Professional Documents

Culture Documents

Chap 3

Chap 3

Uploaded by

bereketc36Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Chap 3

Chap 3

Uploaded by

bereketc36Copyright:

Available Formats

CHAPTER THREE

INSURANCE

Introduction

Devices resembling insurance are said to exist in the early period of human existence. At early

2000 a crude form of insurance designed to protect marine merchants, ship owners and marine

traders in Babylonia who were exposed to risk of robbery, sea perils and capture for ransom

were prevalent. Such risks caused heavy financial loss and distress to the shippers and marine

traders there by curtailing their business ventures.

To deal with such risks the Babylonians were said to have devised the system that can provide

some kind of protection to the ship owners, marine merchants and the creditors who advanced

marine loans for the venture.

Under the system, the creditor and the ship owner or the merchant enter in to a contract whereby

the creditor advanced the loans to the shipper or the merchant for the business venture. The

loan is repayable only up on the safe arrival of the ship at the desired destination. The creditor

collected the nominal interest plus some extra charge for assuming the risk, (risk premium).

Due to such arrangements, ship owners and marine merchants were encouraged to conduct

their venture without fear of financial loss. Ship owners and marine merchants were pledging

their cargo as a security for marine loans.

Commercial insurance in its refined form is believed to have begun with marine insurance

during the out grows of the Italian commerce in the 13th and 14th century. During this period,

cities in Northern Italy were practicing banking and insurance. In fact the term policy insurance

originated from Italian word pollizza, which means a promise. In subsequent periods insurance

business spread to other parts of the world, the USA and Japan.

Marine insurance is considered to be the oldest branch of insurance. It is believed that

merchants from Lombardy were known for their active role in marine contract, introduced

marine insurance to Britain around 4th century.

Learning objectives of the Chapter

At the end of /after studying this chapter, students should be able to:

Define and explain the development of insurance from different

view points

Prepared by: Biniam G. @Bonga University, Department of Management 1

Identify the basic characteristics of insurance

Describe and explain the function, role and importance of

insurance

Illustrate how insurance is different from Gambling and

speculation

List the requirements of insurable contracts/risks.

3.1. Definition of Insurance

Insurance can be defined in several ways and probably no one brief definition does autistic to

its many new features. It may be defined from economic, legal, business, social and

mathematical point of view. In economic sense, insurance is a mechanism of providing

certainty or predictability of loss with regard to pure risk. It accomplishes these by policy or

charity of risk. By reducing uncertainty in the business environment, it will create peace of

mind that enables business people focus on their primary activities instead of worrying about

the existence of possibility of loss so that societies can grow more.

From legal point of view, insurance is a contract whereby, a consideration (price) paid to a

party adequate to the risk, becomes security to other that he shall not suffer loss, damage,

or prejudice by the happening of risks specified in the contract from which he may be

exposed to. The contracting parties are the insured, who is responsible to pay the price from

obtaining the security (premium) and the insurer, who will assume the risk transferred. This

makes insurance a means of transferring risks from a premium (price) from one party

known as the insured to another called insurer.

From business perspective insurance is defined as a cooperative device to spread the loss

caused by particular risk over a number of persons who are exposed and who agree to ensue

themselves against the risk. Every risk involves the loss of one or other kind. The function

of insurance is to spread the loss over a large number of persons who agree to co-operate

each other at the time of loss. The risk cannot be averted but loss occurring due to certain

peril can be distributed amongst the agreed persons. They agree to share the loss because

the chance of loss, the time and amount, to a person is not known. Any of the insured may

suffer loss to a given risk: so, the rest of the persons who have agreed will share the loss.

The larger the number of such persons, the easier the process of distribution of loss will be.

In fact, they share the loss by payment of premium, which is calculated on the basis of

probability of loss.

Prepared by: Biniam G. @Bonga University, Department of Management 2

From the social point of view, insurance is defined as a device to accumulate funds to meet

uncertain losses of capital, which is carried at through the transfer of the risk of many

individuals to one person or to group of persons.

Mathematically, insurance is the application of certain actuarial principles (insurance

mathematics), law of probability, and statistical techniques used to achieve predictability.

