pagesNabunturan National Comprehensive High SchoolVictoria Quebral CarumbaNo ratings yet

- Loay, BoholDocument2 pagesLoay, BoholSunStar Philippine News100% (1)

- Crimpro Compilation of All ReportsDocument265 pagesCrimpro Compilation of All ReportsRewsEnNo ratings yet

- 103-MOUDGIL-Judicial Response To International Commercial ArbitrationDocument15 pages103-MOUDGIL-Judicial Response To International Commercial ArbitrationHarsh Harsh VardhanNo ratings yet

- Compute The Tax Due Assuming That - A The Foreign Taxes Are Claimed As Tax Credit: 2 500 2.5 10 250,000 45,000 Answer M+ K M× % +Document6 pagesCompute The Tax Due Assuming That - A The Foreign Taxes Are Claimed As Tax Credit: 2 500 2.5 10 250,000 45,000 Answer M+ K M× % +Lenny Ramos Villafuerte100% (1)

- Aristotle Revolution and Property PDFDocument2 pagesAristotle Revolution and Property PDFsusapienNo ratings yet

- Amrit Lal Goverdhan Lalan v. State Bank of TravancoredocxDocument2 pagesAmrit Lal Goverdhan Lalan v. State Bank of TravancoredocxBrena GalaNo ratings yet

- Da V NLRCDocument1 pageDa V NLRCJerome CatubigNo ratings yet

- SC223579 PDFDocument10 pagesSC223579 PDFAnonymous qqbYSpgkNo ratings yet

- RA 9344 Sec. 6 As Amended by Sec. 3 of RA 10630Document14 pagesRA 9344 Sec. 6 As Amended by Sec. 3 of RA 10630Anonymous fL9dwyfekNo ratings yet

- 2 Ceu Faculty and Allied Workers Union-Independent V CA, Apron Mangabat As VaDocument1 page2 Ceu Faculty and Allied Workers Union-Independent V CA, Apron Mangabat As VaKia BiNo ratings yet

- Mellon Bank, N.A. V MagsinoDocument20 pagesMellon Bank, N.A. V Magsinoericjoe bumagatNo ratings yet

- Audit ObjectionsDocument8 pagesAudit ObjectionsZab JaanNo ratings yet

- United States Court of Appeals: For The First CircuitDocument16 pagesUnited States Court of Appeals: For The First CircuitScribd Government DocsNo ratings yet

- Antonia Calisterio Armas Vs Marietta CalisterioDocument2 pagesAntonia Calisterio Armas Vs Marietta CalisterioCarlota Nicolas VillaromanNo ratings yet

- 1144 - Brito, SR Vs DianalaDocument7 pages1144 - Brito, SR Vs DianalaDayle ManlodNo ratings yet

- 11.annexure 2 - HBA Application FormDocument2 pages11.annexure 2 - HBA Application FormSubodh GhuleNo ratings yet

- BSDA Request-Revised FormatDocument2 pagesBSDA Request-Revised FormatKrishnan KrishnNo ratings yet

- Parliamentary Committees in IndiaDocument17 pagesParliamentary Committees in Indiaparth bhardwajNo ratings yet

- G.R. No. 246255 - Cordova v. TyDocument12 pagesG.R. No. 246255 - Cordova v. TysdysangcoNo ratings yet