In summary, insurance is an economic system for reducing uncertainty of loss through pooling

of losses together, a legal method of transferring risks from insured to the insurer in a contract

of indemnity, a business undertaking for profit that provides the many jobs in a free enterprise

economy, a social device in which the loss of few is covered by the contribution of many, or

an actuarial system of applied mathematics.

3.2. Basic characteristics of Insurance

An insurance plan or arrangement typically has certain characteristics. They include the

following:

Pooling of losses

Payment of

fortuitous losses

Risk transfer

Indemnification

Pooling of losses/sharing of losses: is the heart of insurance companies. It is the spreading of

losses of an insured by the few over the entire groups, so that in the process the average loss is

substituted for actual loss. Generally, pooling implies:

a. The sharing of loss by the entire group and

b. Prediction of future losses with some accuracy based on the law of large number.

The law of large numbers states that “As the number of exposure units (in other words, persons

or objects exposed to risk) increases, the more certain it becomes that the actual loss experience

will be equal to the probable loss experience. This law is stated based on assumption that the

losses are accidental and occur randomly.

Payment of fortuitous losses: it is one that unforeseen and unexpected and occurs as a result

of chance. For example a person may slip on a muddy side walk and break his leg. The loss

would be fortuitous.

Prepared by: Biniam G. @Bonga University, Department of Management 3

Risk transfer: refers to a pure risk is transferred from the insured to the insurer, who has a

strong financial position to pay the loss than the insured.

Indemnification: means that the insured is restored to his/her approximate financial position

prior to the occurrence of the loss. Let’s see some examples of indemnification:

1. If you house burns in a fire, the home owners’ policy will indemnify you or restore you to

the previous position.

2. If you are sued because of the negligent operation of an automobile, your automobile

liability insurance policy will pay those sums that you are legally obligated to pay.

3.3.The Functions of Insurance

The primary functions of insurance are the followings.

I. Providing certainty: insurance provides certainty of payment at the uncertain of

loss. Better planning and administration can reduce the uncertainty of loss.

Insurance removes all uncertainties and assurance is given to payments of

compensation at the time of loss. The insurer charges premium for providing the

said certainty.

II. Protection: the main function of insurance is to provide protection against the probable

chance of loss. Insurance guarantees the payment of loss and this protects the

assured from sufferings.

III. Risk sharing: when the risk takes place, all persons who are exposed to the same

risk share the loss.

In addition, insurance provides the following secondary functions.

A. Prevention of loss: insurance is primarily concerned with the financial consequences of

losses, but it would be fair to say that insurers have more than a passing interest of in loss

control. It could be argued that insurers have no real interest in the complete control of loss,

as this would inevitably lead to an end their business. This is a rather shortsighted view.

Insurers do have an interest in reducing the frequency and the severity of loss. In a practical

way, buyers of insurance will normally come into a contract with the loss control service

offered by an insurer when they meet the surveyor. The insurer, or indeed the insurance

broker may employ the surveyor, and part of his job is to give advice on loss control. Many

insurers employ specialist surveyors in fire, security, liability and other types of risk.

Prepared by: Biniam G. @Bonga University, Department of Management 4

Insurance assists financially to the fire brigade, educational institutions and other

organizations, which are engaged in preventing the losses. In short, the function of

insurance is not limited to merely compensating those who suffered from the losses at the

time the risk materializes. However, insurance must make sure that adequate loss

prevention and loss control mechanisms were implemented by the insured to minimize the

probability and severity of loss.

B. Providing capital: insurance companies have, at their disposal, large amount of money.

This arises due to the fact that there is a time gap between the receipt of a premium and the

payment of a claim. A premium could be paid in January and a claim may not occur until

December, if it occurs at all. The insurer has this money and can invest it. In fact, the insurer

will have the accumulated premiums of al insured, over a long period of time.

The Role and Importance of Insurance

Insurance is a mechanism of collecting funds from those exposed to risk that would be paid out

for those who suffered a loss at the time it materializes. The accommodated funds are invested

in productive areas.

The existence of a sound insurance market is an essential component of any successful

economy and the proof of this can be seen in many parts of the world.

The role and importance of insurance can be seen in three ways: uses to individuals, to special

group of individuals, and to the society.

1. Uses to individuals:

a) Insurance provides security and safety: Insurance reduces the physical and mental

stress that insured face concerning the possibility of death, disability, and financial loss.

Insured’s, through transfer of their risk to the insurer reduce their worry about any

financial loss they may face due to coincidental misfortune. This means that insured are

to a large extent certain that the loss, if at all occurs will be recovered from the insurer.

b) Insurance affords peace of mind: The knowledge that insurance exist to meet the

financial consequences of certain risks provides a form of peace of mind. This is

important for private individuals when they insure car, house, possessions, and, but it

is also of vital importance n industry and commerce.

c) Insurance protects mortgage property: At the death of the owner of the mortgaged

property, or at the time of damage or destruction of the property, the insurer will provide

Prepared by: Biniam G. @Bonga University, Department of Management 5

an adequate amount to the dependents at the early death of the owners to pay off the

unpaid loans, or the mortgage gets a deflated amount at the destruction of the property.

2. Uses to business:

a) Reduction of uncertainty: why should a person put money in to a business venture

when there are so many risks which could result in the loss of the money? Yet, if people did

not invest in business, then there would be fewer jobs, less goods, the need for even higher

imports and a general reduction in wealth. Buying insurance allows the entrepreneur to transfer

at least some of the risks of being in business to an insurer. Uncertainty of business losses is

reduced in the world of business.

b) Increasing business efficiency: Insurance also acts as a stimulus for the

activity of business, which are already in existence. This is done through the release of

funds for investment in the productive side of the business, which would otherwise

require to be held in easily accessible reserves to cover any future loss. Business

efficiency is increased with insurance when the owner of business is free from

botheration of loss, hence, certainty devote much time to the business. The carefree

owner can work better for maximization of profit. The uncertainty of loss, damage,

destruction, or disappearance of a property, may affect the mind of the business people

adversely. The insurance, removing the uncertainty, stimulates businesspeople to work

hard.

3) Uses to society:

a) Wealth protection: with the advancement of the society, the wealth or the

property of the society attracts more hazards resulting in the creation of new types of

insurance invested top protect them against the possible losses. To present, future and

potential property resources are well protected through insurance in which each and

every member will have financial security against damage and destruction of wealth.

Through prevention of losses, insurance protects the society against degradation of

resources and ensure stabilization and expansion of business and industry.

b) Economic growth: Insurance provides strong hand and mind and protection against

the losses of property. In addition to these, insurance companies accumulate large sum of

money available for investment purpose. Such money accumulated may be invested by the

insurance companies themselves or lent to produce more wealth. This will have its own

contribution to economic growth of the country. The fact that the owner of the business has the

Prepared by: Biniam G. @Bonga University, Department of Management 6

funds available to recover from the loss provides the stimulus to business activity. It also means

that jobs may not be lost and goods or services can still be sold. The social benefit of this is

that people keep their jobs, their sources of income are maintained and they can continue to

contribute to the national economy.

3.4. Insurance, Gambling and Speculation

The essential feature about gambling is that it creates a risk where there existed none hitherto.

The difference between insurance and gambling can be stated as follows.

The man who gambles creates risk, which did not exist before whereas the man who purchases

insurance minimizes a risk which was already in being and which is not in his power to avoid.

The gambler with hope of gain goes out his way to bring me a risk in to being while the man,

who insures, for the purpose of avoiding loss, goes out of his way to hedge against a risk which

already exists.

The man who gambles accepts deliberately the risk of loss in exchange for the possibility of

profit: the man who insures accepts deliberately the certainty of a small loss in exchange for

the freedom from the risk of devastating catastrophic loss. The gambler bears the risk while the

insured transfers the risk.

Speculation on the other hand involves doing some kind of activity with the expectation of

profit in the future. For example, a person who purchases and sells goods, stocks and shares,

etc with the risk of loss and hope of profit through changes in their market values is a clear

case of speculation. Through speculation, individuals create a risk deliberately in the

anticipation of profits. However, an insurance transaction normally involves the transfer of

risks that are insurable, since the requirements of an insurable risk generally can be met. On

the contrary, speculation is a technique for handling risks that are typically uninsurable, such

as protection against a substantial decline in the price of agricultural products and raw

materials.

The other difference between the two is that insurance can reduce the objective risk of insurer

by application of the law of large number. In contrast, speculation typically involves only risk

transfer, not risk reduction. The risk of an adverse price fluctuation if transferred to a speculator

who feels he or she can make a profit because of superior knowledge of forces that affect

Prepared by: Biniam G. @Bonga University, Department of Management 7

market price. The risk is transferred, not reduced, and the speculator’s prediction of loss

generally is not based on the law of large number.

3.5.Social and Economic Values of Insurance

Insurance is obviously desirable that we can enumerate several advantage or value to the social

well-being and economic development of a nation. Some of the advantages are discussed

below.

1. Risk transfer/Indemnification

The primary objective of insurance is to provide financial compensation to those insured who

suffered accidental losses. Indemnification is made out of the fund established by the member’s

contribution or premium payment, who are exposed to the same risk. This means, the loss is

spread to all members on equitable basis and the financial burden of the unfortunate is reduced

and he is restored to his former financial position. By doing so insurance helps stabilize the

financial situation of individuals, families and organizations.

2. Reduction of Uncertainty

Insurance reduces the physical and mental stress that insured's face concerning the risk of loss

and provides peace of mind. It is a psychological benefit that may not be quantified but still of

great importance. Insurance reduces worries and anxieties and help everyone work in a relaxed

manner, which can make everyone to work more productive and perform his duties properly

without anxiety. This has direct implication on the society because the society will be secured

from unexpected loss and interruption of services from those who will face unexpected loss.

3. Encourages Savings

Insurance is a contractual agreement between the insurer and the insured, where the insured is

expected to pay a premium for the risk he/she transferred to the insurer. This compulsory

premium payment is a form of encouragement of the insured to make systematic saving.

Particularly, this is possible in certain life insurance policies that have dual purpose, i.e.,

protection in the event of death and savings in the event of survival.

4. Help Businesses Continue Without Interruption of Operation

Prepared by: Biniam G. @Bonga University, Department of Management 8

The insured firm will not be knocked out of business by fire or liability or other insurable risks.

The insurer indemnifies the losses and restores the firm to its former position. This is also

advantageous to the society because they can get uninterrupted services and goods of the firm.

Moreover, insurance helps small businesses since they cannot bear all the risks by themselves.

By transferring their risk, they can safely perform their operation and compete with larger

firms.

5. Provide Funds for Investment

Premiums collected by insurance companies are not left stagnant. They are used to provide a

big source long-term investment capital for the national economy. The loan is made available

to investors through banks and it serve as a stimulant for the national economy to be healthier.

6. Keeps Families Together

Family can continue to live together after disastrous adversaries. For example, if a husband

with life insurance dies, it may not force his family to disintegrate due to lack of income

because they can receive the compensation from the insurer and can earn their live as it was

before at least to some extent

It relieves pressure on social welfare system, thereby reserving government resources for

essential social security activities.

7. Provides a Basis for Credit

Insurance policies are used as a guarantee for personal and business bank loans. This days

banks lend money on the basis of the collateral security of insurance.

8. Promotes Loss Control Systems

In order to minimize their losses, insurance companies have tried and are continuing to

introduce several kinds of loss reduction and prevention schemes. For example, health

education, inspection, of elevators, and boilers, installation of fire extinguishers, burglar

alarms, on vehicles or houses are risk control mechanisms developed and applied by insurance

companies at different times. The introduction of this loss control programs can reduce losses

to businesses and individuals and complement good risk management thereby benefiting

society as a whole.

Prepared by: Biniam G. @Bonga University, Department of Management 9

9. It provides Financial Stability to the Community

Insurance makes a remarkable contribution to the society as a whole. It creates certainty in the

environment thereby stimulating competition among business enterprises in a certain region.

Fair competition is a greater advantage to the society since it reduces price, encourage efficient

utilization of scarce resources and produce quality products. Insurance also avoids or at least

minimizes production stoppage that produces an economic wastage, and results in loss of profit

to the insured, unemployment and loss of trade and services to the business community. So,

insurance can minimize all these and other consequences of risk.

10. Stimulates International Trade and Commerce

Goods traded at the international market are highly vulnerable to risk of loss due to large

number of perils. As a result, it is difficult to think of international trade without insurance.

Insurance coverage may be a condition for engaging in international trade and commerce.

Insurance serves as a "lubricant of trade", without it trade and commerce may stifle.

3.6. Costs and Limitations of Insurance

3.6.1 Disadvantages/ Costs of Insurance

Insurance is not without some problems. It has the following major problems:

1. It encourages fraud to collect dishonest claims (moral hazard problems). When

individuals are insured against a particular risk, they may intentionally increase the

chance of loss, or exaggerate the claim.

2. Increases carelessness in life (morale hazard problem): it is a condition that causes to

be less careful than they would otherwise be. Some individuals do not consciously seek

to bring about a loss, but the fact that they have insurance causes them to take more

risks than they would if they had no insurance coverage. This manner may result in

excessive losses in the community.

3. Cost of Insurance: insurers incur operating expenses such as loss control costs, loss

adjustment expenses, expense involved in acquiring insured, (advertisement cost), state

premium taxes, and general administrative costs. In addition to these expenses, the

insured is expected to cover a reasonable amount for profit and contingencies.

Prepared by: Biniam G. @Bonga University, Department of Management

10

3.4.2 Limitations of Insurance

Insurance is clearly a useful device for handling risk, but some risks cannot safely be handled

by insurance. It is a device used to deal with pure risks only. Even not all pure risks are

insurable. That means, insurance does not provide protection against a wide range of risks. It

has a limited application. You may question: what types of risks are insurable? To give an

answer to this question, it is necessary to discuss the characteristics of insurable risks. In other

words, for insurance to be used as a risk transfer mechanism the following conditions must be

met to identify the insurable risks from those which cannot be commercially insurable.

Characteristics of Insurable Risks

1. A large number of independent units should be exposed to the same risk. This requirement

follows from the law of large numbers, a mathematical principle which states that a risk

that is not predictable for one person can be forecasted accurately for a sufficiently large

groups of people with similar characteristics. Insurance operation is safe only when the

insurer is able to predict fairly and accurately its expected losses. If the pool of policy

holders is small, volatility in number of claims can lead to unexpected increase in claim

and hence bankrupt the plan the insurance company.

Therefore, there must be a sufficiently large number of risks of a similar class being insured so

as to predict accurately the average loss experience.

2. It must be possible to calculate/measure the chance of loss in monetary terms.

3. The loss should be definite, in time, place, cause and amount; otherwise claim adjustment

will be difficult.

4. the loss should be accidental from the view point of the insured as distinguished from the

expected loss. For example, losses on account of depreciation cannot be insured, as there

is nothing accidental about their occurrence.

5. The possible loss must not be catastrophic. The risks covered by insurance should affect

only a relatively small portion of the total insured population at a given time. If a risk is

likely to cause similar damage to a large proportion of policy holders at the same time, a

single occurrence of the risk would bankrupt the insurance companies. Therefore, with

Prepared by: Biniam G. @Bonga University, Department of Management

11

certain exceptions, it is usual to find exclusions regarding fundamental risks such as war

and earthquake in all insurance contracts.

6. There must be an insurable interest. An insurance contract provides security against the

consequences of a loss and is basically concerned with preserving the interest of the

insured, one who possesses insurable interest (financial relationship) in the subject matter

of insurance can avail the insurance protection.

7. The potential loss must be large. The risk should not be very minor one and the penil must

be capable of causing a loss so large that the insured cannot bear it himself without

economic distress.

8. The cost of insurance should not be prohibitive. The cost of insuring (premium) must be

economically feasible and within the reach of nearly everyone; otherwise it will be confined

to a very small section of the society. For instance, who would be willing to pay Birr 1,000

or 2,000 to insure the risk of losing a 100 Birr property? If you are rational person, the

answer is definitely “no" The premium should be reasonable.

9. The risk must be consistent with public policy. The insurance contract should not be against

the public policies, for example, insurance effected by terrorists for fines imposed for the

offences.

10. The insured must be subject to real risk whatever may be the subject matter of insurance

for which the insured seeks protection, the subject matter must be adversely affected on the

happening of the event, i.e., the subject matter must be potentially exposed to the risk.

Prepared by: Biniam G. @Bonga University, Department of Management

12

Insurable Risk

The following are generally insurable risks.

1. Pure risks: property (direct and indirect property losses; personal and legal liability

losses).

2. Non-catastrophic losses

3. Risk with low probability of occurrence

Uninsurable risks

1. Speculative risks such as market risks,

2. Fundamental risks (war, earthquake, political and economic losses).

3. Wear and tear of goods, eg. Depreciation.

4. Risk that are against public policy.

Prepared by: Biniam G. @Bonga University, Department of Management

13

You might also like

- Temporary Cover Certificate of Motor InsuranceDocument1 pageTemporary Cover Certificate of Motor InsuranceofficialrightmindsetNo ratings yet

- LLB Refresher Notes Insurance LawDocument43 pagesLLB Refresher Notes Insurance LawKriti Bhandari93% (14)

- Basic Own DamageDocument3 pagesBasic Own DamageHarsh PriyaNo ratings yet

- Unit 3: Introduction To Insurance ContentDocument15 pagesUnit 3: Introduction To Insurance Contentdejen mengstieNo ratings yet

- Insurance PrinicilesDocument9 pagesInsurance PrinicilesEmmanuella ChantengNo ratings yet

- Introductionn: Chapter-1Document13 pagesIntroductionn: Chapter-1Anupriya ChuriNo ratings yet

- Ela ManDocument30 pagesEla ManAdnan Abdulkadir MohammedNo ratings yet

- RISK Chapter 3Document13 pagesRISK Chapter 3Taresa AdugnaNo ratings yet

- CH 3 InsuranceDocument28 pagesCH 3 InsuranceYaikob MaskalaNo ratings yet

- 08 - Chapter 1 KeshavDocument71 pages08 - Chapter 1 KeshavSAGARNo ratings yet

- Insurance AssignmentDocument114 pagesInsurance AssignmentNewton BiswasNo ratings yet

- Risk Which Can Be Insured by Private Companies Typically Share Seven Common CharacteristicsDocument10 pagesRisk Which Can Be Insured by Private Companies Typically Share Seven Common Characteristicsمنیب فراز درانیNo ratings yet

- Pb502 - Insurance and Takaful: Principle and Practice - Chapter 1 Introduction To InsuranceDocument6 pagesPb502 - Insurance and Takaful: Principle and Practice - Chapter 1 Introduction To InsuranceChrystal Joynre Elizabeth JouesNo ratings yet

- Insurance and Risk Management Unit 1 LEC. 1Document15 pagesInsurance and Risk Management Unit 1 LEC. 1Preeti ChauhanNo ratings yet

- Chapter III InsuranceDocument15 pagesChapter III Insurancemuradhalid08No ratings yet

- History of InsuranceDocument36 pagesHistory of InsuranceMurali DharanNo ratings yet

- Unit IVDocument59 pagesUnit IVsonuNo ratings yet

- Insurance & UTIDocument22 pagesInsurance & UTIReeta Singh100% (1)

- Insurance: 1 Lesson 1 Introduction To InsuranceDocument14 pagesInsurance: 1 Lesson 1 Introduction To Insurancevipul sutharNo ratings yet

- Art InsuranceDocument62 pagesArt InsuranceAnkita DalviNo ratings yet

- InsuranceDocument144 pagesInsuranceShubhampratapsNo ratings yet

- Functional Definition of Insurance: MeaningDocument6 pagesFunctional Definition of Insurance: MeaningShubham DhimaanNo ratings yet

- InsurancelawDocument136 pagesInsurancelawStuti SinhaNo ratings yet

- Introduction To InsuranceDocument15 pagesIntroduction To InsuranceInza NsaNo ratings yet

- Life and Endowment InsuranceDocument9 pagesLife and Endowment InsuranceAmanuel HabtamuNo ratings yet

- Project WorkDocument75 pagesProject WorkShweta VijayNo ratings yet

- Reliance Life InsuranceDocument101 pagesReliance Life InsuranceVicky Mishra100% (2)

- Insu 1 IntroductionDocument11 pagesInsu 1 IntroductionMahfuzur RahmanNo ratings yet

- Introduction To Insurance: Asstt. Professor, SRCC, University of DelhiDocument30 pagesIntroduction To Insurance: Asstt. Professor, SRCC, University of DelhikanikaNo ratings yet

- 100 Marks ProjectDocument16 pages100 Marks Projectharshad shuklaNo ratings yet

- 1 Lesson 1 Introduction To InsuranceDocument61 pages1 Lesson 1 Introduction To InsurancerachitNo ratings yet

- Basics of Business Insurance - NotesDocument41 pagesBasics of Business Insurance - Notesjeganrajraj100% (1)

- Art InsuranceDocument54 pagesArt InsuranceLove Aute100% (1)

- Nilesh Pandey (BBI)Document60 pagesNilesh Pandey (BBI)Nilesh PandeyNo ratings yet

- Kuch BhiDocument13 pagesKuch BhiSAUMYANo ratings yet

- Bcom Paper Code: BCOM 314 Principles of InsuranceDocument37 pagesBcom Paper Code: BCOM 314 Principles of InsuranceShajana ShahulNo ratings yet

- ch-3 RiskDocument10 pagesch-3 RiskYebegashet AlemayehuNo ratings yet

- Insurnance Chapter Iii-Insurance: An Overview: 3.1. The Nature and Functions of InsuranceDocument29 pagesInsurnance Chapter Iii-Insurance: An Overview: 3.1. The Nature and Functions of InsuranceCanaanNo ratings yet

- ArtDocument54 pagesArtpoojatolani3667No ratings yet

- UNIT-3: Introduction To InsuranceDocument36 pagesUNIT-3: Introduction To InsuranceEdenNo ratings yet

- Risk CH 3 PDFDocument9 pagesRisk CH 3 PDFWonde Biru100% (1)

- What Is InsuranceDocument2 pagesWhat Is InsuranceJamie RossNo ratings yet

- Introduction of Insurance NOTESDocument7 pagesIntroduction of Insurance NOTESReva JaiswalNo ratings yet

- Insurance Insurance-This Is An Undertaking or Contract Between An Individual or Business and An Insurance AnDocument23 pagesInsurance Insurance-This Is An Undertaking or Contract Between An Individual or Business and An Insurance AnangaNo ratings yet

- 03 - Chapter 1Document14 pages03 - Chapter 1fidamehdiNo ratings yet

- Insurance: An Overview Chapter ThreeDocument15 pagesInsurance: An Overview Chapter ThreeAbel HailuNo ratings yet

- Introduction To Insurance and Risk ManagementDocument12 pagesIntroduction To Insurance and Risk ManagementJake GuataNo ratings yet

- Chapter 3 InsuranceDocument20 pagesChapter 3 InsuranceKeneanNo ratings yet

- Insurance Business Environment An IntroductionDocument30 pagesInsurance Business Environment An Introductionbiju83% (6)

- Risk Management Lecture Note CH 3-7Document77 pagesRisk Management Lecture Note CH 3-7Meklit TenaNo ratings yet

- Risk AssignmentDocument11 pagesRisk AssignmentAmanuel HabtamuNo ratings yet

- 9th Chap Insurance & Business RiskDocument9 pages9th Chap Insurance & Business Riskbaigz0918No ratings yet

- Insurance ManagementDocument27 pagesInsurance Managementzaks69No ratings yet

- Chapter ThreeDocument15 pagesChapter Three108 AnirbanNo ratings yet

- Banking & Insurance - Module 6&7Document14 pagesBanking & Insurance - Module 6&7minnuzshilpa71No ratings yet

- Umbrella InsuranceDocument36 pagesUmbrella Insurancesguldekar123No ratings yet

- The Law of Insurance (Exclusive)Document17 pagesThe Law of Insurance (Exclusive)belay abebeNo ratings yet

- Banking and Insurance Unit III Study NotesDocument13 pagesBanking and Insurance Unit III Study NotesSekar M KPRCAS-CommerceNo ratings yet

- Motor InsuranceDocument22 pagesMotor InsuranceAdil SiddiquiNo ratings yet

- Law and Citizenship Education Revision QuestionsDocument123 pagesLaw and Citizenship Education Revision QuestionsNsemi NsemiNo ratings yet

- Quotation - FP025 Lurdes 032024Document10 pagesQuotation - FP025 Lurdes 032024ferminojosecumbaneNo ratings yet

- Winternitz Associates Insurance Brokers Corporation v. CIRDocument11 pagesWinternitz Associates Insurance Brokers Corporation v. CIRPrincess FaithNo ratings yet

- Your Payment Information - This Is A BillDocument2 pagesYour Payment Information - This Is A BillesenombreunicoNo ratings yet

- ĐỀ THI SỐ 2: 75mins Part 1: Multiple Choices (6 Points) - Circle The Correct AnswerDocument4 pagesĐỀ THI SỐ 2: 75mins Part 1: Multiple Choices (6 Points) - Circle The Correct AnswerBích ChâuNo ratings yet

- Gather Go Get The FLORiDA Card - Citizens FloridaCard ChecklistDocument4 pagesGather Go Get The FLORiDA Card - Citizens FloridaCard ChecklistCiara LozanoNo ratings yet

- New Jeevan Anand Plan 815Document6 pagesNew Jeevan Anand Plan 815Anonymous YakppP3vAnNo ratings yet

- 135 - Solidum v. CA G.R. No. 161647Document3 pages135 - Solidum v. CA G.R. No. 161647Joan MangampoNo ratings yet

- Handbook 2021 - MRS InternationauxDocument16 pagesHandbook 2021 - MRS InternationauxVarun PareekNo ratings yet

- 340B Drug Discounts WPDocument20 pages340B Drug Discounts WPScott McClallenNo ratings yet

- Broker Commission Schedule-EDocument19 pagesBroker Commission Schedule-EErvin Fong ObilloNo ratings yet

- Instructionsandwarranty: Downloaded From Manuals Search EngineDocument45 pagesInstructionsandwarranty: Downloaded From Manuals Search Enginearmas1No ratings yet

- The Dive Business Guide To Safe Diving OperationsDocument25 pagesThe Dive Business Guide To Safe Diving OperationsWale OyeludeNo ratings yet

- Insurance Code: Republic Act No. 10607Document54 pagesInsurance Code: Republic Act No. 10607Gino Gino100% (1)

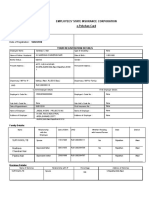

- Employees' State Insurance Corporation E-Pehchan Card: Insured Person: Insurance No.: Date of RegistrationDocument3 pagesEmployees' State Insurance Corporation E-Pehchan Card: Insured Person: Insurance No.: Date of RegistrationSandeepNairNo ratings yet

- Digit Private Car Policy: (AKA The Paper You Pull Out When You Get Pulled Over)Document6 pagesDigit Private Car Policy: (AKA The Paper You Pull Out When You Get Pulled Over)IskerNo ratings yet

- BPCA Application Form 2023Document11 pagesBPCA Application Form 2023BobNo ratings yet

- Probate InventoryDocument4 pagesProbate Inventoryacer paulNo ratings yet

- JinkoSolar-Global Limited Warranty - (Rev.110320-LINEAR)Document8 pagesJinkoSolar-Global Limited Warranty - (Rev.110320-LINEAR)Gossai HanafiNo ratings yet

- Complete With DocuSign App2515089pdf QuotepdDocument8 pagesComplete With DocuSign App2515089pdf QuotepdSilvia GloverNo ratings yet

- PIE INDUSTRIES QUOTE - OdsDocument18 pagesPIE INDUSTRIES QUOTE - OdsAbhishek goyalNo ratings yet

- The Zebra State of Auto Insurance Report 2022Document45 pagesThe Zebra State of Auto Insurance Report 2022WXYZ-TV Channel 7 DetroitNo ratings yet

- ESI ACT (Sickness Benefit)Document5 pagesESI ACT (Sickness Benefit)priyanka pinkyNo ratings yet

- Revision Instruction: Answer All Questions Name: Part A: Multiple Choice QuestionsDocument9 pagesRevision Instruction: Answer All Questions Name: Part A: Multiple Choice QuestionsChaerry MeanieNo ratings yet

- Community-Based Health InsuranceDocument35 pagesCommunity-Based Health Insuranceyakubu I saidNo ratings yet

- Comparison Chart For Guaranty Pledge and MortgageDocument12 pagesComparison Chart For Guaranty Pledge and MortgageClyde Ian Brett PeñaNo ratings yet

- Missing Documents May Negatively Affect The Visa Decision. For Official Use OnlyDocument2 pagesMissing Documents May Negatively Affect The Visa Decision. For Official Use OnlySandeep SinghNo ratings yet

- Ficha Tecnica Up Solar US 72 Cels 300-310 Pos PDFDocument2 pagesFicha Tecnica Up Solar US 72 Cels 300-310 Pos PDFhmr810104No ratings yet